2024-05-15 20:11

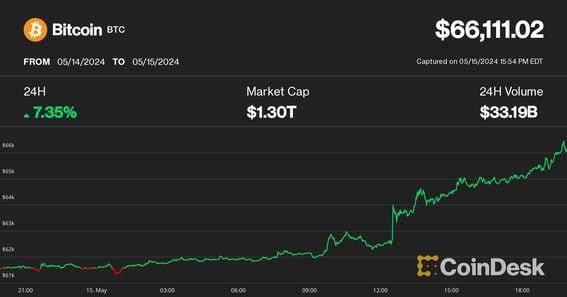

Sluggish U.S. retail sales and softer inflation reports have opened the way for the next leg up in the crypto rally, Swissblock said. BTC climbed to its highest price since April 24, while Solana's SOL and NEAR led crypto gains. Bitcoin could target the $84,000 level with altcoins performing well, Swissblock said. Crypto markets rallied on Wednesday as softer-than-expected U.S. inflation data jolted digital assets from their stupor. Bitcoin (BTC) surged past $66,000 for the first time since April 24, and was recently up more than 7% over the past 24 hours. Ether (ETH) changed hands near $3,000 but underperformed with a 4% advance during the same period. Solana (SOL) and near (NEAR) led gains among crypto majors with 8% and 12% jumps, respectively, and the broader market benchmark CoinDesk 20 Index (CD20) was up 6%. The rally occurred as April U.S. Consumer Price Index (CPI) figures edged lower from March, coupled with a slightly sluggish retail sales report. The data came as a relief for investors fearing that reaccelerating inflation and a red-hot economy might force the Federal Reserve to walk back its dovish pivot and even consider interest rate hikes. "Investors consider this as a bullish regime shift, as it marks the first decrease in CPI inflation over the last three months," Bitfinex analysts said in a market update. This, together with the Federal Reserve previously announcing its intention to taper the central bank's balance sheet run-off, "is seen as a favorable print for risk assets," Bitfinex added. Looking at traditional markets, U.S. equities also climbed during the day, with the S&P 500 index gaining more than 1% and hitting a fresh all-time high, underscoring the return of risk appetite. Today's bitcoin surge also marked a break-out from a downtrend that capped prices for the last few weeks, Swissblock analysts said in a Telegram update. "BTC [is] finally making the bigger move," Swissblock said. "We have been waiting for the trigger for the release of a larger structure since March high. Today we got that," referring to the CPI and retail sales numbers. The analytics firm said the breakout opens the way for BTC to rally $69,000 first, then later potentially towards new all-time highs targeting the $84,000 price level. During the next leg up, "altcoins will follow strongly," the report added. https://www.coindesk.com/markets/2024/05/15/bitcoin-hits-66k-as-soft-inflation-data-sparks-crypto-rally/

2024-05-15 16:24

The alleged 12-second attack related to the controversial practice known as MEV, or maximal extractable value. Two brothers have been arrested by the U.S. Department of Justice for attacking the Ethereum blockchain and stealing $25 million of cryptocurrency during a 12-second exploit, according to an indictment unsealed on Wednesday. The indictment charges Anton Peraire-Bueno, 24, of Boston, and James Pepaire-Bueno, 28, of New York, with conspiracy to commit wire fraud, wire fraud and conspiracy to commit money laundering. The charges are significant because they represent a first-of-its-kind criminal action from the U.S. government related to the controversial practice of MEV, or maximal extractable value, whereby the operators of Ethereum (and similar blockchains) preview upcoming transactions from users to earn an extra profit for themselves. The government suggests in the indictment that the very existence of MEV illustrates how Ethereum itself is a vulnerable system. "[T]he defendants’ scheme calls the very integrity of the blockchain into question," Damian Williams, U.S. Attorney for the Southern District of New York, said in a press release. What is MEV-Boost? According to Wednesday's indictment, the Pepaire-Bueno brothers exploited MEV-boost, an MEV software used by most of the validators that run the Ethereum blockchain. The indictment walks through how Ethereum works, highlighting its staking consensus mechanism and the role of validators as participants who secure the network. When users submit transactions to Ethereum, those transactions are not immediately written to the blockchain's ledger. Instead, they're added to a "mempool" – a waiting area for other yet-to-be-processed transactions. MEV-boost lets "block builders" assemble those mempool transactions into official blocks. MEV bots called "searchers" scour the mempool for profitable trading opportunities and will sometimes "bribe" builders to insert or re-order transactions in a manner that would net them an extra profit. (These "MEV strategies" can sometimes eat into the profits of end users.) Validators, the operators that ultimately add blocks to the Ethereum blockchain, take the pre-built blocks from MEV-boost and then write them to the chain, where they're cemented permanently. The exploit The Pepaire-Bueno brothers exploited a bug in MEV-boost's code that allowed them to preview the content of blocks before they were officially delivered to validators, according to the indictment. The brothers created 16 Ethereum validators and targeted three specific traders who operated MEV bots, the indictment said. They used bait transactions to figure out how those bots traded, lured the bots to one of their validators which was validating a new block and basically tricked these bots into proposing certain transactions. The brothers allegedly frontran the bots on certain trades and also used their validator to "tamper with" the new block by sending a false digital signature that gave them access to the block's full contents and replaced "lure transactions" with "tampered transactions." In those tampered transactions, the brothers allegedly sold illiquid cryptocurrencies they had tricked the victims' trading bots into placing buy orders for. "In effect, the Victim Traders sold approximately $25 million of various stablecoins or other more liquid cryptocurrencies to purchase particularly illiquid cryptocurrencies," the document said. "In effect, the Tampered Transactions drained the particular liquidity pools of all the cryptocurrency that the Victim Traders had deposited based on their frontrun trades." This meant the traders couldn't sell their new illiquid cryptos, which were "rendered effectively worthless," while the defendants made off with the $25 million in stablecoins and other "more liquid cryptocurrencies," the DOJ alleged. The defendants then allegedly laundered the funds through various addresses and sets of transactions, including converting the stolen funds into DAI and then USDC. “These brothers allegedly committed a first-of-its-kind manipulation of the Ethereum blockchain by fraudulently gaining access to pending transactions, altering the movement of the electronic currency, and ultimately stealing $25 million in cryptocurrency from their victims,” Special Agent in Charge Thomas Fattorusso of the IRS Criminal Investigation (IRS-CI) New York Field Office said in the statement. The indictment walks through some of what investigators found, including "a document setting forth their plans," the launch of shell companies, test transactions to identify best practices for attracting MEV bots and internet search histories. https://www.coindesk.com/policy/2024/05/15/brothers-accused-of-25m-ethereum-exploit-as-us-reveals-fraud-charges/

2024-05-15 15:43

After ending its crypto custody plan, Nasdaq pivoted to tokenized U.S. Treasuries, but progress was too sluggish for some now-former employees, a person familiar with the matter said. Stalled or canceled cryptocurrency projects at Nasdaq – including a previously unreported effort to tokenize U.S. Treasury bills – have led to members of the exchange giant's digital assets team no longer working at the company, according to three people with knowledge of the matter. In July, Nasdaq announced it would stop trying to become a licensed custodian of crypto or digital assets, blaming regulatory uncertainty in the U.S. It quietly shifted to the suddenly hot area of tokenizing T-bills, or creating blockchain-based versions of U.S. debt, according to a person familiar with the matter. But some Nasdaq crypto team members are no longer at the company, according to people familiar with the matter. It's not clear how many left or the degree to which layoffs were involved. In some cases, they've joined companies that are expanding faster into crypto, whereas Nasdaq is purposefully taking its time deciding how to support the industry, one person said. Nasdaq declined to comment on its tokenization plans or staff departures. There has been a breathless rush to create blockchain-based versions of traditional financial assets. For instance, asset management giant BlackRock has thrown its weight behind the trend with its BUIDL platform. https://www.coindesk.com/business/2024/05/15/nasdaq-after-pivoting-crypto-ambitions-to-tokenized-t-bills-sees-staffers-exit-amid-delays-sources/

2024-05-15 12:42

In a year of mostly bad news on inflation, the government's Wednesday report gave some hope that Fed rate cuts might still be on the table. Both the headline and core rates of inflation fell modestly in April April retail sales data was also showed some softness Under pressure of late on ideas that interest rates were likely to stay higher for longer, bitcoin rose more than 1% on the news. The monthly pace of inflation in the U.S. eased a hair in April, according to the government's Consumer Price Index (CPI), rising 0.3% versus 0.4% in March and economist forecasts for 0.4%. The rest of the report also showed small declines that were inline with expectations. On a year-over-year basis, CPI was higher by 3.4% versus estimates for 3.4% and 3.5% in March. Core CPI – which excludes food and energy costs – rose 0.3% in April against estimates for 0.3% and 0.4% in March; on a year-over-year basis, core CPI was higher by 3.6% versus forecasts for 3.6% and March's 3.8%. The price of bitcoin (BTC) jumped more than 1% in the minutes following the Wednesday morning report, rising to $63,700. With the spot ETF catalyst sidelined for the past few weeks as inflows have slowed or even reversed, bitcoin's price has been under pressure on the idea that interest rates were going to stay higher for longer. The consistent slide in inflation in 2023 had most, including the U.S. Federal Reserve, coming into 2024 expecting appreciably easier monetary policy throughout the year. Instead, inflation has actual risen a bit thus far this year. Along with an economy that continues to grow, it's put the kibosh on the thought of any imminent central bank rate cuts. Coming into Wednesday's CPI report, the odds of a summer rate cut by the Fed were low and traders had priced in just a 50% chance of move in September, according to the CME FedWatch Tool. Coming at the same time as the inflation numbers was retail sales data for April showing a flat reading versus forecasts for a rise of 0.4% and March's 0.6%. Retail sales ex-autos rose 0.2 in April, in line with expectations, but down from 0.9% in March. A check of traditional markets finds a positive reaction to the soft inflation and economic data, with S&P 500 futures rising 0.5% and the 10-year Treasury yield sliding seven basis points to 4.37%. The U.S. dollar index has dropped 0.5% and gold has added 0.7%. https://www.coindesk.com/business/2024/05/15/us-cpi-softer-than-expected-at-03-in-april-bitcoin-rises-to-635k/

2024-05-15 10:17

The approval of spot bitcoin ETFs was a catalyst for the increase in counterparty engagement in the first quarter as more traditional asset managers and hedge funds entered the industry, the report said. Galaxy's net income rose 40% from the previous quarter to $422 million. The approval of spot bitcoin ETFs was a catalyst for the increase in counterparty engagement. The firm could pursue both mining and AI hosting over time, Canaccord said. Galaxy Digital (GLXY) is evolving its business in a thoughtful and methodical way and, while the regulatory backdrop remains challenging, the company’s opportunity set and competitive positioning remains compelling, broker Canaccord Genuity said in a report on Tuesday after the crypto financial services firm published first-quarter results. The Toronto-based company founded by CEO Mike Novogratz said net income rose 40% from the quarter before to $422 million, and the broker said it expects the positive momentum to continue. “We are encouraged to see solid progress in growth and maturation in each of the company’s three operating units coming into view over the next few quarters,” analysts led by Joseph Vafi wrote. Galaxy Trading grew its total number of counterparties to 1,161 in the first quarter from 1,052 in the fourth, and counterparty trading revenue rose 79% to $66 million, the report noted. The approval of spot bitcoin (BTC) exchange-traded funds (ETFs) in January was behind the development. “Spot bitcoin ETF approvals have been a major catalyst for the increase in counterparty engagement as some of the more traditional asset managers and hedge funds are entering/reentering the space,” the authors wrote. GalaxyOne also saw further traction, with over 75 institutional clients and more than $1 billion of assets on the platform, the note said. “This is a great set of customers for the company to offer its full suite of products, including custody, lending, spot trading, hedging and derivatives.” The asset-management business also enjoyed good momentum, ending the quarter with assets under management (AUM) of $7.8 billion, an increase of 50% on the previous quarter, Canaccord said. “Galaxy continues to grow its infrastructure and GK8 business, growing its assets under stake by 100% quarter-on-quarter to $486m,” the report added. The firm bought self-custody platform GK8 for $44 million in February last year. The firm also increased its proprietary mining hashrate and the Helios facility “presents an opportunity for Galaxy to pursue both mining and AI hosting over time,” the broker said. Canaccord has a buy rating on Galaxy shares with a C$17 price target. The stock closed at C$12.41 on Tuesday. https://www.coindesk.com/markets/2024/05/15/galaxy-digital-has-strong-momentum-across-all-business-lines-canaccord/

2024-05-15 10:00

Lewis Cohen will co-chair the firm’s digital assets and emerging technology practice alongside former SDNY prosecutor Samson Enzer. International law firm Cahill Gordon & Reindel has added three crypto-native lawyers to its growing digital assets and emerging technology practice, in hopes it will become a one-stop shop for cryptocurrency companies looking for legal and regulatory advice. Lewis Cohen, the co-founder of crypto-focused firm DLx Law, will join the firm as a partner and co-chair the expanded practice – which has been renamed CahillNXT – alongside former Southern District of New York (SDNY) prosecutor Samson “Sam” Enzer. Two other lawyers from DLx Law – Delaware-based Gregory Strong and New York-based Sarah Chen – will join Cohen as partners in Cahill’s newly expanded practice. One of Wall Street’s go-to law firms, Cahill’s continued expansion into the crypto sphere is significant, indicating a growing need for crypto legal advice among traditional finance companies. “When I was a kid, the [Chicago] Bulls were the leading team in the NBA,” Enzer said, “That’s what this is – this is the crypto legal Dream Team.” Enzer, a former senior member of the SDNY’s Securities and Commodities Fraud Task Force, joined Cahill in November 2021 and subsequently established the firm’s digital assets practice. The practice has a number of high profile clients, including notorious Bitfinex launderer Ilya “Dutch” Lichtenstein, and major crypto companies like Coinbase. But Enzer said that his expertise is in dispute resolution, including litigation and handling government enforcement actions – but when he needed expert advice on regulatory issues, he found himself regularly turning to Cohen and his team for help. “We worked together for years,” Enzer said. “With the explosive demand for our services, and the burgeoning demand for the specific advice that Lewis [Cohen] and his team offer, we thought it made sense to combine.” That combination, Enzer and Cohen hope, will make seeking comprehensive crypto legal advice easier for current and future clients. “One of the big frustrations for clients is that they don’t really have a one-stop shop that they can go to to find crypto-native lawyers who speak the language, understand the technology,” Enzer said. “What you have is a tax crypto expert here, a crypto litigator there, a securities crypto expert at this place – it makes it very difficult for clients and more expensive, frankly, because they end up having to retain multiple law firms to get what they need.” Crypto-native knowledge In addition to making things easier on their clients, Cohen and Enzer both stressed the value that having more crypto-native lawyers on Cahill’s staff will bring. “We just see far too many lawyers struggle with what is a multi-sig, what is a roll-up, how does a bridge work? All of these things that, if you’re going to give legal advice, you have to understand,” Cohen said. “Part of our mission here is educational. We very much believe in the open source blockchain ethos and we really want to bring that DNA into our practice.” Enzer said that a non-lawyer computer programmer from DLx Law will also join CahillNXT as a consultant, which he said will help Cahill and its clients “bridge the gap between computer code and the law.” “Many big firms who dabble in this space do not speak the language, do not understand the tech, and therefore miss the opportunities to make the best arguments for their clients,” Enzer said. “If you don’t understand that, then you can’t really help clients navigate the maze of regulations” Cohen has been a prominent member of the crypto legal community for years. In 2022, Cohen, Strong and Chen contributed to a paper arguing why cryptocurrencies are not securities. The future of DLx Law DLx Law will continue to operate after Cohen, Strong and Chen’s departure and, according to a Tuesday press release, “continues to zealously serve its existing clients and is welcoming new clients.” Co-founder Angela Angelovska-Wilson has been named Managing Partner of the firm. “I absolutely support [her] and am excited to see all that DLX can continue to do in its current format,” Cohen told CoinDesk. https://www.coindesk.com/policy/2024/05/15/cahill-gordon-reindel-beefs-up-crypto-practice-adds-3-crypto-native-lawyers-including-lewis-cohen/