2024-03-28 10:48

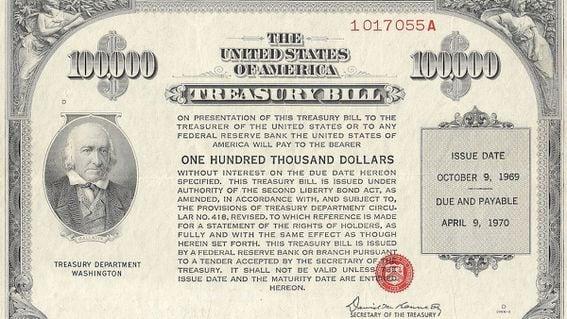

Tokenized Treasuries are digital representations of U.S. government bonds that can be traded as tokens on the blockchain. Data tracked by 21.co shows $1.08 billion in Treasury notes has been tokenized through public blockchains. The tally has risen nearly 10-fold since January 2023 amid elevated interest rates worldwide. The market for tokenized U.S. Treasury debt is booming. The market value of Treasury notes tokenized through public blockchains like Ethereum, Polygon, Valanche, Stellar and others has crossed above $1 billion for the first time, data tracked by Tom Wan, an analyst at crypto firm 21.co, show. Tokenized Treasuries are digital representations of U.S. government bonds that can be traded as tokens on the blockchain. The market value has risen nearly 10-fold since January last year and 18% since traditional finance giant BlackRock announced Etheruem-based tokenized fund BUIDL on March 20. As of writing, BUILD is the second-largest such fund, with a tokenized value of $245 million, trailing only Franklin Templeton's Franklin OnChain U.S. Government Money Fund (FOBXX) – one share of which is represented by the BENJI token – which led the pack with $360.2 million in deposits. "Just happened, $1B Total Tokenized U.S. Treasuries on Public Blockchains. Blackrock's BUIDL increased by 400% from 40M to 240M supply in a week," Wan posted on X. "OndoFinance is now the largest holder of BUIDL, holding 38% of the total supply. Now Ondo's OUSG is fully backed by BUIDL." The rapid rise in Treasury yields in the past two years has fueled demand for their tokenized versions. The 10-year yield, the so-called risk-free rate, has risen to 4.22% from 1.69% since March 2022, denting the appeal of lending and borrowing the dollar-pegged stablecoins in the decentralized finance market. Investing in tokenized Treasuries can help crypto investors diversify their portfolio, allowing them to settle transactions on any given day. "The beauty of tokenization, [is] you can settle the transaction 24/7," Wan said. https://www.coindesk.com/markets/2024/03/28/over-1b-in-us-treasury-notes-has-been-tokenized-on-public-blockchains/

2024-03-28 09:30

If history repeats itself, an even more bullish period for bitcoin and crypto markets could be on the horizon in the months following the halving, the report said. Next month's reward halving could add to the ETF tailwinds for bitcoin, the report said. Spot ETFs could become a more meaningful contributor to bitcoin’s price action. BTC miners show signs of decoupling from the cryptocurrency's price as the halving event raises questions about profitability, Canaccord wrote. The more than 60% rally in bitcoin (BTC) in the first quarter was driven mainly by the approval of spot exchange-traded funds (ETFs), the impending reward halving and an appetite for increased risk in financial markets, broker Canaccord Genuity said in a research report on Thursday. “While the macro outlook and timing of potential rate cuts remain uncertain, the upcoming halving event could add to the ETF tailwinds for bitcoin,” analysts led by Michael Graham wrote, adding that “for the rest of the ecosystem, activity levels continue to rebound from 2023 lows.” The quadrennial halving is when miner rewards are slashed by 50%, thereby reducing the supply of bitcoin. The next halving is expected in April. Canaccord says it is encouraged by the Securities and Exchange Commission’s (SEC) approval of 11 U.S. spot bitcoin ETFs in the quarter. “While bitcoin’s increase in value during Q1 was far greater than ETF inflows, this tailwind should persist as retail investors look to add crypto exposure to IRAs and other tax-advantaged accounts, and we expect spot ETFs could become a more meaningful part of bitcoin’s price action going forward,” the authors wrote. IRAs are a way of saving for retirement in the U.S. Publicly traded miners underperformed bitcoin in the first quarter, showing signs of decoupling from the cryptocurrency's price, the report noted. Canaccord said next month's halving has introduced uncertainty about the profitability of some miners, and spot ETFs have given equity investors an alternative means of gaining exposure to the world’s largest cryptocurrency. “If history were to repeat itself, an even more bullish period for bitcoin and crypto could potentially be on the horizon in the months following this halving event,” the report added. https://www.coindesk.com/markets/2024/03/28/bitcoin-halving-could-bolster-etf-tailwinds-for-the-cryptocurrency-canaccord/

2024-03-28 09:24

The finding, termed a "call to action" by T. Raja Kumar, emerged from a report that explored which jurisdictions have adhered to the FATF's recommendations. A lack of regulation "creates significant loopholes for both criminals and terrorists to exploit" and is "a call to action that we need countries to take this problem seriously," Financial Action Task Force President T. Raja Kumar said in an interview with CoinDesk. FATF published a new report evaluating jurisdictions on their crypto regulation after a 12-month process involving FATF's 39 members and 20 jurisdictions that aren't members. Fewer than 30% of jurisdictions around the globe had started regulating the crypto sector as of June 2023, Financial Action Task Force (FATF) President T. Raja Kumar told CoinDesk in an interview from Singapore. That low level of attention warrants "call to action," said Raja Kumar. The statistic was detailed in a progress report made public on Thursday and shared with CoinDesk, which explored how dozens of jurisdictions have adhered to the FATF's recommendations. The report is titled "Status of Implementation of Recommendation 15 by FATF Members and Jurisdictions with Materially Important VASP Activity." The recommendation had suggested that jurisdictions should move to get a better handle on money-laundering and terrorist-financing risks posed by crypto, and they should license or register virtual asset service providers (VASPs) and conduct reviews of their business practices, products and technology. The FATF recommendations are not mandatory, but non-abiding jurisdictions could face global isolation through drops in their credibility ratings and other actions, such as the repercussions of being put on the FATF's watchlist. The crypto sector has faced a credibility and safety crisis as it's been beset by hacks, many of which are linked to North Korea, sanctions from the U.S. and the U.N., and allegations of being a conduit for terrorist financing, including for those aiding Hamas and ISIS. FATF's 'call to action' The boss of the global money laundering and terrorist financing watchdog said it was "the first such report" addressing the concern that a lack of regulation "creates significant loopholes for both criminals and terrorists to exploit" and is "a call to action that we need countries to take this problem seriously." "I would describe virtual assets as being akin to water, and essentially they will flow to jurisdictions that are less regulated," Raja Kumar said. "Criminals and terrorists are very quick to spot the opportunity leading to regulatory arbitrage. We just can't allow this. Every part of the global chain needs to be strong. This is not a trivial matter." Purpose of report The FATF chief said the report is meant to bring global attention to the issue as a "constructive" effort to inform regulators and the private sector about what's going on with the group's standards. "Virtual assets are inherently international and borderless, meaning a failure to regulate VASPs in one jurisdiction can have serious global implications," the report said. In one example, the report referred to "the Democratic People’s Republic of Korea’s (DPRK) theft and laundering of hundreds of millions of dollars’ worth of virtual assets," which have been said to be used for "weapons of mass destruction." It also noted the increasing use of cryptocurrencies to raise and move funds for terrorist groups. The report contended that bad actors were 'almost exclusively' demanding ransomware payments in cryptocurrencies. Compliance levels of jurisdictions The FATF has been urging jurisdictions to fully implement its recommendations for some time now. The table in the report rates each jurisdiction as compliant, largely compliant, partially compliant, or non-compliant. The criteria include enacting legislation or regulation requiring the licensing or registration of VASPs, having registered or licensed such businesses, conducting supervisory inspections, taking enforcement actions against VASPs or enacting the travel rule for them. FATF's controversial "travel rule" requires crypto service providers to collect and share information on transactions above a certain threshold. In several cases such as India, Singapore, Spain, Portugal, Italy and Malaysia, their assessments around compliance with Recommendation 15 are ongoing so the table rated them as N/A (not applicable). Other nations, such as Argentina, had conducted a risk assessment covering VASPs but had not completed any of the other seven relevant criteria. North Korea is blacklisted by the FATF, while Russia's membership was suspended in Feb. 2023. Raja Kumar said the FATF isn't demanding jurisdictions implement their recommendations by passing laws but that notifications from the government could be enough. Methodology At a FATF plenary held in February 2024, the group agreed to publish an overview of the steps jurisdictions have taken to regulate VASPs, resulting in this analysis. The 12-month examination took a look at the FATF's 39 members and 20 other jurisdictions who host materially important crypto-related activities. The selection of "materially important" jurisdictions was based on jurisdictions that hosted VASPs with more than 0.25% of global virtual asset trading volume or that had at least one million virtual asset users. Collectively, those jurisdictions accounted for 97% of global crypto activity. Read More: G-7 Must Take Charge in Ending 'Lawless' Crypto Space, FATF Chief Says https://www.coindesk.com/policy/2024/03/28/fewer-than-30-of-jurisdictions-globally-have-started-regulating-crypto-fatf-chief/

2024-03-28 07:34

The Bitcoin Cash halving is expected on April 4, blockchain trackers show, and has historically preceded price bumps. Some traders warned of a further market-wide pullback if bitcoin lost the $69,000 level in the coming days. Dogecoin jumped 6%, while Bitcoin Cash saw a 13% rise ahead of an expected halving event on April 4, which historically has preceded a bull market for the token. Bitcoin (BTC) prices were little changed over the past 24 hours amid few catalysts after a volatile week. Prices briefly jumped above $71,000 on Tuesday, but have since retreated and remain steady around $70,000 level ahead of a major options expiry on Friday. Most major tokens posted slight losses. CoinGecko data shows that Solana’s SOL, XRP, and BNB Chain’s BNB dropped as much as 2%, while Internet Computer’s ICP fell 6%. Some traders warned of a further market-wide pullback if bitcoin were to lose the $69,000 level in the coming days. “Bitcoin has fallen back below $70K, which can be attributed to the bulls’ need to let off steam and the general decline in risk appetite in global markets,” said FxPro senior market analyst Alex Kuptsikevich in an email. “The short-term focus for traders will be to see if bitcoin can retest Tuesday’s intra-day lows near $69.5K. A break below this level could signal a more protracted correction,” he added. Dogecoin (DOGE) posted the most gains among majors with a 6% bump. Historic price action suggests the token is showing similar fractals that have preceded significant rallies. The increase took the token over 21 cents for the first time since December 2021. The CoinDesk 20, a broad-based liquid index of top tokens minus stablecoins, was down 1.4%. Meanwhile, Bitcoin Cash (BCH) zoomed 13% ahead of an expected halving event on April 4. The current block reward is 6.25 BCH, but after the next halving, it will be 3.125 BCH. Open interest on BCH-tracked futures more than doubled to $500 million on Thursday from $213 million last week, showing an increase in levered bets on more expected price volatility. Halving occurs when the reward for mining transactions is cut in half, reducing the rate at which new coins are created and thus lowering the available amount of new supply. Bitcoin’s own halving is expected on April 20, trackers show and has historically preceded a bull market for the token. https://www.coindesk.com/markets/2024/03/28/bitcoin-cash-rallies-13-ahead-of-bch-halving-bitcoin-steady-around-70k/

2024-03-28 06:38

Dealer hedging could breed volatility at around $70,000, one observer said. On Friday, leading crypto options exchange Deribit will settle bitcoin and ether options contracts worth $9.5 billion and $5.7 billion, respectively. Deribit’s Luuk Strijers told CoinDesk that many options are set to expire in-the-money (ITM), which could inject upward pressure or volatility into the market. Dealer hedging could also breed volatility around $70,000, FRNT’s David Brickell said. The impending quarterly expiry of bitcoin (BTC) and ether {{ETH} options contracts worth several billion dollars could breed bullish price volatility, according to observers. On Friday at 08:00 UTC, Deribit, the world’s leading cryptocurrency options exchange, will settle quarterly contracts worth $15.2 billion. Bitcoin options account for $9.5 billion or 62% of the total notional open interest due for settlement, while ether options comprise the rest. The $15 billion expiry is one of the largest in the exchange’s history, Deribit data show. The expiry will wipe out 40% and 43% of bitcoin and ether’s total notional open interest across maturities. Notional open interest refers to the dollar value of the number of active contracts at a given time. On Deribit, one options contract represents one BTC and one ETH. The exchange accounts for over 85% of the global crypto options market. A call option is a type of financial contract that gives the buyer the right, but not the obligation, to purchase an underlying asset at a preset price at a later date. A put gives the right to sell. Luuk Strijers, chief commercial officer at Deribit, said large amounts of options are set to expire in-the-money (ITM), which could inject upward pressure or volatility into the market. A call option expiring ITM has a strike price lower than the underlying asset’s going market rate. On expiry, the ITM call gives the purchaser the right to buy 1 BTC at the strike price (which is lower than the spot market rate), generating a profit. A put option expiring ITM has a strike price higher than the underlying asset’s going market rate. At the going market rate of around $70,000, bitcoin options worth $3.9 billion are set to expire in the money. That’s 41% of the total quarterly open interest of $9.5 billion due for settlement. Similarly, 15% of ETH’s total quarterly open interest of $5.7 billion is on track to expire in the money, as data from Deribit shows. “These levels are higher than usual, which can also be seen in the low max pain levels. The reason is, of course, the recent price rally. Higher levels of ITM expiries might lead to potential upward pressure or volatility in the underlying,” Strijers told CoinDesk. The maximum pain points for BTC and ETH's quarterly expiry are $50,000 and $2,600, respectively. The max pain is when option buyers stand to lose the most money. The theory is that option sellers (writers), usually institutions or traders with ample capital supply, look to pin prices near the maximum pain point to inflict maximum loss on option buyers. During the last bull market, bitcoin and ether consistently corrected lower in the direction of their respective max pain points only to resume the rally after the expiry. Similar dynamics could be at play, according to Strijers. “The market could see upward pressure as the expiry removes the lower max pain magnet,” Strijers explained. Dealer hedging David Brickell, head of international distribution at Toronto-based crypto platform FRNT Financial, said hedging activities of dealers or market makers could boost volatility. “The big impact, however, is [from] the gamma positioning of dealers into the event. Dealers are short some $50 million of gamma, with the majority focused at around the $70,000 strike. As we near the expiry, that gamma position gets larger and the forced hedging will exacerbate volatility around $70,000, providing for some whippy, choppy moves either side of the said level,” Brickell told CoinDesk. Gamma measures the movement of Delta, which gauges the option’s sensitivity to changes in the underlying asset’s price. In other words, gamma shows the amount of delta-hedging market makers need to do to keep their net exposure neutral as prices move. Market makers must maintain a market-neutral exposure while creating liquidity in order books and profiting from the bid-ask spread. When market makers are short gamma or holding short options positions, they buy high and sell low to hedge their books, potentially amplifying the price. https://www.coindesk.com/markets/2024/03/28/bitcoin-ether-could-witness-upside-volatility-as-15b-options-expiry-looms/

2024-03-27 20:53

The DeFi protocol, which generates yield from ether derivative funding rates, is set to airdrop 750 million ENA tokens, 5% of the total supply. Ethena's ENA governance tokens will be distributed to users who hold the protocol's "synthetic dollar" USDe, and they will start trading on exchanges on April 2. USDe grew to $1.3 billion from $85 million at the start of this year, bolstered by its high yield and anticipation of the airdrop. Decentralized finance (DeFi) protocol Ethena, which offers the $1.3 billion USDe token, unveiled plans Wednesday to debut its governance token by airdropping tokens to users on April 2, according to a blog post. The protocol is set to airdrop 750 million ENA tokens, or 5% of the total supply. The campaign to earn "shards," which qualify users for the token airdrop, will end on April 1. Those who unstake, unlock or sell all their USDe before this date will not be eligible for the airdrop. Users will be able to claim tokens starting the next day, when ENA will be listed on centralized exchanges, per the blog post. After the airdrop, Ethena will start a campaign with new incentives for the next phase of the airdrop. Ethena's USDe token, often referred to as "synthetic dollar," offers steady yields to investors by using ether (ETH) liquid staking tokens such as Lido's stETH as backing assets, pairing them with an equal value of short ETH perpetual futures position on derivatives exchanges to keep a "rough target" of $1 price. This is also known as a "cash and carry" trade, which harvests derivatives funding rates for a yield. The protocol's USDe token mushroomed recently, growing to over $1.3 billion from $85 million at the start of the year, per DefiLlama data, propelled by its lofty yield due to frothy crypto markets and in anticipation of the airdrop. https://www.coindesk.com/markets/2024/03/27/ethena-a-13b-yield-earning-protocol-to-debut-governance-token-next-week/