2024-05-03 11:22

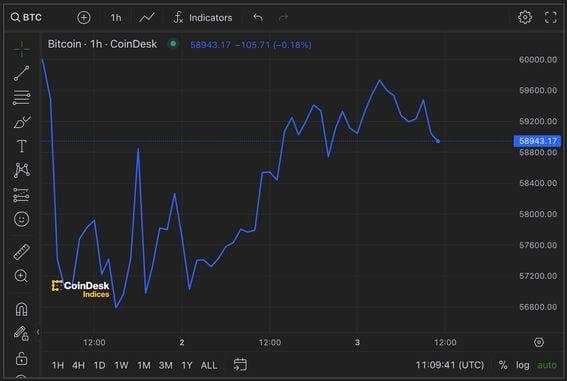

Bitcoin held steady as the dollar index nursed losses ahead of a U.S. jobs report that is expected to show the unemployment rate remained below 4% for the 27th straight month. BTC traded little changed while the dollar index fell, maintaining the post-Fed bearish momentum. The U.S. NFP report is expected to show the pace of job creation slowed in March. Bitcoin's price sell-off has stalled since Wednesday's Fed meeting, allowing for a minor price recovery. Further gains hinge, at least partially, on the impending U.S. nonfarm payrolls data. The U.S. Labor Department's closely watched nonfarm payrolls report due 12:30 UTC is expected to show the world's largest economy added 243,000 jobs last month following March's 303,000 additions, according to Reuters. The unemployment rate is expected to have stayed below 4% for a 27th straight month, while average hourly earnings are forecast to have risen 0.3% month-on-month, matching March's gain. Ahead of the data, bitcoin (BTC) is showing signs of stability, while the dollar index is weaker. Fed fund futures are showing renewed expectations for an interest-rate cut or liquidity easing in November. The leading cryptocurrency by market value traded near $59,000 at press time, up over 4% from Wednesday's lows near $56,500, according to CoinDesk data. The dollar index, which gauges the greenback's exchange rate against major fiat currencies, has declined over 1% to 105.20 after Fed Chair Jerome Powell ruled out a rate hike as the next likely move during a press conference after the Federal Open Markets Committee's decision. Thus, the impending jobs report could be a pivotal event for markets, testing more optimistic bets on Fed rate cuts, according to ING. "Our 210k call for payrolls means we do not expect today’s data to dent the bearish dollar momentum as markets may fully price in a cut in September and keep short-term USD rates capped," ING's strategists said in a note to clients. "CFTC data shows net-speculative positioning on the dollar versus reported G10 currencies was at 24% of open interest, the highest since June 2019, so the room for a further long squeeze in the dollar remains substantial should U.S. data soften over the coming weeks," the strategists added. Continued weakness in the dollar could bode well for risk assets, including bitcoin. The cryptocurrency tends to move more or less in the opposite direction of the greenback, which single-handedly influences global liquidity conditions. https://www.coindesk.com/markets/2024/05/03/bitcoins-price-recovery-faces-nonfarm-payrolls-test/

2024-05-03 10:33

The business has a number of positive catalysts including its smart wallet, Coinbase Prime, layer-2 network Base and its growing international offering, the analysts said. Coinbase had a blowout first quarter as crypto market conditions improved, analysts said Canaccord and KBW raised their price targets while maintaining their ratings. Coinbase shares slipped 3.7% in premarket trading on Friday. Coinbase (COIN) had a blowout first quarter as it benefited from improving crypto market conditions and business diversification efforts, broker JMP said in a research report on Thursday. The crypto exchange reported first-quarter net income of $1.2 billion and diluted earnings per share (EPS) of $4.40. Earnings included a mark-to-market gain of about $650 million on crypto assets held for investment. The world’s largest cryptocurrency, bitcoin (BTC), gained more than 34% in the first quarter, while the CoinDesk 20 Index (CD20) rose nearly 17%. The broker reiterated its market outperform rating and $320 price target. Canaccord Genuity raised its price target to $280 from $240 while maintaining its buy rating. KBW also raised its price target, boosting it to $240 from $230 and reiterated its market perform rating. The shares were 3.6% lower at $220.62 in early trading on Friday. “While we believe investors must remain level-headed around the ebbs and flows of enthusiasm into the industry, which often coincide with fluctuations in price, we see a number of underlying trends supporting our positive thesis that Coinbase will be a relevant player in virtually all aspects of the crypto economy,” JMP analysts led by Devin Ryan wrote. Several areas that JMP is most excited about for Coinbase include the introduction of its smart wallet, Coinbase Prime, and its growing international opportunity. Consumer and institutional transaction revenue grew 101% and 133%, respectively, from the quarter before, Canaccord Genuity said in a report on Thursday. This growth was “driven by improved broader market activity from spot exchange-traded funds (ETFs) alongside continued investment in product offerings and active user growth,” analysts led by Joseph Vafi wrote. The broker said it was encouraged by launch and traction around Coinbase’s layer-2 blockchain, Base. “We believe the launch of this layer 2 can help solidify COIN’s leading position by being able to drive low-cost transactions across what is a growing user/AUM base.” Coinbase also posted strong growth balances for the USDC stablecoin, both on its platform and in total market cap, and this generated $197 million of revenue, broker KBW said in a Friday report . USDC is a stablecoin issued by Circle, which is itself backed by Coinbase. The company earns gross interest income on USDC outstanding balances. Looking ahead, KBW said it is cautious on USDC balances due to the recent rapid growth of the business and its “assumption that balances will eventually subside once rates begin to fall, though the consensus higher-for-longer narrative has likely extended the longevity of USDC balances in the near term.” https://www.coindesk.com/markets/2024/05/03/crypto-exchange-coinbase-had-a-blowout-first-quarter-analysts/

2024-05-03 08:42

Early Friday, Friend.Tech airdropped its native token, FRIEND, while debuting version 2 of the platform. Friend.Tech airdropped its native token, FRIEND, while debuting version 2 of the platform. The token's price plummeted from as high as $169 immediately after the airdrop to $2.5. Decentralized social platform Friend.Tech on Friday airdropped its native token, FRIEND, while unveiling version 2 of the platform, which is packed with new features, including the Money Club. The token's price rose as high as $169 immediately after it began trading on Base before quickly collapsing to $2.5, data from DEXscreener show. "It looks like the price dump has been driven by liquidity issues, similar to what happened with Renzo last week," Hitesh Malviya, founder of crypto analytics platform DYOR, told CoinDesk. Liquidity refers to market's ability to absorb large buy and sell orders at stable prices. In a low liquidity environment, a few large orders can have an outsized impact on the market price. Friend.Tech debuted in August last year on Coinbase's Ethereum-based layer-2 blockchain Base as an invite-only platform with a point system that rewards users for their engagement. The new Money Club feature will facilitate an exclusive space for financial discussion and networking alongside a new point system. At press time, crypto assets worth $29.8 million were locked in Friend.Tech, more than 40% off the peak of $52.04 million in early October, according to DeFiLlama. Activity picked up last month in anticipation of the version 2 launch, initially planned for April 20 as well the FRIEND token airdrop teased by developers. The platform took a snapshot for the highly anticipated 100% airdrop of FRIEND last week. Several users, however, seem to be having issues with claiming their airdrop. "I'm not selling my FRIEND airdrop (cause I can't even claim it)," Dubai-based crypto analyst and trader Reetika Malik said on X. Malviya said the distribution was a "concentrated airdrop," where leading creators took the most supply home. "Most users got 10x less airdrop than what they were expecting, so they are not even claiming that airdrop, as its less than 200$ for most of the retail investors," Malviya told CoinDesk in a direct message on X. "But at the same time few people ended up making crazy amount. So its a clear case of very concentred airdrop where leading creators took the most supply home through airdrop, leaving retail in disguise." Friend.Tech had not responded to a request for clarification by publication time. https://www.coindesk.com/markets/2024/05/03/friendtechs-native-token-tanks-to-25-after-debut/

2024-05-02 20:46

The company announced the news alongside its first quarter earnings report on Thursday afternoon. Payments firm Block (SQ) has begun a dollar cost averaging (DCA) program to add to its already sizable bitcoin (BTC) stack. Led by CEO Jack Dorsey, the company in April began using 10% of its monthly bitcoin-related gross profit to buy additional bitcoin, with plans to do this each month for the remainder of 2024. For perspective, Block had $80 million in bitcoin gross profit in the first quarter, according to its earnings results. Were that level of profit to continue through the rest of the year, the company under this program would add another $24 million worth of bitcoin to its balance sheet. Block already has substantial bitcoin holdings, having purchased 4,709 bitcoins in October 2020 and another 3,318 tokens in early 2021. At today's price of about $59,000, that bitcoin is now worth roughly $4.7 billion. Alongside that news, the company also released its Bitcoin Blueprint For Corporate Balance Sheets, in which it describes the process through which it is able to acquire large amounts of the crypto without unduly moving the market, and how it custodies, insures and accounts for the holdings. https://www.coindesk.com/business/2024/05/02/jack-dorseys-block-adding-more-bitcoin-to-balance-sheet-presents-road-map-for-others/

2024-05-02 18:51

The monitoring system would help Tether identify risky crypto addresses that could be used for bypassing sanctions or illicit activities like terrorist financing, the company said. Tether, issuer of the largest stablecoin USDT, said Thursday it has teamed up with blockchain surveillance company Chainalysis to monitor transactions with its tokens on secondary markets. The surveillance system includes international sanctions compliance and illicit transfer detection that could be associated with activities like terrorist financing, and would help Tether identify crypto wallets that could "pose risks or may be associated with illicit and/or sanctioned addresses," according to Tether's blog post. "Our collaboration with Chainalysis marks a pivotal step in our ongoing commitment to establishing transparency and security within the cryptocurrency industry," Tether CEO Paolo Ardoino said in a statement. The action comes as pressure from regulators and policymakers globally is mounting on Tether for USDT's alleged role to circumvent international sanctions and facilitate illicit finance. Venezuela's state-run oil company reportedly has been using USDT to bypass U.S. sanctions. A United Nations report earlier this year said the stablecoin plays a key role in underground banking and money laundering in East Asia and Southeast Asia. USDT is the most popular stablecoin with over $110 billion of tokens in circulation. It's price is pegged to $1 and is backed by mostly U.S. Treasury bonds in the reserve, managed by Wall Street trading house Cantor Fitzgerald. Tether yesterday reported first quarter earnings of $4.52 billion. https://www.coindesk.com/policy/2024/05/02/tether-enters-transaction-surveillance-partnership-with-chainalysis-as-regulatory-pressure-mounts/

2024-05-02 16:00

Crypto markets have seen significant profit taking in recent weeks with retail investors playing a bigger role than institutions, the report said. JPMorgan maintained its cautious view on crypto markets. The bank said retail investors have been taking profits in recent weeks. The market is still faced with headwinds such as elevated positioning, the report said. Wall Street giant JPMorgan (JPM) said it's keeping its cautious stance on cryptocurrency markets in the near term due to a lack of positive catalysts and because the retail impulse is disappearing. The bank notes that retail investors sold both crypto and equity assets in April and spot bitcoin exchange-traded funds (ETFs) have seen outflows. The three headwinds the bank has already identified – elevated positioning, high bitcoin prices versus gold and versus the estimated bitcoin production cost, and subdued crypto venture capital (VC) funding – are also still in place. Cryptocurrency markets have seen significant profit taking in recent weeks, with retail investors playing a bigger part in the sell-off than institutional investors, the report said. Bitcoin fell 16% in April, the biggest monthly decline since June 2022. Investors sold U.S.-based spot bitcoin ETFs at the fastest pace ever on Wednesday. The 11 ETFs saw a cumulative net outflow of $563.7 million, the largest since the funds started trading on Jan. 11. With regards to institutional investors, “it has been mostly momentum traders such as commodity trading advisors (CTAs) or other quantitative funds taking profit on previous extreme long positions in both bitcoin and gold,” analysts led by Nikolaos Panigirtzoglou wrote. Still, analysis of the futures market suggests a “more limited position reduction by other institutional investors outside quantitative funds and CTAs,” the authors wrote. https://www.coindesk.com/markets/2024/05/02/crypto-market-sell-off-was-driven-by-retail-investors-jpmorgan-says/