2024-04-05 06:41

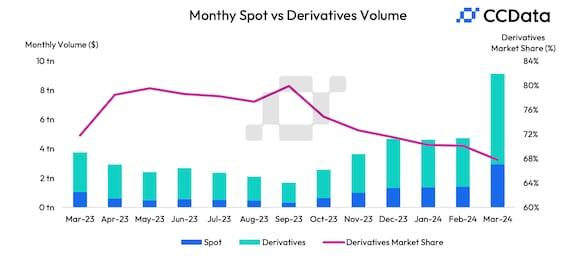

The share of crypto derivatives in total market activity slipped to 67.8% in March, according to CCData. In March, derivatives trading volumes surged by 86.5% to a record high of $6.18 trillion. The share of crypto derivatives in total market activity slipped to 67.8% in March, the sixth consecutive monthly decline, according to CCData. Crypto derivatives trading became bigger than ever in March, but its share in the total market activity declined for the sixth consecutive month, according to London-based digital assets data provider CCData. Trading volume in futures and options tied to cryptocurrencies on centralized exchanges rose 86.5% to a record high of $6.18 trillion, translating to three times of the total market capitalization of all cryptocurrencies. Still, the market dominance of derivatives slipped to 67.8%, the lowest since December 2022 as traders flocked to the spot market, where cryptocurrencies are exchanged for immediate delivery. Spot trading volume jumped 108% to $2.94 trillion, the highest monthly volume since May 2021. The combined spot and derivatives trading volume increased 92.9% to a record $9.12 trillion. "The spike in spot trading activity on centralized exchanges coincides with the growing excitement around Bitcoin reaching new all-time highs and the initial signs of returning retail participants in the market," CCData's monthly report said. Derivatives are often criticized for creating artifical demand and supply via leverage, injecting volatility into the market and are considered a proxy for speculative activity often observed at major market tops. As such, the decline in derivatives' share of the total market activity might be a good news for crypto bulls anticipating a continued price rally. Bitcoin (BTC), the leading cryptocurrency by market value, rose 16.6% in March, setting new record highs above $73,000, CoinDesk data show. Prices rose over 68% in the first quarter. The CoinDesk 20 Index, a broader market gauge, jumped over 50% in the first three months. https://www.coindesk.com/markets/2024/04/05/crypto-derivatives-lost-overall-market-share-in-march-despite-hitting-record-high-trading-volume-of-618t/

2024-04-05 04:00

Maximum extractable value (MEV), in which blockchain operators reorder transactions to squeeze out additional profits, usually at the expense of whoever is sending the transactions, is not inherently bad, some policy experts point out. The European Securities and Markets Authority (ESMA) flagged a technique employed by some crypto miners as a potential form of market abuse in its latest regulatory proposals under MiCA. Crypto policy watchers want the regulator to clarify that reordering transactions to maximize profits, known as MEV, is not all bad. The European Union markets regulator flagged maximum extractable value (MEV), whereby blockchain operators reorder user transactions to maximize their own profits, as a potential form of market abuse, a stance that is worrying some industry watchers who say the case is not clear-cut. In regulatory proposals published last week by the European Securities and Markets Authority (ESMA) under the digital assets law known as MiCA, the watchdog referred to MEV as potentially suspicious. MEV is broadly defined, but generally encompasses trading strategies where blockchain operators – the companies and individuals that add blocks to the chain – preview the network's transaction queue to extract extra profits for themselves. Frequently, such tactics involve reordering user transactions – shifting how they're ordered into blocks, or frontrunning them with new transactions – just before the trades are written to the chain's ledger. MEV is often called an "invisible tax" on users, since certain methods for extracting it, like sandwich attacks and frontrunning, can eat directly into end-user profits. While MEV is a controversial topic even within the industry, some industry advocates argue that MEV plays a positive role in general since it can help to improve blockchain network efficiency. “MEV by itself should not at all be considered as a market abuse and should not have a negative connotation," Anja Blaj, a policy expert at the European Crypto Initiative (EUCI), said in an interview over WhatsApp. "There are very limited scenarios and tactics that have similar effects to those of market abuse. This should be emphasized over and over again as MEV's purpose in the first place is to compensate the good actors for the validation work they do.” Out of scope? Some crypto policy watchers have argued that MEV is not even within MiCA’s scope, and EUCI has warned that applying MiCA to MEV could lead to overregulation. While it's true the MiCA text does not mention MEV, ESMA's consultation on proposals to tackle market abuse notes that the legislation extends the EU’s existing market abuse rules to include reporting suspicious activity resulting not just from transactions but also “the functioning of the distributed ledger technology such as the consensus mechanism.” “MiCA is clear when indicating that orders, transactions, and other aspects of the distributed ledger technology may suggest the existence of market abuse e.g., the well-known maximum extractable value," it said. ESMA also noted that MiCA doesn’t require crypto service providers to report activity such as “scams, payments fraud or account takeover.” Peter Kerstens, an adviser to the European Commission on financial sector digitalization and cybersecurity, said MEV is neither good nor bad but may lead to questions about market integrity. Investors have a legitimate expectation that transactions on the blockchain will be validated in the order they were submitted, and MEV reordering can lead to frontrunning, where the "validators" that operate blockchains can move their own transactions ahead of others to ink an extra profit, according to Kerstens. “So MEV may lead to questions about the integrity of the market and it may trigger market abuse/frontrunning, but it does not have to in every instance,” Kerstens, who was instrumental in the creation of MiCA, said in a statement to CoinDesk. Search for regulatory clarity The legislation, whose full name is Markets in Crypto Assets, was finalized last year and made the EU the first major jurisdiction to comprehensively regulate the burgeoning digital assets sector. ESMA and the European Banking Authority (EBA) have been consulting on measures and guidance they’re required to issue under MiCA, with industry watchers engaging with the watchdogs to improve clarity on the rules – particularly for various service providers. EUCI is seeking more clarity from ESMA, ensuring that the regulator is clear on what scenarios involving MEV constitute market abuse. “When, if, a malicious MEV tactic is detected, it should further be elaborated who's responsible for it," Blaj said. "We cannot talk about effective enforcement without clarity around the 'who' and 'what for.'” Kerstens noted his thoughts on MEV are his personal views, but added that ESMA’s consultation seeking public feedback is in response to the European Commission – which proposed the MiCA framework – asking the regulator to provide advice on “if and when MEV is/leads to/can lead to market abuse.” “So an official/institutional view on this may be forthcoming,” Kerstens said. ESMA’s latest consultation is open for comments until June 25. https://www.coindesk.com/policy/2024/04/05/eu-watchdog-says-reordering-blockchain-transactions-might-be-market-abuse-industry-says-its-not/

2024-04-04 20:30

M&As could give birth to tokens such as 'ShibaPepes' and 'FlokiDoges,' according to one expert. Projects with commoditized technology that have high liquidity, but not a very active team could become targets of hostile takeover. Traditional players could also be scooping up Web3 projects that are "most innovative." M&A in the memecoin sector could reach a "fever pitch," leading to the creation of tokens such as "ShibaPepes' and 'FlokiDoges." Between tokens that replicate complex financial instruments like rehypothecation to many "a dog with a hat" type projects, there are a lot of tokens in the crypto ecosystem these days. Too many, according to some experts, who are predicting a wave of consolidation in the coming weeks and months. With more than 13,000 tokens and about $2.5 trillion market cap, the question becomes - why are there so many tokens when the utilization and adoption of the technology are not even close to where it should be? Enter mergers and acquisitions (M&A) which could help clean up the sectors such as decentralized finance (DeFi) to NFT projects and even memecoins, according to industry observers. Similar to the late-90s dot-com era, heavy interest from venture capital and the general public during the 2021 bull run has led to capital flowing into too many different crypto projects trying to solve similar problems, creating more tokens than needed. "Venture capital and excessive funding rounds during bull markets have led to the creation of a slew of projects often looking to solve similar challenges, just taking a slightly different approach," said Julian Grigo, head of institutions and fintech at smart-wallet infrastructure provider Safe. Taking a cue from the traditional sectors such as the internet, semiconductors and health care, mergers and acquisitions (M&A) can solve the problem for crypto. "There are already too many tokens and too many 'projects' for not enough adoption and utility," said Chiliz network CEO Alex Dreyfus, who previously said he is looking at "some aggressive M&A" this year. "Eventually, consolidation will be key," he added. In fact, there is already a three-way merger that happened last month as artificial intelligence (AI)-related crypto projects Fetch.ai, SingularityNET and Ocean Protocol said they are merging to create one 7.4 billion dollar token that will make an AI collective to fight the Big Tech firms. Deals are 'infinitely harder' But that's just one recent example of somewhat large-scale M&A. Why aren't there more? The simple answer might be that the industry is still very young and needs more time to reach a level where mergers can become more frequent. "The crypto M&A market is still in its infancy and, as such, there often isn’t a template or rulebook in place which can make deals more difficult and complex," said Safe's Grigo. Another unique challenge to crypto is the nature of the token markets. "M&A is harder in crypto, because there is a lot of money in crypto trading and therefore, unlike traditional finance, where a ‘stock’ could die … crypto never dies. Everything is always a trading opportunity," said Dreyfus. One way this can potentially be managed is by doing the deals at the token level rather than corporate, meaning each team "can work on their own initiatives while supporting and growing the same ecosystem. It will make more decentralized ecosystems and also have very powerful network effect," he added. But that's not an easy task to accomplish, according to Shayne Higdon, co-founder and CEO of The HBAR Foundation, part of the Hedera ecosystem. "With crypto, where the ethos is open-sourced and decentralized, what are you actually buying or merging? Are you merging operations or just a token? The former is incredibly difficult to do when the business is centralized and will be infinitely harder in a decentralized world," he said. “In crypto, it’s about growing the ecosystem and subsequent network effects. Having a common goal is paramount to ensure communities vote to merge. These communities also hope, as a result of a merger, that they will make more money in the long run," Higdon said. M&A in crypto may lead to "short-term token appreciation," but may dilute value in the long-run. "Without the presence of clear, non-redundant roles and responsibilities for the company, teams, and personnel, it will be difficult to reach efficient, economies of scale," he added. That's not to say the fundamentals of M&A can't work for crypto. The first rule of any M&A would be to ensure synergies between the companies or projects and if the new company can get an edge over the competitors by merging. "From an infrastructure side, we will increasingly see interoperability play a crucial role in aligning these ambitions and likewise, I expect to see increased M&A activity amongst projects that share a common goal,” said Safe's Grigo. Next would be figuring out the tokenomics and incentives for holders to vote for the deal - similar to how bankers would structure a merger or acquisition offer, may it be friendly or hostile. "For projects where founders, investors, or teams control the bulk of circulating supply, it is easy to negotiate the deal with a small number of players," said Oleg Fomenko, co-founder of the decentralized app Sweat Economy. "Whereas for sufficiently decentralized projects, it is easy to launch a ‘hostile takeover’ making the offer for tokens to all token holders in order to accumulate a sufficient amount to influence the governance of the protocol," Fomenko added. Other considerations are figuring out if a merger can increase the project awareness, reach a larger community, creating a stronger team to achieve a common goal, said Fomenko adding that lack of central medium to deliver a potential takeover offer as one of the biggest barrier right now for the Web3 ecosystem. In decentralized systems, you often don't know all the token holders. There's no proxy agency who can contact holders to get then vote - as there would be with traditional companies. Regulation: blessing or a curse? In traditional finance, one of the biggest hurdles for a deal to finish is the regulatory uncertainties. TradFi is littered with such high-profile M&A failures, including the more than $40 billion takeover of NXP Semiconductors by tech giant Qualcomm that failed after China blocked the deal. Another example was when Canada thwarted mining giant BHP Billiton's $39 billion hostile takeover of Potash Corp. Crypto's relatively immature regulatory landscape could be a net positive for the industry, according to Sweat Economy's Fomenko. "Given the track record of Web3, it is likely to have the opposite effect and projects with significant treasuries, active teams, and communities are likely to take advantage of the current regulatory climate and acquire other businesses before M&A regulation emerges in this field,” he said. Conversely, a better regulatory regime might incentivize bigger M&As as it could encourage larger financial institutions to step in as they'll have a better idea of how regulators will see a potential deal, according to Safe's Grigo. A 'ShibaPepe' coin? So, if deal-making takes off in the digital assets space, what should investors be watching? Naturally, projects that aren't able to compete with the larger competitors will look to merge their businesses to stay afloat. “The next wave of M&A is likely to occur in sectors where there is a high degree of fragmentation, like Layer 1 chains that didn’t break Top 10, DEXs, DeFi protocols, node operators, and possibly even NFT projects,” said Aki Balogh, co-founder and CEO of DLC.Link Meanwhile, Safe's Grigo sees M&A playing out "right across the board," as he doesn't see any one specific area that is immune to consolidation. He also expects traditional players to scoop up Web3 projects that are "most innovative." However, projects that are only high-quality will be able to garner top dollar for potential M&A. "The big winners of this trend are likely to become businesses that have very sophisticated cross-chain analytics capabilities as well as businesses able to deliver the message to the holder of the specific token about the potential offer," according to Sweat's Fomenko. He said projects with higher liquidity that lack active teams could become targets of hostile takeovers. "I foresee that this will likely happen in the fields where technologies are largely similar between different players — decentralized exchanges (DEXs), collateralized liquidity providers, and liquid staking protocols. However, any project with a token that is a governance token might become a target." Fomenko thinks that this might become a dominant force within the memecoin sector. "My prediction is that this will reach a fever pitch in the world of memecoins where I foresee the emergence of 'ShibaPepes' and 'FlokiDoges' in no time.” https://www.coindesk.com/business/2024/04/04/crypto-has-too-many-tokens-and-mergers-are-coming/

2024-04-04 19:32

The world's largest crypto regained the $69,000 level at one point in the session before slipping a bit. It was a day of positive divergence for crypto bulls as stocks tumbled late in the U.S. trading session while bitcoin (BTC) managed to erase most of the week's losses. In late afternoon action, the S&P 500 and Nasdaq were each lower by nearly 1% – not a huge loss, but about a 2% reversal off of earlier session highs. Behind the moves lower were hawkish comments from Minneapolis Fed President Neel Kashkari. "If we continue to see inflation moving sideways, then that would make me question whether we [need] to do those rate cuts at all," said Kashkari at a virtual event on LinkedIn. Kashkari has been among the more hawkish Fed members this cycle so his remarks shouldn't have been too unexpected, but stocks quickly reacted to the downside. His comments were also at odds with those yesterday from Fed Chairman Jerome Powell, who told an audience at Stanford that he continues to expect rate cuts at some point this year. Nevertheless, the rate outlook could come more clearly into focus on Friday with the release of the government's March employment data. To date, those hoping weakening jobs numbers might prompt the Fed to move more quickly to a rate cut cycle have been disappointed, with employment growth maintaining robust levels throughout 2023 and so far in 2024. Economist estimates are for 200,000 jobs to have been added in March, a strong number, though down from 275,000 in February. The unemployment rate is expected to hold steady at 3.9%. Bitcoin, which had slipped as low as $65,000 overnight, rallied throughout much of the U.S. day, at one point topping $69,000. At press time, the crypto was trading at $68,750, up 4.5% over the past 24 hours. The broader CoinDesk 20 Index was ahead 3.25% over the same period, with ether (ETH) a notable laggard, up just 1.75%. https://www.coindesk.com/markets/2024/04/04/bitcoin-adds-45-as-stocks-reverse-lower-on-hawkish-fed-commentary/

2024-04-04 19:27

Bulgarian national Irina Dilkinska pleaded guilty to wire fraud and money laundering charges in 2023. Bulgarian national Irina Dilkinska, the former head of legal and compliance for OneCoin, was sentenced to 4 years in prison for money laundering and wire fraud. Dilkinska helped executives launder hundreds of millions in fraud proceeds. She is the latest OneCoin executive to be brought to justice for her role in the $4 billion crypto Ponzi scheme. OneCoin’s former head of legal and compliance was sentenced to four years in prison on Wednesday for her role in the infamous $4 billion crypto ponzi scheme. Instead of ensuring OneCoin was operating within legal and regulatory parameters, prosecutors say Bulgarian national Irina Dilkinska helped with the day-to-day operations of the scheme and, after its collapse in 2016, helped executives launder their ill-gotten gains by working with American lawyer Mark Scott to squirrel away $400 million to the Cayman Islands. Scott, a former partner at international law firm Locke Lord, was sentenced to 10 years in prison for his role in the scheme earlier this year. Dilkinska, 42, was extradited to the U.S. in March 2023 and charged with one count each of conspiracy to commit wire fraud and conspiracy to commit money laundering. She pleaded guilty to both charges in November 2023. New York District Court Judge Edgardo Ramos also ordered Dilkinska to forfeit $111.4 million. Dilkinska is the latest OneCoin executive to be put behind bars for her involvement in the scam, which started in Bulgaria in 2014 and shut down in early 2017. OneCoin’s co-founders, Bulgarian national Ruja Ignatova and joint U.K. and Swedish citizen Karl Greenwood, promoted the fictitious cryptocurrency – which never existed on any blockchain – through a kind of multi-level marketing scheme, paying initial investors to bring in more investors. By the time OneCoin was revealed to be a scam, an estimated 3.5 million people had fallen victim. Greenwood was sentenced to 20 years in prison in September 2023 and ordered to forfeit $300 million. Read More: OneCoin Co-Founder Karl Greenwood Sentenced to 20 Years in Prison So-called “Cryptoqueen” Ignatova remains at large, seven years after vanishing in Athens in 2017. In 2022, Ignatova was added to the FBI’s Most Wanted List, offering a $250,000 bounty for information leading to her arrest. Whether Ignatova will ever be brought to justice remains unclear. The FBI has suggested she could have altered her appearance with plastic surgery or may be traveling on a German passport in the Middle East or Eastern Europe. There are also rumors that Ignatova may be dead. In 2023, a report from a Bulgarian media organization suggested that Ignatova was murdered and subsequently dismembered on a yacht in the Ionian Sea in 2018 at the command of a Bulgarian drug lord known as “Taki.” Jesse Hamilton edited this story. https://www.coindesk.com/policy/2024/04/04/onecoin-compliance-chief-sentenced-to-4-years-in-prison-for-role-in-4b-ponzi-scheme/

2024-04-04 18:37

XRP has plenty of internet fans but Ripple has struggled to win real enterprise customers. Will its new stablecoin fill the gap and overshadow its existing token? Ripple has declared the death of (XRP). Well, to be fair, to be accurate, Ripple CEO Brad Garlinghouse has said the exact opposite when announcing the Silicon Valley crypto mainstay would launch a U.S. dollar-pegged stablecoin later this year. But in the grand scheme of things, XRP’s usefulness is dwindling. (Sorry, XRP Army, it’s my job to speak it how it is.) The Ripple stablecoin, expected later this year, will apparently be backed 1-to-1 by cash equivalents including U.S. dollar deposits, U.S. government bonds and other low-risk investments, according to the company’s announcement. The idea is reportedly to create a more trustworthy alternative to assets like Tether’s (USDT) and Circle’s (USDC). Indeed, as many others have pointed out, the $150 billion stablecoin market is crowded — but it’s also highly lucrative. Tether, the first and largest stablecoin that currently dominates the market, is essentially being used as a cash cow to fund Tether CEO Paolo Ardoino’s many wild ambitions (from AI to decentralized messaging). It’s possible, facing as much as a $2 billion fine from the U.S. Securities and Exchange Commission (SEC), Ripple is looking for a new, proven revenue source. Garlinghouse is apparently unfazed by the crowded competition, telling CNBC: in the future the stablecoin “market will look different, certainly based on size.” In many ways Ripple’s existing business model — selling financial services based around its XRP Ledger as well as On Demand Liquidity and RippleNet protocols — is falling short. Although Ripple has seen some success forming partnerships, it seems increasingly clear legitimate financial institutions do not want to take on the volatile currency risks of working with unpegged digit assets. Over Ripple's decade-plus history, it often seemed better at building community (the XRP Army) and being a crypto cause (taking the SEC to court over the crucial question of whether tokens are securities). It's been less successful at building products companies and individuals actually want to use. “Nobody is using XRP itself as the method of payment, just like nobody is really using BTC much for that,” Columbia Business Professor and former Paxos stablecoin fund manager Austen Campbell said in a direct message. Of course, that isn’t totally true. Diameter Pay CEO David Lighton said he partnered with Ripple on an early pilot experiment of xRapid (rebranded as Ripple ODL) to send remittances between the U.S. and the Philippines. While he no longer uses that particular service, he does use the RippleNet messaging platform for some cross-bank transactions, which doesn’t rely on XRP. “Ripple has sort of a best in class data structure, most of the banks are kind of behind,” Lighton said. “It's a good product, but they don't really sell it that much anymore. I think that they're sort of keeping it alive for their legacy clients — it's not entirely clear to me why that is.” Lighton said he stopped using ODL when he left the consumer remittance business, but found it also to be a useful product. It helped him manage currency risk by providing real time settlements for small tokenized trades. “It's not entirely clear how all of that has been put together, because I'm not currently using it. But it's reasonable to say there's some value added because it helps firms reduce their cost of working capital,” he said. However, many of Ripple’s higher profile partnerships have fallen through. Santander, one of the largest banks in the E.U., put Ripple on ice after the bank realized using XRP wouldn’t work for its customers’ needs. A storied relationship with MoneyGram ended due to the increasing costs associated with cross-border XRP payments, and the need for MoneyGram to form third party relationships with crypto exchanges in dispersed regions. MoneyGram terminated the deal with Ripple, which invested $30 million in the remittance giant in 2019 to use RippleNet, after a class-action lawsuit was filed by shareholders alleging MoneyGram should have been aware that XRP could have been deemed a security and thus impact MoneyGram’s bottom line. The question of whether XRP is a security won’t really be answered until Ripple’s four year legal battle with the SEC ends after appeals. Right now it’s a complicated situation. Judge Analisa Torres found last year that XRP is NOT a security by default (specifically when traded on exchanges), but it does represent an investment contract when Ripple sells the token to qualified investors. And that’s the rub. For years, Ripple has essentially funded itself by selling quarterly tranches of XRP for hundreds of millions of dollars to investors. The SEC alleged that Ripple and two of its executives raised over $1.3 billion from the sale of XRP through unregistered securities offerings, about $770 million of which in institutional sales was found to violate Section 5 of the Securities Act. It’s unlikely, no matter the appeals process, that that activity will be able to continue on the same scale. It’s hard to get a sense of Ripple’s financials as a private company. But, in many quarters leading up to the SEC’s suit, these programmatic sales represented a decent chunk of non-bot XRP trading activity. Ripple has claimed in the past it has had over 200 clients for RippleNet from central banks and financial institutions across over 40 countries. But often, beyond the initial announcement that companies will be using XRP for cross border liquidity, there is very little indication how often Ripple’s financial services are actually used. Often times the pilots are just internal, and not used for consumer-facing applications. Bank Dhofar, Omar’s second largest bank, for instance, announced it would use RippleNet in 2021 and offers customers the option to “Deposit up to OMR 1,000 to deposit accounts in India instantly through Ripple.” But that is the only mention on the bank’s website. Many others — including payments apps and remittances services — make no mention of Ripple at all on their corporate sites. Lighton said he’d consider using ODL again if it was “a good enough commercial proposition” and that if he could “get comfortable with the regulatory and compliance risks,” but when it comes to financial services there’s a lot of up- and downstream relationships that do internal risk ratings to figure out whether to work with you that aren’t yet comfortable with crypto. “It's really a tough environment right now to do something cool and sexy,” he said. “I'm a regulated entity. My top loyalty is to our anti-money laundering obligations.” Asked whether he’d be more comfortable using stablecoins or stablecoin-based services, Lighton said he’s even more hands off there following the Federal Reserve’s Novel Activities Supervision Program instituted last summer, which dialed up the heat on entities using stablecoins. “There's some brilliant ideas behind stablecoins. The problem is no one is really sure how to regulate them,” Lighton said. He mentioned that PayPal is allowed remittances through its PUSD stablecoin on its Western Union-like platform Xoom, which might be an avenue that Ripple goes down. To be fair, Ripple’s XRP-based financial tools are largely meant to work in the background — though many would still likely prefer financial rails built on fiat rather than a free floating currency. That may be why a growing number of crypto companies and projects decide to go down the stablecoin route. In fact, Ripple’s soon-to-be competitor, Circle, issuer of the second largest stablecoin, went through a number of corporate reevaluations — going from a peer-to-peer payments platform to a bitcoin wallet — before it landed on the stablecoin business. Maybe that is the natural crypto lifecycle. https://www.coindesk.com/consensus-magazine/2024/04/04/what-does-ripples-stablecoin-mean-for-xrp/