2024-05-07 16:49

"As an environmental lawyer, scion of a Democratic political dynasty, and now maverick presidential candidate, Kennedy will explain his support for cryptocurrency and self-custody," according to a statement. Robert F. Kennedy Jr., the independent U.S. presidential candidate who has promoted a pro-cryptocurrency stance during his campaign, will speak later this month at the Consensus 2024 crypto conference in Austin, Texas. "As an environmental lawyer, scion of a Democratic political dynasty, and now maverick presidential candidate, Kennedy will explain his support for cryptocurrency and self-custody," according to a press release from CoinDesk, which puts on the annual event. Kennedy is polling well behind the presumptive Republican and Democratic candidates in the presidential election, Donald Trump and incumbent Joe Biden, respectively. He is running as an independent after not making headway in the Democratic primary. Crypto has increasingly become politicized in the U.S., with many Republicans pro-crypto and Democrats opposed or skeptical at best. Kennedy is a member of a famously Democratic family (that has endorsed Biden). His uncle, John F. Kennedy, served as U.S. president in the 1960s, and his father served as U.S. Attorney General during that administration before running for president. On the issue of crypto, he's breaking away from those Democratic roots. https://www.coindesk.com/policy/2024/05/07/robert-f-kennedy-jr-a-pro-crypto-presidential-candidiate-to-appear-at-consensus-2024/

2024-05-07 16:37

Ethena's USDe tokenized yield strategy has attracted over $2 billion in deposits and some scrutiny of the token's risks. Bybit has integrated USDe as a collateral asset for derivatives trading and also listed spot bitcoin and ether pairs against the token. Using USDe as collateral could help perpetuals traders to reduce risk, derivatives trader Joshua Lim of Arbelos said. Decentralized finance (DeFi) protocol Ethena's governance token ENA rose sharply Tuesday on the news that crypto exchange Bybit integrated the protocol's USDe "synthetic dollar" for various trading activities expanding the token's utility. Bybit has added USDe as a collateral asset for perpetual futures trading with leverage and also listed spot bitcoin (BTC) and ether (ETH) trading pairs against the token, according to a press release. ENA hit its highest price in two weeks before retreating somewhat to $0.96, still up more than 8% through the past 24 hours, CoinGecko data shows. It has outperformed the mostly flat broader crypto market benchmark CoinDesk 20 Index (CD20). Bybit's move to accept USDe as collateral asset makes makes Ethena "even more of a bridge between centralized finance (CeFi) and decentralized finance (DeFi)", Joshua Lim, co-founder of derivatives dealer company Arbelos, said in an interview with CoinDesk. Lim pointed out that the addition helps reduce risk for perpetual traders as USDe carries an embedded short position in itself. "[This] is actually a huge deal," Lim said. Ethena has stormed the crypto scene this year, becoming one of the fastest growing DeFi protocol with its tokenized yield-generating investment offering that attracted over $2 billion in deposits, while also drawing plenty of scrutiny of risks from market observers still marred by the crypto implosions of the bear market. The protocol's USDe token, often referred to as "synthetic dollar" instead of a stablecoin, is a structured finance product wrapped in a token. It offers steady yields to investors by using ETH liquid staking derivatives such as Lido's stETH as backing assets, pairing them with an equal value of short ETH perpetual futures position on derivatives exchanges to keep anchored at $1 price. This strategy is also known as a "cash and carry" trade, which harvests derivatives funding rates for a yield. Recently, the protocol also added BTC to its backing assets and debuted its governance token called ENA. https://www.coindesk.com/markets/2024/05/07/ethenas-ena-jumps-8-as-bybit-endorses-usde-token-as-collateral-for-derivatives-trading/

2024-05-07 16:21

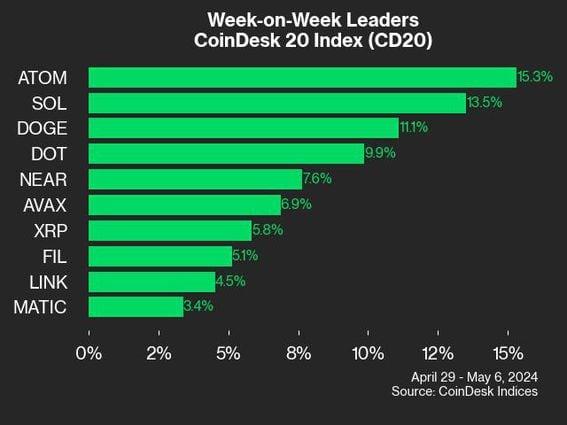

Ether significantly underperformed as 16 out of 20 assets posted gains last week. CoinDesk Indices (CDI) presents its bi-weekly market update, highlighting the performance of leaders and laggards in the benchmark CoinDesk 20 Index (CD20) and the broad CoinDesk Market Index (CMI). The CoinDesk 20 gained 2.7% over the past week, with 16 of the 20 cryptos in the gauge closing higher. This recovery comes after a tumultuous month of April, in which the index lost more than 25% of its value. Leading the move higher was Cosmos (ATOM) and Solana (SOL), which strengthened 15% and 13%, respectively. Ether (ETH) was a notable underperformer over the past week, falling 3.4% as optimism waned over approval of a spot ETF. CoinDesk 20 tracks top digital assets and is investible on multiple platforms. The broader CMI comprises approximately 180 tokens and seven crypto sectors: currency, smart contract platforms, DeFi, culture & entertainment, computing, and digitization. https://www.coindesk.com/markets/2024/05/07/solana-and-cosmos-lead-coindesk-20-higher-coindesk-indices-market-update/

2024-05-07 12:01

The latest price moves in crypto markets in context for May 7, 2024. Latest Prices Top Stories Bitcoin fluctuated between $63,000-$64,000 during the Asian and European mornings on Tuesday, consolidating its recovery from last week's crash below $57,000. Despite retreating from Monday's high of around $65,500, BTC appears to have settled into a range comfortably above the $60,000 level. At the time of writing, it was priced at $64,114, largely unchanged from its price 24 hours before, but nonetheless up around 10% since the start of May following a slide of over 16% in April. The broader digital asset market has dropped 1.33% since yesterday, as measured by the CoinDesk 20 Index (CD20). Robinhood would probably win a court case against the U.S. Securities and Exchange Commission, according to broker KBW. The SEC's issuing of a Wells Notice against the trading platform is surprising given its conservative approach to digital asset listings, KBW said in a research report on Monday. “Our preliminary view is that HOOD would likely fight the SEC in court and has a higher likelihood to prevail than most U.S. competitors (if put in similar situations) given HOOD’s stricter listings standards,” the authors wrote. KBW added that HOOD shareholders won't have full clarity on the outcome of any legal case until late 2025, based on the timescales of the SEC's ongoing suit with Coinbase. Digital bank Revolut's new crypto exchange is now available to professional cryptocurrency traders. Revolut X is designed to entice users to trade through it rather than buying and selling with the Revolut app by offering lower fees. Revolut will charge zero fees to the maker of a trade and 0.09% to the taker. Revolut has allowed the buying and selling of crypto within its app for several years and has now launched its own exchange to compete with other leading participants. The London-based company, which has more than 40 million customers worldwide, is among the first banks to build a standalone crypto exchange. Chart of the Day The chart shows monthly venture capital funding in the crypto market since October 2022. VC funding surpassed the $1 billion mark for the second straight month in April. According to Tagus Capital, the U.S. accounted for 35% of the global fundraising, followed by Singapore's 9.2% and Britain's 7.4%. Source: Tagus Capital, Rootdata - Omkar Godbole Trending Posts Binance CEO Teng Says Nigeria Must Release Gambaryan, Detention Sets 'Dangerous New Precedent' AI Tokens Lead Crypto-Market Recovery as Nvidia Hits One-Month High Poloniex Hacker Sends $3.3M Worth of Ether to Tornado Cash https://www.coindesk.com/markets/2024/05/07/first-mover-americas-bitcoin-settles-into-63k-64k-range/

2024-05-07 10:37

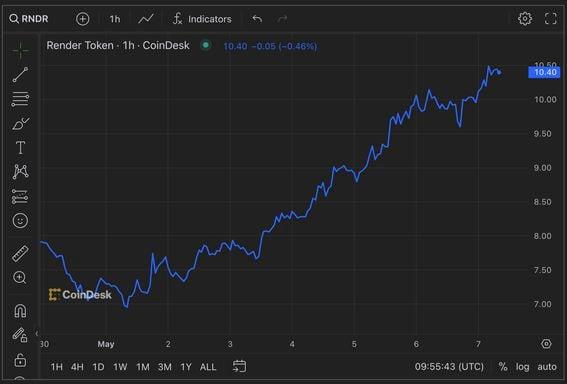

"We are in an AI super cycle right now," one market observer said. AI tokens such as RNDR, AGIX, FET outshine bitcoin by a wide margin. NVDA rallies to a one-month high as excitement builds around the chipmaker's impending earnings report. Native cryptocurrencies of blockchain projects supposedly using artificial intelligence (AI) have led the crypto market recovery in recent days, while shares of Nasdaq-listed chipmaker Nvidia (NVDA), the poster child for all things AI, also rallied. RNDR, the utility token of decentralized GPU-based rendering solutions, The Render Network, has surged almost 40% to $10.432 in seven days, the biggest gain among the top 100 cryptocurrencies by market value, according to data source CoinGecko. Other AI coins, such as SingularityNET's AGIX, Bittensor's TAO and Fetch.ai's FET, have gained between 17% and 23%, outperforming the broader market. Bitcoin, the largest cryptocurrency by market value, has risen 1.7%, while the CoinDesk 20 Index, a broader market gauge, has rallied 0.6%. Crypto analytics platform DYOR's relative strength crypto narrative tracker shows decentralized AI coins and DePIN – or decentralized physical infrastructure – tokens are among the best performers of the past seven days. "There is a strong buzz around Nvidia's impending earnings," Hitesh Malviya, founder of DYOR, told CoinDesk. "AI coins will keep having cyclical runs [higher] as they are directly correlated with the whole AI-side development happening around us." The chipmaker is set to report first-quarter earnings on May 22 after the market close. Zacks Investment Research expects the company to report earnings per share of $5.49, a 403% year-on-year increase. Recent results from other AI companies have been largely positive, according to Bloomberg. Shares in NVDA rose to $922 on Monday, hitting the highest since April 1. They have recovered more than 20% from the low of $756 reached on April 19, according to data source TradingView. Over the years, bitcoin and the broader crypto market have developed a strong positive correlation with NVDA, whose chips were used to power mining rigs before garnering interest from AI. NVDA and the crypto market bottomed out in late 2022, ending an almost year-long downtrend with the debut of OpenAI's ChatGPT, which helped raise general awareness about artificial intelligence. Speculation is rife that OpenAI is likely to launch version 5 of ChatGPT in the coming months. Late last month, technology giants reported a better-than-expected quarterly earnings growth powered by substantial investments in artificial intelligence. Notably, during Apple’s recent earnings call, CEO Tim Cook talked about the company’s continued investments in generative AI and teased major AI-related announcements at "Let Loose event" on May 7 and the Worldwide Developers Conference (WWDC) on June 10. "OpenAI will launch a new model in the coming months, better hardware will be developed, and more funds will be injected into the space. We are in an AI super cycle right now," Malviya said. 12:23 UTC: Adds a para on Apple's Let Loose event. https://www.coindesk.com/markets/2024/05/07/ai-tokens-lead-crypto-market-recovery-as-nvidia-hits-one-month-high/

2024-05-07 09:42

The platform being issued a Wells Notice by the SEC is surprising given the company’s conservative approach to digital assets listings, the report said. The SEC issuing Robinhood a Wells Notice is surprising, KBW said. The broker expects no change to the platform’s current U.S. crypto operations or asset listings. Robinhood has a higher likelihood of winning a case with the SEC than most of its U.S. competitors, the report said. Robinhood (HOOD) being issued a Wells Notice by the Securities and Exchange Commission (SEC) is surprising given the company’s very conservative approach to digital asset listings, KBW said in a research report on Monday. KBW notes that Robinhood only offers fifteen cryptocurrencies on its U.S. platform, while some of its peers offer more than two hundred digital assets. “We expect no change to HOOD’s current U.S. crypto operations or asset listings - and expect the SEC to bring forward a suit within the coming months,” analysts led by Kyle Voigt wrote. “Our preliminary view is that HOOD would likely fight the SEC in court and has a higher likelihood to prevail than most U.S. competitors (if put in similar situations) given HOOD’s stricter listings standards,” the authors wrote. Crypto trading makes up 12% of Robinhood’s revenue, the report said, and KBW assumes that the SEC will likely go after a subset of digital assets on the platform. “The worst case scenario from a revenue-at-risk perspective is if the SEC chooses to move forward with categorizing ether (ETH) as a security - as this likely makes up ~25% of HOOD’s crypto assets/trading,” the report added. The broker has a market perform on the stock with a $20 price target. The shares were trading 1.3% higher in early trading on Tuesday at around $18. KBW said that Robinhood shareholders won’t have full clarity on the outcome of a potential legal case until late 2025 at the earliest, citing the regulator’s ongoing case against crypto exchange Coinbase (COIN). https://www.coindesk.com/markets/2024/05/07/robinhood-would-likely-win-crypto-court-case-with-the-sec-kbw/