2024-07-01 15:00

Circle Mint France will issue the euro-denominated EURC stablecoin and USDC in the European Union in compliance with MiCA. Circle is claiming bragging rights as the first global stablecoin issuer to comply with MiCA. Before the rules took effect on June 30, some exchanges delisted euro-denominated stablecoins, such as Tether’s EURT. Circle became the first global stablecoin issuer to secure an Electronic Money Institution (EMI) license, a prerequisite to offering dollar- and euro-pegged crypto tokens in the European Union (EU) under the Markets in Crypto Assets (MiCA) regulatory framework. The license gives the company, whose USDC trails behind rival Tether's market-leading USDT, pole position in grabbing market share among the 27-nation trading bloc's 450 million people. Stablecoins are a key piece of infrastructure in the digital asset market, facilitating trading on exchanges and, increasingly, used for transactions and remittances. Circle's $32 billion USDC is the second-largest stablecoin and the gap to market leader Tether's $110 billion USDT has been widening. Armed with a license from the French banking regulatory authority, Circle Mint France will “onshore” the issuance of its euro-denominated EURC stablecoin to the EU and issue USDC from the same entity, the company said. Before MiCA's stablecoin rules took effect on June 30, some crypto exchanges delisted euro-denominated stablecoins, such as Tether’s EURT. MiCA’s comprehensive stance on stablecoins was catalyzed by the specter of big tech, like Meta's Diem (formerly Libra) initiative, entering financial markets. That prompted five years of concerted policy development in Europe, said Circle’s head of policy, Dante Disparte, who was involved in the Libra project. “Personally, I feel a little bit of a semi-parental relationship with MiCA because in some ways it was accelerated by my prior life and my prior project, Libra Diem,” Disparate said in an interview. “MiCA is both vindicating of the industry and its permanence, but it's also clear that there is no more shortcuts, at least not in the third-largest economy in the world. Gone are the days where you could operate in a regulatory haven or in the shadows and then expect to have liberal and free access to consumers and market participants.” https://www.coindesk.com/business/2024/07/01/stablecoin-issuer-circle-snags-mica-compliant-emi-license-for-europe/

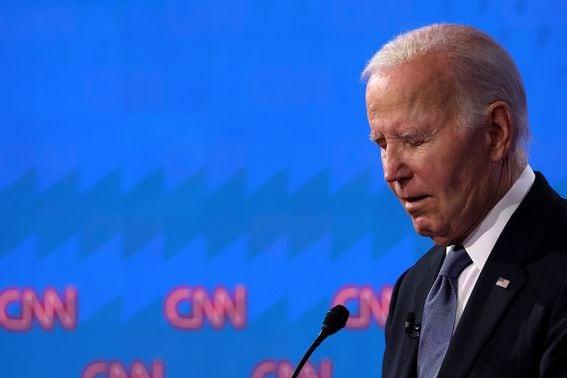

2024-07-01 14:11

President Biden's blunders during last week's debate are the latest factor driving volume on the crypto-based prediction market. This week in prediction markets: Polymarket topped $100 million in volume in June, a record month in the middle of a breakout year for the crypto-based prediction market platform. Biden: Will he stay or will he go? Short term stability for BTC prices, but a dip below $50K is in the cards before a rally to over $75K. "Stranded" astronauts unlikely to depart International Space Station via Boeing ship in late July. Polymarket's volume soared well past $100 million in June, a record month during a breakout year for the crypto-based prediction market platform. A total of $111 million in bets were placed on Polymarket last month, according to Dune Analytics data. It was by far the best month ever for the company, which celebrated its four-year anniversary last month and is riding high on enthusiasm for the November U.S. election. The most recent catalyst is President Joe Biden's performance at last week's presidential debate, an unmitigated disaster. The New York Times' editorial board, usually a source of stalwart support for a Democratic White House, is calling on him to step down. A CBS/YouGov poll says 72% of voters believe Biden does not have the cognitive health to serve as President. Biden's odds of becoming President dropped from 33.5% pre-debate to 18% as of Monday morning U.S. time, with Trump solidifying his lead at 63%. Another contract, this one about the possibility of Biden dropping out of the race entirely, also rocketed off in trading volume post-debate, with "yes" shares hitting 44 cents in the hours after, up from 19 cents prior. Each share pays out $1 (in the USDC stablecoin) if the prediction comes true and zero if not, so the 44 cent price indicated a 44% probability Biden would bow out. A story from NBC that Biden was to spend the weekend with his family at the Mount David Presidential retreat to discuss the future of his campaign pushed the odds up to 50%. Those odds leveled out to just over 40% as of Monday morning U.S. time as over the weekend the White House pushed back on reports, saying the trip was pre-planned. For his part, President Biden is adamant that he will remain in the race. “I understand the concern after the debate. I get it,” NPR quoted the President as saying to a room full of donors. “I didn’t have a great night. But I’m going to be fighting harder and going to need you with me to get it done.” The contract has attracted serious political bettors, with the largest holders on both sides of the digital aisle largely betting on politics-themed markets. "Therealbatman," the largest No holder, holds $2.9 million in different political contracts, consistently betting that Biden and Trump will win their respective nominations, that Biden will win the popular vote, and that Trump won't win the U.S. Presidential Election. The only exception to Therealbatman's largely political portfolio involves a $50,000 bet that the Eigen token, the native token for the Eigenlayer protocol, won't be transferable before former Binance CEO Changpeng "CZ" Zhao, gets out of prison. On the other side of the aisle, the largest holder of the "yes" side of the Biden drop-out contract, an anonymous user only known by his or her Ethereum wallet address, holds a $184,000 position on Biden's fate, as well as a $6,200 stake that Michelle Obama will with the Democratic nomination. This user also has a $9,700 bet that longshot independent candidate Robert F. Kennedy Jr. will win the presidential election, which is currently trading at 2 cents. Bitcoin price predictions Traders on prediction markets have mixed opinions on where the price of bitcoin is going. In the short term: stability. A Polymarket contract gives bitcoin a 78% chance of being above $61,000 by July 5. For reference, CoinDesk Indices data had bitcoin trading above $63,300 for most of the Monday business day in Asia, a marked recovery from its tests below $60,000 as last week began. CoinDesk Indices' Bitcoin Trend Indicator notes that the world's largest digital asset is in a period of "significant downtrend." Here's where things start to get complicated. The markets "tea leaves" that bettors are trying to read put us in for a correction before a rally that might test BTC's all-time high. First, one contract on the U.S.-regulated Kalshi platform projects a 65% chance of bitcoin dipping below $50,000 by the end of 2024 and a 22% chance of it reaching below $40,000. At the same time, another contract projects a 70% chance of BTC hitting $75,000 or above by the end of the year. Unlike Polymarket, which does business almost everywhere except the U.S., Kalshi is U.S.-only, and its bets are settled in dollars. There are a couple of indicators that the market expects bitcoin's price to be challenged by continued dollar strength. This will certainly subside once the Federal Reserve begins to cut rates, which bettors are almost certain will happen by the last quarter. Stranded in space Boeing has had a tough time on Earth and its troubles seem to have extended past the confines of the planet. The troubled aerospace giant's first space capsule is stuck at the International Space Station (ISS) after helium leaks and thruster issues have kept it docked without a definite return date. Starliner's trip was supposed to conclude on June 13. Bettors think that the astronauts will be on the ISS for some time longer, with a Polymarket contract giving only an 11% chance of the astronauts departing on the Starliner by July 21. The market's fine print says that the astronauts must depart on Boeing's Starliner. A rescue vessel from SpaceX or Russia won't count. Nor does it specify that the astronauts would have to safely return to Earth. https://www.coindesk.com/news-analysis/2024/07/01/bidens-blunder-ignites-trading-frenzy-on-polymarket/

2024-07-01 10:55

The new parliament is likely to be more polarised between left and right wings, making crypto policy development uncertain and difficult, said Mark Foster, the EU policy lead at the Crypto Council for Innovation. National Rally, the far-right party associated with Marine Le Pen, won the first round of France's two-part election. The second, and final, round of votes will be held on July 7. Marine Le Pen's far-right National Rally (RN) party led voting after the first round of France's surprise general election on Sunday, Ministry of Interior data showed. The party, founded by Le Pen's father Jean-Marie Le Pen, secured about 19% of the registered vote according to the provisional data. The opposition Union of the Left came second with 18.19% and Ensemble, which includes President Emmanuel Macron's Renaissance party, followed with 13.02%. The results echo RN's victory in the European Parliament elections, which prompted Macron to call the election at short notice. Regardless of who wins, Macron has said he does not plan to resign. However, if his party fails to secure the 289-seat majority, this could make passing legislation harder. "It's difficult to say what will happen next week, but what’s clear is that Macron’s gamble seems at this stage to have backfired," Mark Foster, the EU policy lead at the Crypto Council for Innovation, told CoinDesk in a statement. "He had hoped that RN would not do as well in legislative elections as in the European ones, but they actually got a higher score. It looks like the new parliament will have much larger far left and far right contingents, making domestic policy development (including on crypto/digital assets) uncertain and difficult whilst limiting the president’s authority on international and European stages." National Rally, now led by Jordan Bardella while former leader Marine Le Pen heads the parliamentary party, wants to cut funding to the European Union, reduce immigration, remove the right to citizenship by birth and expel foreign offenders. According to Brittanica.com, it has been accused of fostering xenophobia and anti-Semitism. The first round of the election eliminates anyone that does not score 12.5% of the locally registered vote. The second round, which will be held on July 7, is a choice among whoever remains in each constituency. The nation has already made significant progress with crypto. Last year, France registered 74 crypto companies, a number that was expected to jump to 100, and regulators have been trying to attract more. The Markets in Crypto Asset legislation, the European Union's wide-ranging crypto package, which includes measures for stablecoins, passed last year. The stablecoin rules have already come into effect while the rest of the legislation is expected to come into force by the end of the year. France has already enforced its own rules for the sector, something that is expected to give it a head start when it comes to implementing MiCA. https://www.coindesk.com/policy/2024/07/01/marine-le-pens-far-right-national-rally-party-leads-in-first-round-of-french-election/

2024-07-01 10:11

The Japanese investment adviser said it acquired more than 20.2 BTC. Metaplanet spent $1.2 million to buy more than 20.2 BTC as part of its strategy to build up holdings of the world's largest cryptocurrency by market cap. The investment is part of its strategy, announced a week ago, of buying another $6 million worth of BTC. Metaplanet (3350), a publicly listed Japanese investment adviser, said it bought more than 20.2 bitcoin (BTC) as part of a $6 million strategy to boost BTC holdings in its treasury. In a statement on its website, the Tokyo-based company said it bought 200 million yen ($1.2 million) worth of bitcoin, taking its total holdings to 161.3 BTC. It posted a statement about the purchase to its account on social media platform X shortly after the close of trading on the Tokyo Stock Exchange. A week ago, the company said it planned to increase its bitcoin holdings by buying an additional $6 million worth of BTC. At the time, it already owned $9 million worth of the world's largest cryptocurrency by market cap. The focus on bitcoin was engendered by changes in the investment environment resulting from the Covid pandemic, according to the Metaplanet website. The bitcoin-accumulation strategy mirrors the approach taken by Tysons Corner, Virginia-based software developer MicroStrategy, which has been buying BTC for almost four years and now owns over 226,000 BTC, more than 1% of the entire number of bitcoin that will ever be issued. Metaplanet shares rose 1% before the announcement. CORRECTION (July 1, 10:53 UTC): Corrects number of bitcoin held by MicroStrategy in penultimate paragraph. https://www.coindesk.com/business/2024/07/01/metaplanet-buys-another-12m-worth-of-bitcoin-as-investment-strategy-progresses/

2024-07-01 08:00

The service will provide corporates, family offices and non-profits with a range of digital asset treasury management solutions. Abra has launched a treasury service for companies that want to hold bitcoin on their balance sheet as a reserve asset. The integrated offering combines custody, trading, borrowing, and yield services through separately managed accounts. Abra, the digital asset prime services and wealth management platform, has launched Abra Treasury, a service for corporates that want to hold crypto on their balance sheet as a reserve asset, the company said in a press release on Monday. The service will be operated by Abra Capital Management, which is an SEC-registered investment advisor, and will provide corporates, family offices, and non-profits with a range of digital asset treasury management solutions. Abra Treasury’s offering combines custody, trading, borrowing, and yield services and clients can hold their crypto in separately managed clients, allowing them to retain title and ownership over their digital assets, the company said. The current uncertain macro environment, characterized by higher inflationary pressures and rising geopolitical tension, has forced some corporate treasurers to consider adding bitcoin (BTC) as a reserve asset to their balance sheets. MicroStrategy (MSTR) is the largest corporate holder of bitcoin, with a stash of 226,331 tokens. The Nasdaq-listed software firm led by Michael Saylor started accumulating the oldest cryptocurrency in 2020. “A sign of adoption and institutionalization of the digital asset industry has been the increase in non-crypto-native businesses showing interest in using bitcoin as a treasury reserve asset,” said Marissa Kim, head of asset management at Abra Capital Management. “We are increasingly seeing clients that are business owners and CEOs of small to medium-sized businesses (SMBs), in particular real estate companies, with interest in buying BTC for their treasury or borrowing against BTC to finance business needs or real estate projects, which we did not see last cycle,” Kim said in the release. Abra and its founder and CEO William “Bill” Barhydt settled with 25 state financial regulators for operating its mobile application without the proper licenses, according to an announcement on Wednesday from the Conference of State Bank Supervisors (CSBS). Under the terms of the settlement agreement, Abra will return up to $82.1 million in crypto to U.S. customers in the settling states. https://www.coindesk.com/business/2024/07/01/abra-launches-treasury-service-for-corporates-that-want-to-hold-crypto/

2024-07-01 06:45

Short-term holders wallets sitting on loss may liquidate holdings near $65,000, capping a renewed upswing in bitcoin's price. Short-term holder wallets are in the red and may liquidate near their breakeven level at $65,000. Long-term holder wallets, with average cost of less than $20,000, are incentivized to hold or boost their coin stash. As bitcoin (BTC) looks to recover from the July loss, new challenges loom, with onchain data suggesting a potential resistance at $65,000. The leading cryptocurrency by market value traded nearly 1% higher at $63,200 as of writing, looking to regain some poise after ending June with a 7% loss. June's drop, which reversed May's upswing, mainly occurred due to miner selling and concerns that ETF inflows represent non-directional arbitrage bets instead of outright bullish bets. Notably, the decline has pushed prices well below the widely tracked aggregate cost basis of short-term bitcoin holders, or wallets storing cost for 155 days or less. As of writing, the aggregate cost basis for short-term holders was $65,000, according to data source LookIntoBitcoin. Onchain analytics firms consider realized price as the aggregate cost basis, reflecting the average price at which coins were last spent on-chain. In other words, short-term holders now face losses or hold positions in the red and could attempt to exit the market at a loss or breakeven, potentially adding to selling pressure near $65,000. "The price of bitcoin has fallen below the aggregate cost basis of short-term holders for the first time since August 2023. In the short-term, we should expect some resistance around the ~$65,000 level as short-term market speculators may look to exit their positions at a 'breakeven' level," analysts at Blockware Intelligence said in the latest edition of the newsletter. "Last summer when BTC lost the STH RP [realized price] support level, price traded sideways for another two months before finally breaking out again," analysts added. Meanwhile, long-term holder wallets are strongly incentivized to maintain or boost their coin stash as their average cost is less than $20,000, per LookIntoBitcoin. Yes, you read it right; their average cost basis is nearly 70% less than the BTC's going market price. Besides, bitcoin's 15% price pullback from the record high of over $73,500 in March may appear substantial for a traditional market investor, but is a normal bull market correction for a long-term crypto holder. "During the 2017 cycle BTC had 10 drawdowns of 20% or more. This is a normal, healthy, bull market correction. Bitcoin’s price volatility shakes out weak hands and provides opportunities for strategic capital deployment to those with a longer time horizon," Blockware said. https://www.coindesk.com/markets/2024/07/01/bitcoins-potential-rebound-may-face-resistance-at-65k-onchain-analysis-shows/