2024-06-04 07:06

The crime proceeds were generally purchased by the scheme participants at discounted rates of up to 80 cents per dollar in exchange for an unspecified cryptocurrency. Epoch Times CFO Bill Guan was charged with participating in a scheme to launder $67 million in illicit funds to benefit himself and the company. The scheme involved using cryptocurrency to purchase crime proceeds at a discount and funneling them into the company's accounts, leading to a significant increase in Epoch Times' reported annual revenue. Epoch Times chief financial officer Bill Guan was indicted by the U.S. Department of Justice (DoJ) early Tuesday. The DoJ accused him of being involved in a scheme to launder $67 million using crypto. Epoch is a popular political conservative media outlet known for its criticism of the Chinese government. Guan is accused of spearheading a scheme in which he managed Epoch’s “Make Money Online” team overseas from in or about 2020 through or about May 2024. These charges do not concern the firm’s news and information-gathering activities. “Under Guan’s management, members of the team and others used cryptocurrency to knowingly purchase tens of millions of dollars in crime proceeds, including proceeds of fraudulently obtained unemployment insurance benefits, that had been loaded onto tens of thousands of prepaid debit cards,” DoJ said. The proceeds were then allegedly “laundered” through a certain cryptocurrency platform and turned into an unspecified cryptocurrency at 70 to 80 cents on the dollar. Team members then used stolen personal identification information to open accounts and funnel the profits there and subsequently into accounts held in their own names. These funds were then further laundered through other bank accounts held by the media entity’s accounts, Guan’s personal bank accounts and through his crypto accounts. Guan faces charges of conspiring to commit money laundering and bank fraud. The money laundering charge carries a maximum sentence of 20 years, while each bank fraud charge could result in up to 30 years imprisonment, as per the DoJ indictment. Hints of possible wrongdoing emerged after investigators started looking into the company’s 410% increase in annual revenue, which flew to $62 million from a relatively lesser $15 million. Guan claimed the boost in funds came from “donations” at the time, which riled suspicion. https://www.coindesk.com/policy/2024/06/04/epoch-times-cfo-charged-with-67m-fraud-scheme-involving-crypto-platform/

2024-06-04 06:27

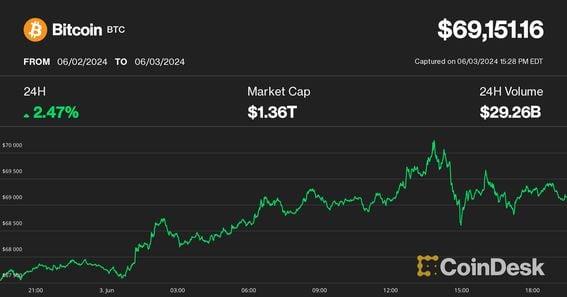

On-chain data shows over 50% of Bitcoin supply remains inactive, a sign of strong long-term conviction in the asset. Bitcoin price dipped to $69,200 amidst profit-taking and broader U.S. stock market movements. Despite negative news, sentiment remains bullish due to long-term holder conviction and anticipation of further spot ETF approvals. Bitcoin (BTC) slid to $69,200 early Tuesday amid profit-taking after briefly crossing the $70,000 level late Monday. Price action across major tokens was mixed. BTC prices moved alongside broader U.S. stock markets, reflecting risky bets in the market. Some meme stocks and tokens jumped more than 100% on the apparent return of influential equity trader Keith Gill. Crypto exchange Bitfinex said in a report on Monday that bitcoin’s slump since March was likely driven by long-term holders selling. However, blockchain data shows the trend has stalled, and investors are accumulating BTC. On-chain analysis firm CryptoQuant shared with CoinDesk in a Tuesday report that 50% of the long-term bitcoin supply was “inactive,” showing no movements or changes in holdings across tracked wallets. This is considered a sign of strong long-term conviction, which may indicate further price gains. As such, the sentiment around bitcoin’s continued growth remains “stubbornly bullish,” with Singapore-based QCP Capital seeing an increase in trading activity. “The market remains stubbornly bullish in spite of negative headlines about Mt. Gox and the DMM hack last week, BTC rallied confidently above $69,000 in Asia,” QCP said in a broadcast message late Monday. “This bullishness is likely to continue as the market waits for the ETH spot ETF to usher in new demand.” “Another reason for persistent bullishness is speculators increasing long positions in other crypto majors in anticipation of additional spot ETF approvals in the near future,” the firm said. Elsewhere, ether (ETH) and dogecoin (DOGE) showed slight losses, while Cardano’s ADA and Solana’s SOL rose as much as 3%. The CoinDesk 20 (CD20), a broad-based index of the largest tokens minus stablecoins, is up 0.41% in the past 24 hours. Among other larger tokens with a market capitalization above $1 billion, dog-themed floki (FLOKI) and synthetic dollar project Ethena’s ENA tokens rose more than 10%. https://www.coindesk.com/markets/2024/06/04/bitcoin-sees-profit-taking-around-70k-amid-stubbornly-bullish-sentiment/

2024-06-03 23:29

Plus: Polymarket traders doubt Trump will go to prison; Kalshi bettors are at odds with the CME FedWatch poll on rate cuts. This week in prediction markets: Trump is convicted, but bettors on Polymarket have a conviction he'll stay out of prison and return to the White House. No rate cut this year, Kalshi traders say Donald J. Trump is the first U.S. president, former or otherwise, to be convicted in criminal court. But this dubious distinction did little to sway his odds of retaking the White House, prediction markets indicate. For the uninitiated, on prediction markets, when the trade settles, those who bet on the correct outcome get $1 per contract purchased, and those who bought "shares" in the incorrect one get zero. The contract's value can be read like a poll; a contract with a value of 40 cents could be read as a 40% chance of the prediction coming true. On crypto-based Polymarket, where the election contract is nearing $150 million in total bets, Trump's guilty verdict didn't do much to move prices, knocking just a penny off the "yes" contract's value. Week-over-week, the probability of Trump winning is down around two percentage points, to 54%. But on May 31, the day a jury convicted Trump of felony crimes, it lost only one percentage point. Trump's 16-point lead over President Joe Biden on Polymarket is still much more pronounced than the polling averages. By that traditional measure, the presumptive GOP nominee is still ahead of the incumbent, but by less than a percentage point according to an aggregate produced by 270 to Win. On PredictIt, a more mainstream betting site where trades are placed in dollars rather than stablecoins, the Trump contract actually gained 1 cent following the guilty verdict, although at 51-48 his lead over Biden is narrower and closer to the polls than on Polymarket. Unlike Polymarket, which blocks U.S. users under a regulatory settlement but has traders around the world, PredictIt is open only to Americans. Legal experts have said that Trump is unlikely to face a prison sentence for his crime, and the market is in line with this sentiment. On a Polymarket contract asking if Trump will go to prison, bettors are fairly confident he won't see the inside of a cell, giving a 76% probability he will serve no time; a 18% change he will get less than a year; and a 2% change he will get one to two years. Polymarket bettors were fairly accurate when predicting the sentence for former Binance CEO Changpeng "CZ" Zhao. CZ was sentenced (and is now serving) a four-month prison sentence. Before sentencing, the market was confident that he'd get less than a year, and more specifically, less than six months. The Department of Justice had asked for a three-year sentence, while CZ's attorneys had argued for 18 months in his plea agreement. Rate cut wen? Kalshi and Polymarket traders are not pricing in a rate cut, creating a stark contrast with the CME FedWatch poll, which does anticipate a cut by the fall, and gives some certainty of another by the winter. On Kalshi, the only U.S.-regulated platform for these contracts, bettors are giving a 32% chance of zero cuts, while they are pricing in a 29% chance of one cut. "Two cuts" is coming in next at 24%. Over at Polymarket, bettors are split between zero and two cuts, giving a 30% chance of each happening. Economists are split on whether the Federal Reserve will lower interest rates in 2024. Factors such as elevated inflation, a resilient economy, and a labor market that remains strong, though slightly softening, suggest that easing monetary policy may not be necessary. However, the persistence of these conditions throughout the year adds an element of doubt. Some, like Steve Englander from Standard Chartered Bank, argue there's a chance for a July cut, citing potential slowdowns in core inflation and seasonal factors affecting current inflation readings. The CME's FedWatch, a poll of market participants, paints a different picture. It's targeting a 54% chance of the first rate cut occurring by the Sept. 18 meeting of the Federal Open Market Committee, and growing confidence that a second – or even third – cut will occur by December. This divergence will be something to watch, to see if the market participants on CME's FedWatch know more than the market observers on prediction markets. https://www.coindesk.com/news-analysis/2024/06/03/trump-conviction-barely-dents-his-odds-of-winning-election-prediction-markets/

2024-06-03 21:26

Bitcoin's slump since March was driven by long-term holders selling, but blockchain data shows the trend has stalled and investors are accumulating BTC, Bitfinex said in a report. Bitcoin (BTC) briefly topped $70,000 Monday for the first time in a week before retreating to its familiar trading range, continuing its sideways price action. The largest crypto by market capitalization recently changed hands at around $69,200, up 2% over the past 24 hours, while Ethereum's ether (ETH) was little changed slightly below $3,800. The broad-market CoinDesk 20 Index gained 1.6% over the past 24 hours. Bitcoin and the broader crypto market have spent more than two months consolidating since March, when BTC hit a record price above $73,000. "This correction phase now appears to be nearing an end," Bitfinex analysts said in a Monday market update. According to the report, selling by long-term holders was a key reason for bitcoin's correction from all-time highs, but blockchain data suggests that these holders have started to re-accumulate BTC for the first time since December 2023. The number of new bitcoin and ether accumulation addresses has also been growing over the past month, a sign of increasing bullish sentiment despite the price stability, Bitfinex analysts added, citing CryptoQuant data. Crypto analytics firm Swissblock noted that the $70,000 and $73,000 levels pose significant resistance capping BTC's price. "Short-term pullbacks are being treated as buying opportunities, with the $67,000 level proving to be a reliable support," Swissblock said in a report. The next week "could be an interesting one to watch" with key inflation data release and Federal Reserve meeting that could fuel volatility in either direction, Joshua Lim, co-founder of crypto derivatives principal trader Arbelos Markets, told CoinDesk. https://www.coindesk.com/markets/2024/06/03/bitcoin-knocks-on-70k-level-bitfinex-hopeful-selling-pressure-that-sparked-a-correction-is-ending/

2024-06-03 18:23

David Krause, a professor of finance at Marquette University, said the initial investment by the State of Wisconsin Investment Board is just "a toe in the water" to test the public’s reaction. The investment by the State of Wisconsin Investment Board into the spot bitcoin ETFs earlier this year is just a trial phase, a professor said. David Krause said that the board has always been innovative and it's no surprise that it's experimenting with bitcoin. The first quarter addition of two spot bitcoin exchange-traded funds (ETFs) to the portfolio of Wisconsin's pension plan was likely just the beginning for that U.S. state’s investments into crypto, said David Krause, a professor of finance at Milwaukee-based Marquette University. The SWIB purchased shares of BlackRock’s iShares Bitcoin Trust (IBIT) and Grayscale’s Bitcoin Trust (GBTC) valued at $164 million as of March 31, a filing with the U.S. Securities and Exchange Commission revealed in May. The news shocked the industry as big institutions, specifically pensions, don’t normally invest in young ETFs like the spot bitcoin ETFs, but the state’s investment board has been ahead of the game before, said Krause in an interview with PBS Wisconsin. “Wisconsin’s investment board has always been innovative,” he said. “This is a fully funded pension fund so in a way, they have the luxury of being able to invest for the long term. They don’t need to worry as much about liquidity as, say, the pension fund for the state of Illinois, which is only funded at 50% of its level,” he added. As of the end of 2023, the SWIB managed roughly $156 billion in assets, according to its website, meaning its holdings in the bitcoin ETFs were a negligible roughly 0.1% of its portfolio. Krause, however, said the investment was just a “toe in the water” and he expects the SWIB to add to that amount and for other pensions to eventually follow suit. “I think it’s just an entry point. I think they’re testing to see the reaction of the public to whether or not there’s resistance to owning this and they’re using it as a trial run, because it really is not going to impact the portfolio substantially, until you get to maybe a 1% or 2% positioning,” he said. Nearly 500 institutional investors revealed allocations into the spot bitcoin ETFs in the first three months of the year. The biggest owner as of March 31 was hedge fund Millennium Management, which revealed $2 billion in holdings across a number of the funds, or roughly 3% of its total assets under management. https://www.coindesk.com/business/2024/06/03/wisconsin-pension-plan-likely-to-invest-much-more-in-bitcoin-etf-says-marquette-professor/

2024-06-03 17:37

The Uniswap Foundation keeps punting on a "fee switch" proposal that would give UNI governance token holders a cut of liquidity providers' revenue. On Friday, the Uniswap Foundation announced it was delaying a key vote on whether to upgrade the protocol’s governance structure and fee mechanism to better reward holders of the UNI governance token. The nonprofit cited concerns from a “stakeholder,” thought to have been an equity investor in the organization behind the largest Ethereum-based decentralized exchange. Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates. "Over the last week, a stakeholder raised a new issue relating to this work that requires additional diligence on our end to fully vet. Due to the immutable nature and sensitivity of our proposed upgrade, we have made the difficult decision to postpone posting this vote,” the foundation wrote on X (formerly Twitter). Although the foundation said the decision was “unexpected” and apologized for the situation, this is far from the first delay to a vote on whether to engage the “fee switch” that would direct a modest amount of protocol trading fees to token holders. It is also far from the only time that the interests of token holders have seemingly been at odds with those of other “stakeholders” in Uniswap. “We will keep the community apprised of any material changes and will update you all once we feel more certain about future timeframes," the foundation added. Uniswap issued the UNI token in the aftermath of “DeFi Summer” in 2020 to stave off what was known as a “vampire attack” by Sushiswap, which launched with the governance token SUSHI and quickly began to attract liquidity. Sushiswap was seen as relatively more community-aligned given that it was managed by a DAO and directed trading fees to token holders. Version 2 of Uniswap contained code that would enable the 0.3% of trading fees paid to liquidity providers (or those who contribute tokens to be traded on the decentralized exchange) to be split, with 0.25% going to LPs and the remaining .05% to UNI token holders. But the “fee switch” was never activated. Talks again arose about fee switch activation with the launch of Uniswap V3. GFX Labs, maker of the Oku, a front end interface for Uniswap, proposed a plan that would test out the protocol fee distribution on a few pools on Uniswap V2 that received a lot of attention. But talks ultimately fizzled out, due in part to concerns that activation might drive LPs and liquidity away from the platform, as well as legal fears. One of the main worries at the time was that the fee switch could have tax and securities law implications for UniDAO given that it would essentially be paying a type of revenue-based dividend to token holders. It’s unclear exactly what concerns Uniswap Foundation was responding to when deciding to once again delay the vote. Gabriel Shapiro, a prominent legal expert in crypto, wrote that this is another example of a DeFi protocol treating token holders as “second class” citizens whose desires are subordinated to a smaller group of stakeholders. Similar arguments were made late last year when Uniswap Labs imposed a 0.15% trading fee on its frontend website and wallet – the first time the development group sought to directly monetize its work. The fee only applied to products maintained by Uniswap Labs, not the exchange protocol itself, but did come after a $165 million raise. There is no reason to be completely cynical here, and suggest that the hardcoded fee switch to reward UNI token holders will never be implemented. Uniswap Labs and UNI token holders are distinct entities with their own interests; ideally both would be aligned to do what’s best for the protocol itself But if there is a lesson to be learned across DeFi, it’s that token holders do not always get the final say. https://www.coindesk.com/tech/2024/06/03/uniswap-vote-delay-shows-defi-stakeholders-arent-all-in-it-together/