2024-04-17 04:25

Bankman-Fried has 91 days to file a brief This week on "Nik learns legal processes": Here's what to expect with Sam Bankman-Fried's appeal of his conviction last year. Appeals process As expected, Sam Bankman-Fried's legal team filed a notice of his intent to appeal his conviction on fraud and conspiracy charges. So far all we have is just the notice – the actual brief won't come for some time yet. Martin Auerbach, of counsel with Withers Bergman, told CoinDesk that Bankman-Fried's legal team must file the brief within 91 days of his receiving the completed transcript from the hearing. The Department of Justice would likewise have 91 days in which to file its opposition, and Bankman-Fried's team will have another three weeks to file a reply. "Skilled appellate counsel – which SBF has – will scour the record for any procedural or substantive issue that offers hope on appeal," he said. "The review of the record will presumably focus first on those issues on which [Bankman-Fried's] trial counsel specifically objected and noted, preserving their objections." They may also look at areas where they could argue that "'plain error' occurred affecting 'substantial rights,'" which would be an issue the appeals court may take up. "The focus here will likely be on novel substantive and procedural rulings by the court that an appellate court might see as significant," he said. Another possible option would be for Bankman-Fried's appeal attorneys to argue "ineffective assistance of counsel," though Auerbach said this option was "rarely if ever made." Bankman-Fried's team is likely to request an oral argument as well – though really, either party could – and the Court of Appeals must hold a hearing should that happen. "It is unlikely that oral argument will be heard less than nine months from now, since the Court of Appeals will want to fully review the briefs and the record before the hearing," he said. "Once oral argument has been held, the Court can and will take as much time as it needs to reach a thorough and carefully reasoned decision." Stories you may have missed Avi Eisenberg May Testify in $110M Crypto Fraud Trial, Defense Says: While Avraham Eisenberg's attorneys said he may testify in his own defense in the Mango Markets trial, it looks like closing arguments will kick off Wednesday without his testimony. UK to Issue New Crypto, Stablecoin Legislation by July, Minister Says: U.K. Economic Secretary Bim Afolami expects the government to push legislation on stablecoins, staking, exchange and custody services by June or July. Coinbase Seeks to Take Core Question in U.S. SEC Case to Higher Court: Coinbase filed for an interlocutory appeal of the judge's order in its Securities and Exchange Commission case, hoping an appeals court will make a ruling on how securities laws apply to crypto. This week Tuesday 14:00 UTC (10:00 a.m. EDT) The House Financial Services Committee held a hearing on ransomware. Thursday 9:00 UTC (11:00 a.m. CEST) Germany's Federal Financial Supervisory Authority and central bank will hold a joint briefing on the regulation of crypto assets. Elsewhere: (Arkansas Times) Arkansas lawmakers are considering a set of bills that would overturn or restrict a previous law that allowed bitcoin miners to expand in the state, citing concerns about noise pollution and water and electricity usage. (The New York Times) The Times wrote about large language models' data needs. One interesting detail: Google changed its terms of service in a way that might allow it to train its own models on publicly-available material. (TechCrunch) Some ransomware gang tried to exploit a company and blackmail them by calling the front desk. Unfortunately, they got Beth. (CNN) The House of Representatives passed a bill reauthorizing government surveillance tools, after a failed vote earlier last week. (Kansas Reflector) So this was a pretty weird story. Earlier this month the Kansas Reflector published an opinion piece about Meta (formerly Facebook) blocking the promotion of a documentary about climate change. Then, it blocked the piece about the blocking. Then, it blocked all links to the Kansas Reflector. A day later, it blocked two other sites that included the piece, which was critical of Meta. And apparently, an "unrefined artificial intelligence" tool may have been responsible for a domain-level blocking. If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Twitter @nikhileshde. You can also join the group conversation on Telegram. See ya’ll next week! https://www.coindesk.com/policy/2024/04/17/looking-at-sam-bankman-frieds-appeals-process/

2024-04-16 20:32

In the House, Rep. Patrick McHenry recently said he remained optimistic about getting a U.S. stablecoin law passed. Sherrod Brown (D-Ohio), a crypto-skeptic who runs the influential Senate Banking Committee, is open to advancing long-sought legislation for stablecoins, Bloomberg reported Tuesday, citing an interview with him. Brown, according to Bloomberg, said that his concerns would have to be addressed before he would fully get behind a stablecoin law, however. Congress has for years struggled to get any new laws passed for cryptocurrencies, providing greater clarity sought by both critics and proponents of digital assets. Stablecoin legislation may, nonetheless, be the lowest-hanging fruit given that stablecoins strongly resemble other regulated products like money-market funds, and there's a strong incentive to create guardrails since they own important conventional assets like U.S. Treasuries. Brown's reportedly tentative support to advance legislation could be an important sign progress can be achieved. His Democratic Party controls the U.S. Senate and thus sets legislative priorities. Over in the Republican-controlled House, soon-to-retire Rep. Patrick McHenry (R-N.C.) recently said he remains optimistic the U.S. can get a new stablecoin law this year. https://www.coindesk.com/policy/2024/04/16/crypto-skeptic-sen-sherrod-brown-is-open-to-advancing-stablecoin-legislation-bloomberg-reports/

2024-04-16 19:26

Byun, who spent two years as CEO of Okcoin, had built out a global government relations role; Wei Lan was head of product for the exchange. Tim Byun was CEO of U.S. arm Okcoin between 2018 and 2020, and later became head of global government relations at OKX. Wei Lan was head of product and ran the trading desk at the second-largest exchange by volume, according to a person familiar with the setup. Long-term senior OKX executives Tim Byun, who was in charge of global government relations at the world's second-largest cryptocurrency exchange, and Head of Product Wei Lan have both recently left the company, according to people familiar with he matter. For two years, between 2018 and 2020, Byun held the position of CEO at Okcoin, the exchange's U.S. subsidiary, before taking up the government relations role. Wei Lan oversaw much of the trading desk activity at OKX, according to a person familiar with the situation. The exchange group is in the process of consolidating its parts under the single OKX brand, shifting away from having a separate U.S. brand. Other recent departures include OKX Global Compliance Chief Patrick Donegan, who left in January after just six months. OKX declined to comment. Byun and Lan did not respond to requests for comment. https://www.coindesk.com/business/2024/04/16/okx-og-execs-tim-byun-and-wei-lan-leave-crypto-exchange/

2024-04-16 17:49

Bitcoin has pulled back more than 15% since hitting an all-time high one month ago, with some major altcoins nosediving 40%-50%, but "few understand how normal corrections like these are in bull markets," one observer noted. Crypto correction has clobbered investor sentiment, but there are still plenty of reasons to stay bullish on digital assets, analysts say. Leverage wipe-out made the market "much healthier," a K33 analyst said. Bitcoin halving may have positive impact on price with spot BTC ETFs reaching a wider audience, an LMAX Group strategist noted. Stock market weakness could weigh on crypto assets, but drop would be short-lived with other narratives at play, macro analyst Noelle Acheson said. Crypto markets took a sizable gut punch over the weekend, sending investors' sentiment to the basement from euphoric highs only a few weeks ago. Bitcoin (BTC) tumbled below $62,000 on Tuesday, lower by more than 15% from its latest record price above $73,000, while altcoin darlings solana (SOL), pepe coin (PEPE) and dogwifhat {{WIF}} suffered 40%-50% setbacks from recent highs. Despite the sizable drawdown across the board, there are still a handful of reasons to be bullish on digital assets even if prices cool off further or chop sideways for a while. Bitcoin halving effect Bitcoin will undergo its fourth halving later this week, a recurring event in roughly every four years when the newly issued supply of tokens – the rewards for miners – will be cut in half. Historically, bitcoin's price didn't move much around the time of halving, but the event preceded parabolic rallies. "As far as the halving event goes, we’ve been in the camp where we don’t expect there to be much additional upside momentum," said Joel Kruger, a market strategist at LMAX Group, adding that "this is a known event that has been well telegraphed by the market." However, with spot exchange-traded funds (ETF) listed in the U.S. from traditional finance giants like BlackRock and Fidelity starting ramping up their sales machines to financial advisors and wealth managers introducing bitcoin to a broader investor base, this halving might bring some tailwinds for bitcoin's price. "At the same time, we do believe there is some room for a rally when considering this is the first bitcoin halving that will be playing out in front of a much wider audience, now that the bitcoin spot ETFs are up and running," Kruger pointed out. "The halving event could therefore get these investors more excited about bitcoin, as they are forced to take a deeper dive, which could then translate to the desire to take on even more exposure," he added. Eric Balchunas, senior ETF analyst at Bloomberg Intelligence, last week noted BlackRock advertising its bitcoin fund IBIT on financial news outlet Bloomberg's homepage. Defying macro turbulence While momentum on crypto markets faltered over the past weeks, the catalyst that eventually kickstarted to correction last Friday stemmed from macro events. Traditional markets turned jittery on increasing fears of military escalation between Israel and Iran, while bond yields and the U.S. dollar rose sharply as investors priced out rate cut expectations amid strong U.S. economic data and rising concerns of sticky inflation. Noelle Acheson, macro analyst and author of the Crypto Is Macro Now newsletter, pointed out that the earnings yield on the S&P 500 is now below that of both 3-month and the 10-year U.S. Treasuries, which could foreshadow further downside for U.S. equities. The relation should be the other way, to compensate investors for the higher risk in owning stocks rather than bonds, she explained. "If [the stock market] drops sharply, BTC and other crypto assets could get temporarily hit as well," Acheson said. However, "the crypto drop would be short-lived, though, as other ongoing narratives – store of value, halving, currency hedge, new use cases, growing adoption – will encourage accumulation at lower levels," she added. Acheson said that there might be some potential good news on the short-term that would offer relief from rising yields that squeezed risk assets recently, although it's not very likely. "The Federal Reserve could revert to insisting that rate cuts are imminent, which should temper the rise in yields," she said. "I'm not expecting this, but if it happens, risk assets should do well." Leverage wipe out Massive liquidation events on derivatives markets often mark the bottom for asset prices, wiping out excessive leverage and cleansing the market from exuberance. Crypto markets endured one of their most brutal leverage flush, liquidating over $1.5 billion of bullish bets on Friday and Saturday combined. "The market is now much healthier," Vetle Lunde, senior market analyst at K33 Research said. "Both open interest and funding rates have been drastically reduced, reducing the likelihood of liquidation cascades onwards." "This, accompanied by a bitcoin holding firm above $60,000, is a robust signal," Lunde added. The events are reminiscent of last August's action, when BTC plunged from $28,000 to near $24,000 with liquidations nearing $1 billion across all digital assets. Following the largest daily drawdown since the FTX crash, prices hovered in a range for almost two very dull months until October's breakout above $30,000 to much higher prices. Typical bull market pullback With BTC pulling back 16% from its recent all-time high in March, the current drawdown is in line with typical drawdowns of previous bull markets. The 2016-2017 and 2020-2021 bull cycles all had multiple 20%-30% pullbacks before continuing to much higher prices. "Few understand how normal corrections like these are in bull markets," crypto analyst On-Chain College said in an X post. Despite the current nervousness, hedge fund QCP Capital said Tuesday that it continued to see consistent, sizable demand for BTC and ETH calls for longer-term expiries out to March 2025, signaling that market participants still expect higher prices coming. https://www.coindesk.com/markets/2024/04/16/is-the-bitcoin-rally-over-reasons-to-stay-bullish-on-btc-despite-correction/

2024-04-16 16:48

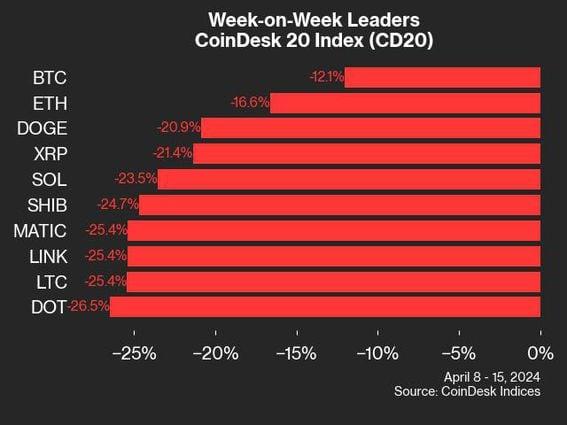

Five cryptos lost more than 30% this week, led by steep declines in Uniswap and Aptos. CoinDesk Indices (CDI) presents its bi-weekly market update, highlighting the performance of leaders and laggards in the benchmark CoinDesk 20 Index (CD20) and the broad CoinDesk Market Index (CMI). All 20 assets in the CoinDesk 20 lost ground over the past week, but Bitcoin (BTC) and ether (ETH) outperformed peers, losing 12.1% and 16.6%, respectively, for the seven days ending on Monday. Uniswap (UNI), filecoin (FIL) and Aptos (APT) bore the brunt of the selloff with losses of more than 35%. Overall, five cryptos fell more than 30% over the last week. Within the broader CMI universe, which contains 187 tradable digital assets, only three tokens outperformed bitcoin over the week. Real-world assets (RWA) platform Ondo Finance's governance token (ONDO) was the only coin with positive returns. CoinDesk 20 tracks top digital assets and is investible on multiple platforms. The broader CMI comprises approximately 180 tokens and seven crypto sectors: currency, smart contract platforms, DeFi, culture & entertainment, computing, and digitization. https://www.coindesk.com/markets/2024/04/16/bitcoin-and-ethereum-show-relative-resilience-amid-widespread-losses-coindesk-indices-market-update/

2024-04-16 16:20

DePIN involves taking real-world infrastructure like a wireless network and running it with a blockchain-powered system. VCs are salivating, but there aren't many customers yet. Venture capitalists have pumped billions into the DePIN sector already, with some dedicating entire funds to DePIN protocols. Although DePIN projects currently have a combined market capitalization of tens of billions of dollars, the industry faces one of the oldest challenges in crypto: relatively few customers. Analysts point out that DePIN projects that have serious potential are ones where demand for the underlying service is clearly identifiable, meaning that the customers already exist. So much of the cryptocurrency industry lives in the ether, figuratively or literally: data moving around blockchains, lines moving up or down on price graphs and other largely intangible things. But a hot emerging trend that has venture capitalists salivating promises a direct tie to the real world: running infrastructure with blockchains. Projects like the Helium protocol, which drives a wireless network with a token-powered ecosystem, or Filecoin's data-storage platform. The not-so-catchy term for all this is decentralized physical infrastructure networks, which usually gets shortened as DePIN. A catchy amount of money has already been invested, a sign venture capital firms see potential. According to a Crypto.com report, the top DePIN projects have raised more than $1 billion combined. "We believe DePIN is a category that has the potential to host a killer app with a billion users," Pranav Kanade, a portfolio manager of VanEck's digital assets alpha fund, said in an interview. "These users would be using public blockchains without necessarily realizing they are interacting with a crypto product." Yet for all the obvious interest from the VC community, DePIN faces one of the oldest challenges in crypto: relatively few customers. DePIN projects collectively have tokens worth tens of billions of dollars. But how much revenue are they, as a group, generating? Something like $15 million a year, said Rob Hadick, a general partner at Dragonfly, a crypto venture capital fund. "Most of the protocols aren't constrained by supply, but by a lack of demand," he said in an interview. Nonetheless, DePIN is quickly shooting up the list of crypto buzzwords. What is DePIN? DePIN projects are blockchain-based and operate physical hardware infrastructure in a decentralized way. They often use token reward systems to incentivize users to help build out their networks. The sector covers a wide range of areas including wireless connectivity, data collection, computing and data storage to name a few. Traditionally, infrastructure like a wireless network is completely centralized; giants like AT&T, Deutsche Telekom or China Mobile are in full control of their telephone networks and their customers pay a fee to use their service, and that's as far as users' clout goes. Helium's DePIN-driven network, on the other hand, is decentralized; members of the public can set up hotspots and get rewarded with HNT tokens for helping run the wireless network. Other DePIN projects have similar community-driven systems. The total market capitalization of all DePIN tokens exceeded $25 billion as of February, according to Crypto.com research. Computing, storage and artificial intelligence accounted for the majority of that. While that is an eye-catching amount, that market cap is not pumped up by a flood of retail investors' money, according to Christopher Newhouse, a decentralized finance, or DeFi, analyst at Cumberland Labs. Instead, DePIN is so far a playground for large institutions and VCs, he added. "This could be a good opportunity to get involved and pick up a few DePIN-related tokens while people aren't watching," Newhouse said in an interview. For retail traders, there are myriad other distractions at the moment – bitcoin (BTC) hitting a record high and meme coins posting huge rallies, to name just two. "There is a very retail-driven frenzy for hot coins," Newhouse said. By comparison, it can be harder to buy DePIN tokens since they're not broadly available on retail-friendly exchanges. Newhouse said he was examining a few liquid DePIN tokens, including Nosana {{NOS}} and Render (RNDR). "But some of the most interesting ones like io.net haven't even launched a token yet." Solana's role Render, io.net and Nosana – which run decentralized computing networks, or platforms to which people can contribute computing resources that others can use – are all built atop the Solana (SOL) blockchain. About 20 DePIN projects are, according to the Solana Foundation. One of the most prominent ones, Helium (HNT), last year abandoned its own blockchain in favor of Solana's. (Despite Solana's own history of outages, it is more reliable and stable than Helium's was, according to Helium blog posts.) Sean Farrell, head of digital asset strategy at FundStrat, many are there because Solana makes it easy for them. "A lot of these DePIN projects would have been required to build on a high-throughput chain with no adoption or to build their own," he said. "Now that Solana has entered the fold as a legit place to build, this has solved the infra problem." One key advantage Solana has over other layer-1 blockchains like Ethereum (ETH): It has the bandwidth to relatively inexpensively handle a high volume of transactions, rather than needing to pass them off to a more-efficient layer-2 blockchain. It's famously expensive and sluggish to do transactions on Ethereum, giving rise to the bundle of layer 2s in its ecosystem; Solana has gone a different route. Hivemapper, a decentralized mapping network that rewards contributors with its native token HONEY, is built on Solana. According to co-founder Ariel Seidman, there were three reasons Hivemapper chose it: low transaction fees, ease-of-use and the quality of the ecosystem. "DePIN tokens become immediately usable in DeFi apps on Solana as opposed to perhaps being built on an L2 and needing to have interop tools to interact with apps on ETH mainnet or other L2s," said Farrell. "I think Helium Mobile has demonstrated how to effectively build both sides of a network," he added. "Supply and demand – I think that's what was missing from" the layer-1 blockchain it had built. "This is a good proof of concept that other projects can build off of," Farrell said. Venture capital interest DePIN projects have attracted a significant amount of attention from venture capital funds. Borderless Capital, for instance, has been investing in projects since 2021 and was an early backer of the Helium network. It runs a dedicated DePIN fund that has done more than 30 investments in the space and has raised money from the likes of Jump, Telefónica and OKX. Borderless Capital noted in their DePIN investment thesis that adoption and usage of these networks (including Helium) are still at very early stages. Borderless told CoinDesk that it is in the process of creating the $100 million DePIN Fund III to support the growing DePIN ecosystems in Solana. "We see a lot of potential in the intersection of Crypto+AI, mobility, mapping, wireless networks and digital resources, where DePIN has a competitive advantage in terms of efficiency that translates into better and cheaper services being built for the end consumer," said David Garcia, managing partner at Borderless. Dragonfly's Rob Hadick thinks that while DePIN interest amongst VCs is here to stay, there is an issue to be tackled with the lack of users on said protocols. "Investors spend a lot of their time imagining how crypto and blockchains will bring about a new financial or social paradigm," Hadick said. "But the hot DePIN projects look and feel more tangible, making it easier to drum up excitement." That said, these projects currently generate very little revenue. "This means that their token mechanisms don't solve the core problem of having to execute traditional go-to-market strategies in very competitive verticals filled with entrenched incumbents," Hadick said, adding that no DePIN project has accumulated a notable number of users. "It's unclear how this momentum sustains until, or if, we see someone buck that trend." Anand Iyer, founder of Canonical Crypto, an early stage VC, said they are seeing the true utility of decentralized hardware come to life as the computing needs for AI surge. "Companies and protocols like Akash Network and Ritual are leading the way here and we expect to see more players leveraging decentralized networks for non-crypto use cases," Iyer said. Risks and challenges According to Strahinja Savic, head of data and analytics at FRNT, DePIN projects pose a higher risk for investors compared to more established investments like exchanges, mining or staking infrastructure. He noted: "Incentivizing the development of physical infrastructure is another level of commitment towards a project." A large proportion of DePIN projects use tokens as a form of reward to incentivize users to crowdsource and build connected real-world physical infrastructure. "The use of tokens with questionable long-term value to incentivize the development of what can at times be costly physical infrastructure can be a tall order," Savic said. "DePIN is higher along the risk curve in a space where risk abounds." Brian Rudick, a strategist at GSR, echoes Savic. While he thinks there will be several DePIN projects that make a breakthrough, the key determinant will be the quality of the product or service provided. "In theory, DePIN projects can pass through their lower infrastructure build costs to customers to spur demand," he said. "However, in practice, the DePIN products or services offered can be of lower quality than incumbent solutions that were optimized over decades, negating this cost advantage." AI-related DePIN projects like Render, as well as decentralized cloud marketplaces like Akash, are ones to watch, according to Rudick. A Crypto.com report also points out that price volatility could pose a challenge for DePIN projects. Most rewards for DePIN networks are paid out in the platform's own token, which means price fluctuation in these tokens could impact the earnings for contributors over time, the report said. "Major volatility may discourage ongoing involvement if rewards are seen as an unreliable revenue stream," said the report. Most DePIN projects follow the burn and mint equilibrium model, a format that requires both supply and demand to work. The model uses a two-token system: contributors earn tokens and consumers burn tokens upon using them for payments – sustaining an economic equilibrium. Pranav at VanEck's digital assets liquid fund splits a DePIN's project likelihood of success into two categories. The first: projects that take the "build and they will come" approach. These need to scale the supply side of a network with token incentives, which inflates the token supply. "Only if the supply of that service reaches a critical scale can the demand side be addressed. These projects tend to be highly speculative, and in many cases, the demand doesn't exist, making it difficult to find users," said Pranav. He said he doesn't believe this bucket of DePIN projects will succeed in the long-run, as the demand (token burn) is unclear, and the token supply schedule ends up being ever-inflating. Projects that do have potential, according to Pranav, are ones where demand for the underlying service is clearly identifiable, meaning that the customers already exist. The end goal of these types of protocols is usership that will be using public blockchains without actually realizing they are interacting with a crypto product, according to Pranav. "This approach would allow the DePIN project to build an economic moat against its legacy centralized competitors," Pranav explains. "We believe these projects have a higher likelihood of success, as they can balance token supply and demand much earlier in the lifecycle of the token's existence." CORRECTION (April 16, 2024, 16:58 UTC): Corrects the names of the firms that have invested in Borderless Capital's DePIN fund and also fixes the name of the fund. https://www.coindesk.com/markets/2024/04/16/depin-is-venture-capitalists-latest-crypto-obsession-can-it-match-the-hype/