2024-04-19 22:24

According to court documents, Chirag Tomar used his ill-gotten gains to buy Rolexes, Lamborghinis, Porches and more. An Indian citizen pleaded guilty this week to U.S. charges that he created a fake version of Coinbase's website, letting him steal login credentials on the real thing and plunder more than $9.5 million of cryptocurrency from hundreds of victims. Chirag Tomar, 30, was arrested at the Atlanta airport on Dec. 20, 2023, while visiting family on a travel visa. He was charged with one count of conspiracy to commit wire fraud and one count of conspiracy to commit money laundering. Both carry a maximum sentence of 20 years in prison. Tomar’s case was first flagged by Seamus Hughes of CourtWatch. According to court documents filed in the Western District of North Carolina, Tomar and his co-conspirators created a fake version of Coinbase Pro’s website to fool Coinbase customers to fork over their login info. Between at least June 2021 and Tomar’s arrest in late 2023, at least 542 victims were scammed out of their crypto. Court documents show that the U.S. Secret Service was able to identify Tomar as a member of the crime ring because he used an email account in his real name to communicate with known and unknown co-conspirators in the fraud. He also kept a spreadsheet of his victims and how much had been stolen from each and sent “stolen or fraudulently obtained” identity documents to other email addresses used to open up accounts at Binance, another cryptocurrency exchange. Between June 2021 and October 2022, Tomar made internet searches for “fake coinbase page,” “coinbase scam,” “scams in the USA,” and “how to take money from coinbase without OTP.” Tomar used the same email address to apply for his travel visa to the U.S. Using the proceeds of his fraud, Tomar funded a lavish lifestyle, purchasing Rolex and Audemars Piguet watches, “high-end luxury vehicles such as Lamborghinis and Porches,” and traveling to London, Dubai and Thailand. Tomar has not yet been sentenced. https://www.coindesk.com/policy/2024/04/19/indian-man-pleads-guilty-to-creating-spoofed-coinbase-website-stealing-95m-in-crypto/

2024-04-19 17:54

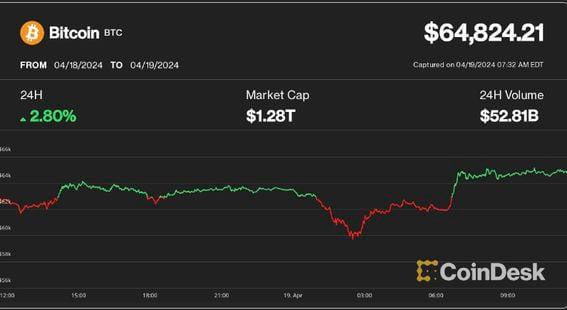

IntoTheBlock data shows that the largest bitcoin investors added nearly 20,000 BTC to their holdings as the top crypto briefly buckled below $60,000 on fears of military escalation between Iran and Israel. The whale purchases marked a change in behavior compared to their inaction during previous dips over the past week. The action perhaps helped bitcoin's rebound to $65,000, marking the $60,000 level as a key support level for bitcoin's price where buyers step in. Large bitcoin (BTC) investors substantially increased their holdings as prices dipped below $60,000 in early Friday's panicky action on the crypto markets ahead of the asset's much-anticipated halving event. Blockchain analytics firm IntoTheBlock's "large holder netflow" metric shows that Bitcoin addresses holding at least 0.1% of the supply added 19,760 BTC worth over $1.2 billion to their holdings on Friday at an average price of $62,500. Large holders – often called whales in crypto slang – are major market players who control large amounts of a digital asset and are usually considered to be smart, well-informed investors. Their purchases and sales can have a sizable impact on markets, thus crypto watchers closely follow their behavior to anticipate price movements. "Bitcoin whales may have finally started buying the dip," IntoTheBlock said in an X post on Friday. "Historically, accumulations by these addresses have often preceded rises in bitcoin's price." The recent action marks a significant change in whales' behavior compared to earlier this week, when large investors didn't step in to capitalize on weakness, prompting fears about further downside. The purchases perhaps fomented bitcoin's sharp rebound past $65,000 from its overnight lows of $59,600 as Israel carried out airstrikes in Iran. Prominent crypto trader Skew also pointed out that the recovery was at least partly driven by spot BTC buyers. Recently, BTC settled at around $64,000, up 1% over the past 24 hours. Zooming out, the largest crypto by market capitalization has been consolidating for the past few weeks, cooling off from record-breaking prices last month ahead of its four-year halving scheduled for April 20 (UTC). The event will cut the reward for miners by half, reducing the issuance of new tokens to circulation. Prices bounced from around the $60,000 area after sell-offs for the third time in a week, carving out a significant support level where buyers step in to capitalize on lower prices. "While sellers on the margin appear to be derisking, there has also been opportunistic buying between $60,000-62,000 levels," Coinbase Institutional research analyst David Han said in a Friday report. "We think this directional uncertainty speaks to our thesis of bitcoin’s divergent roles both as a risk and a safe haven asset," he added. https://www.coindesk.com/markets/2024/04/19/bitcoin-whales-bought-12b-btc-amid-the-price-dip-fueling-the-quick-rebound/

2024-04-19 17:50

The rule that calls for the new 1099-DA isn't finished, yet, but the U.S. tax agency has shared what the form might look like to report brokered sales of digital assets. The U.S. Internal Revenue Services has revealed what the agency has in mind for the first-even crypto tax reporting form. Observers suggest the industry will need some more information before the draft form makes sense. The U.S. Internal Revenue Service (IRS) has previewed what crypto investors' future tax form might look like when it finishes its much-debated rule on how cryptocurrency transactions should be reported to the federal government. The IRS offered a draft of the 1099-DA form that would be meant to figure out the taxable gains or losses when brokered digital assets change hands. The form reveals the agency will likely have an array of individual token codes that can be filled in, and it includes spaces for wallet addresses and where to find transactions on the relevant blockchain. "Brokers must report proceeds from (and in some cases, basis for) digital asset dispositions to you and the IRS on Form 1099-DA," according to the instructions included with the form, which shows a 2025 date. "You may be required to recognize gain from these dispositions of digital assets." This unveiling is preliminary and may still change depending on the final outcome of the tax rule proposed last year. While the establishment of U.S. tax practices for crypto is among the necessary steps toward ridding investors of uncertainty and confusion, cryptocurrency businesses are nervous about how the IRS will identify the digital asset brokers that would need to comply with the new system – potentially including wallet providers, decentralized platforms and payment processors. This version of the form asks the filer to check a box that describes the type of broker they are: kiosk operator, digital asset payment processor, hosted wallet provider, unhosted wallet provider or "other." "Some of those boxes relate to economic activity such as kiosks or payment processors, while others are customer-relationship based such as hosted or unhosted wallet provider," Miles Fuller, the head of government solutions at TaxBit, told CoinDesk. "I am curious how the IRS anticipates using this information and how certain brokers such as centralized exchanges or decentralized protocols that are covered under the current regulations may fit into these boxes." Fuller was also interested in the Treasury Department's IRS anticipating that brokers would be "using some sort of digital asset registry to identify which crypto was being sold on the form," he said. "No formal registry currently exists, so it will be interesting to see how that plays out." Jessalyn Dean, vice president of tax information reporting at Ledgible, pointed out references to so-called wash sales and that the form provides for transactions that are only recorded internally by crypto firms. She contended in her analysis of the form that at least one of the boxes on non-deductible losses would need more guidance on how it works. "As expected, the look and feel are similar to the Form 1099-B for reporting sales of traditional financial products," Dean said, also noting the IRS has "packed a lot of lines and boxes into this form." The IRS is inviting public comments about the draft form. It remains unclear when the tax agency will produce a final rule, though the 2025 form suggests a completion at some point this year. Read More: New Form 1099-DA: What it Means for Digital Asset Brokers and Their Customers https://www.coindesk.com/policy/2024/04/19/irs-unveils-form-your-broker-may-send-next-year-to-report-your-crypto-moves/

2024-04-19 17:13

One of the closely watched indicators of retail interest is booming. Google searches for the term “Bitcoin halving” have hit an all-time high, surpassing the previous record set during the last halving in May 2020. According to Google Trends data, which uses a 100 point scale to determine the relative popularity of keyphrases, there is more interest than ever in the Bitcoin network halving. This article is part of CoinDesk’s “Future of Bitcoin” package. Interest in the term has steadily ramped up since the start of 2024, alongside search interest in the phrase “Bitcoin” (which is still below its 2017 peak in terms of search interest). The surge in interest this month is notable considering bitcoin’s (BTC) recent rally has stalled out, including turbulence this week, which saw it drop from a high around $70,000 last Friday to $63,000 today. Less than 60 blocks away, the fourth Bitcoin halving will see the number of bitcoin paid out as a block reward to miners cut in half from the current 6.25 BTC to 3.125 BTC. This particular halving is notable for a number of reasons, including the resurging interest in Bitcoin as a developer ecosystem, the onshoring of the U.S. mining industry following China’s ban and the relatively recent launch of spot bitcoin ETFs that helped ignite a (now ebbing) market rally. “This is the first halving in which major U.S. asset managers are educating on Bitcoin, and there’s no better Bitcoin education than learning about the halving. It’s a narrative event first – a quadrennial market moment – and a supply event second, though I think both aspects will be impactful,” Galaxy Digital head of research Alex Thorn told CoinDesk via email. Though it's not just fund managers having fun. As Decrypt initially reported, search frequency for “Bitcoin halving” surpassed the cannabis culture meme number “420” for the first time in its history. This is especially notable because the halving was initially scheduled to coincide with the April 20 holiday known for its cannabis-oriented celebrations, though is now likely to occur Friday evening. https://www.coindesk.com/consensus-magazine/2024/04/19/google-searches-for-bitcoin-halving-get-higher-than-420/

2024-04-19 12:14

These influences include rising geopolitical tensions, higher interest rates for longer, reflation and ballooning national debts, the report said. Crypto markets will be driven by macro factors in the short term, Coinbase said. Previous halvings were accompanied by other cryptocurrency ecosystem catalysts that acted as tailwinds. The growth of investors using bitcoin as a macro hedge has reduced volatility this cycle, the report said. The direction of digital asset markets following the bitcoin (BTC) halving is more likely to be driven by macroeconomic factors even as crypto fundamentals remain strong, Coinbase (COIN) said in a research report on Thursday. “These factors are largely exogenous to crypto and include increased geopolitical tensions, higher for longer rates, reflation, and rising national debts,” analyst David Han wrote. The recent elevated correlation of altcoins to bitcoin underlines this, Han wrote, “indicating BTC’s anchor role in the space even as BTC firms its position as a macro asset.” While previous halvings have historically kickstarted a bull market, “these cyclical runups have often been accompanied by other ecosystem catalysts that provide additional tailwinds,” the report said. The quadrennial reward halving slows the rate of growth in bitcoin supply by 50% and is expected to occur late this evening or early tomorrow UTC. While crypto has been largely been viewed as a “risk on” asset class, Coinbase says “bitcoin’s continued resilience and the approval of spot exchange-traded funds (ETFs) has created a bifurcated pool of investors (for bitcoin in particular) – one which sees bitcoin as a purely speculative asset, and another that treats bitcoin as a ‘digital gold’ and hedge against geopolitical risk.” The growth of investors that use bitcoin as a macro hedge partly explains the reduced magnitude of pullbacks this cycle, the report added. Wall Street giant Goldman Sachs (GS) expressed similar sentiment in a report last week. It said “caution should be taken against extrapolating the past cycles and the impact of halving, given the prevailing macro conditions.” https://www.coindesk.com/markets/2024/04/19/crypto-markets-will-be-driven-by-macro-factors-following-the-halving-coinbase-says/

2024-04-19 12:01

The latest price moves in crypto markets in context for April 19, 2024. Latest Prices Top Stories Bitcoin recovered slightly as its halving event approaches, adding 5% over 24 hours. Ether also rose, rising 4% to $3,000. According to Laurent Kssis, a crypto ETP specialist at CEC Capital, the uptick for bitcoin will continue for U.S. markets and then readjust and push back to earlier levels. Bitcoin reached a weekly low of $58,800 this week and is currently approaching the $65,000 mark. The halving is predicted to take place late Friday or early Saturday UTC. The quadrennial event slows the rate of growth in bitcoin supply by 50%. Altcoins also gained, with dogwifhat (WIF) jumping 18%, Ethena Labs’ ENA 16% and Sei Networks’ SEI by 14%. U.S.-based spot bitcoin (BTC) exchange-traded funds (ETFs) registered outflows totaling $4.3 million on Thursday, extending a four-day run of withdrawals ahead of the supposedly bullish mining-reward halving. Since April 12, the ETFs have witnessed a cumulative net outflow of over $319 million, with Grayscale's GBTC accounting for a large share of the withdrawals, provisional data published by Farside Investors showed. On Thursday, GBTC lost $90 million in outflows, which was partially offset by inflows into Fidelity's FBTC and BlackRock's IBIT. The Grayscale ETF has experienced outflows since day one for several reasons, including the fund's relatively costly fees. So, while GBTC outflows may not be a cause for concern, the recent slower inflows into other ETFs might be. Cryptocurrency exchange Kraken is acquiring TradeStation Crypto, the digital asset-focused division of online brokerage TradeStation, to expand its regulatory licensing in the U.S. "We can confirm Kraken has recently purchased TradeStation's crypto business," a Kraken spokesperson said via email. "The transaction is part of our efforts to accelerate our U.S. presence and will unlock further growth and new product opportunities for Kraken in the U.S." The company declined to disclose the amount paid. The takeover hasn't previously been disclosed publicly. Florida-based TradeStation Crypto has acquired money transmitter and other types of regulatory licenses in most U.S. states over the past few years. Chart of the Day The chart shows changes in prices for bitcoin perpetual futures on Binance and aggregate market-wide open interest (lower pane) over the past 24 hours. As perpetuals recovered from Asian session lows, open interest declined. The divergence indicates that the price recovery was partly fueled by a short squeeze. Source: Velo Data Trending Posts Bitcoin Miners Are Better Positioned for the Halving This Time Round: Benchmark Chia Network Makes Progress Toward an IPO, CEO Says This Bitcoin Halving Is Different. But Is It 'Priced In'? https://www.coindesk.com/markets/2024/04/19/first-mover-americas-bitcoin-price-bounces-as-halving-nears/