2024-04-15 06:44

Increases in trading volume, coupled with market depth, for DOGE and SHIB suggests meme tokens, often criticized for lacking utility, are here to stay, according to FalconX. Top meme coins like DOGE, SHIB, WIF, PEPE and others have taken a bigger hit than bitcoin in the past seven days. Still, the market for meme coins appears more liquid than early this year, a sign meme coins are more than a passing trend. The meme coin frenzy may have slightly subsided with bitcoin (BTC), the industry leader, losing upside momentum. Still, markets for top meme coins remain more liquid than early this year, a sign that the supposedly nonserious cryptocurrencies, which are often criticized for lacking utility, are here to stay. Over the past week, top meme coins like DOGE, SHIB, WIF, PEPE, FLOKI, and BONK have dropped in value, ranging from 19% to 27%, registering bigger losses than bitcoin, CoinDesk data show. The leading cryptocurrency by market value has declined 6% as escalating geopolitical tensions in the Middle East have spurred an outflow of money from risk assets and into safe havens like gold. The price pullbacks have led to a decline in trading volumes. According to data tracked by institutional crypto exchange FalconX, the average daily trading volume in the leading meme coins has cooled to $3 billion from $5.8 billion in March. However, it remains significantly higher than $500 million daily in January. More importantly, the 1% market depth, a measure of liquidity to gauge how easy it is to execute large orders at stable prices, remains resilient. Per FalconX, the 1% market depth for DOGE, the world’s biggest meme coin by market value, was $10 million on Friday, the highest in at least a year. Meanwhile, the market depth for the second largest meme token, SHIB, was $4 million. In other words, buy/sell orders worth $10 million and $4 million are needed to move the price of DOGE and SHIB, respectively, by 1%. The 1% market depth represents a collection of buy and sell offers within 1% of the mid-price or the average of the bid and ask prices. “These levels are very respectable for alts [altcoins] liquidity. For reference, SOL has a market depth of roughly $20 million. Such increases [in] volumes coupled with market depth are not that common and have traditionally happened to assets believed to have staying power, such as SOL recently,” FalconX said in the weekly newsletter. “All in, if the price and volume trends show a tired market in the short term, market depth is showing that meme coins could have more staying power than some expect,” FalconX added. https://www.coindesk.com/markets/2024/04/15/sticky-liquidity-in-doge-and-shib-suggests-meme-tokens-have-staying-power/

2024-04-15 05:38

The market has shaken off concerns of escalations between Iran and Israel as the U.S. appears to have talked Israel out of a counter-attack. BTC is back above $65,000 as geopolitical volatility subsides. Traders are also anticipating the approval of BTC ETFs in Hong Kong, which is expected later Monday or this week. Bitcoin (BTC) is trading above $65,000, while ether (ETH) is back above $3100 as market volatility has calmed after Iran launched a massive drone and missile attack against Israel that was mostly thwarted by air defense systems. Bitcoin dropped below $62,000 over the weekend as geopolitical tension shook the markets. However, tension seems to have subsided, and this conflict will not escalate further as the U.S. has ruled out joining an Israeli counter-attack on Iran, according to Al-Jazeera. Traders on Polymarket give a 4% chance of Israeli military action against Iran by April 15. This is down from nearly 57% in the immediate hours after Iran’s missile attack. At the height of the tensions, PAXG, a tokenized gold digital asset created by Paxos, was trading at a 20% premium over its analog counterpart as crypto traders fled risk assets for the safety of the yellow metal. Before the tension kicked off, the digital asset market had already been under immense selling pressure because of U.S. tax season, which also occurs in the run-up to the halving. “Given that the halving occurs at a time when dollar liquidity is tighter than usual, it will add propellant to a raging firesale of crypto assets,” Arthur Hayes wrote in a blog post on the topic. Traders are also anticipating the launch of bitcoin and perhaps ether ETFs in Hong Kong this week, giving traders in China easier access to digital assets exposure. Matrixport estimates that these ETFs could unlock up to $25 billion in demand. https://www.coindesk.com/markets/2024/04/15/bitcoin-back-in-green-as-crypto-market-awaits-hong-kong-spot-etf-decision/

2024-04-14 17:46

Bitcoin traded at a perfect negative correlation to PAXG in a sign of weak demand as a geopolitical hedge, according to one observer. PAXG spiked as high as $2,923 on Saturday, trading at premium of over 20% to gold's per ounce price of $2,342.90 on Friday. Bitcoin traded at a perfect negative correlation to PAXG in a sign of weak demand as a geopolitical hedge. Prices for PAX Gold (PAXG), a gold-backed digital asset created by Paxos, surged over the weekend as escalating geopolitical tensions in the Middle East catalyzed demand for haven assets. PAXG rose as high as $2,923 on Saturday, trading at a premium of over 20% to the yellow metal's per-ounce price of $2,342.90 at Friday's New York close, CoinDesk data show. As of writing, PAXG still drew a notable premium, trading at $2,471. Meanwhile, bitcoin and other major cryptocurrencies traded under pressure as Iran fired explosives at Israel in retaliation for a suspected Israeli attack on its consulate in Syria on April 1. On Sunday, Iran warned Israel and the United States of a much larger response after Tel Aviv said it would respond to Iran's retaliatory aggression. With a market capitalization of over $446 million, PAXG is the world's second-largest tokenized gold coin. Leading the pack is tether gold (XAUT) with a market capitalization of $581.9 million. PAXG's weekend surge did not spill over into XAUT and other gold tokens. "Geopolitical events create price movements; it is not simple or straightforward to know what the price of gold should be at any given moment," Paxos' spokesperson told CoinDesk in an email. "In addition, the main spot gold markets are only open from Sunday at 6pm until Friday early afternoon. When events occur globally over the weekend, the price of gold could not be referenced against the main spot market because it is closed. Gold has been very volatile recently and even on Friday, gold traded in a $100 range, which is virtually unprecedented," spokesperson added. Gold has surged over 8% in four weeks, while bitcoin has declined by 10%. On Friday, analysts at Goldman Sachs raised its year-end price forecast for gold to $2,700 from $2,300, saying that momentum and retail investors haven't yet piled into the yellow metal. Leading indicator Several traditional market participants closely followed PAG's spike and BTC's slide over the weekend, wondering if the classic risk-off action in the 24/7 crypto market was a sign of things to come in stocks on Monday. "And so now everyone who isn't involved in crypto is watching BTC to gauge the market impact of war cuz it's the only thing that's open when drones fly," Andy Constan, founder of macroeconomic research firm Damped Spring, said on X. Former Bridgewater Executive and CIO of Unlimited Funds Bob Elliot said BTC's perfect negative correlation with PAXG over the weekend dented the leading digital asset's appeal as a geopolitical hedge. "Bitcoin may be many things, but it is not a geopolitical hedge. This weekend was another good empirical test. BTC traded with a near-perfect negative correlation over the last day to PAXG, a gold-backed token. If anything it's becoming an even worse hedge over time," Elliot said on X. April 15, 4:17 UTC: Adds comments from Paxos. https://www.coindesk.com/markets/2024/04/14/gold-backed-paxg-token-spikes-to-29k-amid-geopolitical-tensions/

2024-04-13 22:49

Other major cryptocurrencies saw similar declines. Bitcoin (BTC) and the broader cryptocurrency market fell nearly 10% on Saturday, with the price of the largest digital asset briefly falling below $62,000 before recovering to around $64,000 as of press time. It wasn't alone: other major digital assets saw similar falls over the past 24 hours, including ether (ETH), which fell 7% to just under $3,000, BNB (BNB) (down 9%) and solana (SOL) (down 12%), according to CoinGecko. Trading volume has risen over that same time period. The decentralized finance (DeFi) sector has been hit particularly hard as a result of the market chaos, with depressed prices forcing liquidations and raising the potential of havoc for some protocols. Among the protocols being closely watched is Ethena, the buzzy Ethereum project behind USDe, a "synthetic dollar" built to mirror the price of the US dollar. Ethena has attracted more than $2 billion in deposits, but it uses a controversial method for maintaining USDe's one-dollar "peg" that hasn't been tested under such adverse market conditions. The immediate cause of Saturday's market declines was not clear, though former BitMEX CEO Arthur Hayes wrote in a blog post last week that dollar liquidity would drop right before tax payments are due in the U.S. on April 15 – this coming Monday. Lower liquidity would lead to lower prices, he said. The declines also came as Iran launched drone and missile strikes against Israel, in what the Iranian government said was retaliation for an airstrike on its consulate in Damascus, Syria that it attributed to Israel. Crypto market prices began to recover after the X (formerly Twitter) account associated with Iran's Permanent Mission to the United Nations said "the matter can be deemed concluded," though it warned of a "considerably more severe" attack "should the Israeli regime make another mistake." https://www.coindesk.com/markets/2024/04/13/bitcoin-falls-8-drops-below-62k-before-rebound/

2024-04-12 19:10

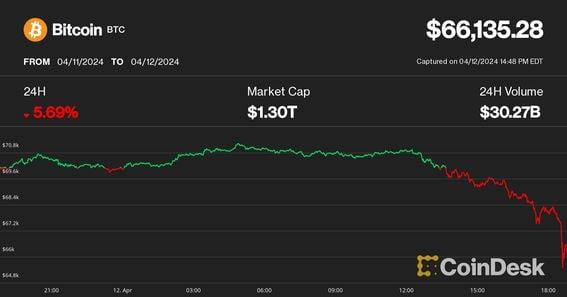

Looking beyond today's decline, investors may expect continued market weakness due to the tax season, Ryze Labs said in a report. Cryptocurrencies tumbled Friday as risk-off sentiment in traditional markets amid flared-up geopolitical risks spread over to digital assets. In fast downward afternoon action during U.S. trading, bitcoin (BTC) plunged below $66,000 after having challenged the $71,000 level just hours earlier. At press time, bitcoin had bounced back to $66,700, down more than 5% over the past 24 hours. Ether (ETH), the second-largest cryptocurrency by market cap, fell as much as 12% to $3,100 before a modest bounce cut the decline to 8%. Smaller cryptos suffered even heavier losses in the panicky action. The broad-market CoinDesk 20 Index (CD20) dropped nearly 10%, with Cardano's ADA, Avalanche's AVAX, bitcoin cash (BCH), filecoin (FIL) and aptos (APT) plummeting 15-20%. The drawdown triggered the largest leverage washout in a month, liquidating some $850 million of leveraged derivatives trading positions across all digital assets, CoinGlass data shows. Some $770 million of those positions were longs betting on rising prices, caught off-guard by the sudden decline. The dip occurred as stock markets sank during the U.S trading session amid rising fears of broadening conflict in the Middle East, as U.S. authorities warned that Iran could prepare to launch a significant attack on Israel. Treasury bonds and the U.S. dollar index (DXY) surged as traders flocked to hedges, while key U.S. equity indices the S&P500 and Nasdaq 100 slipped 1.7% an hour ahead of the close of the trading session. Gold, long considered as a haven asset, surged past $2,400 to a new all-time high before paring its gains, while oil ticked 1% higher. Digital asset investment firm Ryze Labs, formerly Sino Global Capital, said in a Friday commentary to anticipate some "short-term market softness" for crypto assets due to the upcoming tax season. However, it maintained a more constructive long-term outlook, expecting relief for the asset class as policymakers will slow quantitative tightening and potentially adjust monetary policy to facilitate U.S. government debt rollovers. https://www.coindesk.com/markets/2024/04/12/bitcoin-plunges-to-66k-altcoins-tumble-10-15-on-ugly-day-for-risk-assets/

2024-04-12 18:39

The famously pre-planned, programmatic event, currently predicted for April 19, is surprisingly hard to predict at minute scales. The Bitcoin network halving is fast approaching, likely to fall in seven days (April 19), according to the most recent estimates. But trying to pin down the exact minute or even hour for this pre-planned, programmatic update is surprisingly unpredictable. Just take a look at any of the Bitcoin halving countdowns online: they’re all out of sync! Watcher Guru, for instance, shows the halving will strike in seven days, seven hours and 20 minutes, while CoinMarketCap says it will happen two hours later. The “Bitcoin Block Reward Halving Countdown” says it’ll be in seven days and 15 hours. While these estimations are all generally aligned, for someone looking to trade on the halving may be a bit frustrated. The Bitcoin halving is scheduled to occur every 210,000 blocks, or roughly every four years. This particular event will be executed automatically by the network at exactly blockheight 840,000. Based on the way Bitcoin’s creator Satoshi Nakamoto designed the system, bitcoin miners “find” the next block to hash to the blockchain every 10 minutes, meaning it should be easy to figure out precisely when the next halving should happen down to the minute. In practice, however, things are a bit messier. “Calculating the time to bitcoin halving has three important elements: The current block height, the block at which the next halving occurs and the average block time,” according to Simon Cousaert, director of data at The Block Research (which currently predicts the halving will fall in seven days, 15 hours and 40 minutes). “Since the second element, the target block, is a constant, the accuracy of the countdown depends on the current block height and the average block time,” he said. Likewise for counting the current block height, which should be easy data to fetch. Where the discrepancy likely comes in is how different halving calculators are counting the time between blocks. Again, theoretically the time to mine a block should be even 10 minutes, by design. But the amount of miners directing computational power to mine and secure the Bitcoin blockchain is not static, meaning that that figure can fluctuate. “The average block time is harder to estimate accurately,” Cousaert said. “One can take a simple constant, and assume that every block takes 10 minutes to be mined.” But what halving calculators are likely doing is taking “the rolling average block time” over some time scale, whether it’s over the past 100, 90 or 30 days (or any other arbitrary period of time). “This does not necessarily lead to a more accurate prediction, because the average of the last days does not necessarily predict the average for the next few days,” Cousaert added. NiceHash lead mining manager Marko Tarman echoed this point saying that everyone in the world has the same access to some “static” data regarding Bitcoin: the halving block height. However, there are two other “dynamic pieces of information,” the current block height and block time. “It's important to note that block times can fluctuate considerably,” Taman said. “If the average block times are shorter than 10 minutes, the predicted halving event will appear to be sooner. Conversely, if the average block times exceed 10 minutes, the halving event will seem to be delayed.” In other words, counting down to the halving — an event not only known in advance, but actively anticipated to the point that people argue over whether it is “priced in” — is more of an art than a science. “While this detail may not be critical when observing the countdown a year in advance, accuracy becomes increasingly important as the event approaches,” Tarman said. https://www.coindesk.com/consensus-magazine/2024/04/12/why-bitcoin-halving-calculators-are-out-of-sync/