2024-07-02 13:11

The blockchain spent $87 million in the first six months this year, with marketing activities accounting for the majority of expenses. Polkadot spent $87 million worth of DOT on various activities in the first half of this year, with marketing and outreach activities accounting for the largest portion of spending, totaling over $36 million. The treasury has just over $245 million worth of DOT tokens left for spending, estimated to last for two years at current prices. Concerns in the ecosystem about the usage of the Treasury are increasing. Polkadot, one of the crypto industry’s earliest Ethereum rivals, spent $87 million worth of DOT tokens on various activities for the first half of this year, doubling from the pace of the prior six months, community representatives for the blockchain published in a treasury report over the weekend. The treasury has just over $245 million worth of DOT left for spending, an amount community members estimate will last for two years at current prices. The first-half spending represents a more than 125% jump from the nearly $25 million spent in the second half of 2023. It's worth noting that Polkadot's treasury is topped up by the inflationary mechanism of the DOT token and that the treasury will grow before net spend is taken into account over the next two years. "The whole notion of a 'runway for the on-chain treasury is misleading. The treasury has continuous inflows. It’s never going to run out of funds," Web3Foundation CEO Fabian Gompf said on X. Marketing and outreach activities accounted for the biggest chunk of spending, with over $36 million spent on advertisements, events, meetups, conference hosting, and other initiatives. These efforts were intended to attract new users, developers, and businesses to the ecosystem. Software development costs were the second-largest money sink, with over $23 million used to build services, such as wallets and toolkits to support developers. Some $15 million was spent on liquidity provision and incentives on Polkadot-based trading platforms. A detailed breakdown of each transaction has been published on a publicly-viewable spreadsheet. As such, community members expressed concerns about the large amount of spending on various activities and the possibility of running out of liquidity. “The Treasury has about 32m DOT (200m USD) in liquid assets available within the next year. At a current net loss of 17m DOT (108m) USD per year, this leaves about 2 years of runway left if the DOTUSD rate stays the same,” the report said. “The volatile nature of a mostly DOT-denominated treasury makes it hard to predict the future, but concerns in the ecosystem about how the Treasury is used are increasing,” it added. https://www.coindesk.com/business/2024/07/02/polkadots-245m-treasury-will-last-2-years-at-current-spending-rate/

2024-07-02 12:00

Tools for Humanity (TFH), a contributor to the Worldcoin project, hired four executives to advance its mission to ensure a more just economic system, the company said on Tuesday. Worldcoin builder Tools for Humanity hired former X (previously, Twitter) executive Damien Kieran as chief privacy officer. Ex-Google executives Adrian Ludwig and Ajay Patel joined as chief information security officer and head of World ID, respectively. Former Apple executive Rich Heley joined as chief device officer. Tools for Humanity (TFH), builder of decentralized identity project Worldcoin, has hired four seasoned experts to beef up areas like privacy, security and identity management. Damien Kieran joins as chief privacy officer, having held the same position at X (formerly Twitter), and general counsel at BeReal. Adrian Ludwig, who served as director of Android security at Google and chief information officer at Atlassian, a developer of collaboration software, becomes chief information security officer. Ajay Patel, who led the Google Payments identity team, becomes head of World ID. Rich Heley, who previously held vice president and executive roles at Apple, Meta and Tesla, becomes chief device officer, overseeing Worldcoin’s retina-scanning orb, the means of collecting human identity data. Worldcoin’s unique approach to biometric data harvesting may be divisive, but there’s no doubt a gathering AI and machine learning revolution has increased the need for proof of humanness and tackling online fakery, particularly as half the world’s population votes in elections this year. In recent years, Worldcoin has been probed by data protection regulators in countries such as France, and earlier this year the project’s iris scanning and identification operations were said to contravene Hong Kong's data protection principles, according to the region’s Privacy Commissioner for Personal Data (PCPD) Kieran said his new CPO role is to ensure the company complies with the regulations and frameworks around privacy and ensuring external audiences, in particular privacy regulators, understand and have transparency into the tools behind Worldcoin. “I look forward to continuing to engage with regulators and data privacy officers in the EU and around the world to answer their questions, and share information transparently and debunk common misperceptions as we continue to serve individuals by giving them greater access to financial and identity networks,” Kieran said in a statement. https://www.coindesk.com/business/2024/07/02/worldcoin-hires-former-google-x-and-apple-execs-to-beef-up-privacy-security/

2024-07-02 09:19

BTC mining stocks, AI and gaming sector might stand out in the third quarter, one observer said. BRETT, TON and KAS Shine in a lame quarter for the broader crypto market. TON's surge stemmed from messaging giant Telegram's involvement, while KAS benefitted from sentiment around its technology stack. BTC mining stocks, artificial intelligence (AI) and the gaming sector might stand out in the third quarter. The second quarter saw three tokens – brett (BRETT), Ton Network's TON, and Kaspa's KAS – emerge as shining stars as the crypto market bellwether bitcoin (BTC) wilted, pulling most major digital assets, including ether (ETH), lower. BRETT, a memecoin native to the Base Chain and inspired by the character of Brett from Boys' Club comic series, more than doubled to 15 cents, becoming the best-performing digital asset among the top 100 coins by market value, according to data tracked by TradingView and CoinMarketCap. Toncoin (TON), the native cryptocurrency of The Open Network (TON), a decentralized, layer-1 network popularly known as the TON blockchain, rose 42% to $7.65 and Kaspa blockchain's KAS surged over 35%. Meanwhile, the total crypto market capitalization fell 13.8% to $2.2 trillion. Here's what may have helped these coins stand out from the broader market malaise. Meme mania The BRETT surge was not an isolated event but a part of a broader uptrend in meme coins. Analytics platform DYOR's Dune-based relative strength crypto narrative tracker shows the meme coin sub-sector rose over 45% in three months while others registered losses. Culture coin mog (MOG) emerged as another top performing asset driven by positive sentiment and a cult-like following on social platforms such as X. MOG market capitalization zoomed from $220 million in early April to over $700 million, briefly putting it among the top hundred tokens by that metric. The performance is typical of a bullish cycle in which investors rotate profits from bigger coins like bitcoin into smaller tokens like meme coins, fueling a price rise and retail investor FOMO (fear of missing out). In other words, the fate of meme coins is tied to investor risk appetite and credit availability. BRETT began its meteoric rise in May after Bitcoin began consolidating at record highs near $70,000 and, at one point, saw its market capitalization near the $2 billion mark. "The $2.0bn mark is the liquidity wall many of the established meme coins hit before profit-taking and sideways volatility ensue. Of course, for every $1bn higher from there, retail investors will take a lot of momentum and risk-taking (a.k.a Apes) to get these meme coins to the levels of DOGE and SHIB. Let's see what the Degens can make happen later in this Bull Market cycle," Kenny Hearn, chief investment officer at SwissOne Capital, told CoinDesk in an interview. Hearn added that SwissOne's Top 50 smart passive index fund holds six of the largest meme coins in its portfolio following this quarter's rebalance. TON and Telegram TON's surge stemmed from its involvement in the cloud-based mobile and desktop messaging app Telegram, which boasts 1.56 billion users worldwide and 800 million active users. "A toncoin (TON)-based economy is starting to take root in the messaging app Telegram," TON's Director of Investments Justin Hyun told CoinDesk in April. Several catalysts boosted TON's adoption, including Telegram's decision to pivot to TON payments for advertisements and the Open League reward program. TON's network activity also got a boost from integrating tether (USDT), the world's largest dollar-pegged stablecoin, and the debut of Telegram-based game Notcoin's digital token. TON's daily active addresses rose to nearly 600,000 in June, surpassing Ethereum, the world's largest smart contract blockchain, housing prominent DeFi projects worth several billions of dollars. "During Q2, the daily active users (DAUs) for TON experienced a significant surge, even surpassing Ethereum. This growth was attributed to the introduction of mini apps, which are decentralized apps embedded into the Telegram messaging app. Notcoin, one of these apps, gained notable traction as users could 'mine' Notcoin by simply pressing a button within Telegram," Katie Talati, head of research at Arca, said in an email to CoinDesk. "Other significant catalysts include the launch of USDT on TON, with approximately $550 million USDT currently on the network, positioning it for payments, a key feature of WeChat," Talati added, noting Pantera's recent "largest investment ever" in TON. KAS to solve the blockchain trilemma Per Hearns, KAS's parent proof-of-work (PoW) blockchain, Kaspa's attempts to solve the blockchain trilemma helped the token grab investor attention. The blockchain trilemma refers t to the trade-off between three key aspects of blockchain technology: scalability, decentralization, and security. Kaspa's GHOSDAG allows transactions to be processed in a more asynchronous, parallel manner, unlike traditional blockchains, which rely on sequential processing. That helps enhance performance and security while retaining the security of the PoW consensus mechanism. "It appears this team is on a mission to solving the trilemma (scale, speed, security) through its DAG versus blockchain structure (supporting speed and scalability) while using the security benefits of POW (supporting security). What appears to be a strong "hodler" base meaning low free float it would appear the market is very supportive of this leading-edge technology. Again, support over the fundamentals," Hearn explained. KAS token also received a bullish boost from listed bitcoin miner Marathon Digital's announcement that it has started mining KAS to diversify its revenue stream. What next? The third quarter has historically been the weakest one, with bitcoin chalking out an average gain of just 5% over the past 13 years versus 60% in both the second and fourth quarters. There is a risk that incumbent U.S. President Joe Biden's recent poor performance in the presidential debate might prompt Democrats to replace him with a strong candidate against the crypto-friendly rival Donald Trump. That could keep animal spirits at bay until the Nov. 4 elections. Besides, the Fed and other central banks could heed BIS' advice to avoid premature easing of the monetary policy. Still, crypto sub-sectors with strong fundamentals could continue to stand out. "The long-term game is the key for many projects building quietly in the background and delivering on real use cases," Hearn added. "We note that ONDO, JASMY, and ENS fall into this category of strong fundamentals, user growth." Arca's Talati said bitcoin mining stocks, artificial intelligence, gaming and DeFi sectors could witness growth. https://www.coindesk.com/markets/2024/07/02/these-hot-crypto-tokens-beat-bitcoin-gains-in-q2-heres-what-drove-prices-and-whats-next/

2024-07-02 07:12

The ETH products recorded $60 million in net outflows each week, the most since August 2022. Professional investors withdrew over $120 million from ether (ETH)-tracked exchange-traded products in the past two weeks, crypto firm CoinShares said in a Monday report. Such products recorded $60 million in net outflows each the past two weeks, the most since August 2022. Elsewhere, multiasset and bitcoin (BTC) ETPs recorded inflows at $18 million and $10 million, respectively, suggesting sentiment may be turning. Ether ETFs are close to becoming available for trading in the U.S. after the Securities and Exchange Commission (SEC) approved applicants' filings last month. The regulator must also approve their S-1 filings before the products are cleared to trade. Firms such as Galaxy say ether ETFs could see $5 billion of net inflows in the first five months, while Bitwise expects $15 billion in their first 18 months. The demand for the planned products is expected to come from independent investment advisers and broker/dealer platforms. https://www.coindesk.com/markets/2024/07/02/ethereum-products-see-highest-outflows-since-2022-ahead-of-ether-etfs/

2024-07-02 06:01

Bitcoin has a median return of 9.6% in July and tends to bounce back strongly, one trading firm said. Since April, Bitcoin's price has ranged between $59,000 and $74,000, but historical trends suggest a potentially bullish July. Seasonal cycles, such as profit-taking around tax season in April and May, and increased demand in December, can influence cryptocurrency prices, leading to predictable changes. Bitcoin (BTC) bulls may have reason to cheer in the coming weeks as possible seasonal cycles boost prices of the largest cryptocurrency after months of declines and rangebound trading. BTC has traded between $59,000 and $74,000 since April, weighed down by billions in sales, upcoming selling pressure, outflows from exchange-traded funds (ETFs), and peak negative sentiment among retail traders. But a historically bullish month of July could soon change that. The first day of the month saw U.S.-listed ETFs record nearly $130 million in inflows – their highest since early June after more than $900 million in outflows over the month. “Bitcoin has a median return of 9.6% in July and tends to bounce back strongly, especially after a negative June (-9.85%),” Singapore-based QCP Capital flagged in a Telegram broadcast Monday. “Our options desk also saw flows positioning for an upside move last Friday into the month-end, possibly in anticipation of the ETH spot ETF launch. Many signs point to a bullish July,” QCP added. Over the last decade, bitcoin has gained by an average of more than 11% in July, with 7 out of 10 months showing positive returns, data shows. Crypto fund Matrixport said in a 2023 report that July returns from 2019 to 2022 have been around 27%, 20%, and 24%, respectively. Seasonality is the tendency of assets to experience regular and predictable changes that recur every calendar year. While it may look random, possible reasons range from profit-taking around tax season in April and May, which causes drawdowns, to the generally bullish “Santa Claus” rally in December, a sign of increased demand. https://www.coindesk.com/markets/2024/07/02/bitcoin-traders-position-for-bullish-july-as-btc-etfs-record-124m-inflows/

2024-07-01 19:39

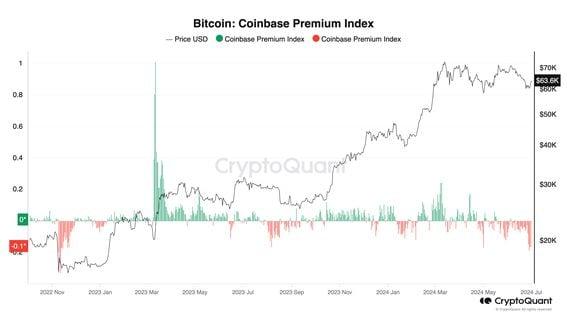

Previous deeply negative readings occurred near local bottoms in price, with the most recent occurring just prior to BTC's rally between October and March to all-time highs, FalconX's David Lawant noted. Bitcoin's price premium on Coinbase has plummeted to negative levels rarely seen, CryptoQuant data showed. Similar readings in November 2022 and August 2023 foreshadowed imminent local price bottoms and subsequent rallies. Bitcoin (BTC) is trading at a deep discount on crypto exchange Coinbase, which could be a sign that the largest crypto asset's price is bottoming foreshadowing the next leg higher. "Always darkest before the dawn," asked David Lawant, head of research at institutional crypto trading platform FalconX, in an X post. "The last time the Coinbase premium was this negative was a couple of months before the massive rally from Oct '23 to March '24," he added. The so-called "Coinbase Premium Index" measures the price difference for bitcoin on Coinbase, widely used by U.S. users and many institutional market participants, compared to the off-shore Binance, the leading exchange by trading volume and popular among retail users. The metric has been negative for an extended period during June and most of May, echoing last year's market lull in August and September, according to data from analytics firm CryptoQuant. On Friday, it slid to nearly -0.19, its lowest reading on the daily timeframe since the November 2022 collapse of crypto exchange FTX. Such negative readings suggest weak demand and selling pressure from U.S. investors, as bitcoin has been consolidating range-bound since March's all-time highs. Investors have also grown concerned about outflows from the U.S.-listed spot BTC exchange-traded funds – many of which use Coinbase for settlements – and the U.S. government selling seized assets through Coinbase, which might have contributed to the price discount on Coinbase. However, such a deeply negative Coinbase Premium previously appeared near to local bottoms in price, followed by significant rallies in the coming months. The early November 2022 reading coincided with the bear market low for BTC at below $16,000, with prices later surging to nearly $25,000 by February. That was a more than 50% rally. The August 2023 low in the premium occurred a couple weeks before bitcoin hit a local bottom around $25,000. Then, BTC traded range-bound until October to almost double in price by January driven by anticipation for the upcoming U.S. bitcoin ETFs, and later to new all-time highs. Most recently, the metric spiked to similarly low levels (-0.17) during the May 1 capitulation to $56,000, from where BTC rallied about 27% to near $72,000 in June before faltering. "At least recently, the Coinbase premium has become a reliable, confirming, and sometimes even leading indicator of overall market trends," Lawant told CoinDesk in a direct message. "This underscores the significant influence of the U.S. market in determining market price formation." Given that several upcoming catalysts are U.S.-centric – such as ETF flows, U.S. monetary policy and the presidential election, he said he expects this trend to continue. "Something tells me the next 6-12 months will be splendid—and probably volatile," Lawant predicted. https://www.coindesk.com/markets/2024/07/01/bitcoins-bottom-in-price-could-be-near-or-already-in-the-coinbase-premium-index-suggests/