2024-04-03 15:33

Wood called bitcoin an "insurance policy against rogue regimes and horrible fiscal and monetary policies." Cathie Wood said currency devaluations in Nigeria, Egypt and Argentina are behind bitcoin's rise this year. Wood labelled bitcoin as an "insurance policy" against rogue regimes. Last month she reiterated her bitcoin price target of $1.5 million. ARK Invest CEO Cathie Wood has said bitcoin's rise to a record high this year has been in part due to national currency devaluations around the world. Bitcoin (BTC) has gained more than 130% in the past 12-months, hitting an all-time high of $73,800 last month alongside a wave of demand from spot bitcoin ETFs in the United States. Wood touted a separate narrative in an interview with CNBC, stating that bitcoin is an "insurance policy against rogue regimes and horrible fiscal and monetary policies." "There is something else going on around the world." Wood said. "There are currency devaluations taking place that people are not talking about. The Nigerian naira is down 50, 60% in the last nine months. Egypt just devalued by 40%. Argentina, continuing to devalue. I think is a flight to safety taking place, a hedge against devaluation a hedge against a loss of purchasing power and wealth." Two weeks ago Wood reiterated a $1.5 million price target for bitcoin, labelling it as a “financial super highway.” "We saw this even here last year in the United States, regional banks imploded, bitcoin went up 40%," she said today. "Bitcoin does not have counterparty risk. This is both a risk on asset and it is risk off. I remember we got in at $250 when Greece was threatening to leave the euro." https://www.coindesk.com/business/2024/04/03/cathie-wood-attributes-bitcoins-rise-to-national-currency-devaluations/

2024-04-03 13:54

The influencers, representing Bitcoin and Ethereum, will enter the pit at the Consensus festival May 30, 2024. Fyre Festival’s Billy McFarland is also on the fight card. CoinDesk’s Consensus has seen plenty of heated blockchain battles over its ten year history. But 2024’s matchup in the Karate Combat Pit takes the dueling to a new level. Crypto influencers Nic Carter and David Hoffman are set to go toe-to-toe on May 30 during this year’s conference in Austin, Texas. “Influencer Fight Club 2” is the part of the increasingly popular Karate Combat series, essentially a no-holds-barred version of UFC without the (time-wasting) on-mat grappling. Carter, co-founder of data analytics leader Coin Metrics and VC fund Castle Island Ventures, will represent Bitcoin, while Hoffman, the founder of media platform Bankless, will fly the colors for Ethereum. The bout is two rounds of two minutes each, with a third round scheduled if a tiebreaker is needed. Also on the card is Billy McFarland, the infamous Fyre Festival entrepreneur, who squares off against Alex, better known by his handle @shillin_villain. “I’m very confident,” said Carter, via X DMs. “I’ve never trained in martial arts before this and I don’t think David has either. But we are both very fitness focused – which makes us a good matchup.” Both fighters have hired trainers to work on basic fighting skills and they’re preparing hard around other day-to-day commitments. The friends have a side bet where they’ll donate $10,000 to the winner’s chosen open-source development group. Carter’s choice is the Bitcoin Core, which maintains the Bitcoin network. Hoffman’s is Protocol Guild, the equivalent organization in the Ethereum community. When the news leaked on X last week, several commenters made fun of the fighters’ physiques and mocked their fighting skills. But the two are undeterred. “At the end of the day, it’s me and David that are taking the risk and getting in the ring and all they can do is watch,” Carter said. “If they want to fight they can try and get in the undercard, they are welcome to reach out to Karate Combat. But David and I aren’t claiming to be amazing fighters. The objective is to entertain and take on a new challenge, not to begin decorated fight careers.” “It’s been funny to hear all the haters who want to fight us,” adds Hoffman. “I have no interest in fighting anyone but Nic Carter.” This is the 46th Karate Combat event and the second under the banner “Influencer Fight Club (IFC).” The first, featuring Ben “BitBoy” Armstrong and meme coin creator “More Light,” in Mexico City in February, drew hundreds of thousands of views on YouTube. BitBoy beat the more-fancied More Light in a match full of aggression and flanging fists and arms. Karate Combat founder ONLYLARPING said he wants the format to “be the first official sport of Web3.” “It makes sense to partner with the biggest and best conferences in the world and the most entertaining influencers and founders.” Research by Karate Combat found that a large percentage of its audience don’t enjoy sports unless there is a side-bet element to it. The platform has a no-loss gaming feature, where Karate token-holders plump for a winner and are given a small share of the prize money if they pick the right horse. If they pick the loser, they don’t give up anything. The Karate Combat series at Consensus features six influencer fights and 10 more conventional bouts involving professional fighters. The action begins May 30 at 7 pm local time. Weigh-ins take place May 29 at 5 pm on the Town Square stage. https://www.coindesk.com/consensus-magazine/2024/04/03/texas-takedown-nic-carter-and-david-hoffman-square-off-for-karate-combat-at-consensus/

2024-04-03 12:25

As well as cyber and crime markets, Relm is offering reimbursement for losses associated with staking on the Ethereum network. Relm Insurance, regulated by the Bermuda Monetary Authority, is offering a five-product suite of crypto cover offerings. As well as cyber and wallet custody cover, Relm is providing professional liability insurance for crypto trading, as well as cover for losses relating to staking assets on the Ethereum blockchain. Relm Insurance, a specialty insurance carrier regulated by the Bermuda Monetary Authority, has unveiled a new suite of products covering a range of cryptocurrency-related risks, from wallets to investment management. Relm, which also provides insurance to emerging industries like cannabis and psychedelics, has created a five-part offering for digital asset risks, such as cyber cover, crime coverage for holding crypto in hot wallets (connected to the internet), or covering investment managers of digital assets funds. In addition, there are more esoteric cover options like reimbursement for losses associated with staking Ethereum, where a participant can have their assets “slashed” for being offline, for example. Adequate insurance cover for crypto has traditionally been hard to come by, and tended to be focused on two areas: commercial crime market – which covers things like cash in ATMs or moved around in armored cars – and the specie market, which is focused on specially designed vaults and the like, for storing high value items like gold bullion or art. There has also been a lack of capacity when it comes to crypto risks, but that might be changing. Insurance broker Marsh recently announced an $850 million insurance offering covering cold storage, as well other custody solutions such as Multi-Party Computation (MPC), where cryptographic keys are split into shards. Over the past several years, Relm has provided insurance cover to exchanges, payment and remittance platforms, custodians, software developers, and foundations that anchor decentralized autonomous organizations (DAOs) for some of the biggest decentralized finance (DeFi) protocols, said the insurer’s CEO Joseph Ziolkowski, without naming any companies. Ziolkowski said his new product suite applies to areas within crypto where there is a dearth of cover available and the capacity limits depends on each company and situation. “If you look at the amount of capacity in London for something like cold storage, or specie cover, it's the most basic exposures arising from digital asset operations, and as a result, there's massive amounts of capacity that exists,” Ziolkowski said in an interview. “We deal with much more complex exposures that have far fewer markets that are willing to put their balance sheet on the line for these types of products.” https://www.coindesk.com/business/2024/04/03/bermuda-licensed-relm-insurance-unveils-suite-of-crypto-risk-products/

2024-04-03 12:00

Based on the debut price, the project's W token has a fully diluted value of $16.5 billion. Token debuts at $1.66, $3 billion market cap. Heavy congestion on Solana-based decentralized exchange OpenBook causes downtime. A 6% share of the total supply was allocated to the airdrop. Cross-chain bridge Wormhole initiated an airdrop that will see early users rewarded with 617 million of its newly issued governance token, W. The token opened at $1.66 on Solana-based decentralized exchange (DEX) OpenBook with a market capitalization of $2.98 billion and a fully diluted value figure of $16.5 billion, according to CoinGecko. OpenBook experienced a period of heavy congestion after the token was released with several users reporting that it was inaccessible. The tokens released represent 6% of the total supply, a further 12% of which has been allocated to core contributors and 23.3% will be put toward the foundation's treasury. The token was launched initially on Solana and will be natively issued on Ethereum and layer-2 networks at a later date. Holders will be able to delegate W tokens to take part in governance votes. Delegation can take place on Solana or any of the compatible Ethereum-based chains in a process that is being dubbed the "first ever" multichain governance system. https://www.coindesk.com/business/2024/04/03/wormhole-debuts-at-3b-valuation-in-617m-token-airdrop/

2024-04-03 10:53

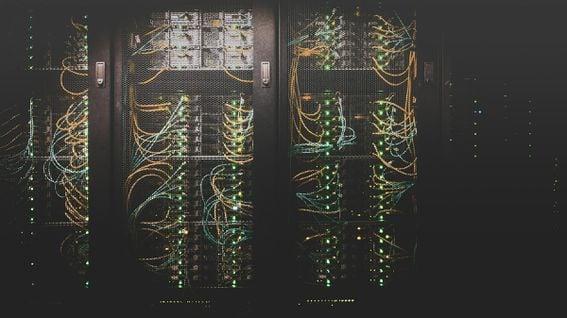

The first client to use the tool will be a partnership between asset manager DWS, Flow Traders and Galaxy to manage a fully collateralized euro-denominated stablecoin, GK8 said. GK8, which was acquired by Galaxy Digital just over a year ago, has entered the tokenization sector with a self-custody offering. The company offers a patented flavor of cold storage, a process of creating, signing and sending messages to the blockchain without ever being connected to the internet. The first client to use the Tokenization Wizard will be a partnership between asset manager DWS, Flow Traders and Galaxy itself to manage a fully collateralized euro-denominated stablecoin. GK8, the crypto currency custody firm acquired by Galaxy Digital just over a year ago, has introduced Tokenization Wizard, a platform for building blockchain-based versions of real-world assets, as well as securely managing stablecoins and assorted Web3 applications. Demand for tokenization has risen sharply, with many traditional finance firms getting on board. Among them, asset management giant BlackRock, which recently unveiled its BUIDL platform in association with Securitize and others. GK8’s tokenization engine follows strict principles of self-custody, the firm’s co-founder and CEO Lior Lamesh said. That contrasts with the managed custody offered by Coinbase and many other major crypto custody providers. In addition, GK8 offers its own patented flavor of cold storage, a process of creating, signing and sending messages to the blockchain in the form of outputs only, avoiding any connection to the internet. This is paired with multiparty computation (MPC), a popular method of splitting up cryptographic keys. “Blockchain is an interactive protocol and at some point, according to the transaction structure, there are some mandatory data that you should receive from the internet,” Lamesh said in an interview. “We have seven patents in different stages around cryptographic innovations that enable us to avoid the mandatory step of receiving input from the internet, allowing us to use only outbound unidirectional communication to send and sign transactions. Since there are never any inputs, we are never exposed to any cybersecurity attack vectors.” The first client to use the Tokenization Wizard will be a partnership between asset manager DWS, Flow Traders and Galaxy to manage a fully collateralized euro-denominated stablecoin, GK8 said. https://www.coindesk.com/business/2024/04/03/galaxy-digital-owned-crypto-custody-specialist-gk8-unveils-tokenization-wizard/

2024-04-03 09:35

Supporting the creator economy with AI-generated video will take more GPUs than all major tech companies operate. The possibility of text-to-video generation excites the crypto market, and AI tokens rose when OpenAI first unveiled a demo of Sora But to make this mainstream the compute power will be staggering. More server-grade H100 GPUs will be required than Nvidia produces in a year, or what its largest customers run in their data centers collectively. How many Graphics Processing Units (GPUs) will be required to make text-to-video generation mainstream? Hundreds of thousands – and more than are currently in use by Microsoft, Meta and Google combined. The first demo of OpenAI's text-to-video generator Sora amazed the world, and this renewed interest in Artificial Intelligence (AI) tokens, with many surging in the aftermath of the demo. In the weeks that followed, many crypto AI projects emerged, also promising to do text-to-video and text-to-image generation, and the AI token category now has a $25 billion market cap according to CoinGecko data. Behind the promise of AI-generated videos are armies of Graphics Processing Units (GPUs), the processors from the likes of Nvidia and AMD, which make the AI revolution possible thanks to their ability to compute large volumes of data. But just how many GPUs will it take to make AI-generated video a mainstream thing? More than major big tech companies had in their arsenal in 2023. An Army of 720,000 Nvidia H100 GPUs A recent research report by Factorial Funds estimates that 720,000 high-end Nvidia H100 GPUs are required to support the creator community of TikTok and YouTube. Sora, Factorial Funds writes, requires up to 10,500 powerful GPUs for a month to train, and can generate only about 5 minutes of video per hour per GPU for inference. As the chart above demonstrates, training this requires significantly more compute power than GPT4 or still image generation. With widespread adoption, inference will surpass training in compute usage. This means that as more people and companies start using AI models like Sora to generate videos, the computer power needed to create new videos (inference) will become greater than the power needed to train the AI model initially. To put things in perspective, Nvidia shipped 550,000 of the H100 GPUs in 2023. Data from Statista shows that the twelve largest customers using Nvidia's H100 GPUs collectively have 650,000 of the cards, and the two largest—Meta and Microsoft—have 300,000 between them. Assuming a cost of $30,000 per card, it would take $21.6 billion to bring Sora's dreams of AI-generated text-to-video mainstream, which is nearly the entire market cap of AI tokens at the moment. That's if you can physically acquire all the GPUs to do it. Nvidia isn't the only game in town While Nvidia is synonymous with the AI revolution, it's important to remember that it's not the only game in town. Its perennial chip rival AMD makes competing products, and investors have also handsomely rewarded the company, pushing its stock from the $2 range in the fall of 2012 to over $175 today. There are also other ways to outsource computing power to GPU farms. Render (RNDR) offers distributed GPU computing, as does Akash Network (AKT). But the majority of the GPUs on these networks are retail-grade gaming GPUs which are significantly less powerful than Nvidia's server-grade H100 or AMD's competition. Regardless, the promise of text-to-video, which Sora and other protocols promise, is going to require a herculean hardware lift. While it's an intriguing premise and could revolutionize Hollywood's creative workflow, don't expect it to become mainstream anytime soon. We're going to need more chips. https://www.coindesk.com/markets/2024/04/03/ai-crypto-tokens-love-openais-sora-narrative-but-the-compute-power-to-scale-it-is-enormous/