2024-05-14 21:13

Core contributor Hoak blamed his actions on a "crippling gambling addiction." Solana-based crypto trading protocol Cypher has endured its share of hacks and heists. But its latest loss – of money meant for down-bad customers – was an inside job. On Tuesday, a pseudonymous developer known as Hoak admitted to stealing hundreds of thousands of dollars worth of cryptocurrencies from Cypher's hack reimbursement fund. "I took the funds and gambled them away," Hoak said in a statement, blaming his activity on a "crippling gambling addiction." Hoak's admission comes one day after Cypher's founder Barrett accused him of systematically draining troves of valuable cryptos from the protocol's redemption contract over multiple months, beginning in December. Citing on-chain data, Barrett said Hoak ultimately sent assets worth around $300,000 (at current market prices) to Binance, presumably to cash them out. Hoak broadly stated Tuesday that "the allegations are true." In a tweet, he said he doesn't expect anyone "to let this go unpunished." Barrett told CoinDesk he had sent information about the heist and Hoak's true identity to law enforcement and was following their lead. "This is incredibly saddening to me. I never thought this would be a possibility, having a core contributor who stayed on after the exploit to try and rebuild the project be the one who rugged funds from the redemption contract," Barrett wrote. Cypher contributors created the redemption contract to reimburse customers who shouldered a $1 million loss in an exploit in August. Barrett said the team discovered the funds were missing after one user reported issues in claiming their redemption. https://www.coindesk.com/business/2024/05/14/insider-at-solanas-cypher-protocol-admits-to-stealing-300k/

2024-05-14 19:47

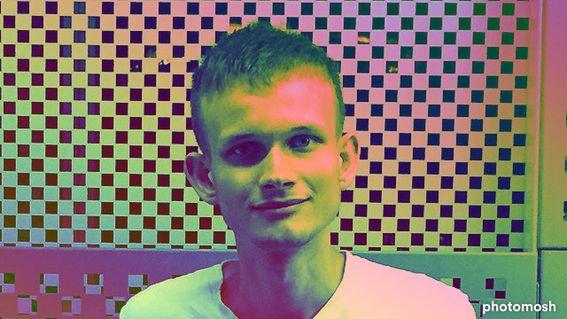

After a technical proposal to improve Ethereum wallets met with some opposition, a familiar figure swooped in last week to devise an alternative. After a technical proposal to improve Ethereum wallets met with some opposition, a familiar figure swooped in last week to devise an alternative: none other than Vitalik Buterin, the blockchain's co-founder. It reportedly took him 22 minutes. The origin of the story dates back to last month, when Ethereum developers decided to include Ethereum improvement proposal EIP-3074 – allowing for certain functions in wallets to be controlled by smart contracts – in its next big network upgrade, known as the Pectra hard fork. The work to make Ethereum wallets less clunky is part of a technological move called account abstraction, in which Ethereum externally-owned account (EOA) wallets, the most popular on the blockchain, are turned into smart-contract wallets. After EIP-3074 was released, some in the community praised the proposal, while others expressed their displeasure. The main concern was that it was not compatible with an earlier proposal, called ERC-4437, which has been on mainnet since February 2023. A couple days after EIP-3074 was released, Buterin co-wrote a new one, EIP-7702, which serves as an alternative to what is now included in the upcoming Pectra upgrade. Ethereum core developer Ansgar Dietrichs, who co-wrote EIP-3074 and EIP-7702 with Buterin, said in an interview with CoinDesk via chat that the newest proposal was “the result of a week or so of him being involved in the account abstraction research conversation.” After the research was done, Dietrichs said, Buterin “indeed speedran the process of writing that EIP.” “I challenged him to do it in 15," Dietrichs recalled. "It took him 22.” Since the release of EIP-7702, many have praised the alternative, and it seems likely to replace the original EIP-3074. "There is positive sentiment among all stakeholder groups" for Buterin's alternative, Christine Kim, a vice president of research at the digital-asset firm Galaxy, wrote in a May 20 research note. Jarrod Watts, the developer relations engineer at Polygon, wrote on X that “It's one of the most impactful changes Ethereum is going to have... EVER.” For now, EIP-3074 is still considered to go live with Pectra. That might change once the details of EIP-7022 are worked out. “People are still understanding the exact differences to 3074,” Dietrichs told CoinDesk. “But I would say it’s pretty likely that we will replace 3074 with it.” Galaxy's Kim suggested that the episode offered an example of how Ethereum's decentralized governance works in practice. "It can result in constructive dialogue between different stakeholder groups in an open-source project that ultimately results in a new path forward with higher consensus among participants than before," Kim wrote. Once Buterin got involved, it didn't take long. https://www.coindesk.com/tech/2024/05/14/vitalik-buterins-ethereum-wallet-proposal-scribbled-in-22-minutes-gets-positive-reviews/

2024-05-14 15:17

The new feature from Colony Lab, a developer and project incubator in the Avalanche blockchain ecosystem, called "liquid vesting," lets early investors, such as founders or VC backers, sell their tokens before their vesting period is over. Even in anything-goes crypto trading, there are conventions designed to protect the little guy. One of those is the vesting period – a window of time following a digital-token sale or airdrop where early investors, such as founders, project contributors and venture-capital backers, are locked up from dumping their allocations. Projects typically do this so that the price of that token doesn’t crash immediately after a listing, say if big stakeholders were to sell right away. Another goal is to make sure insiders and early backers keep skin in the game, an assurance of good faith, as it were. Now comes a new feature from Colony Lab, a developer and project incubator in the Avalanche blockchain ecosystem, called "liquid vesting." If it sounds like a workaround, that's because it basically is. Have your bags and keep them too. Take liquidity now, without having to wait for the end of the vesting period. “Liquid vesting allows early investors to trade their tokens before they invest without impacting the projects, without impacts in the secondary market, " said Wessal Erradi, co-founder of Colony Labs. The positive spin? “It also allows new buyers to establish long-term positions,” Erradi said. Colony announced the liquid vesting feature Tuesday in conjunction with the launch of its decentralized fundraising platform, which has the stated aim of "democratizing access to seed sales investments in early-stage projects, previously limited to a select group, including VCs and high-net-worth individuals,” the team wrote in a press release. The rollout comes after Colony shared in November that it invested $10 million in the Avalanche blockchain ecosystem, by buying more than 500,000 AVAX tokens, which went towards a validators program for AVAX holders. Elie Le Rest, another co-founder, said there is some precedent for this in traditional markets, but "in crypto, not that much.” “We had the infrastructure to be able to build something like this,” Le Rest said in an interview with CoinDesk. How does it work? According to Le Rest, "we kind of tokenized again, the vesting contracts." "So we issue a new token, one-to-one, that matches the ones that are locked, and then we distribute that to the users," Le Rest said. "And then they can basically trade that on our decentralized exchange that we built." As often is the case in crypto, the solution to a token problem is another token. https://www.coindesk.com/tech/2024/05/14/liquid-vesting-is-oxymoronic-blockchain-feature-that-lets-early-investors-sell-without-waiting/

2024-05-14 14:47

The state’s investment board bought 94,562 shares of BlackRock’s iShares Bitcoin Trust in the first quarter of the year. The U.S. state of Wisconsin purchased 94,562 shares of BlackRock’s iShares Bitcoin Trust (IBIT) in the first quarter of the year, a filing shows. The shares are worth nearly $100 million. Bitcoin rose 1% on the news, currently trading at $61,957, down 1.7% over the past 24 hours as new inflation data came in hotter than expected during U.S. morning hours. Wisconsin, which filed its quarterly 13F report with the Securities and Exchange Commission (SEC) on Tuesday, is the first state to disclose the purchase of bitcoin. The investment board also purchased shares of Grayscale's Bitcoin Trust (GBTC) worth roughly $64 million. "Normally you don't get these big fish institutions in the 13Fs for a year or so (when the ETF gets more liquidity) but as we've seen these are no ordinary launches," Bloomberg Intelligence senior ETF analyst Eric Balchunas wrote in a post on X. "Good sign, expect more, as institutions tend to move in herds." The investment board, also known as SWIB, was founded in 1951 and currently manages more than $156 billion in assets, according to its website. It manages the holdings of the Wisconsin Retirement System (WRS), the State Investment Fund (SIF), and other state trust funds. The disclosure comes as March 15 is the deadline to file quarterly holdings by institutional investment managers with at least $100 million in assets under management. The market is watching these disclosures to see if any large TradFi funds invested in the bitcoin ETFs since their launch earlier this year. https://www.coindesk.com/business/2024/05/14/state-of-wisconsin-buys-nearly-100m-worth-of-blackrock-spot-bitcoin-etf/

2024-05-14 14:00

The series B funding round comes during a breakout year for the crypto-based prediction market platform, and brings its total funding well over $70 million. Prediction market Polymarket raised $45 million from investors including Peter Thiel's Founders Fund and Ethereum creator Vitalik Buterin. Combined with an earlier round, the company has raised well over $70 million. Polymarket is seeing brisk business in the run-up to the U.S. presidential election. Polymarket, the cryptocurrency-based prediction market platform that's enjoying a breakout year in the run-up to the U.S. presidential election, raised $45 million in a series B funding round with a roster of big-name investors. Billionaire Peter Thiel's Founders Fund is the lead investor, Polymarket founder Shayne Coplan told CoinDesk via Telegram message. Other participants include Ethereum creator Vitalik Buterin, 1confirmation, ParaFi and Dragonfly Capital, Coplan said. He did not disclose how much the company was valued in the transaction. The round follows a previously undisclosed $25 million series A led by General Catalyst, Coplan said. Factoring in a $4 million seed round in 2020, Polymarket has raised well over $70 million. The company said it also hired Richard Jaycobs as head of market expansion to prepare for its next phase of growth. Jaycobs previously served as executives of tradfi firms, including president of the Cantor Exchange and as the CEO of The Clearing Corporation. Polymarket is the most successful attempt to build prediction markets on crypto infrastructure. In prediction markets, traders bet money on verifiable outcomes of real-world events in a specified time frame. These events range from sporting matches to celebrity engagements to nuclear armaments. For example, a contract on Polymarket asks if the U.S. Securities and Exchange Commission will approve a spot exchange-traded fund for Ethereum's ether (ETH) by May 31. "Yes" shares were recently trading at 16 cents, indicating the market sees a 16% chance of it happening. Each share pays out $1 if the prediction comes true, and zero if not. More than mere gambling, these markets create positive spillover effects by giving more accurate reads on public sentiment and more reliable forecasts than polls and pundits, advocates such as economist Robin Hanson have long argued. Late last year, analysts at Bitwise Investments estimated that a record $100 million would be staked on crypto-based prediction markets (of which Polymarket is the largest by far) in 2024. A single contract on Polymarket has already blown past that estimate. More than $125 million of bets have been placed on the presidential election through the platform. All told, traders have wagered $202 million on Polymarket this year, according to the company. Polymarket has a big disadvantage: It is locked out of the U.S., the world's largest economy. Under a 2022 settlement with the Commodity Futures Trading Commission, it is barred from doing business with U.S. residents. This has left the field open for Kalshi, the sole CFTC-regulated prediction market platform (which settles bets in dollars rather than crypto). However, that imprimatur is a double-edged sword. The CFTC has soured on what it calls "event contracts;" last week it proposed a ban on election-related bets, which would affect Kalshi and PredictIt (which operates in the U.S. under a no-action letter, or regulatory exemption) but not the already-banished Polymarket. Coplan is scheduled to speak at CoinDesk's Consensus 2024 event in Austin, Texas, on May 31. Register here. https://www.coindesk.com/business/2024/05/14/peter-thiels-founders-fund-vitalik-buterin-back-45m-investment-in-polymarket/

2024-05-14 12:01

The latest price moves in crypto markets in context for May 14, 2024. Latest Prices Top Stories Bitcoin fell below $62,000 during the European morning on Tuesday, losing about 1.63% over 24 hours. The CoinDesk 20 Index (CD20), a broad measurement of the digital asset market as a whole, fell almost 1.1%. Ether declined more than 2% to just above $2,900, while solana was largely unchanged at $145. In the next 24 hours, attention will turn to inflation reports out of the U.S. The latest Producer Price Index (PPI) is set for release at 08:30 ET today and the Consumer Price Index (CPI) is due tomorrow. Stubbornly high inflation has previously put paid to hopes of rate cuts in the U.S., which can have the effect of a handbrake on risk assets such as crypto. The rally in GameStop (GME) stock has prompted a surge in meme coins PEPE, FLOKI and MOG. A post on X by retail trader @TheRoaringKitty, who was at the center of the GME short squeeze in 2021, sent the video-game retailer's stock flying on Monday, triggering a rally in the major meme tokens. PEPE, FLOKI and MOG all jumped as much as 30% in the last 24 hours, suggesting traders may be preempting a repeat of the DOGE rally in 2021 which occurred following GME's surge. "Roaring Kitty's return was perceived as bullish for meme coins because the market remembered that much of the GameStop mania of 2021 spilled over to $DOGE and other meme coins,” MOG token developer Shisui told CoinDesk in a message. Coinbase (COIN) suffered a three-hour outage from 04:15 UTC on Tuesday, returning to use at 07:42, according to its status page. Website visitors had received a "503 Service Temporarily Unavailable" message beforehand. While the outage has been tackled, Coinbase noted that some users may still experience failure when sending crypto or withdrawing fiat. COIN shares were down around 2.25% at $195 during mid-morning in Europe before the U.S. market opened. The bitcoin price appeared to be unaffected. Coinbase had noted that "Your funds are safe," in a post on X during the outage, and did not disclose anything further on the nature of the problem. Chart of the Day The table shows the top 10 trending words on crypto social media – Telegram, Reddit and X – in the past 24 hours. At the top of the list are gme, gamestop, roaring and kitty, a sign that a 2021-like meme frenzy has gripped the market. Shares in video game retailer GameStop (GME) surged Monday after Keith Gill, popularly known as Roaring Kitty, returned to social media with an image of a man sitting on a chair holding a gaming console. Source: Santiment - Omkar Godbole Trending Posts U.S. Blocks China-Tied Crypto Miners as 'National Security Risk' Near Nuke Base Indian Crypto Exchange CoinDCX’s DeFi Arm Okto to Launch Blockchain and OKTO Token Industry Stakeholders Believe a UK Election Won't Derail Crypto Plans https://www.coindesk.com/markets/2024/05/14/first-mover-americas-bitcoin-dips-below-62k-ahead-of-us-inflation-figures/