2024-06-21 15:40

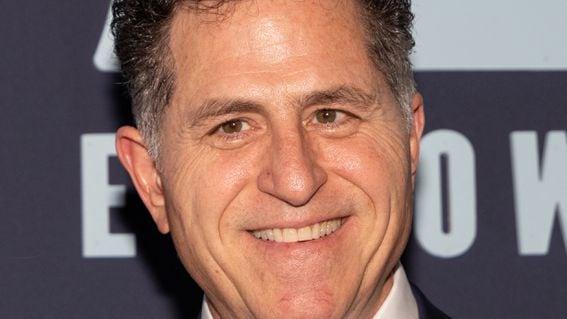

Dell and Saylor engaged in a short back-and-forth on X over the past day. Michael Dell, CEO of $100-billion-plus market cap Dell Technologies (DELL), showed at least some vague interest in bitcoin (BTC), recirculating a BTC-friendly post on X from Bitcoin evangelist Michael Saylor. It started Thursday when Dell posted, "Scarcity creates value." That prompted a reply from Saylor, the executive chairman of MicroStrategy (MSTR), saying, "Bitcoin is Digital Scarcity," which Dell then reposted. The exchange didn't end there, with Dell later posting an image of Sesame Street's Cookie Monster that had been digitally altered (apparently by Saylor) to show the famous children's character gobbling bitcoin instead of cookies. As first CEO and now executive chairman at MicroStrategy, Saylor has not only led that company to its acquisition of 226,331 bitcoin worth $15 billion over the past almost four years (the latest being the acquisition of 11,900 BTC just this week), but he's also evangelized for other corporations to follow suit with their own balance sheets. To this point, only a small number of other companies have seen fit to make bitcoin a part of their treasury strategies, and none to anywhere near the extent of what Saylor has done with MicroStrategy. Per a recent filing, Dell had $34.6 billion of current assets on its balance sheet as of May 3, with $5.8 billion of that in cash and cash equivalents. Bitcoin isn't mentioned. https://www.coindesk.com/business/2024/06/21/billionaire-tech-ceo-michael-dell-signals-bitcoin-interest-via-michael-saylor-retweet/

2024-06-21 13:24

Lame price action has apparently caused crowd sentiment to be in negative territory for four straight weeks, a sign that may spell relief for bulls in the near term. Bitcoin's (BTC) slow bleed lower over the past weeks has sped up Friday, the price dipping more than 3% in the past 24 hours to slide to about a five-week low of $63,700, now lower by 9% over the past month. Contrarian bulls, however, might take comfort as indicators tracked by analysis firm Santiment show that crowd sentiment for BTC is now in its fourth week of “extreme negative” reading. “The crowd is mainly fearful or disinterested toward Bitcoin," the firm said in an X post Friday. "This extended level of FUD is rare, as traders continue to capitulate,” they added. "BTC trader fatigue, combined with whale accumulation, generally leads to bounces that reward the patient." Santiment’s Weighted Sentiment Index measures bitcoin mentions on X and compares the ratio of positive to negative comments and trading volumes to gauge what the crowd is generally feeling about bitcoin. The index, which shows a -0.73 reading as of Friday, has been negative since May 23. Elsewhere, data from Google Trends shows a decline in retail search interest. The tool allows users to compare the relative volume of searches. A line trending downward means that a search term's popularity relative to other popular terms is decreasing. Worldwide searches for “bitcoin” have steadily fallen since March 2024, data shows. BTC prices have generally suffered in the past few weeks amid $1 billion in sales from large holders, dollar strength and a strong U.S. technology index market that may be drawing investor money. Outflow activity from U.S.-listed spot bitcoin exchange-traded funds (ETFs) has also reached its worst since late April, with $900 million leaving the products so far this week. These figures are nearing the $1.2 billion in total net outflows in trading sessions from April 24 to May 2. Some traders expect bitcoin to reach the $60,000 level in the near-term due to the lack of growth catalysts, although the long-term outlook remains bullish, as previously reported. https://www.coindesk.com/markets/2024/06/21/bitcoin-slumps-under-64k-amid-historic-negative-sentiment/

2024-06-21 11:55

Generally, increased liquidity leads to a tighter bid-ask spread, but that's not the case with meme coins. Record liquidity, measured by 1% market depth, suggests ease in executing orders and stable prices. Nevertheless, bid-ask spreads remain elevated, a sign the tokens are still considered relatively risky. Executing trades in prominent meme coins is easier than ever now that liquidity, as measured by 1% market depth, has surged to record highs, according to data tracked by Paris-based Kaiko. The combined figure for DOGE, SHIB, PEPE, WIF, BONK, GROK, BABYDOGE, FLOKI, MEME, HarryPotterObamaSonic10Inu and HarryPotterObamaSonic, recently rose to $128 million, the data shows. The figure describes the total value of buy and sell orders within a 1% range of the current market price. The deeper the liquidity – that is, the higher the figure – the easier it is to execute large orders at stable prices. Generally, increased liquidity leads to a narrower gap between the highest price a buyer is willing to pay and the lowest a seller is willing to accept, the bid-ask spread. Tighter spreads ensure better trading pricing and reduce the cost of executing trades. Meme coins, however, aren't responding, according to Kaiko, and the bid-ask spreads remain above 2 basis points on most centralized exchanges. "This suggests that while more market makers are venturing into providing liquidity for these tokens, they are still considered risky due to their high volatility," Kaiko added. "While part of this increase is related to price appreciations, many small-cap meme tokens such as Dogwifhat (WIF), Memecoin (MEME), or Book of Meme (BOME) have seen significant growth in liquidity in native units, ranging from 200% to 4000%," Kaiko said in a weekly newsletter. https://www.coindesk.com/markets/2024/06/21/meme-coin-liquidity-hits-record-high-even-as-bid-ask-spread-spotlights-risk/

2024-06-21 10:30

The two House members said Tigran Gambaryan is being wrongfully detained and should be freed. Rep. French Hill and Rep. Chrissy Houlahan visited Tigran Gambaryan in Kuje prison. Hill asked the U.S. embassy to advocate for the humanitarian release of the Binance executive. Gambaryan has been detained in Nigeria since February. U.S. lawmakers Rep. French Hill (R-Ark.) and Rep. Chrissy Houlahan (D-Penn.) visited Tigran Gambaryan in a Nigerian prison on Wednesday as the Binance executive remains incarcerated facing money-laundering charges due to his involvement with the crypto exchange. Visiting the country to discuss anti-terrorism efforts,"we also had the opportunity to advocate for an American that's been wrongfully detained by the Nigerian government in the horrible prison that we got to go see, that's called Kuje prison," Hill said in a video posted to his X account on Thursday. Hill said Gambaryan, who has been held since arriving in February for talks with the government, is suffering from malaria and double pneumonia. The executive reported he has lost significant weight and is being denied access to adequate medical attention, Hill said. Shortly after being detained, Gambaryan was moved to the prison, whose inmates include members of the terror group Boko Haram. Another Binance executive held with him has since escaped. "We have a taskforce in Congress that is on Americans wrongfully detained abroad, or held hostage. Clearly in our view, Tigran fits in that camp," Hill said in the video. "We want him home and we can let Binance, his employer, deal with the Nigerians." Hill added that he had asked the U.S. embassy to advocate for the humanitarian release of Gambaryan because of the "horrible conditions in the prison, his innocence and his health." Hill was among the signatories of a June 4 letter to President Joe Biden urging him to work for Gambaryan's release. Two days later, over 100 former prosecutors wrote to Secretary of State Antony Blinken to echo this message, Hill said. Meantime, the trial continues. Yesterday, the cross examination of a witness from the Nigerian Securities and Exchange Commission began. The case continues today. CORRECT (June 21, 12:15 UTC): Removes local media report of request for compensation from fourth paragraph after family says it's incorrect. https://www.coindesk.com/policy/2024/06/21/us-lawmakers-visit-detained-binance-exec-in-nigeria-call-for-release/

2024-06-21 09:40

The new London-based desk will start operations soon and be part of the bank's FX trading unit. Standard Chartered would become one of the first global banks to enter spot cryptocurrency trading. The bank is a backer of digital asset custodian Zodia Custody and its exchange arm Zodia Markets. Standard Chartered (STAN) is establishing a spot trading desk for buying and selling bitcoin and ether. The new London-based desk will start operations soon and be part of the bank's FX trading unit, Standard Chartered told CoinDesk. The news was first reported by Bloomberg, citing people familiar the matter. Standard Chartered would become one of the first global banks to enter spot cryptocurrency trading, though others have been trading crypto derivatives for several years. “We have been working closely with our regulators to support demand from our institutional clients to trade Bitcoin and Ethereum, in line with our strategy to support clients across the wider digital asset ecosystem, from access and custody to tokenization and interoperability,” Standard Chartered said in an emailed statement. The banking giant's involvement in cryptocurrency is now well established, as a backer of digital asset custodian Zodia Custody and its exchange arm Zodia Markets. Read More: Fireblocks, Zodia Markets Partner to Improve Cross-Border Payments https://www.coindesk.com/business/2024/06/21/standard-chartered-is-building-a-spot-btc-eth-trading-desk-bloomberg/

2024-06-21 07:52

Thursday marked the fifth straight day of net outflows for the U.S.-listed ETFs in their worst performance since mid April. Spot bitcoin ETFs in the U.S. experienced their fifth consecutive day of outflows on Thursday, totaling over $900 million in losses for the week. Grayscale's GBTC and Fidelity's FBTC led the outflows, while BlackRock's IBIT was the only ETF to record net inflows. Spot bitcoin (BTC) exchange-traded funds (ETFs) listed in the U.S. recorded their fifth-straight day of outflows on Thursday, losing over $900 million so far this week. Data tracked by SoSoValue shows that the 11 listed ETFs lost $140 million on Thursday, with $1.1 billion in trading volumes. Grayscale’s GBTC – which has mostly seen outflows since its conversion to an ETF in January – led outflows at $53 million followed by Fidelity’s FBTC at $51 million. BlackRock’s IBIT, the biggest ETF by assets held, was the only product that recorded net inflows at $1 million. Other products saw zero net inflow or outflow activity. Such outflow activity is the worst since late April, which saw $1.2 billion in total net outflows in trading sessions from April 24 to May 2. Inflows since picked up and saw the products add more than $4 billion in the next 19 days of trading – before the ongoing outflow deluge started on June 10. BTC prices have generally suffered in the past few weeks amid $1 billion in sales from large holders, dollar strength and a strong U.S. technology index market. https://www.coindesk.com/markets/2024/06/21/bitcoin-etfs-record-900m-in-net-outflows-this-week/