2024-05-30 14:33

Ether spot ETFs could attract as much as $3 billion of net inflows this year, the report said. Spot ether exchange-traded funds are likely to see much lower demand than the bitcoin ETFs, the bank said. JPMorgan said bitcoin had the first mover advantage. The ether funds could see inflows of as much as $3 billion this year, the report said. The demand for spot ether (ETH) exchange-traded funds (ETFs) will be a lot lower than for their bitcoin (BTC) equivalents for a number of reasons, JPMorgan said in a research report on Thursday. JPMorgan said it expects spot ether ETFs to attract as much as $3 billion of net inflows for the rest of this year. If staking is permitted, the figure could rise as high as $6 billion, it said. “Bitcoin had the first mover advantage, potentially saturating the overall demand for crypto assets in response to spot ETF approvals,” analysts led by Nikolaos Panigirtzoglou wrote. Ether ETFs are close to becoming available in the U.S. after the Securities and Exchange Commission (SEC) approved key regulatory filings from applicants last week. They are not yet cleared to trade because the regulator must also approve their S-1 filings before that can occur. Bitcoin ETFs began trading in January. The bitcoin reward halving in April was an additional demand catalyst for spot bitcoin ETFs, the report said, noting that there is no similar impetus for ether in the future. The lack of staking for approved spot ether ETFs also makes these products less attractive compared with other platforms that offer staking yields, the bank said. Ether as an application token, “differs from bitcoin in its value proposition for investors with bitcoin having a broader appeal by competing with gold in portfolio allocations,” the authors wrote. The bank noted that less liquidity and lower assets under management (AUM) would make ether's spot ETFs less appealing to institutional investors than those of its larger rival. The market’s initial reaction to the launch of spot ether ETFs is likely to be negative, as speculative investors who bought the Grayscale Ethereum Trust (ETHE) in expectation of it being converted to an ETF are likely to take profit. ETHE could see $1 billion of outflows, putting downward pressure on ether prices, the report said. https://www.coindesk.com/markets/2024/05/30/ether-spot-etfs-to-see-much-lower-demand-than-bitcoin-versions-jpmorgan-says/

2024-05-30 12:16

The uptick signals a bullish outlook, according to Wintermute. Ether's put-call open interest ratio rose to 0.61 Wednesday, Glassnode data show. The uptick signals a bullish outlook, Wintermute said. Ether’s (ETH) price rally has stalled since Monday. Still, a popular options market gauge continues to exhibit a bullish bias. The token's price has pulled back to $3,730 from the two-month high of $3,973 reached Monday, CoinDesk data show. Prices were on a tear last week after the U.S. SEC moved closer to approving the highly-anticipated spot ether exchange-traded funds (ETFs). Ether’s put-call open interest ratio, which compares the number of active put or bearish contracts versus bullish or call options, rose to 0.61 on Deribit early Thursday, the highest in at least a year, according to data source Glassnode. An uptick in the ratio is said to reflect a bullish bias, although movements in the ratio are subject to interpretations. “Ethereum’s put-call ratio has reached 0.6, signaling a bullish outlook following spot ETH ETF approvals,” algorithmic trading firm Wintermute said in a note shared with CoinDesk. A put option gives the option buyer the right to sell the underlying asset at a specific price by a stated date. Savvy traders and investors typically use options to hedge spot market positions and collect additional yield on top of coin holdings. A relatively higher number of active put options can stem from traders adding puts to protect their coin holdings (bullish spot market position) from a sudden price drop. Another possibility is traders selling put options in a rising market to generate additional income in addition to their spot market holdings. A put option seller receives a premium as compensation for offering insurance against price drops. The bullish interpretation of the rising ratio is consistent with positive call-put skews across time frames. As of writing, the seven-day skew stood at 2% while the 30-, 60-, 90- and 180-day skews returned a value of over 5%, according to Amberdata. That’s a sign of the relative richness of calls or bullish bets. That said, traders should be mindful of a continued rise in the put-call open interest ratio. A very high ratio, above 1, indicates extreme bullishness and is taken to represent an impending market top by contrarian investors. Readings below 0.20 and lower indicate extreme bearishness, traditionally seen at bear market bottoms. https://www.coindesk.com/markets/2024/05/30/ether-put-call-ratio-hits-one-year-high-hints-at-bullish-bias-despite-pause-in-rally/

2024-05-30 10:58

Crypto markets are expected to remain shaky ahead of Friday’s U.S. inflation report, one trading desk said. Crypto majors experienced a significant decline in the past 24 hours, with meme coins like shiba inu and dogecoin leading the drop. The market is looking toward Friday's U.S. PCE inflation data for guidance on bitcoin's direction, with some analysts predicting a drop to as low as $60,000. Some of the largest cryptocurrencies lost as much as 5% in 24 hours as traders looked toward Friday's Personal Consumption Expenditures inflation report in the U.S. and warned of further declines in the price of bitcoin (BTC). Meme coins shiba inu (SHIB) and dogecoin (DOGE) led the market lower, each losing about 5%. XRP, Solana’s SOL and BNB Chain’s BNB fell 2%, while the CoinDesk 20 (CD20), an index of the largest tokens minus stablecoins, slipped 1.6%. Bitcoin has been testing support at $67,000 after briefly recovering to $70,000 at the start of the week. Ether (ETH), which was among the biggest advancers last week after favorable regulatory decisions, has dropped over 5% since Monday. According to the trading desk of Japanese crypto exchange bitBank, stronger-than-expected consumer sentiment and weak Treasury sales are adding to the pressure on the price of bitcoin. “The price will likely show no clear direction until Friday’s U.S. PCE announcement, and it could be a make-or-break event for bitcoin,” bitBank said in an email. “If the inflation data comes in hotter than expected, bitcoin could give up about a half of its gain in the past two weeks and decline to around $65,000.” FxPro senior market analyst Alex Kuptsikevich echoed the sentiment: “In the most bearish scenario, the price could roll back to $60,000. A more optimistic scenario suggests a decline to the $65K area, where the 50-day moving average lies,” he said in a Telegram interview. The March figure rose 2.7% year-on-year. The April reading is due at 12:30 UTC tomorrow. Elsewhere, on-chain analytics Glassnode recorded signs of a recovery in buyer interest in bitcoin. Long-term BTC holders, defined as those holding the asset for more than 155 days, have resumed accumulation for the first time since December 2023 after months of selling. Traditional stock indices showed signs of weakness ahead of the inflation figure, which could provide clues on the Federal Reserve's interest-rate trajectory. Historically, higher interest rates tend to cause bearish sentiment among investors due to the strain on market liquidity – with sell-offs across assets. https://www.coindesk.com/markets/2024/05/30/bitcoin-traders-warn-of-pullback-as-us-inflation-data-looms-dogecoin-leads-majors-slide/

2024-05-30 09:41

The addresses supposedly owned by DBS has already made $200 million on its ether holdings, according to Nansen. The blockchain address – 0x9e927c02c9eadae63f5efb0dd818943c7262fb8e – supposedly owned by DBS held 173,753 ETH at press time, according to Nansen. The address has already made $200 million from its ether holdings. DBS, the largest bank in Singapore, is an ether (ETH) whale, according to on-chain analytics firm Nansen. The blockchain address – 0x9e927c02c9eadae63f5efb0dd818943c7262fb8e – supposedly owned by DBS held 173,753 ETH, worth $647 million at press time. At the time of writing, Ether changed hands at $3,730. Nansen said that the address has made over $200 million from its ether holdings. “In relation to the post, DBS does not have this position on our books,” a spokesperson said. Ether is the native token of Ethereum, the world’s leading distributed computing platform for creating smart contracts and decentralized applications. Over the years, Ethereum has become a go-to technology for investment banks to tokenize capital markets. The bank is not new to crypto and offers a range of services, including digital asset custody, a trading exchange for security tokens, and a portfolio management app for both traditional and crypto assets. A recent report by the bank highlighted the growing interest in the crypto market from retail investors, high-frequency traders, and hedge funds. Nansen's revelations of DBS' ether holdings come as the crypto market patiently awaits the debut of spot ether exchange-traded funds in the U.S., which are expected to boost the cryptocurrency's mainstream institutional adoption. Since 2020, several listed firms have turned to crypto, mainly bitcoin, to diversify their reserves. Bitcoin ETFs began trading in the U.S. in January. https://www.coindesk.com/markets/2024/05/30/singapores-largest-bank-dbs-is-an-ether-whale-with-nearly-650m-in-eth-nansen/

2024-05-30 07:01

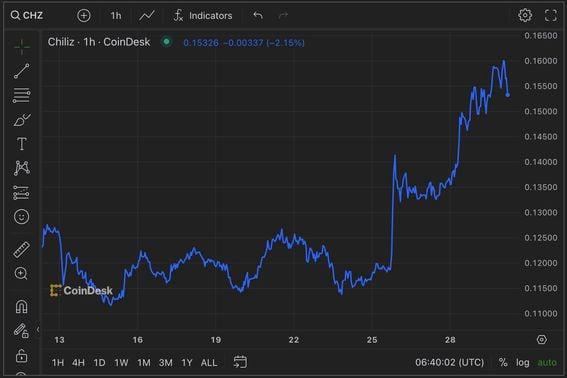

CHZ has surged over 20% in seven days, the third-biggest gain among the top 100 cryptocurrencies by market value. CHZ, the native token of the Chiliz blockchain, which powers sports token fan creator Socios.com, surges as the UEFA football championship nears. The token doubled in value in the months before the 2022 FIFA World Cup, only to slide later. 10X Research expects the FIFA scenario to repeat itself. A cryptocurrency, representing an intersection of blockchain and sports, has recently emerged as a source of excitement to crypto markets as major digital assets trade listless. CHZ, the native token of the Chiliz blockchain (CHZ), which powers the largest sports fan token creator platform, Socios.com, has risen 25% in seven days, reaching a two-month high of over 15 cents. Prices hit a three-week high of 16 cents early today, according to data source Coingecko. The double-digit price surge is the third largest among the top 100 cryptocurrencies by market value, including bitcoin and ether. (Notcoin and dogwifwhat are best performers). Excitement about the upcoming 24-country Union of European Football Associations (UEFA) Euro, which will be held from June 14 to July 14, seems to have amplified CHZ’s valuations. Most fan tokens are procured on Socios.com utilizing CHZ. Thus, the cryptocurrency represents the degree of interaction between fans and their favorite sports teams. A much bigger rally unfolded in the lead-up to the 2022 FIFA World Cup. The token doubled in value to nearly 30 cents through the summer of 2022, topping out a day before the global sporting event, which kicked off on November 20, 2022. Prices tanked nearly 40% in December that year. 10X Research expects the FIFA scenario to repeat itself, ensuring more gains for CHZ by mid-June and a potential sell-off afterward. “The Chiliz (CHZ) token rallied over 100% from the summer of 2022 until one day before the FIFA World Cup started on November 20, 2022 (lasted until December 18, 2022). Only to then decline by -60% one day before the start of the FIFA Soccer World Cup (from November 19, 2022). Markus Thielen, founder of 10X, said in a note to clients. “This scenario might repeat itself. A slightly smaller version than the World Cup of 2022, the UEFA European Football Championship will be held from June 14, 2024, to July 14, 2024, with teams from 24 countries competing,” Thielen noted, adding that the company usually promotes its token around these events. In general, sports tokens are vulnerable to “buy the rumor, sell the news” tendencies, representing a pre-event period of optimism and price rallies and subsequent price declines, a recent study titled “Anticipatory Gains and Event-Driven Losses in Blockchain-Based Fan Tokens: Evidence from the FIFA World Cup,” published in Research in International Business and Finance, revealed. Football events are known to boost consumption and economic activity in Europe. A 2019 paper found a relevant direct statistical link between the market value of regional football clubs in Europe and the economic performance of the respective regions. The availability of fan tokens and blockchains like Chiliz has made it easier to price in and measure sporting events' financial and economic impact. https://www.coindesk.com/es/markets/2024/05/30/chilizs-chz-token-pre-uefa-euro-price-surge-revives-fifa-memories/

2024-05-30 06:43

A 'Seed Capital Investor' has purchased 400,000 shares of the proposed filing, BlackRock revealed in its document. Bloomberg analyst Eric Balchunas called the updated S-1 a “good sign,” adding that a launch by the end of June was “a legit possibility.” On Tuesday, BlackRock became the largest publicly traded bitcoin fund, flipping Grayscale. BlackRock filed an amended S-1 form for its proposed spot ether (ETH) exchange-traded fund (ETF) that revealed more information about the product that was recently approved for listing in the U.S. The form revealed a “Seed Capital Investor” had purchased the initial shares for the proposed product. “On May 21, 2024, the Seed Capital Investor, an affiliate of the Sponsor, subject to conditions, purchased the Seed Creation Baskets, comprising 400,000 Shares at a per-Share price equal to $25.00,” the S-1 form showed. “The net asset value of the Trust was $10,000,000.” Subject to regulatory approval, assets held in the ETF can be redeemed for cash or even ether. The iShares Ethereum Trust ether ETF will list and trade under “ETHA.” Bloomberg analyst Eric Balchunas called the updated S-1 a “good sign,” adding that a launch by the end of June was “a legit possibility.” The updated S-1 comes nearly a week after the Securities and Exchange Commission (SEC) approved several ether ETFs for listing in the U.S., buoying bullish sentiment in the broader crypto market. BlackRock’s bitcoin ETF has proven to be a success so far for the company so far. On Tuesday, it became the world’s largest publicly traded bitcoin fund, flipping Grayscale, with nearly $20 billion in assets under management. IBIT has taken over $16 billion in net inflows since going in January, as reported, with major state pension funds among its investors. https://www.coindesk.com/markets/2024/05/30/blackrock-amends-ethereum-etf-application-bloombergs-balchunas-sees-etf-going-live-by-june/