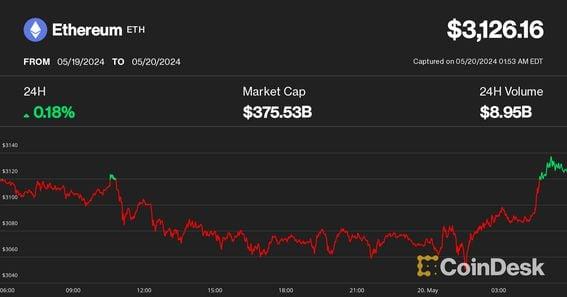

2024-05-20 07:02

The market has priced in a rejection for the first set of Ethereum ETFs, but there are reasons to be optimistic about an approval next year, says one fund manager. ETH and BTC are trading flat as Asia's business week opens. Traders are looking at the ETH ETF decision, and Nvidia earnings this week. The crypto market was listless early Monday, with bitcoin (BTC), the biggest digital asset market by value, trading flat at $67,156 and ether (ETH) changing hands at $3,127, according to CoinDesk Indices data. The consolidation follows a week of bullish action triggered by renewed optimism about a U.S. rate cut and the rally in stocks. Things could soon get busier again with the first decisions for ether exchange-traded funds (ETFs) due. The Securities and Exchange Commission is set to weigh in on VanEck's ether exchange-traded fund (ETF) on May 23 and the Ark/21 Shares one on May 24, as well as Nvidia earnings. March Zheng, managing partner of Bizantine Capital, told CoinDesk in an interview that while the market has priced near the certainty of a rejection, there are still some reasons to be optimistic. "There are reasons to believe that the report will contain silver linings for the delay, which should signal an eventual approval of Ethereum in the next year," Zheng said. "The removal of staking prepositions by filers reclassifies underlying ETH as commodities supported by the CFTC and can pave a major pathway going forward." Polymarket currently gives a 10% chance of an ether ETF being approved by May 31, a 13% chance of approval by June 30, and a 28% chance of approval this year. Recently, Coinbase analyst David Han wrote that the market may be "underestimating the timing and odds of a potential approval." Zheng argued that positive ETH ETF news might also boost trading sentiments for BASE, a Layer-2 network, whose native token's price has dropped by nearly 25% in the last two weeks. Traders are also going to be eyeing Nvidia's earnings, scheduled for Wednesday. Bitcoin trades strongly in correlation with Nvidia, as do Artificial intelligence-themed tokens, which surged in February as the chip designer reported better-than-expected earnings. The direct correlation between Nvidia and ether market movement isn't as strong as it once was during the mining boom. Still, the rising tide of bitcoin and AI tokens – should Nvidia's earnings remain strong – will likely lift all boats. https://www.coindesk.com/markets/2024/05/20/ether-bitcoin-open-asia-trading-week-flat-as-eth-etf-decision-nvidia-earnings-loom/

2024-05-20 06:33

Research firm 10x suggests bitcoin holders use the options strategy to enhance portfolio yield by 17%. 10x Research suggests selling out-of-the-money (OTM) call and put options tied to bitcoin while holding the cryptocurrency in the spot market. The so-called covered strangle strategy will generate a 17% yield, in addition to the upside from the spot market holding Bitcoin (BTC) investors looking to generate extra income in addition to their spot market holdings should consider setting a "covered strangle" options strategy, research firm 10X, which has an impeccable record of predicting market trends, said Monday. The 'covered strangle' strategy involves holding the underlying asset in the spot market and simultaneously selling an out-of-the-money (OTM) call option at levels (known as strikes in options parlance) above the underlying asset's going market rate and selling an OTM put at strikes below the underlying's spot market price. The premium received for selling/shorting the call option, or protecting the counterparty from price rallies, and selling the put or insurance against downtrends, represents the extra yield. 10x suggests selling a $100,000 strike call, which is 50% above BTC's current market price, and a $50,000 strike put, both expiring in December 2024, while holding the cryptocurrency in the spot market. "Our favorite strategy is to buy bitcoin Spot, Sell 100,000 strike call, and Sell 50,000 strike put for the December 2024 expiry. Selling the call could yield 11%, and selling the put could yield 6%," Markus Thielen, founder of 10x Research, said in Monday's client note, detailing the suggestion. "Hence, this strategy provides us with either a 17% downside buffer or 17% more yield, depending on where BTC closes in December, plus we would capture all the upside (or downside) for bitcoin," Thielen added. The strategy is preferred when the market outlook is bullish, but the uptrend is expected to unfold slowly, keeping implied volatility or investors' expectations for price turbulence low. In such conditions, options, particularly OTM call and put options, bleed value faster as expiry nears, making money for sellers. The strategy, though appealing, is now without risks and requires a high tolerance for risk. That's because the risk is leveraged below the level at which the put option is sold, in this case, $50,000. "Below the lower strike price, both the long stock and short put incur losses, and, as a result, percentage losses are twice what they would be for a covered call position [buy spot = sell OTM call] alone," Fidelity said in a 'covered strangle" explainer. In other words, 10x's strategy is for those who believe bitcoin's bull market will progress slowly and corrections, if any, will not see prices drop below $50,000. As of writing, bitcoin changed hands at $67,170, representing a 58% year-to-date gain, CoinDesk data show. Several analysts, including Thielen and Arthur Hayes, former CEO of crypto exchange BitMEX, expect a slow grind higher. https://www.coindesk.com/markets/2024/05/20/research-firm-favors-bitcoin-covered-strangle-strategy-to-enhance-portfolio-yield-by-17/

2024-05-20 05:47

Bankruptcy claims began trading at 35% of account balance value when they were initially listed on claim trading marketplace Xclaim. Genesis will return 77% of customer assets, worth $3 billion, in a court-approved liquidation plan Bankruptcy claim trading platforms were initially pricing in 35% of claims would be repaid shortly after the insolvency was announced Digital Currency Group (DCG) will not be among the entities receiving a payout Genesis recently secured court approval to distribute $3 billion in cash and crypto to its creditors, according to a recent filing, representing approximately 77% of the value of customer claims – however Digital Currency Group (DCG) will not be included in the list of entities paid out. Genesis Global Holdco LLC, the holding company of Genesis, and its subsidiaries filed for Chapter 11 bankruptcy protection in New York in January 2023 due to significant losses from the collapses of Three Arrows Capital and FTX, with over $3.5 billion owed to its top 50 creditors. In the immediate aftermath of the filing, the market was skeptical that customers would be made whole and the bankruptcy proceedings would be completed in an expedient manner. Bankruptcy claim marketplace Xclaim initially listed Genesis claims at 35% of their value in January 2023. As of today, Genesis claims for bitcoin or ether are trading between 97-110% for claims over $10 million, while claims under $1 million are trading for between 74-94%. Claims for fiat currency or stablecoins in Genesis accounts are trading between 89-91% for accounts worth between $1-10 million, and between 73-88% for claims under $1 million. DCG, the parent company of Genesis, will not be paid out in the proceedings. "The record here clearly establishes that there is not sufficient value in the Debtors’ estates to provide DCG a recovery as equity holder after unsecured creditors are paid," Judge Sean Lane wrote in the filing. "Given the size of the creditor claims, DCG is out of the money as an equity holder by billions of dollars, even if the Court valued creditor claims using the method DCG proposes." DCG had previously argued for customer claims to be capped at the value of cryptocurrencies as of January 2023, which they believed would allow for full repayment to customers and potentially a recovery for DCG. In the filing, Judge Lane noted that DCG assumed $1.1 billion of Genesis's debt from the Three Arrows Capital collapse with a 10-year promissory note, but this illiquid obligation did not cover the losses, leading to scrutiny of DCG's financial practices. DCG and Genesis also had credit lines between the two companies, and Genesis ended up suing DCG over claims that the company missed payments on the loans it took. DCG and Genesis announced in November 2023 that the two companies have reached a repayment plan, with DCG having paid $227.3 million so far and planning to pay another $275 million by April, to settle a lawsuit over $620 million in loans. https://www.coindesk.com/markets/2024/05/20/genesis-set-to-return-3b-customer-assets-in-finalized-bankruptcy-liquidation-plan/

2024-05-17 19:59

Roughly 13 out of the 25 biggest U.S.-based hedge funds held the spot bitcoin ETFs at the end of March, according to data from bitcoin brokerage River. Steve Cohen's Point72 held $77.5 million of the Fidelity Wise Origin Bitcoin Fund in the first quarter. Point72 joins several other hedge funds who have disclosed allocations into the spot bitcoin ETFs. Point72, the $34 billion hedge fund of billionaire and owner of the New York Mets, Steven Cohen, held $77.5 million of the Fidelity Wise Origin Bitcoin Fund (FBTC) as of the close of the first quarter, according to a filing. This follows several other hedge funds who have disclosed that they purchased shares of the spot bitcoin exchange-traded funds, including Paul Singer's Elliott Capital and Izzy Englander’s Millennium Management, with the latter being the biggest institutional holder of the new funds with roughly $2 billion as of March 31. Out of the top 25 hedge funds in the U.S., 13 of them bought into the ETFs in the first quarter, according to data compiled by bitcoin brokerage firm River. Among them, in addition to the names mentioned earlier, were Fortress Investment Group and Schonfeld Strategic Advisors. While hedge fund purchases of the spot ETFs might be a long-term bet on "number go up," these vehicles could be bought for other reasons, market making, hedging, yield generation, or for a short-term flip, to name a few. https://www.coindesk.com/markets/2024/05/17/steven-cohens-point72-also-an-owner-of-bitcoin-via-spot-etfs/

2024-05-17 18:34

The fifth-largest cryptocurrency is benefitting from multiple catalysts, including bustling meme coin and DeFi activity, upcoming network upgrade and increasing interest in restaking arriving to the ecosystem. Solana's SOL hit its highest price in a month Friday outperforming most crypto majors. The token is "still the best trade this cycle," and could reach $200 by the end of May, Syncracy Capital co-founder said. Solana's native token (SOL) has been leading the recent rebound in cryptocurrency prices, outperforming most digital asset majors, and could soon target new cycle highs. SOL hit $170 on Friday, its highest price in more than a month, before slightly retreating to $166 recently. It has advanced nearly 7% over the past 24 hours and is now up more than 40% from the crypto market's local bottom in early May, while BTC sank to $56,000. On the weekly timeframe, solana's 17% gain was the most among the members of the broader crypto market benchmark CoinDesk 20 Index (CD20), only behind Chainlink's (LINK) benefitting from news of a fund tokenization pilot partnership. "Strength on SOL has been incredible on this bounce," Daniel Choung, co-founder of digital asset hedge fund Syncracy Capital, said in an X post. "Very clear this is still the best trade of this cycle." Choung said he's increasingly "confident" that SOL could retake the $200 level by the end of the month and target new record highs "soon." SOL reached its $260 all-time high in November 2021 at the peak of the previous bull cycle. Solana is benefitting from multiple catalysts, including bustling meme coin trading, strong stablecoin volumes and decentralized finance (DeFi) activity. Choung cited incoming network upgrades are paving the way for the highly anticipated Firedancer, a secondary chain client developed by Jump Crypto that aims to improve the network's performance. There's also an "increasingly growing interest in shared cryptoeconomic security" – usually referred to as restaking – arriving to the ecosystem, David Shuttleworth, research partner at Anagram, said in an X direct message. https://www.coindesk.com/markets/2024/05/17/solanas-sol-could-hit-200-by-month-end-hedge-fund-founder-says/

2024-05-17 15:26

The Wall Street giant held roughly $270 million worth of Grayscale’s Bitcoin Trust as of the end of March, according to a filing. Morgan Stanley held nearly $270 million of GBTC as of March 31. The investments were likely made on behalf of clients and not a bet on bitcoin by the bank itself. Morgan Stanley was the owner of $269.9 million of Grayscale’s Bitcoin Trust (GBTC) as of March 31, a 13F filing showed. Other banking giants, among them JPMorgan, Wells Fargo, and UBS, also disclosed holdings in the spot bitcoin exchange-traded funds during the first quarter. It is important to note that these purchases don't necessarily represent the banks' views on the direction of bitcoin's price, but instead were likely either made on behalf of the banks' wealth management clients or necessary for market making and/or ETF authorized participant duties. Morgan Stanley opened up spot bitcoin ETF allocations to its clients shortly after their approval in January, though only on an unsolicited basis, meaning that the client had to propose the investment to the broker. https://www.coindesk.com/business/2024/05/17/morgan-stanley-latest-bank-to-disclose-spot-bitcoin-etf-holdings-for-clients/