2024-04-03 08:32

Trading volumes for the exchange-traded funds soared to $110 billion, three times higher than either January or February, led by BlackRock's IBIT. U.S.-listed bitcoin (BTC) exchange-traded funds (ETFs) captured over $110 billion in trading volume in March, a figure three times higher than the volumes in January and February, as the largest cryptocurrency soared to record highs. Trading was led by BlackRock’s IBIT, which comprised almost 50% of the total, Bloomberg Intelligence analyst Eric Balchunas said on X. Grayscale’s GBTC was next with 20% of the total share, followed by Fidelity’s FBTC at 17%. “$IBIT won the volume race and is officially the $GLD of bitcoin,” Balchunas said, referring to a gold ETF. “I can't imagine April will be bigger but who knows.” The U.S. bitcoin ETFs were approved by the Securities and Exchange Commission in January and started trading Jan. 12, when the asset was priced around $45,000. Since then, bitcoin has climbed to a record $73,000, prompting a change in the market dynamic from fundamentals to spot ETF performance, some firms say. BlackRock’s volumes have all originated from inflows since March 15, data from Farside Investors show, and it held over $16 billion worth of bitcoin as of Tuesday's close. As previously reported, a large chunk of BlackRock’s volumes come from retail investors with an average trading size of $13,000. https://www.coindesk.com/markets/2024/04/03/bitcoin-etf-trading-volumes-tripled-in-march-as-the-largest-cryptocurrency-hit-record-highs/

2024-04-03 08:14

Tuesday's outflows from the ARKB exchange-traded fund marked the first time a provider lost more than Grayscale’s GBTC. Bitcoin outflows from the ARK 21Shares ETF surpassed those of Grayscale's Bitcoin Trust for the first time on Tuesday, with ARKB losing $88 million versus GBTC's $81 million. The sector's net inflows were $40 million, with BlackRock's IBIT and Fidelity's FBTC leading growth. Bitcoin (BTC) outflows from the ARK 21Shares exchange-traded fund (ARKB) on Tuesday surpassed those of Grayscale’s Bitcoin Trust (GBTC) for the first time. Provisional data from Farside Investors shows ARKB saw nearly $88 million in outflows on Tuesday, more than GBTC’s $81 million. The two products were the only losers among the 11 ETFs. ARKB’s outflows were the biggest since it went live in January. It lost $300,000 on Monday, notching its first ever outflows. Grayscale’s total outflows now exceed $15 billion, the data shows, and it has seen outflows continuously since March 15. BlackRock’s IBIT, the usual leader, took on another $150 million, followed by Fidelity’s FBTC at $44 million. Overall net inflows stood at $40 million, up from net outflows of $80 million on Monday. Bitcoin prices are little changed over the past 24 hours, trading at just over $66,000 as of European morning hours. The broad-based CoinDesk 20 is down 0.6%. https://www.coindesk.com/business/2024/04/03/ark-21shares-bitcoin-etf-logs-88m-of-outflows-overtaking-grayscale-for-first-time/

2024-04-03 08:09

The broker raised its price target to $230 from $160 and maintained its market perform rating. The broker raised its price target for Coinbase to $230 from $160. The broker believes the crypto exchange offers unique exposure to the long-term growth of the crypto economy. Coinbase’s trading activity continues to surge, with daily volume for March averaging $5.1 billion, the report said. Coinbase (COIN) offers investors unique exposure to the long-term growth of the crypto economy, KBW said in a research report on Tuesday. KBW raised its Coinbase price target to $230 from $160 while maintaining its market perform rating. The crypto exchange’s stock closed at $245.84 on Tuesday, having risen over 40% year-to-date. “We see a significant near-term revenue opportunity from inflecting USD Coin (USDC) outstanding balances, elevated crypto asset levels, and an apparent retail re-engagement from trough levels in 2023,” analysts led by Kyle Voigt wrote. USDC outstanding balances continue to grow, rising 32% in the first quarter, the report said. USDC is a stablecoin issued by Circle, which is itself backed by Coinbase. The crypto exchange earns gross interest income on about 56% of USDC outstanding balances, KBW said. Surging trading volumes are also a tailwind for the stock, with March average daily volume (ADV) of $5.1 billion versus $2.4 billion in February, the report added. Still, Coinbase’s legal battle with the U.S. Securities and Exchange Commission (SEC) and the uncertain regulatory environment make it very difficult for many institutional investors to own the stock, the authors wrote. https://www.coindesk.com/markets/2024/04/03/coinbase-offers-unique-exposure-to-the-long-term-growth-of-crypto-kbw/

2024-04-03 05:06

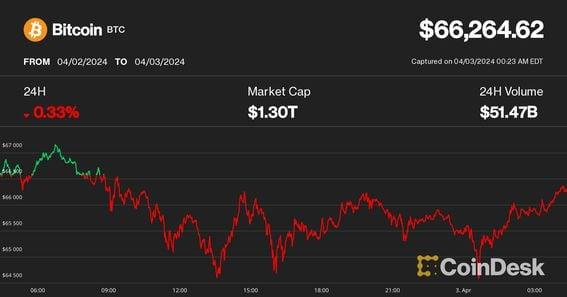

Prediction markets and CME's Fed Watch Tool have virtually ruled out a rate cut until later this year Bitcoin hovers near $66,000, with the CoinDesk20 Index signaling broader market weakness. Crypto futures rates and open interest have decreased, signaling a potential end to a two-month rally. Bitcoin (BTC) held on to losses during the Asian trading hours on Tuesday, trading at around $66,000, as traders digested resurgent Treasury yields and the possibility that the Fed might delay rate cuts until later this year. At the time of writing, ether (ETH) changed hands above $3,300, while the CoinDesk 20 (CD20) was down 0.6% to 2,532. The yield on the 10-year Treasury note clocked a two-week high of 4.40% overnight due to persistent inflation and unexpectedly strong manufacturing activity. An uptick in the so-called risk-free rate typically spurs an outflow of money from risk assets and zero-yielding investments like gold. The yellow metal, however, remained resilient amid the weak tone in bitcoin and Wall Street’s tech-heavy index, Nasdaq. “Bitcoin retraced down to $65,000, mostly attributed to the recent macro outlook on interest rates and rising Treasury yields,” Semir Gabeljic, director of capital formation at Pythagoras Investments, said in an email interview. “Higher interest rate environments typically tend to reduce investor appetite to risk.” On Polymarket, bettors have ruled out a rate cut by May and are split 50-50 on whether one will happen in June. Most of the certain money is on it happening in the fall. The CME Fed Watch tool has a 97% chance of rates staying the same after May’s meeting. Coinglass data shows that over $245 million in long positions have been liquidated in the last 24 hours, with $60 million in BTC positions getting rekt. “Perpetual futures funding rates for most crypto assets are back to 1bps, and global futures open interest decreased by 10 percent overnight, indicating some leveraged long positions are closed,” Jun-Young Heo, a Derivatives Trader at Singapore-baed Presto, added. “As recent bitcoin ETF inflows are stagnating and BTC and ETH market prices came below the 20-day moving average, some trend followers would have regarded yesterday’s downturn as the end of a two-month-long rally,” he continued. https://www.coindesk.com/markets/2024/04/03/btc-back-down-to-66k-as-rising-treasury-yields-catch-investor-interest/

2024-04-03 02:30

A federal judge had a lot to say about the SEC's claims in its suit against Coinbase. Between Coinbase, Custodia, Roman Storm and Sam Bankman-Fried, there was a lot of news last week. Let's get to it. Big week The narrative Coinbase and Custodia both lost early and preliminary court fights. The Coinbase loss was more or less expected – companies rarely win much on a motion for judgment at such an early stage – but still pretty enlightening. Why it matters At some point the cases involving the U.S. Securities and Exchange Commission are going to move to appeals courts and maybe even the U.S. Supreme Court, if they're not settled first. Until that point, these decisions in the district court are shedding light on how judges view the crypto industry. Breaking it down Judge Katherine Polk Failla ruled mostly against Coinbase after an initial motion for judgment, dismissing the SEC's claims about Coinbase Wallet but leaving a substantial part of the complaint intact. The usual disclaimers apply: This is an initial motion and the judge was bound to accept the SEC's complaint's facts as alleged. We also don't usually see cases fully dismissed at this stage anyway, so the chances of Coinbase succeeding were also pretty slim. That said, the judge drew a pretty clear roadmap in her 84-page ruling, taking on common industry arguments about whether crypto meets the standards for the major questions doctrine (no), what a cryptocurrency ecosystem means in terms of this kind of litigation (more on this later), whether there needs to be a written contract to satisfy the terms of an "investment contract" as defined in SEC v. Howey (no) and whether some of the assets the SEC named in its complaint are securities (it's plausible). In her ruling, the judge rejected some of Coinbase's arguments about how cryptos could be treated in the U.S. As far as the major questions doctrine goes, Judge Failla agreed with Judge Jed Rakoff, who's in the same district, in ruling that the crypto industry does not meet the Supreme Court's standards for what might be a major industry. In doing so, she became the latest judge to say that the SEC is well within its bounds to pursue enforcement actions and regulate crypto, and does not need a Congressional mandate. Failla agreed with Rakoff in other parts of her order as well. "Contrary to Defendants’ assertions, neither Howey nor its progeny have held that profits to be expected in a common enterprise are limited just to shares in income, profits, or assets of a business," the judge wrote, also pointing to another Supreme Court decision. Again citing Rakoff, Failla said a common enterprise would exist if a token issuer used proceeds from a token sale "to further develop the tokens' broader 'ecosystem.'" Judge Failla explicitly rejected an argument that there needs to be a formal contract for an "investment contract" to exist, pushing back against another fairly common argument in these kinds of cases. "To begin, there need not be a formal contract between transacting parties for an investment contract to exist under Howey," she wrote. "Indeed, courts in this Circuit have consistently declined invitations by defendants in the cryptocurrency industry to insert a 'contractually-grounded' requirement into the Howey analysis." Arguments that cryptocurrencies are akin to Beanie Babies or baseball cards fell flat before the judge, as did the suggestion that the SEC could take over jurisdiction on "essentially all investment activity" if a formal contract isn't needed. The judge seemed to suggest that any crypto is part of a common enterprise because a token does not exist as an individual product. "Unlike in the transaction of commodities or collectibles (including the Beanie Babies discussed during the oral argument…), which may be independently consumed or used, a crypto-asset is necessarily intermingled with its digital network – a network without which no token can exist," she wrote. The judge also looked at the question of whether Coinbase listed securities, finding that the regulator did plausibly allege that with at least two of them, solana (SOL) and chiliz (CHZ), holders could "reasonably … expect to profit" from Solana Labs or the Chiliz team's efforts around their respective tokens. "The parties do not dispute that, to prevail on its claims, the SEC need only establish that at least one of these 13 Crypto-Assets is being offered and sold as a security, and that Coinbase has intermediated transactions relating therewith, such that transacting in that Crypto-Asset would amount to operating an unregistered exchange, broker or clearing agency," the order said. The case will now move into the discovery phase, with both parties facing an April deadline to work together on a case management plan. Presumably the case will heat up after that, as the parties argue over who gets what and exchange documents. Stories you may have missed Fewer Than 30% of Jurisdictions Globally Have Started Regulating Crypto: FATF Chief: Financial Action Task Force President T. Raja Kumar told Amitoj Singh that more jurisdictions need to develop crypto regulations. Dutch Prosecutors Seek 64-Month Jail Sentence for Tornado Cash Dev Alexey Pertsev: Tornado Cash developer Alexey Pertsev's trial in the Netherlands took place last week. A verdict will be rendered in mid-May. Tornado Cash Dev Roman Storm Moves to Dismiss Indictment Over Crypto-Laundering Allegations: Roman Storm's legal team filed a motion to dismiss the criminal indictment against the Tornado Cash developer. Coincidentally, this case is also overseen by Judge Katherine Polk Failla. Sam Bankman-Fried Sentenced to 25 Years in Prison: FTX founder Sam Bankman-Fried will spend 25 years in prison, though his lawyer said he'll appeal last year's conviction. Custodia Bank Loses Lawsuit Challenging Fed Rejection of Master Account Application: A federal judge ruled that Custodia Bank – a Wyoming special-purpose depository institution – isn't entitled to a Fed master account or membership in the Federal Reserve, and hadn't proven that the Fed Board of Govenors unduly influenced the Kansas City Fed to reject its application. This week This week I have no specific events on my calendar, though the U.S. Securities and Exchange Commission's trial against Terraform Labs continues in the U.S. District Court for the Southern District of New York. Elsewhere: (The Verge) The Verge's Liz Lopatto delved into the downfall of Vice in this thoroughly reported piece that also sneaks in some excellent lessons about journalism. (The Verge) Liz was also at last week's sentencing hearing for Sam Bankman-Fried. (The Wall Street Journal) Large language model companies need more information – "high-quality text data," in the words of Deepa Seetharaman's article – than may be available to continue developing their artificial intelligence tools. If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Twitter @nikhileshde. You can also join the group conversation on Telegram. See ya’ll next week! https://www.coindesk.com/policy/2024/04/03/what-a-judge-said-about-the-secs-suit-against-coinbase/

2024-04-02 19:07

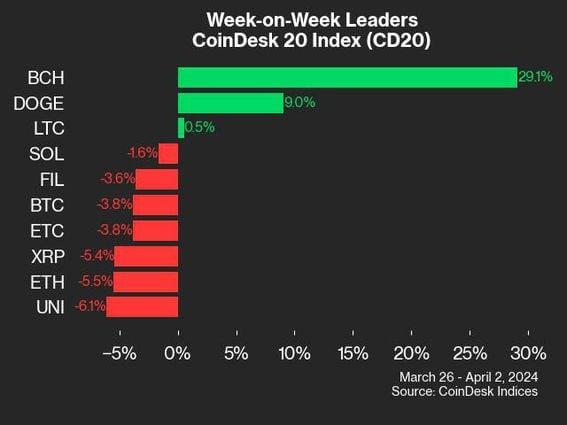

All but three cryptos in the index posted losses last week, with alternative L1s NEAR, APT, and AVAX declining the most. CoinDesk Indices (CDI) presents its bi-weekly market update, highlighting the performance of leaders and laggards in the benchmark CoinDesk 20 Index (CD20) and the broad CoinDesk Market Index (CMI). Only three assets in the CoinDesk 20 closed higher compared to one week ago: bitcoin cash (BCH) up 29%, dogecoin (DOGE) up 9% and litecoin (LTC) up 0.5%. Bitcoin cash has gained more than 4x year-over-year, but still maintains a market cap that is less than 1% of that of bitcoin (BTC). Six assets in the CoinDesk 20 weakened more than 10% this past week, led by Layer 1s (NEAR), (APT) and (AVAX). The CoinDesk 20 Index fell 4.3% over the week, with 17 assets declining. Bitcoin and ether (ETH) contributed to this downturn, dropping 3.8% and 5.5%, respectively. CoinDesk 20 tracks top digital assets and is investible on multiple platforms. The broader CMI comprises approximately 180 tokens and seven crypto sectors: currency, smart contract platforms, DeFi, culture & entertainment, computing, and digitization. https://www.coindesk.com/markets/2024/04/02/bitcoin-cashs-29-advance-led-coindesk-20-gainers-last-week-coindesk-indices-market-update/