2024-04-29 06:11

FBI Computer Analysis and Response Team agents first found the material during a search of Eisenberg's devices in January 2023 Mango markets exploiter Avraham Eisenberg has been charged with the possession of child pornography FBI agents first discovered the material during a search of his devices in January 2023 Avraham Eisenberg, who was recently found guilty of fraud and market manipulation in relation to his $110 million heist from Mango Markets, has been charged with possession of child pornography. The court documents that are dated April 3, but were released on April 26, allege that some of the images in his possession were of prepubescent minors who were under the age of 12. The allegations have not been proven in court. A prior court document filed in August revealed that the material was first discovered on Eisenberg’s cell phones and laptops during an initial search of them related to the charges of market manipulation and fraud. Upon discovery of the material, the Government applied for and obtained a second warrant, expanding the scope of the original warrant to search for evidence of offense related to the possession and receipt of child pornography in February 2023, court documents read. The child pornography charges were first reported by investigative journalist Christopher Brunet, who also claims to have screenshots of Eisenberg “talking about children in really disgusting ways.” https://www.coindesk.com/policy/2024/04/29/mango-markets-exploiter-charged-with-possession-of-child-pornography/

2024-04-29 06:00

With MiCA stablecoin rules taking effect in June, CoinDesk reached out to regulators in all 27 EU member states to show where countries are at with implementation. European Union member states are gearing up to enforce MiCA, the landmark crypto law that requires national regulators to license and supervise service providers. MiCA is an EU-level regulation but nations can implement slightly different technical standards, which crypto firms should follow closely, policy watchers say. The European Union’s 27 member states are getting ready to enforce its landmark crypto laws this year – and businesses looking to operate in the bloc should be watching what national authorities are doing, policy watchers say. In a few months, the Markets in Crypto Asset (MiCA) regulation’s specialized rules for stablecoin issuers will take effect, followed by licensing and other requirements for crypto firms broadly in December. MiCA was voted into law in 2023 after the European governments spent three years developing the regulatory framework. Once effective, crypto firms, such as issuers, exchanges and wallet providers, will be able to operate throughout the European Union if they secure licensing in any single member nation. That means each jurisdiction must transpose the bloc-wide EU regulation into local law, select which of their regulators will oversee crypto and prepare to authorize token issuers and other service providers. For some EU countries – such as Germany, France and others – that chose to regulate crypto internally through strict regimes, transitioning to the MiCA age may not be a big shift. For some other countries, the change may be significant and place new burdens on local authorities. CoinDesk reached out to regulators and government ministries in all 27 nations on their thoughts and progress on MiCA, 20 of whom responded by press time. These countries are in various stages of preparation. At least 10 countries are finalizing or have already finalized local legislation. Some others are not quite as far ahead yet, but experts say there is time to get things in order. MiCA is an EU-wide regulation, which means it takes direct effect across the bloc on the agreed deadlines, said Sophie Lessar, partner at law firm DLA Piper, focusing on fintech and digital financial services. “The rules will come into effect. There's nothing that any regulator will do to hold that up,” she said during an interview with CoinDesk. However, there are some technical requirements that have to be implemented at a national level, Lessar added. While national authorities decide how they want to implement some of the more flexible technical standards under MiCA – such as how long their grandfathering periods will last or what their supervision fee structure would look like – crypto businesses, too, should be preparing for compliance and be aware of nuances in implementation at the national level. “The key thing is for people to navigate, what does that mean for my business? Where am I doing business? Are there any differences where there is the ability under MiCA for the national authorities to have slight differences in implementation?” Lessar said. Picking watchdogs European countries are in various stages of transposing MiCA into local law, which can involve deciding on the local regulators who will be at the helm of supervising crypto – referred to as National Competent Authorities (NCA) in the MiCA text – as well as deciding on whether to take advantage of a transitional period allowed under the regime. With MiCA, there was an expectation that local supervision duties might be divvied up between a country’s markets regulator and its central bank (to handle stablecoins), according to Marina Markezic, co-founder of the European Crypto Initiative (EUCI), which has been tracking the progression of national legislation. France, for instance, has designated its financial regulator, the Autorité des marchés financiers (AMF) and banking authority, the Autorité de contrôle prudentiel et de résolution, as its MiCA supervisors under France’s Article 9 of Law no. 2023-171 of March 9, 2023, the AMF told CoinDesk. The AMF told CoinDesk that it’s now working to align requirements in its existing regulation for digital asset service providers with authorization requirements under MiCA. Croatia is aiming for a similar setup where, once the national legislation is adopted, MiCA duties will be split between the Croatian National Bank and financial regulator Hanfa, the latter told CoinDesk. “Hanfa will license and supervise the operations of crypto-assets service providers… However, as per MICA requirements, Hanfa will not approve crypto asset white papers,” the regulator said in a statement. Some countries, such as Slovakia and Hungary, don’t have two financial regulators so crypto supervision will fall solely to their central banks, Markezic said. Hungary’s central bank MNB confirmed to CoinDesk that it was designated as the country’s crypto regulator through its national MiCA legislation. Although this is more of an organizational matter, there could be room for regulators to be overburdened with licensing requirements. Rosvaldas Krušna, adviser to the Board of the Bank of Lithuania, said that the new need for crypto firms to be approved “will bring significant challenges” to the central bank, which will be handling licensing. “Given the fact that we have around 580 [crypto asset service providers] in Lithuania, the Bank of Lithuania initiated preparations well in advance, and we believe we are rather well prepared,” Krušna said. “We have put a lot of resources into preparation, both in terms of additional staff and tools required for supervision.” Some countries with smaller financial markets may not have the need or capacity to hire a large number of new employees to work in their regulatory bodies, according to Policy Expert Anja Blaj at EUCI. As there's not enough information about how many applications NCAs will receive individually, some states may find it hard to prepare ahead of time, she added. “This also is kind of related to the overall, I would say, fragmentation in the way that European Union member states operate and the difference in the financial markets,” Blaj continued. “Because that is still something that is very member-state specific, even though we have many regulations, or much more regulations will be coming in this space, it's still very much specific to the member state.” Blaj and the EUCI team, who have been speaking with industry representatives in member states, say that each country’s crypto industry has its own concerns about implementation, proposed laws and who their NCAs are going to be. National legislation Austria, Estonia, Denmark and Croatia are among the countries whose parliaments still need to approve draft national legislation to align with MiCA, according to what regulators told CoinDesk. ”The Danish Parliament is currently in the process of adopting national legislation that will mandate the Danish Financial Supervisory Authority (DFSA) to become the national competent authority with regards to MiCA in Denmark. This is expected to be adopted during the spring,” said Tobias Thygesen, head of the DFSA's Fintech, Payment Services and Governance Division. Croatia plans to adopt legislation implementing MiCA rules In the second half of 2024, the country’s financial regulator Hanfa told CoinDesk, while Portugal’s central bank said that the country has yet to designate a national competent authority. Other nations such as Ireland, Slovenia, Poland and Lithuania have consulted publicly on draft legislation, CoinDesk was told by respective authorities in the country. Regulators in Belgium, Bulgaria, Greece, Malta, Romania, Slovakia and Sweden did not respond by press time, while those in Italy and the Czech Republic declined to comment. Grandfathering One area where nations can diverge in the implementation of MiCA is with their grandfathering period, or the time crypto firms are allowed to continue operating under old rules while transitioning to the new regime, Lessar said. Crypto firms would need to navigate carefully between diverging transitional periods when beginning operations in the EU, she added. While MiCA allows nations an optional 18-month transitional period, the EU’s markets watchdog has since called for limiting that to 12 months. Spain's financial regulator, the National Securities Market Commission (CNMV), told CoinDesk that the country will apply a 12-month grandfathering period in which MiCA-authorized crypto firms and unauthorized ones will operate “at the same time.” “This will be a relevant challenge for NCAs,” the CNMV said, adding that regulators will have to make a “big” effort to make the distinction clear to users. In preparation, the CNMV said it’s planning to hire 70 people to work on MiCA and the EU’s cybersecurity law known as DORA. Finland hasn’t yet decided whether it will implement the transition period for crypto firms registered in the country because it is still preparing the national legislation, the country’s financial regulator FIN-FSA told CoinDesk. “The legislative proposal must be passed by the Finnish parliament. The expectation is that the national legislation is adopted during [the first half of] 2024 still,” Elina Pesonen, market supervisor at FIN-FSA told CoinDesk in a statement. Latvia’s central bank, Latvijas Banka, is planning to start the licensing process and accept applications on Jan. 1, 2025, after a six-month grandfathering period, Marine Krasovska, head of the bank’s financial technology supervision department, told CoinDesk. To make the process easier, it will pre-evaluate crypto firms interested in operating in the country, she added. Dutch financial regulator AFM told CoinDesk that it has started accepting licensing applications from crypto firms starting April 22, 2024. If approved, the licenses will kick into effect when MiCA does on Dec. 30, 2024. The country’s central bank (DNB) will be handling stablecoin regulation, the AFM said. From what Croatia’s Hanfa told CoinDesk, it might make use of the full 18 months of grandfathering. “Based on the current draft law, all those listed in the Register (as at the end of 2024) will be able to use the MiCA transitional period for adjustment (up to June 2026) by the end of which they will have to align their operations and obtain a MiCA authorization from Hanfa to operate as crypto-asset service providers. Entities that did not provide crypto-asset services prior to the end of 2024, and want to start doing so after that date, will have to be licensed before they can provide such services,” Hanfa said. Looking ahead Regulators that are licensing crypto firms for the first time are expecting an increased workload, and just as Spain’s CNMV is planning to hire new personnel, other regulators are also beefing up their teams or getting them the training needed to handle what’s coming. “National competent authorities are already working hard to accommodate their capabilities and workforces to it,” Spain’s CNMV said. Denmark’s DFSA will be accepting applications from companies as soon as the country finalizes national legislation, and the regulator has set up a “dedicated MiCA team responsible for the implementation,” Thygesen said. “With the objective to effectively tackle the challenges posed by MiCA, the MNB has adopted multiple organizational changes and established a dedicated directorate focusing on MiCA related matters,” Hungary’s crypto regulator said. Under MiCA, countries have a say in setting fee structures for licensing and compliance, said the EUCI's Markezic, which would hopefully be more conducive to attracting and promoting businesses in the EU than deterring. “Member states are pretty sovereign when it comes to their own financial markets. And they are their own markets, which means that they also, in a way, act in terms of like, 'okay, I want now to have as many projects as possible coming to my ecosystem, because I have the ecosystem that can support it. And this is how I'm also competitive, in a way, competing with other members,'” Markezic said. Meanwhile, several regulators, including France’s AMF, told CoinDesk that they are also working with the EU’s markets regulator (ESMA) and banking authority (EBA) as they consult on technical standards under MiCA. ESMA's Executive Director Verena Ross described to CoinDesk the regulator's role in implementing MiCA as bringing more detailed guidance to the market and bringing the regulators together. It's looking at June as an initial deadline for regulatory technical standards and guidance for public comments, with the end of the year as a deadline for finalization. Policymakers in the EU are already thinking of revisions to MiCA that could see its scope expanded and certain rules tightened. “MiCA is an important first step towards the regulation of cryptoasset services and their providers,” German crypto regulator BaFin told CoinDesk in a written statement. “It also provides for the further development of regulatory requirements, for example with regard to pooling, lending and staking, i.e. loaning cryptoassets for a fee. BaFin will play an active role in this process.” Enforcement-wise, things largely seem to be moving along as they should be. “So far the delegated acts and implementing rules are on track. Also, bear in mind that it is only the ‘stablecoin’ provisions (titles 3 and 4) of MiCA that kick in end of June,” Peter Kerstens, adviser to the European Commission on financial sector digitalization and cybersecurity, said in a statement to CoinDesk. The rest is “a full summer and a full autumn and even some of winter away,” he added. https://www.coindesk.com/policy/2024/04/29/heres-how-eu-nations-are-preparing-to-enforce-mica/

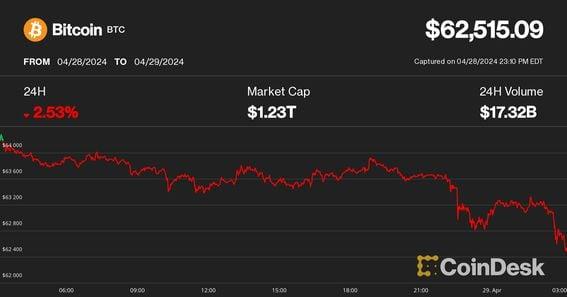

2024-04-29 04:32

The crypto market is balancing the threat of stagflation against a potential liquidity injection from the Treasury General Account (TGA), and the launch of Hong Kong's bitcoin ETFs. Bitcoin and ether trade lower as Asia begins its business week. There are mixed bullish and bearish market signals as the week begins. Crypto markets are in the red amid renewed fears of U.S. stagflation, a worst-case scenario for risk assets. Bitcoin (BTC), the leading cryptocurrency by market value, traded near $62,400 at press time, down 2.5% on a 24-hour basis, according to CoinDesk Indices data. Ether (ETH) traded 3% lower at $3,200, and the CoinDesk 20 (CD20), a measure of the most liquid digital assets, was down 2.6% at 2,197 points. The market appears to be on a precipice right now as it debates which direction to take, with significant bullish and bearish narratives on the horizon. As QCP wrote in a note over the weekend, the threat of stagflation – a period of high inflation and low growth – is very real. "The weaker than expected [U.S.] GDP print points to a more sluggish economy while the higher Core PCE warns of an inflation problem that continues to be a thorn in the Fed's side," QCP wrote. Last week's U.S. GDP report showed the world's largest economy grew at an annualized rate of 1.6% in the first quarter of this year following the preceding quarter's 3.4% growth. Meanwhile, the personal consumption expenditures price (PCE) index, the Fed's preferred inflation metric, showed prices rose to a 3.4% annualized rate in the first three months of the year from 1.8% in the final quarter of 2023. The stagflationary combination of slower growth rate and sticky inflation has further weakened the probability of the Fed rate cuts. Most traders on the prediction market platform Polymarket still see no rate cuts as the most likely scenario, with a 35% chance of this happening, but the chance of 1 rate cut is creeping up, now at 29% versus 26% a week ago and 14% at the start of the month. QCP also wrote that Janet Yellen's fiscal strategy, leveraging the Treasury General Account (TGA)—holding close to USD 1 trillion in assets—and the Reverse Repurchase Program (RRP) with USD 400 billion, could inject up to $1.4 trillion in liquidity into the financial system pushing up all risk assets. As CoinDesk's Omkar Godbole wrote last week, the key to a continuing bitcoin bull market is the U.S. Treasury's impending quarterly refunding announcement, which maintains or reduces the current TGA balance of $750 billion. This $750 billion figure in the TGA is key because it serves as a significant signal to financial markets about the U.S. government's fiscal intentions, profoundly impacting economic stability and growth. Meanwhile, the launch of the bitcoin exchange-traded funds (ETFs) in Hong Kong on April 30 is also catching the eye of traders. However, news that mainland Chinese investors won't be able to trade the ETFs has dialed down the bullishness of the launch. https://www.coindesk.com/markets/2024/04/29/bitcoin-ether-nurse-losses-as-us-stagflation-fears-grip-market/

2024-04-28 23:00

Liberal Democratic Party leader and Prime Minister Fumio Kishida once called Web3 a “new form of capitalism,” but he faces a party leadership election in September. Japan's current government, led by Prime Minister Fumio Kishida, has championed Web3 development and regulation. Kishida faces party leadership elections in September as the ruling Liberal Democratic Party (LDP) grapples with record-low support, potentially spelling uncertainty for the future of Web3 policy and progress. Japan’s Prime Minister Fumio Kishida and his ruling Liberal Democratic Party (LDP) have shepherded the country’s Web3 strategy along with a host of regulations and plans for the crypto sector. A major corruption scandal, however, bodes ill for Kishida and the party’s future – leaving the country's crypto progress on uncertain footing. The LDP has maintained power for nearly 70 years, with brief interruptions in 1993 and 2003. The party faces by-elections this month and is set to have its party leadership election this September, which some political analysts say might see Kishida, who called Web3 “a new form of capitalism,” replaced as president of the party and – consequently – as prime minister of Japan. In 2023, Japan became one of the major jurisdictions to regulate stablecoins, which are crypto assets tied to the value of other currencies. When much of the world collectively detached itself from the scandal-ridden cryptoverse amid the market collapse of 2022, Kishida’s government saw it as an opportunity and a pillar for economic growth. Kishida’s cabinet has a Web3 project team, which last year released a white paper outlining the national non-fungible token (NFT) and decentralized autonomous organization (DAO) strategy, which is now working to introduce new Web3 policies. The LDP is also proposing corporate tax cuts, and making way for venture capital firms to hold crypto. It’s unclear how these efforts may be affected by the party's shaky future. The LDP’s Web3 white paper has manifested in more than 160 active Web3 projects across the country, many of them focused on revitalizing Japan’s vanishing traditions and rural villages. Kishida has vowed to take disciplinary action against party members involved in the scandal, which saw three lawmakers and a handful of political aides arrested on accusations of taking kickbacks, before the lower house of parliament is dissolved. https://www.coindesk.com/policy/2024/04/28/japans-embrace-of-web3-uncertain-as-ruling-party-under-threat/

2024-04-26 19:11

The yen's volatile episode may spread to other fiat currencies as U.S. rate cuts remain elusive amid sticky inflation, which could drive investors to gold and bitcoin, Noelle Acheson said in an interview. The Japanese yen fell Friday to its weakest level against the U.S. dollar since 1990. Bitcoin remained flat around $64,000 as some altcoins slid lower. Intervention may follow soon if yen devaluation continues, Lekker Capital's Quinn Thompson said. Cryptocurrencies, widely known for their often volatile nature, were a sea of calm Friday as the Japanese yen's tumble to a fresh 34-year low against the U.S. dollar left traditional market observers mulling over potential knock-on effects. Bitcoin (BTC) continued its recent choppy action during the day within a tight range around $64,000, down 0.9% over the last 24 hours. The broad-market CoinDesk 20 Index (CD20) fell slightly more with smart contract network tokens solana (SOL), ICP and decentralized exchange Uniswap's UNI declining 2%-4%. The Japanese yen (JPY) dove another 1.3% during the day – a huge move for a major currency – to its weakest level against the U.S. dollar since 1990 after the Bank of Japan (BOJ) held interest rates at near zero and didn't indicate much concern over the weakening currency. In the U.S., meanwhile, continuing solid economic growth and stubbornly high inflation are snuffing out hopes for perhaps any easing of monetary policy this year. "Moves of this size and speed in currencies is not normal so I expect some intervention or coordination fairly soon if it continues into the next few weeks," Quinn Thompson, founder of hedge fund Lekker Capital, told CoinDesk. The yen's devaluation didn't impact crypto markets yet, but this could change if the BOJ steps in to prop up the currency, Noelle Acheson, analyst and author of the Crypto Is Macro Now reports, said in an email interview. A possible intervention would mean the BOJ selling U.S. dollar assets (U.S. Treasuries) to buy yen, and a weaker greenback could in theory help crypto prices, she added. Another form of intervention could arrive from U.S. policymakers deciding to inject liquidity to the markets, which could support risk assets such as cryptos, Lekker's Thompson said. "We could see a collective selling of U.S. treasuries to raise cash to support local currencies, adding further upside pressure to U.S. yields while adding to inflationary pressures elsewhere," Acheson said. "This currency volatility and vulnerability could encourage more corporate and even sovereign holdings of hedges such as gold and bitcoin." https://www.coindesk.com/markets/2024/04/26/bitcoin-chops-around-64k-with-japanese-yens-tumble-maybe-signaling-currency-turmoil-analyst-says/

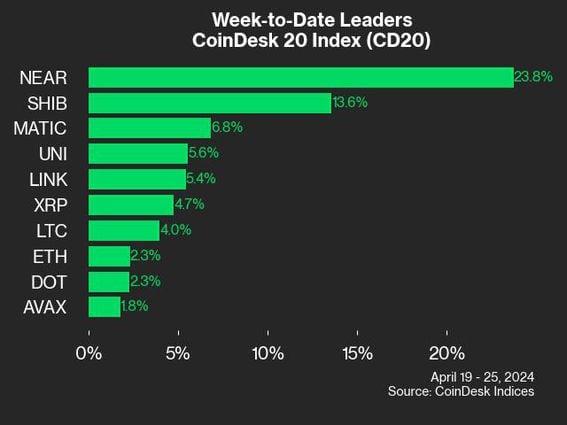

2024-04-26 16:50

The majority of the assets posted gains despite a choppy market, but there were notable decliners as well. CoinDesk Indices (CDI) presents its bi-weekly market update, highlighting the performance of leaders and laggards in the benchmark CoinDesk 20 Index (CD20) and the broad CoinDesk Market Index (CMI). The majority of assets within the Index closed Thursday higher than they did a week earlier despite choppy price action. Just five tokens closed lower. Overall, the CoinDesk 20 gained 2.1% on the week. Near Protocol (NEAR) continued to outperform the rest of the CoinDesk 20 with a 24% advance. The protocol has recently been making moves in the decentralized AI space, which has coincided with an outsized move higher over the past few weeks. Aptos ((APT)) was among the undeperformers, losing 5.1% of its value last week. Filecoin ((FIL) and bitcoin cash ((BCH) were the only other assets to see meaningful moves lower. CoinDesk 20 tracks top digital assets and is investible on multiple platforms. The broader CMI comprises approximately 180 tokens and seven crypto sectors: currency, smart contract platforms, DeFi, culture & entertainment, computing, and digitization. https://www.coindesk.com/markets/2024/04/26/near-and-shib-led-coindesk-20-gainers-last-week-coindesk-indices-market-update/