2024-05-15 09:47

The layer-3 blockchain for meme coins was offline for over 50 hours. Degen Chain, a blockchain dedicated to meme coins, is back online after a two-day hiatus. The problem stemmed from issues with its rollup provider. Degen Chain, an Ethereum layer-3 blockchain dedicated to meme coins, is back online after a two-day outage. The chain had been unusable since it effectively shut down at 20:15 UTC on May 12. For over 50 hours, it failed to validate transactions or produce new blocks. The protocol relies on Conduit, a rollup infrastructure platform, for its technical framework and operational support, particularly for managing transactions and data availability. Rollups process transactions off-chain, then bundle and submit them to Ethereum, increasing speed and reducing costs. By using Conduit, Degen Chain can function as a layer-3 blockchain, allowing it to handle high transaction volumes. On May 14, Degen Chain announced it was working with Conduit to resolve the downtime, which Conduit attributed to a "custom config change" that halted block production for Degen Chain. Degen Chain launched earlier this year and quickly hit $100 million in trading volume thanks to the current meme coin craze. According to DefiLlama, the chain has a market cap of just under $200 million and a total locked value of $2.17 million. The outage pushed the value of its native token, DEGEN, down by 6% to $0.16. https://www.coindesk.com/business/2024/05/15/degen-chain-back-online-after-two-day-hiatus/

2024-05-15 09:11

Attackers stole ether, velo and stablecoins before developers mitigated the hack and paused operations. Sonne’s markets on the Base blockchain were not affected. Sonne Finance's SONNE token plummeted 60% to 2.5 cents after a hack drained $20 million from the decentralized lending protocol. The exploiters used a "donation" attack to manipulate markets. The incident occurred on the Optimism blockchain version; the Base blockchain version was unaffected. The exploit happened after the protocol added token markets for Velodrome Finance's VELO. The attacker took advantage of a two-day timelock to execute four transactions, creating markets and adding collateral factors. Sonne Finance's SONNE token slumped after the developers acknowledged a hack that drained $20 million from the decentralized lending protocol early Wednesday. SONNE slid 60% to 2.5 cents, its lowest level in over a year, cutting market cap to $20 million even after the developers said they were able to stop $6.5 million being siphoned off once they realized the attack was happening. The exploiters utilized a “donation” attack to manipulate certain markets offered by the platform, stealing various tokens before being interrupted. The incident occurred on Sonne’s platform on the Optimism blockchain. The Base blockchain version was not affected. (Think of this as a mobile application getting hacked on Apple iOS, but remaining safe on Android.) How the Exploit Happened The exploit occurred after the protocol added token markets for Velodrome Finance’s VELO following a recent community proposal. The attacker took advantage of a two-day timelock to execute four transactions, which included creating markets and adding collateral factors. A timelock contract is a smart contract embedded in a blockchain that executes a transaction at a specific time, in this case, two days after it was locked. The attacker executed transactions by donating large amounts of cryptocurrency to manipulate the exchange rate between two tokens. That effectively tricked the platform into believing it had more collateral than was really available. Blockchain data shows the attacker managed to transfer millions of VELO, ether, and USD Coin (USDC) following the manipulation. They later converted this to $8 million in bitcoin and ether and transferred the funds to a new wallet address in early European hours. The protocol had previously avoided similar issues by adding markets with zero collateral factors, manually adding collateral, and permanently removing it before anyone was able to manipulate the market. In a report on the exploit, the developers said they were working on retrieving the stolen funds and floated a bounty for the hacker. https://www.coindesk.com/tech/2024/05/15/sonne-finance-token-drops-60-after-20m-exploit-on-optimism/

2024-05-15 07:30

Bitcoin's mean transaction fee has reversed the post-halving Runes-led spike, squeezing miners' revenue. Bitcoin’s mean transaction fee has reversed the post-halving Runes-led spike. Analysts said the decline in fees and the stalled BTC price rally may lead to selling pressure from miners. Bitcoin (BTC) miners reduced their coin inventory before the reward halving took effect on April 19. The trend could soon resume as the blockchain has become cheaper to use, squeezing miners’ revenue. "Daily average network fees spiked after the halving, offsetting some pain for bitcoin miners. However, fees have since come down as the initial rush of users to the Runes protocol cooled off," analysts at Kaiko said in a weekly note titled "Reality Bites for Miners." "The recent decline in fees could lead to selling pressure from miners," analysts added. Bitcoin's price already face downside risks from long-defunct cryptocurrency exchange Mt.Gox's impending $9 billion payout to its creditors, and a potential increase in selling pressure from miners may worsen the situation. Bitcoin miners earn revenue from two sources: block rewards and transaction fees. Miners receive a fixed amount of BTC as a reward for adding new blocks to the blockchain, along with transaction fees for including transactions in the blocks they mine. Last month's halving reduced the per-block coin emission to 3.125 BTC from 6.25 BTC, putting the onus of compensating the negative impact on miner profitability on transaction fees and bitcoin's price. The mean transaction fee initially cooperated, surging from 0.0003 BTC to a six-year high of 0.00199 BTC immediately after halving, according to data tracked by Glassnode. The spike came as traders rushed to "etch" and mint tokens on top of the Bitcoin blockchain with the help of fungible token protocol Runes. However, the sugar rush from Runes was short-lived and the mean fee quickly tanked levels seen before halving. As of Tuesday, the mean transaction fee was 0.000039 BTC. Meanwhile, bitcoin's price has declined over 4% to $61,990 since halving, CoinDesk data show. "The higher fees had alleviated some of the post-halving stress on bitcoin miners, but they are beginning to feel the pressure of the slashed miner rewards," Kaiko said. "The halving has typically been a selling event for Bitcoin miners as the process of creating new blocks incurs significant costs, forcing miners to sell to cover costs." At press time, wallets associated with miners held 1.805 million BTC ($111.5 billion), according to Glassnode. Markus Thielen, head of 10x Research, expects miners to liquidate roughly $5 billion of BTC in the coming months. "Why would they keep inventory when the price is not going up," Thielen said, explaining his view. Crypto exchange Deribit made a similar observation on X, discussing an option strategy called "bear call spread" to navigate a potential miner-led drawdown in bitcoin's price. "Bitcoin forms lower highs and miners facing shrinking revenues and fees, are pressurized to sell their holdings. For traders looking to navigate this market, the Bear Call Spread strategy can be a suitable approach to consider," Deribit said. A bear call strategy is a two-legged option strategy taken when the view on the market is moderately bearish. https://www.coindesk.com/markets/2024/05/15/bitcoin-fee-crash-could-lead-to-faster-miner-selling-analysts-say/

2024-05-15 05:46

Salame's attorneys highlight that he wasn't involved in the core fraud perpetuated by Sam Bankman-Fried, and he has had nearly his entire net worth destroyed by the implosion of FTX. Attorneys for former FTX executive Ryan Salame are asking for 18 months in prison, citing his cooperation with authorities and remorse. They argue that Salame wasn’t involved in the core fraud perpetrated by Bankman-Fried’s inner circle. Attorneys for Ryan Salame, a former FTX executive who pled guilty to election fraud charges in September, are asking the court for leniency in the form of an 18-month sentence, according to a sentencing memorandum filed on Tuesday. While at FTX and Alameda, Salame managed wire deposits and fiat currency conversions for FTX customers, participated in political contributions using Alameda funds, and led charitable initiatives in The Bahamas. In filings, his attorneys argue that Salame’s role at the shuttered companies was less central to the fraud and more operational. They also cite cooperation with authorities, genuine remorse, efforts to address his substance abuse issues, and the significant personal and financial losses he has already suffered as a result of the exchange’s collapse. “He had absolutely no knowledge that the four people at the center of Alameda and FTX had conspired to lie and to steal from their customers. Ryan stole from no one. He did not lie to customers,” his attorneys wrote in a filing. “He was duped…when he finally understood the FTX fraud, he was the first person to blow the whistle to authorities in The Bahamas." In the document, his attorneys point out that information provided to Bahamanian authorities initiated their investigation into FTX, and he also provided documents to the U.S. Attorney’s Office without a grand jury subpoena. Salame’s attorneys also write that the "incessant media criticism of FTX and all else within Bankman-Fried’s orbit has ensured [he] will be punished for the rest of his life" and argue that the legacy of FTX and his association with Bankman-Fried means that he'll never be able to seek another job without this association acting as a barrier. Former Alameda-FTX executives Caroline Ellison and Gary Wang have pled guilty to charges and have sought plea deals from U.S. authorities to avoid jail time. https://www.coindesk.com/policy/2024/05/15/former-ftx-exec-ryan-salame-asks-for-lenient-18-months-in-prison/

2024-05-14 22:35

Samil Ramji, who led BlackRock’s ETF business including the launch of the firm’s spot bitcoin product, departed the firm in January. Vanguard named the BlackRock executive who oversaw the firm's launch of its bitcoin exchange-traded fund as its new CEO on Tuesday evening. Salim Ramji left BlackRock in January to “seek a new leadership or entrepreneurial opportunity outside the firm,” he said then. The move came shortly after the asset manager launched the iShares Bitcoin Trust (IBIT), which Ramji oversaw the filing and logistics for, according to Bloomberg Intelligence senior ETF analyst Eric Balchunas. "He has been quoted about his interest in digital assets although I'm not sure that's going to change Vanguard's stance but he will be the CEO. Who knows. Door much more open now IMO," Balchunas wrote in a post on X. The Wall Street Journal first reported the appointment earlier on Tuesday, with the company confirming his appointment in a press release later in the evening. In a statement, Ramji said he would be working with Vanguard's leadership to "lead the company into the future." "The current investor landscape is changing, and that presents opportunities for Vanguard to further its mission of giving people the best chance for investment success, which is more relevant today than at any time in the firm's five-decade history," he said. "My focus will be to mobilize Vanguard to meet the moment while staying true to that core purpose – remaining the trusted firm that takes a stand for all investors." Nate Geraci, president of the ETF Store said: “Will be interesting to see if Salim Ramji tries to help Vanguard investors gain access to crypto as he believed in doing for BlackRock investors." The pick comes as a surprise given Vanguard’s negative stance on bitcoin and Ramji’s known interest in the industry, sparking chatter on social media that the asset manager might change its stance. “The underlying technology that underpins bitcoin and the blockchain technology, something that we’re incredibly excited about, and we’re excited about it because it removes frictions or at least has the promise of removing frictions across the ecosystem,” Ramji said in an interview on Bloomberg TV in July 2023. “The underpinnings are really powerful for us and that really sparked our interest.” If confirmed, this will also mark the first time that Vanguard is hiring a CEO from outside the company. https://www.coindesk.com/business/2024/05/14/vanguard-said-set-to-name-ex-blackrock-etf-exec-as-ceo-wsj/

2024-05-14 22:32

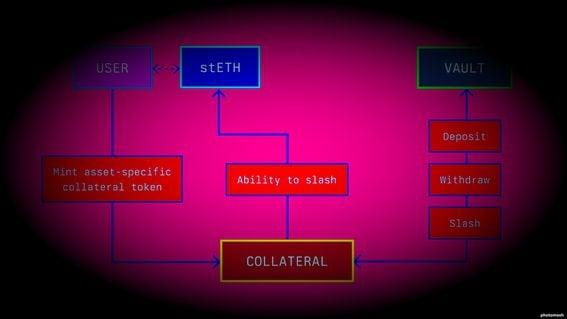

The popularity of new blockchain "restaking" protocols led by EigenLayer has drawn a response from the principals behind the liquid staking platform Lido, which itself burst onto the scene a couple of years ago to become the largest project in decentralized finance. The co-founders of dominant liquid staking protocol Lido, along with the venture capital firm Paradigm, are secretly helping to fund a new company, Symbiotic, that would compete in the fast-growing arena of "restaking," according to people briefed on the matter. Internal company documents obtained by CoinDesk lay out diagrams of how the project would work. The emergence of a restaking player with deep-pocketed backers could portend a face-off that might redefine the DeFi landscape. The co-founders of Lido, the biggest liquid staking protocol on Ethereum, are secretly funding a competitor to EigenLayer, the buzzy "restaking" service that has emerged rapidly this year to become a powerful force in decentralized finance. According to several people with knowledge of the matter, the project is called Symbiotic and has drawn backing from not only the Lido co-founders, Konstantin Lomashuk and Vasiliy Shapovalov, through their venture firm Cyber Fund, but also Paradigm, the crypto venture capital firm that is one of Lido's lead investors. CoinDesk also obtained internal Symbiotic documents that describe the project, which allows users to "restake" using Lido's staked ether (stETH) token in addition to other popular assets that are not natively compatible with EigenLayer. Developed by the team that previously built a staking service called Stakemind, Symbiotic will be "a permissionless restaking protocol that provides flexible mechanisms for decentralized networks to coordinate node operators and providers of economic security," according to the internal company documents reviewed by CoinDesk. The documents were marked as "preliminary" and "not for distribution," but several teams working in the nascent restaking ecosystem – including actively validated services (AVSs) and liquid restaking services building on EigenLayer – say they have already been in discussions to integrate with the protocol. Representatives of Paradigm, Symbiotic and Cyber Fund declined to comment on the deal. New kid in town Lido was the breakout sensation in DeFi just a couple of years ago when it developed a protocol that allowed users to stake cryptocurrency on Ethereum – essentially locking it in – but still get a token "stETH" that they could use to trade in the meantime. The project proved so popular that it now ranks as the largest decentralized finance protocol on Ethereum, with $27 billion worth of deposits, attaining such a dominant position that some players worried about the operational risks of its outsize influence. But lately, Lido has been grappling with a falling market share as users shifted assets over to EigenLayer, a newer service that allows users to restake Ethereum's native ETH token to help secure other networks. EigenLayer is one of the biggest crypto success stories in recent memory, drawing in some $16 billion worth of deposits since it opened up to investors last year. Similar to EigenLayer, Symbiotic will offer a way for decentralized applications, called actively validated services, or "AVSs," to collectively secure one another. Users will be able to restake assets that they've deposited with other crypto protocols to help secure these AVSs – be they rollups, interoperability infrastructure, or oracles – in exchange for rewards. The key difference between Symbiotic and EigenLayer is that users will be able to directly deposit any asset based on Ethereum's ERC-20 token standard into Symbiotic – meaning the protocol will be directly compatible with Lido's staked ETH (stETH) token, as well as thousands of other assets that use the ubiquitous ERC-20 standard. EigenLayer, meanwhile, only accepts ETH tokens. In what might be a twist of irony, when crypto venture giant Paradigm approached Sreeram Kannan, co-founder of EigenLayer, to invest in his project, he turned their money down in favor of rival venture capital firm Andreessen Horowitz, according to several people briefed on the matter. Paradigm told Kannan that they would invest in a competitor to his project instead. Kannan didn't immediately reply to a request for comment. Uber, Lyft and a potentially huge market The emergence of a potentially formidable EigenLayer competitor underscores how companies and investors have become eager to capitalize on restaking as the trend has taken over the industry conversation. Blockworks reported in April that Karak, another restaking upstart, had secured funding from the major U.S. crypto exchange Coinbase, among others. "The space is big enough for more than one player to be big," said one restaking infrastructure operator who plans to integrate with Symbiotic but spoke on the condition of anonymity since the project remains in stealth. "Uber and Lyft, I think, are perfect examples. It's the same thing here. Restaking is going to be massive." The involvement of Cyber Fund, led by Lido's co-founders, and Paradigm, its main venture backer, could put Symbiotic in a strong position to challenge EigenLayer. It's also further evidence that people close to Lido perceive EigenLayer's approach to restaking as a potential threat to its own dominance. Although Lido remains the largest decentralized finance protocol on Ethereum by a wide margin, the project's strategy around restaking will play a major role in whether (and how) it manages to maintain its lead in the general staking realm. Liquid restaking startups that deposit user funds into EigenLayer have eaten into the market for Lido's stETH token. The two largest liquid restaking protocols, Ether.Fi and Renzo saw $625 million in net inflows over the past 30 days. Lido, meanwhile, saw $75 million in net outflows over that same period. This week, members of Lido DAO (decentralized autonomous organization), the governance body that controls the Lido protocol, publicly proposed the "Lido Alliance," a guiding framework for thinking about restaking that would place stETH squarely at the trend's center. "Lido DAO will identify and recognize projects that share the same values and mission and have a way to positively contribute to the stETH ecosystem," the proposal stated. "Growing an Ethereum-aligned ecosystem around stETH helps decentralize the network.” While Lido is not directly tied to Symbiotic, the restaking startup funded by Lido's co-founders lines up well with the Lido Alliance framework. Whereas EigenLayer only accepts deposits of ether (ETH) tokens and certain ETH derivatives (including Lido's stETH), Symbiotic will not accept ETH deposits at all. Instead, it will allow users to directly deposit any ERC-20 token, including Lido's staked ETH (stETH) and other tokens that use the popular token standard. "Collateral in Symbiotic can encompass ERC-20 tokens, withdrawal credentials of Ethereum validators, or other onchain assets such as LP positions, without limitations regarding which blockchains the positions are held on," the project said in its its documents. Discussions with restaking firms Symbiotic's approach to collateral ties into its broader ambition to become a "permissionless" protocol, meaning apps that build on the platform should have substantial leeway over how they augment it to serve their use case. "I’m excited about what they’re working on. It seems interesting and innovative," Mike Silgadze, co-founder of Ether.Fi, one of the largest restaking protocols, said in a Telegram message. "It seems like they’re very focused on building something fully permissionless and decentralized." Renzo, another large liquid restaking service, is already in discussions to integrate with Symbiotic after it launches, according to a source close to both teams. Symbiotic has not released any information publicly and would not confirm when it plans to launch, but four sources consulted for this article said they expect the platform to be released in some form by the end of this year. Margaux Nijkerk contributed reporting. CORRECTION (May. 15, 17:11 UTC): Clarifies that EigenLayer accepts deposits of some ETH derivatives, in addition to pure ETH. https://www.coindesk.com/tech/2024/05/14/lido-co-founders-paradigm-secretly-back-eigenlayer-competitor-as-defi-battle-lines-form/