2024-05-16 07:35

Increased transactions on the Shibarium blockchain will lead to a higher burn rate for the SHIB token, reducing its circulating supply. ShibaSwap expanded to the Shibarium blockchain, allowing users to create new liquidity pools and earn fees from providing liquidity. Increased transactions on the Shibarium blockchain will lead to a higher burn rate for the SHIB token, reducing its circulating supply. ShibaSwap, the decentralized exchange (DEX) associated with the Shiba Inu (SHIB) cryptocurrency, said Thursday it was live on the Shibarium blockchain, an Ethereum layer 2 built by the SHIB token team. The developers said the increased use of the Shibarium blockchain for transactions will result in a higher burn rate for the SHIB token, reducing supply. The SHIB price has risen 8.8% in the past 24 hours, in line with a broader market jump. The CoinDesk 20 Index (CD20), a measure of the wider crypto market, has rallied almost 7%. Users can now float new liquidity pools (LPs) on Shibarium, allowing traders to swap tokens on the network and earn a cut of trading fees for providing liquidity. ShibaSwap held over $25 million in locked tokens as of Thursday, data shows, with $1.7 million in trading volumes in the past 24 hours. “The more transactions will run on Shibarium blockchain, the more the protocol will burn base gas fees which will impact the overall burn rate of $SHIB,” they said. Burns refer to the permanent removal of tokens from circulating supply by sending them to an address that no one controls. Every swap and stake on ShibaSwap contributes to the ecosystem's growth as increased trading volumes bring higher fees for stakers and LP providers, developers said in an X post. https://www.coindesk.com/markets/2024/05/16/shib-to-get-more-scarce-as-key-exchange-expands-to-shibarium/

2024-05-16 07:04

The CME is already the top bitcoin futures exchange by open interest, while the offshore, non-regulated Binance dominates the spot market. 10x Research founder Markus Thielen said crypto exchanges may lose business if CME starts offering spot bitcoin trading. CME is one of the top bitcoin futures exchanges by open interest. Futures powerhouse Chicago Mercantile Exchange (CME) plans to offer spot bitcoin trading to clients as demand for the product mounts among market participants, the Financial Times reported on Thursday. CME is already the top bitcoin futures exchange by open interest, while offshore, non-regulated Binance dominates the spot market. The exchange has held discussions with traders who want to trade bitcoin on a regulated marketplace, the FT reported, citing people with direct knowledge of the talks. CME's spot trading business could be run through the EBS currency trading venue in Switzerland, the report added. The exchange did not want to comment on the report. The spot market will complement the CME’s existing standard and micro futures contracts, which are widely considered a proxy for institutional activity, and help the exchange become more dominant in the crypto market. The CME is already the top bitcoin futures exchange by open interest, while the offshore, non-regulated Binance dominates the spot market. Coinbase (COIN), the only U.S. traded crypto exchange, is No. 3 by daily trading volume. The availability of the spot market means traders can now set up complex multi-leg strategies involving spot and futures markets in one regulated place. Carry traders are known to short CME futures against long spot market positions on other exchanges or in spot ETFs. “Crypto exchanges might lose some business with the potential debut of a bitcoin spot market on the CME, a global derivatives giant, as the present bull run is particularly driven by institutions, who prefer to trade on regulated avenues," Markus Thielen, founder of 10x Research, said. https://www.coindesk.com/markets/2024/05/16/cme-looks-to-take-on-binance-and-coinbase-could-launch-spot-bitcoin-trading-report/

2024-05-16 06:49

“We are working on an offering to service those clients really well on a one-off basis — to have them trade with us and stay with us," a Coinbase official said. Coinbase is planning to provide a service to target Australia’s self-managed pensions sector. The exchange’s Asia-Pacific Managing Director John O’Loghlen told Bloomberg, "We don’t see this as cannibalizing the ETF players." Coinbase is developing a service that will specifically target Australia's self-managed pensions sector, the exchange’s Asia-Pacific Managing Director John O’Loghlen told Bloomberg. Crypto’s relationship with the pensions sector and retirees isn't exactly new. Self-managed funds in Australia have increasingly held crypto since March 2019. According to the latest data from the Australian Taxation Office, nearly A$1 billion ($664 million) is allocated to crypto. That’s a steep increase from only A$197 million in December 2019. Thousands of Australians who used self-managed pension funds to bet on cryptocurrencies have even lost millions of dollars, Reuters reported in March 2023. “Self-managed super funds might just make a single allocation, set it and forget it,” O’Loghlen told Bloomberg. We are working on an offering to service those clients really well on a one-off basis—to have them trade with us and stay with us.” Coinbase did not immediately respond to CoinDesk's request for comment. Crypto interest in the self-managed pensions sector may be driven by the recent momentum the crypto sector has gained after spot-ETF approvals in the U.S. and the likelihood that Australia, too, could see similar approvals this year. “We don’t see this as cannibalizing the ETF players, but more a rising tide and a big enough interest for someone to come in through their own self-managed portal,” said O’Loghlen. Read More: Australia’s Tax Office Tells Crypto Exchanges to Hand Over Transaction Details of 1.2 Million Accounts: Reuters https://www.coindesk.com/policy/2024/05/16/coinbase-to-target-australias-self-managed-pension-funds-bloomberg/

2024-05-16 06:08

The net percent of global central banks cutting rates is increasing in a positive sign for risk assets, including cryptocurrencies. BTC rose over 7.5% on Wednesday, capping its best performance since March 20. Weak U.S. data strengthened the case of a Fed rate cut in September. The BOE and ECB are likely to cut rates in June. Bitcoin (BTC) posted its biggest single-day gain in nearly two months on Wednesday as weak U.S. economic data raised the probability that the Federal Reserve (Fed) will join its advanced nation peers in easing monetary policy with rate cuts over the summer months. According to data sources TradingView and CoinDesk, the leading cryptocurrency by market value rose over 7.5% to $66,250, the largest percentage rise since March 20. Like other risk assets, BTC is sensitive to expected changes in the monetary policy stance of major central banks and rallies when the cost of borrowing fiat money is forecast to decline. Data released by the U.S. Labor Department Wednesday showed the consumer price index (CPI) increased less than consensus estimates in April, signaling a renewed downward shift in the cost of living in the world’s largest economy. The headline CPI rose 0.3% last month after advancing 0.4% in March and February. The core CPI, which excludes food and energy prices, rose 0.3% in April after advancing 0.4% in March. Other data showed that headline retail sales growth stalled in April, with the sales in the “control group” category, which feeds into the GDP calculation, declining 0.3% month-on-month. As such, rate-cut expectations shifted significantly. Fed funds futures show traders expect the Fed to deliver the first 25 basis point rate cut in September. (This year’s summer is set to start on June 20 and end on September 22). The Fed recently signaled that it will reduce the pace of quantitative tightening, also a liquidity tightening tool, from June. It’s not just the Fed. Markets expect the Bank of England (BOE) and the European Central Bank (ECB) to cut rates in June. The Swiss National Bank (SNB) and Sweden’s Riksbank have already reduced their benchmark borrowing costs. Central banks worldwide are pivoting toward renewed monetary or liquidity easing, which is a positive sign for risk assets, including cryptocurrencies, as evident from the chart below from the data tracking website MacroMicro. The percentage of global central banks whose last move was a rate hike is falling fast, while the percentage of banks with rate cuts as the last move is rising. In other words, the net percentage of central bank cutting rates is rising. “The higher the proportion goes, the more central banks are cutting rates, which could help improve market liquidity. The lower the proportion, the less liquidity there is in the market,” MacroMicro said in the explainer. Prospects for liquidity easing over Summer should support equities, giving investors adequate confidence "to remain further out on the risk curve," according to broking firm Pepperstone. https://www.coindesk.com/markets/2024/05/16/bitcoin-has-best-day-in-2-months-as-markets-anticipate-a-summer-of-easing/

2024-05-15 21:19

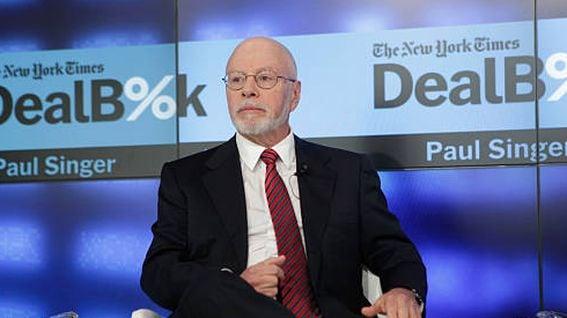

Apollo Management was also a buyer in the spot bitcoin ETF space in the first quarter. More big names have revealed allocations into the spot bitcoin exchange-traded funds. Wednesday marked the deadline for institutional investors to file their quarterly 13F report with the U.S. Securities and Exchange Commission, revealing positions held as of March 31, 2024. After Tuesday’s surprising disclosure of a $161 million allocation from the State of WIsconsin, more investment whales turned out to have been part of the unprecedented success of the ETFs. Hedge fund Millennium Management, with more than $64 billion in assets under management, held roughly $2 billion across a number of the spot bitcoin ETFs, according to its filing. The hedge fund, which is led by billionaire Izzy Englander, held its biggest allocation in BlackRock’s iShares Bitcoin Trust (IBIT), roughly $844 million. It also owned more than $800 million of the Fidelity Wise Origin Bitcoin Fund (FBTC) and $202 million of Grayscale’s Bitcoin Trust (GBTC), as well as stakes in ARK/21's ARKB and Bitwise's BITW. Another major hedge fund, Paul Singer's Elliott Capital disclosed a stake of nearly $12 million in BlackRock's IBIT as of the end of the quarter. Finally, Apollo Management Holdings disclosed a quarter-end $53.2 million stake in ARK/21's ARKB. Other notable names who revealed allocating assets into the spot bitcoin funds on Wednesday are Aristeia Capital and Hudson Bay Capital. https://www.coindesk.com/business/2024/05/15/izzy-englanders-millennium-paul-singers-elliott-among-bitcoin-etf-holders/

2024-05-15 20:27

In a highly technical overview of an exploit that has since been patched, government prosecutors find that exploiting code is a crime. CoinDesk reached out to several experts in the Ethereum community to get their views on the case. The U.S. Department of Justice charged two brothers with orchestrating an attack on Ethereum trading bots, charging them with conspiracy to commit wire fraud, wire fraud and conspiracy to commit money laundering. In essence, the brothers found a way to target bots that were frontrunning transactions in a process called maximal extractable value, or MEV, which refers to the amount of money that can be bled out of the block production process by ordering transactions. MEV, which itself is controversial, can be a highly lucrative game dominated by automated bots that often comes at blockchain users’ expense, which is partially why so many in the crypto community have rushed to denounce the DOJ’s complaint. However, this is hardly a Robinhood situation, where two brothers, Anton and James Peraire-Bueno, of Bedford, Massachusetts, were stealing from the rich to give to the poor. As indicated by the DOJ’s filing, the brothers brought in approximately $25 million in at least eight separate transactions in what, according to the DOJ, was a highly orchestrated and premeditated plot. They set up shell companies and searched for ways to safely launder funds to avoid detection. The highly technical complaint spells out the process by which the exploit occurred, which the DOJ calls “the very first of its kind.” “They used a flaw in MEV boost to push invalid signatures to preview bundles. That gives an unfair advantage via an exploit,” former employee of the Ethereum Foundation and Flashbots Hudson Jameson told CoinDesk in an interview. Jameson added that the Peraire-Bueno brothers were also running their own validator while extracting MEV, which violates something of a gentleman’s agreement in MEV circles. “No one else in the MEV ecosystem was doing both of those things at once that we know of,” he added. “They did more than just play by both the codified and pinky promise rules of MEV extraction.” “It's not some kind of robin hood story as they didn't return the money to people MEVers extracted it from,” pseudonymous researcher Banteg said. At a more technical level, the brothers were able to exploit an open-source built by MEV firm Flashbots called mev-boost that gave them an unequal view into how MEV bots were ordering transactions. (Mev-boost is an open-source protocol that allows different actors to compete to “build” the most valuable blocks by ordering transactions.) “Having access to the block body allowed the malicious proposer to extract transactions from the stolen block and use them in their own block where it could exploit those transactions. In particular, the malicious proposer constructed their own block that broke the sandwich bots’ sandwiches up and effectively stole their money,” according to a Flashbots’ post-mortem in 2023. In particular, and central to the DOJ’s case, is that the brothers found a way to sign false transactions in order to run the scheme. “This False Signature was designed to, and did, trick the Relay to prematurely release the content of the proposed block to the defendants, including private transaction information,” the document reads. “The invalid header part is going to be the needle that this all balances on I think,” a crypto researcher, who asked to remain anonymous, said. “I feel the indictment indicates that and therefore it may actually be a good thing that SDNY is verryyyy tech savvy in this and clearly layed out where they fucked up and alluded to the inevitability of MEV in blockchains,” Jameson said. Others have also noted the technical sophistication of the DOJ’s argument, which seems to be less of an indictment of MEV or Ethereum itself than of an attempt to profit by unfairly gaining information. “If you hope Ethereum will always be a ‘dark forest’ where on-chain predators compete with each other for arbitrage opportunities, then you probably dislike this prosecution,” Consensys General Counsel Bill Hughes told CoinDesk in an interview. “Thankfully, I think there are only a few who are actually like that. If you prefer predatory behavior like this be curtailed, which is the vast majority, then you are likely to feel the opposite.” “All of the defendants' preparation for the attack and their completely ham-fisted attempts to cover their tracks afterwards, including extensive incriminating google searches, just helps the government prove they intended to steal. All that evidence will look very bad to a jury. I suspect they plead guilty at some point,” he added. Still, others remain convinced that exploiting MEV bots designed to reorder transactions is fair game. “It's a little hard to sympathize with MEV bots and block builders getting f*cked over by block proposers, in the exact same way they are f*cking over end users,” the anonymous researcher said. Jameson, for his part, said the MEV is something the Ethereum community should work to minimize on Ethereum, but that it’s a difficult problem to solve. For now, the process is “inevitable.” “Until it can be eliminated, let's study it. Let's illuminate it. Let's minimize it. And since it does exist, let's make it as open as possible for anyone to participate with the same rules,” he said. If there is any silver lining, the Flashbots team were able to patch the error that enabled the attack fairly quickly, Cornell Tech professor Ari Juels said. “There are no lasting implications,” he added. “There is of course an irony in what took place: A thief stealing money from sandwich bots, which themselves exploit users in the view of many in the community.” https://www.coindesk.com/opinion/2024/05/15/what-the-dojs-first-mev-lawsuit-means-for-ethereum/