2024-05-02 15:21

MicroStrategy has already built one application using its service. "Orange For Outlook" integrates digital signatures into emails to enable recipients to verify the identity of the sender MicroStrategy Orange will provide "trustless, tamper-proof and long-lived" decentralized identities using the Bitcoin blockchain, founder Michael Saylor said. The company pitched itself as a "bitcoin development company" earlier this year, saying it would work on development of the Bitcoin network through financial markets, advocacy and innovation. MicroStrategy (MSTR), the largest corporate holder of bitcoin, unveiled plans to develop a decentralized identity service using Ordinals inscriptions. The software consulting firm began pitching itself as a "bitcoin development company" earlier this year, saying it would work on development of the Bitcoin network through financial markets, advocacy and innovation. "MicroStrategy Orange," as it has been called, is a sign the company is putting this aim into practice. The goal of MicroStrategy Orange is to provide "trustless, tamper-proof and long-lived" decentralized identities using the Bitcoin blockchain, founder Michael Saylor said at the company's Bitcoin For Corporations conference on Wednesday. The service allows users to issue decentralized identifiers (DIDs), which enable pseudonymity. Just as bitcoin transactions are not linked to real-world identities, neither will DIDs. Orange harnesses Bitcoin's Ordinals Protocol, which allows for information to be stored and communicated on individual satoshis (the smallest increment of bitcoin (BTC), equal to 1/100,000,000th of a BTC). MicroStrategy has already built one application using its service called "Orange For Outlook," which integrates digital signatures into emails to enable recipients to verify the identity of the sender. MicroStrategy holds 214,400 BTC ($10 billion), which is more than 1% of the all the bitcoin will ever exist. Read More: Ordinals Defy Bitcoin's Design Principles but Offer Miners Huge Post-Halving Advantages https://www.coindesk.com/tech/2024/05/02/microstrategy-unveils-plan-for-bitcoin-based-decentralized-identity-using-ordinals/

2024-05-02 11:48

The cryptocurrency is already showing signs of maturity as its volatility drops to all-time lows on a yearly scale, the report said. Bitcoin is becoming less volatile as the digital asset matures, the report said. The crypto’s volatility has reached new all-time lows on a yearly scale, Fidelity noted. Fidelity said bitcoin has been less volatile than Netflix over the last two years. Bitcoin (BTC) has long been viewed as a highly volatile asset, but its volatility is falling and will continue to do so as the cryptocurrency matures, Fidelity Digital Assets said in a research report on Wednesday. “New assets typically take time to undergo price discovery, maturation and then settle into lower volatility,” analyst Zack Wainwright wrote, noting that even gold exhibited high volatility when the U.S. abandoned the gold standard in the 1970s. Bitcoin has already shown signs of maturation in its 15 years of existence and the volatility has reached new all-time lows on a yearly scale, the report said. “There is a clear downward trend in volatility for bitcoin over its lifetime and we believe this trend will continue as bitcoin continues to mature over time,” Wainwright wrote. Bitcoin is currently less volatile than 33 of the S&P 500 companies and was less volatile than 92 of the stocks in the index as recently as October 2023, when using 90-day realized historical volatility figures, Fidelity said. Over the last two years the cryptocurrency has been less volatile than Netflix (NFLX), and when compared with the “magnificent seven,” a group of high-performing stocks, “bitcoin’s volatility does not appear as an outlier,” the report noted. As is the case with all emerging asset classes with a small market cap, the cryptocurrency is more likely to experience higher volatility due to new capital flows, the note said. “However, as the asset class matures and its total market cap grows, the inflow of capital is expected to have a smaller impact because it will be flowing into a larger capital base.” The approval of U.S. spot bitcoin exchange-traded funds (ETFs) in January and the ensuing inflows were predicted to damp the cryptocurrency’s volatility. Still, the cryptocurrency fell over 16% last month. “New capital inflows will not move the market or the marginal buyer or seller as much,” the report added. https://www.coindesk.com/markets/2024/05/02/bitcoins-volatility-is-falling-and-this-will-continue-as-it-matures-fidelity/

2024-05-02 11:02

The asset manager has been helping educate pension funds, endowments and sovereign wealth funds about the new spot bitcoin ETF products, BlackRock’s head of digital assets said. Financial institutions are holding diligence and research conversations, with BlackRock playing an educational role, said Robert Mitchnick, the firm's head of digital assets. BlackRock has been talking about bitcoin to these sorts of institutions for several years. While becoming the biggest spot bitcoin ETF would be an impressive milestone, BlackRock says it isn’t really focused on the size competition with Grayscale’s GBTC. Don't be fooled by the first break in inflows into spot bitcoin exchange-traded funds (ETFs) after 71 straight days. The current lull is likely to be followed by a new wave from a different type of investor, said Robert Mitchnick, head of digital assets for BlackRock, the world's largest asset-management company. The coming months could see financial institutions such as sovereign wealth funds, pension funds and endowments start to trade in the spot ETFs, Mitchnick said in an interview. The firm is seeing “a re-initiation of the discussion around bitcoin,” which turns on the topic of allocating to bitcoin (BTC) and how to think about it from a portfolio construction perspective. Read More: BlackRock's Bitcoin ETF Posts First Day of Outflows, Leading Record $563M Exit From U.S. Spot Products “Many of these interested firms – whether we're talking about pensions, endowments, sovereign wealth funds, insurers, other asset managers, family offices – are having ongoing diligence and research conversations, and we're playing a role from an education perspective,” Mitchnick said. And the interest is not new: BlackRock has been talking about bitcoin to these sorts of institutions for several years, he said. Pent-up demand for the much-anticipated ETFs has seen more than $76 billion accumulated across these products since their approval in January. So far, some registered investment advisors (RIAs), a decent-sized subset of wealth advisory, are already offering BlackRock’s IBIT ETF, but only on an unsolicited basis. The next step is expected to be the unrestricted offering of bitcoin ETFs to clients of large wealth advisory players like Morgan Stanley. AUM Horse Race A lot of social media focus has been on the ETF assets under management (AUM) horse race, and in particular the comparison between IBIT and Grayscale’s GBTC, which can be considered an incumbent because the existing BTC trust uplisted to an ETF. At last count IBIT stood at $17.2 billion and GBTC at about $24.3 billion. A chunk of the current IBIT assets comes from Grayscale substitutions. Other sources could be outflows from higher priced international products in Canada or Europe, and some of it comes from bitcoin futures ETFs being recycled into spot products. There are also existing bitcoin holders who would rather own the cryptocurrency in a brokerage account and not have to worry about custody, tax reporting complexities and other challenges associated with holding bitcoin on an exchange, Mitchnick said. And while becoming the biggest spot bitcoin ETF would be an impressive milestone, BlackRock isn’t really focused on that competition, but rather on educating its clients, he said. Backing Ethereum BlackRock filed for an ether (ETH) ETF back in November of last year, followed by CEO Larry Fink talking up the potential of tokenization, the representation of traditional assets on blockchains. But an ether ETF raises the question of how BlackRock would go about educating clients, given the complexity of the Ethereum blockchain ecosystem. Moreover, why would investors want exposure to another crypto ETF if the Sharpe ratios of their portfolios had already been boosted by a spot bitcoin ETF? The ratio measures the return from an investment adjusted for its risk. “When we think about this space, we see the potential for digital assets to benefit our clients and capital markets, with a focus in three areas: cryptoassets, stablecoins and tokenization,” Mitchnick said. “And these pillars, they're all interrelated. That's a really important thing for people to understand. And the work that we do across each informs our strategy and our insights for the others.” https://www.coindesk.com/business/2024/05/02/blackrock-sees-sovereign-wealth-funds-pensions-coming-to-bitcoin-etfs/

2024-05-02 07:48

Gruhn said he bought the watch for his wife, Maren Gruhn, and that they would display the watch in museums, according to the report. The former head of FTX Europe has paid the highest sum ever for a Titanic buy memorabilia. Gruhn said he used money earned from the sale of his companies and did not know about the fraud at FTX before it imploded. Patrick Gruhn, the former head of FTX Europe, has paid nearly $1.5 million, “the largest sum ever spent at auction on a piece of Titanic memorabilia,” for a gold pocket watch recovered from the body of the Titanic’s richest passenger, The Wall Street Journal reported. The watch belonged to American property magnate John Jacob Astor IV, who was returning from a European honeymoon with his pregnant wife, Madeleine Astor. When the Titanic hit an iceberg in 1912, an officer told Astor he couldn’t join his wife on a lifeboat until all women and children were safe. A week later, Astor’s body was found in the water, along with his possessions - a 14-karat “Gold watch, cuff links gold and diamond, diamond ring,” and a “gold pencil,” the report said. Gruhn said he used money earned from the sale of his companies to buy the watch for his wife, Maren Gruhn, and that they would display the watch in museums. In July 2023, the FTX bankruptcy estate asked a U.S. bankruptcy court to award recovery of more than $323.5 million from FTX’s Europe leadership. Later, as part of a settlement, Gruhn and others agreed to buy back FTX’s European assets for about $33 million. Grohn also said he did not know about the FTX fraud before it imploded. Since the FTX collapse in Nov. 2022, Gruhn has moved to Oregon, from where he runs a German Catholic TV network and is attempting to build a crypto derivatives exchange in Europe. Read More: Sam Bankman-Fried Expresses Remorse for His Actions After Getting a 25-Year Prison Sentence https://www.coindesk.com/business/2024/05/02/former-ftx-europe-head-pays-15m-for-gold-watch-recovered-from-titanic-wsj/

2024-05-02 06:04

Rabotnik, 24, has also been ordered to pay over $16 million in restitution. Rabotnik, an affiliate of the REvil ransomware group, has been sentenced to 13 years and seven months in jail. Previously, Rabotnik was extradited to the U.S. from Poland and then pleaded guilty to an 11-count indictment. Yaroslav Vasinskyi, the Ukrainian national who is also known as Rabotnik, has been sentenced to 13 years and seven months in prison for his role in conducting over 2,500 ransomware attacks and demanding over $700 million in ransom payments, the Department of Justice announced on Wednesday. The sentencing is part of a wider crackdown on ransomware groups which U.S. President Joe Biden promised in Nov. 2021. That promise came after REvil demanded $70 million in bitcoin (BTC) after hacking Miami-based software provider Kaseya. In March 2022, on requests from the U.S., Russian authorities raided and dismantled REvil. “As this sentencing shows, the Justice Department is working with our international partners and using all tools at our disposal to identify cybercriminals, capture their illicit profits, and hold them accountable for their crimes,” said Attorney General Merrick B. Garland. Rabotnik, 24, has also been ordered to pay over $16 million in restitution for his role as an affiliate of the groups that use the ransomware variant known as Sodinokibi or REvil to demand payments in cryptocurrency and using mixing services to “hide their ill-gotten gains.” Previously, Rabotnik was extradited to the U.S. from Poland and then pleaded guilty to an 11-count indictment charging him with "conspiracy to commit fraud and related activity in connection with computers, damage to protected computers, and conspiracy to commit money laundering." In 2023, the DOJ confiscated nearly 40 bitcoin, worth nearly $2.3 million based on current prices, and $6.1 million in funds traceable to ransom payments received by other conspirators. Read More: U.S. Bans Crypto Addresses Tied to LockBit Ransomware Group From Financial System https://www.coindesk.com/policy/2024/05/02/rabotnik-affiliate-of-ransomware-group-revil-sentenced-to-13-years-in-jail/

2024-05-02 05:37

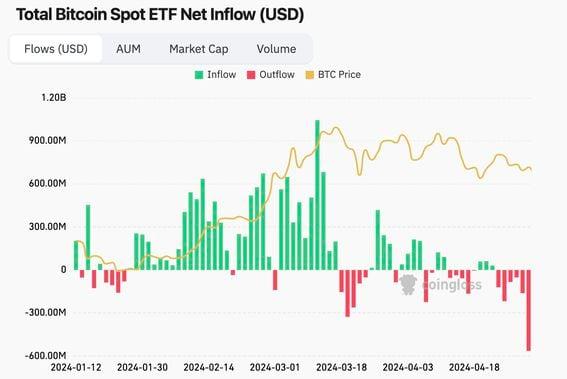

Fidelity's FBTC, not GBTC, led outflows on Wednesday in what may be an alarming development for the bulls. BlackRock's IBIT had its first-ever day of outflows, with $36.9 million exiting the fund. Fidelity's FBTC led outflows, shedding $191 million, followed by GBTC, ARKB and IBIT. Fed Chair Powell ruled out a rate hike as the next move, catalyzing a brief bounce in BTC. Investors dumped U.S.-based spot bitcoin (BTC) exchange-traded funds (ETFs) at the fastest pace ever on Wednesday, even as Federal Reserve (Fed) chairman Jerome Powell dismissed the prospect of a rate hike. The 11 ETFs saw a cumulative net outflow of $563.7 million, the largest since the funds began trading on January 11, extending a five-day losing streak, according to data source Farside Investors and CoinGlass. Investors have pulled out nearly $1.2 billion from the ETFs since April 24. Also notable Wednesday were the first-ever outflows from BlackRock's iShares Bitcoin Trust (IBIT), which saw $36.9 million exiting the fund. Read More: BlackRock Sees Sovereign Wealth Funds, Pensions Coming to Bitcoin ETFs Fidelity’s FBTC led outflows on Wednesday, losing $191.1 million in withdrawals. This might be alarming to bulls as FBTC and BlackRock’s IBIT consistently attracted funds in the first quarter, more than compensating for the regular large outflows from the relatively costly Grayscale ETF (GBTC). On Wednesday, GBTC witnessed the second-largest outflow of $167.4 million, followed by ARKB’s $98.1 million and IBIT's $36.9 million. Other funds also bled money even though Powell's net-dovish approach put a floor under risk assets, including bitcoin. A dovish stance is one where the central bank prefers employment and economic overgrowth over excessive liquidity tightening. The Fed on Wednesday kept the benchmark interest rate unchanged between 5.25% and 5.5% as expected. During the press conference, Powell said the economy is too strong to cut rates while pushing back against fears of renewed rate hikes or liquidity tightening stoked by recent disappointing inflation figures. The Fed also said it will significantly curtail its alternate liquidity tightening program, called quantitative tightening (QT), starting June. Meanwhile, the U.S. Treasury announced a program to buy back billions of dollars in government debts for the first time in over two decades to improve liquidity in the bond market. Like other risk assets, bitcoin is sensitive to expected changes in liquidity conditions and witnessed a brief rally from $56,620 to $59,430 following Powell’s comments. The yield on the 10- and two-year Treasury notes fell along with the dollar index. BTC’s bounce, however, was short-lived, with bitcoin falling back to $57,300 at press time. Early this week, Asia's first spot bitcoin and ether (ETH) ETFs debuted in Hong Kong with disappointing volumes, worsening the mood in the crypto market. CORRECTION (May 2, 12:05 UTC): Adds dropped "million" in second paragraph. https://www.coindesk.com/markets/2024/05/02/us-bitcoin-etfs-bleed-record-563m-even-as-feds-powell-rules-out-rate-hike/