2024-07-03 05:59

The class action suit from DraftKings buyers alleges that NFTs are investment contracts. A U.S. judge in Massachusetts has denied a motion to dismiss a class action suit against DraftKings alleging its NFTs are securities. This sets the stage for a future trial about NFTs as securities. A U.S. Judge in Massachusetts has denied a move by DraftKings to dismiss a class action lawsuit brought on by buyers of its non-fungible tokens (NFTs). The suit alleges that the tokens are investment contracts, setting the stage for a future court battle on whether NFTs are securities. DraftKings offers sports-themed NFTs on its marketplace via the Polygon blockchain. Justin Dufoe, a buyer, first filed suit against DraftKings, on behalf of other owners in March 2023, alleging that these NFTs met the prongs for the Howey test. In this recent ruling, a court agreed that DraftKings' NFTs involved an investment of money, pooled assets into a common enterprise with shared risks and profits, and created a reasonable expectation of profit from DraftKings' efforts, thus plausibly classifying them as securities under the Howey test. It is plausibly alleged that the NFTs' values were dependent on the success of the DraftKings Marketplace, the court found, noting that the value moves in tandem with interest in that specific marketplace, an issue that has been addressed in prior cases examining NFTs. Dapper Labs faced a similar case All this comes after Dapper Labs agreed in June to pay $4 million to settle a similar class action suit. It was reported earlier by Fortune that the SEC had once launched an investigation into Dapper Labs but closed it in September 2023. However, the difference between Dapper Labs' NFTs and those offered by DraftKings is that Dapper uses its own proprietary blockchain called Flow, while DraftKings issues its tokens on Polygon. The use of Flow, a private chain, the court decided, means Dapper Labs runs a higher risk of violating securities laws because its Flow blockchain created a dependency on Dapper’s managerial efforts and success, satisfying the Howey test criteria of a common enterprise and expectation of profit. A date to continue the DraftKings class action suit has not yet been set. https://www.coindesk.com/policy/2024/07/03/us-judge-sets-stage-for-nft-securities-trial-as-draftkings-lawsuit-moves-forward/

2024-07-03 05:56

The blockchain was paused early Wednesday to contain the exploit, with security researchers suspecting a private key leakage. The Bittensor blockchain was temporarily halted after an attack on several user wallets, causing a 15% drop in TAO prices. Investigations are ongoing into the attack, which is suspected to have been caused by a private key leakage, and Bittensor has been put into "safe mode" to prevent further transactions until more information is available. The Bittensor blockchain was temporarily halted early Wednesday as team members detected an attack on several user wallets, with at least one wallet drained of $8 million worth of the project’s TAO tokens. TAO prices dropped as much as 15% in the aftermath of the attack, but slightly recovered as core members said steps were in place to mitigate further mishaps. “We are investigating, and in an abundance of caution, have recently fully halted transactions on-chain until there is more information available to us about the nature of this attack,” a Bittensor core team member wrote on the project’s Discord channel. Later, co-founder Ala Shaabana confirmed on X that the chain was put on “safe mode,” meaning blocks were getting produced but no transactions were being processed. Blockchain trackers for the Bittensor network show the latest transactions and blocks were processed at or around 23:00 UTC on Tuesday. Meanwhile, independent security researcher @ZachXBT said on his Telegram channel that one user was drained of 32,000 TAO, worth $8 million at the time, and suspected a private key leakage that led to the attack. A private key is a string of letters and numbers that acts as a password to protect and manage tokens in a wallet. Investigations for the attack are ongoing as of Wednesday morning. Bittensor connects machine learning models owned by various individuals worldwide. It is one of the biggest artificial intelligence-focused crypto projects with a market capitalization of $1.6 billion. https://www.coindesk.com/tech/2024/07/03/bittensors-tao-slides-15-after-8m-wallet-drain-attack/

2024-07-03 05:37

Traders are now giving a 55% chance President Biden abandons his campaign and a 42% chance he does it before the Democratic convention Polymarket bettors give a 55% chance that Biden will drop out of the Presidential race. Barack Obama has privately expressed concerns over Biden's campaign performance, according to the Washington Post The chance that President Biden drops out of the race for the White House hit an all-time high of 55% on Polymarket after former president Barack Obama expressed concerns about the Biden campaign and debate performance. The Washington Post reported late Tuesday that former president Barack Obama, concerned about Biden’s reelection chances after a poor debate performance, as well as highlighting his belief that Trump has strong electability, has been privately advising and supporting him while publicly expressing confidence in his campaign. Bettors are less sure as to when Biden will withdraw. The market is giving a 42% chance that Biden drops out before the Democratic convention, scheduled for August 19. Democratic party bosses have already prepared a scenario for Biden pulling out of the election, according to reports from the New York Times, and the process of securing a new nominee will be a complex one. The easiest route would be to nominate Vice President Kamala Harris, Biden's running mate. Sensing that this would be the path of least resistance, the market pushed up Harris' odds of becoming the Democratic nominee to 31% on Tuesday, CoinDesk reported earlier. Meanwhile, Polymarket bettors give a 13% chance to Harris winning the presidential election, and a 16% chance to Joe Biden. More than $211 million has been bet on the general presidential election contract on Polymarket, while nearly $10 million has been bet on Biden dropping out. https://www.coindesk.com/markets/2024/07/03/bidens-odds-of-dropping-out-surges-to-55-on-polymarket-as-obama-raises-concerns-about-presidential-campaign/

2024-07-02 22:35

Supporters are calling on the vice president to step up following boss Biden's doddering debate debacle. Vice president Kamala Harris' odds of becoming the Democratic nominee for president this year more than quadrupled on Tuesday, according to traders on Polymarket, the crypto-based prediction market platform that's seen torrid growth in an election year. "Yes" shares in a contract asking whether she will get the nod traded as high as 31 cents in the afternoon New York time, indicating the market saw a 31% chance it will happen, up from 7% earlier in the day. The shares retraced some gains and recently traded at 23 cents. Each share pays out $1 (in USDC, a stablecoin, or cryptocurrency pegged to the U.S. dollar) if the prediction comes true, and zero if not. Officially, President Joe Biden is still the presumptive Democratic nominee. But many supporters are calling on him to step aside, and some of them want Harris to step up following her boss's doddering performance at last week's debate with former commander-in-chief and almost-certain Republican standard-bearer Donald J. Trump. "We should do everything we can to bolster her, whether it’s in second place or the top of the ticket," Rep. James Clyburn, D-S.C, said on television Tuesday. A Newsweek op-ed by former Congressman Tim Ryan, the first presidential candidate to endorse Biden in 2020, was more blunt: "Kamala Harris Should Be the Democratic Nominee for President in 2024." An analysis by The Wall Street Journal called Harris "Biden’s Likeliest Replacement." The trend was similar Tuesday on PredictIt, a more traditional prediction market platform where bets are settled in dollars rather than crypto. "Yes" shares for Harris there more than doubled to 35 cents. PredictIt's volume on the question of who will win the Democratic nomination totals $31 million, dwarfed by Polymarket at $75 million. Under a settlement with the Commodity Futures Trading Commission, Polymarket is barred from doing business in the U.S., whereas PredictIt is allowed to operate in the country under a regulatory exemption. Tuesday was Polymarket's fifth-largest volume day in its four-year history, with $5.7 million in trading, according to Dune Analytics data. June was the first month Polymarket saw more than $100 million in volume. Its largest contract by far, with $211 million in bets, asks who will win the U.S. presidency in November. Trump remains the favorite, with a 66% chance of victory. Meanwhile, KAMA, a meme coin named after the vice president, rallied Tuesday, more than doubling in price over 24 hours to $0.007815. https://www.coindesk.com/markets/2024/07/02/kamala-harris-odds-of-winning-democratic-nomination-surge-on-polymarket/

2024-07-02 15:27

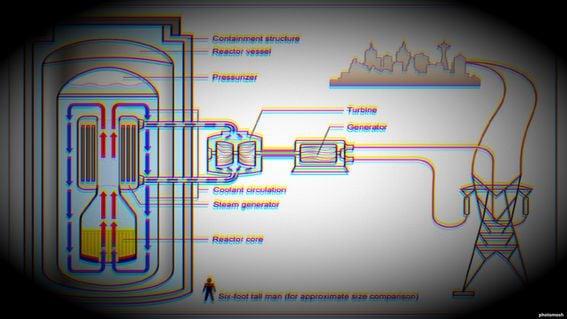

Massive demand for energy from high performance computing and artificial intelligence firms is changing the landscape in terms of power stability, the company’s CTO said in an exclusive interview with CoinDesk. Kraken is considering using nuclear energy as a power source for its data centers. The crypto exchange is looking to partner with energy providers that can supply small modular reactors. The company is exploring nuclear power options in North America and Europe. Kraken is considering using nuclear energy to power its data centers, amidst an expected boom in decentralized finance (DeFi) and increased demand for its services, the company’s chief technical officer, Vishnu Patankar, said in an exclusive interview with CoinDesk. Kraken is not looking to build its own reactors, but is considering partnering with energy providers that can supply nuclear power with small modular reactors (SMRs). These reactors can be co-located with data centers and don’t have space or weather constraints, according to Patankar. “With institutions moving into the crypto asset class and activity moving on-chain, the need for reliable fiat onramps continues to grow,” Kraken’s CTO said. “Bolstering our energy resiliency means we strengthen a direct avenue into the crypto ecosystem, supporting its continued growth.” The crypto exchange is looking to secure its energy supply given the massive surge in demand from artificial intelligence (AI) and high performance computing (HPC) firms which is changing the landscape in terms of power stability, Patankar said. Kraken is exploring nuclear power options in North America and Europe. “Crypto’s round-the-clock and global nature means Kraken needs a constant supply of energy, particularly as we facilitate a larger proportion of global trading volumes,” Patankar said. Due to the 24/7 demands of running a cryptocurrency business and expected mass adoption of crypto over time, Kraken is looking at how it can scale its business in terms of energy supply and latency. Nuclear backup Kraken's exploration of the idea comes as more tech companies explore deals with nuclear operators to power data centers needed to meet the demands of artificial intelligence. The Wall Street Journal reported Tuesday that the trend is increasingly apparent, with firms including Amazon Web Services seeking to lock in contracts with nuclear plants to power data centers. Surging demand from power-hungry AI companies has seen bitcoin miners pivot away from crypto mining to supplying infrastructure for these firms. Core Scientific (CORZ) signed a deal with artificial intelligence firm CoreWeave earlier this month. “A nuclear backup means Kraken can continue to operate even if there was major disruption to local energy supply,” Patankar said, noting that “it adds redundancy and protects our energy resiliency so we can continue to offer round-the-clock products and services to our clients globally.” Whether running nodes for validators or for transactions, Patankar said Kraken is expecting a big boom in DeFi and because of this the firm’s energy needs could potentially be exponentially higher in the future. Whilst a final decision has not been made yet, Patankar said Kraken was definitely considering nuclear power as an option as other alternatives such as wind and solar are weather dependent and energy storage also posed a challenge. A criticism often leveled at the crypto industry is that it is extremely wasteful in terms of energy usage, with proof-of-stake blockchains such as Bitcoin requiring huge amounts of processing power. Nuclear energy also suffers from similar negative perception but for different reasons, however, in this case it might be a more environmentally friendly solution. Any excess energy that is generated by the reactors can be captured and used to power the cooling systems of the data centers. https://www.coindesk.com/tech/2024/07/02/crypto-exchange-kraken-is-considering-going-nuclear/

2024-07-02 13:28

The tokens were originally allocated to the now sunsetted Polakdot parachain auctions. 5% of ASTR's total supply will be burned following a governance vote, an additional 70 million tokens will be transferred to the community treasury. Token burns are often seen as a bullish event. ASTR is up by more than 7% over the past 24-hours. Multi-chain smart contract network Astar Network will burn 350 million ASTR tokens, 5% of its total supply after a governance vote. The tokens were originally allocated for Polkadot parachain auctions, a product which has since been shelved by Polakdot. The 350 million tokens yielded 70 million ASTR in rewards, which will now be transferred to the community treasury. A token burn is typically considered a bullish event as it removes potential supply from the market. Popular meme coin Floki conducted several token burns over the past year, one of which spurred a 70% rally to the upside. ASTR is up by more than 7% over the past 24-hours, outperforming CoinDesk's CD20 Index which is up by 0.27% in the same period. Trading volume has also topped $50 million to mark an 84% increase over Monday, CoinMarketCap shows. Astar Network struck a deal with Polygon to integrate the layer 1 blockchain's AggLayer in March. The product is designed to connect various blockchains using zero-knowledge proofs and provide unified liquidity. https://www.coindesk.com/business/2024/07/02/astar-network-to-burn-350m-astr-5-of-total-supply/