2024-05-09 10:51

A Binance team found that "VIP" clients – those trading more than $100 million per month – were engaging in pump-and-dump schemes and wash trading, the Wall Street Journal said. The former staff member and his colleagues on Binance's market-surveillance team had been hired to winkle out signs of market manipulation. The team had submitted a report identifying manipulation of various tokens by Binance client DWF Labs. Binance fired a member of staff who uncovered evidence of market manipulation at crypto investment firm DWF Labs, one of cryptocurrency exchange's clients, the Wall Street Journal reported on Thursday, citing interviews with Binance employees past and present, documents, emails and other industry participants. The former staffer and his colleagues on Binance's market-surveillance team had been hired to winkle out signs of market manipulation and other nefarious activities as part of the exchange's efforts to clean up its act in the face of scrutiny from financial regulators. The team found that "VIP" clients – those trading more than $100 million per month – were engaging in pump-and-dump schemes and wash trading that were prohibited by Binance's terms and conditions, according to the WSJ article. DWF Labs, which was making more than $4 billion in monthly trades, emerged as a prolific investor in crypto projects in early 2023 when it was at the center of a stream of funding rounds in an otherwise sedate market. Differing from the traditional venture capital model, the firm, whose founders made their money as crypto high-frequency traders, generally bought millions of dollars worth of a project's token at a discount and benefited when the price rose. The Binance investigators submitted a report alleging DWF had manipulated the price of several tokens on the back of $300 million of wash trades in 2023, but Binance deemed there was insufficient evidence of market abuse, the WSJ said. A week after the report's submission, the head of the team was fired, according to the newspaper. Binance told the WSJ it rejected claims it had permitted market manipulation, and the person was dismissed after an inquiry found the allegations against the client weren't "fully substantiated." After the article was published, DWF Labs said in a posting on X that the allegations about it were "unfounded and distort the facts." Binance also responded, without relating to the member of staff's dismissal. "We do not tolerate market abuse," it said in an X post. "Over the last three years, we have offboarded nearly 355,000 users with a transaction volume of more than $2.5 trillion for violating our terms of use." The company did not respond to CoinDesk's request for comment. https://www.coindesk.com/business/2024/05/09/binance-fired-investigator-who-uncovered-market-manipulation-at-client-dwf-labs-wsj/

2024-05-09 10:15

The positive momentum seen in the first quarter has continued, with the platform taking in a record $5 billion in deposits in April, the analysts said. KBW raised its price target to $21.50 from $20; JMP raised its target to $30 from $28. A surge in crypto trading contributed to the 40% year-on-year increase in revenue. Positive momentum continued into April with a record $5 billion in deposits, the analysts said. Trading platform Robinhood (HOOD) reported strong first-quarter earnings yesterday as a surge in crypto trading fueled a 40% year-on-year jump in revenue, leading some analysts to upgrade their earnings estimates and price targets. KBW raised its price target to $21.50 from $20, while maintaining its market perform rating. Rival broker JMP raised its price target to $30 from $28 and reiterated its market outperform rating. The shares, which closed yesterday at $17.85, rose over 4% in early trading on Thursday. They have gained over 40% this year. A “solid beat in the quarter to us and consensus as stronger than expected crypto trading revenues drove earnings per share (EPS) higher, with lower expenses also contributing a penny to the $0.05 adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) beat,” KBW analysts led by Kyle Voigt wrote. Crypto transaction revenue more than tripled from the year-earlier quarter. Two other key takeaways were the strong reception by customers to new products such as the platform’s Gold Card, and the business’ EBITDA margin expansion, KBW said. JMP noted the company “delivered record net new deposits of $11.2 billion (a 44% annualized rate), including positive net flows from every major brokerage, and also 75% of deposits coming from customers that have been on the platform for over one year.” The popular trading platform added 500,000 new accounts in the quarter, more than in all of last year and the highest quarter for new accounts since first-quarter 2022, JMP said. Positive momentum has continued, with a record $5 billion in deposits in April versus the monthly average of $3.7 billion in the first quarter, the broker noted. “We expect further acceleration in deposits and new customers, with enhancements to the Gold offering also increasingly contributing,” JMP analysts led by Devin Ryan wrote. Bernstein said it expects Robinhood “to put up a strong fight against the SEC and not back down on its crypto business.” Robinhood received a Wells Notice – a preliminary warning from the regulator saying it believes it has enough information to bring an enforcement action – on May 4. “We continue to expect continued customer traction in crypto trading, while regulatory clarity takes its course,” analysts Gautam Chhugani and Mahika Sapra wrote. https://www.coindesk.com/markets/2024/05/09/robinhood-delivers-big-earnings-beat-driven-by-booming-crypto-trading-analysts/

2024-05-09 10:04

CoinMarketCap registered a record 138 memecoins in April, according to one analyst. CoinMarketCap registered a record 138 meme coins in April, according to pseudonymous analyst Crypto Coryo. Fast money has been chasing PEPE and WIF. The meme coin season continues to march forward, undeterred by the stalled rally in bitcoin (BTC). Data tracking website CoinMarketCap listed a record 138 meme coins this April, extending the parabolic rise from April 2023's tally of just 18, according to pseudonymous analyst Crypto Coryo. The number could be much higher, as CoinMarketCap reportedly lists only 10% of all tokens, Crypto Coryo said on X. At press time, 2,229 meme coins were listed on CoinMarketCap, boasting a combined market capitalization of over $50 billion, nearly matching investment banking giant JPMorgan (JPM) and U.S. electric car maker Tesla's (TSLA) market value. That's an impressive feat, as meme coins are often criticized for lacking utility or actual use case and considered a proxy for pure speculation. "In principle, people participate in meme coins because (i) the value might go up, (ii) they feel democratic and open for anyone to participate, and (iii) they are fun," Vitalik Buterin, founder of leading smart contract blockchain Ethereum, which is also the home to several popular meme coins, said in a blog post. Arthur Hayes, a co-founder and former CEO of crypto exchange BitMEX and chief investment officer at Maelstrom, favors a deeper understanding of meme coins as a driver of blockchain ecosystem growth. "You can poo-poo these things as stupid and valueless, but if it brings attention and more engineers to the space, it's positive value for the chain itself," Hayes said in an interview with Real Vision on March 30. Programmable blockchain Solana, being cheaper and faster than its rival Ethereum, has become the new home for these tokens since late last year. At one point in the first quarter, the meme frenzy led to record network activity on Solana, pushing SOL's price above $200 for the first time since November 2021. "Due to high gas fees, degen activity has moved (partially) away from Ethereum. We've seen it with Bonk on Solana and Bald on Base. But Solana is now the home of meme coins," Crypto Coryo noted. Fast money chasing PEPE Bitcoin's recent dour price action has speculators chasing a popular meme token pepe (PEPE). The token has risen nearly 17% in seven days, becoming the ninth-best-performing cryptocurrency on CoinMarketCap's list. Besides, it has the second-highest perpetual futures open interest (OI) to market capitalization ratio, according to data tracked by Paris-based Kaiko. Dogifwhat (WIF), also a meme coin, has the highest OI-to-market cap ratio. "Pepe (PEPE) and Dogwifhat (WIF) exhibit twice the ratio relative to other altcoins. A higher ratio indicates that the derivative market positioning for an asset is large compared to its market cap, making price discovery for these tokens more concentrated in perpetual futures markets," Kaiko said in the weekly newsletter. Notional open interest refers to the dollar value locked in the number of active or open futures contracts. https://www.coindesk.com/markets/2024/05/09/meme-coin-demand-is-stronger-than-ever-crypto-data-tracker-says/

2024-05-09 07:31

The index contains a variety of dog-themed coins and other popular meme tokens. MarketVector has started a meme coin index, which is up 195% on a yearly basis. The index constituents include Dogecoin, Shiba Inu, Pepe, Floki Inu, Dogwifhat, and BONK. VanEck's MarketVector has jumped on the meme coin bandwagon, starting a new index based on the highly popular token category. MarketVector’s Meme Coin Index, which trades under the symbol MEMECOIN, tracks the top six meme tokens. The largest holdings of the meme coin index include Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE). Other holdings include dogwifhat (WIF}, Floki Inu (FLOKI), and BONK. Based on the performance of its constituents, MarketVector’s new index would be up over 195% on a yearly basis. For comparison, the CoinDesk 20, which measures the 20 largest tokens except stablecoins, is up 97% during the same period, while bitcoin (BTC) has risen 123%. Meme coins have a market cap of $51 billion, according to CoinGecko, and the MarketVector index tracks $44.67 billion of it. Some investment managers who previously spoke to CoinDesk believe that the meme coin craze will continue due to low fees on Solana, allowing users to make small bets for potentially large profits, unlike previous manias hindered by high Ethereum fees. Recently, a new category of meme tokens called PoliFi has come into the spotlight. The market cap of the new token category surged to $586 million as the election season heats up. One token in particular, BODEN, is up 16% after former President Donald Trump made a comment about it at a campaign event, while Trump-themed MAGA is up 28% and TREMP 142%. https://www.coindesk.com/markets/2024/05/09/vanecks-marketvector-starts-index-to-track-the-largest-meme-coins/

2024-05-09 07:01

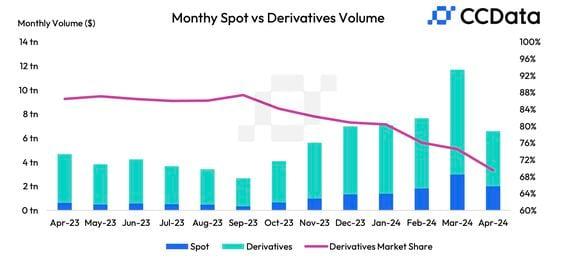

Bitcoin, the leading cryptocurrency by market value, fell nearly 15% in April, ending a seven-month streak. Cumulative monthly spot and derivatives trading volume tanked by 43.8%, CCData said. Binance’s spot market volume registered its first decline since September 2023. Cryptocurrency trading volume cooled in April, registering the first decline in seven months as escalating geopolitical tensions and slower inflows into U.S.-listed spot ETFs weighed over the digital assets market. The cumulative volume in spot and derivatives markets fell by 43.8% to $6.58 trillion, a sharp retracement from March’s record high of $9.12 trillion, according to a report by London-based digital assets data provider CCData. Derivatives fell out of investor favor again as activity in the futures and options market declined by 47.6% to $4.57 trillion. Meanwhile, the spot market volume suffered a relatively measured drop of 32.6% to $2.01 trillion. “This decline followed unexpected macroeconomic data, an escalation in the geopolitical crisis in the Middle East, and negative net flows from U.S. spot bitcoin ETFs, leading to major crypto assets retracing the gains they made in March,” CCData said in a report shared with CoinDesk. Bitcoin (BTC), the leading cryptocurrency by market value, fell nearly 15% to under $60,000 last month, snapping a seven-month winning trend. The sell-off came as an overheated bull market ran into broad-based risk aversion characterized by renewed tensions in the Middle East, dwindling probability of rapid Fed rate cuts this year and strength in the dollar index. The CoinDesk 20 Index, a measure of the most liquid digital assets, traded nearly 20%, and the total crypto market capitalization slipped by 16.8% to $2.177 trillion. While Binance remained the largest crypto exchange by volume, its combined spot and derivatives market share fell to 41.5%. The exchange’s spot market trading volume tanked 39.2% to $679 billion in April, recording the first decline since September 2023. “The decline in Binance’s market share also coincided with the news that its founder and previous CEO, Changpeng Zhao, was sentenced to four months in prison for the violation of U.S. money laundering laws,” CCData noted. Binance CEO Changpeng “CZ" Zhao stepped down after pleading guilty to U.S. criminal charges in November and was replaced by Richard Teng. Since then, Binance’s spot market share has increased from 30.8% to 33.8%, CCData said. https://www.coindesk.com/markets/2024/05/09/crypto-monthly-trading-volume-drops-for-first-time-in-seven-months-to-658t/

2024-05-09 02:05

"I don't like that investment," former U.S. President Donald Trump said of a token mocking his rival, Joe Biden. Trump also said he's open to cryptocurrency donations. The old saying "any publicity is good publicity" appears to hold true for memecoins. Even the flimsiest kind of publicity. Jeo Boden (BODEN), a joke crypto token referring to a misspelling of U.S. President Joe Biden's name, surged as much as 25% Wednesday after his Republican challenger, former President Donald Trump, responded to a fan's question about it. The real estate mogul, reality TV star and populist firebrand was hosting the Trump Cards NFT Gala for holders of the digital collectibles that bear his name and likeness. A few hundred people were in attendance at his Mar-a-Lago resort in Palm Beach, Florida. "I don't like that investment," Trump said at an impromptu audience Q&A after an attendee described BODEN to him and said it had a $240 million market capitalization. After peaking at $0.42, BODEN fluctuated and at press time was trading at $0.40, still up about 15% from when Trump made his comment (such as it was). Trump crypto donations? Trump's presidential campaign is not currently accepting donations in cryptocurrency, but he said at the impromptu gathering he intends to. When asked, "Can we donate using crypto?" the almost-certain GOP nominee responded, "If you can't, I'll make sure you can." Meanwhile, on Polymarket, the crypto-based prediction market platform, trading remained flat Wednesday in the contract "Will Trump mention $boden before July?" The contract defines a "mention" as either "a verbal usage of the word 'boden' specifically in reference to the cryptocurrency" or "any written usage of the word 'boden' published through Trump's social media or other official communication channels." His quip didn't fit the bill, and "yes" shares in the contract, which will pay out $1 if he utters the word "Boden" by July 1, were little changed at $0.05 – meaning traders are giving 5% odds that he will say the word. CORRECTION (May 9, 2024, 02:38 UTC): Corrects fourth paragraph to say that Trump was doing a Q&A with the audience, not a press conference. Danny Nelson contributed reporting. https://www.coindesk.com/markets/2024/05/09/boden-memecoin-surges-after-trump-quips-about-it/