2024-06-24 15:29

The funding came from Coatue Management, which is also an investor in CoreWeave, a cloud-computing firm looking to take over miner Core Scientific. Coatue Management is investing $150 million in crypto miner Hut 8 to build AI-related infrastructures The deal benefited HUT's shares as well as other bitcoin mining-related data-center stocks such as SHLN, APLD. Coatue is also behind CoreWeave, a cloud-computing firm that is looking to buy Hut 8 rival Core Scientific. The thirst for power by Artificial intelligence (AI) firms is unrelenting, and bitcoin (BTC) miners are cashing in. Bitcoin miner Hut 8 (HUT) shares outperformed most peers on Monday after the Miami-based company received a $150 million investment from Coatue Management to build artificial intelligence (AI) infrastructure. The funding will be through convertible notes with an 8% annual interest rate and a conversion rate of $16.395 per share, according to a statement. Hut 8 shares rose almost 4% in Monday morning trading. Most of the company's peers are following BTC lower. The investment provided a boost for other bitcoin mining-related data centers that also service AI and high-performance computing (HPC) on Monday. Soluna Holdings (SLNH) surged nearly 17% and Applied Digital (APLD) added about 10%. AI and HPC firms are increasingly looking to the bitcoin mining industry to secure their need for computing power. The miners often already have the computing capacity and the deals with power suppliers that AI and HPC hanker after. In fact, JPMorgan said that the demand for power by large-scale data centers and AI firms could start a new era of mergers and acquisitions for bitcoin miners with attractive power contracts. Most recently, cloud computing provider CoreWeave signed a 200 megawatt (MW) deal with miner Core Scientific (CORZ) for AI-related services and offered to buy the whole company for more than $1 billion. Core rejected the takeover, saying it undervalued the company. Interestingly, Coatue Management is one of the investors in CoreWeave, underlining the level of interest in utilizing bitcoin miners' current infrastructure to power AI-related services. Hut 8 reaffirmed this need for power in Monday's press release. "Many traditional data center operators are failing to meet the surging demand for AI compute capacity due to power shortages, long lead times to bring new capacity online, and the extensive upgrades required for existing data centers to support the latest generation of high-density compute," it said. That's a gap Hut 8 says it can help narrow. https://www.coindesk.com/business/2024/06/24/hut-8-receives-150m-investment-as-thirst-for-energy-brings-ai-firms-to-bitcoin-miners/

2024-06-24 14:48

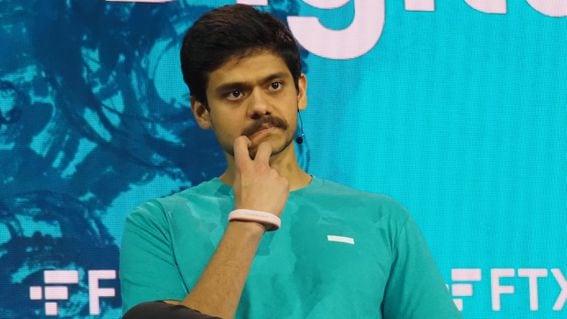

The Wormhole hack and Terra/Luna blowup happened while he ran Jump's crypto operation. Kanav Kariya, who ascended from intern to the head of cryptocurrencies at Chicago-based trading heavyweight Jump Trading by the age of 25, has left the company. The news follows a Fortune report last week that the U.S. Commodity Futures Trading Commission is investigating the company's crypto dealings. Kariya posted on X Monday that he's exiting today, "a moment I'm receiving with both a heavy heart and great excitement about the road ahead." His appointment as president was announced in 2021. The company faced a series of setbacks in the aftermath. The Wormhole cryptocurrency bridge that Jump backed was hacked in early 2022 to the tune of more than $300 million, prompting Jump to replenish losses out of its own pocket. And then Do Kwon's Terra/Luna project blew up, leading to criminal charges again Kwon. U.S. officials say Jump earned more than $1 billion from that ecosystem before it fell apart. He was just 25 when he got the president job at Jump Crypto. Now, in his late 20s, "I plan to stay engaged with the portfolio companies I've been most involved with and hopefully take some time to process the unbelievably eventful few years we've had," he said on X Monday. https://www.coindesk.com/business/2024/06/24/jumps-kariya-who-went-from-intern-to-crypto-leader-is-leaving-trading-giant/

2024-06-24 14:09

Riot is Bitfarms' largest shareholder, owning 14.9% of the firm. Bitcoin miner Riot Platforms (RIOT) dropped its proposal to buy peer Bitfarms (BITF) and is looking to overhaul the board before engaging in further takeover attempts. "Over the course of more than a year of attempting to engage constructively with the Bitfarms Board regarding a potential combination of Bitfarms and Riot, it has become evident to Riot that good faith negotiations simply will not be possible until there is real change in the Bitfarms boardroom," Riot said in a press release on Monday. The miner is nominating John Delaney, Amy Freedman and Ralph Goehring to replace the current Bitfarms board members. Riot, which became Bitfarms' largest shareholder and owns 14.9% of the company, called for a special meeting to remove Bitfarms' Chairman and interim CEO Nicolas Bonta, director Andrés Finkielsztain and anyone who might fill the vacancy created by the resignation of co-founder Emiliano Grodzki. Riot will also look to remove any additional director appointed by the current board of Bitfarms after today. The hostile takeover bid became public last month after Riot offered to buy Bitfarms for $2.30 per share, an approach that was swiftly rejected. Riot continued to buy its rival's shares to exert pressure on the board to engage with the miner. Subsequently, BItfarms implemented a shareholder rights plan or "poison pill" to deter Riot from buying the company. Riot said it will continue pursuing a takeover because a combination would create the world's largest publicly listed bitcoin miner that is "well positioned for long-term growth." Bitfarms shares fell more than 6% on Monday, although the stock is trading above its $2.30 per share buyout offer, implying the traders still see BITF as a potential takeover target. Riot shares were slightly down as bitcoin fell 3% in the last 24 hours. https://www.coindesk.com/business/2024/06/24/bitcoin-miner-riot-platforms-ditches-bitfarms-takeover-bid-seeks-to-overhaul-board/

2024-06-24 09:46

Permission-based repo ledgers are among the most successful applications of blockchain technology. Financial technology consultancy Broadridge says it handles $50 billion a day of repurchase agreements involving big banks on its permission-only DLR platform. Europe-focused securities finance private blockchain firm HQLAx says its platform can save banks as much as 100 million euros ($107 million) a year. The multitrillion-dollar repo market is the lifeblood of funding in capital markets. Tokenization enthusiasts in both crypto and traditional finance might be surprised to hear that well over $1.5 trillion worth of repurchase agreements and other forms of securities financing are executed monthly using private blockchains. While this is a sliver of a highly fragmented, multitrillion-dollar market, these private blockchain loops are being employed at a decent scale by many of the world’s biggest banks and institutions, easily dwarfing the much-hyped tokenization of real-world assets (RWA) associated with open chains like Ethereum. Indeed, it could be argued these permission-based, under-the-radar repo ledgers are some of the most successful applications of blockchain technology in existence because repo – where cash is borrowed against securities, often highly liquid Treasuries, with an agreed buy-back date and price – is the lifeblood of funding in capital markets. Wall Street titans like JPMorgan and Goldman Sachs are reluctant to share specific data when it comes to areas like repo trading. JPMorgan reportedly processes up to $2 billion of transactions a day on its Onyx blockchain, which allows its clients to “settle repo transactions worth billions of dollars within minutes, using smart contracts to tokenize and deliver cash and collateral on a single ledger,” Nikhil Sharma, head of growth at Onyx Digital Assets, said in an email. There’s more visibility into the hundreds of billions in live repo transactions some of the systemically important banks are aggregating on tech consultancy Broadridge’s Distributed Ledger Repo (DLR) platform, which handles $50 billion in repo volume a day and is used by the likes of Societe Generale, UBS, HSBC and Chicago-based trading giant DRW. Another prominent player is Europe-focused HQLAx (the acronym is for high-quality liquid assets). Interoperability everywhere As well as clocking up significant volume, these platforms are also building cross-chain interoperability and integrating bank-grade cash settlement tokens. Last week, HQLAx, which is built using R3’s enterprise-grade Corda ledger and includes HSBC, BNY Mellon and Goldman on its platform, completed a delivery versus payment (DvP) repo settlement with London-based startup Fnality, a provider of institutional-grade digital cash built on a permissioned version of Ethereum. Last month, Broadridge’s DLR, built using Canton Protocol, a smart-contract ledger created by Digital Asset, became interoperable with JPMorgan’s JPM Coin, which also runs on a privacy-focused fork of Ethereum. DLR is also used Commerzbank, with more banks soon to be named. “Working with JPM Coin, on the cash side, is probably the largest digital-cash initiative in the world, and we are probably the largest collateral initiative in the world,” said Horacio Barakat, head of digital innovation at Broadridge, in an interview. “So working together towards that interoperability is very important.” Goldman Sachs' global head of digital assets, Mathew McDermott, points to inefficiencies in conventional repo and securities lending markets brought about by years of layering and fragmentation. “DLT has the potential to significantly improve existing processes and create new markets like intraday repo and intraday FX so it's fantastic to see the success of platforms such as Broadridge’s DLR and HQLAx as they continue to grow and scale," McDermott said in an email, using an acronym of digital ledger technology. ‘Spaghetti mess’ To those involved in securities financing, blockchain has always looked like a killer application. An “incredible spaghetti mess” is how HQLAx CEO Guido Stroemer describes the vast tangle of securities that need to be physically moved around so big banks can meet their collateral obligations. This complexity leads to banks buying expensive excess collateral buffers, dealing with occasional settlement failures and time lags that result in intraday counterparty credit exposure. “We believe that relieving those headwinds can save banks between 50 million euros ($54 million) and 100 million euros per year, and we actually think that’s conservative,” Stroemer said in an interview. “We can enable the banking industry to transfer ownership of securities to the collateral obligation of choice, without actually moving them from the custody locations where they are.” Stroemer expects HQLAx volumes to reach into the high tens of billions by the end of the year. “We have a very strong pipeline of volumes that institutions are planning on putting on the platform. Over time, we expect to have a market share of roughly 400 billion euros to 500 billion euros of activity that stays on the platform,” he said. Gateway drug? Given that tokenization is firmly entrenched in the crypto mindset, it will be interesting to see how these closed loops feed into the public blockchain meets TradFi narrative. Although it primarily flies under the radar, Broadridge’s intraday repo business may have the best product market fit in all of the tokenization space, said Rob Hadick, general partner at VC firm Dragonfly. “These types of on-chain products are going to become the norm for Wall Street," Hadick said in an interview. "That said, it’s unclear how this might translate into any value accrual for public chains and the broader crypto economy. There’s an argument that it could be a ‘gateway drug,’ so-to-speak, but that requires a lot of belief.” Yes, there could be a transformative scenario where native securities are issued on a public network and settled with open digitized cash, said Broadridge’s Barakat. But, he said, that requires regulatory changes, and there's the natural risk aversion that comes with incorporating new technology, particularly something as disruptive as using a public blockchain for transacting repo. “If you wait for that to happen, then you miss out on a lot of the immediate opportunities that are there today, which is where private and semi-private networks are popping up,” Barakat said. https://www.coindesk.com/business/2024/06/24/dont-tell-anyone-but-private-blockchains-handle-over-15t-of-securities-financing-a-month/

2024-06-24 09:43

Call buyers are implicitly bullish on the market. A ton of buying activity observed in ether $4,000 calls expiring in September. The bullish flow is consistent with elevated volatility expectations. Catching a falling knife is risky, but some crypto options traders look to be doing just that, betting on a bullish outcome in a falling market. Ethereum's native token ether (ETH), the second-largest cryptocurrency by market value, has dropped over 5% to $3,350 in one week, according to CoinDesk data. The decline follows speculation that ether ETFs could begin trading in the U.S. next month and is consistent with weakness in market leader bitcoin and other alternative cryptocurrencies. Still, according to Amberdata data, some traders have been buying large numbers of ether September expiry call options at the strike level of $4,000 on crypto exchange Deribit. A call option is a derivative contract that gives the holder the right to buy the underlying asset at a specified price within a predetermined time frame. When traders purchase call options, they do so with the expectation that the price of the underlying asset will rise above the strike price, that is, $4,000 in this case, before the expiry of the option. "Looking at the block flows this week, we see a ton of buying activity for the September $4,000 calls," Greg Magadini, director of derivatives at Amberdata, said, adding it is a sign of traders betting that "if ETH gets above $4k we likely test and breakout new all-time-highs." Block trades are large orders typically negotiated privately between two parties and listed on an exchange. They are commonly preferred by institutional investors, hedge funds, and large market participants. Ether, which came into existence in 2015, set a record price of over $4,800 since November 2021. While BTC surpassed its 2021 early this year, ether only briefly managed to top the $4,000 mark, with the upside relatively restricted due to regulatory uncertainty and low odds of ETH getting a spot ETF listing in the U.S. Since then, the U.S. Securities and Exchange Commission (SEC) has set the stage for a spot ether ETF approval and dropped an investigation into Ethereum 2.0, removing significant regulatory uncertainty from the market. Now, Bloomberg's ETF analyst Eric Balchunas expects ether ETFs to begin trading in the U.S. on July 2. Perhaps traders buying $4,000 calls expect fireworks once the ETFs go live. The bullish flow is consistent with the elevated volatility expectations in the ether market. However, some observers, including JPMorgan, aren't buying the excitement. https://www.coindesk.com/markets/2024/06/24/ether-traders-buy-4k-calls-in-anticipation-of-record-high/

2024-06-24 09:41

The defunct crypto exchange is supposed to return over 140,000 bitcoin to victims of the 2014 hack. Defunct bitcoin exchange Mt. Gox said it will start distributing assets stolen from clients in a 2014 hack in July 2024, after years of postponed deadlines. The repayments will be made in bitcoin and bitcoin cash, and could possibly add selling pressure to both markets. Defunct bitcoin exchange Mt. Gox said Monday it will start to distribute assets stolen from clients in a 2014 hack in the first week of July, years after continually moving deadlines. “The Rehabilitation Trustee has been preparing to make repayments in Bitcoin and Bitcoin Cash under the Rehabilitation Plan,” trustee Nobuaki Kobayashi said in a Monday statement posted on the Mt. Gox website. “The repayments will be made from the beginning of July 2024,” Kobayashi said, adding that due diligence and certain safety steps will be required before the payments go through. The repayments are largely considered to add selling pressure to bitcoin (BTC) markets as early investors will receive assets at a much higher value than their entries before 2013, making them inclined to sell at least a part of holding, traders said. Mt. Gox was once the world’s top crypto exchange, handling over 70% of all bitcoin transactions in its early years. In early 2014, hackers attacked the exchange, resulting in the loss of an estimated 740,000 bitcoin ($15 billion at current prices). The hack was the biggest of the many attacks on the exchange in the years 2010-13. Trustees have put together a repayment plan that has been in the works for several years, and received a deadline of October 2024 from a Tokyo court last year. In May, the exchange moved over 140,000 BTC, worth around $9 billion, from cold wallets to an unknown address in 13 transactions for the first time, marking the first on-chain wallet movements for the first time in five years. Bitcoin prices dropped from over $62,300 in early Asian hours to under $62,100 in the minutes following the release of Mt. Gox’s statement, CoinGecko data shows. https://www.coindesk.com/markets/2024/06/24/mt-gox-to-begin-bitcoin-bitcoin-cash-repayments-in-july/