2024-07-11 06:18

Jump Trading's Tai Mo Shan subsidiary is seeking nearly $264 million in damages over a failed delivery of SRM tokens – more than the protocol's current market cap. Jump Trading's Tai Mo Shan says the FTX estate owes it $264 million over a loan involving 800 million SRM that Alameda never delivered. Lawyers for the estate say this claim is invalid because the loan was never initiated. The FTX bankruptcy estate is pushing back against a claim by Jump Trading's subsidiary Tai Ho Shan, which asserts that Alameda didn't deliver 800 million Serum (SRM) tokens and wants $264 million in damages, but Alameda says that the claim is invalid because the loan never commenced. SRM was the native token of the decentralized exchange (DEX) Serum. Jump Trading announced in the fall of 2020 that it had made a significant investment in Serum and would provide market making services. The DEX collapsed after FTX went bankrupt in November 2022, and at the time, insiders told CoinDesk that the exchange was decentralized in name only as orders came from FTX. Market data shows that the 800 million SRM tokens would account for approximately 80% of the roughly 1 billion SRM in existence and more than the 372.7 million current circulating supply. The token was scheduled to have a max supply of over 10.1 billion tokens, but this was cut short due to its demise in 2022. In court documents, Jump Trading argued that the FTX-Alameda estate owes it more than $264 million in damages based on an options model. The options model uses the market price of SRM on the bankruptcy filing date, the repayment option price, SRM's implied volatility, and the interest rate on the loan, among other factors. In its heyday, SRM was once one of the shining stars in the constellation of coins backed by Sam Bankman-Fried's former FTX-Alameda, and partners. SRM peaked at just over $12.50 in September 2021, with $1.2 billion in trading volume, according to CoinDesk Indices data. Its nearly unprecedented surge in 2021 minted millionaires at the exchange, which eventually annoyed Bankman-Fried, according to the book Going Infinite, because he feared these newly wealthy employees weren't interested in long hours. Now, market data shows that SRM is worth approximately 3 cents. In court documents, the FTX-Alameda bankruptcy estate argued that the loan agreement was never fulfilled because Alameda did not deliver the SRM tokens as specified. "It is undisputed that Alameda failed to deliver the cryptocurrency contemplated by the Loan Confirmation to the Master Loan Agreement. The loan therefore did not commence," lawyers for the FTX-Alameda estate wrote. "The Master Loan Agreement gives Tai Mo Shan one remedy when a loan does not commence: voiding the applicable Loan Confirmation." The estate challenged the valuation amount presented by Jump, arguing that Tai Mo Shan's damages calculation is "wholly unsupportable" and based on a flawed "options model" though it did not provide an explanation or documentation to support this. Lawyers for FTX estate also alleged that Tai Mo Shan might have engaged in fraudulent transfers. "For the reasons stated here and more following discovery, Tai Mo Shan may be liable to the Debtors for fraudulent transfers," court filings read. "The debtors submit that Tai Mo Shan may have been the recipient of certain constructively fraudulent transfers...including the purported loan at issue here." The lawyers also argue that the Master Loan Agreement and Loan Confirmation provide that Tai Mo Shan would receive 800 million SRM tokens for no fee and no interest, which is questionable. "There are no contract provisions specifying any amount of collateral or consideration given by Tai Mo Shan in return for the alleged loan," they write. https://www.coindesk.com/policy/2024/07/11/jump-trading-drags-ftx-estate-to-court-over-264m-serum-token-loan/

2024-07-10 23:29

The former president will give a 30-minute speech at 2 p.m. CT The presumptive Republican U.S. presidential nominee will be speaking at the upcoming Bitcoin conference in Nashville, Tennessee, later this month, the conference organizer announced Wednesday. Earlier in the day, speculation of a Trump appearance increased as speakers told CoinDesk their slot was reassigned to make room for what an email described as “a very special guest.” Former President Trump will be speaking at 2 p.m. CT for 30 minutes on the last day of the conference, which runs from July 25-27, a spokesman for the conference told CoinDesk. Trump has learned into Bitcoin and crypto rhetoric since coming out in favor of the industry at his NFT gala this spring. He’s since baked pro-Bitcoin policies into the core Republican Party platform, casting a strong contrast with the Biden administration. Trump’s upcoming speech is likely to further burnish a self-assigned image of crypto booster, despite previous misgivings of the tech during his first administration. His attendance at the annual Bitcoin gathering was widely expected. https://www.coindesk.com/policy/2024/07/10/tumps-odds-of-nashville-conference-appearance-rise-after-speakers-told-of-very-special-guest/

2024-07-10 22:24

Four BitMEX executives have previously pleaded guilty to the same charge. BitMEX has pleaded guilty to violating the Bank Secrecy Act (BSA), according to a Wednesday announcement from the U.S. Department of Justice (DOJ). According to newly published court documents, the Seychelles-based crypto exchange willfully failed to set up an adequate know-your-customer (KYC) and anti-money laundering (AML) program at the exchange between September 2015 and September 2020, when the Commodity Futures Trading Commission (CFTC) charged the exchange with offering illicit crypto derivative trading services to U.S. customers and the DOJ charged four of the exchange’s employees with violating the BSA. Until September 2020, BitMEX allowed customers to register and trade cryptocurrency basically anonymously, without providing any identifying information or documentation, and advertised itself as a place where retail customers could trade without real-name verification, the DOJ alleged. Because of the lax AML/KYC standards, prosecutors say, BitMEX became a destination for money laundering and sanctions violations. “As BitMEX’s founders and long-time employee admitted in federal court in 2022, the company, one of the leading cryptocurrency derivatives platforms in the world from 2015 to 2020, operated in the United States without any meaningful anti-money laundering program, as required by federal law,” said U.S. Attorney Damian Williams in a DOJ press release. “As a result, BitMEX opened itself up as a vehicle for large-scale money laundering and sanctions evasion schemes, posing a serious threat to the integrity of the financial system. Today’s guilty plea indicates again the need for cryptocurrency companies to comply with U.S. law if they take advantage of the U.S. market.” The 2020 charges against BitMEX’s three co-founders Arthur Hayes, Samuel Reed and Benjamin Delo – and its first employee, Gregory Dwyer – are nearly identical to the charge BitMEX pleaded guilty to, and concern the company’s actions over the same time period. The executives all previously pleaded guilty as well. However, BitMEX also pleaded guilty to lying to a foreign bank as part of its violation of the BSA. According to the court documents, the company and its executives made false statements to an unnamed international bank to convince the bank to open a bank account for a shell company called Shine Effort Inc. Limited, ultimately controlled by Delo, for which BitMEX was the beneficial owner. A DOJ spokesperson declined to comment on why the charges against BitMEX as a company were filed four years after the same charges were filed against four of its executives. BitMEX has not yet been sentenced. The case is being overseen by U.S. District Judge John G. Koeltl of the Southern District of New York (SDNY). A representative for BitMEX did not respond to CoinDesk’s request for comment. https://www.coindesk.com/policy/2024/07/10/crypto-exchange-bitmex-pleads-guilty-to-violating-the-bank-secrecy-act-from-2015-to-2020/

2024-07-10 20:27

The DOE dropped an earlier attempt to compel commercial crypto mining outfits to cooperate with an “emergency” energy-usage survey. After the U.S. Department of Energy’s (DOE) first attempt to survey crypto mining companies about their energy usage was kneecapped by a lawsuit, the department is getting ready to try again – but this time, it’s seeking input from crypto industry participants first. The Energy Information Administration (EIA), a federal agency within the DOE that oversees energy statistics and analysis, hosted a public webinar on Wednesday to hear comments from interested members of the public – including crypto miners and industry participants – about how such a survey should be crafted ahead of a planned rulemaking proposal to be published in the Federal Register. In January, the agency floated a mandatory survey for nearly 500 “identified” commercial crypto miners, requiring them to respond with detailed data about their energy use or else risk civil and criminal penalties. The survey was authorized by the Office of Management and Budget (OMB), which oversees federal agencies and administers the federal budget, as an emergency collection of data request, meaning it did not go through the normal notice and comment process. The proposal was immediately met with outrage from crypto miners, including Marty Bent, director at bitcoin mining firm Cathedra Bitcoin, who called the mandatory survey “Orwellian” in a blog post and expressed concern that it could be used to create a “hyper-detailed registry of mining operations” in the U.S. The following month, the Texas Blockchain Council (TBC), an industry group, and mining company Riot Platforms filed suit against the DOE, EIA, OMB and various officials, accusing them of violating the Administrative Procedure Act (APA) and calling for a temporary restraining order and injunction to suspend the survey until proper a notice and comment process had been observed. The EIA ultimately agreed to temporarily suspend their survey in February – now, they’re taking another stab at it. Take two More than 100 attendees joined the EIA’s 45-minute webinar on Wednesday, and 10 people – including crypto miners, industry participants, researchers and one member of the public – spoke. Bitcoin researcher Margot Paez, a PhD candidate at the Georgia Institute of Technology and sustainability consultant at the Bitcoin Policy Institute, agreed that a survey needed to be conducted, but said the industry was “wary” of the EIA’s motives and suggested that an outside institution be selected to run the survey. Lee Bratcher, president and founder of the Texas Blockchain Council, suggested that the EIA also include traditional data centers in its survey, and not just limit the request for information to crypto-focused data centers. The suggestion was seconded by Jayson Browner, senior vice president of government affairs at Marathon Digital Holdings, who said the industry would be “skeptical” of the survey if traditional data centers were cut out of the request. “At this point we’re considering everything,” said Stephen Harvey, an official with the EIA, adding that including traditional data centers in the survey was “clearly on the table.” Harvey said that the EIA is currently in the process of developing a preliminary proposal which is expected to be published in the Federal Register sometime this quarter. It will then go through a 60-day comment period during which the industry can respond to the proposal. “At the end of that 60 days we will take all the information in as well, and we’ll look at that and make any adjustments based on new information that we think are necessary. We will respond to major issues that get raised in that process, and file a new posting for the federal registry,” Harvey said. Following that, there will be a 30-day review process, Harvey explained, after which the decision on whether the EIA can move forward with its survey rests in the hands of the OMB. https://www.coindesk.com/policy/2024/07/10/as-doe-preps-for-take-two-of-controversial-crypto-mining-survey-industry-weighs-in/

2024-07-10 20:01

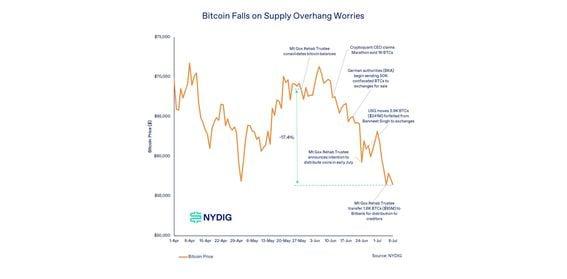

Recent blockchain movements sparked "irrational" fears, offering a buying opportunity for investors, NYDIG's Greg Cipolaro said. Bitcoin (BTC) has plunged 15% over the past month, with many market observers placing the blame on selling pressure from bitcoin mining operators, Mt. Gox refunds and, most recently, the German state of Saxony. The case for the above catalysts as behind the major price decline has been overstated, said Greg Cipolaro, research head at NYDIG, in a Wednesday note. "While emotions and psychology may rule over the short-term, our analysis suggests that the price impact from potential selling may be overblown," he wrote. "We aren’t oblivious to the fact that other factors may be at play here, but it is reasonable to think that the rational investor may find this an interesting opportunity created by irrational fears," he added. Over the past weeks, investors have been fixated on transfers related to Bitcoin addresses linked to the estate of defunct exchange Mt. Gox, the U.S. government and the German state of Saxony, sparking fears about imminent sales of the over $20 billion worth of stash these three entities held combined. Even if all three were selling all their assets – roughly 375,000BTC as of June 9 – at once, Cipolaro found that BTC's price decline over the past weeks was deeper than it would have been for stocks based on Bloomberg's transaction cost analysis (TCA) – a well-followed indicator long used in traditional markets for estimating the price impact of block sales of common stocks. Cipolaro also argued that recent reports about miners capitulating and selling their BTC stash en masse after this year's halving event has not just been overstated, but in some cases wholly inaccurate. NYDIG's data showed that publicly listed mining companies actually increased their bitcoin holdings in June. And while the amount of BTC sold picked up slightly last month, it was still well below levels seen earlier this year and last year. Cipolaro advised against relying on blockchain data about miners moving assets without knowing the nature of those transactions. "Identifying that bitcoins move to an exchange or OTC desk, even if done correctly, only tells us that coins moved. That’s it," he argued. "They could’ve been posted as collateral or lent out, not necessarily sold." https://www.coindesk.com/markets/2024/07/10/bitcoin-price-decline-on-germany-mt-gox-and-miner-sell-pressure-may-be-overblown-nydig/

2024-07-10 14:27

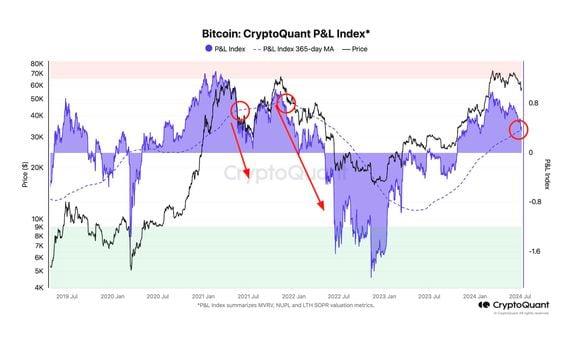

Several factors point towards continued downside, but bitcoin whales continue to accumulate at the fastest rate in more than a year. The Bitcoin profit and loss index is hovering around its 365-day moving average; previous crossovers to the downside have led to major market corrections. Tether's market cap growth, often considered a key driver of bull markets, has stalled. Large BTC holders, however, increased their stash by 6.3% over the month, the highest since April 2023. Bitcoin (BTC) is it a crucial stage of this market cycle as several factors signal continued downside while others indicate that prices are set to bottom out. Currently trading at $57,700 having bounced from last week's low of $53,600, bitcoin remains in a technical downtrend from March's record high of $73,800, having made consecutive lower highs at $71,300 and $63,900. Data from CryptoQuant suggests that a major correction or the onset of a sustained bear market could be on the horizon as the profit and loss index is hovering around its 365-day moving average. Previous crossovers to the downside acted as a precursor to deep declines begun in both May and November 2021. CryptoQuant's bitcoin bull-bear market cycle indicator is also approaching a key level that suggests descent into a bear market. A lack of growth in tether's (USDT) market cap also shows that a rally might be hard to come by as historical recoveries can be attributed to a rise in stablecoin liquidity, CryptoQuant added. However, bitcoin whales have been increasing their stash during the recent downswing, with large holders boosting their stack by 6.3% over the past month, the fastest pace since April 2023. Germany's aggressive selling of seized BTC also appears to be coming to a close as it has nearly emptied its wallet after seizing 50,000 BTC from from Movie2k in January. Several other bullish factors such as an ether ETF being approved in the U.S. and the continued growth of U.S. stock indices, which bitcoin has historically correlated with, signal that 2024 will experience continued upside despite signs of short-term exhaustion. https://www.coindesk.com/markets/2024/07/10/bitcoin-at-pivotal-point-as-bear-market-beckons-onchain-data/