2024-07-11 22:47

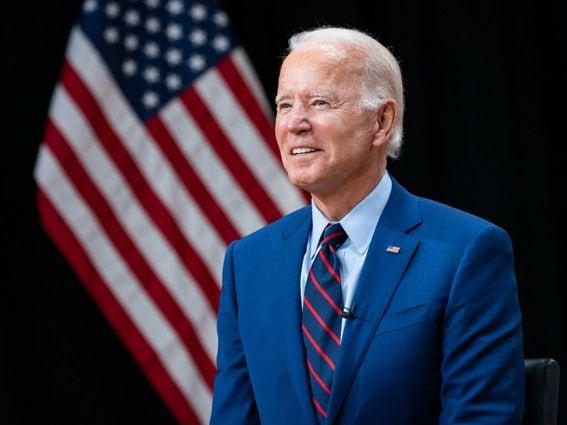

The president said he plans to stay in the race but "it's important that I allay fears." Joe Biden's odds of being the Democratic nominee for president overtook those of his vice president, Kamala Harris following his first press conference in months, according to traders on crypto-based prediction market platform Polymarket. Traders at one point gave him a 51% shot of being the nominee, way up from 33% earlier in the day, according to a contract on Polymarket. The odds were recently back down to 45%. Meanwhile, Harris' probability of getting the nod dipped as low as 37% before rebounding to 42% at press time. Biden's chance of victory in November stands at 13%, less than Harris' 15%, according to Polymarket. Former President and likely Republican nominee Donald Trump remains the favorite to win the White House. "Yes" shares in Polymarket's contract for Trump recently traded at 61 cents, and will pay out $1 per share (in USDC, a stablecoin, or cryptocurrency pegged to the dollar) if he wins and zilch if not, meaning the market gives him 61% odds of victory. Biden slurred his words several times during the press conference and mistakenly referred to Harris as "Vice President Trump," but he also spoke in depth about foreign policy issues following a NATO summit and at one point his voice neared a yell as he talked about American children getting killed by guns. The president reiterated that he plans to stay in the race but acknowledged "it's important that I allay fears" about his condition. Concerns about his age and cognitive health have led to widespread calls among prominent Democrats and donors, including actor George Clooney, for the president to step aside, despite his insistence he is staying in. Hundreds of millions of dollars are riding on the election's outcome on Polymarket, which is enjoying a breakout year despite having to geofence U.S. users under a regulatory settlement. The platform's bets are programmed into smart contracts on the Polygon blockchain. https://www.coindesk.com/markets/2024/07/11/bidens-odds-of-dropping-out-jump-again-on-polymarket-ahead-of-presidents-press-conference/

2024-07-11 18:41

OKX previously said in May 2023 that France would be its preferred European hub. "Compliance in Malta is way more lenient," said a person with direct knowledge of OKX's EU regulatory efforts. OKX plans to use Malta as its European Union hub to comply with the region's new MiCA regulation; previously, it had targeted France for this. "Compliance in Malta is way more lenient, and that's not the tag you want to have when you're in crypto and trying to make it in the EU," said a person with direct knowledge of OKX's European regulatory efforts. The cryptocurrency exchange is looking to fill several high-profile roles in Malta, including head of compliance, operations lead and head of internal audit. OKX, the world's second-largest cryptocurrency exchange, plans to make the Mediterranean island of Malta its European hub and base for compliance with the newly arrived Markets in Crypto assets (MiCA) regulatory framework, according to two people familiar with the matter. It's a change of tack for OKX, which said in May of last year that France would be its preferred European Union hub. OKX's France arm has been registered with France's financial regulator Autorité des marchés financiers (AMF) since December. "Compliance in Malta is way more lenient, and that's not the tag you want to have when you're in crypto and trying to make it in the EU," said a person with direct knowledge of OKX's European regulatory efforts. OKX declined to comment on the Malta decision. Companies have been looking to get registered with one of the European Union's 27 nations to get ready for upcoming MiCA rules, which require firms to secure a crypto asset service provider, or CASP, license with an EU nation to operate across the entire bloc. First, firms need to have a physical presence in that nation, carry out some business in the country and already be registered to get the CASP license. MiCA's stablecoin rules are already in place but the rest of the rules will come through in December. Malta, which is home to many gaming companies and some investment firms, has embraced crypto in recent years. In late 2023, Malta's Financial Services Authority (MFSA) updated its rules for crypto companies to fall in line with the oncoming MiCA regime. The exchange is looking to fill several high-profile roles in Malta, including head of compliance, operations lead and head of internal audit. Earlier this year, OKX agreed to a "goodwill" settlement of 304,000 euros ($329,000) with the Maltese financial watchdog for certain regulatory failings. Camomile Shumba contributed reporting to this story. https://www.coindesk.com/business/2024/07/11/okx-picks-malta-over-france-as-europe-hub-to-comply-with-eus-mica-crypto-rules-sources/

2024-07-11 16:50

Crypto wasn't a major topic in a four-person confirmation hearing before the Senate Banking Committee, though SEC Commissioner Crenshaw was questioned on bitcoin ETFs. Four nominees for regulatory positions across the Biden administration were questioned in a Senate Banking Committee confirmation hearing on Thursday. Crypto only came up a few times, including in the questioning of the Securities and Exchange Commission's Caroline Crenshaw on bitcoin trading products. Commissioner Caroline Crenshaw of the U.S. Securities and Exchange Commission (SEC) told senators on Thursday that rampant fraud in crypto markets left her unwilling to approve bitcoin exchange traded products earlier this year. In a nomination hearing before the Senate Banking Committee, Crenshaw and others seeking Senate confirmations defended their records. Crypto issues received only minimal attention, including in the questioning of Crenshaw as she seeks another SEC term. In January, after the SEC lost a court battle with Grayscale and reversed its position on bitcoin spot exchange traded funds (ETFs), Crenshaw maintained her opposition to those trading products, which she pointed out aren't technically ETFs but are exchange traded products (ETPs) that operate under different rules. The commissioner said that the agency's approval of the bitcoin (BTC) products would "put us on a wayward path that could further sacrifice investor protection." In weighing whether it was in the public interest, she reiterated on Thursday that she felt she had to oppose it "given the significant fraud in the underlying spot markets globally, given the opacity." "I am concerned that these products will flood the markets and land squarely in the retirement accounts of U.S. households who can least afford to lose their savings to the fraud and manipulation that appears prevalent in the spot bitcoin markets and will impact the ETPs," Crenshaw had argued in January. Her agency is now in the process of similarly approving trading products for Ethereum's ether (ETH). The committee also heard testimony Thursday from Christy Goldsmith Romero, the member of the Commodity Futures Trading Commission (CFTC) who President Joe Biden tapped to chair the Federal Deposit Insurance Corp.; Kristin Johnson, another CFTC commissioner, to be the Treasury Department's assistant secretary for financial institutions; and Hawaii Insurance Commissioner Gordon Ito to be a Member of the Financial Stability Oversight Council. Crenshaw has been a commissioner at the SEC since being sworn in four years ago, having been unanimously confirmed in the Senate. In that tenure, she's backed the approach to the digital assets sector led by SEC Chair Gary Gensler, who has maintained a view that crypto tokens should mostly be approached as securities that must be registered with the agency. This round of four nominations for financial regulatory positions is especially significant for the CFTC, which would lose two Democratic members if their appointments are confirmed. It's uncertain how effective that agency – key to digital assets oversight and enforcement – will be if it loses two of its five commissioners and leaves Chair Rostin Behnam as the only Democrat appointee. The nomination process for financial watchdogs requires approval initially in this committee, then a vote by the entire Senate. Thursday's hearing also briefly raised the question of the custody of digital assets at U.S. banks. Sen. Cynthia Lummis (R-Wyo.) asked Goldsmith Romero about her view on banks handling customers' cryptocurrency and doing other business with digital assets firms. "I don't think it's the FDIC's role to tell banks what industries or companies banks should be providing services to," the commissioner responded. Read More: Bitcoin ETFs Win SEC Approval, Bringing Easier Access to Biggest Cryptocurrency https://www.coindesk.com/policy/2024/07/11/sec-commissioner-grilled-on-bitcoin-etfs-as-senators-weigh-us-regulator-nominees/

2024-07-11 16:46

A continuing series of record highs for the S&P 500 and Nasdaq over the past weeks has done nothing to prop up sliding crypto prices, but Thursday saw both asset classes tumbling together. While bitcoin (BTC) has struggled mightily over the past months, with its price falling more than 20% since hitting a record high in mid-March, U.S. stocks – as represented by the Nasdaq Composite and the S&P 500 – have seemingly been on a one-way path higher. Both of those equity averages closed in the green for the seventh consecutive day on Wednesday, with both hitting all-time highs. For the S&P 500, it was its 37th record close of 2024 and for the Nasdaq, its 27th, according to MarketWatch. A report yesterday in The Block noted that bitcoin's correlations with those gauges had fallen to multi-month lows – to minus 0.84 with the Nasdaq and minus 0.82 with the S&P 500. (A reading of minus 1 would mean they're moving essentially the same amount but in opposite directions.) That's not the case today. They're all moving in lockstep. But unfortunately for the bulls, it's as stocks have turned sharply lower. At midday New York time, the Nasdaq is lower by 1.8% and the S&P 500 by 0.9%. Bitcoin, which earlier in the session climbed above $59,000 on welcome U.S. inflation news, is now lower by 0.6% to $57,500. The broader CoinDesk 20 Index is down 0.4%. There could be further downside for cryptocurrencies if the equity market's bad day turns into a broader correction, Joel Kruger, market strategist at the LMAX Group, said in a morning update. "Right now, the biggest risk we see to crypto assets is the risk that highly overbought U.S. equities could be on the verge of rolling over," Kruger said. "The correlation isn’t absolute by any means, but there is evidence that would suggest a sharp pullback in stocks could weigh on crypto, at least for a moment." https://www.coindesk.com/markets/2024/07/11/crypto-bulls-frustrated-as-bitcoin-and-stocks-recouple-to-the-downside/

2024-07-11 16:00

The app is available on both desktops and mobile devices. Coinbase is launching an app that lets users track all of their on-chain wallets. This is in a continued effort to make access and user experience easier for newcomers to the space. The crypto exchange has previously said it plans to turn into a "super app". Jumping in on a continued effort by wallet makers to simplify access and user experience, particularly for newcomers, Coinbase (COIN) is introducing an app that lets users manage all of their on-chain wallets and activities in one place, the company announced Thursday. The app will allow users to connect multiple wallets and let them buy, swap, send, stake or mint coins from their wallets. Adopters of the app will also be able to interact with each other. “Today, many people use manual spreadsheets and need to open multiple browser tabs to track their assets holistically,” Coinbase said in a statement. “Many people also manage several crypto wallets, and until now, achieving a comprehensive view of all their assets in one place has been a challenge.” The app will be available on both desktops and mobile devices and will also work with smart wallets. Other wallet providers, such as Exodus, have previously launched similar products as the industry tries to welcome less tech-savvy investors to the space. Cold or decentralized wallets, for instance, can be difficult to navigate at times. For Coinbase, the new app is another step towards the company's long-term goal of becoming a “super app,” similar to China's popular WeChat. If that continues to be the end goal for the exchange, broadening access to a wider audience is crucial. https://www.coindesk.com/business/2024/07/11/coinbase-unveils-web-app-to-track-personal-onchain-wallets/

2024-07-11 15:51

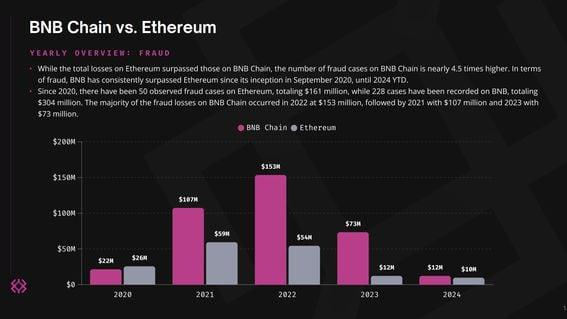

The blockchain remains the primary target for bad actors performing rug pulls. As much as $1.64 billion has been lost to hacks and rug pulls since BNB Chain's inception in 2017. Some $368 million has been attributed to rug pulls, making it the primary target for launching nefarious tokens. There was a reduction in losses in 2023 and 2024 following a series of hard forks to address the network's vulnerabilities. BNB Chain retains the dubious honor of "preferred target for rugpulls," according to a report by bug bounty platform Immunefi. Some $1.64 billion has been lost to hacks and rug pulls on BNB Chain since its inception seven years ago, Immunefi said. Of that, $1.27 billion has been attributed to hacks, with the remainder linked to rug pulls. A rug pull is a type of fraud that involves creating a project with the sole purpose of stealing deposited funds and abandoning the project. In total, the report assesses 228 rug pull cases that account for $368 million, the largest of which was the $40 million DeFiAI rug pull in November 2022. In contrast, Ethereum, the second-largest blockchain and the largest smart-contract platform, has racked up losses of $3.6 billion, but just 4.4% of that is due to rug pulls, the report said. The primary reason BNB Chain is the most common blockchain for rug pulls – a title it's held for more than a year – is developers using forked code, Immunefi said. It also claimed that the BNB Chain community is often lured in by "quick ways to make money." Still, losses dropped last year following the ZhangHeng, Plato and Hertz hard forks, which were aimed at addressing network vulnerabilities. This year saw a further reduction, with just $38 million being lost year-to-date. The blockchain has also suffered numerous exploits and hacks, with $200 million being lost to price manipulation of the Venus Protocol's native token in 2021, and, in 2022, DeFi protocol Qubit Finance suffered an $80 million loss after the QBridge was hacked. BNB Chain had not replied to an email seeking comment by publication time. https://www.coindesk.com/business/2024/07/11/hacks-rug-pulls-cost-bnb-chain-16b-since-inception-immunefi/