2024-07-10 07:40

Funding rates in perpetual futures tied to TIA are most negative since January, indicating a bias for shorts or bearish bets. TIA surges 25% in one week, hinting at a positive turnaround following a five-month downtrend. Traders continue to short TIA perpetual futures, negative funding rates suggest. TIA's rally may have legs, according to one observer. Data availability blockchain network Celestia's native cryptocurrency TIA has jumped 25% to $7.30 this week, registering the best performance among the top 100 digital assets by market value. Traders seem skeptical about the ongoing price surge and are taking bearish bets by shorting perpetual futures tied to the cryptocurrency, according to funding rates tracked by CoinGlass. Average funding rates across exchanges flipped negative over the weekend and have dropped to -0.1231% since then, reaching levels last seen in January. In other words, bias for bearish bets is most pronounced in six months. Calculated and collected from traders every eight hours, funding rates represent the cost of holding bullish or bearish bets. A negative rate implies that traders with short positions, betting on a price drop, are paying a funding fee to longs. It occurs when there is a high demand for short positions relative to long positions. The bias for shorts amid a price rally looks like a classic case of recency bias, whereby trades are placing more weight on the TIA's price crash in recent months than other vital developments. TIA's latest bounce comes after a five-month downtrend that saw prices slide 80% from $21 to less than $5. As such, it's not particularly surprising to see traders sell the bounce. However, traders could be overlooking modular blockchain Celestia's role as a data availability layer for layer 2 networks like the booming permissionless liquidity layer for Web3 trading, Orderly Network, which means the price bounce could be sustainable. "The need for a data availability layer here makes sense after realizing that safe/permissionless liquidity is by far one of the biggest hurdles in making onchain perps markets usable. So having a middle layer that can provide shared liquidity to any exchange seems like an obvious solution moving forward," psuedonymous analyst DeFi^2 explained on X. "As an actual core piece of infrastructure for cases like this, Celestia has a lot of the right factors coming together this week for a strong market bottom to be put in, including the Modular Summit taking place this week with Celestia at the center of it," DeFi^2 added. Celestia, a modular blockchain, separates consensus from execution, boosting scalability. It acts like a storage system for data used by rollups and layer 2 networks, helping them become faster and handle more transactions. Orderly Network, a permissionless liquidity layer and infrastructure provider for Web3 trading built on top of the Near blockchain, uses Celestia for data availability. On July 5, Orderly Network's cumulative trading volume reached a record $6.2 billion, with cumulative net fees exceeding $6.6 million while accounting for 40% of the total data posted on the Celestia network, the network told CoinDesk in an email. Besides, the bias for short positions could catalyze further price rise. The funding fee that traders holding shorts are currently paying will become a burden if prices remain resilient, eventually forcing them to square off their bearish bets. That, in turn, could bump up prices in what is a known as a short squeeze rally. https://www.coindesk.com/markets/2024/07/10/celestias-tia-token-surges-25-leaves-crypto-traders-in-disbelief/

2024-07-09 21:28

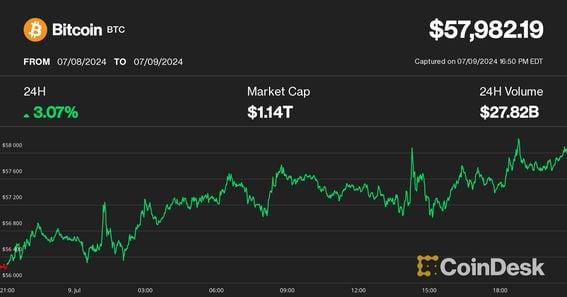

The market will have to absorb $4 billion to $7 billion of bitcoin selling pressure throughout the middle of the year, which will weigh on prices, K33 Research said. Cryptocurrencies rebounded on Tuesday with bitcoin (BTC) climbing nearly 3% to around $58,000 as fears after last week's breakdown allayed. The recovery was broad-based, with the market benchmark CoinDesk 20 Index up 2.4% over the past 24 hours, led by gains by solana (SOL), filecoin (FIL) and native tokens of Avalanche (AVAX) and Internet Computer Protocol (ICP). The grind higher could last a while with BTC potentially reaching $60,000, but the rally will be short-lived, said Markus Thielen, founder of 10x Research. "The $55,000-$56,000 range is forming a base from a technical analysis perspective. However, given the medium-term technical damage, we anticipate no more than a short-term tactical bullish countertrend rally," Thielen said in a Tuesday market update. "We anticipate Bitcoin could rally back to nearly $60,000 before experiencing another decline to the low $50,000 range, creating a complex trading environment," he added. Seasonal trends are not helping bitcoin either, with the third quarter historically offering the weakest returns, Vetle Lunde, senior analyst at K33 Research, noted Tuesday. Weak seasonality coincides with the German state of Saxony selling seized assets and the ongoing distribution of Mt. Gox refunds weighing on prices, he added. According to K33 Research's estimates, the market will have to absorb 75,000 to 118,000 BTC of selling from Saxony and Mt. Gox customers throughout the summer, worth $4.3 billion to $6.8 billion at current prices. "We expect these flows to burden performance in the months to come and the choppy market conditions to last until October," Lunde said. https://www.coindesk.com/markets/2024/07/09/bitcoin-rebounds-toward-60k-but-choppiness-likely-to-persist-analysts/

2024-07-09 18:58

Since confiscating nearly $3 billion worth of bitcoin in January, Germany's state of Saxony has sold over half of its initial holdings, causing distress in the market. It's not the country of Germany that's been selling millions of dollars worth of bitcoin, but a small German state called Saxony. The state confiscated almost 50,000 BTC in January and has been selling its holdings as per standard practice for assets seized during criminal investigations, an expert said. For days, news outlets worldwide have reported on Germany's sale of hundreds of millions of dollars worth of bitcoin (BTC) and the ensuing distress in markets and major sell-offs in crypto prices. First, it's not Germany itself that is selling the cryptocurrency. It is a small state in the eastern part of the country called Saxony. Second, though crypto fans have roasted the decision to dump so much of their beloved bitcoin, Saxony doesn't have a choice. Earlier this year, the state's Criminal Police Office (known by its German acronym LKA) seized 49,857 bitcoin (worth almost $3 billion at current prices) from the operator of Movie2k.to, a website Saxony found guilty of money laundering and other illegal activities. About a week ago, a crypto wallet that belongs to the German Federal Criminal Police Office, or BKA, started moving thousands of BTC to exchanges including Kraken, Coinbase and Bitstamp, signaling an intent to sell them. The wallet's bitcoin holdings have dwindled to 23,788. Reactions on social media have been harsh. "Germany selling all their #Bitcoin will go down as one of the most retarded things their politicians ever did," one X user wrote. "Germany's govt officials are literal idiots," another said. But what's happening in Germany isn't a bad investment strategy – it is merely standard procedure that applies to assets confiscated in criminal investigations, an expert said. "The general prosecutor's office of Saxony is responsible for liquidating confiscated assets, and the sell-off is hardly surprising," said Dr. Lennart Ante, co-founder and CEO of German-based Blockchain Research Lab. "Seized assets are always liquidated within a certain period. This is a routine business process, although at a larger-than-normal scale." The reason why the wallet belongs to the country's BKA – not Saxony itself – is probably because the police agency was involved in the initial investigation and had the technical know-how to handle such a large amount of bitcoin, he speculated. However, BKA does not have decision-making power and solely acts on instructions from the state. In most cases, confiscated assets can only be transferred or sold with the proceeds going to the state budget once a judge rules that the state is allowed to do so, which isn't the case in this particular situation. However, states can request to initiate an emergency sale, which could be issued if the asset's value might quickly lose value or is difficult to store, for example, Ante explained. "In the case of bitcoin, this could at least be argued on the grounds of volatility," he said. There is evidence, however, that Saxony is trying to sell too much bitcoin at once. On Tuesday, it received $200 million back from some of the exchanges, indicating that there wasn't enough demand to buy such a huge sum. https://www.coindesk.com/news-analysis/2024/07/09/its-not-germany-thats-selling-bitcoin-its-one-of-its-states-and-it-has-no-choice/

2024-07-09 18:05

There are several ways to front-run a pending bitcoin transaction. One in particular could lead to private mempools, and thus centralization of authority on the blockchain. Arbitrage opportunities exist in traditional finance and in crypto, but in the latter they are more pronounced due to the visibility of pending transactions and slow settlement times. Although less prominent than on Ethereum, MEV on Bitcoin is emerging through practices like "sniping" Ordinal inscriptions, mining empty blocks, and miner cartelization. MEV emerging on Bitcoin could lead to pressure from the market for mempools to “go private” which would undermine the cryptocurrency's founding tenets. One of the supposed “killer apps” for cryptocurrencies and blockchains is the ability to trade all kinds of assets (if you can call them that) without a centralized financial intermediary. Never mind that the majority of these assets do nothing or purportedly do something by doing nothing at all. People have made immense returns trading them. Like the time in 2020 when everyone got rich off of SHIB and then again in 2023 trading WIF and trading PEPE. When the early capital piled into these tokens, they were first purchased on decentralized exchanges with Automated Market Makers (AMM) well before they were available on centralized crypto exchanges. AMMs are decentralized applications which match buyers and sellers of crypto tokens without all the data sharing rigmarole associated with a regulated exchange. No passport pictures or snaps of your driver’s license or treble selfies or need to wait for anything or anyone in particular. All you have to do is connect your crypto wallet, tell the AMM you want to buy a certain amount of a certain asset, click buy, and you’re on your way. What’s immediately interesting about these AMMs (aside from the convenience and privacy of avoiding identity checks) is that while crypto opinion leaders promote crypto and blockchains as the “next iteration” of the stock market (imagine the stock market, but it never closes… and if you make a mistake there is no recourse … which isn’t great unless you somehow profit off of a mistake or glitch, like say if you were on the right side of the trade when Berkshire Hathaway stock appeared to trade at around $180 instead of around $600,000), in a way equities markets are more real-time than AMMs are. Crude example: Person A wants to buy Stock XYZ at $100 and Person B is selling Stock XYZ at $99. Because today’s financial markets are so hyperconnected, Person C somehow knows this (there are legal and illegal ways to find and act on this information) and buys Stock XYZ from Person B for $99 and instantly sells it to Person A for $100. Everyone is happy: Person A gets Stock XYZ, Person B gets $99, and Person C gets $1 arbitraging the trade. That money making trade is now over, done and dusted, and with it gone and gobbled up by the arbitrageur Person C is the inefficiency in the market for Stock XYZ (the $1 difference between Person A’s buying price and Person B’s selling price). And this all happened in real time, by which we mean linearly, Person C had to get in between Person A and B at exactly the right time to execute that trade and it had to happen in that order (A to C to B). We can, of course, see the same type of arbitrage with AMMs, albeit in a slightly different form. Suppose you heard about SHIB early and you wanted to buy some before it was available on a centralized exchange. Because it’s not on an exchange you called on an Ethereum-based AMM (SHIB was created on Ethereum as an ERC-20 token), and you clicked the buttons to make your purchase of SHIB tokens. When you make that order, it gets thrown into a big batch of proposed Ethereum transactions. Some of those transactions could be people buying stuff online with USDC, but many of them are trades for tokens like SHIB or WIF or PEPE. All these transactions are viewable by everyone before they’re finalized and carried out because they hang out in a digital waiting room called the mempool. If the AMM you used for your trade mispriced SHIB because of a market inefficiency (like in our Stock XYZ example) someone on the network could construct an Ethereum transaction that purchases the SHIB before you using a different AMM to then sell it to you for a profit (because, remember, these transactions are viewable before they’re finalized). To take this example even further, let’s assume your purchase of SHIB is rather large. In this situation everyone can see your very large, market-moving transaction is pending and can place trades around yours to take advantage of both market inefficiencies and the market-moving nature of your order. Trades like this can be grouped together under the rubric of sandwich trades. Some opt for the term sandwich attacks because the AMM is not matching the buyer to the intended seller or sellers and because it could lead to the original buyer losing out in a big way before their trade even goes through (imagine if you wanted to buy 1 billion SHIB tokens and you only got 800 million because of an AMM inefficiency getting sandwich-traded). Sandwich trades and other types of “inefficiency finding” are more broadly called Maximal (or Miner) Extractable Value. (Miners don’t exist in Ethereum anymore, hence the rebrand). This is what crypto technobabblers mean when they use the initialism MEV in conversation as if that’s common parlance (a la high finance’s EV or IRR). All MEV means is that in crypto those who verify transactions choose to order them in a way which is most profitable for themselves rather than for the transactors. Because block times (the time it takes for transactions to be verified) are not real time (in Ethereum transactions are verified every 12 seconds or so), there’s plenty of real-world time to make arbitrage trades. Especially if you are a bot instead of an actual human. With this in mind, it shouldn’t take much to imagine that MEV has expanded beyond AMMs. A fair conclusion to the preceding technobabble is this: The more complicated the thing you’re trying to do is, the more likely MEV will occur (just like in regular ol’ finance). MEV: Merits, drawbacks, and its tenuous existence on Bitcoin The discussion around MEV is expansive. Is it good? Is it bad? Is it illegal? Depends whom you ask. On the plus side, MEV is the free market figuring out the actual costs of things on blockchains by snuffing out inefficiencies which will be taken advantage of until the inefficiency approaches zero. On the minus side, MEV makes it possible for unknowing laypeople and newer users to get absolutely demolished by the experts and the power users (sound familiar?). So far, we’ve only mentioned Ethereum because, for all its first mover advantage, MEV has historically not existed on Bitcoin. It existed in theory, but in practice it’s not economically viable (except in very specific situations). You’re probably wondering: “No MEV? If there’s MEV for Ethereum-based AMMs then surely there’s one for the Bitcoin-based AMMs?” And you’d be right except that there aren’t any (meaningfully sized) Bitcoin-based AMMs. That’s because Ethereum is more expressive than Bitcoin, meaning you can “do more stuff with it,” like create coins with dog mascots or other memes to trade on AMMs and become rich. And because Bitcoin isn’t as expressive, there isn’t a thriving market or AMM for new tokens on Bitcoin. And without new, fresh non-bitcoin assets on Bitcoin how could an AMM-related MEV opportunity present itself? What exactly would you be doing? Trading bitcoin for other bitcoin? Well, yes. This is exactly where MEV on Bitcoin has begun to present itself. MEV on Bitcoin MEV is nowhere close to as robust on Bitcoin as it is on Ethereum and when the topic is discussed among experts it’s always larded with caveats. “It’s more like games you can play than MEV,” said Colin Harper, head of research and content at bitcoin mining firm Luxor Technology (no relation to the hotel in Vegas). Three years ago, Bitcoin went through an update called Taproot, which made the network more expressive. This expressivity also accidentally made the Bitcoin equivalent of NFTs possible through Casey Rodarmor’s Ordinals protocol. This is what I mean by “trading bitcoin for other bitcoin”: “NFTs” can work on Bitcoin because the Ordinal protocol is able to see which satoshis (the smallest unit of bitcoin, a hundred millionth) are inscribed with arbitrary data which can be a picture or text or something else. These collectibles are called inscriptions so as to not be confused with NFTs (which are separate tokens). If you were buying an inscription, instead of buying an entirely new token as you would on Ethereum, you’re just buying some bitcoin that’s only special when seen through the lens of the Ordinals protocol. This is, literally, buying bitcoin with bitcoin (buying less with more, of course). And like buying SHIB for ETH or USDC for USDT, buying bitcoin with bitcoin is an activity that can be front-run. “When you sell inscriptions on Magic Eden or another marketplace like it, you’re using a PSBT [Partially Signed Bitcoin Transaction]," Harper explained. “The seller signs their half, and when the buyer purchases it they complete the transaction with their signature and the buyer pays the fee for the transaction. So if an NFT trader sees the transaction in the mempool, they can snipe it by broadcasting their own transaction that replaces the original buyer's payment and address with their own. To do so, they broadcast an RBF [Replace-By-Fee] transaction with a higher fee to ensure that their transaction is confirmed before the original one.” Although this isn’t quite like the pure-play MEV as discussed in the first section of this article, it still looks like MEV: The intended buyer and seller weren’t matched because a third party came in and offered more compensation for miners in exchange for the inscription and miners maximized their own value in the transaction by accepting the third party transaction. Other things that feel like MEV on Bitcoin Bitcoin still has miners (read here what that means compared to Ethereum's validators) and in the business of mining there are some things happening somewhat regularly which look like MEV. One common example is the mining of empty blocks. Periodically, a bitcoin block is mined with nothing in it. The block is useless to anyone save the miner who won the block, as no transactions which are waiting to be confirmed are verified except for the coinbase (small "c," not the company) transaction which rewards the miner with the block reward. There’s a technical reason this happens, and really it’s an accident that empty blocks even occur, but it’s hard to argue that this is a) not MEV and b) good for Bitcoin (although it is also hard to argue that it’s bad). There’s also the cartelization of miners. Many bitcoin miners now use mining pools to smooth out their revenue by mining in aggregate and being paid their proportional share. This could present an issue, especially as mining pools get bigger and bigger. As Walt Smith of VC firm Cyber Fund wrote in an extensive “MEV on Bitcoin” piece: Right now, some mining pools control a massive share of total network hashrate and two or three of them could club up to control over half of the computational power. If this cartel of pools won enough blocks in a row, it could exercise its monopoly power to maximize profits. There’s one more real example of bitcoin miner behavior which might be MEV: out-of-band payments. These are instances where bitcoin miners are paid (either off-chain, or in a separate and seemingly unrelated bitcoin transfer) to accept transactions which are considered non-standard. Again, this isn’t pure-play MEV, because the extracted value does not occur on the blockchain as the result of savvy programmatic decisions. Instead, value is extracted by miners being paid more than they would have been paid otherwise to do something. Some researchers worry that out-of-band payments are the first step on a slippery slope and could obscure incentives. But miners are jumping at the opportunity. Publicly traded mining giant Marathon (NASDAQ: MARA) has launched a service called Slipstream offering to accept non-standard transactions. The concern is that this under-the-table practice could lead to private mempools, which would be troubling on any blockchain. As CoinDesk’s Sam Kessler writes: “Most pressingly, there's the worry that private mempools might cement new middlemen at key areas in Ethereum's transaction pipeline.” If private mempools become where most transactions are submitted for confirmation, that would make it so only the selected few, the somehow ordained few, can affect Bitcoin transactions. This would centralize authority on the blockchain, an obviously unsavory situation for anyone who values censorship resistance. There are other examples of MEV on Bitcoin and more will inevitably crop up. Since it’s here in some form, network participants need to pay attention. Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates. https://www.coindesk.com/opinion/2024/07/09/mev-has-spread-to-bitcoin-in-subtler-forms-than-on-ethereum/

2024-07-09 17:30

Spot ether exchange-traded funds may begin trading as soon as this Friday or in a few weeks. There's a lot of excitement over the possibility that a spot ether exchange-traded fund (ETF) may be around the corner. Here's what still needs to happen before one may launch. Following BTC The narrative The U.S. Securities and Exchange Commission (SEC) seems poised to approve spot ether exchange-traded funds (ETFs), and they could begin trading as soon as this week – though there's still a bit of work left to be done. Why it matters The crypto industry has pushed for spot ether (ETH) ETFs for years, nearly as long as it's pushed for spot bitcoin (BTC) ETFs. The SEC approved the bitcoin products in January after a decade of rejections, but did not seem ready to approve the ether counterparts until May. As with the spot bitcoin ETFs, advocates for spot ether ETFs argue they'll create a safe and regulated investment vehicle that will grant the general public exposure to the second-largest cryptocurrency by market cap without requiring them to invest in it directly. Breaking it down A handful of would-be issuers filed amended S-1 forms on Friday and Monday, suggesting progress is being made. Notably, the filings did not contain fee information, so there's likely to be at least one more round of comments from SEC staff before trading can begin. Invesco and Galaxy published a fee – 0.25% – on Tuesday. VanEck was the only would-be issuer to publish a fee prior to the latest round of updates. To be clear, there's no firm timeline for approval. Unlike the 19b-4 filings the SEC approved in may, there's no imminent final deadline the agency must meet for a final decision, and so the back-and-forth between regulators and issuers could wrap up as soon as Friday or take a few weeks still. One individual familiar with the process told CoinDesk they expected the dialogue to continue for a few weeks. The filings also do not detail expense ratios. If amended filings include those key details, that may signal they are the final set of amendments. Should the SEC provide feedback by the end of the day Tuesday, it's entirely plausible the issuers will file a final set of amended forms by Wednesday. They would have to include fee information and any other details required by the regulator. For the spot bitcoin ETFs, it took the SEC two days to send out the final approvals after issuers had submitted fees. If that holds this time round, provided issuers submit their fees by Wednesday, it is possible that an approval could be in by Friday. The products could begin trading relatively quickly afterward. Hours before the spot bitcoin ETFs were approved by the SEC in January, one of the listing exchanges, Cboe, added the funds to its “New Listings” page, saying that was “standard procedure” before the approval of a new ETF. If so, given that five of the potential ether ETFs will be listed on Cboe, we may well see a similar situation happening on the day that these ETFs receive approval. Stories you may have missed Former FTX Execs Nishad Singh, Gary Wang to Be Sentenced Later This Year: Nishad Singh will be sentenced on Oct. 30, and Gary Wang on Nov. 20. Both pleaded guilty to criminal charges after FTX's collapse, and both testified against former FTX CEO Sam Bankman-Fried. Trump's Official Republican Platform Pledges to Halt Crypto 'Crackdown': The Republican Party platform officially contains crypto, after standard bearer Donald Trump and other lawmakers in the party have campaigned on crypto issues. France Votes for Hung Parliament as Major Parties Fall Short of Majority: France held its Parliamentary election over the weekend. Labour Landslide Sets Up Starmer as UK Prime Minister With Unstated Crypto Plans: The U.K. held its elections last Thursday. This week Tuesday 14:00 UTC (10:00 a.m. EDT) Federal Reserve Chairman Jerome Powell testified before the Senate Banking Committee. 18:00 UTC (2:00 p.m. EDT) Following a federal judge's ruling last week, there was a scheduling conference in the SEC's ongoing case against Binance. Wednesday 14:00 UTC (10:00 a.m. EDT) Fed Chair Powell is back, this time before the House Financial Services Committee. 14:00 UTC (10:00 a.m. EDT) The Senate Agriculture Committee is holding a hearing on digital asset regulation with CFTC Chair Rostin Behnam. 17:00 UTC (1:00 p.m. EDT) The Department of Energy's Energy Information Administration is holding a webinar on its proposal to collect information from crypto mining firms. Thursday 14:00 UTC (10:00 a.m. EDT) The Senate Banking Committee will hold its confirmation hearing for CFTC Commissioners Christy Goldsmith Romero and Kristin Johnson, who have been nominated to chair the Federal Depository Insurance Corp. and be an assistant secretary for the U.S. Treasury Department (respectively); a renewal hearing for SEC Commissioner Caroline Crenshaw to serve another term and Gordon Ito to join the Financial Stability Oversight Council. Friday 14:00 UTC (10:00 a.m. EDT) There will be a hearing in the U.S. criminal case against Roman Storm. Storm's attorneys have asked for his trial to be postponed from September 2024 to January or February 2025. Elsewhere: (Time) Time Magazine's Andrew Chow spoke to dozens of residents of Granbury, Texas, who have suffered from unusual medical conditions. A local Bitcoin mine appears to be the likely suspect – the noise from cooling fans may be causing people's bodies to exhibit stress responses (this isn't unheard of). If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Twitter @nikhileshde. You can also join the group conversation on Telegram. See ya’ll next week! https://www.coindesk.com/policy/2024/07/09/what-still-needs-to-happen-before-spot-ether-etfs-can-trade/

2024-07-09 16:34

Polychain says Niraj Pant broke the fund's policies by secretly accepting "adviser" tokens from Eclipse. Polychain says Niraj Pant, its former general partner, made a secret deal with portfolio company Eclipse Labs that broke the fund's policies. A CoinDesk investigation reveals former Eclipse Labs CEO Neel Somani pledged Pant a stake in Eclipse tokens worth $13.3 million. Somani pledged the tokens as an incentive for Pant to secure Polychain's funding, according to sources close to Eclipse. Polychain says Pant did not disclose the deal to the fund. It later invested in Ritual, Pant's AI startup. Pant confirms Eclipse Labs allocated him "adviser" tokens but says he didn't strike a deal with the company until after Polychain invested. The situation provides a glimpse into the shadowy dealings that have come to typify the crypto industry's fundraising scene, where venture firms cozy up to projects and invest in exchange for tokens instead of traditional equity. Crypto venture capital giant Polychain has accused Niraj Pant, a former employee, of making a backroom deal with portfolio company Eclipse Labs that broke the fund's policies. According to three sources close to the situation and internal Eclipse documents reviewed by CoinDesk, Neel Somani, the former CEO of Eclipse Labs, quietly allocated Pant 5% of a forthcoming Eclipse crypto token in September 2022 – just days after Pant directed Polychain to lead the company's $6 million pre-seed funding round. The allocation was eventually reduced to 1.33%, worth $13.3 million at the token's most recent fully diluted valuation in a private investment round. (According to a source close to Eclipse Labs, the company's latest funding round valued the token at a fully diluted value (FDV) of $1 billion.) Polychain was founded by Olaf Carlson-Wee, the first employee of crypto exchange Coinbase, and is one of the largest and best-known crypto venture firms, with more than $11 billion in assets under management. Pant was a general partner there from 2017 to 2023, tasked with steering the firm's venture money into promising crypto startups. Pant has since become a prominent figure in the crypto industry, currently serving as co-founder of the blockchain AI startup Ritual, another portfolio investment of Polychain's. Eclipse Labs builds a blockchain that mixes technology from the popular Solana and Ethereum networks. After leading Eclipse's August 2022 pre-seed funding round, Polychain went on to participate in its $50 million Series A funding round in March 2024. Pant spearheaded the pre-seed deal, and a CoinDesk investigation revealed that around that same time, he was allotted about as many Eclipse crypto tokens as Polychain itself. The deal was not, according to CoinDesk's sources, disclosed to most of Eclipse's executives, advisors or large investors. Pant insists the arrangement was completely kosher because it wasn't finalized until September 2022 – the month after Polychain had already invested in Eclipse. He shared legal documents with CoinDesk showing that his "advisory" allocation of Eclipse tokens was revised to 1.33% in 2024 but declined to comment on the size of his original stake, or why it was altered. Polychain told CoinDesk it was unaware that Pant had a financial stake in Eclipse until after he left the firm in 2023. The fund said he should have disclosed the deal under its policies, which are meant to protect the firm and its investors against conflicts of interest. "Polychain was unaware of the financial relationship between Eclipse and Niraj Pant until after his departure from the firm," a Polychain spokesperson said in an email to CoinDesk. "Polychain has robust policies and procedures surrounding employees serving in advisory roles. Following Mr. Pant’s departure from Polychain, the firm became aware that he violated its policies and investigated the matter." Polychain's statement to CoinDesk grants a rare insight into the sausage-making process of the cozy world of crypto VC firms and the projects they fund. Venture firms rarely discuss personnel matters or deal structures publicly, and Polychain did not publicly disclose Pant’s policy breach until CoinDesk reached out for this story. A murky timeline The revelation could deepen the controversial narrative surrounding Somani, who stepped aside as Eclipse's CEO in May amid allegations of sexual misconduct. Somani denied those allegations and declined to comment for this story. Two sources close to Eclipse who spoke to CoinDesk on the condition of anonymity claim Somani promised Pant his 5% advisory stake in Eclipse tokens before the pre-seed deal even closed. According to documents reviewed by CoinDesk, Pant's stake was higher than that of any Eclipse investor except Polychain, which was also slotted for 5% of Eclipse's token. Pant's stake exceeded the allocations to other advisers, investors and every Eclipse employee except for the former CEO. Somani told his inner circle that the generous token grant was meant to incentivize Pant to secure Polychain's cash and the veteran VC's coveted endorsement, according to two people familiar with the matter. According to Polychain officials, the arrangement was not disclosed to the venture capital firm or its limited partners at the time. Tokens, not equity The episode also provides a glimpse into the dealings that have come to typify the crypto industry's unique fundraising norms, with digital tokens often granted alongside any equity, or in lieu of it. Blockchain apps, digital assets and decentralized ledgers are often pitched as a more transparent alternative to traditional finance, but the ownership structures of many leading projects and cryptocurrencies remain opaque. Eclipse Labs builds a layer-2 blockchain that offers users a faster and cheaper way to transact on the Ethereum network. The network's main draw is that it borrows elements of the popular Solana blockchain to power key elements of its technical design – a detail that has helped it earn buzz across two of the largest blockchain communities. In the case of Eclipse's fundraising, the token allocations were crucial because few investors received equity in the project. Most were simply promised a cut of Eclipse's token – a cryptocurrency that doesn't exist yet and that Eclipse has not even publicly announced. This setup isn't atypical. Crypto investors frequently offer cash in exchange for tokens rather than traditional equity, and companies rarely disclose these arrangements to the public, lest they arm financial regulators with ammunition in their fight to classify cryptocurrencies as investment securities. "Eclipse Labs does not disclose investor ownership percentages to the public," a spokesperson for Eclipse Labs told CoinDesk. According to internal token allocation tables reviewed by CoinDesk, Eclipse's employees, investors and advisers have already been promised nearly 50% of the supply of a future Eclipse token. Pant insists that his own advisory agreement with Eclipse was above board. He shared legal documents with CoinDesk showing that he is set to receive a 1.33% stake in Eclipse’s token. This sum – revised from an earlier total that Pant did not disclose – is lower than the 5% that documents and people familiar with the matter reveal Pant was initially promised, but still higher than that of every other Eclipse adviser and almost all of its investors and employees. The advisory agreement shared by Pant is dated April 29, 2024 – after he left Polychain – and signed by two parties: Neel Somani, on behalf of Eclipse Labs; and Niraj Pant, on behalf of "The Psychological Operations Co." Under the agreement, Psychological Operations Co. would receive a grant of Eclipse's tokens in exchange for "periodic teleconference sync meetings" as requested by Eclipse. The agreement itself says nothing about Polychain or its pre-seed investment into Eclipse. The version of the agreement provided to CoinDesk by Pant states that it is an "amendment" to an earlier advisory agreement dated Sept. 8, 2022 – just weeks after Eclipse's pre-seed round would have closed and while he was still a general partner at Polychain. Pant declined to share that original agreement. Polychain's policies Whether or not Pant’s advisership was finalized before the pre-seed deal, if his initial advisership with Eclipse started while he was still at Polychain – as his own documents attest – then he may still have been required to disclose this under the firm’s ethics policies, which the firm described in a lengthy disclosure to the U.S. Securities and Exchange Commission. In an official policy filing with the SEC, Polychain writes: “In order to monitor any conflict of interest, Polychain employees are required to pre-clear certain contemplated transactions in their personal accounts which may present the appearance of impropriety, and must disclose on an initial and annual basis the holdings of all personal accounts, as well as all transactions on a quarterly basis.” The situation is particularly remarkable because Pant is not only an ex-employee of Polychain but also the co-founder of Ritual, one of Polychain's buzziest portfolio companies. After departing Polychain and founding Ritual last year, Pant quickly rose to become a staple of the blockchain industry's speaker circuit, looked to as a thought leader on the intersection between crypto and artificial intelligence. Ritual, which aims to decentralize the execution of AI models, is among a category of blockchain-meets-AI projects that have evolved into a venture darling in its own right. Last November, it raised $25 million from Polychain and others. Polychain declined to comment on whether its relationship with Ritual has changed as a result of Pant's supposed policy breach, or whether it learned of the breach before it invested in Ritual. Despite the alleged policy breach, Polychain's investment in Eclipse might still pay off. According to a source close to the fund, its stake in Eclipse has increased in value 10-fold since the company initially invested in 2022. If you have your own information on token allocations or VC funding that might be worthy of a separate investigation, please email Sam Kessler at [email protected]. CORRECTION (July 9, 2024, 17:33 UTC): Niraj Pant's original token allocation was larger than the current CEO of Eclipse's, according to someone familiar with the matter. CORRECTION (July 9, 2024, 18:36 UTC): Pant is Ritual's co-founder. The company does not have a CEO. https://www.coindesk.com/tech/2024/07/09/top-crypto-vc-says-ex-general-partner-made-undisclosed-side-deal-with-portfolio-company/