2024-04-09 21:52

Jan Van Eck told CoinDesk TV's Jen Sanasie that not hearing back from the SEC is a sign that ETH exchange-traded funds likely wont make the May deadline. The CEO of VanEck – the global investment firm whose Bitcoin Trust (HODL) is among the almost dozen spot bitcoin ETFs – thinks the cryptocurrency industry should focus more on transaction fees and not so much on Bitcoin (BTC) and Ethereum (ETH) or their related exchange-traded funds. Jan van Eck said on CoinDesk's "Markets Daily" that the transaction fees on the Bitcoin and Ethereum blockchains are unpredictable, making it harder to build applications in those ecosystems. "The most important story of 2023, which people know, but I don't think they focus on enough, which is simply that transaction costs are now available at affordable rates through Solana or the so-called layer 2s," van Eck told CoinDesk TV's Jen Sanasie in an interview. "Because you see the transaction fees for Bitcoin and Ethereum, no one would ever use that database to build anything on, right? My analogy for non-crypto people is, would you want to fill your car at $50, you know, week after week, and then one week at $600? And that's effectively what high gas fees are on Ethereum," he said. Solana (SOL), often referred to as an Ethereum killer, is a layer 1 protocol with cheaper costs and faster transaction speeds than Ethereum. Layer 2s are separate blockchains that are built on top of layer 1 chains, such as Ethereum, to reduce bottlenecks with scaling and data that layer 1s face. Ethereum rollups and the Lightning network on Bitcoin are examples of layer 2s. With new solutions for lower and much more predictable transaction fees, developers can now build applications that are much more useful, which Jan Van Eck predicts will be more prominent going forward. "The most interesting thing happening in crypto to me right now is that you have databases that can scale, that can take a lot of users of high uptime and now have predictable costs. And so real stuff can be built on these databases now," he said. "We're going to see that in the next couple of years." He also said that its unlikely that ether ETFs will be approved by their May deadline, as unlike the bitcoin ETF approval process, the U.S. Securities and Exchange Commission has been not responsive to filings by the prospective issuers. "We've filed our S1 and we haven't heard anything. So that's kind of a sign. It won't happen without getting the disclosure documents in order," Jan Van Eck said. https://www.coindesk.com/business/2024/04/09/vaneck-ceo-says-transaction-fee-is-bigger-story-than-bitcoin-or-ethereum-etfs/

2024-04-09 19:53

With the halving and new tech set to give Ordinals a further lift, Bitcoin-based inscriptions are demonstrating staying power and some advantages over NFTs. Christie’s is taking notice with a new initiative. NFTs aren’t for everyone. In the years since non-fungible tokens first entered public consciousness there has been a fierce backlash against what is essentially just a way of authenticating data. Part of this negativity was as a response to the gross financialization and speculation around these tokens, and environmental concerns that have since basically been resolved by Ethereum’s switch to proof-of-stake in 2022. However, the general public’s distaste of NFTs hasn’t stopped the art industry from embracing them. In 2021, Christie’s auction house made history with the $69 million sale of Beeple’s “Everydays” collage. Since then, the storied company has expanded further into the realm of crypto, including countless NFT auctions, investments in Web3 firms via Christie’s Ventures and even the launch of its own NFT marketplace, Christie’s 3.0. The company, founded before the birth of the American Republic, is taking this one step further today through its first auction of inscriptions, the NFT-like tokens on Bitcoin made possible by Casey Rodarmor’s Ordinals Protocol. The “Ordinal Maxi Biz (OMB)” sale, although not the first inscriptions auction (Sotheby’s beat its closest competitor to the punch late last year), is something of a turning point for Ordinals, and a signal that these objets d’art may just have staying power. “Slowly but surely people are getting very interested,” Christie’s Director of Digital Art Sales Nicole Sales Giles told CoinDesk in an interview. “The market has matured quite significantly since the boom in 2021 when Christie’s first got involved. We don't take our responsibility lightly.” This is a meaningful statement from Sales Giles, who was instrumental in setting up Beeple’s auction that first brought public attention to NFTs. While the auction house doesn’t yet have current plans for more inscriptions sales, Sales Giles said that this was just the beginning of its move into the world of inscriptions. The works at auction were curated by pseudonymous Ordinals advocate and OMB co-creator ZK Shark, and contain works by artists Tony Tafuro and berkinbags. Each auction lot has a starting bid of $100, a callback to the starting price of the Beeple’s auction, which was set at that price because Christie’s “didn't really fully understand the market at that time,” Sales Giles said. There’s an argument to be made that Ordinals represents a significant technological advancement over NFTs, in part because it's a method that actually allows artists to inscribe data directly on-chain. In contrast, NFTs are better thought of as digital signatures for data that often exists elsewhere. Because they exist on “someone else’s server,” they can’t truly be owned. An example of how this can go wrong happened after the disastrous collapse of FTX: When the exchange went down the images associated with 1.5 million worth of NFTs minted at the Coachella Festival became inaccessible because it was stored on an FTX website. With Ordinals, the only way for the data to be erased is if Bitcoin goes down. “I don't think inscriptions will ever fully replace current NFT token standards like ERC-721,” Sales Giles said, mentioning the current file limitations of inscriptions that can prevent artists from minting data intensive things like HD videos on-chain. “There's still going to be a market for every new technology that's come up.” But the auction comes at an interesting time for inscription adoption. Currently, two of the five largest NFT projects by market capitalization, Runestones and NodeMonkeys, are built on Bitcoin, according to CoinGecko data. And, Ordinals are less than a year old. While the Bitcoin community has torn itself apart over the question of whether Ordinals is destroying something meant to primarily be a monetary network and driving up transaction fees, it’s clear that inscriptions aren’t going away. As ZK Shark noted in a recent X post, Bitcoin has been both a system for transferring value and storing data since the very beginning, with Satoshi Nakamoto inscribing the blockchain’s “genesis” with a message to the world. “We are interested in the artistic historical story around these collections,” Sales Giles said. “It's really interesting to us to see the zeitgeist form around this community.” https://www.coindesk.com/consensus-magazine/2024/04/09/why-christies-first-bitcoin-inscriptions-auction-matters/

2024-04-09 16:52

The defense countered that Eisenberg "risked 13 million of his own dollars" to net $110 million from Mango Markets. NEW YORK – To federal prosecutors, Avi Eisenberg's $110 million crypto trade on Mango Markets put a digital twist on an old scam. But to the DeFi trader's defense team, it was a legitimate windfall from the risky world of crypto, where finance's old rules don't apply. Each side presented crisp opening statements Tuesday in the U.S. government's commodities manipulation and fraud trial against Eisenberg. Their competing narratives gave the courtroom's 15 jurors a taste of the highly complex two-week trial ahead. At issue is the October 2022 trade where Eisenberg turned $13 million of crypto into $110 million by draining the trading venue Mango Markets of all of its assets, in part by trading against himself. He did so by making a massive bet on the future price of MNGO tokens and then allegedly gaming the crypto markets to drive up their value. Once the token was up over 1,000% he borrowed against their inflated value to capture virtually all of the crypto on MNGO, rendering it insolvent. These kinds of trades aren't allowed at the banks, swaps shops and equities exchanges that power traditional financial markets and are closely regulated in the U.S. Mango Markets isn't like those institutions; rather than a company, it's a set of computer programs that operate on a blockchain where the old rules don't so easily apply. But they should, according to federal prosecutors bringing this landmark criminal case against Eisenberg, the first crypto trader facing potential jail time for allegedly breaking commodities rules while trading in DeFi. Assistant U.S. Attorney Tian Huang kicked off the government's case by comparing Eisenberg's "scam" to a con artist who lures his victim into loaning him money by offering a "beautiful, fake diamond ring" as collateral. "He wasn't really borrowing, he was stealing," she said in her opening statement, adding "he committed commodities fraud and market manipulation." The government plans to use Eisenberg's private chats, public trades and flight records to prove he knew his "huge, fake bets" were illegal. Eisenberg's five-person trial team hinted they intend to use crypto's nascent state and cloudy regulatory status to their advantage. In his opening statement, Sanford Talkin said the government "is not going to get out of the gate" in its attempts to apply commodities rules to highly speculative tokens, like MNGO. Regardless, their defense appears to hinge on the proclaimed legitimacy of Eisenberg's actions in a trading landscape punctuated by high-risk, high reward bets. "Avi Eisenberg risked $13 million of his own dollars" to net $110 million from Mango Markets, Talkin said, adding "he could have lost everything." He said Mango Markets' traders understood and accepted the risks of playing in this murky field. Eisenberg just happened to hit it big. "It is in this world that Avi Eisenberg operated a successful, legal, trading strategy," Talkin said. https://www.coindesk.com/policy/2024/04/09/defi-trader-eisenberg-wasnt-borrowing-he-was-stealing-prosecutor-says-in-opening-argument/

2024-04-09 16:33

Sen. Cynthia Lummis said there's an effort underway to ensure Republicans trying to take seats from Democrats on the Senate Banking Committee are versed in crypto advocacy. Sen. Cynthia Lummis, a Republican, sees crypto as a likely topic coming up in Senate races that are vital to the future leadership of the Senate Banking Committee. She asked crypto enthusiasts to attend public forums in the elections and make sure the candidates have to answer questions about their positions on digital assets. U.S. Senator Cynthia Lummis (R-Wyo.) said that the high-stakes Ohio election that could decide both the Senate majority and the leadership of the Senate Banking Committee is likely to dig into cryptocurrency issues, and she encouraged industry insiders to make sure it does. Crypto skeptic Sen. Sherrod Brown (D-Ohio), whose Democratic Party currently controls the Senate, is the chairman of the Banking Committee and has been reluctant to allow digital assets regulatory bills to move through the panel, despite some progress in the House of Representatives. In Ohio's general election, he faces Republican challenger Bernie Moreno, an Ohio businessman and crypto enthusiast who founded a blockchain startup, and Lummis – a member of Brown's committee – predicted on Tuesday that digital assets could be front and center in this matchup. At a Bitcoin Policy Institute event in Washington, she suggested that industry supporters should make sure to attend public forums in that race and make sure the candidates get on the record about crypto. "Have people in the crowd to ask questions," she said, adding that Brown "seems to have Elizabeth Warren whispering in his ear on this topic," referring to the Massachusetts Democratic senator widely seen as crypto's chief detractor in Congress. Read More: Crypto Fan Won Ohio Senate Primary That Could Alter the Industry's U.S. Destiny "The Banking Committee is kind of the obstacle here," Lummis said. Lummis also flagged the Montana race against Sen. Jon Tester (D-Mont.), another Democrat on the Senate Banking Committee that'll likely be instrumental in any future crypto bills. She said she's been "trying to educate" his Republican opponent on blockchain and crypto matters. Lummis noted that her Democrat partner in one of the leading crypto legislative efforts, Sen. Kirsten Gillibrand (D-N.Y.), is also facing an election this year. Earlier at the same event, Rep. Patrick McHenry (R-N.C.), the chairman of the House Financial Services Committee, said a stablecoin bill still has a shot at being approved by Congress this year. However, the weeks available for legislative action are waning this year as the elections heat up. https://www.coindesk.com/policy/2024/04/09/lummis-crypto-will-erupt-as-big-issue-in-senate-races-including-banking-chair-browns/

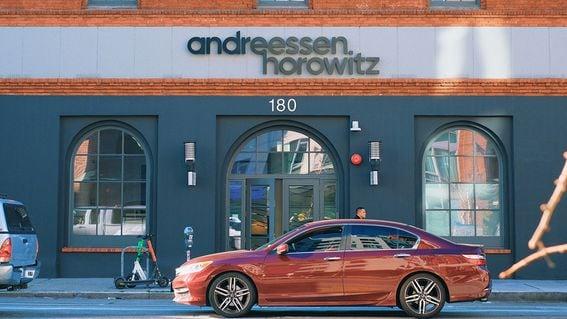

2024-04-09 16:00

The release is the product of a16z's first foray into deep tech research. Silicon Valley venture giant Andreessen Horowitz (a16z) made news last year when it announced that it was wading into deep tech research – switching off its investor cap to become a part-time computer science researcher and builder. On Tuesday, the firm unveiled some of the first fruits of that foray with the release of an open-source code implementation for "Jolt," its zero-knowledge virtual machine (zkVM). In addition to positioning a16z as a bona fide research and development firm, the new code could help blockchains – and some of a16z's own portfolio companies – scale their operations. Virtual machines, colloquially known as VMs, are software-based computer environments that serve as the foundation for blockchains and other programs. The "zero-knowledge" (ZK) bit of Jolt refers to a form of cryptographic trickery that powers a16z's VM under the hood – allowing the virtual computer to process and verify data while adhering to special constraints around privacy and security. Jolt currently supports RISC-V instruction set architecture (ISA) – an open-source standard for designing computer processors – and applications written in the Rust programming language. Programmers can run an application through Jolt to "verify its execution," explained Eddy Lazzarin, CTO at a16z crypto. The program will "output a 'proof' that proves that the result of that program indeed came from the correct running of that program." A16z's big claim with Jolt is that it's "10x" faster than RISC Zero, its nearest competitor. ZK cryptography has applications outside of blockchain, but ZK research has boomed in parallel with the industry's rise. So-called "ZK proofs" – the mathematical proofs outputted by ZK programs – have become the dominant method for helping blockchains reduce fees, increase speeds, and preserve transaction privacy. The tech powers many of the so-called zkEVMs – zkVMs specific to Ethereum's runtime environment, known as Ethereum Virtual Machine, or EVM – that have emerged in recent years to make that blockchain quicker and more secure. (A16z is an investor in Matter Labs, one of the leading zkEVM makers). ZK proofs “scale blockchains by kind of doing the hard work off-chain, and only having the blockchain verify the proofs,” Justin Thaler, an a16z researcher and associate professor at Georgetown University who co-authored the Lasso and Jolt research, explained in an interview last year. With ZK proofs, “you can get a guarantee that this work was done correctly, but not have all the blockchain nodes in the world doing all the work.” While Jolt has not been fine-tuned for Ethereum or any other blockchain, a16z insists its tech can be layered into zkEVMs and other blockchain-based ZK applications. "Fine-tuning specific circuits makes them very brittle. It's very hard and opaque to do that properly," said Lazzarin. "Our techniques are not just simpler, but faster." A16z first embarked on its deep tech journey in August of last year when it announced a pair of projects: Jolt, the one that's launching today, and Lasso, a special method for powering ZK systems that undergirds some of Jolt's programming. According to Lazzarin, a16z embarked on its deep-tech research journey in part as a way to improve its cache as an investor: "I mean, why take money from someone who is just money when you can take money from someone who is right there with you at the cutting edge, doing the hardest possible things in crypto?" But that's not the only way Lazzarin thinks a16z's research initiatives can help advance the firm's bottom line. The code for Jolt has been open-sourced, meaning anyone can theoretically use or repurpose it without paying a16z. "Because we're long-term investors, we don't trade day-to-day, week-to-week, or even month-to-month," said Lazzarin. "We benefit most if the space advances fastest over the next five to 10 years, and so our incentive is purely to advance everyone through public goods that we will never monetize." https://www.coindesk.com/tech/2024/04/09/venture-firm-a16z-releases-jolt-a-zero-knowledge-virtual-machine/

2024-04-09 15:57

Bitcoin is showing resilience despite the slip, but the corrective period might continue for a while before a return to growth, one observer noted. Bitcoin and ether dropped 4%, while SOL and DOGE lost 6%-7% in the past 24 hours. The move lower triggered the largest amount of leveraged long liquidations in a week, CoinGlass data show. Bitcoin (BTC) buckled below $69,000 as cryptocurrencies slid Tuesday, paring optimism after Monday's rally. BTC slipped as low as $68,580 from above $71,000. The largest cryptocurrency by market cap was recently priced near $69,000, down about 4% over the past 24 hours, CoinDesk data shows. The drop echoed through the crypto markets, with the broad-market CoinDesk 20 Index (CD20) losing 3.2% in the same period. Ether (ETH) fell below $3,500, almost 4% lower, and major altcoins solana (SOL) and dogecoin (DOGE) slid as much as 6% to 7%. The declines led to almost $200 million worth of leveraged derivatives trading positions being liquidated across all digital assets as of 15:45 UTC, CoinGlass data shows. The overwhelming majority, some $175 million worth of positions, were longs betting on prices to rise. This was the largest daily leveraged long flush in a week, the data show, suggesting that leveraged traders were caught off-guard. While bitcoin's Monday breakout above $70,000 prompted some analysts to predict higher prices, some technical analysis indicated a different conclusion. Monday's high price was below the record highs recorded in March, meaning that the subdued prices might continue for a while before targeting fresh highs, according to Joel Kruger, a market strategist at LMAX Group. "Bitcoin continues to demonstrate remarkable resilience, finding support amidst a period of consolidation," he said in an emailed note. "The daily chart hints at a potential lower top around $71,800, suggesting the possibility of corrective price action before a fresh attempt at record highs. https://www.coindesk.com/markets/2024/04/09/bitcoin-buckles-below-69k-as-crypto-bulls-endure-175m-liquidations/