2024-04-24 22:03

This marks the first step towards reintroducing functionality removed from Bitcoin by creator Satoshi Nakamoto in 2010. A serious attempt to bring Ethereum-like smart contract functionality to Bitcoin called OP_CAT has finally been granted a “BIP number:” 347. This is the first step towards actually launching the long-proposed software upgrade. “Getting a BIP number does not signal any sort of consensus on the part of the community," Ethan Heilman, one of the co-authors of the proposal alongside Armin Sabouri, said in an interview. "It just makes discussing and writing software around the proposal easier because the proposal now has a unique numeric identifier that everyone agrees on.” In other words, getting assigned BIP 347 means the argument over the controversial proposal can finally begin in earnest. On one side are those who want to reserve the Bitcoin network simply for monetary transactions; on the other are those who want to build new things on-chain, of which proponents of OP_CAT are just a sliver. OP_CAT has a long history in Bitcoin circles. Initially included as one of the first op_codes (essentially programming shortcuts built into Bitcoin), Satoshi Nakamoto himself removed the functionality in 2010 after concerns were raised about excessive memory usage and the possibility of introducing vulnerabilities. But in recent years, especially following the release of the Ordinals protocol that reinvigorated developers' desire to build on-chain, proponents have returned to OP_CAT as a possible way to increase the amount of things that can be built using Bitcoin. Other proposals include things like Bitcoin developer Jeremy Rubin’s CTV and feature-rich scaling solutions like Stacks and Ark. Heilman and Sabouri began studying reintroducing OP_CAT in 2022, and first proposed launching it a year later on the Bitcoin Mailing List via a backward-compatible soft fork. The idea would be to redefine and expand upon an existing code called “OP_SUCCESS126,” without having to hard fork the chain. If the proposal goes through, OP_CAT covenants could enable the creation of more sophisticated applications and multi-signature setups on Bitcoin. It works by introducing “covenants,” or rules that can be established to determine how a specific transaction will function, to Bitcoin. “Bitcoin allows users to set rules on who and how their bitcoins can be spent. All CAT does is that it joins two values together. So if you have ‘abc’ and ‘def,’ CAT will join these two values together to make ‘abcdef,’” Heilman said, adding that such a basic maneuver isn’t possible today. “The CAT is just shorthand for conCATenate.” “After the community is confident the software works as designed, we will put together a PR into bitcoin-core. This is where the real fun begins because the question changes from ‘is the software correct?’ to ‘does the Bitcoin community want OP_CAT?,’” Heilman said. “This could be a quick process or it could take years.” Among the biggest proponents of OP_CAT have been the co-founders of popular Ordinals project Taproot Wizards, Eric Wall and Udi Wertheimer, who created the Quantum Cats inscriptions project as a sort of marketing campaign for Heilman and Sabouri’s proposal. While Quantum Cats is one of the most popular inscription projects to date, OP_CAT itself is far from universally accepted. There is some speculation, for instance, that despite Heilman and Sabouri submitting their BIP proposal several months ago, it was being held off from approval by lone BIP editor and Bitcoin Core dev Luke Dashjr, who is not alone in his skepticism of recent on-chain experimentation. On Monday, the Bitcoin community named five additional BIP editors. According to GitHub, OP_CAT's BIP number was assigned by an editor who goes by "Roasbeef." Heilman said that now that OP_CAT has a BIP number, it’s up to the community to determine whether it should move forward. “Speaking only for myself, at this point I plan to remove myself from the process and let the community debate if OP_CAT is something they want or not want," he said. "I don't plan to enter that debate except if needed to clarify technical questions.” https://www.coindesk.com/tech/2024/04/24/op-cat-proposal-to-bring-smart-contracts-to-bitcoin-finally-gets-a-bip-number/

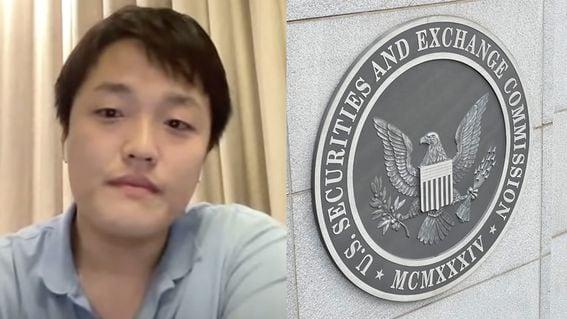

2024-04-24 20:24

Suggested fines the securities watchdog suggested for Terraform Labs and Ripple are out-of-line with what it has collected from crypto firms in the past. The U.S. Securities and Exchange Commission is looking to impose its steepest fine yet on a cryptocurrency project, a $5.3 billion penalty for Do Kwon and Terraform Labs, the man and company behind the fatally flawed algorithmic stablecoin that jumpstarted a multi-billion-dollar, industry-wide contagion event when it imploded two years ago. Following a protracted investigation and relatively short two-week trial in New York earlier this month, Kwon and Terraform were found liable for fraud – hiding obvious dangers lurking in the trading scheme that would allegedly keep its UST stablecoin solvent and the unsustainable 20% yields offered by Terraform's Anchor lending platform. Kwon, who was arrested in Montenegro carrying a false passport last year, did not attend the trial. He is currently awaiting extradition either to the U.S. or his native South Korea. The monetary penalty is not a done deal; a court will decide the final punishment. But what the SEC said it's seeking, according to an April 19 court filing, is to send “an unequivocal message." To experts, the gigantic size of the fine is a sign the SEC isn't playing around anymore, as it follows its proposed $1.8 billion penality for Ripple. (And it comes on the heels of the $4.3 billion fine imposed on Binance by a bundle of U.S. regulators, though the SEC was conspicuously absent from that settlement, and prosecutors this week asking for Binance ex-CEO Changpeng Zhao to spend three years in prison.) “The recent high-profile cases against Terra/Do Kwon and Ripple, with penalties reaching hundreds of millions or even billions of dollars, do signal a change in the SEC's strategy,” University of Pennsylvania assistant law professor Andrea Tosato told CoinDesk in an interview. "Overall, I would say that it appears the SEC is trying to send the message that … the reward is just not worth the risk.” While SEC Chair Gary Gensler has been more or less anti-crypto since taking office in 2021, the financial carnage caused by the collapse of Terra, Three Arrows Capital and FTX in 2022 made it a matter of national priority to try to get the industry in order. The Biden administration, for instance, sent out a memo noting that regulating crypto would be a “whole of government” affair. And so Binance, Ripple and now Kwon and Terraform are feeling the weight of that. While Terraform lawyers have argued that the U.S. lacked jurisdiction, they are now arguing to cap the fine at $3.5 million. Kwon’s defense council suggested a maximum fine of only $1 million. For its part, Ripple proposed a civil penalty of no more than $10 million, arguing the SEC’s suggested fine was excessive because it was more than 20 times what it had ever collected from a crypto settlement so far. That’s true, to an extent. The SEC was able to collect over $1.2 billion from Telegram – but almost all of that amount was meant to be returned to investors while the popular messaging company only had to pay a $18.5 million civil penalty. That was in line with Block.one’s $24 million civil penalty in 2019. (CoinDesk is owned by Bullish, which is in turn majority owned by Block.one) In 2022, the year the SEC grossed the most from enforcement actions with $6.4 billion in fines, the average civil penalty was slightly above $9 million. So what accounts for the SEC’s seemingly aggressive turn? Rutgers Law School professor Yuliya Guseva suggested it’s likely a confluence of factors including the fact that as crypto projects grow in size, so does the potential for disgorgement. But there’s also the legal strategy of “terrorem,” which, as the latinate word suggests, is meant to cast fear over the industry to incentivize compliance. “This latter approach indicates that the SEC may be strategic in its choices as it attempts to bring the crypto industry within the ambit of securities law,” Guseva told CoinDesk in an interview. Disgorgement isn’t actually mentioned anywhere in securities laws, according to Tosato, but has been standard operating procedure since the 1970s as a way to return funds to investors and deter future violations. Civil penalties on the other hand are supposed to follow a rulebook, which includes the degree of unlawfulness, the actual (or potential) harm caused to investors and the extent to which defendants complied with regulators. However, in practice, this process "does involve a degree of discretion which the SEC exercises within established legal frameworks,” Tosato added. While ratcheting up the amount firms are fined is definitely meant to send a message to others, Tosato said he doesn’t think the SEC is “especially out of line compared to what it has done in other industries” when it comes to clear-cut cases of fraud and securities violations – of which there are many. “In my mind, what is different is that the applicability of the regulatory framework in the crypto space is far more uncertain than it is in many industries,” Tosato said. “Recent case law continues to leave many unresolved questions.” https://www.coindesk.com/consensus-magazine/2024/04/24/do-kwons-huge-fine-shows-the-sec-is-ratcheting-up-penalties-against-crypto-firms/

2024-04-24 19:10

Prosecutors are alleging Samourai Wallet laundered over $100 million in criminal proceeds. Federal prosecutors charged Samourai Wallet founders Keonne Rodriguez and William Lonergan Hill with conspiracy to commit money laundering on Wednesday, as the U.S. government continues its approach to prosecuting crypto mixing tools that may be used by illicit actors and foreign governments to hide fund transfers. According to a press release issued Wednesday, the pair developed, marketed and operated the mixer, which "facilitated more than $100 million in money laundering transactions from illegal dark web markets." Samourai overall facilitated around $2 billion in "unlawful transactions” between 2015 and the present, the release alleged. An accompanying indictment said this figure was calculated by converting the value of bitcoin laundered through the funds to U.S. dollars, based on bitcoin's price "at the time of each transaction." Rodriguez, 35, and Hill, 65, collected approximately $4.5 million in fees for their mixing services, according to prosecutors. Different features had different pool fees, according to the indictment. The pair are charged with conspiracy to commit money laundering and conspiracy to operate an unlicensed money transmitting business. The charges carry a maximum sentence of 20 years and five years, respectively. Rodriguez was arrested on Wednesday morning and will be arraigned in Pennsylvania today or tomorrow, according to the press release. Hill, Samourai Wallet’s CTO, was arrested on Wednesday morning in Portugal and will be extradited to the U.S. The Samourai Wallet website, which was hosted in Iceland, has also been seized, and a seizure warrant issued for Samourai’s mobile application to the Google Play Store. Samourai has been in development since 2015, the DOJ press release said, and Rodriguez and Hill "encouraged and openly invited users to launder criminal proceeds" through the mixer, the press release said, citing tweets and private messages. The mobile application has seen more than 100,000 downloads. "At Samourai we are entirely focused on the censorship resistance and black/grey circular economy," one private message attributed to Hill said. "This implies no foreseeable mass adoption, although black/grey markets have already started to expand during covid and will continue to do so post-covid…" The pair sought investors by marketing the same premise – that "dark/grey market participants" would be included in their user base, the release said. A screenshot from marketing materials listed "Restricted Markets" as a target demographic, alongside online gambling and asset protection. Wednesday's arrests come as the DOJ prepares for its upcoming trial against Roman Storm, a developer and co-founder of crypto mixing service Tornado Cash. That case is being pursued by the DOJ's Southern District of New York division. Recently, the DOJ's Washington, D.C. unit successfully won a conviction against Roman Sterlingov, the operator of crypto mixer Bitcoin Fog, on money laundering charges. CORRECTION (April 25, 09:47 UTC): Correct spelling of "Samouri" in first paragraph. https://www.coindesk.com/policy/2024/04/24/samourai-wallet-founders-arrested-and-charged-with-money-laundering/

2024-04-24 16:37

One of the issuers waived management fees for the first six months, undercutting rival offerings. Hong Kong regulators approved ETFs by Harvest Global Investments, China Asset Management and a jointly managed product of Bosera Asset Management and HashKey Capital. The products could start trading on April 30, Bloomberg reported Management fees of the ETFs are lower than previously thought, one analyst noted Hong Kong’s market regulator has officially approved the first batch of crypto-related spot exchange-traded funds (ETFs), a first for the city and a move that could establish it as Asia’s leading digital-asset hub and unleash further growth in the sector. The Securities and Futures Commission (SFC) gave the nod Tuesday to spot-based bitcoin and ether ETFs by asset managers Harvest Global Investments, China Asset Management (ChinaAMC) and a consortium of Bosera Asset Management and HashKey Capital, according to the regulator's website. The funds could start trading on April 30, Bloomberg Intelligence analyst Eric Balchunas said Wednesday, adding that the management fees are lower on average than previously expected. James Seyffart, senior ETF analyst at Bloomberg Intelligence, noted a "potential fee war" unfolding between issuers, with Harvest waiving all fees for the first six months. After the initial period, it will charge 0.3% for both its spot BTC and ETH funds, undercutting the Bosera-HashKey funds' 0.6% and ChinaAMC's 0.99% management fees. The approval comes after U.S. regulators three months ago greenlit the first spot-based bitcoin ETFs in that country, a major breakthrough for the crypto industry that expanded the investor base for the largest and oldest crypto asset and dominated the digital asset market narrative for months. Led by global asset management giant BlackRock's offering, the funds have since amassed over $12 billion in net inflows,, helping propel BTC one month ago to a fresh all-time high price over $73,000. The Hong Kong-listed spot crypto ETFs are another key step towards making crypto assets more accessible to traditional investors globally, but the impact will likely not replicate the success of the U.S.-based offerings, analysts told CoinDesk earlier. The issuers whose products were approved in Hong Kong are significant players regionally, but are dwarfed by their U.S. counterparts, some of whom have multiple trillion dollars of assets under management. China Asset Management, for example,had just $266 billion AUM at the end of last year, while Harvest Global Investments AUM stood at $207 billion, according to their respective company websites. https://www.coindesk.com/business/2024/04/24/spot-bitcoin-ether-etfs-get-official-approval-in-hong-kong-potential-fee-war-unfolding-says-analyst/

2024-04-24 15:51

The new regulations could offer banks a competitive edge by limiting institutions without a banking license to a maximum stablecoin issuance of $10 billion, the report said. Regulatory clarity should encourage banks to enter the stablecoin market, S&P said. Tether could see its dominance wane if the stablecoin bill is approved, the report said. New digital asset custody providers could emerge leading to greater competition. Regulatory clarity in the U.S. should inspire banks from the traditional financial world to enter the stablecoin market and may also reduce the dominance of Tether's USDT, S&P Global Ratings said in a report on Wednesday. A stablecoin is a type of cryptocurrency that serves as bedrock in crypto markets. U.S. Senators Cynthia Lummis (R-Wyo.) and Kirsten Gillibrand (D-N.Y.) introduced a new stablecoin bill last week that seeks to define how stablecoins will operate in the country. The U.S. dollar is the most popular peg for stablecoins, but most stablecoin issuers aren't subject to specific U.S. regulations, the report said. This could change following the introduction of the Lummis-Gillibrand Payment Stablecoin Act last week. "The new rules may offer banks a competitive advantage by limiting institutions without a banking license to a maximum issuance of $10 billion," analyst Andrew O'Neill wrote. Tether's USDT has a market capitalization of $110 billion, making it the third-biggest cryptocurrency, according to CoinDesk data. Circle's USDC is in second place among stablecoins at $34 billion. Both track the U.S. dollar. "An approval of the stablecoin bill would accelerate institutional blockchain innovation, in particular for tokenization or digital bond issuances involving on-chain payments," O'Neill said, adding that the "growth of institutional use cases for stablecoins would create opportunities for banks as stablecoin issuers and may also reduce tether's dominance in the global stablecoin market." S&P said that USDT is issued by a non-U.S. entity and therefore is not a permitted payment stablecoin under the proposed bill. This means that U.S. entities can't hold or transact in it, which could reduce USDT's demand while at the same time giving a boost to U.S.-issued stablecoins. Still, USDT transaction activity is located mainly outside the U.S. in emerging markets and is driven by retail investors and remittances, the report noted. "New providers of digital asset custody services could emerge with the removal of the SEC's requirement that custodians report digital assets on their balance sheet," the report added, and this could lead to greater competition. S&P previously critiqued USDT for being worse than rivals at doing its core task: being valued at $1. https://www.coindesk.com/business/2024/04/24/tethers-stablecoin-dominance-may-wane-following-proposed-us-rules-sp/

2024-04-24 14:12

The firm also completed the development of its three-nanometer mining chip, which it had been working on since April 2023. The firm said it has completed the development of a three-nanometer mining chip. Block said that it will develop a full bitcoin mining system based on its chip design. Block, the payments company founded by former Twitter CEO Jack Dorsey, is building its own bitcoin (BTC) mining system as it deepens its footing in the challenging crypto mining space, the firm said on Tuesday. The firm, formerly known as Square, said in a blog post that it completed the development of its three-nanometer mining chip, which it had been working on since April 2023. The full design is in process with a leading global semiconductor foundry, according to the post. In addition to that, Block said that after speaking to community members about the pain points in the industry, it decided to also develop a full bitcoin mining system, which will include system design. “We’ve spent a significant amount of time talking to a wide variety of bitcoin miners to identify the challenges faced by mining operators,” it said in the post. “Building on these insights and pursuant to our goal of supporting mining decentralization, we plan to offer both a standalone mining chip as well as a full mining system of our own design. The bitcoin mining industry is dominated by only a few players, with Beijing-based miner Bitmain controlling roughly 60% of the market, according to estimates by CoinShares. “There are few serious competitors, which indicates significant potential for disruption,” said James Butterfill, head of research at CoinShares. Block announced the completion of a five-nanometer bitcoin mining chip prototype in May 2023, which is the same technology that Bitmain’s S21 mining machine uses. “This leads us to believe that 3nm chips could achieve even greater efficiencies,” he said. Although chip efficiency has rapidly improved in recent years as demand for bitcoin has picked up, the latest halving event on April 20, which cut the issuance of new bitcoin by 50%, adds even more importance for faster mining speed, as well as lower costs and enhances reliability, Butterfill said. https://www.coindesk.com/business/2024/04/24/jack-dorseys-block-is-building-a-bitcoin-mining-system/