2024-05-09 01:15

Exodus was supposed to uplist to NYSE American on Thursday morning, but this is now delayed, the company said. Crypto wallet company Exodus Movement will not be listing on NYSE American, the New York Stock Exchange’s sibling market, on Thursday as planned, the company announced late Wednesday. NYSE American told Exodus on Wednesday that U.S. Securities and Exchange Commission staff were still reviewing Exodus' registration statement, which the company said had gone effective at the end of April, according to an Exodus press release. Exodus was supposed to uplist from OTC (over-the-counter) trading, the company announced earlier this week, with its Class A Common Stock continuing to trade on OTCQX through the end of the day Wednesday. Its common stock will now continue trading on OTCQX. "The Company may reconsider listing on a national securities exchange at a future date once the SEC Staff has completed its review of the registration statement," Wednesday's press release said. The uplisting would have led for Exodus "creating long-term value for our investors by expanding our global shareholder base and boosting stock liquidity," Exodus CEO JP Richardson tweeted earlier this week. In Wednesday's statement, Richardson said the company was "surprised and confused by this last-minute decision." "We remain hopeful that the SEC will follow through on its commitment to treat us as the law intends. Exodus has been fully transparent and responsive throughout this process and we expect a swift resolution in this matter," he said. "In the meantime, we will continue to provide the best possible service and value for our customers and shareholders." https://www.coindesk.com/policy/2024/05/09/crypto-wallet-provider-exodus-nyse-american-stock-listing-postponed-for-sec-review/

2024-05-08 21:16

Bitcoin was lower by 2.5% to $61,500 late Wednesday, with solana and bitcoin cash each down more than 7%. Cryptocurrencies are still stuck in a corrective phase, but a wave of supply events worth billions of dollars could further delay any meaningful recovery. "A rapid succession of nearly $2 billion of token unlocks during the next ten weeks could lower the market for altcoins," crypto analytics firm 10x Research noted in a Wednesday report. Large token unlocks in crypto are usually bearish events, increasing supply by distributing assets that were previously locked up in vesting contracts to team members, organizations and early investors including venture capital firms. Over the next two months, some $97 million of aptos (APT), $79 million of starkware (STRK), $94 million of arbitrum (ARB), $53 million of Immutable X's (IMX), $330 million of Avalanche's (AVAX), $64 million of optimism (OP), $28 million of PRIME, nearly $1 billion of sui (SUI), $48 million of ethena (ENA), $171 million of Altlayer's ALT and $135 million of XAI tokens will be added to circulation, according to data compiled in the report. "Venture capital investors might be pressured to lock in recent gains, which could cap any upside performance of tokens with positive momentum, especially those where unlocks become available," the report said. Not just altcoins facing selling pressure Over $11 billion worth of bitcoin (BTC) will be distributed to creditors of crypto exchange Gemini's Earn program and long-defunct crypto marketplace Mt. Gox, K33 Research analyst Velte Lunde warned in a Tuesday report. "The next months are rigged to see waves of good old crypto FUD," said Lunde, referencing the popular crypto acronym for fear, uncertainty and doubt. Amid upcoming supply events, one market observer suggested that the FTX repayments might offer some relief. Pending bankruptcy court approval, some $14-$16 billion of funds in U.S. dollars could be paid out to creditors, and a good chunk of that may flow back to the crypto market, said Arthur Cheong, founder and chief investment officer of DeFiance Capital. "Expect at least $3-$5 billion of crypto-native liquidity to be injected back into the market," Cheong said in an X post Wednesday. Ugly action in crypto on Wednesday Late in the U.S day, the broad CoinDesk 20 Index was lower by 3.4% over the past 24 hours, with bitcoin down 2.5% to $61,500 and ether (ETH) lower by 3.6%. Bitcoin cash (BCH) and Solana (SOL) were the index's worst performers, each off by more than 7%. https://www.coindesk.com/markets/2024/05/08/crypto-markets-under-pressure-as-2b-worth-of-altcoin-token-unlocks-and-11b-bitcoin-distribution-loom/

2024-05-08 20:37

Shares in the popular trading platform were higher by 7% after the company topped first quarter revenue and earnings estimates. Robinhood (HOOD) saw a first-quarter notional crypto trading volume of $36 billion, up 224% from year-ago levels. That led to a 232% increase in crypto-related a revenue to $126 million, a primary factor, said the company, in driving overall first quarter transaction-based revenue up 59% year-over-year to $329 million. Robinhood had $26.2 billion in user's crypto in custody as of March 31, a 78% jump from the end of 2023. The larger transaction revenue due to crypto trading isn't surprising as another publicly traded crypto peer, Coinbase (COIN), also reported "blowout" first quarter numbers due to improving crypto market conditions. Robinhood also handily beat its first-quarter sales and earnings estimates. The company reported $618 million in revenue in the quarter, ahead of analyst estimates of $552.7 million, according to FactSet data. First quarter earnings were $0.18 per share, topping the average analyst expectation of $0.06. Shares of Robinhood were up about 7% in post-market trading on Wednesday, while Coinbase shares were down slightly. HOOD stock has risen about 40% for the year, while COIN has gained 22%. The company last week disclosed receipt of a Wells Notice from the U.S. Securities and Exchange commission for its crypto unit. Robinhood's CFO Jason Warnick said during an earnings conference call that "we're, of course, disappointed to have received the notice." However, he noted that the Well Notice has no impact on the customer accounts and that it is "business as usual" for the company's crypto arm. "We've been very conservative in our approach in terms of points listed and services offered. And we're a highly regulated company and have applied the same legal and compliance standards we use for our brokerage to the way we run our crypto. So it's disappointing to see more regulation by enforcement," Warnick added. https://www.coindesk.com/business/2024/05/08/robinhoods-q1-crypto-trading-volume-surged-224-as-sec-action-looms/

2024-05-08 20:17

The House of Representatives voted in favor of a resolution to oppose the SEC's crypto accounting policy, Staff Accounting Bulletin No. 121, as President Biden defends it. The House resolution starts a formal process to kill the Securities and Exchange Commission's controversial accounting policy on crypto custody. President Joe Biden said he'll veto the resolution if it reaches his desk for approval. The U.S. House of Representatives voted Wednesday to approve a resolution rejecting Securities and Exchange Commission (SEC) cryptocurrency accounting guidance that the industry said has deterred banks from handling crypto customers, but President Joe Biden is already promising he'll veto the effort if it hits his desk. The SEC's Staff Accounting Bulletin No. 121 – also known as SAB 121 – has been a focus of criticism from digital assets businesses and Republican lawmakers since its arrival. The bulletin was meant to clarify accounting treatment for crypto assets, directing a bank holding customer's digital tokens should do so on its own balance sheet, potentially incurring massive capital expenses. But the policy guidance has since been found in one government review to have been handled badly, though the agency and Chair Gary Gensler have defended it. "Gary Gensler, in his jihad against digital assets, used what is supposed to be mundane staff accounting guidance to essentially freeze out large publicly traded banks from taking custody of digital assets," said Rep. Mike Flood (R-Neb.), the effort's sponsor, in a Wednesday interview with CoinDesk. And the SEC didn't consult with the banking regulators about it, Flood pointed out, arguing that Gensler "doesn't have any business in the banking world." The White House considers the policy worth defending with a veto, according to a statement from Biden. "SAB 121 was issued in response to demonstrated technological, legal, and regulatory risks that have caused substantial losses to consumers," Biden said in a Wednesday statement, saying he "strongly opposes" disrupting the SEC's work on this. Despite that, the House vote went strongly in favor of the resolution – including support from 21 Democrats who weren't moved by Biden's threat. The SEC's accounting policy "made a joke of the rulemaking process and ignored other regulatory agencies," Rep. Patrick McHenry (R-N.C.), the chairman of the House Financial Services Committee, said in a speech on the House floor earlier on Wednesday, calling SAB 121 "a massive deviation for how highly regulated banks are traditionally required to treat assets on behalf of their customers." But a key House Democrat thought the resolution went too far. "This bill takes a sledgehammer to fix an issue that may merely need a scalpel, and it does so because my colleagues on the other side of the aisle are not only interested in doing the bidding of special interest groups, they are also interested in attacking and undermining the SEC in every possible way," said Rep. Maxine Waters (D-Calif.), the ranking Democrat on McHenry's committee. SAB 121 was originally introduced as staff guidance, but a subsequent Government Accountability Office (GAO) review determined that the agency should have handled it as a rule, with full public comments and submission to Congress. Read More: U.S. Lawmakers Seek to Overturn SEC's Crypto Accounting Policy Rep. Flood introduced the resolution to formally disapprove of the regulator's guidance alongside two Democrats, and Sen. Cynthia Lummis (R-Wyo.) has been pushing for a matching resolution in the Senate, which would be needed before the joint resolution could make it to Biden's desk. When an agency rule is reversed under the Congressional Review Act, it's not only erased, but anything similar is forever blocked from future implementation. Waters argued that SAB 121 – apart from the controversial custody component – also provided guidance on crypto disclosures that are necessary and would be threatened if Congress overturns the policy, and Biden echoed the concern about policies that would be blocked. "By virtue of invoking the Congressional Review Act, it could also inappropriately constrain the SEC’s ability to ensure appropriate guardrails and address future issues related to crypto-assets including financial stability," Biden said. "Limiting the SEC’s ability to maintain a comprehensive and effective financial regulatory framework for crypto-assets would introduce substantial financial instability and market uncertainty." Flood called it "disappointing" that the president would approve the improper use of a bulletin to do the work of a full-fledged federal rulemaking. He said he and his allies will "look for every single vehicle between now and the end of the year that will go to the president's desk and add this language in there." https://www.coindesk.com/policy/2024/05/08/house-poised-to-vote-on-erasing-sec-crypto-policy-while-president-biden-vows-veto/

2024-05-08 16:11

The Lehman Brothers-driven global financial crisis of 2008 showed the danger of spreading money around too much. If you're reading this ensconced in a traditional finance career, you know the deal: If money is idle, make it do more work. Are you, for instance, a broker with collateral quietly sitting in a vault? That's boring! Do that rehypothecation thing! Use it to finance your own trades! (The Lehman Brothers–fomented global financial crisis of 2008 helps illustrate what can go wrong.) The cryptocurrency biz has invented its own version of rehypothecation, called something else, of course: restaking. It caught fire on Ethereum (ETH) with the help of EigenLayer (which is inching toward an airdrop of its EIGEN token). As a proof-of-stake blockchain, Ethereum's plumbing relies on folks called validators "staking" their ETH to the network. Validators are rewarded for pledging their assets, given something akin to interest payments. But that ETH is locked up. Sitting idle. Financial engineers hate that, right? With restaking, that locked-up ETH is kinda sorta freed up via the creation of a derivative, and the owner of that ETH can earn a bit more money. (So, too, can the restaking platform like EigenLayer that enables this.) Many billions of dollars of ETH are now restaked. CoinDesk's Danny Nelson just reported that several firms are trying to bring restaking to Solana (SOL), including a titan of that blockchain: Jito (JTO). Not everyone is keen on the idea. To proponents, restaking can help make Solana startups' blockchain-powered apps more secure. See Nelson's story for some discussion of that. Critics fret over the systemic risks (if something goes wrong, the entanglements can get ugly real quick, as shown in 2008). Meanwhile, ETH restakers are presumably happily earning more than the current Ethereum staking yield (3.13%, according to CESR). It's all fun until it isn't. MetaMask vs. MEV Confession time: I'm both really curious about MEV (aka maximal extractable value) and really befuddled by it. In the broadest terms, MEV involves validators tinkering with the order they add transactions to a blockchain to maximize their profit. To my (possibly naive?) eye, some of it resembles arbitrage. Some looks like front-running clients' trades in TradFi. As you can imagine, some people love it (they're making money, either by engaging in MEV or by building tools that enable it or fight it or whatever it) and some hate it (they're getting sandwiched). Anyway, MetaMask, the widely popular Ethereum wallet, is introducing a new feature designed to protect MetaMask users from MEV. It reminds me of dark pools in TradFi: those stock trading platforms that obscure details of orders until they're executed, to protect from those who want to move prices against the placers of larger orders. Crypto has MEV, TradFi has high-frequency traders. There is (almost?) nothing new in the world of money. https://www.coindesk.com/consensus-magazine/2024/05/08/restaking-is-hot-in-ethereum-and-entering-solana-should-we-worry/

2024-05-08 13:00

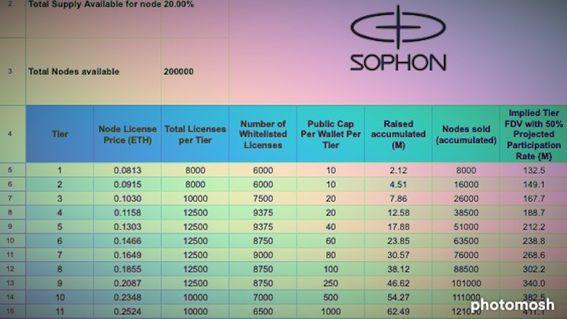

The blockchain project's founders aren't even publicly named, but they've enjoyed remarkable success in fundraising, partly thanks to this increasingly popular fundraising method, where the longer you wait, the higher price you pay. Sophon, an entertainment-focused blockchain ecosystem, raised more than $60 million in a node sale, an increasingly popular type of fundraising method. Node sales, described as a way of helping to decentralize projects, are structured in pricing tiers, where the longer buyers wait, the more they have to pay. The project is built on zkSync's technology, using a data solution provided by Celestia. It's the blockchain industry's latest innovation – not in technology, but in rounding up cash from investors. Sophon, an entertainment-focused blockchain ecosystem, has attracted more than $60 million in a node sale – a novel form of project fundraising that is catching on in crypto circles as token sales come under greater scrutiny from securities regulators. The Sophon project, built as a rollup network atop the Ethereum blockchain using technology from the zkSync project, sold about 121,000 network nodes, netting some 20,391 ETH ($62.7 million), according to a data dashboard on the blockchain-analytics website Dune. A total of 200,000 nodes were offered in the sale. Many of the nodes were likely purchased by venture capital firms, a person with knowledge of the matter told CoinDesk. Technically, buyers purchased Ethereum-based ERC-721 tokens, or NFTs, allowing them to operate nodes. That in turn qualifies them to collectively earn 20% of the project's eventually-to-be-released SOPH tokens over the first 36 months after the network's main launch, expected in the third quarter of this year. Underscoring the explicitly financial aspects of running a node on Sophon, project officials acknowledged in the press release that the network doesn't even need the full 200,000 nodes. Users don't have to actively operate the nodes themselves. "They can simply delegate and reap the rewards for it," according to the press release. "Furthermore, the node licenses that are unsold and unused when the sale ends won't come into circulation and will be burned." Using Celestia for data availability Sophon previously had raised $10 million in a traditional funding round led by the investors Paper Ventures and Maven 11, with participation from Spartan, SevenX and OKX Ventures. The fundraising track record looks especially impressive given that the project's principals aren't publicly named. According to a press release, the project is co-founded by "several well-known semi-anonymous builders, including Sebastien ('Seb'), previously head of DeFi at zkSync; as well as Pentoshi, the legendary Crypto Twitter persona and trader and team member at Merit Circle." In a May 3 post on X, Seb wrote that it had come to his attention that "a lot of folks were weary of the node sale and questioning the technical legitimacy of what we were doing, and thus of the overall project." "We will use this money to build cool shit, innovate, fund projects and make strategic partnerships – always with the goal of delivering value to our core community," Seb wrote. "As a crypto-native user myself, I know exactly what it means to risk funds on a new project and the value of transparency from the founder." Data services will come from plugging into another blockchain project, Celestia, according to an investor slide deck for the project. What is a node sale? Node sales, still a relatively new phenomenon in fast-moving crypto, are becoming more common, many of them with help from the DeFi protocol Impossible Finance, which itself raised $7 million from institutional and angel investors in a 2021 seed funding round. Amounts raised from these node sales aren't tiny: Aethir, a decentralized GPU cloud infrastructure provider, disclosed last week that it had distributed more than 73,000 node licenses valued at over 41,000 ETH ($126 million). Other blockchain projects raising funds via node sales include CARV, XAI Games and Powerloom. The marketing pitch is that the node sales help to decentralize the fledgling networks right off the bat, while still giving investors the ability to earn token rewards on top of their nodes – a form of yield. The goal is to "decentralize network participation, educate more users in their community about their tech, involve more participants than equity and involve retail users at larger skin-in-the-games than public," said Calvin Chu, a former Binance researcher who helped start Impossible Finance. Chu goes by the title of "Core BUIDLer," he said. FOMO Certain mechanics of node sales appear designed to drive the fear of missing out, such as a system of tiering, where the price goes higher as more nodes are sold, and the use of exclusive whitelists that reserve early spots for certain users. In Sophon's deal, for example, a Tier 1 node license cost 0.0813 ETH, roughly tripling to 0.2524 by Tier 11. And according to the Dune Dashboard, about three-fourths of nodes were sold to whitelisted buyers. There's also the teaser that node operators may qualify for future token airdrops from related projects. Crypto traders have speculated that zkSync, one of the biggest Ethereum layer-2 networks, might at some point announce plans for a new token. "I cannot comment on 'wen zks token,'" Sophon's Seb wrote in the May 3 tweet. Buyers of the Sophon nodes are subject to a 12-month restriction on transferring them, a stipulation designed to keep participants from simply cashing out and moving on, as sometimes happens after big token distributions. Often, however, venture capital firms that receive token allocations are locked up from selling them anyway. So the opportunity cost of owning a node may not look like too much of an additional burden – especially if the investments are accruing awards in the meantime. "Buyers hope to get high quality projects," Impossible Finance's Chu said in an interview with CoinDesk over Telegram. "This doesn't work well with low quality projects, because there is a lockup effectively. Because the nodes don't give instant tokens." https://www.coindesk.com/tech/2024/05/08/its-not-a-token-offering-its-a-node-sale-sophon-blockchain-raises-60m/