2024-07-08 14:03

Plus: Polymarket traders remain skeptical about Biden's insistence he's staying in the U.S. presidential race; will ETH fall to $2,630? This week in prediction markets: Nobody could predict France's electoral upset The market is skeptical that Biden is staying in Kalshi bettors put ether at $2,630 by year's end Prediction markets often outperform polls in forecasting elections – but sometimes both get it wrong. The French election was one such case. A week ago, it looked like France's right-wing National Rally party would secure a majority in the country's National Assembly. Bettors on Polymarket, the crypto-based prediction market platform that's riding high on U.S. election betting this year, were signaling a 97% chance that the National Rally would win the most seats. This was in line with polls. Neither the prediction market traders nor the polls saw a hung parliament (an inauspicious development for France's domestic crypto legislation) coming. A concentrated get-out-the-vote campaign by the French left, and the strategic use of coalition parties meant that when everything was counted, the National Rally came in third place to the Ensemble (ENS) (which supports incumbent President Emanuel Macron) and the UG Union of the Left parties. So does that mean a windfall for the Polymarket traders who bet "no" on the question of whether Marine Le Pen's party would win the most seats? Not necessarily. As often happens when there's an unexpected result, there's a dispute over how this Polymarket contract should be resolved. This dispute concerns whether coalitions like Ensemble should count as parties. If they don't, then the National Rally still technically won the most seats, despite losing the election. "The 'Liste des nuances' includes both individual parties and coalitions, which supports the interpretation that the official French election results do not strictly differentiate between the two types of entities," wrote bettor kipakipa, who had a "no" bet on the National Rally winning the most seats. "This is important for resolving the market because it suggests that official results treat coalitions as significant and comparable entities alongside individual parties." Some of the largest bettors on the No side bought in at 8 to 10 cents per share, meaning that if the contract resolves in their favor, they will be in for a large payout of $1 per share. Currently, the user known as asc has the largest bag on the no side with 24,192 shares that he or she purchased for an average of 10 cents a share. Eye on Biden "I’m the sitting President of the United States. I’m the nominee of the Democratic party. I’m staying in the race," Joe Biden's campaign posted on X on Friday, hours before ABC News broadcasted his interview with George Stephanopoulos. Markets were not convinced. The President's reelection odds remained at 11% on Polymarket after the ABC interview, CoinDesk reported over the weekend, though they ticked up slightly to 15% by Monday. Biden's chances of dropping out lingered around 65% after the broadcast, sliding to 57% by Monday – leaving a still better-than-even chance he'll throw in the towel. On Monday morning U.S. time, Biden reiterated: he's not dropping out. The President's re-election campaign took to X to post a letter he shared with Democrats that outlined his commitment to run again, and asked the party to come together to defeat Republican Donald Trump at the polls. This sent the odds of him dropping out a few percentage points lower to 50%, but his chances against Trump remained virtually unchanged. While Biden may intend to stay in, some lawmakers, and, crucially, donors, are trying to get him to reconsider. Other related contracts are giving Biden a 37% chance of being nominated before the Democratic National Convention in August, and a 53% chance that a "major candidate" announces he or she intends to challenge Biden at the convention for nomination. Both White House staffers and DNC elites are no doubt looking at Biden's approval numbers as the convention – and the formal kick-off of the campaign – gets closer. On U.S.-regulated platform Kalshi, which is not allowed to offer direct bets on races for U.S. political offices, there is a market to bet on Biden's rating on 538, a poll aggregator, by the end of the month. Currently, bettors are saying that it'll be approximately 36%, lower than former president Trump's numbers from Gallup in July 2020. Ether at $2,600? Even though ether (ETH) has been showing some strength as traders anticipate Ethereum exchange-traded funds (ETFs) possibly hitting the market in the near future, Kalshi bettors are forecasting that the cryptocurrency will test $2,600 by the end of the year and maybe even dip under $2,000. Currently ether is trading above $3,000. The crypto market has been giving mixed signals, with bitcoin seeing some of its worst performance since the height of the 2022 FTX crisis. Overall, the world's largest digital asset is down more than 17% in the last month, according to CoinDesk Indices data. Ether has largely followed bitcoin's direction, though throughout the Monday trading day in Asia it did find support as sellers hit an exhaustion point. A big question will be how much support an ETF will give ether. Bitcoin is flat since Jan. 11, the day the ETFs started trading, while ether is down 11% in the same time period. That's the kind of support roughly $14.7 billion in inflow can bring to an asset. https://www.coindesk.com/news-analysis/2024/07/08/prediction-markets-and-polls-both-got-the-french-election-wrong/

2024-07-08 13:43

Spot bitcoin ETFs saw their second worst month since launching in the U.S., with an estimated $662 million of net outflows, the report said. The total crypto market cap declined by 8% in June, the bank said, noting that March 2024 might have been the peak of the current cycle. JPMorgan noted that spot bitcoin ETFs saw their second-worst month since launch, with an estimated $662 million of net outflows. The market cap of the U.S.-listed miners grew almost 20% as the sector re-rated due to AI-related power use cases, the report said. The total cryptocurrency market cap fell by 8% in June to around $2.25 trillion, giving back most of the gains from May, JPMorgan (JPM) said in a research report on Monday. “Tokens, decentralized finance (DeFi) and non-fungible tokens (NFTs) all saw market cap contraction in June,” analyst Kenneth Worthington wrote. The move is in contrast to traditional markets as the S&P 500 index gained 4% for the month, and the technology-heavy Nasdaq climbed 6%, the bank noted. The CoinDesk 20 index {{CD20}} fell almost 20% in June. However, it's not all doom and gloom for the digital assets sector. Stablecoins outperformed the rest of the crypto ecosystem in June, and their market cap was flat to slightly higher, the report said, with the appreciation driven primarily by tether (USDT). Bitcoin miners were also an outlier. The total market cap of the publicly listed bitcoin (BTC) miners grew 19% as these companies benefited from gains due to “artificial intelligence-related power use cases.” Core Scientific (CORZ) recently inked a 12-year, 200 megawatt (MW) deal with cloud computing firm CoreWeave to provide AI-related infrastructure, which triggered a re-rating of the sector and a wave of mergers and acquisitions. The bank noted that the data suggests that daily spot crypto trading volumes fell as much as 18% versus the previous month, and “it now appears that March 2024 was the peak for the crypto ecosystem in the current cycle both from a valuation and volume perspective.” JPMorgan added that spot bitcoin ETFs saw their second worst month in terms of flows since launching, and estimates that the 10 U.S. spot ETFs saw $662 million of sales over the month. https://www.coindesk.com/business/2024/07/08/stablecoins-miners-outperform-as-18b-gets-wiped-out-from-crypto-in-june-jpmorgan/

2024-07-08 12:05

Markets have priced in Mt. Gox’s ongoing repayments and U.S. policies could now start influencing the market, one trading desk said. Bitcoin reversed a 4% loss to regain the $57,000 mark, with Ether surpassing $3,000. The market is shifting focus from Mt. Gox's repayments to U.S. Federal Reserve policies, with traders eyeing economic data releases and Fed Chair Jerome Powell's testimony later this week. Bitcoin reversed a 4% loss from the Asian trading session to regain the $57,000 mark in European morning hours Monday as some majors rose as much as 3%. Ether {{ET}} jumped back over $3,000 after losing the level on Friday, while Cardano’s (ADA) led gains with a 3.3% rise over the past 24 hours. Solana’s SOL, BNB Chain’s BNB and dogecoin (DOGE) were up at least 1%. Celestia’s TIA led gains among tokens with a market capitalization between $1 billion and $5 billion, jumping 15% ahead of its flagship Modular Summit conference scheduled for Thursday. The broad-based CoinDesk 20, an index of the largest tokens, edged higher, reversing a 7% loss from earlier in the day. Meanwhile, BTC traders are back to tracking U.S. Federal Reserve speeches and policies as the market has largely priced in the impact of defunct crypto exchange Mt. Gox’s repayments. BTC saw one of its steepest falls last week as prices fell more than 8% in the span of a few hours on Friday, falling to as low as $53,600 shortly after Mt. Gox started moving millions worth of the token to the Japan-based bitBank exchange. The exchange’s trading desk, however, told CoinDesk in a Monday email that they expect lesser market impact from Mt. Gox’s wallet movements ahead. “Bitcoin was already fluctuating around $54,000 by the time Mt.Gox’s trustee officially announced that they had commenced repayment,” Yuya Hasegawa, crypto market analyst at bitBank, said. “The price bounced back after the announcement and briefly recovered $58,000 during the weekend.” “The market had overly priced in the repayment before it actually started, and later reacted to the (U.S.) jobs report on Friday, which was announced after the beginning of Mt.Gox’s repayment," Hasegawa added. "This suggests that the market’s concern for Mt.Gox’s repayment is starting to wane and their focus is shifting back to the Fed’s policy decisions." The latest U.S. Consumer Price Index (CPI) report is scheduled for Thursday. In addition, Federal Reserve chair Jerome Powell will testify to Congress Tuesday and Wednesday, possibly providing clues as to whether the central bank intends to ease monetary policy in coming months. That aside, some market observers expect dim price action to continue, citing the summer holiday months. “It’s a case of more summer blues for investors,” shared Philippe Bekhazi, CEO and co-founder of digital asset services firm XBTO, in an email. “The bottom line is sellers are more motivated than buyers right now. Lots of people are on holiday, many small miners are shutting down and long-term holders are trimming their positions.” “However, the key thing here is that this pattern is not really any different to what we normally see following the months after a bitcoin halving event,” continued Bekhazi, referring to the seasonality commonly observed in bitcoin market cycles. https://www.coindesk.com/markets/2024/07/08/bitcoin-climbs-over-57k-with-some-saying-mt-gox-sales-already-priced-in/

2024-07-08 11:02

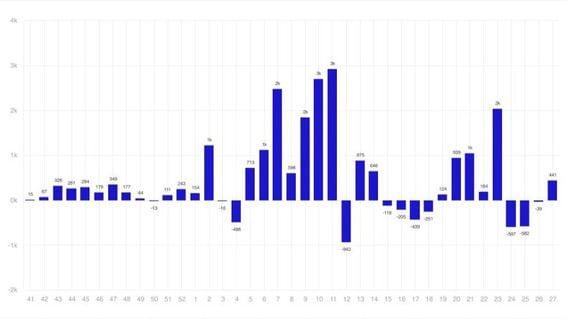

CoinShares attributes the inflows to recent price weakness prompted by defunct crypto exchange Mt. Gox initiating preparing to initiate repayments to creditors. Bitcoin accounted for $398 million of the $441 million of inflows, and CoinShares noted it is unusual for BTC to represent only 90% of the total. Investment products last registered net inflows in the week ended June 7, when investors added more $2 billion. Digital asset investment products saw $441 million of net inflows last week, breaking a three-week string of net outflows, according to CoinShares. The products last registered net inflows in the week ended June 7, when investors added more than $2 billion. Bitcoin (BTC) accounted for $398 million of inflows. CoinShares noted it is unusual for BTC to represent only 90% of the total. Solana stood out among altcoins, with SOL-linked products registering $16 million. CoinShares attributed the flows to recent price weakness prompted by defunct crypto exchange Mt. Gox preparing to initiate repayments to creditors and the German government's law-enforcement agency moving large amounts of bitcoin to exchanges. Investors likely saw this as a buying opportunity, CoinShares said. However, the sentiment was not reflected in blockchain equities, which saw $8 million in outflows to take their year-to-date total to $556 million. Read More: Bitcoin ETF Investors Bought the Dip on Friday, With Inflows Topping $140M https://www.coindesk.com/markets/2024/07/08/digital-asset-funds-flip-positive-for-first-time-in-4-weeks-coinshares/

2024-07-08 09:06

U.S.-listed mining companies produced a greater share of bitcoin in June than May as they brought on new capacity while the network hashrate dropped, the report said. Bitcoin mining was more profitable in June than May, the report said. Jefferies cut its Marathon Digital price target to $22 from $24. The bank also reduced its price target for Argo Blockchain ADRs to $1.20 from $1.50 and for the U.K.-traded stock to 9.5p from 11.9p. Bitcoin (BTC) mining was more profitable in June than May as the price of the cryptocurrency rose 2% and the network hashrate dropped by 5%, and as the market adjusted to the effects of the halving, investment bank Jefferies said in a research report on Monday. “June was a month of modest recovery from the immediate impacts of the halving that were most pronounced in May,” analyst Jonathan Petersen wrote. Hashrate refers to the total combined computational power used to mine and process transactions on a proof-of-work blockchain and is a proxy for competition in the industry and mining difficulty. The quadrennial reward halving, which occurred in April, slowed the rate of growth in bitcoin supply as miners' rewards were cut by 50%. Jefferies cut its price target for hold-rated Marathon Digital (MARA) to $22 from $24. The bank also reduced its price target on Argo Blockchain ADRs (ARBK) to $1.20 from $1.50 and on the U.K. traded shares (ARB) to 9.5p (12 cents) from 11.90p. It maintained its hold rating on the company. One ADR is equivalent to 10 shares. The bank noted that a number of bitcoin miners have pivoted towards to high-performance computing (HPC) and artificial intelligence (AI) hosting to diversify their revenue and capitalize on surging demand for AI and cloud computing infrastructure. “This strategic shift has been driven by the declining profitability of bitcoin mining, particularly after the recent halving events,” Petersen wrote. U.S.-listed mining companies produced a greater share of new bitcoin in June than May, the bank said, increasing to 20.8% of the total network versus 19.1% the month before as they brought on new capacity and the network hashrate dropped. Marathon mined the most bitcoin in June, 590, though that was 4% fewer than in May. CleanSpark (CLSK) mined 445 tokens, an increase of 7%, the report said. Marathon’s installed hashrate remained the largest of the U.S. listed miners, at 31.5 exahashes per second (EH/S) with Riot Platforms (RIOT) second with 22 EH/s, the report added. https://www.coindesk.com/business/2024/07/08/bitcoin-mining-profitability-rose-in-june-as-market-adjusted-for-the-halving-jefferies/

2024-07-08 08:09

The absence of an outright majority could hamper the passing of new legislation, including crypto regulations. The New Popular Front, a coalition of left-wing parties, won 188 seats in France's election on Sunday – the biggest winners, but not enough for a majority. President Emmanuel Macron's Ensemble won 161 seats, while Marine Le Pen's far-right National Rally secured 141. The lack of an outright majority could make forming new policy, including crypto regulations, harder, said Mark Foster, the EU policy lead at the Crypto Council for Innovation. France's general election unexpectedly saw a left-wing coalition, the New Popular Front, win the most seats on Sunday, but the group fell short of a majority in the National Assembly contest, leading to a hung parliament that could make forming any new policy, including crypto regulations, harder. The coalition won 188 seats – 289 are needed for a majority – while President Emmanuel Macron's centrist Ensemble coalition now has 161 seats. National Rally (RN), the far-right party associated with Marine Le Pen, came third with 141 seats according to Politico data. After the results came out France's Prime Minister Gabriel Attal, who is from the Renaissance party, said he would hand in his resignation to Macron but the French president asked him to stay in the role. "The President has asked Gabriel Attal to remain prime minister for the time being in order to ensure the country's stability," Macron's office said in a statement, Reuters reported. CoinDesk also reached out for comment. Politicians from several parties including Macron's Renaissance party began strategically cooperating after the first round of voting last week resulted in the right wingers securing the largest share of the vote. Third-placed candidates withdrew from the race in an attempt to prevent the anti-RN vote being split. The result is likely going to make passing legislation, including new crypto regulations, much more difficult, Mark Foster, the EU policy lead at the Crypto Council for Innovation, told CoinDesk in an earlier statement. "It looks like the new parliament will have much larger far-left and far-right contingents, making domestic policy development (including on crypto/digital assets) uncertain and difficult whilst limiting the president’s authority on international and European stages," Foster said after the first round of voting on June 30. France has already taken significant strides with crypto. Last year, it registered 74 crypto companies, a number that was expected to jump to 100, and regulators have since been trying to attract more digital asset businesses. Regulators started enforcing the European Union's wide-ranging crypto asset legislation, the Markets in Crypto Asset (MiCA) rules on stablecoins, at the end of June. The rest of the crypto rules are due to go live by the end of the year. Update (July 8, 2024, 12:58 UTC): Adds that President Emmanuel Macron has asked the Prime Minister to stay on. https://www.coindesk.com/policy/2024/07/08/france-votes-for-hung-parliament-as-major-parties-fall-short-of-majority/