2024-09-16 06:26

PLUS: Sony’s Soneium blockchain is growing, with Circle announcing that USDC will be listed on the chain. Bitcoin started the week with a 3% decline, falling below $58,400. The drop came ahead of expectations of the U.S. Federal Reserve potentially cutting rates, influencing market sentiment. U.S.-listed Bitcoin ETFs saw significant inflows on Friday at over $263 million in the highest since July 22. Ether ETFs also saw inflows, though much smaller at $1.5 million, indicating continued investor interest in crypto assets. Bitcoin (BTC) began the trading week down 3%, trading below $58,400, as the CoinDesk 20, a measure of the largest digital assets, was down 5%. BTC spent much of the weekend over $60,000 after favorable U.S. data fueled a rise late Friday. BTC exchange-traded funds (ETFs) listed in the U.S. recorded over $263 million in net inflows - the highest since July 22 - while ether ETFs recorded their second day of inflows since August 28 at $1.5 million. However, crypto markets slumped Monday as Asian exchanges opened for trading ahead of a key week where traders worldwide expect the Federal Reserve to make its first rate cuts in over four years. Polymarket bettors are giving it a 51% chance of a 50 basis points cut and a 48% chance of a 25 basis point cut, while only a 2% chance of no change. A pivot to lower borrowing costs has historically buoyed bullish sentiment among traders as cheap access to money spurts growth in riskier sectors. Ether (ETH) led losses among majors with a 5.5% drop over the past 24 hours, per CoinGecko data, to mark its worst one-day slide since early August. Cardano’s ADA fell 5%, Solana’s SOL lost 4%, while BNB Chain’s BNB emerged as the best performer with a 1.1% loss. Nervos’ CKB was one of the few movers in the green with a 10.5% jump in the last 24 hours on continued positive sentiment after Korean exchange Upbit – where traders have a strong taste for memecoins – listed the token. Futures traders betting on higher prices lost over $143 million amid the sudden drop, CoinGlass data shows. Elsewhere, the widely-watched BTC/ETH ratio, which tracks the relative movement of the two largest tokens, fell to four-year lows. Ethereum as a protocol has had some serious competition in the last year, as Solana looks to be the destination of choice to launch memecoins, and new chains like Base and Telegram-affiliated (TON) capture more mindshare - which has likely impacted demand for ETH. Sony’s Soneium may also provide some competition as it continues to be built out. Sony and Circle announced today that USDC would be offered on the chain. Absent from the announcement was precisely how much would be issued. https://www.coindesk.com/markets/2024/09/16/bitcoin-ether-plunge-5-ahead-of-widely-anticipated-fed-rate-cuts/

2024-09-15 02:10

The regulator asked the court to extend the pause of Kalshi's political prediction markets for as long as the agency's appeal is pending. Warning of an imminent "explosion in election gambling," the U.S. Commodity Futures Trading Commission asked an appeals court to extend the pause on Kalshi's political prediction markets for as long as the agency's appeal is pending. "The district court’s order has been construed by Kalshi and others as open season for election gambling," the CFTC said in a filing Saturday, referring to a judge's Sept. 6 decision that the regulator shouldn't have stopped the company from offering contracts on which party will control each house of Congress. In the wake of that decision, the agency noted, Wall Street heavyweight Interactive Brokers announced it would offer contracts on the presidential election through a CFTC-regulated subsidiary. Unless the U.S. Appeals Court for the District of Columbia extends the pause on Kalshi's contracts for the appeal's duration, other CFTC-regulated exchanges will follow suit, the agency said. "An explosion in election gambling on U.S. futures exchanges will harm the public interest." The harms include market manipulation and "damage to electoral integrity," the CFTC reiterated. Industry repercussions Separately, the CFTC has proposed to ban election contracts at all exchanges on its watch. Several legal experts said the district court's opinion could torpedo that proposal. The district court's opinion also has potential ramifications for cryptocurrency businesses. The opinion relied on the Supreme Court's Loper Bright ruling, which curtailed regulators' power to interpret their statutory authority, shifting such power to the courts. "It’s likely that federal agencies will continue to see their authority curtailed as a result of the Lopper Bright ruling and in the absence of new, clearer legislation from Congress," wrote Alex Thorn, head of firmwide research at crypto investment bank Galaxy Digital, in a research note Friday. "This could have wide implications for the crypto industry." A long-running fight Kalshi filed to list election markets last year. The CFTC blocked it. The company sued and won last week. The CFTC filed for an emergency stay blocking Kalshi from immediately listing its contracts, but lost that fight too. The contracts went live Thursday, before being temporarily suspended by the D.C. Appeals Court while it considers the emergency stay. Such a stay would cause "irreparable harm" to Kalshi, the company contended in a Friday filing. The CFTC's latest filing calls that claim "deeply misleading" and said any financial losses suffered by Kalshi "pale compared to the harm that would flow from allowing election gambling on U.S. futures markets." Kalshi offers hundreds of other event contracts, the agency noted, and "[i]f it prevails on appeal, it can list election contracts into the foreseeable future and make up its losses." Besides, Kalshi should seen this fight coming, the CFTC said. "Kalshi's sunk costs are not attributable to a stay, they are attributable to Kalshi’s decision to spend big on election gambling, knowing that the Commission disapproved such contracts in the past." Ask permission or beg forgiveness? Kalshi, which does business only in the U.S., in dollars, has complained that while it was locked out of this year's election betting action, Polymarket, a crypto-based competitor, logged massive trading volumes. "We are the ones who were trying to comply with the law, and the beneficiaries of the delay are the actors who don't want to comply with the law," Yaakov Roth of Jones Day, Kalshi's lead attorney, said at a hearing Thursday. In Saturday's filing, the CFTC called that argument "sophomoric." "A pharmacy does not get to dispense cocaine just because it is sold on the black market," the agency said. https://www.coindesk.com/policy/2024/09/15/an-explosion-of-election-gambling-is-nigh-cftc-warns-appeals-court/

2024-09-13 19:44

The FTX founder is six months into a 25-year prison sentence. FTX founder Sam Bankman-Fried has formally appealed his fraud conviction, requesting a new trial and accusing the judge overseeing his case of being unfairly biased against him. Last November, a New York jury convicted Bankman-Fried of seven counts of fraud and conspiracy tied to the collapse of his crypto exchange in November 2022. In March, U.S. District Judge Lewis Kaplan of the Southern District of New York (SDNY) sentenced Bankman-Fried to 25 years in prison for his crimes. In the 102-page appeal filed Friday afternoon in the Second Circuit Court of Appeals, Bankman-Fried’s lawyers argued Judge Kaplan was unfair to the FTX founder throughout the trial, making “biting comments undermining the defense” and “deriding” his testimony in front of the jury. “Sam Bankman-Fried was never presumed innocent,” his lawyer, Alexandra Shapiro wrote in the filing. “He was presumed guilty by the judge who presided over his trial.” Shapiro took over from Bankman-Fried's trial lawyers, Mark Cohen and Christian Everdell, after his conviction. The filing emphasized this point throughout, pointing to the judge's blocking of certain defense arguments, testimony about Bankman-Fried's well-performing investments (such as Anthropic), pieces of evidence Bankman-Fried's lawyers also charged procedural violations, saying the judge ordered an "unlawful" forfeiture and "Bankman-Fried was erroneously deprived of Brady material" – evidence that would have favored the defense which, if deliberately withheld, could result in the case being thrown out. The 32-year-old Bankman-Fried's trial lawyers had suggested a lighter sentence of 6.5 years. The government had sought a much heftier 40-50 years in prison. Several of Bankman-Fried’s closest friends and colleagues – including his ex-girlfriend Caroline Ellison, Nishad Singh, Gary Wang, and Ryan Salame – testified against him during his trial, and pleaded guilty to their own counts of fraud. Salame was sentenced to 7.5 years in prison in May. Ellison is set to be sentenced later this month, and has asked for no jail time. Bankman-Fried’s defense, as well as his supposed grounds for appeal, have heavily rested on the customer recovery achieved by the FTX estate. Bankman-Fried has insisted that the collapsed exchange was never actually insolvent, and claimed that he was pushed to file for bankruptcy prematurely by the estate team, including turnaround CEO John J. Ray III and white-shoe law firm Sullivan & Cromwell. In his appeal, Bankman-Fried’s attorney criticized a ruling from Judge Kaplan that blocked Bankman-Fried from claiming to the jury that FTX customers had not actually lost money, because they were expected to get it back in the bankruptcy process. “The government thus presented a false narrative that FTX’s customers, lenders, and investors had permanently lost their money,” Bankman-Fried’s lawyer wrote. “The jury was only allowed to see half the picture.” The defense team also alleged the DOJ worked with the bankruptcy estate more closely than was allowed, but used the veneer of distance to block Bankman-Fried from accessing potential Brady materials. "The district court summarily refused to order discovery, or even a hearing to determine whether the Debtors and their counsel were an 'arm of the prosecution,'" the filing said. Nikhilesh De contributed reporting. https://www.coindesk.com/policy/2024/09/13/sam-bankman-fried-appeals-fraud-conviction-requests-new-trial-nyt/

2024-09-13 18:33

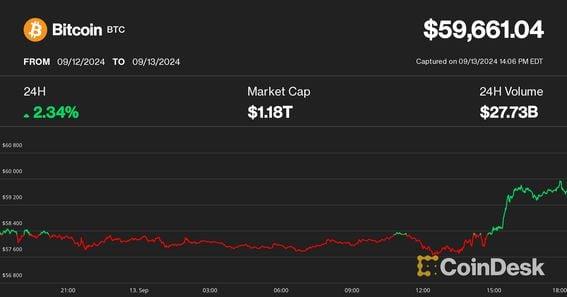

The key variable for risk assets is the U.S. economy as concerns of a recession linger, crypto investment firm Ryze Labs said. Bitcoin, ether (ETH) advanced 2%-3% over the past 24 hours on strong day for cryptos. BTC bottomed last week and should rise further based on daily cycles theory, according to chartist Bob Loukas. The Federal Reserve is expected to lower interest rates next week, but market participants are divided on the size of the cut. Cryptocurrencies rallied on Friday with bitcoin (BTC) nearing the $60,000 level, buoyed by strong gains across the board on traditional markets. Bitcoin tumbled some 1% to $57,600 earlier during the day after software company MicroStrategy announced the purchase of 18,300 BTC for $1.1 billion. The largest crypto quickly recovered the losses and rose sharply later in the session, up 2.2% over the past 24 hours at $59,700. Ethereum's ether (ETH) reclaimed the $2,400 level, up 2.7% during the same period. Crypto analytics firm IntoTheBlock noted that Ethereum's revenues from fees rose nearly 60% in the past week as blockchain activity picked up. The broad-market benchmark CoinDesk 20 Index advanced 2.5%, led by double-digit gains of Polygon's native crypto (MATIC) as Binance added spot and perpetual trading of the recently upgraded POL token. The price action happened as U.S. stocks climbed higher, with the S&P 500 less than 1% away from its July record high a few hours before the market close. Gold continued to break record highs, hitting $2,600 per ounce for the first time ever. A decline in the U.S. dollar against major currencies supported the rally across asset classes. More room to run Bitcoin's rally may have more fuel in the tank based on the asset's daily cycles analysis, well-followed trader and analyst Bob Loukas noted. Cycles theory in technical analysis argues that prices move in waves and have certain periodicity between local peaks and troughs. According to a chart shared on X, bitcoin likely found a local bottom below $53,000 on September 6 and is only on its 7th day in a fresh cycle. The previous daily cycle lasted over sixty days and topped on the 24th day, leaving plenty of time for BTC to make news highs before rolling over. "These cycles have time left should remain strong into FOMC," Loukas said. Next week's key event to watch will be Wednesday's Federal Open Market Committee (FOMC) meeting, which will most certainly mark the Federal Reserve's first interest rate cut since 2020. Observers are still divided about the size of the cut, with probabilities almost evenly split between a 25 basis point and a larger, 50 bps cut, according to CME FedWatch Tool. Despite the prospect of looser monetary policy, which would in theory be beneficial to risk assets, lingering concerns of a forthcoming recession weigh on the market, crypto investment firm Ryze Labs said in a Friday report. "The key variable here is the state of the U.S. economy," the report said. "If it remains resilient and avoids a recession, risk assets are likely to continue their upward trajectory. If not, then we’re in for a bumpy ride," the report added. https://www.coindesk.com/markets/2024/09/13/bitcoin-eyes-60k-and-likely-have-more-room-to-rally-analyst-says/

2024-09-13 17:29

The crypto might need more than some modest rate cuts to embark on a new bull run. A global coordinated monetary ease campaign is underway Most asset classes are on the rise as a result, but bitcoin remains under pressure The crypto may need more than a handful of modest rate cuts before a new bull run can get started What if bitcoin bulls were told that Western central banks had embarked on a new monetary easing campaign, the S&P 500 and Nasdaq – even with a mid-summer mini-panic – were tripping along very close to record highs, U.S. Treasury yields were falling to multi-year lows and gold was soaring to all-time levels? Is that something they might be interested in? While it remains up in the air about whether the Federal Reserve will cut its benchmark lending rate by 25 or 50 basis points next week, it's a certainty the U.S. central bank will embark on its first easing cycle since 2019. In this, the Fed will be joining other major Western central banks – the European Central Bank, the Bank of England and the Bank of Canada – all of whom have already cut interest rates, some more than once. While Japan hasn't yet joined in and in fact has made the first initial steps towards tightening, its benchmark policy rate of 0.25% is only a few basis points above zero. The reaction in traditional markets has been as expected, with stocks, bonds and the price of gold all sharply higher as a coordinated developed market monetary easing campaign began to manifest itself. Bitcoin (BTC), though, hasn't joined in the fun. Though putting in a nice rally on Friday, the price remains below $60,000 and roughly 20% below an all-time high above $73,500 set six months ago. Bitcoin's struggle Zoom out, said one smart observer CoinDesk talked to, noting even with the major pullback since March, bitcoin remains higher by more than 40% year-to-date and 127% from year-ago levels. Much of bitcoin's underperformance over the past few months might be nothing more than a breather after an outsized upside move. The crypto's performance in 2024 and year-over-year remains far ahead of U.S. stocks and gold. Still, zooming out even further might be frustrating to bulls. After all, bitcoin today is well lower than its level nearly three years ago when it touched what was then a record $69,000. Taking into account the speedy inflation in those three years, the performance looks even worse, particularly if bitcoiners would like the crypto to be known as an inflation hedge. The S&P 500 is higher by about 33% over that time frame and the barbarous relic gold is up more than 50%. Steno Research noted that bitcoin hasn't seen a whole lot of rate cutting cycles – really just the one that started in 2019. Bitcoin, the team said, actually declined about 15% between the time of the Fed's first rate cut in August and the end of November, by which the Fed had trimmed by 75 basis points. It wasn't until the massive Covid-era monetary push in March 2020 that bitcoin finally put in a bottom and began what became a meteoric rise. It's possible that a short, pedestrian series of rate cuts might do very little for bitcoin's price and only larger, emergency-style central bank measures will be enough to spark a new bull run. https://www.coindesk.com/markets/2024/09/13/bitcoin-left-out-as-stocks-bonds-and-gold-party-on-global-monetary-easing/

2024-09-13 13:15

A decent jobs report last week and speedier than expected inflation data this week had most assuming the U.S central bank would initially proceed cautiously as it begins a monetary easing cycle. A 25 basis point Fed rate cut was nearly fully priced in, but a WSJ article questioned that assumption Odds are now nearly evenly split between a 25 basis point and 50 basis point move Bitcoin appeared to move a bit higher on the news, but the gain was short-lived Just 24 hours ago, it was thought to be nearly a done deal that the U.S. Federal Reserve could trim its benchmark fed funds rate by just 25 basis points when it meets next week, but the calculus has quickly changed. After all, the employment picture, as suggested by the August jobs report last week remained robust. And inflation, as shown by this week's CPI and PPI reports, continued to remain a bit stickier than hoped. Wall Street Journal report Nick Timiraos – occasionally referred to as "Nikileaks" due to his excellent sources inside the Fed – Thursday afternoon, however, published an article suggesting the decision on the size of the rate cut was still up for debate. "I think [it] is a close call," Jon Faust, previously a senior advisor to Fed Chair Jerome Powell, told Timiraos. "You can make a very good case for 50," said Esther George, president of the Kansas City Federal Reserve for more than a decade until last year. She noted that the Fed moved quickly to tighten policy above the "neutral" rate, so it might make sense for the central bank to move just as quickly to ease. Shortly following the article, the chances of the Fed slashing 50 basis points next week – per CME FedWatch, which tracks positions in short-term interest rate markets – jumped to more than 40% from percentages in the high teens just a few days earlier. At press time, the odds of a 50 basis point cut had risen a bit further to 45%. The news may also have been responsible for a quick turnaround in the U.S. stock market Thursday afternoon, which closed with decent gains after sporting losses earlier in the session. Bitcoin (BTC) too rose to about its highest in more than a week to $58,400 (it's since slipped to $57,800). All things being equal, easier monetary policy is generally assumed to be a good thing for risk assets, bitcoin included. But in bitcoin's current bear phase, assumptions can quickly change. At least some analysts have said the Fed moving faster with rate cuts – to the extent that it signals the bank's worry about a struggling economy – might send prices even lower. https://www.coindesk.com/markets/2024/09/13/odds-of-50-basis-point-fed-rate-cut-next-week-jump-to-45/