2024-06-14 14:38

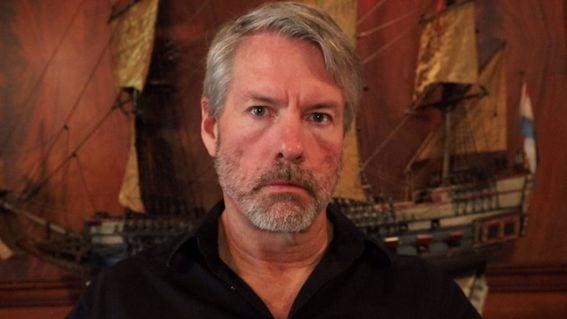

The company's shares rose nearly 2% in the early Friday session following yesterday's tumble. MicroStrategy raised its latest convertible note offering by $200 million from an original plan of $500 million. It also offered initial buyers an option to purchase an additional $100 million of the notes. Broker Bernstein set a $2,890 price target for the company's shares. Nasdaq-listed software firm MicroStrategy (MSTR), the largest corporate holder of bitcoin (BTC), increased its convertible note offering by 40% to $700 million and priced it to offer a 2.25% annual yield. The notes, available to institutional investors in a private offering, will be unsecured, senior obligations and mature in June 2032, the company said in a Friday press release. The Tysons Corner, Virginia-based company also granted initial buyers an option to purchase an additional $100 million of notes within 13 days of the first issuance. The company expects to close the offering on Monday. The proceedings of the issuance will be used to acquire more bitcoin and for general corporate affairs. The company's shares added nearly 2% in the early Friday session, changing hands at slightly above $1,500 following yesterday's 7.5% decline. Earlier today, brokerage firm Bernstein initiated coverage of Microstrategy, setting a $2,890 price target and assigning an outperform rating. MicroStrategy started buying the oldest and largest crypto asset in 2020 for its treasury. Now, it holds 214,400 BTC worth some $14 billion, making the company the biggest publicly listed bitcoin holder. The company's executive chairman, Michael Saylor, is a vocal supporter of bitcoin. https://www.coindesk.com/business/2024/06/14/microstrategy-increases-convertible-note-offering-by-40-to-700m-in-bitcoin-splurge/

2024-06-14 14:30

A series of unfortunate sports losses have left Drake very close to losing $1 million worth of bitcoin bets. The Edmonton Oilers and Dallas Mavericks are both down 3-0 after another round of losses. Drake bet $500,000 on each team to win the National Hockey League and National Basketball Association finals. Drake placed the bets using bitcoin on crypto casino Stake. Canadian singer Drake is on the cusp of losing $1 million worth of crypto after he placed two individual $500,000 bets on the Edmonton Oilers and the Dallas Mavericks to win their respective Stanley Cup and NBA finals. The Oilers lost their third straight game against the Florida Panthers in the hockey championship on Thursday whilst the Mavericks are down 3-0 in the basketball tournament after losing in consecutive games against the Boston Celtics. Both contests are best-of-seven series. Drake indicated on June 6 that he had placed the bets on crypto casino Stake using bitcoin (BTC) by posting the betting slips on Instagram, accompanied by a message: "Dallas cause I'm a Texan. Oilers are self explanatory. Picks in are @stake." It's worth pointing out that Drake has had partnerships with Stake in the past, so he may have an incentive to post about his bets on the platform, even if they don't pay off. Stake partnered with Drake in 2022 in a deal that the singer described as "inevitable." Stake made $2.6 billion in revenue in the same year. Drake stood to win $1.025 million and $1.375 million if the Oilers and Mavericks managed to win their respective series, according to the betting slips. To date, no NBA team has ever managed to win a series in the playoffs or finals after being down three games with no wins. Drake won’t have to wait long to know the outcome of both bets; tipoff for game 4 of the NBA Finals is Friday whilst the Oilers play Saturday. Both teams need to avoid defeat to extend the series. The 37-year-old is no stranger to losing bitcoin by betting on sports. He also placed a $615,000 bet on Francis Ngannou to beat Anthony Joshua in a boxing bout in March; Joshua ended up winning by knockout in the second round. https://www.coindesk.com/business/2024/06/14/drake-on-brink-of-1m-bitcoin-loss-as-nhl-and-nba-bets-go-sour/

2024-06-14 12:39

Egorov’s $100 million in loans taken from various protocols using Curve’s CRV tokens started to automatically liquidate on Thursday, sending the token down as much as 30% before it briefly recovered. The Monday exploit of UwU Lend resulted in a series of events that led to Michael Egorov's $100 million loans from various protocols being automatically liquidated, causing the CRV token to drop by up to 30%. Despite the bad debt and liquidations, Egorov said he remains committed to ensuring that all users can withdraw their deposits and is focused on making Curve Finance's lending/borrowing products the safest in the industry. The exploit of UwU Lend on Monday put in motion a series of events that led to Thursday’s multimillion liquidations on DeFi lending giant Curve, representatives for its founder Michael Egorov told CoinDesk over Telegram messages on Friday. Egorov’s $100 million in loans taken from various protocols using Curve’s CRV tokens started to automatically liquidate on Thursday, sending the token down as much as 30% before it briefly recovered. The catalyst for the bad debt and liquidations has been traced back to UwU Lend, a crypto protocol that allows users to burrow, lend, and stake tokens. “On April 15 they (UwU Lend) deployed vulnerable code for new (sUSDe) markets, and those markets are not isolated, so the whole platform takes the risk,” Egorov said. “UwU was hacked, and the hacker, as a part of cash-out play, deposited CRVs taken from UwU to lend.curve.fi (LlamaLend) and disappeared with the funds, leaving his debt in the system.” UwU Lend lost $20 million on Monday after being hit by a flash loan attack and another $3.7 million on Thursday in a separate attack. As of Friday, it is offering a bounty reward of $5 million to catch the attackers. In an X post, Egorov estimated bad debt in a particular CRV lending pool at $10 million. While this market is fully isolated from other lending pools, depositors in the CRV could not withdraw their funds as long as the bad debt existed. However, Egorov said that the situation could help bolster Curve’s security measures and loan mechanisms and could create a better service for users in the coming months. “Yesterday the system was tested in unthinkable conditions,” Egorov said. “We have a lot to process, but most importantly we have all the information on how to make the safest and the most resilient lending/borrowing ever existed.” “I am dedicated to ensuring that all users can withdraw their deposits without any hassle. I always think that Curve Finance is my priority, and the most important is our community,” he added. Curve is among the largest crypto protocols with over $2 billion in locked assets as of Friday, DefiLlama data shows. https://www.coindesk.com/tech/2024/06/14/defi-heavyweight-curve-focused-on-becoming-safest-lending-platform-founder-says/

2024-06-14 12:14

The latest price moves in crypto markets in context for June 14, 2024. Latest Prices Top Stories Bitcoin wavered near $67,000 early Friday as the crypto market consolidated. BTC is stuck in a sideways channel after previous attempts for rallies earlier this week fizzled out. In a sign of diminishing investor confidence, U.S.-listed spot bitcoin exchange-traded funds suffered $226 million of net outflows on Thursday. Fidelity's FBTC led the outflows with only BlackRock's IBIT recording positive, albeit minor, inflows. BTC declined 1.3% over the past 24 hours, while the broader crypto market was also down nearly 1%, as measured by the CoinDesk 20 Index (CD20). Bitcoin will hit $1 million within 10 years, brokerage company Bernstein said while setting a massive price target for MicroStrategy. BTC, the largest and oldest crypto asset, could reach a cycle-high of $200,000 by 2025 en route to the 2033 forecast. The firm also initiated coverage for Michael Saylor's MicroStrategy (MSTR), the biggest corporate owner of bitcoin, setting a price target of $2,890 per share with an outperform rating. That would translate to an almost 100% rally for the stock, which closed Thursday at $1,480. Former Goldman Sachs executive Connie Shoemaker joined the board of directors of crypto custody firm Anchorage Digital. The company is the only crypto bank chartered by the Office of the Comptroller of the Currency (OCC) in the U.S. In a Thursday announcement, the company said the addition was part of an effort to “meet rising institutional demand for safe, secure and federally regulated digital asset infrastructure.” Shoemaker was Goldman Sachs’ global head of strategy during the 2008 global financial crisis overseeing the growth of Goldman Sachs Asset Management (GSAM), and later served as chief administrative officer. Chart of the Day The chart shows the seven-day change in open interest (OI)-adjusted cumulative volume delta (CVD) in futures tied to the top 25 cryptocurrencies by market value. TRX is the only coin to have seen a positive CVD, a sign of new inflows into the market. A positive CVD means more buyers are in action, while a negative print implies there are more sellers. - Omkar Godbole Trending Posts Taiwan Crypto Advocacy Body Becomes Formally Active With 24 Entities U.S. Judge Signs Off on $4.5B Terraform-Do Kwon Settlement With SEC More Central Banks Are Exploring a CBDC, BIS Survey Finds https://www.coindesk.com/markets/2024/06/14/first-mover-bitcoin-struggles-near-67000-as-cryptos-lag-behind-stocks/

2024-06-14 11:19

The executives, Tigran Gambaryan and Nadeem Anjarwalla, are still named in a money-laundering case. Tax charges against Binance executives Tigran Gambaryan and Nadeem Anjarwalla have been dropped by Nigeria's Federal Inland Revenue Service. The FIRS revised the charges so that only Binance, through its local representative, is named. Nigeria took Binance and its executives to court to answer to money laundering and tax evasion charges after detaining its executives. Tax charges brought by the Federal Inland Revenue Service (FIRS) of Nigeria against Binance executives Tigran Gambaryan and Nadeem Anjarwalla have been dropped. The FIRS agreed to revise the charges so that only the crypto exchange, through its local representative, is named. Gambaryan, who is now sick, will no longer need to appear in court for the FIRS case and Binance is now the sole defendant. The two executives remain named in a money-laundering case brought by the Economic and Financial Crimes Commission. Binance has been trying to convince Nigerian authorities that Gambaryan does not have decision making powers in the firm, so should not have to represent it in court and should be released. Gambaryan and Anjarwalla were detained in February while the country investigated the exchange. Anjarwalla escaped shortly after. Nigeria later took the executives and Binance to court for money laundering and tax evasion charges. "This goes to show that both Tigran and Nadeem are not decision makers at Binance, and should never have been detained and charged," a family spokesperson said in an emailed statement on Friday. Gambaryan is head of financial crime compliance at Binance; Anjarwalla was a director for the company's Africa operations. The next hearing in the money-laundering case is scheduled for June 19 "where the application for an order for the enforcement of fundamental rights will be heard," the statement said. The trial is due to resume on June 20. Gambaryan is still detained at Kuje prison. "In order for Tigran to be allowed to go home to his family, we are hopeful that the Economic and Financial Crimes Commission (EFCC) will take similar steps," a Binance spokesperson said in an emailed statement. "Tigran has been detained for 110 days, and his physical health is deteriorating, including a recent malaria and pneumonia diagnosis. Binance is committed to continuing to work with the Nigerian government to resolve this." Worsening Conditions On May 23, Gambaryan collapsed in court from malaria, the statement by the family spokesperson said. Since then, the "conditions have worsened and Tigran now has pneumonia." Despite a court order by Justice Emeka Nwite to take the executive to hospital, the prison authorities took 11 days to take him for a brief check-up and the results of this have not yet been released to his family, the spokesperson said. "We really need the U.S. government to intervene more forcefully for the immediate release of an innocent American citizen," Tigran's wife Yuki Gambaryan said in the statement. "This has gone on too long and Tigran's life is at risk." Neither the Federal Inland Revenue Service nor the Supreme Court of Nigeria had responded to a request for comment by publication time. Update (June 14, 12:28 UTC): Adds context, background throughout. Update (June 14, 14:07 UTC): Removes attribution to family spokesperson in headline, first par; adds Binance statement in sixth paragraph. https://www.coindesk.com/policy/2024/06/14/nigeria-drops-tax-charges-against-binance-executives-family-spokesperson/

2024-06-14 11:17

Persistent testing of the lows sets the bears up for quick success with their next target at $60,000, one trader said. Traders anticipate a deeper drop for bitcoin (BTC) in the coming weeks, despite a strong equity market and favorable U.S. crypto policies, pointing to selling activity from miners and general profit taking. Bitcoin's upper potential may be limited due to miners' cash demand, with on-chain data showing an increase in the transfer of BTC from mining pools to exchanges. The movement of funds to an exchange is often seen as a sign of an impending sale. Traders foresee a deeper bitcoin (BTC) price correction in the coming weeks despite a strong equity market and favorable U.S. crypto policies due to selling activity from miners and general profit-taking. "There's a new wave of dollar strength and demand for equities. Risk asset demand is gradually diminishing, forming a sequence of declining intraday highs for bitcoin," shared Alex Kuptsikevich, FxPro senior market analyst, in a Friday email to CoinDesk. "Bitcoin continues to test the strength of the 50-day moving average, but it doesn't find enough reason to dive lower. Such persistent testing of the lows sets the bears up for quick success with their next target at $60,000," he added. Miners, or entities that supply extensive computing resources to keep the bitcoin network running, may be among the selling groups, some observers said. "Bitcoin's upper potential may be limited due to miners' cash demand," shared analysts from Japanese crypto exchange bitBank in an email. "Since May, bitcoin miners' net position–BTC inflow - BTC outflow–has been gradually declining, suggesting their operation has become tight after the Bitcoin network went through halving in April." "The increasing net BTC outflows from miners do not necessarily put pressure on the price of bitcoin. However, prices tend to stagnate," analysts added. On-chain data cited by CryptoQuant in a Wednesday report showed an increase in the transfer of BTC from mining pools to exchanges – which reached a two-month high on June 9. Selling via professional over-the-counter desks also spiked to the largest daily volume since late March, the firm said. Bitcoin jumped from $68,000 to $70,000 on Wednesday as May's U.S. CPI came in cooler than expected. However, the price quickly retraced the gains on Thursday after agencies at the Federal Open Market Committee (FOMC) reduced their rate cut forecast for this year from three times to only once. Major tokens such as BNB Chain's BNB, XRP and Solana's SOL are down more than 10% since Monday, while riskier meme coins such as dogecoin (DOGE) and shiba inu (SHIB) have lost 15%. Such moves came amid continual outflows in U.S.-listed spot BTC exchange-traded funds (ETFs), which have seen a net $500 million leave the 11 products since Monday. This marks their worst week since the end of April when they lost $1.2 billion over six days. Bitcoin has also seemingly decoupled from the technology index Nasdaq, deviating from its usually positive correlation with this index, which is heavy on technology stocks. Meanwhile, some market observers said that ether "looks worse" than bitcoin in terms of short-term sentiment. "Looking at the technicals, both Bitcoin and Ethereum look bearish, but ETH looks worse than BTC," Rachel Lin, CEO and co-founder of SynFutures, said in a Telegram message. Unless ETH reclaims the $3,700 level soon, we might see more downside in the coming days and weeks. "For BTC, $67,000 remains the crucial level," Lin said, adding the long-term outlook remains bullish in her view. https://www.coindesk.com/markets/2024/06/14/bitcoin-traders-see-short-term-bearish-target-at-60k-as-miners-pare-holdings/