2024-04-09 06:10

In South Korea’s election, voters casting their ballot based on crypto policies could be decisive given the predictions of a tight election. South Koreans will vote on April 10 having considered crypto-related poll promises that the two main parties have made. The role of crypto may have become even more significant in this election than the previous one. In March 2022, former prosecutor Yoon Suk Yeol won the South Korean Presidential election by a margin of less than 1%, or 247,077 votes. It was the closest presidential election in the nation’s history. Just about two months later, the Terra stablecoin crash wiped away some $60 billion globally, with some 280,000 South Koreans reported to have been victims. There are more than 280,000 crypto investors in the nation – South Korean prosecutors said there were 6.27 million crypto users in September 2023. If even 247,078 of these voters had cast their ballot only based on the crypto policies of candidates, the numbers suggest, the election result could have turned out differently. South Korea is one day away from an important election in which crypto has certainly been an issue. The role of crypto may have become even more significant in this election than the previous one. Young people could play a decisive role, analysts say, in a nation of about 52 million people. The crypto ecosystem of which young people make up a majority, has gone through a frenzy, shaking off and emerging from the shadow of Do Kwon and Terra, but crypto-related political promises may have acted as dopamine to activate voters from the sector. 2024 Legislative Election On April 10, 2024, the nation is heading into its legislative polls which will see multiple parties and coalitions battle it out for 300 seats in the national assembly. It’s expected to come down to two parties – President Yoon Suk Yeol’s conservative People Power Party (PPP) will be seeking to improve its tally of 114 seats, while the liberal Democratic Party of Korea (DPK) will hope to consolidate its 156-seat hold on the assembly. South Korea’s legislative elections take place every four years. In 2020, the liberal party (DPK) won the election with ease. Thus, crypto, which was not as prominent as it is today, likely had a minimum impact. But in this election, political analysts said it will be difficult for either party to get a majority, making any group of voters significant. “I would think so,” said the Seoul-based Head of Legal at Hashed Jin Kang when asked whether crypto could be a deciding factor in the coming election. "In the close presidential election of 2022, a key deciding demographic was the young population in their 20s and 30s. Both parties will be interested in capturing these younger votes." Perhaps what is unclear is whether the crypto-savvy voters will vote as one block. “A close election is a given,” said Abel Seow, the Seoul-based BitGo Asia-Pacific director. “But it’s hard to say whether crypto will be a deciding factor. What I can say is that with the passage of time and each cycle, the market has become bigger and bigger. Not only the involvement of investors but also traditional corporations. So, at some stage when these traditional corporations come in, and they have a crypto angle, elections could be impacted by the space.” Crypto-related political promises In the presidential election of 2022, President Yoon Suk-Yeol pledged to restrict taxes for crypto gains and allow initial coin offerings (ICO). It is unclear whether his crypto-pledges were decisive in helping him win the historically close election. In the end, he couldn’t live up to the promise of allowing ICOs, and – with bipartisan support in the assembly – the taxes were deferred if not restricted. But the potential for crypto election influence does explain why both the major parties in South Korea are making new crypto-related pledges in the lead-up to this election. The opposing Democratic Party (DPK) has promised to allow investors to purchase spot bitcoin (BTC) exchange-traded funds (ETFs), while the PPP has said it’s also looking for ways to allow the ETFs. The slight difference in the promises comes from their political outlook on pending crypto taxation policies. The PPP has said it would prioritize a regulatory framework before taxation, effectively delaying a crypto gains tax scheduled to be implemented in January 2025. Taxation on income from virtual assets, as well as income from the “transfer or lending of virtual assets,” was initially delayed from 2023 to 2025. The DPK is expected to propose a comprehensive framework too, and wants to maintain the start of crypto-taxation in 2025. But it wants to put the 22% tax on crypto asset gains exceeding 50 million Korean won ($37,316) instead of the currently proposed 2.5 million Korean won ($1,865). The PPP has also promised to establish a ‘digital asset promotion committee’ to propose laws and impose sanctions. “When it comes to taxes, both parties are giving a reason for a crypto-savvy person to vote for them, and the same goes for ETFs,” Seow said. “The fact that the topic of digital assets and whether or not to proceed with a spot bitcoin ETF during an election is a reflection of how the digital asset market has grown and the importance of it to the Korean economy, including to that of institutional investors.” Crypto-friendly policies for institutions in South Korea may still be a long way off, because in this year of elections, known as the "super election year," lawmakers may want to make sure their framework is not cast in stone before global consensus. “It is unlikely that we will see a market regulation during this super election year,” Kang said. “South Korean authorities are wary of jurisdictional arbitrage in crypto regulation that may be inconsistent with approaches of major countries such as the EU and the U.S." South Korea’s election is “part of a slew of upcoming elections across the world that will inevitably influence the direction and pace of crypto policy making, but I think it’s the U.S. presidential elections that will be a major one for crypto policy,” said Angela Ang, a senior policy adviser for blockchain intelligence firm TRM Labs. Read More: As Justice Is Sought for Do Kwon, South Korea’s Crypto Scene Emerges From Terra’s Shadow https://www.coindesk.com/policy/2024/04/09/south-koreas-april-10-election-whats-at-stake-for-the-crypto-universe/

2024-04-09 04:55

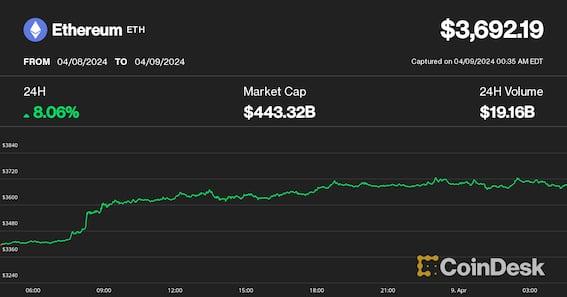

Liquid staking tokens like Lido, Rocket Pool, and ether.fi follow ether's gains. Ether rallied in the early morning of East Asia's trading day, outperforming the CoinDesk 20 Index. Ether's performance seems to be based on market interest in new DeFi protocol Ethena, versus an anticipation of a spot ether ETF approval Ether (ETH) prices rallied during the early hours of the East Asia trading day while Bitcoin (BTC) remained relatively stable. According to CoinDesk Indicies data, ether prices rose to $3600, while bitcoin was in stasis around $71,000. The CoinDesk 20, a measure of the world's most liquid digital assets, was up 3.5% and trading above 2,600. Decentralized liquid staking protocols like Lido DAO and Rocket Pool ETH also saw their tokens push well into the green, up 10% and 8%, respectively, according to CoinGecko data. ETH's bitcoin-bearing performance could be attributed to continued market interest in decentralized finance (DeFi) protocol Ethena, which has seen its total value locked (TVL) cross the $2.2 billion mark over the last few days after crossing $2 billion on April 6. Ethena's USDe synthetic stablecoin recently added bitcoin as collateral, CoinDesk reported. This may be purely a rally based on token demand rather than the hope of an ether spot exchange-traded fund being approved in the near future. Bettors on Polymarket see a 16% chance of a spot ether ETF being approved in the U.S. by the end of May and only a 45% chance of it being approved by the end of June. Some traders were positioned for bitcoin leadership after the ether-bitcoin ratio dipped below key support last week. As such, ETH's market-beating rise has brought rapid adjustment in market positioning, leading to a sharp uptick in the perpetual funding rates or cost of holding long/short positions, Singapore-based QCP capital explained in a note on Telegram. The upside volatility has also led to a significant short covering in ETH front-end call options. "Last Friday, we speculated a possible leg higher, and we expected the move to be led by BTC," QCP wrote. "We were wrong about the leader, as this move has been very much led by ETH." https://www.coindesk.com/markets/2024/04/09/ether-rallies-to-36k-as-bitcoin-holds-steady-at-71k/

2024-04-08 23:08

The two-week trial will test the government's strategy of portraying complex crypto trades as simple fraud. NEW YORK – Crypto trader Avi Eisenberg's criminal fraud and manipulation trial will open Tuesday after a federal judge seated a 15-person jury that includes a seller of rare books, an elementary school music director and at least two finance professionals. Expected to run for two weeks, the trial will determine whether Eisenberg broke the law when in October 2022 he deployed a self-described "highly profitable trading strategy" that crippled Mango Markets, the once popular venue for betting on cryptocurrencies on the Solana blockchain. The trial represents an evolution in the government's attempts to police alleged crimes in decentralized finance (DeFi), a sector of the crypto trading space governed by the notion that "code is law." Mango Markets is not tightly controlled like its counterparts in centralized finance, like Coinbase. Instead, trades, borrowings and loans execute on smart contracts. Eisenberg is accused of illegally gaming Mango Markets' futures contracts by manipulating the price of the MNGO token and then borrowing effectively all of Mango's deposits against his position. He walked away with $110 million in cryptocurrencies other people had deposited on the platform, later returning a portion of that in exchange for a promise that Mango's backers would not seek his prosecution. That promise was not kept. Negotiation or extortion? In court on Monday, prosecutors and defense teased upcoming testimony from Mango's founder, Dafydd Durairaj. He spoke with a ransomware negotiator for assistance in the wake of Eisenberg's trade, prosecutors said. This fact, they argued, could help the jury understand that Durairaj did not view the negotiations as an "arm's-length" deal between two parties, but rather a hostage situation that could implode at any time. Judge Arun Subramanian sided partially with Eisenberg's defense team and told the government not to bring up the ransomware negotiator, lest it prejudice the jury. But he said if the defense opened the door by arguing the negotiations were "arm's length," the prosecutors could walk through it. The parties sparred over the word "manipulation," its potential use by witnesses and its presence in online terms-of-service documents. They also clashed over the phrasing of what traders on Mango Markets were "obliged" to do when operating on the site. Was that word a legal concept, or rather a reference to the outcomes of executing a transaction on a smart contract? Arguments over jargonistic minutiae foreshadow the complexities ahead in a trial that will test the government's recent strategy of presenting knotty crypto misdeeds as simple cases of fraud. The feds took that tactic in last year's prosecution of Sam Bankman-Fried as well as in the recent civil fraud case against Terraform Labs and Do Kwon. But Eisenberg's case delves perhaps even deeper into the philosophical and practical questions about trading tokens on permissionless blockchains. His is the first federal criminal trial to involve a DeFi trader accused of breaking U.S. law in a sector that once viewed itself as beyond its reach. Inside the courtroom The prospective jurors sounded none too pleased to spend Eclipse Day on the 15th floor of a federal courtroom. One remarked she was supposed to be watching the generational event at a science museum, not a jury box. At one point the judge said he would turn off the lights during the event's pinnacle, which he did not. More than a few came ready with eclipse glasses. They did get to use them, if only for a few minutes, while the judge and lawyers sidebarred over peremptory strikes. Prospective jurors, reporters and even the U.S. Marshal took turns peering out the tall windows at the partially covered sun. "You can see it again in 20 years," the Judge later told the courtroom. https://www.coindesk.com/policy/2024/04/08/crypto-trader-eisenbergs-110m-fraud-trial-to-put-defi-under-microscope/

2024-04-08 15:54

Brad Garlinghouse highlighted several macroeconomic factors behind the potential growth of the total crypto market value. The value of the cryptocurrency market could almost double to $5 trillion by the end of the year, propelled by the January approval of spot bitcoin exchange-traded funds in the U.S. and the mining-reward halving due later this month, according to Ripple CEO Brad Garlinghouse. “I’m very optimistic. I think the macro trends, the big picture things like the ETFs, they’re driving, for the first time, real institutional money,” Garlinghouse said in an interview with CNBC. “You’re seeing that drives demand, and at the same time demand is increasing, supply is decreasing,” said Garlinghouse. The rate at which new bitcoin (BTC) are produced will be reduced after the reward halving, scheduled for April 20. That event, which takes place roughly every four years, has historically preceded a bull market for the largest cryptocurrency by market value. It lowers the number of bitcoin that miners are awarded for approving blocks to be added to the blockchain by 50%. This month's cut will take the payment to 3.125 BTC per block. The crypto market is currently valued at around $2.68 trillion. Bitcoin has gained 63% since the start of the year and recently reached record highs above $73,000. The CoinDesk 20 Index, a measure of the broader crypto market, has rallied 49% in the same period. Despite multiple regulatory crackdowns in the U.S., Garlinghouse said he remains positive on the future of crypto regulation in the country. Last June, the Securities and Exchange Commission (SEC) sued crypto exchanges Coinbase (COIN) and Binance, alleging they listed and traded unregistered securities in the form of various cryptocurrencies. “One of the things actually I’ll say on the macro tailwinds for the industry: I think we will get more clarity in the United States,” he said. “The U.S. is still the largest economy in the world, and it’s unfortunately been one of the more hostile crypto markets. And I think that’s going to start to change, also.” The SEC also filed a lawsuit against Ripple, a blockchain-based digital payment network, alleging it sold the (XRP) token illegally. Ripple denies the claims. https://www.coindesk.com/business/2024/04/08/crypto-market-cap-to-double-to-5-trillion-by-year-end-ripple-ceo/

2024-04-08 15:06

The next Bitcoin halving, scheduled for April 20, is poised to significantly impact the mining landscape. Below Jaran Mellerud, of Hashlabs Mining, forecasts for what lies ahead. Bitcoin’s hashrate will not drop by that much Contrary to popular belief, this halving will likely not cause a major decrease in the network's hashrate. After Bitcoin’s first three halvings, the hashrate plummeted by 25%, 11%, and 25%, and it appears many analysts and miners are expecting (or hoping for?) a similar hashrate reduction this time. I concur with Pennyether's prediction that the forthcoming Bitcoin halving is expected to result in a modest decrease in the hashrate, ranging from 5 to 10%. This prediction is also not far from that of Hashrate Index, which sits at 3-7%. This cautious forecast stems from the present high profitability of Bitcoin mining, driven by its high price, and the observation that approximately 70% of Bitcoin's hashrate was introduced since January 2022, operating under mining economics that at times were less favorable than those now anticipated post-halving. Additionally, the hashrate is expected to quickly bounce back from this slight dip. In the past three halvings, the network recovered its pre-halving hashrate levels within an average of 57 days. This trend highlights an important perspective: halvings should not be viewed as events that lower the hashrate, but rather as brief pauses in the hashrate's relentless upward trajectory. The hashrate's robustness is further enhanced by the continuous efforts of miners to update their equipment with the newest and most efficient models. This strategy is anticipated not just to offset any short-term reductions in hashrate, but is also likely to lead to a significant uptick in hashrate in the forthcoming months. In essence, the upcoming Bitcoin halving is likely to be a brief hiccup in the network's hashrate trajectory, rather than a significant setback. High-cost miners will be forced to upgrade fleets Data from CoinMetrics highlights that most of the industry currently operates with relatively inefficient machines like the Antminer S19J Pro. These miners require an operating cost of $0.05/kWh or lower to maintain healthy gross profit margins post-halving. However, with the average hosting rate in the United States sitting just below $0.08/kWh, as indicated by Hashrate Index, many U.S.-based miners could face cash flow challenges after the halving and thus be forced to undertake massive fleet upgrades. Bitmain's launch of its new machines, including the S21, T21, and S21 Pro — each boasting efficiencies below 20 J/TH — arrives just in time for the halving. This development is prompting many U.S.-based hosting providers to push their customers to switch from S19J Pro to S21 models. Given the high hosting fees in the U.S., this push can be seen as a necessity rather than a choice. Referring to the chart above, it's evident that the S19J Pro models are unlikely to generate positive cash flow when hosted at $0.08 per kWh, considering their direct bitcoin production cost stands at $75,000. Thus, miners facing higher operational expenses must transition to more efficient hardware, such as the Antminer S21 or similar models, to maintain profitability. While upgrading to the latest machines allows operations to continue even in high-cost environments, it's hardly a viable long-term strategy. The necessity to constantly update hardware, often before the previous investments are recouped, underscores the unsustainability of such an approach. My underlying message is clear: if you need to use the latest-generation hardware to stay cash flow positive, your operating costs are too high. Miners will find creative ways to increase profits Bitcoin mining is one of the most free and competitive markets globally, a market that Adam Smith himself would admire. This inherent competitiveness fuels a relentless pursuit of innovation, especially during challenging periods such as the halving events. In response to the pressures exerted by the halving, miners are adopting some of the most inventive strategies to maximize the utility of their existing resources. One such strategy is underclocking, a process in which the machines’ electricity consumption is reduced to increase the energy efficiency and reduce costs. This process, which can be facilitated by third-party firmware like LuxOS, significantly improves machine efficiency — a critical adaptation in an environment where margins are thin. The movement towards underclocking is likely to gain momentum. Moreover, the quest for increased profitability extends beyond operational tweaks to include novel revenue-generating approaches. A compelling example comes from Hashlabs in Finland, where we are undertaking a project taking advantage of several revenue streams to boost mining profitability. In Finland, we have diversified our income streams to include selling waste heat from our miners to a district heating system, earning fees for contributing to the stabilization of the electric grid, and strategically selling electricity back to the market during periods of high spot prices. These ancillary revenue channels are significantly bolstering the profitability of our mining operation. The upcoming halving is set to act as a catalyst, driving miners worldwide to emulate Hashlabs by exploring and implementing creative strategies to augment their profits. Some miners will diversify away from mining The fierce competitiveness that defines the current state of the mining industry is prompting many, especially public miners, to explore new horizons. Increasingly, there's a move towards AI computing, with companies like Iren and Hive Digital Technologies leading the charge. The trend towards diversification is expected to pick up momentum over the challenging coming months. Yet, the dynamics of the mining industry are cyclic. Predictions for a bull market in 2025 portend a reversal of this diversification trend. As the value of bitcoin potentially climbs, miners may set aside their diversification strategies in favor of maximizing returns from mining, diving back into the fray with renewed vigor on extracting value from every hash. This shift between diversification and focused mining reflects the broader ebbs and flows of the market. Miners' strategies evolve with the market, balancing between seizing immediate opportunities in new industries and preparing for the next upsurge in bitcoin mining profitability. Bitcoin mining will become more geographically decentralized Currently, the United States commands a substantial portion of the global hashrate, accounting for 40%, while China and Russia are also key players, contributing 15% and 20%, respectively. However, the industry is gradually shifting towards a more globally dispersed model, driven by the perpetual quest for cost efficiencies, especially cheaper electricity. As miners brace for the upcoming halving, many are exploring emerging mining markets across Africa, Latin America, and Asia where electricity is exceptionally cheap. For instance, Bitfarms is making strides in Argentina and Paraguay; Bitdeer is expanding its capacity in Bhutan; Marathon is entering the United Arab Emirates and Paraguay; and Hashlabs is offering hosting solutions in Ethiopia. The impending halving event acts as a catalyst for hashrate migration, compelling miners to venture beyond developed nations to secure more economical electricity sources. This move towards a more geographically decentralized mining network is poised to have a profound positive impact on Bitcoin. By distributing the hashrate more evenly across the globe, Bitcoin mining will not only become less susceptible to regional regulatory risks and power cost fluctuations but also align more closely with the decentralized ethos that underpins Bitcoin itself. Little impact on the bitcoin price The forthcoming Bitcoin halving is eagerly awaited as a potential trigger for the next bull market. Yet, considering the current annualized issuance rate sits at an already meager level of 1.6%, and with nearly 94% of all Bitcoin already in circulation, the anticipated supply shock from this halving is likely to have a minimal impact on the bitcoin price. The impact of the negative supply shocks in earlier halvings was profound, especially during the first halving when the annualized issuance plummeted from 25% to 12.5%, and the second when it dropped from 8.4% to 4.2%. However, in this upcoming halving, the decrease from 1.6% to 0.8% represents a much less significant shift compared to the dramatic changes observed in previous cycles. Don't misunderstand my position; I still foresee a bull market in the wake of this halving. However, the growing demand, and not the meager supply decline, will be the main factor fueling the price surge. I like Dylan LeClair’s analogy of the halving as a "global advertisement," suggesting that its principal effect on bitcoin's price is not so much the immediate result of decreased supply but rather the increased media attention and investor enthusiasm it generates. This heightened awareness could stimulate demand, turning the halving into a self-fulfilling prophecy of bullish market sentiment. This perspective also aligns with insights from Daniel Polotsky questioning the continuing relevance of bitcoin's four-year cycle. While fluctuations in demand will persist, the impact of supply changes is becoming increasingly negligible. At this point, the issuance rate of Bitcoin has become so low that its supply has a minimal effect on its price, which is now primarily influenced by demand. While the narrative surrounding the halving continues to be a strong driver and is expected to propel bitcoin into a new bull market, this influence is likely to diminish in the future. As a result, it's probable that bitcoin will eventually decouple from the four-year halving cycle. Bring the halving on! I have great memories from the halving in 2020. The atmosphere within the Bitcoin community was electric with anticipation as we approached the moment when the block subsidy would be cut in half. This pivotal event sparked an incredible wave of bullishness throughout the summer of 2020, setting the stage for the monumental bull market of 2021. Although I remain skeptical that the modest reduction in supply due to this halving will significantly alter bitcoin's price equilibrium, the prospect of it igniting increased demand and investor enthusiasm is something I eagerly await. From the vantage point of a miner, the halving presents more than just a potential market rally; it's an opportunity to introspect and innovate within our operations. It prompts us to explore new methodologies to reduce costs and enhance efficiency, ensuring our survival and success in this highly competitive field. The halving isn't just a test of resilience but a catalyst for evolution within the mining community. As we look forward to the next halving, it is essential to remember the core ethos of Bitcoin. Bitcoin wasn't created for the miners; its heart beats for the hodlers. Miners play a crucial role, no doubt, servicing the Bitcoin network and ensuring its robustness. Yet, the true spirit of Bitcoin lies in its ability to empower holders, providing a decentralized alternative to traditional financial systems. The anticipation and excitement for the halving resonate not just among miners but throughout the entire community of Bitcoin enthusiasts and investors. So, as we edge closer to this pivotal event, let's embrace the halving with open arms and a spirit of innovation. It's a reminder of the dynamic landscape of Bitcoin, a testament to its resilience, and a beacon of the exciting developments yet to come. To all hodlers and miners alike, let's gear up for the halving. Bring it on! https://www.coindesk.com/consensus-magazine/2024/04/08/6-ways-the-halving-will-impact-bitcoin-mining/

2024-04-08 13:32

Eigenlayer has a 66% chance of sending users free tokens by June 30, the odds on Polymarket signal. Plus: Kalshi lands a big Wall Street account. Crypto market participants are betting big money on which billion-dollar protocol will next give them token airdrops — a practice that often nets users thousands of dollars worth of new assets. The “Airdrops by June 30?” market on Polymarket has garnered $400,000 worth of bets so far. While that might sound small, it's a substantial figure for the crypto prediction platform, excluding its U.S. presidential election market (which has attracted more than $105 million, dwarfing past records for the entire sector). In the running are 23 different networks, platforms and layer 2s, each one active for at least two months with meaningful user activity. Four of those – Solana NFT marketplace Tensor, real estate exchange platform Parcl, derivatives platform Drift, and restaking platform Swell – have already confirmed an airdrop, netting gains of as much as 80% to speculators who were laying bets since February. Eyes are now on hyped platforms such as layer 2s Blast and Base, restaking tool Eigenlayer, multichain network LayerZero and social finance application Friend.Tech. Nearly $100,000 has been bet on whether LayerZero will drop a token by the end of April. "Yes" shares are trading at two cents, meaning the market thinks there is only a 2% chance it will happen. Each share pays out $1 if the prediction turns out to be correct. LayerZero, which connects 50 blockchains using its network, has previously confirmed airdrop plans sometime in the first half of 2024, but there have been few details since. Blast and Friend.Tech have amassed just over $30,000 in wagers–likely on expectations of their points programs, which reward an on-screen numerical value to users based on platform activity, with loose promises they'll eventually be rewarded with tokens. Eigenlayer has captured the biggest mindshare, however. Over $56,000 is betting on whether the platform will release a token before June 30 on the general airdrop market, with a 66% probability. A separate market that ends on April 30 has attracted even more money—$63,000—but with just a 17% chance of an airdrop. Don’t want to bet on when? Bet on how much: A significantly smaller market is betting on the expected valuation of Eigenlayer after its token is released, with scenarios ranging from no token launch to a $40 billion market cap. Layer 2s are secondary networks or infrastructure built atop a main blockchain, such as Ethereum, to help with scalability and speed. Restaking is one of the hottest crypto sectors birthed in the bear market; it is essentially a way to put one’s ether holdings to work in various protocols in addition to the main Ethereum blockchains. Value locked on platforms such as EigenLayer has grown to over $13 billion in just nine months, data shows, mainly buoyed by a slightly higher interest on deposits than conventional ETH staking (over 5%, compared to 3.3% on Lido) plus the allure of a future token drop. Flashback to 2021: ‘Wen Token?’ Polymarket’s New Airdrop Futures Market Has Answers It's easy to see why airdrops are a popular topic for prediction markets. They represent free money, after all. And if investors have an inkling of which protocols are likely to do airdrops for participants in a certain timeframe, and which ones aren't, it can inform their decisions about where to put money to work. Was last month the hottest March ever? While the sun hasn’t managed to fry eggs on the sidewalks (yet), there’s a prediction market that’s betting on last month being the hottest March in recorded history. A $212,000 bet will resolve on May 1 if the data for the Global Land-Ocean Temperature Index for March 2024 shows an increase of 1.37°C or greater when it is released. Speculators have placed odds of a 72% chance as of Monday, modeling data using land and sea surface areas. Kalshi's big score Wall Street powerhouse Susquehanna International Group is launching a trading desk focused on "events contracts,” hoping to attract Wall Street investors interested in betting on things other than traditional financial assets. The firm will use the U.S.-regulated platform Kalshi to place and settle bets, as per Bloomberg. Most of the bets on Kalshi are aimed at retail traders and have limits of $25,000, but the firm recently got the green light to allow bigger investors to bet up to $7 million. Kalshi is currently engaged in a legal battle with the Commodity Futures Trading Commission over whether to allow people to bet on U.S. elections. https://www.coindesk.com/markets/2024/04/08/which-crypto-projects-will-airdrop-next-prediction-markets-are-placing-bets/