2024-06-21 06:28

Demand for BTC calls at $100K suggests traders preparing for a renewed rally into 2025, according to one trading firm. Options market shows bias for calls even as BTC's price continues to drop. Demand for calls at $100K suggests traders preparing for a renewed rally into 2025, according to one trading firm. Crypto options traders are strategically placing bets that diverge from the ongoing downtrend in bitcoin's (BTC) price. In the past 24 hours, the leading cryptocurrency by market value has declined over 1% to $64,500, extending the pullback from recent highs near $72,000, CoinDesk data show. Still, the flow in bitcoin options listed on leading exchange Deribit has been biased toward call options at levels (strikes) well above the cryptocurrency's going market rate, perhaps a sign sophisticated investors expect the ongoing price weakness to set the stage for a more extensive run higher. In the options market, we observed an abnormally large buying flow of Dec and Mar [expiry] $90-$100K calls in the last 24 hours. We believe this suggests the market is calling the bottom and positioning itself for a sustained rally, possibly last into 2025," Singapore-based QCP Capital said in a market update. A call option gives the purchaser the right but not the obligation to buy the underlying asset, BTC, at a predetermined price at a later date. A call buyer is implicitly bullish on the market. The chart shows the most active bitcoin options on Deribit over the past 24 hours. The activity has been mostly concentrated in June expiry calls at $65,000, $68,000, and $70,000, July expiry call at $110,000 and December expiry call at $95,000. The divergence in options market sentiment and bitcoin's price is more strongly evident in the call-put skew, which indicates what traders are willing to pay to acquire an asymmetric payout in the upward or downward direction. Per Amberdata, the one-, two-, three-, and six-month skews have held consistently positive through the recent BTC price pullback, suggesting a bias for calls or upside. Only the seven-day skew has flipped negative, signaling demand for downside protection. Bitcoin has decoupled from Nasdaq's uptrend in recent weeks, largely due to long-term holders and miners selling coins and growing chatter about the non-directional nature of the ETF inflows. On Thursday, the German government moved BTC worth $425 million to some cryptocurrency, likely with the intention of selling. https://www.coindesk.com/markets/2024/06/21/bitcoin-options-market-isnt-buying-btc-price-weakness-shows-bias-for-100k-calls/

2024-06-20 21:56

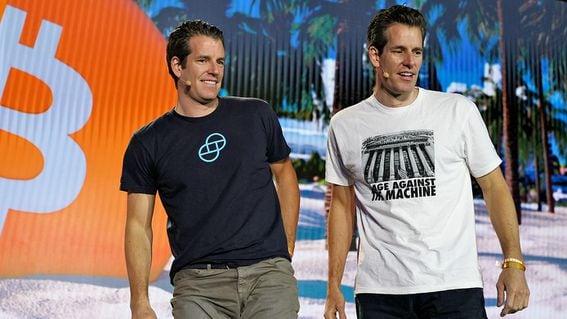

The Winklevoss brothers have become two of the first big-name crypto CEOs to cross the campaign-contribution barrier that had kept big-time donations from the presidential race. Tyler and Cameron Winklevoss, the executives atop Gemini, gave $1 million each to the campaign of former President Donald Trump, the two announced on X. The two had already been major donors for 2024 U.S. campaigns, each previously giving about $2.7 million, mostly to the industry's super PAC, Fairshake. Gemini CEO Tyler and his twin brother Cameron Winklevoss, the company's president, have made two of the first major presidential contributions from prominent crypto executives, favoring former President Donald Trump with $1 million each in support, Tyler explained Thursday in a extensive posting on X. "Over the past few years, the Biden Administration has openly declared war against crypto," Winklevoss began in the lengthy case against President Joe Biden's administration. "It has weaponized multiple government agencies to bully, harass, and sue the good actors in our industry in an effort to destroy it." Gemini was targeted last year in a U.S. Securities and Exchange Commission case that accused the exchange of offering unregistered securities, which Tyler Winklevoss called at the time a "manufactured parking ticket." His explanation for supporting Trump was much more about opposing Biden. "President Donald J. Trump is the pro-Bitcoin, pro-crypto, and pro-business choice," he concluded. Tyler Winklevoss said he used Trump's recently established willingness to take crypto contributions and gave his contribution in the form of 15.47 bitcoin, and his brother posted later that he'd done the same. The money goes to the Trump 47 Committee Inc., according to a spokeswoman. That's a "joint fundraising committee" which may divide the amount to comply with legal limits for campaign contributions, meaning the money could be spread across a longer list of Republican benefactors. The brothers have – all along – donated matching amounts to U.S. election efforts. It was already a large sum that placed them among the major individual contributors in the 2024 campaigns. Before today, the two had given a total of about $2.7 million each, according to Federal Election Commission disclosures. On the presidential level, they'd already backed most of the prominent contenders that had tried earlier to yank the Republican nomination out from under Trump: Vivek Ramaswamy, Nikki Haley, Sen. Tim Scott and Florida Gov. Ron Desantis. The bulk of their donations, however, have been to the industry's main political action committee (PAC), Fairshake. Their combined $5 million represents a small but significant share of the Fairshake super PAC contributions that have now almost reached $169 million. That money has been devoted to buying outside ads for congressional candidates in the hope of loading Congress with crypto supporters. The Winklevoss donations to Trump 47 join similar maxed-out contributions from Jeffrey Sprecher, the founder, chairman, and CEO of Intercontinental Exchange, and his wife Kelly Lynn Loeffler, a former U.S. senator and CEO of Bakkt; Joe Ricketts, the founder and former CEO of TD Ameritrade; and Robert Bigelow, who owns Budget Suites of America and founded the now-defunct Bigelow Aerospace. Nikhilesh De contributed reporting. Read More: Jump Crypto Adds $10M to Industry's U.S. Political War Chest, Raising PAC to $169M https://www.coindesk.com/policy/2024/06/20/winklevoss-twins-say-they-each-gave-1-million-to-trump-presidential-campaign/

2024-06-20 21:28

U.S. District Court Judge Phyllis Hamilton dismissed all four of the class action claims against Ripple but will allow one state law claim to proceed to trial. A civil lawsuit on a securities claim against Ripple CEO Brad Garlinghouse will proceed to trial in California. A judge dismissed several other claims made in the lawsuit. A California judge has ruled that a civil securities lawsuit against Ripple will proceed to trial, denying in part the crypto firm’s motion for summary judgment in a suit alleging that Ripple’s CEO violated state securities laws in 2017. A jury will hear arguments on whether Ripple CEO Brad Garlinghouse made “misleading statements” in connection with the sale of securities in a 2017 televised interview. The other four claims in the class action securities lawsuit – the so-called “failure to register claims” – were tossed out on Thursday by Judge Phyllis Hamilton of the U.S. District Court for the Northern District of California. “We are pleased that the California court dismissed all class action claims. The one individual state law claim that survived will be dealt with at trial,” said Ripple’s Chief Legal Officer Stu Alderoty in an emailed statement. The plaintiff has alleged that Garlinghouse violated California’s securities laws by professing to be “very, very long XRP” while simultaneously selling “millions of XRP on various cryptocurrency exchanges” throughout 2017. According to court documents, Ripple’s lawyers argued that the claim should be tossed because XRP doesn’t meet the definition of a security under the Howey Test and “thus cannot give rise to a claim for misleading statements in connection with a security.” In her Thursday ruling, Hamilton said that Ripple’s lawyers urged her to “follow the reasoning” of U.S. District Court Judge Analisa Torres who, in a parallel case in the Southern District of New York (SDNY), ruled that XRP did not meet all the prongs of the Howey Test when sold directly to retail participants on crypto exchanges. Torres’ ruling constituted a partial victory for Ripple, and was celebrated by many in the crypto industry as a step in the right direction for long-awaited regulatory clarity, as well as a potential precedent for other crypto securities cases. But Torres’ ruling hasn’t seemed to have as much sway as hopefuls once thought it might. Last year, Torres’ colleague in the SDNY, District Judge Jed Rakoff, rejected her ruling in a separate case brought by the U.S. Securities and Exchange Commission (SEC) against Singaporean crypto firm Terraform Labs. Hamilton, in her Thursday ruling, also broke with Torres’ legal opinion that that XRP sold to “programmatic” (meaning non-institutional) traders was not a security because those traders had no expectation of profits due to the efforts of others, one of the four prongs of the Howey Test. “The court declines to find as a matter of law that a reasonable investor would have derived any expectation of profit from general cryptocurrency market trends, as opposed to Ripple’s efforts to facilitate XRP’s use in cross-border payments, among other things,” Hamilton wrote. “Accordingly, the [court] cannot find as a matter of law that Ripple’s conduct would not have led a reasonable investor to have an expectation of profit due to the efforts of others.” In his statement, Alderoty added that Torres’ ruling in the SEC case “still stands.” “Nothing here disturbs that decision,” Alderoty wrote. https://www.coindesk.com/policy/2024/06/20/california-judge-breaks-with-new-york-counterpart-sends-ripple-securities-lawsuit-to-trial/

2024-06-20 12:29

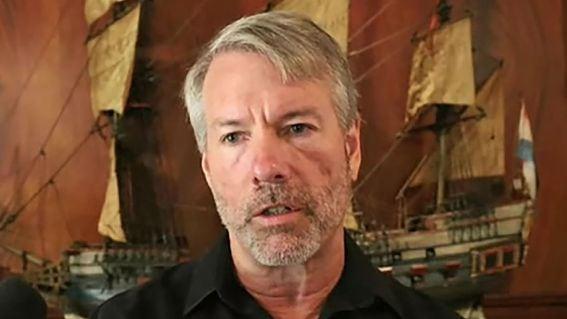

The company now holds 226,331 bitcoins worth just shy of $15 billion. Nasdaq-listed software firm MicroStrategy (MSTR), the largest corporate holder of bitcoin (BTC), has acquired another 11,931 BTC for $786 million, according to a Thursday morning press release. Led by Executive Chairman Michael Saylor, the company as of the end of April held 214,400 bitcoins. This latest acquisition brings the company's total holdings to 226,331 tokens worth just under $15 billion at bitcoin's current price of roughly $66,000. The company's bitcoins were purchased at an average price of $36,798 each, or roughly $8.33 billion. This most recent purchase followed the company's $800 million convertible note offering to institutional investors. That offering size was originally to be for $500, then raised to $700M and finally closed at $800M. In March, the company added 9,245 BTC for $623 million after raising money in a similar debt issuance. Saylor and MicroStrategy started accumulating the largest and oldest cryptocurrency in 2020 and since have attempted to spearhead a movement to adopt BTC as a reserve asset for other corporate treasuries. While a handful of companies have added modest amounts of bitcoin to their balance sheet, of particular note is U.S.-listed Semler Scientific (SMLR), which over the past three weeks has not only added bitcoin as a relatively sizable treasury asset, but – in similar fashion to MicroStrategy – is attempting to tap capital markets to buy bitcoin in amounts far larger than what its current market cap might indicate. MicroStrategy shares have risen roughly ten-fold since the firm's bitcoin purchases began four years ago. Semler shares are higher by more than 60% since the company disclosed its first bitcoin buys in late May. Last week, brokerage firm Bernstein initiated coverage of Microstrategy, setting a $2,890 price target for the company's shares with an outperform rating. MSTR is currently up 2% premarket to $1,507. https://www.coindesk.com/business/2024/06/20/michael-saylors-microstrategy-acquires-119k-more-bitcoin-for-786m/

2024-06-20 11:56

The donations appear to be mandatory and the LayerZero Foundation will match proceeds upto $10 million. LayerZero's ZRO token airdrop requires recipients to donate 10 cents worth of ether (ETH) or a stablecoin for each token they wish to claim. This "proof-of-donation" mechanism is a unique approach in the crypto community, where donations are usually voluntary, and has received mixed reactions from users. LayerZero’s newly introduced ZRO token, which will go live on Thursday, requires claimants to pay 10 cents worth of ether (ETH) or a stablecoin for each token they want to unlock from their airdrop kitty. “By donating to Protocol Guild, eligible recipients show long-term alignment with the LayerZero protocol and a commitment to the future of crypto,” LayerZero said in an X post. “To claim ZRO, users must donate $0.10 in USDC, USDT, or native ETH per ZRO. This small donation goes directly to the Protocol Guild.” “The LayerZero Foundation is matching all donations up to $10 million,” it added. The so-called “proof-of-donation” mechanism is the first time a project is asking users to donate a small amount of money to claim tokens. While crypto donations are commonplace and appreciated among developers in the market, they are usually not mandated or placed as a requirement upon users – especially for an airdrop. Early reactions in the crypto community were mixed. Some users expressed their disagreement with the move, while others stated it would help support development. Airdrops refer to the distribution of tokens to project users, usually based on their interaction with that blockchain or usage of related products. LayerZero is one of the most-anticipated and high-profile airdrops for 2024, with 85 million ZRO set to be available for distribution on Thursday. Over 50% of the supply has been earmarked for investors and core contributors subject to a three-year vesting period with a one-year lock and a monthly unlock over the following two years. Meanwhile, ZRO trades at $4.27 in pre-market futures trading ahead of its Thursday launch. The token is scheduled to go live for trading on crypto exchanges such as Binance at noon UTC. https://www.coindesk.com/markets/2024/06/20/layerzero-says-users-must-pay-10-cents-per-zro-to-claim-token/

2024-06-20 11:46

Stablecoin issuers are fast emerging as a significant source of demand for the U.S. Treasury notes as concerns about Washington's debt management grow. Stablecoin issuers are the world's 18th biggest holders of U.S. debt. Of the many crypto bills in the U.S. political corridors, stablecoin legislation has been the closest to moving past the U.S. Congress to become law. Stablecoin issuers are fast emerging as a significant source of demand for the U.S. Treasury notes as concerns about Washington's debt management grow. 'According to data tracked by Tagus Capital, issuers now cumulatively hold more than $120 billion in U.S. Treasury notes. That makes them the world's 18th largest holders of U.S. debt, ahead of major current account surplus nations like Germany and South Korea. Tether Ltd, the issuer of tether (USDT), the world's leading dollar-pegged cryptocurrency by market value, alone holds around $91 billion in Treasuries and Circle, the issuer of USDC, holds short-dated U.S. debt, including repos, worth $29 billion, according to Tagus Capital. Coincidentally, of the many crypto bills in the U.S. political corridors, stablecoin legislation has been the closest to moving past the U.S. Congress to become law. Hopes that the U.S. will get a new stablecoin law before the elections this year remain. In April, key congressman Patrick McHenry was bullish that the U.S. would have a stablecoin law by the end of the year. However, attempts to include a stablecoin regulation in an unrelated must-move reauthorization bill failed. McHenry later told CoinDesk that “we’re so close on this, we just need a legislative calendar, so that we can get things across the finish line in the Senate.” He also echoed the sentiment of the Majority Whip in the House of Representatives, Republican Tom Emmer who suggested that the lame duck session, might be the opportune time to attach a legislation to a must-pass bill. A lame duck session occurs in the transition period after elections before the president-elect takes over in January 2025. The U.S. government debt surpassed the $34 trillion mark early this year and has been growing faster, roughly $1 trillion every 100 years. Interest payments on the debt, also known as the debt-servicing cost, are projected to reach $892 billion in 2024. The burgeoning debt has caused the Treasury to step up bond supplies since 2023. On Tuesday, the Congressional Budget Office said the national debt could reach $50 trillion by 2034, equaling 122 percent of annual economic output. Early this year, COB warned that Unattended mounting debt concerns could lead to Liz-Truss-style market chaos, characterized by the sharp drop in the U.S. dollar and political uncertainty. Crypto pundits have long echoed a similar sentiment, saying debt concerns and loss of confidence in Treasuries could spur widespread adoption of alternative assets like bitcoin and gold. https://www.coindesk.com/markets/2024/06/20/stablecoin-issuers-now-18th-largest-holder-of-us-debt/