2024-07-08 07:49

The protocol was one of the first ICOs on Ethereum, raising $8.6 million worth of ether in 29 minutes and setting the precedent for thousands of other ICOs in the years since. Golem, an Ethereum-based project, has transferred over $100 million worth of ether (ETH) to exchanges in the past month, potentially increasing selling pressure in the market. Golem raised millions of dollars during the 2016 ICO boom and has seen its token value decline significantly from its all-time high, despite ongoing development efforts in AI tools. Golem, one of the earliest Ethereum initial coin offerings (ICOs), has sent over $100 million worth of ether (ETH) to exchanges in the past month, possibly adding selling pressure to the market. ICOs were a popular way to raise funds to build cryptocurrency projects, with billions of dollars raised from 2016 to 2019. These lost charm among investors in the following years, however, amid regulatory tussles and a general lack of demand. Data tracked by Arkham shows that Golem’s main wallet has transferred millions of ETH to other wallets, which were later sent to exchanges such as Binance, Bitfinex, Coinbase, and others. Most of these transactions are below $10 million in value and are sent daily. Independent journalist Colin Wu first reported on Golem’s wallet movements. Golem’s X account did not immediately respond to requests for comment, and the project has not publicly revealed any major upcoming product releases on its X account. Golem is working on artificial intelligence (AI) based tools as the sector gains interest among traders, as per a roadmap spotlight released in May. Transactions to crypto exchanges usually imply an intention to sell holdings, as large amounts of tokens are usually not held on an exchange service for a long time for security reasons. Golem raised over $8.7 million worth of ETH in 2016, becoming one of the biggest benefactors of the ICO frenzy in those years as its decentralized computing narrative did the rounds on social media sites. It positioned itself as a marketplace for computing power, where users can rent out their unused computational resources in return for Golem’s GLM tokens. But popularity has waned since: Golem currently trades at just 30 cents with a market cap of $300 million, down from an all-time high of $1.32 in January 2018. https://www.coindesk.com/markets/2024/07/08/ethereum-ico-era-stalwart-golem-sent-100m-ether-to-exchanges-in-the-past-month/

2024-07-08 05:58

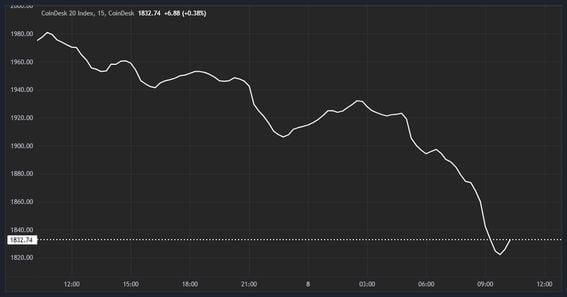

Germany has been running down its coin stash since mid-June. Germany still holds 29,286 BTC worth $2.2 billion, according to Arkham Intelligence. The potential selling pressure equates to 9% of bitcoin's 24-hour trading volume. Germany has been running down its coin stash since mid-June. Germany's bitcoin (BTC) sales and Mt. Gox's reimbursements have recently shaken up the crypto market, and the drama may not be over yet. The Eurozone's biggest economy still holds 39,826 BTC worth $2.2 billion, according to data tracked by Arkham Intelligence. The pending coin stash, a potential selling pressure, represents nearly 9% of BTC's 24-hour trading volume of $25.3 billion, suggesting further price turbulence. Early this year, the German Federal Criminal Police Office (BKA) seized 49,857 BTC from the operators of Movie2k.to, a privacy website that was last active in 2013. Since mid-June, the government has liquidated over 10,000 BTC, putting downward pressure on the cryptocurrency's going market rate. BTC's spot price has declined by nearly 20% to $55,490 in four weeks, with prices slipping nearly 13% in the past seven days alone, according to CoinDesk data. The CoinDesk 20 Index (CD20), a broader market gauge, has dropped nearly 14% to 1,870 points in one week. Last week, Tron founder Justin Sun offered to purchase BTC from the German government off-market to reduce the negative impact on the spot price. Per some observers, Germany's BTC sales amount to a strategic blunder that puts the country at a disadvantage in geopolitical terms. "Foolishly, the German Government has transferred more than $390 million worth of BTC to exchanges over the past few weeks to be sold for fiat currency. From a geopolitical perspective, it is a strategic blunder for any nation-state to sell bitcoin holdings for fiat currency given that they can simply print the latter out of thin air," the July 5 edition of the Blockware Intelligence newsletter said. "Comparatively, bitcoin is much more difficult to acquire given the immense amount of physical energy necessary to mine it and its limited supply of 21,000,000," the newsletter added. https://www.coindesk.com/markets/2024/07/08/germany-sill-holds-22b-worth-of-bitcoin-blockchain-data-show/

2024-07-08 04:27

Nearly $175 million in long liquidations as broader market contracts The CD20 index is down 7% and BTC is in the red 5%. Uncertainty over interest rates is likely dragging on the market. The CoinDesk 20 (CD20), a measure of the largest digital assets, began the Asia trading week down 7%, while bitcoin traded 5% lower amid increased expectations for Fed rate cut in September. Nearly every constituent in the CD20 is in the red, posting bigger losses than bitcoin. Ether (ETH) is down 5.8%, Solana (SOL) down 7.8%, and XRP down 7%. CoinGlass data shows there has been $175 million in long liquidations over the last 24 hours. BTC has been down 13% in the last week, which puts it in similar territory to the aftermath of the FTX collapse. Stronger than expected U.S. jobs data, but a rising unemployment rate has penciled in a Fed rate cut for September, according to a recent note by ING. ING's James Knightley wrote that private sector job growth has been particularly weak, with only 136,000 new jobs added in June, below the 160,000 expected. Government, education, and healthcare services contributed nearly 60% of new jobs, while retail, temporary help, professional business services, and manufacturing all saw job losses. Citi Research is making a more aggressive prediction, writing in a recent note that it is forecasting eight Federal Reserve rate cuts starting in September 2024 through July 2025, lowering the benchmark rate by 200 basis points to 3.25%- 3.5%. Bettors on Polymarket are punting that the Fed will have 1-2 rate cuts by the end of the year, with a 34% chance of 1 cut and a 37% chance of 2. The so-called dovish Fed expectations also failed to lift Asian stocks as the European Union's decision to impose steep tariffs on the import of Chinese electric vehicles soured the sentiment. Elsewhere, French voters gave leftists more seats than far right but failed to secure a majority, leaving a potentially hung parliament, a recipe for political and policy paralysis and potential risk aversion in European markets. https://www.coindesk.com/markets/2024/07/08/coindesk-20-down-7-bitcoin-sinks-by-5-as-asia-trading-week-begins/

2024-07-06 14:23

The price of the world's largest crypto has seen a very modest bounce since tumbling below $54,000 early Friday. Returning to their screens following the July 4 break, U.S. traders were confronted with a historic plunge in bitcoin (BTC) that saw its price fall more than 10% from the pre-holiday level. Based on ETF data, they decided to lift the offer. According to numbers compiled by Farside Investors, U.S.-based spot bitcoin ETFs saw $143.1 million in net inflows on Friday, the highest level of inflows in at least two weeks. Leading the way was Fidelity's Wise Origin Bitcoin Fund (FBTC), which took in $117.4 million of net new money. Other funds with net inflows were the Bitwise Bitcoin ETF (BITB), the ARK/21 Shares Bitcoin ETF (ARKB) and the VanEck Bitcoin Trust (HODL). Per usual, the high fee Grayscale Bitcoin Trust (GBTC) continued to bleed assets. As for price action, bitcoin has seen a very modest of bounce since tumbling from nearly $61,000 Wednesday to under $54,000 early Friday, currently trading back to $56,800. That's down 6% from the week-ago levels and roughly 23% from its all-time high above $73,500 set in mid-March. Taking the blame for this latest downdraft in price was worry about a massive surge in supply as trustees for defunct exchange Mt. Gox began the return of 140,000 bitcoin to former customers and the German government apparently moved to sell at least some of the thousands of bitcoin it holds. https://www.coindesk.com/markets/2024/07/06/bitcoin-etf-investors-bought-the-dip-on-friday-with-inflows-topping-140m/

2024-07-06 01:26

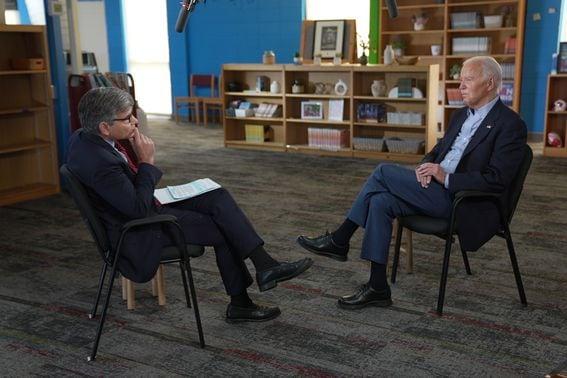

The president's chances of reelection languished at 11% and his probability of dropping out lingered around 64%, according to traders on the crypto-based prediction market platform. U.S. President Joe Biden may have seemed more coherent on Friday night's televised interview compared to the debate a week ago, but his odds of reelection did not substantially change, according to traders on crypto-based prediction market platform Polymarket. For the contract asking who will win the presidency in November, "yes" shares for Biden were trading at 11 cents shortly after the ABC News interview with George Stephanopoulos aired, a penny lower than right before the broadcast. Each share pays out $1 (in USDC, a stablecoin, or cryptocurrency that trades at par with the dollar) if the prediction comes true, and zilch if it does not. Therefore, an 11-cent price means the market believes the incumbent has an 11% chance of winning. A month ago, the shares were trading at 36 cents. They tanked after Biden's disastrous performance in the debate against former president and Republican candidate Donald Trump. Now, Sen. Mark Warner (D-Va.,) is rallying fellow Democrats to urge the president to drop out of the race, the Washington Post reported Friday. The presidential winner contract is Polymarket's largest, with $229 million of bets placed. For a separate contract concerning who will win the Democratic nomination, Biden's odds climbed just one percentage point after the broadcast to 42%. This contract has $89 million staked. A third contract asks if Biden will drop out of the race, with $12 million riding on the outcome. Odds there inched up three points, to 65%. Four-year-old Polymarket's volume has surged this year as the U.S. election in November fuels enthusiasm for political betting. June was the platform's first month with more than $100 million in volume. Polymarket also recently won accolades for signaling early on, through the trading levels on the "Biden drops out?" contract, that the president's cognitive health was a concern long before mainstream media outlets discussed the matter seriously. "Prediction markets have long been sought as a prime use case for blockchains," wrote Zack Pokorny, an analyst at Galaxy Digital, in a research note Friday. "Their censor/tamper resistant, transparent, and global nature makes them well suited for the task, as they allow for the unfiltered casting of opinion on any topic from anyone, anywhere." However, on-chain prediction markets have limitations, Pokorny wrote. "They solely reflect the opinions of individuals who are active on blockchains, which, today, is a small sect of people with possibly similar beliefs. With crypto becoming an increasingly partisan political issue, and Polymarket only able to be used with crypto, it's possible that Polymarket's political markets may be skewed by the pro-crypto biases of its participants." https://www.coindesk.com/markets/2024/07/06/bidens-odds-on-polymarket-little-changed-after-abc-tv-interview/

2024-07-05 17:02

The two executives, Joshua Porter and Gulsen Kama, say they were fired for attempting to blow the whistle on alleged accounting and securities fraud at the company. Two former executives of Tether-backed German tech company Northern Data have filed suit against the firm, alleging that they were wrongfully terminated after raising concerns about the company’s financial health and alleging tax evasion. Northern Data is the largest bitcoin miner in Europe. In addition to bitcoin mining, the company also operates data centers used for artificial intelligence. In their recently unsealed California lawsuit, the two executives – Joshua Porter and Gulsen Kama – allege that Northern Data lied to investors about the strength of its finances, hiding the fact that it is “borderline insolvent,” and, additionally, is “knowingly committing tax evasion to the tune of potentially tens of millions of dollars.” The allegations come amidst growing media buzz that Northern Data is considering a U.S initial public offering (IPO) of its artificial intelligence unit, which Bloomberg reported was valued at up to $16 billion. Porter joined the U.S. subsidiary of Northern Data as COO and was later promoted to CEO of the U.S. arm of the company. Only after his promotion, the suit claimed, did Porter get a true look behind the curtain at the reality of the company’s financial situation. According to Porter’s suit, Northern Data had a “$30 [million] German tax liability and additional liabilities of almost $8 [million] while simultaneously having only $17 [million] cash on the balance and a monthly burn rate of $3 [million]-$4 [million].” Porter also grew increasingly concerned about the company’s potential U.S. tax liabilities. The suit alleges that the firm committed “rampant tax evasion” in its early years and had no plan to take remedial measures to account for it. Porter worried that Northern Data’s U.S. tax liability “could easily be in the tens of millions of dollars” and, if it were to be audited by the Internal Revenue Service (IRS), it could wind up insolvent. Porter took his concerns to his superiors at Northern Data. When his concerns “fell on deaf ears”, as his lawyers described, Porter threatened to escalate matters by going to the company’s board of directors. Shortly after, he said he was fired – a move his superiors strangely blamed on an “internal decision to eliminate the position of North American [COO]” – a position he had not held in months. Kama, who started out as the CFO of the U.S. subsidiaries before being promoted the group’s CFO, reported similar concerns “regarding accounting and securities fraud” to her superiors at Northern Data – ”to no avail, because the CEO and COO were perpetuating the accounting and securities fraud,” the suit claims. Northern Data’s CEO is Aroosh Thillainathan and its COO is Rosanne Kincaid-Smith. After repeated attempts to warn the company about the fraud it was allegedly committing, Kama claimed she was sacked in an act of illegal retaliation for her whistleblowing activities. “Specifically, Kama was terminated for her admonitions that Northern Data was flagrantly violating securities and tax laws and her attempts to ensure Northern Data did not continue to make fraudulent representations in connection with the company’s audit process and to impose audit controls and governance procedures on Northern Data’s most senior management,” the plaintiffs’ lawyers wrote. Porter and Kama’s suit is seeking compensatory and special damages for their alleged wrongful termination. Though a figure has not yet been named, their lawyers wrote in the complaint that Northern Data’s alleged activity potentially exposes them to “millions of dollars of liability.” A spokesperson for Northern Data said the firm "refutes the allegations in the strongest terms, and we are contesting them vigorously to protect ourselves against false assertions which damage our company and our business. "Integrity is paramount to Northern Data Group and its leadership," the spokesperson added. "As a publicly listed company we have comprehensive policies and procedures to ensure the accuracy of our financial reporting. Our 2022 accounts received an unqualified audit opinion and we will release our 2023 audited financials shortly. A spokesperson for Tether declined to comment on "ongoing legal matters" but added: "We reaffirm our commitment to our investors and stakeholders to maintain trust and uphold the principles that guide our operations. We've always operated with the highest standards of integrity and transparency and remain confident in the long-term potential of the company and sector." https://www.coindesk.com/policy/2024/07/05/sacked-northern-data-execs-file-suit-against-tether-backed-company-alleging-fraud/