2024-04-11 09:58

Stablecoins boost demand for U.S. Treasury notes, Howard Lutnick, the CEO of Tether custodian Cantor Fitzgerald, said. Stablecoins boost demand for U.S. Treasury notes, said Howard Lutnick, the CEO of Tether custodian Cantor Fitzgerald. Lutnick says China may see a potential digital dollar as a spy wallet. One of the long-running debates in the crypto market is whether U.S. dollar stablecoins – cryptocurrencies whose value is pegged to the currency – strengthen the greenback's global dominance. According to Cantor Fitzgerald's CEO, they do and are beneficial to the world's largest economy. "Dollar hegemony is fundamental to the United States of America," Howard Lutnick said during a Chainalysis Conference on Wednesday, according to Bloomberg. "It matters to us, to our economy. That's why I'm a fan of properly backed stablecoins, Tether and Circle." Stablecoins are "fundamental for the U.S. economy, driving demand for U.S. Treasury notes and do not pose a systemic risk to the world," he said. The dollar's power in the global economy supposedly allows the U.S. to run large deficits, borrow at lower rates than other countries and impose crippling sanctions on enemy nations. Cantor Fitzgerald is a custodian for Tether Holdings, the issuer of the world's largest stablecoin, tether (USDT). As of writing, USDT boasted a market cap of $107 billion, while second-ranked Circle's USDC had a market value of $32.25 billion, according to CoinGecko. Crypto traders widely use stablecoins as funding currencies in the spot market and as collateral in derivatives trading. The cryptocurrencies also served as a haven during the 2022 Federal Reserve tightening cycle. Investor confidence in stablecoins took a hit after Terra's algorithmic stablecoin, UST, collapsed in May 2022. Tether, however, passed the stress test, honoring redemptions amid lingering skepticism about the reserves that backed it. In January, Lutnick confirmed that Tether had the money to back USDT. Lutnick, however, is not a fan of central bank digital currencies (CBDCs) and said Wednesday that China may view a potential digital dollar as an American spy wallet. "My fear is that central banks would like to issue a central bank digital currency, that makes sense right?" he said. "But the problem is what will China think, they will define it as the American spy wallet." Lutnick said real-world assets like bonds could be tokenized and traded on the blockchain over the next 10 years once the technology becomes fast and cheap enough. https://www.coindesk.com/markets/2024/04/11/stablecoins-are-beneficial-to-us-economy-tethers-custodian-says/

2024-04-11 09:01

The halving, due on April 20, will reduce the per-block bitcoin emission to 3.12 BTC from 6.25 BTC, slowing the pace of supply expansion by 50%. Bitcoin options show expectations for pre-halving price weakness and a bullish bias following the pivotal quadrennial event. The long-term outlook depends more on macro factors than halving, analysts said. Options market shows expectations for a price rally into six figures by December. The bitcoin (BTC) options market, historically a reliable indicator of sentiment, is showing investors expect weakness in the run-up to the mining-reward halving due April 20 followed by a rally after the event, which reduces the pace of new bitcoin creation by cutting the per-block coin emission to 3.125 BTC from 6.25 BTC. The world's largest cryptocurrency by market cap is currently trading about $71,000. Put options at strike prices of $61,000 and $60,000 listed on derivatives exchange Deribit have the highest build-up, respectively, of open interest among options expiring a week before and a day before halving, according to data tracked by Amberdata. Put options are derivative contracts that give the purchaser the right, but not the obligation, to sell the underlying asset at the specified price at a later date. A put buyer is implicitly bearish on the market, looking to profit from or hedge against a price slide. Open interest refers to the number of active or open contracts at a given time. The chart shows open interest distribution in options expiring on April 19, a day before halving is expected. At press time, open interest in the $60,000 put was 1,000 contracts or $70.90 million, the highest in the expiry. On Deribit, one options contract represents one BTC. The temporary pre-halving nervousness is consistent with analysts' view that prices may wobble around the halving time. Meanwhile, open interest in options expiring on April 26 – about a week after the halving – was more evenly distributed, with calls or bullish bets at $70,000 and $80,000 more popular than others. A call buyer is implicitly bullish on the market. "Right ahead of the halving, you have notable open interest in the $60,000 put expiring a day before the event, whereas month-end is a bit more spread out," Simranjeet Singh, a trader at the crypto trading firm and liquidity provider GSR, told CoinDesk. "I guess some traders may want to fade the move in the short term, similar to the ETF event, until we reach a nice consolidation level for another leg higher." Singh said the next leg higher partly depends on the U.S. interest-rate outlook and political developments. Bitcoin saw a brief drop to $67,600 on Wednesday after hotter-than-expected U.S. inflation data saw traders push back the timing of the first Fed rate cut to November from June. The losses were short-lived, with prices rebounding early Thursday as the rate cut remains on the table, though delayed. "The newly found 'Fed put' remains in place though, with the Fed focused on both risks to inflation and employment, rather than on inflation alone," trader and analyst Alex Kruger said on X. The "Fed put" is a notion that the central bank will come to the rescue if the economy or markets falter. Trader Christopher Newhouse said bitcoin options expiring after May will be affected more by the macroeconomic environment and organic demand than the halving. The large concentration of open interest in the $100,000 December expiry and the $200,000 March 2025 expiry calls shows expectations that macro factors would continue to act as a tailwind. As of writing, the December expiry call at $100,000 had a notional open interest of $226 million, while the open interest in the March expiry call at $200,000 was $70.7 million. https://www.coindesk.com/markets/2024/04/11/heres-what-the-bitcoin-options-market-says-about-halving/

2024-04-11 08:38

“There exists a large, untapped pool of capital within the Bitcoin ecosystem that remains dormant,” Wintermute’s OTC desk told CoinDesk. Bitcoin’s halving event could increase bets on related networks and ecosystem tokens, with traders expecting tokens such as STX, RUNE, and ORDI to rise. Bitcoin-based meme coins, NFTs, and Ordinals could form part of a “barbell strategy” comprised of both technical and non-serious projects, some traders say. Bitcoin’s (BTC) much anticipated halving event later this month could see a flurry of bets on related networks and ecosystem tokens, with traders expecting upside on both technical and meme coin projects. Halving reduces the rate at which new coins are created and lowers the available new supply. The current block reward is 6.25 BTC, and it will drop to 3.125 BTC after the halving. This event has historically preceded a bull market for the token. Crypto traders say participants seek a “reason to buy” as money narratives continuously shift in the current bullish environment and they may turn their focus on the bitcoin ecosystem in the coming weeks. “There exists a large, untapped pool of capital within the Bitcoin ecosystem that remains dormant, and surprisingly few listed assets that traders can use to gain exposure to the narrative,” the OTC desk of trading firm Wintermute told CoinDesk over email. “Should capital begin to rotate into the Bitcoin ecosystem, tokens like $RUNE, $STX, and $ORDI could benefit significantly and outperform,” they added. THORChain’s RUNE and Stack’s STX have been among the top-performing tokens in the past year, CoinGecko data shows, tracking a bitcoin rise. Meme coin ordi (ORDI) – a nod to the Ordinals protocol on Bitcoin – has surged over 2,500% since its September issuance. Meanwhile, Bartosz Lipinski is the founder of the crypto trading platform Cube.Exchange said in an email that meme coins and the upcoming Runes protocol could rile up risky bets in the bitcoin ecosystem. “Ethereum’s high costs and significant network congestion will cause it to take a backseat as Bitcoin-based projects, like Rune, will redirect meme coin hype to the Bitcoin ecosystem because of the novelty,” Lipinski said. “The BRC-20 (Ordinals NFT) standard is likely to be overtaken by Runes, which is expected to launch on the day of the halving.” “Runes will aim to replace the standard with fungible tokens, which will enable the efficient creation of meme coins to compete with projects on Base and Solana,” he added, referring to the ongoing frenzy for non-serious tokens in the two ecosystems. Ordinals are a way to embed data into the Bitcoin blockchain by inscribing references to digital art into small Bitcoin-based transactions. Ordinal volumes were higher than those of usual leaders Ethereum and Solana in the past week, as reported, led by NodeMonkes and Pups. Non-fungible token (NFT) on other networks buying and selling activity declined 95% across all networks in the same period, suggestive of an isolated interest in Ordinals. https://www.coindesk.com/markets/2024/04/11/bitcoin-ecosystem-tokens-rune-stx-and-ordi-may-see-gains-after-halving/

2024-04-11 07:26

Bitcoin started the year with an RSI of 45. Bitcoin continues to outperform major assets, with a near 100% increase in six months, surpassing Nvidia and the S&P 500. The cryptocurrency’s RSI is 79.02, the highest since the 2021 bull market, indicating potentially overbought conditions. Bitcoin (BTC) is outperforming most major assets, making everything else “look like junk,” Josh Olszewicz, a trader that publishes under the handle CarpoNoctom, said in a recent video, which analyzed its performance against major altcoins and other assets. The world’s largest digital asset is trading above $70,000, according to CoinDesk Indices data. Bitcoin has outperformed the CoinDesk 20 (CD20) Index, a measure of the most liquid digital assets, by over 10% since the beginning of the year. Looking back further, bitcoin is up almost 100% in the last six months, beating chip giant Nvidia (NVDA), which is up around 88%, ether (ETH), up 89%, and the S&P 500 (INX), which is up just 18%. “If you’re investing and trading and not outperforming BTC, why bother?” Olszewicz said in his video. “Almost everything looks like junk against bitcoin.” Bitcoin’s Relative Strength Index (RSI) is also at a level not seen since the height of the 2021 bull market, at 79.02. It was last near this point in October 2021 when it hit 72. The RSI, created by J. Welles Wilder, is a momentum indicator that measures the speed and change of price movements. A reading above 70 would suggest overbought conditions, indicating that an asset’s price has risen too quickly and may soon correct lower. However, the RSI is only an indicator and not a fool-proof predictor. Bitcoin began the year with an RSI of 45. The token’s RSI fell to 38 during the crypto winter in 2022. https://www.coindesk.com/markets/2024/04/11/bitcoins-meteoric-rise-makes-everything-else-looks-like-junk-trader-says/

2024-04-11 04:41

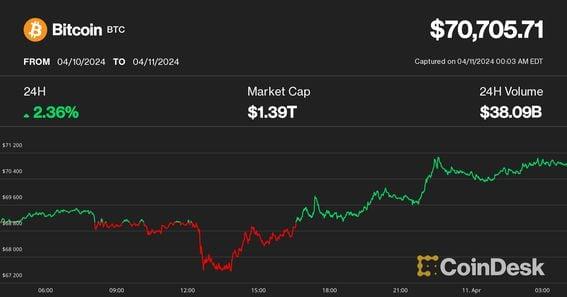

Quantitive trading firm Pythagoras sees risk assets pricing in two, not three Fed rate cuts for 2024 as bitcoin holds steady in Asia. Bitcoin remains above $70K as Asia begins its trading day One trader told CoinDesk that its too early to tell if slowing GBTC outflows will be a positive sign for bitcoin's price Bitcoin (BTC) looks to extend Wednesday's gain, trading near $70,800 while ether {{ETH}} changed hands above $3,500 as the market continues to digest a higher-than-expected U.S. CPI and slowing outflows from the Grayscale Bitcoin Trust (GBTC). "Bitcoin exhibited strength against a hawkish CPI report and strong inflation data seeing only a retracement back down to $67,000 following the fed minutes announcement," Semir Gabeljic, director of Capital Formation at Pythagoras Investments, said in an email note. "[Still] The drop of -2% from Monday's retest of $73,000 showcases risk assets, including BTC, pricing in two rate cuts instead of three for the remainder of 2024," he added. Bettors on decentralized predictions platform Polymarket seem to be evenly split on the number of rate cuts by the end of 2024. Twenty-six percent of bettors have put money on there being one cut, while 28% believe there will be two cuts, and 21% bet on no cuts at all. Meanwhile, Jun-Young Heo, a derivative trader at Singapore-based Presto, pointed out that the market recovered quickly after the higher-than-expected CPI announcement compared to gold or the S&P 500 index. The implied volatility of options expiring on April 26th is still trading at a premium while recent historical volatility is still trending down, Heo noted. Some market participants are noting that bitcoin prices are reacting favorably to slower than usual outflows from the Grayscale Bitcoin Trust (GBTC). On-chain data shows that outflow from GBTC is at $18 million, which is the lowest since the launch of the U.S. bitcoin ETFs. "But we need to see a few more dates to find out whether GBTC outflows are becoming negligible amount since it has a higher fee than any other ETFs," Heo added. https://www.coindesk.com/markets/2024/04/11/bitcoin-is-pricing-in-two-fed-rate-cuts-for-2024-trader-says/

2024-04-11 04:37

"The main problem was our lack of organizational execution," MarginFi's longtime leader Edgar Pavlovsky told CoinDesk. MarginFi’s longtime leader, Edgar Pavlovsky, resigned Wednesday following an internal dispute at the protocol's builder, mrgn. The abrupt exit won’t impact MarginFi's borrow-and-lend functions, but it did spur $100 million in capital flight. Edgar Pavlovsky, the CEO of the company building crypto borrow-and-lend platform MarginFi resigned Wednesday as internal fissures at the major Solana DeFi project erupted into public view. “I don't agree with the way things have been done internally or externally,” Pavlovsky said in a resignation notice on X, formerly Twitter. MarginFi's own account called the departure of its co-founder “a function of internal operational disagreements and of his own personal reasons." The abrupt exit capped a fiery day for Solana's second-largest lending platform that saw allegations fly and tempers flare. Amidst the chaos, users pulled nearly $100 million from the platform, according to analytics site DeFiLlama – MarginFi's largest-ever day of withdrawals. "All products remain fully operational and are unaffected (and can not be affected) by this departure. The point of DeFi is that core contributors can walk away, and the protocol marches on," MarginFi said in a tweet. MarginFi's meltdown comes after weeks of withdrawal function issues at the borrow-and-lend platform and months after it launched a points program that preceded a wave of growth-fueling incentivization loyalty schemes across Solana DeFi. But while other protocols reward their points-earning users with a token, MarginFi hasn't, much to the anger of some of its users. Oracle issues In mid-March, a problem in MarginFi's price data sourcing "oracle" infrastructure had caused some users' withdrawal requests to fail to start when Solana's network congestion was still rising. "The stale Oracle issues currently impact withdrawals, not deposits, I think, so it's leading to some accusations from users who feel that MarginFi is just taking their deposits and not letting them withdraw," the builder of popular liquid staking service SolBlaze told CoinDesk in a Telegram message. SolBlaze lodged its own accusations against MarginFi on Wednesday. The service rewards holders of its bSOL and BLZE tokens with more tokens, which are called emissions. Depositors of SolBlaze tokens on MarginFi also get these reward payouts, but via mrgn and MarginFi. However, for at least eight days those payments through MarginFi had not been getting to bSOL and BLZE token owners, according to SolBlaze. This was due to a quirk in the way MarginFi handled earmarked tokens, but it was left unmonitored and with no communication to SolBlaze, which has since severed its business relationship with MarginFi. "The main problem was our lack of organizational execution," Pavlovsky told CoinDesk in a Telegram message sent hours before he announced his resignation. Leadership transition Pavlovsky's exit throws MarginFi's leadership into uncertainty. An employee of the New York City-centric project referred CoinDesk to MarginFi's statement. "We want to assure the community that the core contributors, the company, and our investors are actively engaged to ensure a smooth transition," the post read without saying who was taking over. Kyle Samani, managing partner at Multicoin Capital, an investor in MarginFi, posted on X that he remains committed to the protocol and is not withdrawing anything. One candidate may be MacBrennan Peet, another co-founder of MarginFi with a history of embracing online controversy, including releasing a video of himself shirtless and crowing "wen token" in December 2023. "Moving forward, I'll be a more authentic person online," he said in a tweet. Peet called his previous social media stunts and "very intentionally controversial" persona a "growth-hacking" strategy that "largely worked" to boost MarginFi's user base. Growth hack or not, that persona also succeeded in making MarginFi its enemies in Solana DeFi. One of them was Solend, once the leading protocol for borrow-and-lend on Solana. Moving to capitalize on its foe's weaknesses, Solend announced it would airdrop a token to MarginFi users who move their money to Solend and keep it there. At press time, the push hadn't yet led to a noticeable uptick in deposits on Solend, according to DeFillama. On a day where MarginFi lost $80 million to withdrawals, the major borrow-and-lend platform Kamino saw $51 million in deposits, its third largest day of inflows ever. Wen token? From Mac's "wen token" shirtless meme video to the daily chants of "wen token" in MarginFi's Telegram channel, the protocol faces intense pressure to drop a new crypto asset to its user base. "People feel like they've been farmed for TVL without getting the airdrop that they would have expected from a points program," SolBlaze said. On Wednesday MarginFi, MacBrennan and mrgn had little to reveal about when, or even if, it would launch a governance token that decentralizes its decision-making. Such an asset would theoretically give holders a vote in the operations of MarginFi. If it were airdropped to users it would likely provide a windfall to the thousands of points earners who have farmed MarginFi since July 2023. "The MRGN development team will carry on work towards full decentralization," a tweet read. Next steps The departure of Pavlovsky will not impact mtnDAO, a biannual month-long coworking event hosted in Salt Lake City by MarginFi and Cypher, said Cypher CEO Barrett Williams, a close friend of Pavlovsky. "I don't have next steps yet, but as mrgn's founder it's ultimately my failure that this happened, and like I've done for years, I'll reflect and evolve," Pavlovksy said in his resignation tweet, which came around three hours after SolBlaze's first accusation. Less than an hour later, he was back: "Okay, what should I build next." https://www.coindesk.com/tech/2024/04/11/marginfi-leader-resigns-on-fiery-day-for-major-solana-lender/