2024-05-17 07:43

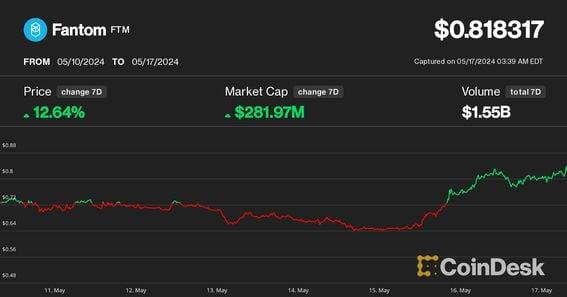

FTM has gained 13% in the last week, and total value locked in Fantom briefly hit $200 million. Fantom's FTM token rose 13% in the past week, outperforming the broad market CoinDesk 20 Index. Investors look favorably upon the blockchain's continuing Sonic upgrade, as well as an increase in the TVL of many decentralized apps. The Fantom blockchain's FTM is one of the best-performing non-meme tokens of the past week as the market looks favorably on the roll-out of its Sonic upgrade and increases in the total value locked (TVL) on the protocol. FTM has gained 13% in the past seven days to about 81 cents, according to CoinDesk Indices data, while the CoinDesk 20 (CD20), a measure of the largest digital assets, is just 1.5% higher. In the past few weeks, the Fantom Foundation has been pushing out its latest upgrade, codenamed Sonic. Currently, 25 out of the 60 nodes have completed the upgrade, according to a dashboard, and the chain will be officially upgraded once the new software hits two-thirds of the nodes. Sonic is expected to boost transaction speeds to 2,000 transacations per second (TPS) with a 1.1-second finality. That compares with just over 2.5 TPS during the past month, on-chain data shows. Investors might also be interested in a recent bump in the chain's TVL. According to DeFiLlama, Fantom's TVL hit $203 million on May 16, up from $111 million two days prior, given a broad increase in TVL on various decentralized exchanges, lending apps, yield aggregators and other decentralized apps (dapps). Many dapps that support the Fantom chain have seen their TVL rise by 10%-20% during the last week. https://www.coindesk.com/markets/2024/05/17/fantom-outperforms-coindesk-20-over-past-week-as-tvl-jumps/

2024-05-17 06:45

The higher implied volatility for short-dated puts suggests investors are willing to pay a premium for downside protection, CF Benchmarks said. CME’s bitcoin options show investors continue to pay a premium for short-dated protective put options after Wednesday’s U.S. CPI release. A broader outlook appears constructive, with longer-dated calls drawing relatively higher implied volatility. While upbeat U.S. inflation data released early this week has restored institutional faith in bitcoin’s (BTC) long-term bullish case, it is yet to alleviate concerns of a near-term price pullback. The odds of a near-term rally are still scant, according to CF Benchmarks’ analysis of options trading data on the Chicago Mercantile Exchange (CME), a platform widely regarded as a barometer of institutional activity. According to CF Benchmarks, implied volatility for short-dated out-of-the-money (OTM) put options was higher than implied volatility for OTM calls following Wednesday’s softer-than-expected U.S. CPI release. These options are based on CME’s cash-settled standard bitcoin futures contract, which is sized at 5 BTC. “The volatility skew, which represents the difference in implied volatility between out-of-the-money (OTM) puts and calls is quite pronounced in the shorter-dated options. The higher implied volatility [demand] for OTM puts compared to calls suggests investors are still cautious about near-term downside risks and are willing to pay a premium for protective puts,” CF Benchmarks said in a note shared with CoinDesk on Thursday. Put options are derivative contracts that protect the buyer from price drops. A put buyer is implicitly bearish on the market, looking to profit from or hedge against potential price weakness. A call option offers insurance against price rallies. Put options at strikes lower than the going market rate and calls above the spot market price are considered out-of-the-money. Implied volatility is an estimate of the future volatility of the underlying asset based on options prices. Implied volatility rises as demand for options increases. CF Benchmarks is the U.K.-regulated provider of digital assets benchmarks like the CF Bitcoin Volatility Index. CF Benchmarks and CME also publish several crypto-related reference rates, including the CME CF Bitcoin Reference Rate and CME CF-Ether Dollar Reference Rate. The volatility surface – a three-dimensional plot of the implied volatilities of bitcoin options – shows implied volatilities for short- and long-dated bitcoin options with different deltas or degrees of sensitivity to changes in the price of bitcoin. OTM options’ delta ranges from 0.5 to 0. As can be seen, the post-CPI bias has been for OTM puts expiring in 20 to 40 days. Meanwhile, as we move toward longer-dated options, the skew flips in favor of calls or bullish bets. “This indicates that investors are growing more optimistic about bitcoin’s longer-term prospects and are willing to pay more to be positioned for potential upside by buying OTM calls,” CF Benchmarks said. The chart also shows relatively flat implied volatility levels for longer-dated options, a sign of increased institutional participation. “This could be interpreted as a sign of increasing institutional involvement, as these investors often have a more nuanced view of the market and are less prone to extreme sentiment swings,” CF Benchmarks added. A similar long-term bullish bias is seen in options trading on the cryptocurrency exchange Deribit, which accounts for over 85% of the global crypto options activity. As of writing, notional open interest or the dollar value of the number of open bitcoin options contracts on Deribit was $15.63 billion. Meanwhile, open interest in CME options was $417 million. At the time of writing, bitcoin was trading at $65,550, representing a weekly gain of 6.6%, according to CoinDesk data. https://www.coindesk.com/markets/2024/05/17/institutions-still-skeptical-of-a-near-term-bitcoin-rally-cme-options-data-show/

2024-05-16 21:08

President Biden's emergency order to halt the Chinese-tied mining on the doorstep of a nuclear-missile base hit days after mining giant CleanSpark struck a deal to buy the property. CleanSpark had just finished hailing the benefits of its purchase of a Wyoming crypto-mining site when the White House declared that the current operation was a national security threat that must be halted. The company says it was unaware of the order before buying the properties but intends to move forward with the acquisition. Order would mark first "the first presidential prohibition relying on the expanded authority over real estate transactions granted to CFIUS and the president." An American bitcoin mining company, CleanSpark (CLSK), got caught up in the U.S.-China political war after buying mining sites in Wyoming within close proximity of a U.S. nuclear missile base from MineOne, a company with Chinese ties. On Monday, President Joe Biden ordered a bitcoin mining facility near Warren Air Force Base in Wyoming to stop operations, citing a threat to national security as it uses foreign-sourced technology. The order said that MineOne is majority-owned by Chinese nationals, and all mining equipment on the property must be removed from within a mile of the military facility in Cheyenne, which houses Minuteman III intercontinental ballistic missiles (ICBMs). While this may not be a surprising move in itself, the timing stands out, as MineOne sold the sites to CleanSpark less than a week prior to the order. On May 9, CleanSpark said it was buying two mining sites for nearly $19 million in cash, with a 45-day closing, without naming a specific seller. The miner said it will deploy China-based Bitmain's latest generation mining machine, noting that it plans to expand the sites by an additional 55 megawatts (MW) from 75MW. A spokesperson for CleanSpark said the company was unaware of the order prior to buying the mining sites but acknowledged the concerns in the executive order and intends to press forward with the deal. "The executive order and the involvement of CFIUS, both of which we were unaware of before signing the deal, has added an unexpected layer to the closing process, but we are working through these developments toward a satisfactory closing," the spokesperson told CoinDesk in a statement. "We respect the oversight process and are dedicated to ensuring that our operations bolster national security and benefit economic development, particularly in Wyoming, a state that has been at the forefront of developing and nurturing a pro-Bitcoin environment," the statement said. Neither MineOne nor lawyers at Loeb & Loeb who handled the property deal for the company responded to requests for comment. The details of the $19 million deal, though, were fully described in filings to the Securities and Exchange Commission (SEC) from CleanSpark. The purchase was highly dependent on the securing of massive amounts of energy required to run the business. The larger of the two properties is about 4,000 feet from the closest edge of Warren Air Force Base. From MineOne, the sale agreement was signed by Jiaming Li, identified as the company's director. Li, who couldn't be reached by CoinDesk for comment, has also been president of China Xiangtai Food Co., a partner in TCC Capital and reportedly managed almost $12 billion in assets at Sinatay Insurance Co. He has a doctorate in economics from Fordham University, according to past press releases. Li was also briefly the president of Bit Origin Ltd., a MineOne investor and a company that was reported to have garnered similar scrutiny previously from Washington. Due diligence The SEC-disclosed contract with CleanSpark outlined a due diligence period extending 15 days from the May 8 date the deal was signed, and the purchase could be scrapped if MineOne didn't satisfy several conditions, including "government compliance matters." "I have been deeply involved in National Security affairs for nearly four decades, and am well aware of the potential risks of many different types of encroachment on important defense infrastructure," said Tom Wood, a CleanSpark board member who once served in senior U.S. Navy roles and as a military analyst, in a statement. "The presence of a CCP-owned data processing facility near a facility like Warren which houses a portion of the nation’s ICBM force is legitimate cause for concern as noted by the president’s order." He said he's familiar with the CFIUS process, calling it "impartial, data-driven and non-arbitrary," and he said that if the U.S. mining business can address the concerns in the order, "I would consider this a significant win-win for the United States and for CleanSpark." This use of Committee on Foreign Investment in the United States (CFIUS) powers to shut down the acquisition by owners tied to China marked the eighth such use of CFIUS – seven of which involved China, according to lawyers at Hogan Lovells who specialize in this issue. Anne Salladin and Brian Curran said in an emailed analysis that this was "the first presidential prohibition relying on the expanded authority over real estate transactions granted to CFIUS and the president under the Foreign Investment Risk Review Modernization Act of 2018." https://www.coindesk.com/policy/2024/05/16/biden-order-to-halt-china-tied-bitcoin-mine-beside-nuke-base-came-as-us-firm-just-bought-it/

2024-05-16 18:37

The stock was the second worst performing among crypto stocks on Thursday. Shares of Coinbase fell nearly 8% on Thursday to a price of $202.49. The drop came after a report from the Financial Times that futures exchange CME was considering offering spot bitcoin trading to its clients. Shares of Coinbase dropped nearly 8% to $202.49 during U.S. morning hours on Thursday after a Financial Times report that the Chicago Mercantile Exchange (CME) might soon offer spot bitcoin trading amid strong interest from clients. Cryptocurrencies were up on the day. The CoinDesk 20 Index, which tracks 20 of the largest digital tokens by market capitalization, is 0.91% higher over the past 24 hours. Bitcoin (BTC) was up by half a percent as it continued to profit from Wednesday’s better-than-expected inflation report. COIN is up 29% year-to-date as crypto prices have rallied since the beginning of the year. Chicago-based CME, with a history dating back more than a century, is the largest futures exchange globally and a financial powerhouse. Until recently, Coinbase profited strongly from being the most trusted crypto exchange in the U.S., but that advantage could change if CME comes into play. The CME has been designated by U.S. regulators as a "systemically important financial market utility," a designation that implies it's subject to more strict supervision. Many investors also assume that the designation implies the government would never let the CME fail in the event of financial duress. CME is already the biggest bitcoin futures exchange by open interest in the U.S. The exchange said that it has been holding meetings with traders who wish to trade bitcoin on a regulated marketplace, people familiar with the matter told the Financial Times. A common reason for traders not wanting to touch digital assets is the lack of trust in crypto exchanges, especially after a series of bad players were outed in recent years, including the once highly-popular crypto exchange FTX. Recently launched spot bitcoin exchange-traded funds (ETFs) gave traders a safer way to invest in the token, which over 500 institutions took advantage of within only the first three months of existence, allocating over $10 billion in the funds alone. The rest, over $40 billion, came from retail traders. https://www.coindesk.com/business/2024/05/16/coinbase-shares-sink-9-on-report-cme-to-consider-listing-spot-bitcoin/

2024-05-16 18:28

The exploiter may not be making any money from the attack. The Solana blockchain's red-hot meme coin factory Pump.Fun descended into chaos Thursday at the hands of an exploiter who compromised the tech central to its issuance of joke cryptocurrencies. "We are aware that the bonding curve contracts have been compromised and are investigating the matter," the months-old project's Twitter account announced two hours into the chaos. "We’ve paused trading – you cannot buy and sell any coins at the moment." Trading has been paused for now, according to Pump.fun, but prior to the announcement, traders were left to speculate on what was happening on the platform. Details of the attack were still coming together at press time. According to people who are helping with the early stages of the investigation, an exploiter was using a combination of trading tactics to overwhelm Pump.fun and seemingly corner the market for dozens of meme coins. Oddly, on-chain evidence suggests the attacker was not making much of a profit. The people spoke with CoinDesk on the condition of confidentiality since the inquiries are still preliminary. Pump.fun is a months-old project for creating and gambling on meme coins on the Solana blockchain. It advertises itself as a "fair launch" platform where investors can buy into joke tokens in their earliest moments. Coins sometimes hit it big for their investors, but most implode before they reach the critical market cap of $69,000 where tokens get released into the wild. Thursday's exploit hit smart contracts responsible for issuing the meme coins on Pump.Fun curve, people said. The attacker tricked the platform's bonding curve into accepting phantom SOL tokens they had borrowed and quickly repaid in what's known as a "flash loan." This resulted in the bonding curves filling up with nonexistent SOL, making tokens look valuable despite no real buy-side interest. The attacker has caused losses of $300,000 in SOL tokens, according to on-chain researchers. Rather than run off with the money, they used it to repay the flash loans and airdrop funds to other people, the people said. https://www.coindesk.com/business/2024/05/16/solana-meme-coin-factory-pumpfun-compromised-by-bonding-curve-exploit/

2024-05-16 16:49

A dozen Democrats joined 48 Republicans in voting to repeal SAB 121. The U.S. Senate joined the House of Representatives on Thursday in seeking to erase the controversial Securities and Exchange Commission (SEC) crypto policy known as Staff Accounting Bulletin No. 121, though President Joe Biden has vowed to veto the resolution. The Senate voted 60-38 on the effort to overturn the policy, commonly referred to as SAB 121, though the crypto industry may not breathe a sigh of relief over the initiative's banking constraints, because Biden said that letting the rule be removed this way would disrupt "work to protect investors in crypto-asset markets and to safeguard the broader financial system." A dozen Democrats voted alongside a majority of Republicans in favor of the resolution, easily giving it well over the simple majority of votes needed to pass. However, the resolution did not receive enough votes to make it veto-proof. Even Senate Majority Leader Chuck Schumer (D-N.Y.) bucked the leader of his party in opposing the SEC's crypto effort, alongside other leaders in the Democratic Party. Sen. Cynthia Lummis (R-Wyo.), who pushed for the resolution in the Senate, said the bulletin was "a disaster" that did not protect consumers. "This is a win for financial innovation and a clear rebuke of the way the Biden administration and Chair Gary Gensler have treated crypto assets and marks the first time both chambers of Congress have passed standalone crypto legislation," she said in a statement. Issued by the agency in 2022, SAB 121 held that a company keeping a customer's cryptocurrencies should record them on its own balance sheet – which could have major capital implications for banks working with crypto clients. Republican lawmakers bashed the SEC for instituting a policy without going through the necessary rule process, and the Government Accountability Office agreed, finding that the regulator erred in how it handled what should have been a rule instead of staff guidance. "SAB 121 is non-binding staff guidance that, if followed, enhances important disclosure to investors in firms that safeguard crypto assets for others," an SEC spokesperson said in a statement after the vote. "Time and again, we have seen crypto firms fail and watched as their customers lined up at the bankruptcy court in hopes of getting what they thought was legally theirs." For years, Republican lawmakers have fought with the federal financial agencies over the role of "guidance" documents, arguing that regulators stretch their authorities, and that the regulated industries feel they can't afford to ignore guidance, whether it's "non-binding" or not. Read More: House Resolution to Overturn Controversial SEC Rule Likely to Pass in Senate: Sources Lawmakers in the House and Senate went after SAB 121 under the Congressional Review Act, which allows Congress to overturn federal rules. A number of Democrats – including 21 in the House – joined with the largely Republican effort, defying the White House's warnings. Rep. Mike Flood (R-Neb.), one of the architects of the resolution, called the vote a "landmark result," noting the bipartisan support. "It is clear there is overwhelming opposition to SAB 121, and I urge President Joe Biden to reconsider his previous statement of intent to veto the resolution. The President should sign my resolution to ensure the SEC reverses course and sets America on a path to growing our digital financial future," he said. Because they sought to kill the policy with the Congressional Review Act, a successful reversal would – by law – mean the SEC wouldn't be able to pursue similar policies in the future, which the White House statement suggested "could also inappropriately constrain the SEC’s ability to ensure appropriate guardrails and address future issues related to crypto-assets including financial stability." Rep. Wiley Nickel (D-N.C.), who also cosponsored the House resolution, said the House "never should've had to resort to" the Congressional Review Act and reiterated his call to the SEC to withdraw the bulletin before it goes to Biden's desk. "Today's Senate vote to repeal SAB 121 sends a clear bipartisan message: Congress will not stand idly by as Gary Gensler and the SEC deliberately sidestep the statutory rulemaking process and overstep their regulatory authority," he said. Apart from a previous crypto taxation provision that made its way into an infrastructure law despite the industry's resistance, this marks the first time that Congress has moved on an issue that focuses on the crypto industry, and it was in a way meant to aid the sector. SEC spokespeople did not immediately return a request for comment. https://www.coindesk.com/policy/2024/05/16/us-senate-votes-to-kill-secs-crypto-accounting-policy-testing-bidens-veto-threat/