2024-06-20 11:33

The next two-year phase of Project Helvetia will see other financial institutions and types of transactions join the party. The SNB and Swiss Digital Exchange are extending their exploration of wholesale central bank digital currencies for two more years. The now-completed Project Helvetia III involved the issuance of seven digital bonds, totaling more than 750 million francs ($843 million). The Swiss National Bank (SNB) and Swiss Digital Exchange (SDX) exploration of settling tokenized securities through a wholesale central bank digital currency (CBDC) is entering a new phase that will see other financial institutions and types of transactions added over the coming two years. Interest in tokenization is adding momentum to CBDC experimentation for institutional market participants looking to settle big trading transactions on blockchains. As well as the Swiss efforts, there are moves like Project Agorá, which involves a number of central banks and the Bank for International Settlements. The next phase of the deployment follows the completion this month of Project Helvetia III, which involved the issuance of seven digital bonds totaling more than 750 million francs ($843 million) and was “a resounding success,” according to David Newns, head of SIX Digital Exchange. “What we’re talking about here is as good as the traditional infrastructure,” Newns said in an interview. “Now we've achieved that sort of equivalence for digital securities around the cash leg, these are eligible for inclusion in the collateral market so you can use them for repo. We have bridges into traditional finance, so an issuer can reach that entire liquidity base you get on a traditional exchange. And as a result of the project, participating members have now tripled, and are using us as a way to further their own digital ambitions.” Like many other central banks, the SNB is not interested in retail CBDC experimentation, only the digital cash flow from institutions for wholesale securities settlement. Newns said other approaches were considered, such as a trigger mechanism in the real-time gross settlement system (RTGS) of the central bank every time a transaction takes place on a blockchain, or a bankruptcy-remote entity holding members' deposits in some kind of stablecoin. “But nothing really works like central bank money does, which is why it is the settlement asset that everyone prefers to use whenever possible,” Newns said. https://www.coindesk.com/policy/2024/06/20/swiss-national-bank-and-sdx-delve-deeper-into-cbdcs-tokenized-securities/

2024-06-20 10:10

DOGE funding rates are starting to flip negative, data shows, as traders move away from riskier assets amid low volatility in the broader crypto market. The crypto market’s biggest meme token is starting to attract short bets amid a general decline in the meme sector, which may spell worry for the meme sector. Coinalyze data shows that Dogecoin (DOGE) funding rates have started to turn negative since Tuesday, reaching -0.0027% as of Thursday – reaching levels previously seen in October 2023. Funding rates are periodic payments made by traders based on the difference between prices in the futures and spot markets. While these rates are not unusually large, they indicate a bearish mood in the market when continually declining alongside a drop in prices. DOGE has lost 12% over the past week, erasing all gains since March. DOGE open interest, or the number of unsettled futures contracts, have decreased from nearly $800 million on Monday to $611 million as of Thursday, also indicating a drop in demand for the tokens. The rates briefly turned red over a few eight-hour trading sessions in March, but not for an extended period as seen this week so far. Tokens across the meme coin sector have recorded losses of as much as 40% over a seven-day period as traders caution a move away from riskier tokens to bitcoin and stablecoins. “When the price of Bitcoin falls, memecoins tend not only to follow, but to lose an even greater share of their value,” shared Neil Roarty, analyst at investment platform Stocklytics, in a Thursday email to CoinDesk. “Any plans for a memecoin summer may have to be put on hold.” As reported earlier this week, DOGE futures traders recorded their worst day since May 2021 as the token saw $60 million in longs liquidated, unusually more than for bitcoin (BTC) futures. These drops came as bitcoin (BTC) prices suffered in the past few weeks amid $2 billion in sales from large holders, net outflows from U.S.-listed exchange-traded funds (ETFs), and dollar strength. https://www.coindesk.com/markets/2024/06/20/dogecoin-traders-appear-to-short-token-as-meme-coin-frenzy-eases/

2024-06-20 09:30

The VanEck Bitcoin ETF rose 1% on its debut after trading 99,791 shares. The VanEck Bitcoin ETF, which offers Australians a way of investing in bitcoin through exposure to the company's U.S. equivalent, debuted on Thursday. The start of trading, weeks after an ETF from Monochrome Asset Management listed on a smaller exchange, is a sign the global BTC ETF wave has arrived in the country. Australia's biggest equity exchange listed its first spot-bitcoin (BTC) exchange-traded fund (ETF) on Thursday as demand for an easy way of investing in cryptocurrencies gathers pace worldwide. The VanEck Bitcoin ETF (VBTC) went live on the Australian Securities Exchange (ASX), which accounts for 90% of the country's equity market. The exchange approved the product listing earlier this week. VBTC rose 1% from its opening price to end the day at A$20.06 ($13.4) after trading 99,791 shares. The ETF is a feeder fund that provides exposure to bitcoin by investing in the company's Bitcoin Trust (HODL), a U.S. ETF listed on Cboe. While the start of trading comes about six months after spot bitcoin products listed in the U.S., and about seven weeks after they debuted in Hong Kong, the product is not the first to offer bitcoin to Australian investors. Monochrome Asset Management’s Monochrome bitcoin ETF (IBTC) went live on June 4 on the Cboe Australia exchange, a smaller rival of ASX. Unlike VBTC, the fund holds bitcoin directly. Since its launch, IBTC has traded an average of around 55,000 units a day on daily average cash volumes of about A$550,000. Together the two exchange-traded funds signal a bitcoin ETF wave arriving in Australia, according to the Australian Financial Review. Read More: Australian Securities Exchange Gives Its First Approval of a Spot Bitcoin Listing to VanEck https://www.coindesk.com/business/2024/06/20/vanecks-spot-bitcoin-etf-goes-live-on-australias-biggest-stock-exchange/

2024-06-20 09:12

The ratio has declined 35% in one month, reaching the lowest since March 13. The SOL/ETH ratio slides as ether ETF narrative weighs over altcoins. Technicals have flipped bearish, signaling more losses ahead for the ratio. A month ago, CoinDesk discussed how spot ether (ETH) ETF speculation could spur an outflow of money from altcoins, including Solana's SOL token and into ether. The market has since behaved as expected, with the ratio between SOL and ETH's dollar-denominated prices falling nearly 35% to 0.038 on Binance, the lowest since March 13, according to charting platform TradingView. The decline has put the bears in control and further losses could be seen, according to crypto trader and analyst Josh Olszewicz. "SOL/ETH [is] rolling over," Olszewicz said on X, noting key bearish developments on the technical chart like the penetration of the Ichimoku cloud support. Japanese journalist Goichi Hosada created the Ichimoku Cloud in the late 1960s. The indicator comprises five lines: Leading Span A, Leading Span B, Conversion Line or Tenkan-Sen (T), Base Line or Kijun-Sen (K) and a lagging closing price line. The difference between Leading Span A and B makes up the cloud, which is used to identify broader trends. Crossovers below the cloud, as in SOL/ETH's case, represent a bearish shift in the market trend. The SOL/ETH chart also shows a failure of a usually bullish pattern called the ascending triangle, identified by a rising support line and a horizontal resistance line. Ascending triangles develop when buyers are dominant and usually pave the way for extending the preceding uptrend. However, the SOL/ETH pair has dived below the ascending trendline support line, signaling a bearish trend change. Though the path of least resistance is to the downside, the pair may see temporary recovery rallies should there be outflows from the Grayscale Ethereum Trust, according to Olzewicz. Note that in the month following the debut of spot bitcoin ETFs in the U.S., the Grayscale Bitcoin Trust ETF saw $6.5 billion in outflows, offsetting substantial inflows into the other funds. Following the expected debut of spot ETFs in July, a similar dynamic might be seen in the ether market, keeping ETH gains in check. Lastly, per Olszewicz, SOL may find takers if BlackRock applies to launch an ETF tied to SOL, although Olzewicz says the ETF giant is unlikely to do so. "Watching for: - ETHE outflows pushing this pair higher, temporarily - Larry SOL ETF application, unlikely otherwise, this pair should continue to decline if the ETH ETF is successful," Olszewicz said. https://www.coindesk.com/markets/2024/06/20/solana-ether-ratio-hits-3-month-low-analyst-anticipates-further-losses/

2024-06-20 09:07

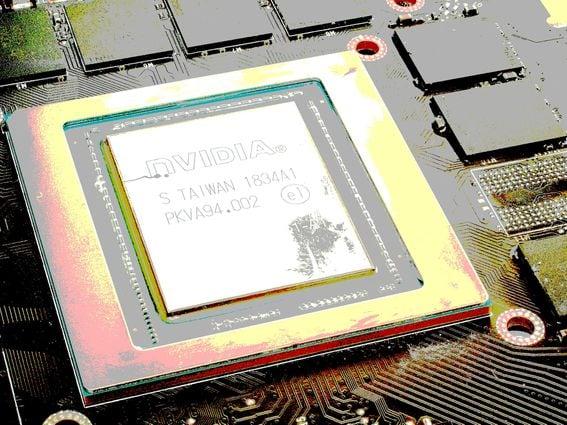

The AI-linked token sector has risen 15% in the past 24 hours, data shows, outperforming other sectors. AI-themed tokens surged up to 35% in the past 24 hours, significantly outperforming the broader crypto market, which remained largely flat. The growth in AI token prices mirrored a rise in Nvidia's stock, which became the most valuable company globally, highlighting the market's increasing interest in AI-related technologies. Tokens of projects said to be using artificial intelligence (AI) technology surged as much as 35% in the past 24 hours, leading gains as a sector amid a little-changed broader crypto market. Fetch.ai’s FET, SingularityNET’s AGIX, and Ocean Protocol’s OCEAN led growth in the AI token sector, CoinGecko data shows, while the sector added 15% on average. Tokens above a $100 million capitalization added a minimum of 4% – beating a 0.22% rise in the broad-based CoinDesk 20 (CD20) index. Such growth mirrored a surge in chipmaker Nvidia’s (NVIDIA) stocks, whose 5% surge since Monday made it the most valuable company in the world, surpassing Microsoft. Nvidia is not directly related to any crypto companies, but growth in its stock prices tends to move AI-related tokens. AI broadly refers to the simulation of human intelligence in machines programmed to think and act like humans. Since early 2023, traders have predicted the sector to lead gains in the next crypto market, and the hopes have been accurate so far. "AI as a sector is hot in both traditional markets and crypto,” Edward Wilson, analyst at Nansen.ai told CoinDesk in a Telegram message Thursday. “It should come as no surprise that on the back of Nvidia becoming the world's most valuable company AI tokens are rallying.” “Tokens such as NEAR and RNDR are up around 300% in the past year, compared to ETH at just over 100% during the same time period, showing high market interest in this sector,” he added. Concerns about the true usage of complex AI technology in blockchain projects remain among some researchers, however. https://www.coindesk.com/markets/2024/06/20/ai-tokens-led-by-fet-agix-surge-as-nvidia-zooms-to-become-worlds-most-valuable-company/

2024-06-19 15:22

The bug found by a "security researcher" led to nearly $3 million stolen from Kraken's treasuries. Kraken said third-party security researchers found a vulnerability, which was fixed by the crypto exchange. The researchers secretly withdrew nearly $3 million and refused to give it back without seeing the bounty amount first, Kraken said. Blockchain code editor Certik said it found a vulnerability in Kraken's platform and claims to have been "threatened" by the exchange. Crypto exchange Kraken said "security researchers" who found a vulnerability on the platform turned to "extortion" after withdrawing about $3 million from the exchange's treasury. Nick Percoco, Kraken's chief security officer, said in a post on social media platform X (formerly Twitter) that the firm received a "bug bounty program" alert from a security researcher on June 9 about a vulnerability that allows users to artificially inflate their balance. The bug "allowed a malicious attacker, under the right circumstances, to initiate a deposit onto our platform and receive funds in their account without fully completing the deposit," Percoco added. Upon receiving the report, Kraken fixed the issue swiftly and no user funds were affected, Percoco noted. What came after raised red flags for Kraken's team. The security researcher, upon finding the bug, allegedly disclosed it to two other individuals, who then "fraudulently" withdrew nearly $3 million from their Kraken accounts. "This was from Kraken’s treasuries, not other client assets," Percoco said. The initial bug report didn't mention the two other individuals' transactions, and when Kraken asked for more details of their activities, they refused. "Instead, they demanded a call with their business development team (i.e. their sales reps) and have not agreed to return any funds until we provide a speculated $ amount that this bug could have caused if they had not disclosed it. This is not white-hat hacking, it is extortion!" Percoco wrote. Kraken didn't disclose who the researchers were, but blockchain code editor Certik subsequently said in a social media post that it found several vulnerabilities in the crypto exchange. Certik said it conducted "multi-day testing" and noted that the bug could be exploited to create millions of dollars worth of crypto. "Millions of dollars can be deposited to ANY Kraken account. A huge amount of fabricated crypto (worth more than 1M+ USD) can be withdrawn from the account and converted into valid cryptos. Worse yet, no alerts were triggered during the multi-day testing period," the post said. However, Certik said things went sour after the initial conversation with Kraken. "Kraken’s security operation team has THREATENED individual CertiK employees to repay a MISMATCHED amount of crypto in an UNREASONABLE time even WITHOUT providing repayment addresses," the X post added. Bug bounty programs – used by many firms to strengthen their security systems – invite third-party hackers, known as "white hats," to find vulnerabilities so the company can fix them before a malicious actor exploits them. Kraken's competitor, Coinbase, has a similar program to help alert the exchange of vulnerabilities. To be paid the bounty, Kraken's program requires a third party to find the problem, exploit the minimum amount needed to prove the bug, return the assets and provide details of the vulnerability, Kraken said in a blog post, adding that since the security researchers didn't follow these rules, they won't get the bounty. "We engaged these researchers in good faith and, in-line with a decade of running a bug bounty program, had offered a sizable bounty for their efforts. We’re disappointed by this experience and are now working with law enforcement agencies to retrieve the assets from these security researchers," a Kraken spokesperson told CoinDesk. https://www.coindesk.com/business/2024/06/19/kraken-says-hackers-turned-to-extortion-after-exploiting-bug-for-3m/