2024-04-01 15:22

The stablecoin issuer's BTC stack now tops 75,000 tokens worth about $5 billion. Tether, the issuer of USDT, the world's largest stablecoin based on market cap, added just shy of 8,889 bitcoin (BTC) in the first quarter, according to on-chain trackers such as Arkham Intelligence. Though Tether made no official announcement of the action, a wallet believed to belong to the company shows as having 8,888.8888 bitcoin moved to it on March 31. Tether, of course, has made no secret of its intention to use a portion of its profits to acquire bitcoin. That wallet is now the holder of 75,354 bitcoins worth about $5.2 billion at BTC's current price of $69,000, putting Tether's profit at roughly $3 billion. https://www.coindesk.com/markets/2024/04/01/tether-added-nearly-89k-bitcoin-to-holdings-in-first-quarter-on-chain-data/

2024-04-01 14:54

Predictions from Anthony Pompliano, Des Dickerson, Cory Klippsten, Isaiah Jackson, David Johnston, Wendy O, Cas Piancey, and others. Just over three years ago, at the start of the last bull cycle, I spoke with experts in the space to write “The Future of Bitcoin: 12 Scenarios From Bullish to Bearish.” Much has changed since then. The price of bitcoin was around $25,000 when I began my reporting, which then seemed astronomically high. No one had heard of SBF, Bitcoin Ordinals or ChatGPT. No one owned a Bitcoin ETF. So as Bitcoin enters its fourth halving this April, it’s time to refresh and revamp these scenarios, once again ranging from bullish to bearish. And once again we vaguely defined the “future” as ten years from now – far enough so there’s room for play and close enough so there’s a link to reality. This feature is part of CoinDesk’s “Future of Bitcoin” package published to coincide with the fourth Bitcoin “halving” in April 2024. There’s one thing that hasn’t changed in our methodology: A humble acknowledgement that we’re all flying blind, and no one really knows what will happen with bitcoin. That’s part of the appeal. “Most of the biggest use cases 10 years from now will be things that would sound insane to us today,” Elizabeth Stark told me in 2021. “Kind of like how an encyclopedia that anyone can edit would have sounded crazy to people in the pre-Wikipedia era.” Welcome to the future(s) of bitcoin, ranging from regulatory hell to telepathic DeFi. 1. Bitcoin to “buy a cup of coffee” Cory Klippsten, CEO of Swan, imagines that in 10 years bitcoin can finally, truly, be used in a mainstream way to pay for things like coffee and beer and donuts. “By 2035, you’ll be able to buy most goods and services around the world in sats,” predicts Klippsten. This doesn’t mean he thinks bitcoin will fully replace the dollar. He envisions that most goods will have “two price tags” — one in fiat, one in bitcoin. “It won’t have replaced all fiat currency,” says Klippsten. “We’re going to live in a multi-currency world, as we always have.” 2. Bitcoin-Powered Games There are over 3 billion gamers on the planet. Des Dickerson, CEO of THNDR Games, envisions a future where these billions of gamers are getting rewarded in bitcoin, thanks to the speed of the Lightning Network. “Bitcoin should be the native currency of the internet,” says Dickerson. “So it goes without saying that bitcoin should inherently exist in games.” This is all, of course, still very much just theoretical. THNDR already has 1.5 million users, says Dickerson, but acknowledges that “we won’t see massive adoption until there’s a viral game that has bitcoin in it.” 3. TradFi Tames Bitcoin In the very first line of his white paper, Satoshi Nakamoto describes bitcoin as peer-to-peer electronic cash that would “allow online payments to be sent directly from one party to another without going through a financial institution.” These words have been discussed and parsed for over 15 years. For many in the space, they’re more iconic and inspirational than “We hold these truths to be self-evident.” And the key clause, for many, is “without going through a financial institution.” Which is why bitcoin’s biggest story of 2024 — the emergence of ETFs — is something of an awkward dynamic. Isaiah Jackson, author of “Bitcoin and Black America,” sees the ETFs as a double-edged sword. On the one hand, yes, the ETFs have unleashed a pipeline of new capital, which Jackson believes will “pump the price sky high.” (So far the charts agree.) But then again, the ETF-injected capital gives more power to the Blackrocks and Fidelities of the world. “If you have enough bitcoin you can buy lobbyists,” says Jackson. “And you can convince them [politicians] of things like, ‘Hey, we need to control bitcoin mining.’” The concern is shared by Wendy O, host of The O Show (and former CoinDesker). She acknowledges the very real benefits of “ethically grifting” on the tailwinds of bitcoin’s ETF-driven price surge, but also envisions a scenario where “TradFi steps in and governs bitcoin for us.” 4. ABI: Artificial Bitcoin Intelligence As AI continues to advance, we’ll soon see the rise of “smart agents” that can do things like book our flights, pay our bills and order us Thai food. “No one is giving AIs a bank account, but bitcoin is perfect as a natively-digital means for AI to transact,” says David Johnston, lead contributor to the Morpheus project, which is building a decentralized platform for AI agents to transact and spend crypto. (Morpheus is technically “chain agnostic,” but the potential for bitcoin seems clear.) The role of bitcoin and AI doesn’t stop at spending sats. “If you have a smart agent that can send transactions or access DeFi, you have a whole new set of tools accessible to you,” says Johnston. Just as ChatGPT made it easier for non-coders to program using plain English, in the future, says Johnston, you can easily use advanced DeFi tools without any technical knowledge, and without using a bank. Johnston gives a quick example. “Let’s say I wanted to earn native bitcoin yield, with no wrapping, no bridges, and no third parties.” This is tough for a layperson. (Not that a layperson would ever say the words “native bitcoin yield,” but you get the picture.) With AI-empowered bitcoin, says Johnston, you could just say something like, “I want my bitcoin to earn some yield in a safe and decentralized manner,” and it would do the research to find solid, reputable, non-custodial solutions, and “not some crap that a YouTube influence is shilling.” 5. Choked by taxation and regulation Of all the bitcoin crystal balls, this is perhaps the foggiest. “We have no idea what’s going to happen with regulation,” says Wendy O. She’s encouraged by the pro-bitcoin policies in El Salvador, but worries that in the United States there’s “so much red tape, so many public servants in so many different sectors, and nobody knows what they’ll classify it as.” She sees an outright ban of bitcoin as unlikely, but fears the government could “make it hard to participate in the ecosystem.” Or perhaps, as Jackson suspects, the government creates “some sort of bottleneck” for converting bitcoin to fiat, such as forcing you to first convert it into a CBDC (Central Bank Digital Currency). The way Jackson sees it, if the value of 1 bitcoin soars to $1 million in ten years — and if they have to use the government’s digital currency as an offramp —- then that will “trap a lot of people into getting the CBDC, and I think that’s what they want for surveillance and control.” Klippsten acknowledges the risk of regulation, but suspects that the politics will eventually play to bitcoin’s favor. “Rules change according to the will of the population,” says Klippsten. “At some point, there will be a lot of people that own mostly bitcoin…and they’ll make things extremely difficult for politicians who get in their way.” 6. Shadow Bitcoins This scenario flows directly from the last. If the government somehow succeeds in choking or over-regulating bitcoin, says Jackson, then there will naturally be a desire for “black market bitcoin” — bitcoin that’s off the government’s grid. People who earn bitcoin from home mining, for example, or own bitcoin that’s tougher (if not impossible) to track with tools like Chainanalysis. These concerns aren’t new. The FBI has been tracking bitcoin for over a decade, which some view as solid law enforcement and others see as a surveillance nightmare. So if the tracking and regulation escalates, we could live in a world of “two bitcoins,” or “shadow bitcoins,” where perhaps people pay one price for Tracked Bitcoin and a premium for Shadow Bitcoin. Then again, while Jackson acknowledges the concern, he also views this as pragmatically difficult for the government to execute. When we reach mainstream adoption, says Jackson, there will literally be billions of bitcoin wallets, so “good luck trying to stop all of it.” 7. Bitcoin thrives as a store of value This one’s dead-simple, but sometimes the simplest scenarios are the most likely. Don’t sleep on common sense. “Bitcoin's core value proposition is a global, digital store of value,” says Anthony Pompliano, aka “Pomp” of Pomp Investments. “There are other potential use cases which may come to fruition, but the core proposition is the one that’s most likely to last for decades.” Pomp even sees a generational shift. He says that bitcoin now serves as “the benchmark for many young investors,” similar to how the S&P 500 is a benchmark for stock-pickers. “If they can't beat bitcoin's performance,” says Pomp, “they simply ’buy the index.’” 8. Machines Send Bitcoin Back in early 2021, well before the explosion of AI-hype, Elizabeth Stark told me that she envisions a future where “Machines will pay machines, natively, instantly,” and that “Teslas will pay for charging with Lightning” over the bitcoin network. Three years later, her prediction looks even more likely. It seems probable that machines and even robots, at some point, will need to spend money. And “robot” doesn’t have to mean the Terminator. It could be as simple as The Internet of Things. And what are the odds that these robots or machines will be spending U.S. dollars from their accounts at Wells Fargo? “Bitcoin, stablecoins, and digital currencies are going to be the currency of choice for many automation use cases,” says Pomp, who argues that machines seeking instantaneous settlement “will be unable to use electronic money because of the multi-day settlement times. This is where bitcoin or stablecoins could really shine.” 9. Bitcoin ordinals blow up This might seem like a well-trodden or even boring topic for those who follow the crypto space closely, but you’ll get a weird look if you ask a random person in the grocery store, “What do you think of bitcoin ordinals?” (Also, please don’t do this.) Ordinals are not yet anywhere close to mainstream. But in 10 years they could be, and that could transform everything about the world of digital collectibles, making 2021’s NFT Summer look quaint by comparison. “Once we start to get closer to mass adoption, I think that people will begin to use ordinals, because they are more secure than NFTs,” says Wendy, who also suspects this is “still a long ways away.” 10. The status quo continues “I know this is not super exciting,” says Cas Piancey, cohost of the Crypto Critics’ Corner podcast, “But what I suspect is going to happen is that bitcoin will largely be used for the exact same things it’s used for now.” Piancey is a self-described crypto cynic, but this doesn’t mean he loves to dunk on bitcoin. He can see the nuance. “When people argue that there isn’t a use case for bitcoin, I generally disagree with that,” he says. And he imagines that in 10 years, bitcoin will still be used on the margins for remittances; it will still be used sporadically as a tool for dissidents; and still held by many as a store of value. He’s not a doomsdayer. So he imagines that in 10 years bitcoin will still be chugging, but cautions that, “People who say it’s going to be the next world currency are out of their minds.” 11. Bitcoin’s Death by Black Swan Maybe bitcoin is hacked by quantum computing. Maybe there’s a 51% attack. Maybe bitcoin is gutted by ChatGPT7. So this is something of a “catch-all doomsday scenario” to acknowledge, with humility, that we don’t know what we don’t know. (I explored the doomsday risks in more detail in the original piece.) Many in the space say that bitcoin’s dominance is “inevitable,” but very little in life is truly inevitable — just ask Thanos. Isaiah Jackson is as bullish on bitcoin as you’ll find, but even he acknowledges that a hack by quantum computing, for example, is still theoretically possible. He considers the risk to be low — and suspects that evil quantum-hackers would focus first on juicier targets, like sovereign nations — but concedes that it’s “always a risk.” 12. Telepathic Bitcoin In the original Future of Bitcoin piece, Jackson provided what was easily the most fun scenario: That at some point bitcoin will be spent on Mars. Now he’s back to outdo himself. Jackson has been thinking about Noland Arbaughf, who is paralyzed below the shoulders. Then Arbaughf became the first patient to get a Neuralink chip implanted in his brain, and now he can play chess and even send Tweets just by thinking. “It was like using the force,” Arbaughf said after he “thought” a tweet into existence. So Jackson realized something. If we can send Tweets just by thinking in 2024, it’s only a matter of time before we can telepathically send bitcoin. “The dude just thought a tweet, and it came out,” says Jackson. Someday we’ll think, “Here’s the code for a private bitcoin wallet.” https://www.coindesk.com/consensus-magazine/2024/04/01/12-future-bitcoin-scenarios-from-bullish-to-bearish/

2024-04-01 13:16

Plus: Free money? "Democrat wins New York" contract trades at 90 cents on the dollar. Sometime in the next few weeks, the Republicans and Democrats will announce their respective presidential candidates' running mates as the U.S. gears up for the November election. On crypto-based prediction platform Polymarket, there's currently $13.7 million pledged toward figuring out who the Republican vice presidential candidate might be, but the market is far from forming a consensus. South Carolina Senator Tim Scott is leading the pack with 23%. But contracts for "other man" and "other woman" have a collective 25%. Other high-profile Republicans aren't even cracking the double digits. Marco Rubio is at 4%, while Vivek Ramaswamy – who holds more name recognition with the Discord crowd than the general electorate – is at 3% but with $1.1 million bet on him specifically. Robert F. Kennedy, Jr., best known for his staunch anti-vax views, is at 2%. While the scion of a Democratic dynasty hasn't quite defected to the GOP, the Twitterati had floated the idea of a unity ticket with Trump and Kennedy, though, again, that idea is farfetched and the market is reflecting its unlikelihood. Free money? Under a regulatory settlement, Polymarket prohibits users that reside in the United States, which creates the possibility that the platform's bettors might not be the best informed out there on the topic of American politics. An uninformed market might be creating price discrepancies where there's a lag between a realistic chance of something happening and the market price – in other words, opportunities for free money. Prediction market trading house CSP Trading may have found such an instance, highlighting in a post on X (formerly Twitter) that Polymarket is giving only a 90% chance that a Democrat will take New York. If 90% sounds high, consider that the last Republican to win the state was Ronald Reagan in 1984. Polls show that Biden will take the state by 10 points, and while that margin is narrowing, it's still a healthy lead. There may be a narrative that urban New York's ailment of crime and chaos is caused by ultra-progressive politics, with a ruling elite more concerned about pronouns in email signatures than the plight of the working stiff. But the answer to this has been a slate of moderate Democrats at all levels of government, and voters have been receptive to them. So the idea that an anti-Democrat protest vote would form seems like a longshot, perhaps wishful thinking among some of the terminally online. Contracts for other deep blue states are presenting similar numbers. The market thinks that there's a 92% chance California goes Democrat; a 10% chance a Republican will take Washington state; and a 93% chance a Republican will take West Virginia. Historically these are all states that have some of the longest single-party voting streaks. California, for instance, has consistently voted Democrat since 1992 when it decided to go for Bill Clinton over a second term of George H.W. Bush and has stayed that way since. Certainly, California had its Republican moments from 1952 to 1988, but current polls have it as a definite landslide for President Joe Biden and the Democrats. But why look a gift horse in the mouth? Betting Yes on Polymarket's "Dems win New York" contract stands to pay out around a 10% return – far more than one would get from a high-interest savings account. Hedging the weather Betting on the weather might seem as degenerate as betting on the chance of a specific crypto project launching an airdrop this year. Compulsive gamblers looking for something new to bet on, the critics might say. Except it's not. Weather derivatives are one of the oldest, most primitive forms of prediction markets as they are a way to hedge against extreme conditions causing crop failure. With climate change causing 2023 to be the warmest year on record, with freak, violent storms, and unexpected cold snaps, there's a new level of unpredictability – and urgency – involved in this. Kalshi, the only regulated prediction market platform in the U.S., has contracts for the day's weather in a number of major American cities. When we think about weather derivatives and hedging, we often associate that with quants hired by major food conglomerates trying to make hedges in the hundreds of millions of dollars. Kalshi's dollar-based contracts can do this at a smaller level, enough for a mom-and-pop shop selling something seasonal. An ice cream shop might want to hedge against a day of rain, or a shop selling fall and winter apparel could prepare for a late summer and unseasonably warm spring. While you can't control the weather, you can still do something about it. And, lastly… Punters on Polymarket are betting on Donald Trump dropping the crypto B-bomb in an upcoming rally. Some crypto people are apparently planning to hold a picture of the meme coin BODEN, a Joe Biden riff which commands a $240 million market capitalization as of Monday morning, at a Trump rally. The idea is to get Trump to spot a large poster of Boden and call it hilarious - which punters think could pump their BODEN bags. BODEN is inspired by Spoderman, a poorly drawn version of Spider-Man, which in turn is an homage to Dolan, a bastardized version of Donald Duck with an attitude problem, should you be wondering. https://www.coindesk.com/markets/2024/04/01/who-will-trump-pick-for-veep-polymarket-gives-tim-scott-best-odds-prediction-markets/

2024-04-01 11:38

Upbit's 24-hour crypto trading volume stood at $3.79 billion at press time, down 75% from the high of $15 billion on March 5, CoinGecko data show. Crypto trading volume has tumbled 75% from March's high as frenzied trading in altcoins eased off. The slowdown raises a question about the sustainability of lofty market valuations for coins other than bitcoin and ether, Matrixport said. Daily trading volume on South Korea's biggest cryptocurrency exchange has tumbled 75% from this year's high in a sign that frenzied trading in alternative cryptocurrencies (altcoins) has fizzled and digital assets other than market leaders bitcoin (BTC) and ether (ETH) may struggle to maintain lofty valuations. Upbit, which lists 192 cryptocurrencies and offers trading in 309 pairs, registered just $3.79 billion of volume in the past 24 hours, according to data source CoinGecko. That's down from as high as $15 billion on March 5, when TradingView data shows the total market cap of altcoins surged to a two-year high of $788 billion. Market cap has since steadied at about $750 billion. "Crypto trading volumes started skyrocketing in early March as a wave of altcoin activity hit the market," Matrixport said in a Telegram broadcast. "The anticipation of the Dencun upgrade with low transaction fees caused this mania, and some political developments brought crypto to the forefront of the political election. However, with volumes declining, the sustainability of the altcoin rally comes into question." Daily volume on Upbit rocketed from $2 billion in the two weeks to March 5 as bitcoin's move to record highs above $70,000 and Ethereum's Dencun upgrade spurred risk-taking in other cryptocurrencies, including meme coins. Such was the trading frenzy that, at one point, volumes on South Korea-based crypto exchanges surpassed the local stock market activity. South Korean crypto fans appear to focus more on altcoins than bitcoin and ether, the two largest cryptocurrencies by market cap. A study by DeSpread Research in October said Upbit's investors are primarily interested in maximizing profits through altcoins and tend to accept the high risks associated with these coins. Bitcoin and ether trading pairs account for a smaller portion of total volume on Upbit than on Nasdaq-listed Coinbase (COIN), where activity is mainly concentrated in BTC an ETH. At the time of writing, bitcoin-Korean won and ether-won trading pairs accounted for just over 9% of the total 24-hour trading volume of $3.8 billion. The rest came from altcoin-fiat trading pairs. https://www.coindesk.com/markets/2024/04/01/trading-volume-on-south-korean-crypto-exchange-upbit-crashes-75/

2024-04-01 08:38

Degen Chain was released last week as a specialized network that sits atop Base, which itself is an Ethereum layer 2. Degen Chain, a new layer-3 blockchain, has attracted significant attention and transactional volume since its introduction on Thursday. Its native DEGEN token has zoomed 500% since its release. The network does not have a supported stablecoin and primarily housed speculative tokens as of Monday, but that hasn't stopped speculators from trading millions of dollars in volumes. The hot ball of money chasing meme coins from Solana to Base networks has found its way to Degen Chain, a so-termed layer-3 blockchain built on top of Base that began operations last Thursday. The four-day-old network has recorded nearly $100 million in transactional volumes in the past 24 hours alone over 272,00 unique transactions, data show. On-chain analysts say over 7,500 contracts and 2,300 tokens have been floated on the network since Thursday—albeit mostly rug pulls or scams. The biggest token by capitalization is that of Degen Swap (DSWAP), an exchange built on Degen Chain, which was valued at just over $14 million as of Monday morning. Non-serious token Degen Pepe (DPEPE) has a higher valuation at $23 million, but is a meme coin with no use beyond speculation. Scores of tokens have a market capitalization of under $1 million, and are mainly serving as speculative bets. The network had no supported stablecoins as of Monday, and users can transact or trade only with the native DEGEN tokens. DEGEN changed hands at 6 cents as of European morning hours, up more than 500% from Thursday’s 1 cent levels, data shows. What is a Layer 3? Degen Chain is a layer 3 network built specifically for the DEGEN token. A relatively new development, a layer-3 blockchain is a customizable and application-specific blockchain built on top of layer-2 protocols. Layer 2s are networks built on a layer-1 blockchain such as Ethereum or Solana that can settle transactions faster and more cheaply than the underlying system. The general idea behind a layer-3 network is to have a blockchain that can quickly and verifiably complete a very specific set of tasks. These tasks can range from payments to gaming transactions, and a layer-3 network will handle only those specific types of transactions. The DEGEN token will be used as the native gas, or fee payment, token of the chain. Its developers say the chain enables new experiments with tipping, community rewards, payments, gaming and more. https://www.coindesk.com/tech/2024/04/01/meme-coins-on-degen-chain-flourish-as-new-layer-3-racks-up-millions-in-volumes/

2024-04-01 06:22

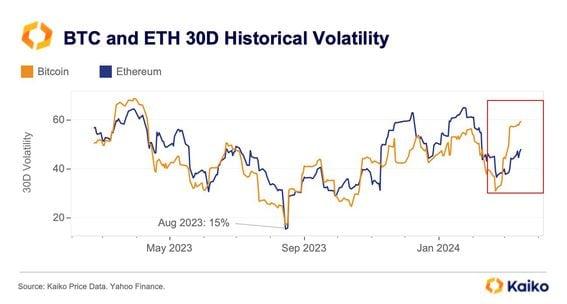

Bitcoin's annualized 30-day historical or realized volatility rose to nearly 60% late last week, surpassing ether's 30-day realized volatility by nearly 10 percentage points. The spread between bitcoin and ether’s annualized 30-day historical volatility gauges increased to the highest in at least a year, according to data tracked by Kaiko. The spot ETF inflows and Bitcoin blockchain’s impending halving seem to have catalyzed greater volatility in BTC. Bitcoin (BTC), the leading cryptocurrency by market value and trading volumes, is supposed to be relatively steady compared to other digital assets, protecting a trader’s portfolio from wild swings in the broader market. However, bitcoin has been more volatile than ether (ETH) recently. Bitcoin’s annualized 30-day historical or realized volatility rose to nearly 60% late last week, surpassing ether’s 30-day realized volatility by nearly 10 percentage points. That’s the highest spread in at least a year, according to data tracked by Paris-based Kaiko. Historical volatility indicates the degree of price turbulence observed over a specific period. The bitcoin-ether volatility spread flipped positive weeks after the U.S. Securities and Exchange Commission (SEC) greenlighted nearly a dozen spot bitcoin exchange-traded funds (ETFs), allowing traders to take exposure to the cryptocurrency without owning it. Since then, traders have been squarely focused on the activity in the spot ETFs, with net inflows breeding upside volatility in bitcoin and the broader crypto market. In the meantime, the dwindling probability of the SEC approving an ETH ETF by May seems to have demotivated ether traders. Bitcoin blockchain’s upcoming reward halving, a quadrennial event that reduces the pace of per block BTC emission by 50%, could be another reason for relatively higher volatility in the cryptocurrency. On April 21, the inbuilt code will reduce the per-block reward paid to miners to 3.125 BTC from 6.25 BTC, halving the miner’s revenue, which, as per ByteTree, is currently at $26 billion annually. The consensus is that halving is bullish as it halves the pace of supply expansion, creating a demand-supply imbalance in favor of a price rise, assuming the demand side remains unchanged or strengthens. Bitcoin chalked out stellar rallies, setting new record highs over 12-18 months following the previous halvings, which occurred in November 2012, July 2016, and May 2020. What’s different this time is that bitcoin has surpassed the previous bull market peak of around $69,000 weeks ahead of the halving, which makes the upcoming event all the more exciting for traders. Per Greg Magadini, director of derivatives at Amberdata, the bullish positioning ahead of the halving means potential for a “sell-the-news" pullback after the event. “The current positioning being so extended is setting the market up for a VERY interesting 'sell-the-news’ halving cycle play,” Magadini said in the weekly newsletter. “Should there be a real pullback, we stand to see excessive ∆1 [futures] OI become liquidated, volatility RR-skew to favor puts and a collapsing basis.” Magadini added that bitcoin’s options market has been pricing the halving event as well. “If we look at the options market, we see an interesting structure. A steep [IV] Contango before 4/26 and a high forward volatility kink for the 4/26 expiration. The options market is pricing in the halving event as well,” Magadini noted. The implied volatility, or IV, is the market’s guess of future realized volatility. Usually, plotting IVs for different durations or expiries produces an upward-sloping curve called a contango. A steep contango ahead of the April 26 expiry means the market is expecting elevated BTC volatility as it heads into the halving. The forward volatility suggests the same. https://www.coindesk.com/markets/2024/04/01/bitcoin-becomes-more-volatile-than-ether-as-halving-approaches/