2024-07-04 08:14

While BTC futures OI has dropped, open interest in BTC terms has held steady. While notional open interest has dropped, OI in BTC terms has held steady alongside positive funding rates. That's a sign of renewed demand for longs amid the price dip, according to observers. Notional open interest in bitcoin (BTC) futures and perpetual futures, a crucial market sentiment gauge, has declined roughly 18% from $37 billion to $30.2 billion in one month, alongside a 14% slide decline in the cryptocurrency's spot market price, according to data source Coinglass. At first glance, the data indicates that longs or bullish leveraged bets anticipating a price rise have been squared off over the past four weeks. In other words, BTC's price drop is bolstered by the unwinding of bullish bets. That interpretation could be partially correct at best and masks the bullish undercurrents in the market. Open interest refers to the number of active or open contracts at a given time, and notional open interest is calculated by multiplying the number of units in one contract by its current spot market price. Therefore, changes in the asset price impact notional open interest even as the total number of contracts remains steady, thereby painting a misleading picture of market activity. That seems to be the case in the BTC market. Per Coinglass, open interest has remained steady above the 500,000 BTC mark over four weeks. Meanwhile, perpetual funding rates charged by exchanges every eight hours have consistently held positive, indicating a bias for bullish bets. The combination of steady open interest in BTC terms and positive funding rates, coupled with the decline in notional open interest, suggests that some traders have been setting fresh long positions, offsetting other market participants' supposed unwinding of bullish bets. That's a sign traders are not yet hesitating to put longs, according to Laurent Kssis, crypto ETF specialist at CEC Capital. "This assumption is indeed correct. Also, more protection strategies are being implemented as the market remains very uncertain. Don't forget the lat liquidity washouts were decent enough to push the market down below the $60K mark. Hesitation to position long orders is still not dominating, but hedging is a rather large part of the trading." Perhaps traders are hopeful that once the selling pressure from Mt. Gox reimbursements and miners is exhausted, bitcoin could resume the upward trend, keeping pace with the Nasdaq. A similar conclusion can be drawn from the consistent positive spread between futures and spot prices, widely referred to as basis. "The basis has dipped slightly but is still attractive, so there is still demand for long positions as part of the basis trade, and expectations of a breakout are building as macro tailwinds accumulate and as the selling pressure is likely to dissipate soon, so investors could be accumulating strategic longs while funding rates are low," Noelle Acheson, author of the Crypto Is Macro Now newsletter told CoinDesk. Activity in the spot and options market also suggests upside bias. According to Griffin Ardern, head of options trading and research at crypto financial platform BloFin, crypto exchange Bitfinex has been the source of bullish pressure during the price dip. "Bitfinex whales have been buying the dips [in the spot] since late June, but I haven't observed similar signals in the other derivatives market," Ardern told CoinDesk. The margin longs on Bitfinex, which involve using borrowed funds to buy an asset in the spot market, have steadily increased since June. Meanwhile, according to QCP Capital, traders have been buying topside bets in the options market. "Despite the sell-off, the options market is still heavily skewed in favor of the topside, suggesting that the market is still anticipating a year-end rally. This aligns with the desk's observation of significant buying interest in the longer-term options at the $100K/$120 strike [calls]," QCP said in a market update on Wednesday. https://www.coindesk.com/markets/2024/07/04/decoding-the-7b-decline-in-bitcoins-notional-open-interest/

2024-07-04 07:21

Selling pressure from Bitcoin Cash (BCH) and lack of liquidity is the story to watch once Mt. Gox begins redemptions, writes Presto Research. Mt. Gox's bankruptcy redemptions are bearish for BCH, not BTC, writes Presto Labs' Peter Chung. Mt. Gox will send back to its former customers $73 million worth of BCH, worth over 20% of the token's daily trading volume. Fears that selling pressure from bankruptcy redemptions from the estate of Mt. Gox will drive down the price of bitcoin (BTC) is unfounded, but it could be a bearish scenario for Bitcoin Cash (BCH), Presto Labs' Head of Research wrote in a note. Bitcoin's price continues to dip below $60,000, with over $200 million in liquidations as the trading day began in Asia Thursday, CoinDesk reported earlier. In addition to the roughly $9.5 billion in BTC the former exchange will send back to its customers, Mt. Gox will also send back 143,000 BCH worth around $73 million. CoinGecko data shows that Bitcoin Cash has a daily trading volume of $308.8 million, making this redemption worth around 24% of that number. "Our analysis shows that the selling pressure for BCH will be four times larger than for BTC: 24% of the daily trading value for BCH vs. 6% of the daily trading value for BTC," Presto Labs' Peter Chung wrote in a note, pointing out that BCH's daily trading value is 1/50 of BTC. In an interview with CoinDesk, Chung said BTC is projected to have limited selling because anyone who wanted out could have sold their claims on bankruptcy claim markets. In the early days of FTX's bankruptcy, many traders who were not optimistic about a quick bankruptcy redemption, did just that. "Weak-handed creditors had plenty of chances to exit over the last ten years on the back of aggressive bidding from the claim funds, so we can safely assume the current group of creditors consists of diamond-handed BTC bulls," Chung told CoinDesk in an interview. Chung argues that traders are going to treat the BCH "as an airdrop" and sell it immediately because Bitcoin Cash's fork occurred three years after Mt. Gox's bankruptcy. "Creditors are oblivious to BCH's cause," he continued. Long BTC perpetuals paired with short BCH perpetuals is the most efficient market-neutral way to express this view, barring funding rate risk, Chung wrote in the note. "Those looking to lock in a funding rate can explore other approaches, such as shorting term futures or borrowing BCH in the spot market," he continued. BCH is currently trading at $360, down 3.8%, according to CoinDesk Indices data. https://www.coindesk.com/markets/2024/07/04/mt-gox-doomsday-scenario-involves-bitcoin-cash-not-bitcoin-analyst/

2024-07-04 05:52

Solana’s SOL and dogecoin (DOGE) lead losses among major tokens, with the CoinDesk 20 index down 4.8%. Fears of sell pressure from Mt. Gox repayments and possible miner sales led to bitcoin dropping below $59,000, with major tokens like ether and Solana's SOL also declining. Trading firm QCP Capital anticipates a subdued market in the next quarter due to uncertainty around the Mt. Gox bitcoin supply release. Fears of looming selling pressure on bitcoin (BTC) from defunct exchange Mt. Gox and possible miner sales pushed the largest cryptocurrency to under $59,000 on Thursday for the first time since late April. Mt. Gox will start distributing assets stolen from clients in a 2014 hack in July 2024, after years of postponed deadlines. The repayments will be made in bitcoin and bitcoin cash (BCH), and could add selling pressure to both markets, as previously reported. BTC lost 3.3% in the past 24 hours, CoinGecko data shows, with the sell-off beginning shortly after Tokyo equity markets opened for trading. Major tokens declined amid the BTC weakness: Ether (ETH) slumped 4%, while Solana’s SOL and dogecoin (DOGE) fell as much as 8%. The broad-based CoinDesk 20 (CD20), a liquid index tracking the largest tokens, is down 4.8% in the past 24 hours. Futures trades betting on higher prices lost over $230 million in the past 24 hours, liquidations data tracked by CoinGlass shows. BTC and ETH-tracked futures saw over $60 million in long liquidations a piece, while products tracking DOGE, SOL, XRP, and pepe coin (PEPE) recorded at least $4 million in losses. For long traders, these liquidations were the highest since late June. Crypto exchange Binance took over $110 million in liquidations, the most among counterparts. Liquidations occur when an exchange forcefully closes a trader’s leveraged position due to a partial or total loss of the trader’s initial margin. It happens when a trader cannot meet the margin requirements for a leveraged position (fails to have sufficient funds to keep the trade open). Such data is beneficial for traders as it serves as a signal of leverage being effectively washed out from popular futures products – acting as a short-term indication of a decline in price volatility. Meanwhile, trading firm QCP Capital said in a Thursday broadcast on Telegram that they expect a dim market in the next few months. “We anticipate a subdued Q3 for BTC as the market remains uncertain around the supply from the Mt. Gox release,” QCP said. https://www.coindesk.com/markets/2024/07/04/bitcoin-plunges-under-59k-as-crypto-bulls-see-230m-liquidations/

2024-07-03 15:48

Pendle has recently lost $3 billion of its TVL with the June expiry as a result of diminishing airdrop farming hype and lower yields amid muted crypto activity. The governance token of Pendle declined 20% earlier this week amid steep roll-off in the value of assets locked on the platform. AAVE, LDO also saw more than 10% price drops as a large investor moved $10 million of tokens to Binance. Cryptocurrencies in the decentralized finance (DeFi) sector were hit harder than the broader crypto market this week, with the CoinDesk DeFi Index losing 9% from its Monday high versus the CoinDesk 20 benchmark's 5% decline during the same time. Leading the plunge was the governance token of Pendle – a DeFi protocol that offers crypto yields in the form of tradable tokens – falling more than 20% during the Tuesday and Wednesday trading sessions, with short positions piling up to bet on further declines. The protocol saw a significant, $3 billion drop in the value of assets locked on the protocol (TVL), Defillama data shows. Analysts reasoned that many users withdrew funds from the protocol instead of rolling over their positions at the end of June lock-up expiry. Pendle also benefited from the airdrop and points farming bonanza earlier this year, which ground to halt lately. "Yields aren't very good for future pools at the moment so people withdrew versus rolling [over]," Rob Hadick, general partner at venture capital firm Dragonfly said. "While there will be TVL noise in the short run due to specific points programs lapsing, we're hearing excitement around upcoming tie-ups, including the Symbiotic-Ethena-Mellow partnership, which should attract fresh inflows," Joshua Lim, co-founder of principal trader Arbelos Markets, told CoinDesk in an interview. Tokens of other major DeFi lending platforms Aave (AAVE) and liquid staking protocol Lido (LDO) were also among the biggest underperformers, falling 10%-15% during the same period. The declines happened as a large crypto investor, or "whale," transferred earlier Wednesday $6.2 million worth of LDO and $4.5 million in AAVE to crypto exchange Binance, likely to sell the tokens, one observer noted citing blockchain data on EtherScan. The DeFi sector's struggle coincided with a period of lull in the crypto market, with bitcoin (BTC) and DeFi hotbed ether (ETH) consolidating range-bound below their March peaks. ETH, the second largest crypto asset, is down about 6% from its Monday highs and has erased most of its gains since odds for regulatory approval for U.S. spot ETFs jumped overnight in late May. https://www.coindesk.com/markets/2024/07/03/defi-tokens-plunge-10-20-led-by-pendle-amid-weak-crypto-price-action-this-week/

2024-07-03 15:21

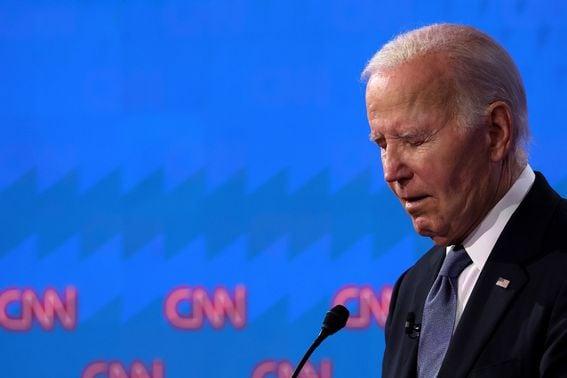

It had been only 55% earlier in the day. A New York Times report that President Joe Biden is weighing his future in the 2024 race prompted traders on Polymarket to boost the odds the Democrat will drop out nearly 80% on Wednesday. That's up from 55% earlier. The wild upswing caps a week of mayhem in Polymarket's "Biden drops out of presidential race?" market, which has garnered nearly $10 million in bets. Before last week's debate with Donald Trump, the same question gave 20% odds. Plenty of Washington talking heads have talked down Biden's ability to prevail in the 2024 election against Trump after a faltering debate performance put a spotlight on his age. But The New York Times is now reporting that Biden thinks he has a short and slimming window to salvage his prospects. "He knows if he has two more events like that, we’re in a different place," the New York Times quoted an unnamed ally as saying about Biden. A White House spokesperson said on X that the New York Times story is false. https://www.coindesk.com/markets/2024/07/03/bidens-odds-of-dropping-out-surge-to-almost-80-on-polymarket-after-new-york-times-report/

2024-07-03 15:17

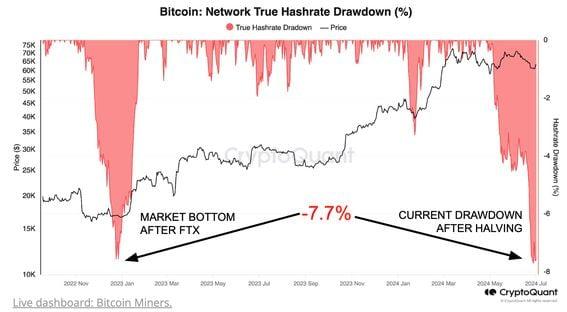

Miner capitulation levels are now comparable with those in end of 2022, which was the market bottom after FTX implosion, CryptoQuant said. Bitcoin miner capitulation metrics are approaching the same level as the market bottom following the FTX crash in late 2022. Daily miner revenue has dropped to $29 million from $79 million following the bitcoin halving earlier this year. The hashrate has slumped by 7.7% since the halving as inefficient miners turn off their equipment. Bitcoin (BTC) miners are showing signs of capitulation, an event that is typically tied to a market bottom after the world's largest cryptocurrency endured a 13% plight over the past 30 days. Bitcoin is currently trading at $60,300 after sliding by 3% on Wednesday. This level has acted as a critical support since April, with bitcoin bouncing three times from this region before heading back towards the $70,000 mark. Data provider CryptoQuant believes this is likely to happen again in the near future as numerous signs point towards capitulation following a period of intense sell pressure. Two signs of miner capitulation are dwindling hashrate and mining revenue by hash (hashprice), both of which are down significantly this month, with hash rate plunging by 7.7% since the halving at hashprice nearing all-time lows. Hashrate is the mining power in the Bitcoin network, and hash price refers to the revenue miners earn from a unit of hashrate. Miners are also experiencing a hit to their daily revenue, which fell to $29 million today from $79 million on March 6. This has led to miners turning off equipment and the subsequent drop in hashrate. "Miners have been hit by a 63% decline in daily revenues due to the halving and the collapse of transaction fees to 3.2% of total revenue," CryptoQuant said in a report. Miner capitulation levels are now comparable with those in December 2022, which was the market bottom following the demise of FTX. https://www.coindesk.com/business/2024/07/03/bitcoin-bottom-is-near-as-miners-capitulating-near-ftx-implosion-level-cryptoquant/