2024-06-11 09:37

Elevated interest rates aimed at taming inflation have become a part of the problem, three Democrat senators said. Now is the time to cut rates, three Democrat senators said in a letter to the Fed on Monday. The Fed should move away from its 2% inflation target, the letter added. The Federal Reserve (Fed) has kept the interest rate too high for too long and it's time for a cut, three Democrat senators said Monday in a letter to the central bank's chairman, Jerome Powell. "We write today to urge the Federal Reserve (the Fed) to cut the federal funds rate from its current, two-decade-high of 5.5 percent. This sustained period of high interest rates is already slowing the economy and is failing to address the remaining key drivers of inflation," Senators Elizabeth Warren (D-Mass.), Jacky Rosen (D-Nev.) and John Hickenlooper (D-Colo.) wrote, according to a document on the HuffPost website. In response to the surprisingly resilient labor market, financial markets pushed out expectations for a first 25 basis-point interest-rate cut to September from July. The hawkish repricing has stalled a rally in bitcoin (BTC). The senators argue that the elevated interest-rate environment aimed at taming inflation adds to the problem by pushing up housing, construction and auto insurance costs, and risks propelling the economy into a recession that could " push thousands of American workers out of their jobs." In April, investment banking giant JPMorgan analysts said higher interest rates are spiraling into rent. The senators said it's time for the Fed to follow the European Central Bank's lead and move away from the 2% inflation target. The ECB and Bank of Canada cut rates last week, diverging from the Fed's higher-for-longer stance. According to the letter, the divergence could lead to a stronger dollar and tighter financial conditions or flow of credit through various sectors of the economy. Tighter financial conditions often lead to economic slowdown. Singapore-based crypto trading firm QCP Capital does not expect the divergence to last long and sees the drop in BTC and ether (ETH) prices as a buying opportunity. https://www.coindesk.com/markets/2024/06/11/fed-should-cut-interest-rate-as-restrictive-stance-adds-to-inflation-democrats-say/

2024-06-11 09:11

The network is ready for its Chang fork and waiting for 70% of operators to install the new node. Cardano's Voltaire phase, the final stage of its roadmap to create a fully decentralized blockchain ecosystem, is set to occur in June. The Cardano Node will reach version 9.0, making it ready for a hard fork to enter the Voltaire era. The Cardano network is set to move into the final phase of a multiyear program to become a wholly decentralized blockchain ecosystem later this month, co-founder Charles Hoskinson said in an X post Monday. As a first step, the validating node software operated by the system's stake pool operators, or SPOs, needs to be upgraded to the latest version. Then, the blockchain will evolve into a backward-incompatible version, a process known as a hard fork, and in doing so, enter a new era known as Voltaire. Cardano is currently in its Basho era. The project's roadmap says that once the switch is complete, the seven-year-old blockchain will no longer be actively managed by Cardano development firm IOHK but will instead be wholly run by community members. “It looks like June will be the month that Cardano Node will reach 9.0,“ Hoskinson posted. “This means that Cardano is Chang fork ready and waiting for 70 percent of the SPOs to install the new node. Then, a hard fork can occur pushing Cardano into the Age of Voltaire.” “We'll have the most advanced blockchain governance system, annual budgets, a treasury, and the wisdom of our entire community to guide us,” he added. According to governance forums and blog posts, the first part of Voltaire will see the implementation of CIP 1694, a proposal that will allow holders of the native (ADA) token to vote on topics and features that benefit Cardano. A second step will enable more novel features, such as proxy participation and treasury withdrawals, allowing users to propose and fund projects within the Cardano ecosystem. ADA tokens are down 1.6% in the past 24 hours, CoinGecko data shows, outperforming losses of 2.2% in major tokens tracked by the CoinDesk 20 (CD20) index. https://www.coindesk.com/tech/2024/06/11/cardano-is-on-track-for-voltaire-upgrade-this-month-co-founder-hoskinson-says/

2024-06-11 07:06

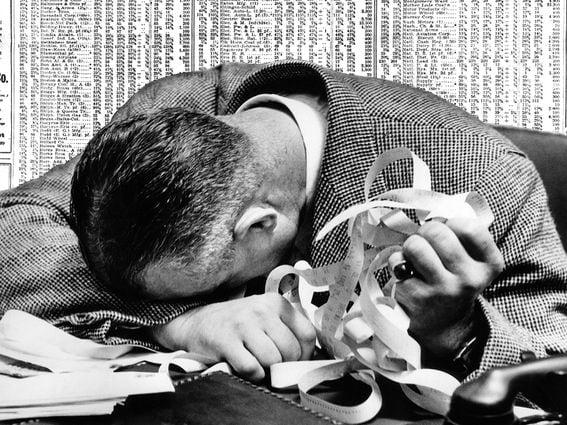

A Solana meme parody of the actual company was down 25% in the past 24 hours, with steep losses across other meme tokens that tended to move in tandem with GameStop. Double-digit losses in GameStop weigh over meme coins. Meme token GME and KITTY fall 25% and 10%, respectively. The controversial GameStop (GME) stock rally saw its second day of reversing on Monday, ending the U.S. trading session down 12% after a 40% drop on Friday This weighed down some meme tokens that tend to mirror the stock’s movements. GME ended Monday trading at $24.89, down 62% from a two-year high of $61 last Thursday. Elsewhere, the Solana-based meme token GME, which parodies the company, slid 25%, reversing a more than 200% rally from the past seven days. Related tokens like Roaring Kitty (KITTY) and some cat-themed tokens, which previously moved alongside GME stock, lost an average of at least 10%, according to data tracked by CoinGecko. Dog-themed tokens doge (DOGE), shiba inu (SHIB) and floki (FLOKI) pared gains from the last week, falling from 4% to 10%. The stock had moved wildly since late May on the apparent return of retail trader and GME bull Keith Gill for the first time since 2021. Gill, known by his @TheRoaring Kitty and “DeepF*uckingValue” aliases, was a key figure in the stock’s short squeeze rally in 2021. Gill flashed a $580 million position of GME equity and options holdings last week, boosting the stock’s prices and putting him on track to a potential billion-dollar exposure position. However, gains were erased after the company said it would sell up to 75 million shares, days after it made $933 million by selling 45 million shares. It also announced a drop in quarterly sales – dampening investor sentiment. https://www.coindesk.com/markets/2024/06/11/meme-sector-sees-sharp-selloff-as-gamestop-losses-extend-to-60/

2024-06-11 07:00

According to the plan released Tuesday, 17.5% of ZK's 21 billion total token supply will be airdropped to users beginning "next week." Matter Labs, the main development firm behind the layer-2 network ZKsync era, has officially disclosed the distribution criteria for its long-awaited ZK token airdrop. According to the plan released Tuesday, 17.5% of ZK's 21 billion total token supply will be airdropped to users beginning "next week." Like other layer-2 networks, ZKsync Era pitches itself as a quick and cheap way to send transactions on Ethereum. According to Matter Labs, the ZK airdrop will be the “largest distribution of tokens to users amongst major L2s,” with just under 3.7 billion tokens going to users. Pre-market prices from Aevo, a crypto perpetuals exchange that currently values ZK at $.66, would place the airdrop's fully diluted value (FDV) above $2.5 billion, which is nearly triple ZKsync Era's current total value locked (TVL) of $815 million. Under the distribution plan, 89% of the airdrop will go to ZKsync users, a group that includes anyone who has transacted on ZKsync and met a certain threshold of activity (a specific threshold was not provided). The remaining 11% will go towards contributors to the ecosystem, including zkSync native projects (5.8%), on-chain communities (2.8%) and builders (2.4%). The airdrop news comes as Matter Labs continues to receive backlash from its layer-2 peers over its decision to trademark the term “ZK,” which is shorthand for "zero-knowledge” cryptography, the core technology underlying ZKsync and a plethora of other blockchain projects. After criticism from the crypto community, Matter Labs withdrew its trademark application, which it originally said it pursued to protect its users from similarly-named projects and token tickers. Matter Labs said that the airdrop will cap the amount that any given address can receive at 100,000 tokens. “By capping whales, the ZK airdrop fairly rewards community members that contribute to ZKsync in different ways,” Matter Labs wrote in a press release seen by CoinDesk. ("Whales" is crypto-speak for especially big-pocketed traders.) The team also shared that Matter Labs employees will get 16.1% of ZK tokens, and Matter Labs investors 17.2%. Those tokens will be locked for a year and then unlocked over the course of three more years. The rest of the token supply will go to ZKsync’s new "Token Assembly" (29.3%) as part of its new governance plans laid out on Monday, and various Ecosystem Initiatives (19.9%). “Awarding more tokens in the airdrop than to the Matter Labs team and investors is more than a symbolic decision for the community," Matter Labs wrote in a statement shared with CoinDesk. "When the ZKsync governance system launches in the coming weeks, the community will have the largest supply of liquid tokens to direct protocol governance upgrades.” Airdrop politics The airdrop follows a series of other airdrops, like those from StarkNet and EigenLayer, which outraged some users who expected to receive larger allotments of tokens. In the case of EigenLayer, in particular, some users took issue with the team's decision to strictly bar airdrop claimants from the U.S. and a long list of other countries. “We have put a lot of thought into the design of the airdrop," Alex Gluchowski, the CEO of Matter Labs, told CoinDesk in an interview. “No matter what you do, some people are going to be disappointed, but we have looked into others," he said. Among the "key pillars" Gluchowski's team used to inform its distribution plan, "number one" was to "prioritize community heavily," said the Matter Labs CEO. Gluchowksi mentioned in the interview that “certain jurisdictions are excluded because they are either banned by sanctioned regimes or are just not welcome, unfortunately for crypto projects doing airdrops, so we have to be compliant and respect those laws.” He did not specify what countries would be allowed to claim tokens, and he didn't say what methods ZKsync would use to enforce its region restrictions. ZK drama The news of the airdrop criteria follows after Matter Labs found itself in hot water with competitors Polygon and Starkware over its applications to trademark the term “ZK.” Given that ZK technology and the term ZK are used by many teams in the Ethereum ecosystem, the trademark filing was seen as an attempt by Matter Labs to seize ownership over a "public good." Gluchowski was defiant when he spoke to CoinDesk this week. “The guys who have accused us registered “STARK” as a trademark,” Gluchowski said, seeming to reference Starkware. (A “STARK” is a type of zero-knowledge proof that was created by Starkware co-founder Eli Ben-Sasson but is now ubiquitous among Ethereum layer-2 teams.) “I mean what are we talking about? Everyone has registered trademarks for their products, for their tokens, for whatever," Gluchowski continued. Gluchowski added, though, that they listened to the community and decided to withdraw their trademark application. “We did not want to leave even the slightest impression that we are trying to manipulate the system to our advantage,” he told CoinDesk. https://www.coindesk.com/tech/2024/06/11/zksyncs-zk-airdrop-is-coming-next-week-heres-what-to-expect/

2024-06-11 05:33

The U.S.-listed spot BTC ETFs registered a cumulative outflow of over $64 million on Monday. BTC, Asian stocks traded lower Tuesday as prices for the safe haven Treasuries rose. The U.S.-listed spot BTC ETFs registered a cumulative outflow of over $64 million on Monday. It was a risk-off day in Asia. Bitcoin, the leading cryptocurrency by market value, fell over 2% to $67,900, extending the retreat from recent highs near $72,000. Ether, the second-largest coin, followed suit, dipping below $3,550 at one point. The broader CoinDesk 20 Index fell 1% to $2,370 points. The losses followed $64.9 million in cumulative outflows from the U.S.-listed spot bitcoin exchange-traded funds (ETFs), the first loss since at least May 23, according to provisional data published by Farside Investors. Inflows have recently been strong, although the market chatter is that they stem from institutions' growing interest in the non-directional basis trade rather than outright bullish bets. In traditional markets, Chinese stocks fell over 1%, leading losses in the Asian equity indices amid lingering property market concerns and reports the Bank of Japan could trim its liquidity-boosting bond purchases this week. The dollar index, which gauges the greenback's exchange rate against a basket of major fiat currencies, consolidated on two-day gains while prices for the supposed safe haven U.S. Treasuries ticked higher, pushing yields lower. The yield on the benchmark 10-year note fell by three basis points to 4.45%, according to charting platform TradingView. Recent gains for right-wing parties in European elections and a snap poll announcement by France revived concerns about the cohesion of the European Union, adding uncertainty in the market. \Meanwhile, Wednesday's U.S. CPI release and the Fed rate decision kept investors on the edge. Wednesday's FOMC will see the central bank publish its latest quarterly projections, including the interest rate dot plot (projections). https://www.coindesk.com/es/markets/2024/06/11/bitcoin-slips-below-68k-as-etfs-bleed-64m-asian-stocks-decline/

2024-06-10 20:20

Tokens of Render, Fetch.ai, SingularityNET and Bittensor slumped 3%-5% despite mostly flat bitcoin and broader crypto prices. Apple shares tumbled nearly 2% as tech giant unveiled its AI plans during the annual developers event. The rout rippled through AI-adjacent cryptos which underperformed the broader digital asset market. Artificial intelligence-linked (AI) cryptocurrencies slumped Monday as tech giant Apple's (AAPL) highly-anticipated annual developers event failed to inspire traders. Native tokens of Render (RNDR), Fetch.ai (FET) and SingularityNET (AGIX) declined 3%-5% over the past 24 hours, while Bittensor's TAO tumbled nearly 6% during the same time. Layer-1 network Near Protocol (NEAR) also dropped 3.2%. The CoinDesk Computing Index, which includes tokens with AI-related utilities, was one of the worst-performing sectors among digital assets, losing 2.5% in market value during the day and underperforming bitcoin (BTC) and the broader digital asset benchmark CoinDesk 20 Index. The decline happened as expectations were high for the tech giant to reveal its AI plans and how it would weave artificial intelligence into its offerings at this week's Apple Worldwide Developers Conference (WWDC2024). The firm on Monday announced Apple Intelligence, a suite of AI features for iPhones, Mac and other products, and a partnership with Sam Altman's OpenAI to integrate ChatGPT into Apple software. Apple shares, however, closed the trading session nearly down 2% despite slight gains for key U.S. equity indexes. https://www.coindesk.com/markets/2024/06/10/ai-linked-crypto-tokens-underperform-as-apples-event-fails-to-impress-traders/