2024-04-12 18:05

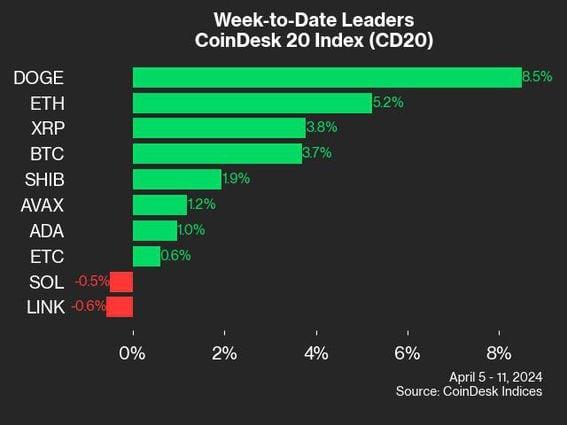

Bitcoin and ether are also among this week's leaders, while Uniswap lags. CoinDesk Indices (CDI) presents its bi-weekly market update, highlighting the performance of leaders and laggards in the benchmark CoinDesk 20 Index (CD20) and the broad CoinDesk Market Index (CMI). Dogecoin (DOGE) led the CoinDesk 20 this week, climbing 5.4% and topping $0.20 at one point before pulling back. This is still far below the meme coin’s all-time high of $0.58 in May of 2021. Only five assets in the index closed yesterday above their levels of one week ago. Despite sizable losses on Friday, bitcoin (BTC) and ether (ETH) were among them. Uniswap (UNI) noticeably lagged this week, falling 19% as the DeFi exchange received an enforcement notice from the SEC. Layer 1s Aptos (APT) and Internet Computer (ICP) were among the worst performers as well. CoinDesk 20 tracks top digital assets and is investible on multiple platforms. The broader CMI comprises approximately 180 tokens and seven crypto sectors: currency, smart contract platforms, DeFi, culture & entertainment, computing, and digitization. https://www.coindesk.com/markets/2024/04/12/dogecoin-climbs-54-tops-coindesk-20-this-week-coindesk-indices-market-update/

2024-04-12 15:53

Shakeeb Ahmed stole over $12 million from Nirvana Finance and a DEX thought to be Crema Finance. Shakeeb Ahmed, a security engineer who stole over $12 million from two different decentralized cryptocurrency exchanges (DEXs) built on Solana, was sentenced to three years in prison and three years of supervised release by a federal judge on Friday. Ahmed was arrested last year on wire fraud and money laundering charges, after federal officials alleged he stole $9 million from a DEX built on Solana – which appears to be Crema Finance. He pleaded guilty to one count of computer fraud in December. He will also forfeit $12.3 million and pay $5 million in restitution as part of his sentence. Prosecutors asked for a four-year sentence, noting that the statutory maximum was five years but Ahmed had accepted responsibility by pleading guilty and surrendering the proceeds of the hacks and therefore warranted "a slightly below Guidelines variance," according to a sentencing memo filed last week. Ahmed's defense team argued for no prison time, saying that in addition to his acceptance of responsibility, he had voluntarily disclosed his hack of Nirvana Finance to prosecutors. "Shakeeb already had been indicted for the Crypto Exchange hack, and the government had offered Shakeeb a deal to plead guilty to that hack," the defense filing said. "Although Shakeeb knew that disclosing another hack would result in additional consequences, and could take his favorable plea deal off of the table, Shakeeb voluntarily came forward anyway." In a statement, U.S. Attorney Damian Williams said Ahmed's guilty plea was "the first ever conviction for the hack of a smart contract." "No matter how novel or sophisticated the hack, this Office and our law enforcement partners are committed to following the money and bringing hackers to justice. And as today’s sentence shows, time in prison – and forfeiture of all the stolen crypto – is the inevitable consequence of such destructive hacks," he said. https://www.coindesk.com/policy/2024/04/12/hacker-sentenced-to-3-years-in-prison-for-stealing-over-12m-from-crypto-exchanges/

2024-04-12 11:56

Expectations for Hong Kong to approve the ETF products are seen as one of the biggest market-moving events for the cryptocurrencies in the near term. Hong Kong may approve spot bitcoin and ether ETFs as soon as Friday, with possible trading by the end of the month, Bloomberg reported, citing sources. The approval timeline isn’t fixed and could be changed at the last minute, the sources said. Hong Kong could approve spot bitcoin (BTC) and ether (ETH) exchange-traded funds as early as Monday, Bloomberg reported, citing two people familiar with the matter. If listing details are worked out in time with Hong Kong Exchanges & Clearing (HKEX), the products could be launched by the end of the month, the report said. Harvest Global Investments, a major asset-management company in China, which was reportedly the first to apply for a spot bitcoin exchange-traded fund (ETF), and a product by Bosera Asset Management (International) Co. and HashKey Capital, could be the first to get approvals. The approval timeline isn’t fixed and remains subject to last-minute changes, the people said. Hong Kong's approval of the ETF products is seen as one of the biggest market-moving events for cryptocurrencies and could establish Hong Kong as Asia's leading digital asset hub. While the U.S. approved spot-bitcoin ETFs in January, leading to a record price rally that has seen bitcoin hitting $73K, it hasn't yet approved ether ETFs. In fact, expectations are muted for the U.S. to approve spot-ether ETF products. Hong Kong's Securities and Futures Commission (SFC), the city's market regulator, declined to comment. Harvest Global Investments, Bosera Asset Management, Hashkey and HKEX, didn't immediately respond to CoinDesk's requests for comment sent after business hours on Friday. https://www.coindesk.com/policy/2024/04/12/hong-kong-could-approve-spot-bitcoin-ether-etfs-as-early-as-monday-bloomberg/

2024-04-12 11:21

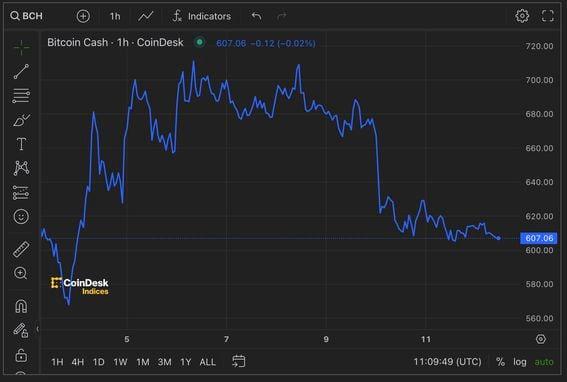

Bitcoin cash has been seen a proxy for the upcoming halving of rewards on the Bitcoin blockchain. BCH's post-halving slide of 15% might be a warning sign for bitcoin bulls. Bitcoin cash has been seen a proxy for the upcoming halving of rewards on the Bitcoin blockchain. Bitcoin's blockchain will halve rewards on April 20. Bitcoin's fourth mining reward halving, a programmed 50% reduction in the pace of supply expansion, is just eight days away. This event, scheduled to happen every four years, has historically presaged multi-month bull runs. However, ahead of the pivotal event, bitcoin's (BTC) offshoot bitcoin cash (BCH) is flashing a warning, asking traders to reassess expectations for an immediate post-halving price rise. The rally in BCH, a cryptocurrency created in 2017 from the hard fork of the original Bitcoin blockchain, ran out of steam above $715 one day after its parent blockchain halved per block coin emission to 3.125 BCH on April 4. Since then, BCH's prices have declined 15% to $604, CoinDesk data show. The notional open interest or the dollar value locked in the number of active perpetual futures tied to BCH has collapsed 70% to $376 million in seven days, according to CoinGecko. Meanwhile, the annualized perpetual funding rates across major exchanges turned negative early this week, indicating an unwinding of bullish bets. Negative funding rates mean perpetuals trade at a discount to the underlying asset's spot price. According to algorithmic trading firm Wintermute, BCH has been seen as a proxy for BTC's impending halving, meaning the leading cryptocurrency could face selling pressure after April 20. "Over the last month, fast money has been seen in BCH - potentially trading the coin as a proxy for the upcoming Bitcoin halving; an interesting move in funding rates as perps currently trade under spot," Wintermute said in a weekly newsletter shared with CoinDesk. Several analysts have warned that BTC has already priced in the impending slowdown in the pace of supply expansion and could drop in a classic "sell the news" type move following the halving. Investment banking giant JPMorgan expects a sell-off to $42,000 once the halving hype subsides. Bitcoin changed hands at $70,700 at press time, representing a 67% year-to-date gain, CoinDesk data shows. Prices recently surpassed the 2021 peak, reaching fresh record highs above $73,000 well before halving. Historically, new highs have come months after halving. According to 10X Research, post-halving miner sales could make it more difficult for bulls to push prices higher in the upcoming summer months. "Based on our calculations, miners will potentially liquidate $5 billion worth of BTC after the halving. The overhang from this selling could last four to six months, explaining why bitcoin might go sideways for the next few months – as it has done in the past," Markus Thielen, founder of 10X Research, said. Bitcoin miners are entities that solve complex mathematical problems to verify transactions and add new blocks to the blockchain in return for rewards paid in BTC. The impending halving is set to reduce their per-block reward by 50%. https://www.coindesk.com/markets/2024/04/12/bitcoin-cash-sends-bitcoin-traders-warning-sign-about-halving/

2024-04-12 08:30

Ordinals and Runes are both projects by long-time Bitcoin developer Casey Rodarmor, which has created trust and lent an idea of authenticity among users. Hype surrounding the upcoming Runes protocol saw Bitcoin meme coin PUPS jump some 50% in the past 24 hours as traders look to bet on Bitcoin-adjacent tokens and networks ahead of the halving. The meme coin was trading over $66 as of Asian afternoon hours with a $516 million market capitalization, making it the third-largest Bitcoin-based token behind ordi (ORDI) and sats (SATS). PUPS led global sales and volumes among all NFT collections, Cryptoslam data shows, with over $11 million in volumes. Uncategorized Bitcoin Ordinals collections and NodeMonkes were next with $7 million and $1 million in volumes – continuing a trend of interest in Bitcoin NFTs from earlier this week. PUPS has rocketed over 1,000% in the past week, data shows, and was widely considered the “first” meme coin on Bitcoin – helping fuel virality and interest. Developers on Friday denied the claim. PUPS is currently offered as an Ordinals token but intends to shift to the upcoming Runes protocol after the halving. Traders on social media platform X are hyping up Runes as the sector to look forward to, following a frenzy in the Solana and Base ecosystems. What is Bitcoin Runes? The upcoming Runes protocol is expected to go live after Bitcoin's halving. It will take the Ordinals protocol a step ahead by making transactions even more cheaper and faster – and traders say it’s a sector to watch for in the coming weeks. Ordinals are a way to embed data into the Bitcoin blockchain by inscribing references to digital art into small Bitcoin-based transactions. Runes takes this concept further by utilizing a UTXO (Unspent Transaction Output) protocol to generate transactions. This allows tokens to create, name, and transfer digital commodities only using the Bitcoin network. UTXO is a technical term for the small amount of tokens that may remain after a cryptocurrency transaction. Ordinals and Runes are both projects by long-time Bitcoin developer Casey Rodarmor, which has created trust and lent an idea of authenticity among users. Rodarmor said in an X post earlier in April that the protocol is designed for “degens and meme coins,” fuelling hype among meme coin traders. “Runes were built for degens and memecoins, but the protocol is simple, efficient, and secure. It is a legitimate competitor to Taproot Assets and RGB,” he said. The ordinals library provides everything needed to encode and decode runestones, so integration should be straightforward.” “I'm highly skeptical of "serious" tokens, but runes are without a doubt a "serious" token protocol,” Rodarmor added at the time. https://www.coindesk.com/markets/2024/04/12/bitcoin-meme-coin-pups-fuelled-by-hype-ahead-of-runes-release/

2024-04-12 08:00

Under its deal with RedStone, Ether.Fi will dedicate $500 million to help secure RedStone's data oracles, which are used to pass information between blockchains and the outside world. RedStone Oracles, which provides data feeds for blockchains, is among a growing field of "actively validated services" (AVSs) waiting to tap into EigenLayer, the buzzy new "restaking" protocol that lets upstart networks borrow Ethereum's security. On Friday, RedStone announced that it had sealed a $500 million deal with Ether.Fi, the largest liquid restaking service on EigenLayer, to help power its oracle protocol. EigenLayer deployed a limited version of its service to Ethereum's mainnet earlier this week, boasting more than $12 billion in user deposits – many of them from liquid restaking middlemen like Ether.Fi that aim to make the deposit process easier (and more lucrative) for end-users. The billions of dollars in restaked deposits are set to play a lead role in the EigenLayer's "pooled security" system, which lets operators "delegate" their stake to help power specific AVSs. Under its deal with RedStone, Ether.Fi will dedicate $500 million to help secure RedStone's data oracles, which are used to pass information between blockchains and the outside world. "A subset of over 20,000 node operators from Ether.fi will manage RedStone's Actively Validated Service (AVS) and employ Ether.fi’s native liquid restaking token - eETH," the companies said in a joint statement, "The restaked Ether will serve as a safeguard against both liveness failures and crypto-economic attacks within the network of RedStone's node providers." Liquid restaking services funnel user deposits into EigenLayer and offer extra rewards on top, along with tradeable "liquid restaking tokens" that represent a user's underlying investment. Ether.fi has $3.8 billion locked up with EigenLayer – assets that will eventually help power the pooled security system. In return for deposits, Ether.fi grants users a derivative token, Ether.Fi ETH (eETH), which earns interest and can be traded in decentralized finance (DeFi). Redstone isn't the first AVS to make a deal with Ether.fi. A similar agreement was announced in March, with Ether.Fi committing $600 million worth of its stake to Omni, an AVS network designed to help layer 2 rollups communicate with each other. EigenLayer's has racked up over $15 billion in deposits in total, but the version live on Ethereum's mainnet is still lacking several core features. The only AVS that has been allowed to deploy onto the network so far has been EigenDA, a data availability service from Eigen Labs, the team behind EigenLayer. AVS networks like Redstone Oracles are allowed to "register" with EigenLayer but will not be allowed to deploy onto the service until some time later this year, according to estimates from Eigen Labs. https://www.coindesk.com/tech/2024/04/12/etherfi-inks-500m-restaking-deal-with-redstone-oracles/