2024-05-06 20:03

MicroStrategy shares are up 89% year-to-date but TD Cowen analyst Lance Vitanza believes the software firm could end the tear “meaningfully higher.” Bitcoin's price may soar this month and so, too, might the shares of MicroStrategy, which owns billions of dollars worth of BTC, a TD Cowen analyst said. MicroStrategy is poised to be "meaningfully higher" at the end of the year, Lance Vitanza said. Bitcoin (BTC) has significant upside potential this month thanks to two big catalysts and Michael Saylor's MicroStrategy (MSTR) stock could surge, too, on its way toward getting "meaningfully higher" by the end of the year, TD Cowen analyst Lance Vitanza said in a note Monday. Last week, MicroStrategy reported a net operating loss of $53.1 million for the first quarter of 2024 after taking a digital asset impairment charge of $191.6 million. But the company hasn't adopted a new digital asset fair value accounting standard that would’ve given it a sizable profit from bitcoin’s rally at the beginning of the year. Vitanza, who attended MicroStrategy’s World 2024 user forum in Las Vegas last week, however, said customers had significant positive feedback regarding the firm’s legacy software business, founded long before Saylor pushed the company to purchase billions of dollars of bitcoin. “This is causing us to rethink the potential upside around the operating business,” he wrote. The company’s stock, which is up 89% year-to-date, could also see meaningful upside due to two main catalysts that could drive up the price of bitcoin. May 15 marks the deadline for institutional investment managers to file form 13-F with the Securities and Exchange Commission. If more firms are shown to have purchased the newly approved spot bitcoin exchange-traded funds during the first quarter, this will show bitcoin has gained further institutional acceptance, the analyst said. Vitanza said another event that could be positive for bitcoin and, thus, MicroStrategy, will be the SEC's likely rejection of an ether ETF, which many in the industry are girding for. “This is significant because while Ethereum's fate may remain up in the air until 2025 or longer, we believe there's a substantial amount of capital waiting for a digital winner to be declared; to the extent Bitcoin proves to be that winner, the incremental demand would likely be felt even more acutely given the recent bitcoin halving,” Vitanza said. Bitcoin is up 43% since the start of the year and reached a fresh all-time high above $73,000 in March, according to CoinDesk data. It is currently trading at $63,000. https://www.coindesk.com/markets/2024/05/06/two-big-bitcoin-catalysts-could-drive-microstrategy-stock-gains-td-cowen-says/

2024-05-06 19:27

Robinhood apparently made strenuous efforts to comply with the agency, even applying to become a special purpose crypto broker-dealer. The SEC is likely to sue for alleged securities violations in any case. Robinhood is the latest firm to draw the ire of the U.S. Securities and Exchange Commission (SEC). This weekend, it reported receiving a Wells notice – an announcement that the securities watchdog is building a case and intends to sue. In an 8-K filing, the fintech firm revealed it received the letter from the SEC’s enforcement division for alleged securities violations. At this point, it’s hard to be surprised by the SEC’s anti-crypto actions – shameless though they may be. Apparently, the agency sent the notice after Robinhood cooperated with the SEC’s investigative subpoenas about its crypto operations. A Wells notice is essentially the last chance the accused has to convince regulators that it didn’t break the law, which would be a sign of good faith except that the vast majority of these letters end up in a lawsuit. As Robinhood legal, compliance, and corporate lead Dan Gallagher noted in a statement, the firm has been in direct communication with the SEC over its crypto offerings for years, which is exactly what you’d expect from a firm that really only dabbles in crypto. It’s not clear from the letter which tokens are considered securities by the SEC, though it’s worth noting the brokerage proactively delisted a number of tokens — including Solana (SOL), Polygon (MATIC) and Cardano (ADA) — in response to previous SEC lawsuits against rival trading firms. “We firmly believe that the assets listed on our platform are not securities and we look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be on both the facts and the law,” Gallagher said. He noted in particular the firm’s “years of good faith attempts to work with the SEC for regulatory clarity” and, like other crypto firms in legal limbo, “well-known attempt to ‘come in and register.’” Further, in heeding “the SEC’s calls,” Robinhood attempted to register as a special purpose broker-dealer with the agency. While there are many licensed crypto firms, so far Prometheum Ember Capital, a trading company that doesn’t yet offer any assets to trade, is essentially alone in receiving a special purpose broker-dealer license, which were introduced in 2020 to allow firms to custody and transact in “crypto asset securities.” While just speculation, I have a sense the SEC started to build a case right around the time Gallagher, himself a former SEC commissioner and securities law expert, testified before Congress that the SPBD process is irrevocably broken and a profound waste of resources. To wit: “When Chair Gensler at the SEC in 2021 said, ‘Come in and register,’ we did,” Gallagher said in a June 2023 House Agriculture Committee crypto hearing. “We went through a 16-month process with the SEC staff trying to register [as] a special purpose broker-dealer. And then we were pretty summarily told in March that that process was over and we would not see any fruits of that effort.” So, to sum up, the SEC announced intentions to sue a firm for failing to register for a license after seemingly denying the firm that very license (though to be accurate, the SPBD licenses are given out by self-regulatory organization FINRA). This fits with a long pattern. Since coming into office in 2021, SEC Chair Gary Gensler has made it his business to rein in the crypto industry, which he says is under his remit (an arguable contention). These efforts dramatically increased in the wake of the collapse of FTX, which was particularly embarrassing for U.S. regulators given how cozy Sam Bankman-Fried was with them. The SEC now spends a disproportionate amount of time and money pursuing legal challenges against crypto firms both large and small. The agency has filed at least one lawsuit per month since last November against a crypto company, the majority of which go unnoticed and typically end in a settlement. “The SEC just sent a Wells notice to Robinhood. The number they've sent about crypto in recent months is astonishing. It's hard to imagine that they would (or could) bring so many enforcement actions at once,” Variant Fund legal lead Jake Chervinsky said on X. “It seems like they're abusing the Wells process as a scare tactic now.” In some sense, these lawsuits — particularly the ones brought against big name firms like Coinbase and Robinhood — are an attempt to signal that crypto is essentially lawless. This is not squarely the fault of the SEC, but also that Congress slept on crypto regulation for over a decade and is now hampered by partisan gridlock. “I don’t know why [the SEC] did what they did. But there’s no going back on rules now,” Beau J. Baumann, a PhD. candidate at Yale Law School, and co-author of an influential crypto law paper, told CoinDesk in an interview. “In that sense, the whole thing is bad faith. If the enforcement actions are unlawful, writing a rule is way more obviously so.” “Congress should enact new legislation to avoid legal pitfalls, but it’s unclear to me whether they actually will,” Baumann added. Gensler, for his part, has stated directly that he doesn’t think crypto needs bespoke legislation or guidance, given his view that everything crypto, bar bitcoin, walks and talks like securities. While the SEC has had legal victories, it’s suffered many court losses as well. It remains to be seen whether Robinhood will actually get sued, and if so whether it goes the way of Coinbase and Consensys and mounts its own offensive legal campaign. If there is a silver lining here, it’s that, after years of trying to eat the entire crypto pie, Gensler’s SEC may have bitten off more than it could chew. Robinhood’s stock dipped in pre-market trading today, but has since bounced back, an indication in part that the market doesn’t take this action seriously, at least materially-speaking. Afterall, even if the SEC wins, it’s hard to imagine the tangible benefits of preventing people from trading Stellar lumens (XLM) or dogecoin (DOGE). https://www.coindesk.com/consensus-magazine/2024/05/06/the-sec-cant-stop-suing-crypto-companies/

2024-05-06 19:00

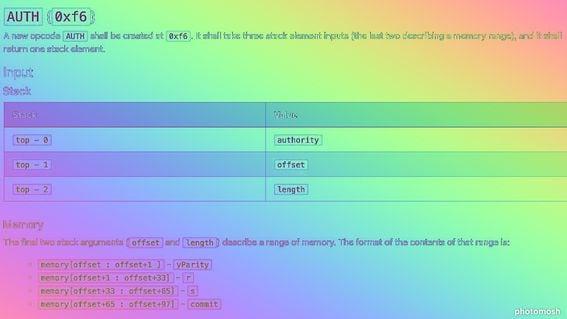

EIP-3074 has drawn both support and concern from the Ethereum community, a code change that is supposed to improve the user experience with wallets on the blockchain. As blockchain teams strive for the holy grail of mainstream adoption, making crypto wallets easier to use is suddenly at the top of the agenda. Ethereum developers have been moving along with their discussions and inclusions of certain Ethereum Improvement Proposals (EIPs) for the blockchain’s next big hard fork, Pectra. One of the proposals that has drawn both support and concern from the Ethereum community is EIP-3074, a code change that is supposed to improve the user experience with wallets on the blockchain. Ethereum developers have tackled issues in the past that would make the user experience with wallets easier, and have deployed features that unlocked newer capabilities. But now, developers are pushing to make the experience even easier, and enshrined in the blockchain. This new change is supposed to allow a specific type of wallet, externally owned accounts (EOAs), to be more programmable, by allowing smart contracts to authorize them. Paradigm Chief Technology Officer Georgios Konstatonopolous said on X that EIP-3074 “is a big deal. Wallet UX will 10x.” Currently on Ethereum, there are two types of wallet accounts: EOAs, which are the most popular, like MetaMask and Coinbase wallet, and smart contract wallets, like Argent and Safe. Users of EOA accounts are given a pair of keys – a public one and private one – while smart contract accounts are wallets that are controlled by code. The problem with EOAs comes down to human error; if you lose a private key to an EOA account, there is no help desk or key recovery process that can help you regain access to your funds. Previous proposals, like ERC-4337, have aimed to make EOAs easier to use, a concept known as account abstraction (AA), which allows users to recover their crypto with smart contract features. EIP-3074 is another step in this type of innovation, delegating transaction capabilities to smart contracts. A key component of the proposal is to allow users to batch transactions together and have them sign off on it once. Other features include having third parties sponsor users' transaction fees, so decentralized applications (dapps) can for instance cover the gas costs for their users. The proposal, created as far back as October 2020, also allows for users to sign transactions that were submitted by a different party – for example, signing transactions from a different interface, or signing them offline. The authors are Sam Wilson, Ansgar Dietrichs, Matt Garnett and Micah Zoltu, according to the document. The key difference between EIP-3074 and ERC-4337 is that “the former focuses on getting all the benefits of execution abstraction, and the latter focuses on getting all the benefits of account abstraction on all EVM chains but in a non-native way that is less efficient,” Ethereum Foundation developer Yoav Weiss writes. “Both are steps to get some of the benefits of full native account abstraction.” Community pushback While many in the community showed their support for the proposal, others have cautioned moving forward with this over security concerns with the batched transactions feature. Lukas Schor, the co-founder at Safe that has advocated for ERC-4337 and for Ethereum wallets to implement full account abstraction, voiced concerns that while this proposal does move in the right direction, he fears the EIP lacks “any clear pathway to full AA and has a net-negative impact on AA adoption.” The co-founder of Argent wallet, Itamar Lesuisse, also posted on X that EIP-3074 might be a serious security concern, writing that it allows “a scammer to drain your entire wallet with a single off-chain signature. I expect this will be a major use case.” Mudit Gupta, chief information security officer at Polygon Labs, also had security concerns, calling for wallets to “ban EIP-3074 MAGIC signatures on a per wallet basis.” “For security reasons, I do not want to expose my cold wallets to AA batching,” Gupta added. https://www.coindesk.com/tech/2024/05/06/ethereum-developers-target-ease-of-crypto-wallets-with-eip-3074/

2024-05-06 15:48

The former Twitter CEO announced its backing of the social networking startup in December 2019 in an effort to decentralize social media. Jack Dorsey has stepped away from the board of directors of social media startup BlueSky. On Saturday, the former Twitter CEO called upon his followers to use "freedom technology" such as X as well as open source protocol Nostr. Dorsey announced his backing of BlueSky in December 2019 in an effort to decentralize social media. Former Twitter CEO turned crypto entrepreneur as well as CEO of payments firm Block (SQ), Jack Dorsey is no longer a board member at BlueSky, the social network startup that he started backing in 2019 in an effort to decentralize social media. Dorsey, in a post on X on Saturday called upon his followers to use “freedom technology” such as X, and to not depend on corporations “to grant you rights.” He said something very similar on Nostr, the open source protocol aimed at enabling a fully decentralized, censorship-resistant social media experience, where he's been very active in past weeks and to which in 2022 he donated 14 bitcoin (worth about $245,000 at the time) to the protocol's founder. One year later, Dorsey donated $10 million to OpenSats, a non-profit organization for free and open-source bitcoin projects, like Nostr. When asked if he was still on the board of BlueSky following his post, Dorsey said “no.” “We sincerely thank Jack for his help funding and initiating the bluesky project,” the company wrote in a post on Saturday. It is now looking for a new board member to replace Dorsey. In Dec 2019, Dorsey announced that Twitter, which he then led as its CEO, was funding a small independent team to develop an “open and decentralized standard for social media,” which Twitter would ultimately follow as well. “New technologies have emerged to make a decentralized approach more viable,” he said back then. “Blockchain points to a series of decentralized solutions for open and durable hosting, governance, and even monetization. Much work to be done, but the fundamentals are there.” The social networking service, which launched to the public in February, is led by CEO Jay Graber, a software engineer and entrepreneur. The ascension of Nostr over the past couple of years, though, essentially obviated the need for BlueSky. "There is no Nostr board," Dorsey said on that platform Monday morning. https://www.coindesk.com/business/2024/05/06/jack-dorsey-leaves-bluesky-board-touts-freedom-technology-of-x-and-nostr/

2024-05-06 13:14

It's the first step on a more ambitious roadmap to transform how Ethereum's biggest wallet works under the hood. MetaMask, the most popular crypto wallet for Ethereum, is rolling out a new feature this week designed to help users avoid the consequences of maximal extractable value, or MEV. The optional new feature, called Smart Transactions, will allow users to submit transactions to a "virtual mempool" before they are officially cemented on-chain. According to Consensys, the company behind MetaMask, the virtual mempool will protect against certain kinds of MEV strategies, and it will run behind-the-scenes simulations of transactions to help users get lower fees. MEV is extra profit that blockchain operators can extract from users by previewing or re-ordering transactions before they are written to the network, sometimes likened to the unsavory practice of front-running orders in traditional financial markets. MEV has a major impact on how Ethereum operates – boosting prices for users, slowing down transaction speeds, and even causing transactions to fail under certain network conditions. "There's $400 million every year that are being wasted on reverting transactions, stuck transactions, and just very obviously predatory MEV front-running and sandwich attacks," Jason Linehan, director of the Special Mechanisms Group division of Consensys, said in an interview. "Everyone agrees it's a huge problem," said Linehan. "From a user experience perspective, the idea that you pay for a transaction that does nothing, that's, like, nonsensical." MetaMask's solution – its virtual mempool – bears some resemblance to a private mempool, which has become an increasingly popular strategy for ensuring transaction privacy and protecting against MEV. It's the platform's first step in a much more ambitious roadmap, which CoinDesk reported on earlier this year, to radically shift how MetaMask routes transactions to Ethereum under the hood. Private mempool services can sometimes raise centralization concerns since they allow middlemen to touch transactions before they are published to Ethereum. Consensys insists its virtual mempool is different, and is necessary for addressing Ethereum's large hidden costs. "We're not going to try to take over Ethereum or something," said Linehan, "but there's no way that this becomes the base layer for the future of the global economy if it's wasting $400 million of its users' money every year on things that literally do nothing for them. That's pure waste." How 'Smart Transactions' works When a user tells a blockchain wallet to submit a transaction to a chain like Ethereum, they are typically sending that transaction to a public mempool – a waiting area for yet-to-be-confirmed transactions operated by a decentralized network of bots and traders. "Block builders" and "searchers" work together to assemble transactions into bundles, called blocks, which eventually get written to the blockchain's digital ledger. Builders and searchers scour the mempool for profitable trading opportunities and will sometimes re-order transactions or squeeze their own trades into blocks to extract an extra profit for themselves. This phenomenon, "maximal extractable value," can sometimes lead to higher costs, failed transactions and slow-downs for everyday blockchain users. Metamask will leverage some of these same operators – builders and searchers – to power its virtual mempool. Unlike on Ethereum's public mempool, the virtual mempool's builders and searchers will be financially penalized if they fail to execute transactions at the prices quoted by MetaMask to users. Linehan says "95%" of the builders and searchers that currently operate Ethereum have already opted into its virtual mempool program, which will begin rolling out in phases over the course of this week. A more limited version of the tech, "Smart Swaps," has already been available for several months. The size of MetaMask's virtual mempool network – combined with its transparent inner workings and novel incentive scheme – makes it wholly unique from conventional private mempools, said Linehan. In addition to ensuring better prices for users, Linehan says that the Smart Transactions feature will make it easier for users to track the progress of their transactions directly from within MetaMask – something that typically would've required users to visit a separate "block explorer" website like Etherscan. Linehan describes Smart Transactions as a "concrete first step," towards MetaMask's grander vision. "It establishes the rails along which we might in the future start to build some of these other interesting use cases that people have buzzed about, like intent-based architectures." https://www.coindesk.com/tech/2024/05/06/popular-crypto-wallet-metamask-rolls-out-smart-transactions-to-combat-ethereum-front-running/

2024-05-06 13:02

The trading platform previously ended support for all tokens that were named in SEC lawsuits against Binance and Coinbase. Robinhood (HOOD), the popular trading platform, received a Wells Notice from the Securities and Exchange Commission (SEC) on May 4. The stock pared earlier losses and rose about 2% on Monday. "On May 4, 2024, RHC received a 'Wells Notice' from the Staff of the SEC (the 'Staff') stating that the Staff has advised RHC that it made a 'preliminary determination' to recommend that the SEC file an enforcement action against RHC alleging violations of Sections 15(a) and 17A of the Securities Exchange Act of 1934, as amended," Robinhood said in a filing on Monday. In a press release, Robinhood took a more combative tone, saying the company had already decided not to provide certain tokens or products that the SEC called securities in past actions, calling these "difficult choices." Robinhood Chief Legal, Compliance and Corporate Affairs Officer Dan Gallagher – a former SEC commissioner – said he was "disappointed" after trying to work with the regulator. "We firmly believe that the assets listed on our platform are not securities and we look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be on both the facts and the law," he said in a statement. Wells Notices are preliminary warnings informing companies that the SEC believes it has enough information to bring an enforcement action against a company, and usually lead to such actions by the regulator. The company said that the potential action from the agency may include "a civil injunctive action, public administrative proceeding, and/or a cease-and-desist proceeding and may seek remedies that include an injunction, a cease-and-desist order, disgorgement, pre-judgment interest, civil money penalties, and censure, revocation and limitations on activities." Previously, Robinhood ended support for Cardano (ADA), Polygon (MATIC) and Solana (SOL) on June 27 – the three tokens that were named as securities in the SEC lawsuits brought against Binance and Coinbase. CORRECTION (May 6, 2024, 14:40 UTC): Corrects date of Wells Notice receipt to May 4. https://www.coindesk.com/policy/2024/05/06/robinhood-shares-fall-after-its-crypto-arm-gets-wells-notice-from-sec/