2024-09-12 16:20

The USDC issuer will move into One World Trade Center, and New York Mayor Eric Adams – who has sought to make the city a crypto hub – will attend the Friday ribbon cutting. Circle, the issuer of the second-largest stablecoin, will move its global headquarters to New York City's iconic One World Trade Center, where the cryptocurrency firm will occupy one of the top floors in what is the tallest building in the Western Hemisphere. According to documents shared with CoinDesk, the move will be officially announced on Friday, and a ribbon-cutting ceremony will be held on Friday. New York Mayor Eric Adams will attend. "This is not going to be an 'office,' it's going to be a powerful convening space that our industry and global leaders will benefit from," Circle said in publicity about the opening. Circle declined to comment. Adams' office never replied to a request for comment. Adams has courted the crypto community and dreamed of making the city a major crypto hub. (Famously, his first paychecks as mayor were immediately converted into crypto.) Standing on the site of the original World Trade Center, the new skyscraper, which is also known as the Freedom Tower, is currently the global headquarters of Condé Nast and home to firms like MDC Partners, Reddit, Code & Theory and BounceX. Circle had announced plans to move its legal headquarters from Ireland to the U.S. ahead of its planned initial public offering. The company previously based its U.S. offices in Boston. Circle's USDC, the second-largest stablecoin behind Tether's USDT, has a market cap of $34 billion and a 24-hour trading volume of $6.37 billion, according to CoinDesk price data. https://www.coindesk.com/business/2024/09/12/stablecoin-giant-circle-is-moving-its-headquarters-to-new-york-city/

2024-09-12 16:12

Contracts on which party will control the Senate and House went live Thursday shortly after a federal judge rejected the regulator's last-minute bid to block them. Kalshi has listed its long-anticipated election prediction markets after winning a nearly year-long court battle with the Commodity Futures Trading Commission. The New York-based company's "which party will win the Senate?" and "which party will win the House?" contracts went live on its website Thursday, shortly after a federal judge rejected the CFTC's last-minute bid for a two-week stay of the court’s earlier decision to allow the contracts. "Today markets the first trade made on regulated election markets in nearly a century," Tarek Mansour, Kalshi's co-founder and CEO, told CoinDesk through a spokesperson. The telephonic hearing took place shortly after U.S. District Court Judge Jia M. Cobb, the judge overseeing Kalshi’s case against the CFTC, issued her full opinion explaining her rationale for granting the prediction market’s motion for summary judgment last Friday. A CFTC lawyer said during the hearing that the regulator plans to appeal the case brought by the trading platform, and even though Judge Cobb denied the agency's motion for a stay, it could still ask the higher court to stop the firm from listing the contracts while the appeal is pending. Kalshi filed suit against the CFTC last November, after the regulator attempted to block the prediction market from listing contracts betting on whether Democrats or Republicans would control each house of Congress after the 2024 election. Cobb ruled Thursday that the CFTC had “exceeded its statutory authority” in trying to ban election betting. As soon as Cobb’s ruling hit the docket last Friday, lawyers for the CFTC filed an emergency motion essentially asking the judge to reconsider staying her order for at least two weeks while the regulator appealed her decision to a higher court. The CFTC’s lawyers argued that Kalshi’s election markets contracts are “susceptible to manipulation” and could shake Americans’ faith in election integrity. “The election gambling contracts pose significant public interest risk,” the CFTC’s lead attorney said during Thursday's hearing. “The Commission noted serious concerns about potential adverse effects on election integrity, or the perception of election integrity, at a time where confidence in election integrity is incredibly low. These contracts would give market participants a $100 million incentive to influence either the market or the election, which could very certainly undermine confidence in election integrity. This is a very serious public interest threat.” While Cobb said that she was not unsympathetic to the regulator’s concerns in general, there would need to be definitive evidence of “both certain and great” irreparable harm in order to convince her to issue a stay – not just the nebulous possibility of future harm. Rather than giving a concrete example of the harm caused by Kalshi’s contracts, the CFTC’s lawyer argued that “the Commission is not required to suffer the flood before building a dam.” Yaakov Roth of Jones Day, the lead attorney for Kalshi, argued that any delay in the company being able to list the elections contracts was causing economic harm to Kalshi – and furthermore, driving business to unregulated competitors, not least of all crypto-based Polymarket, which despite being barred from doing business in the U.S. has seen gangbusters volume. “Whether the agency or the court or anyone else thinks that contracts are good or bad for public interest, they are already happening,” Roth said. “At the end of the day, the court concluded that we're legally entitled to list these contracts," he said. "Staying that judgment would wipe out [Kalshi's] investment, while allowing the same trading activity to continue outside the confines of any CFTC regulation. That would amount to punishing the one party that is trying to play by the rules.” Caroline Pham, one of the CFTC's five commissioners, called the agency's defeat self-inflicted. "The Court's opinion in Kalshi echoes the concerns I raised more than two years ago when the CFTC first embarked on a creative reading of its own rules and governing statutes in this matter," she said. "Oftentimes, the simplest explanation for what a law means is the correct one. The Commission would do well to learn from this experience and respect the limitations of its authority." Better Markets, a lobbying group that advocates robust regulation of financial markets, called the decision an example of the "harmful effects" of the Supreme Court's Loper decision, which ended a longstanding requirement for courts to defer to agencies' interpretation of the law. "Had that requirement been in place here, perhaps the CFTC would still be empowered to protect the public from dangerous contracts like Kalshi's," the group said. "Moreover, although the Supreme Court in Loper Bright specifically allowed courts to still weigh the technical expertise and experience of agencies in interpreting a statute, the judge explicitly refused to do so here." https://www.coindesk.com/policy/2024/09/12/us-election-betting-cftc-loses-last-minute-bid-to-halt-kalshi-contract/

2024-09-12 15:40

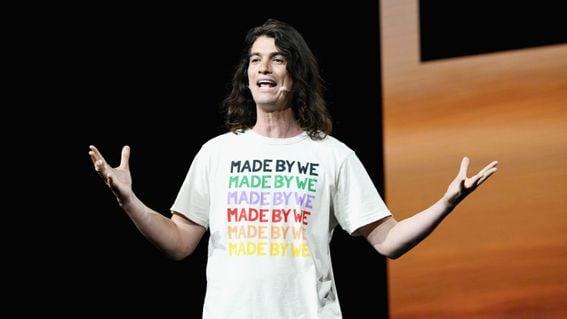

Flowcarbon, which raised $70 million from investors like Andreessen Horowitz, aims to tokenize carbon credits, but the token never launched. Flowcarbon, a climate company co-founded by WeWork's Adam Neumann, is refunding holders of its native crypto token, the "Goddess Nature Token," after it failed to launch, according to a Forbes report. The startup, which started in 2022 and raised $70 million from investors like Andreessen Horowitz to tokenize carbon credits by bringing them onto the blockchain, planned to create a token backed 1:1 by carbon credits. Carbon credits aim to reduce greenhouse gas emissions into the atmosphere by allowing their owners to offset a certain amount of emissions. Each credit represents one metric ton of carbon dioxide removed. While most carbon credits are directly purchased from a project owner or a broker, Neumann's startup planned to sell them as crypto tokens. Out of the $70 million in funding for Flowcarbon, at least $38 million was raised through the sale of the Goddess Nature Token or GNT. But the company has now been reaching out to holders of the token to issue a refund, citing market conditions and resistance from carbon registries for the discontinuation of the token, people familiar with the matter told Forbes. "It's well known that since last year we have been offering refunds to retail GNT buyers due to the industry delays, with standard and customary terms, as we continue to grow Flowcarbon as a leader in carbon finance," Flowcarbon told Forbes. In July 2022, CEO Dana Gibber told the Wall Street Journal that the company had paused the launch of the token to "wait for markets to stabilize." This came after crypto market saw an implosion from the FTX fallout and prominent carbon credit registry Verra warned against tokenizing those credits which are typically retired after purchase. With many countries aiming to be carbon-neutral, the traditional carbon credit market has become very lucrative for investors. In 2022, the market was valued at more than $330 billion. Tokenization, or bringing these credits onto the blockchain, was aimed at making this large market more transparent and accessible for investors. Recently, the tokenized trading project Neutral and DLT Finance, a German brokerage firm, built a regulated blockchain-backed platform for carbon credits where investors can trade them. https://www.coindesk.com/business/2024/09/12/weworks-neumanns-climate-firm-refunds-crypto-token-holders-after-failed-launch-forbes/

2024-09-12 13:30

The only crypto assets U.S. customers will be able to trade on the company’s platform are bitcoin, bitcoin cash and ether, though the company said the practical effects on customers is minimal. Trading platform eToro agreed to pay $1.5 million to settle SEC charges it facilitated trading certain crypto assets as securities, though the specific tokens weren't detailed in the order. The company will make only a limited set of crypto assets available for trading. Only about 3% of customers' crypto assets be dollar value are affected, eToro said. Trading platform eToro agreed to pay $1.5 million to settle charges it operated an unregistered broker, an unregistered clearing agency and facilitated trading certain crypto assets as securities, the U.S. Securities and Exchange Commission said in a statement on Thursday. The company "has agreed to cease and desist from violating the applicable federal securities laws and will make only a limited set of crypto assets available for trading," the statement said, though eToro pointed out the restrictions affect only an estimated 3% of customer's cryptocurrencies by dollar value. Going forward the only crypto assets available for U.S. customers to trade on the company’s platform will be bitcoin (BTC), bitcoin cash (BCH) and ether (ETH), the SEC statement said. However, "in most cases U.S. users don't have to do anything," an eToro spokesperson said. "Only positions that cannot be transferred to the eToro crypto wallet are impacted." Positions in coins which are redeemable to the eToro crypto wallet can remain as open positions, so no action is required for these assets, the spokesperson added. “This settlement allows us to move forward and focus on providing innovative and relevant products across our diversified U.S. business," Yoni Assia, eToro’s Co-founder and CEO told CoinDesk in an earlier press release. The SEC’s order found that since at least 2020, eToro – which didn't admit or deny wrongdoing in agreeing to the settlement – let U.S. customers trade crypto assets being offered and sold as securities and "did not comply with the registration provisions of the federal securities laws," the release said. The eToro case notably doesn't specify what tokens the company was handling that it considers securities. The agency has done so in several past matters, but it hasn't offered a formal, crypto-specific definition for what tokens stray into the SEC's jurisdiction – the primary point of legal contention between the regulator and the industry. The SEC has been clamping down on crypto firms that it argues have violated securities laws. It recently was granted a limited win in its several-years-long case against crypto platform Ripple that dates back to 2020. In August, a federal judge ruled that Ripple should pay $125 million after finding that the company violated federal securities laws with its direct sales of XRP to institutional clients. But this was a fraction of the $2 billion that the SEC initially sought. The SEC also brought an enforcement action against crypto exchange Coinbase Inc. (COIN) for "alleging that Coinbase intermediated transactions in crypto-asset securities on its trading platform and through related services, all in violation of the federal securities laws." The court sided with the SEC, according to a filing in March. In 2023 the SEC also sued another large exchange, Binance, for violating securities laws, and the decision led to Changpeng "CZ" Zhao stepping down after pleading guilty to criminal charges and Richard Teng replacing him. ETH remains a point of dispute, with the Commodity Futures Trading Commission and most of the crypto industry arguing it's a commodity while the SEC declines to say either way, though at least one SEC-registered broker dealer has begun a custody operation that treats it as a security. "We now have a clear regulatory framework for crypto assets in our home markets of the U.K. and Europe and we believe we will see similar in the U.S. in the near future," Assia added. "Once this is in place, we will look to enable trading in the crypto assets that meet this framework.” Jesse Hamilton contributed to reporting. Update (September 12 15:07 UTC): Adds context on SEC in last five pars. Update (September 12 16:02 UTC): Adds comments from eToro spokesperson and Yoni Assia, eToro’s co-founder and CEO. https://www.coindesk.com/policy/2024/09/12/etoro-reaches-15m-sec-settlement-agrees-to-stop-trading-most-cryptocurrencies/

2024-09-12 13:14

The closed-end fund will offer investors exposure to XRP tokens. Crypto fund manager Grayscale is launching an XRP trust that could pave the way for a spot XRP exchange-traded fund (ETF) in the U.S. The closed-end fund will offer accredited investors direct exposure to XRP (XRP). Grayscale previously offered an XRP Trust but dissolved it in 2021 following the U.S. Securities and Exchange Commission’s 2020 lawsuit against Ripple Labs that alleged the XRP token is a security under federal securities law. Ripple has since emerged victorious in a widely-followed court case against the SEC, clearing the regulatory headwinds for the closely related XRP token. “We believe Grayscale XRP Trust gives investors exposure to a protocol with an important real-world use case,” said Grayscale’s Head of Product & Research, Rayhaneh Sharif-Askary in a press release. "By facilitating cross-border payments that take just seconds to complete, XRP can potentially transform the legacy financial infrastructure." The Trust functions like Grayscale’s other single-asset investment trusts, and is solely invested in the token underpinning the XRP Ledger. XRP spiked 8% on the news. https://www.coindesk.com/markets/2024/09/12/xrp-spikes-8-as-grayscale-launches-xrp-trust-in-the-us/

2024-09-12 12:19

The token will initially be offered on Ethereum and Coinbase’s Base networks, with plans to expand to more blockchains in the coming months. Coinbase has introduced its version of wrapped bitcoin, cbBTC, on the Ethereum and Base networks, allowing users to use bitcoin in DeFi applications. cbBTC is supported by various DeFi services for trading, lending, and as collateral, with automatic conversion features for Coinbase users transferring bitcoin to or from these networks. This launch follows Coinbase's hint at entering the wrapped bitcoin market and challenging the existing leader, BitGo's WBTC, with plans to foster a significant bitcoin economy on Base. A tokenized version of bitcoin (BTC) offered by Coinbase (COIN) has gone live on the Ethereum and Base networks. The crypto exchange is entering a market whose biggest player is backed by over $8 billion worth of the asset. The Coinbase Wrapped BTC (cbBTC) is an ERC-20 token backed on a 1:1 basis with bitcoin (BTC) held by Coinbase. Such wrapped tokens allow users to utilize bitcoin they already hold in new ways onchain, such as providing their bitcoin as liquidity to decentralized finance DeFi protocols, or using it as collateral to borrow other crypto assets. Several DeFi services are expected to offer support for cbBTC from Thursday, Coinbase said, including exchanges Aerodrome and Curve, lending applications Aave, Sky Protocol, Compound, real-world assets provider Maple and cross-chain bridges such as deBridge, among others. Bitcoin sent by Coinbase users from the exchange to specific addresses on Base or Ethereum will automatically be converted 1:1 to cbBTC. When users receive cbBTC in their Coinbase accounts, it will be converted 1:1 from cbBTC to BTC. At launch, cbBTC will be available to Coinbase users in the U.S. (excluding New York State), U.K., EEA states, Singapore, Australia, and Brazil. The token comes weeks after Coinbase first teased an announcement amid controversy around BitGo’s wrapped bitcoin (WBTC) token - which leads the wrapped bitcoin category and is worth over $8 billion as of Thursday. At the time, Jesse Pollak, who created Base, said the team planned to build a "massive bitcoin economy" on the network. https://www.coindesk.com/business/2024/09/12/coinbases-wrapped-bitcoin-cbbtc-goes-live/