2024-03-27 20:53

Blockchain analytics firm Elliptic found that the online organization raised a mere $21,000 in crypto for Hamas since the October 7th attacks. Gaza Now and its founder have been sanctioned for facilitating financial donations for Hamas in the wake of the October 7 attack in Israel Elliptic found that Gaza Now received $21,000 in crypto-denominated donations in the weeks after the attack Crypto donations continue to be a small slice of the overall terrorist financing landscape, with most donations are under $500 according to a new report from TRM Labs Gaza Now, a pro-Hamas online media channel, has been jointly sanctioned by the U.S. and the United Kingdom for facilitating public fundraising for Hamas in the wake of the October 7 attack in Israel. The U.S. Treasury Department’s Office of Foreign Asset Control (OFAC) and the U.K.’s Office of Foreign Sanctions Implementation also issued sanctions against Gaza Now’s founder, Mustafa Ayash, as well as another person and two other entities they claim were working with Gaza Now on multiple fundraising efforts, listing several cryptocurrency addresses Ayash and Gaza Now used to raise funds. The sanctions against Gaza Now and its founder are the latest in a string of similar sanctions against other ‘financial facilitators’ it has said are supporting Hamas – including Buy Cash, a Gaza-based crypto exchange and its owner in October 2023. “Treasury remains committed to degrading Hamas’ ability to finance its terrorist activities, including through online fundraising campaigns that seek to funnel money directly to the group,” said Under Secretary of the Treasury for Terrorism and Financial Intelligence Brian E. Nelson in a Wednesday press statement. “The United States, in close coordination with our British partners, will continue to leverage our tools to disrupt Hamas’ ability to facilitate further attacks.” As part of its fundraising attempts, Gaza Now accepted crypto donations. But crypto made up only a small slice of its overall efforts: according to blockchain research firm Elliptic, the group only received $21,000 in crypto in the weeks after October 7. The figure tracks with new research from another blockchain research firm, TRM Labs, which found that crypto-denominated fundraising for Hamas and other terrorist organizations, including ISIS, tends to be small in scale. According to TRM’s 2023 Illicit Crypto Economy Report, three-quarters of terrorism-linked donations last year were under $500 – and 40% were under $100. Only 3% of crypto donations were over $5,000. Of the terrorist financing entities using crypto, however, Tether (USDT) on the TRON blockchain was the most popular choice in 2023, with a 125% increase in TRON addresses linked to terrorist financing last year, according to the TRM report. According to the report, terrorist financing entities could be drawn to TRON for its relatively low gas fees, minimal price fluctuations and “a residual – but outdated – perception that it is more difficult to trace.” Nikhilesh De edited this story. https://www.coindesk.com/policy/2024/03/27/us-uk-issue-joint-sanctions-of-hamas-aligned-gaza-now/

2024-03-27 20:06

The BlackRock CEO isn't worried about the U.S. Securities and Exchange classifying Ethereum's ether as a security. BlackRock CEO Larry Fink said an ether ETF would still be possible even if the U.S. Securities and Exchange Commission designates the cryptocurrency as a security, which would increase the regulatory scrutiny around the second-largest digital asset. Asked Wednesday on Fox Business whether BlackRock – which has made waves in crypto through its bitcoin exchange-traded fund introduced earlier this year – could still list an ETF that holds Ethereum's ether if the crypto is a security, he replied, "I think so." The SEC is reportedly taking a look at the question of whether ether is a security. Fortune reported earlier this month that the regulator is seeking to classify ether as one and has sent subpoenas to several companies as part of that inquiry. This caused concern over whether this would mean an ether ETF would even be possible in the U.S. But Fink's confidence is a striking note of optimism. Eight potential issuers, including BlackRock, have submitted filings with the SEC to bring a spot ether exchange-traded fund (ETF) to the market. The final decision by the regulator is due in May, with industry experts predicting that applications won't get approved, regardless of what the SEC finds the nature of ether to be. BlackRock is also one of the now-11 issuers of spot bitcoin ETFs. The asset management giant's fund, the iShares Bitcoin Fund (IBIT), is by far the most successful spot bitcoin fund after collecting more than $15 billion in assets after only 2 1/2 months. IBIT is the "fastest growing ETF in the history of ETFs," Fink said on Fox Business. "Look, I'm very bullish on the long-term viability of bitcoin," he said. "We're creating now a market that has more liquidity, more transparency, and I'm pleasantly surprised, and I would never have predicted that before." When asked if an ether fund was next, Fink said "we'll see." https://www.coindesk.com/business/2024/03/27/blackrocks-fink-not-concerned-about-possibility-of-sec-designating-eth-a-security/

2024-03-27 19:17

They are "very squeezable" due to short sellers' large positions, according to a report by data analytics firm S3 Partners. MicroStrategy (MSTR) and Coinbase (COIN) have the most possibility of a short squeeze – or a rally spurred by short sellers getting out of their bearish bets – S3 Partners said in a report. The total short interest in crypto stocks is $10.7 billion, with MicroStrategy and Coinbase making up 84% of these bearish bets, the report added. The short sellers are piling into the crypto-linked stocks, wagering that they are primed to reverse their year-to-date jump in prices. However, the trade has become so crowded that it primed these stocks for a short squeeze, said data analytics firm S3 Partners in a report on Monday. A short squeeze is triggered when an unexpected rally in a stock price forces short sellers to unwind their bearish bets, leading to an even bigger jump. Michael Saylor's MicroStrategy (MSTR) and crypto exchange Coinbase (COIN) are the top two crypto stocks with the highest "squeeze score," S3's Managing Director, Ihor Dusaniwsky, said in the report. "These crypto related stocks are extremely crowded and very squeezable relative to the U.S. market, with an average Crowded score of 57.34 versus the street average of 32.41 and an average Squeeze score of 78.69 versus the street average of 34.41," the report said, adding that "MSTR, COIN and CLSK are the most squeezable names in the sector." The total short interest in crypto stocks is $10.7 billion, with MicroStrategy and Coinbase making up 84% of these bearish bets in the sector, Dusaniwsky said in the report. The short interest in the crypto industry is so crowded that it has eclipsed the short bets of the average U.S. stock – over three times larger, the report added. Other crypto-linked stocks that have high short interest include bitcoin miners Marathon Digital (MARA), Riot Platforms (RIOT) and CleanSpark (CLSK). The explanation could be that some traders are going long bitcoin (BTC) but hedging that position by going short related stocks. In fact, "long bitcoin and short miners" was a trade that market participants cited as one of the reasons why mining stocks have underperformed bitcoin. However, the crypto stocks, specifically MicroStrategy and Coinbase, have defied the bearish thesis and enjoyed sizeable gains this year as the price of bitcoin reached an all-time high. MSTR has risen 179% this year and COIN has climbed 52%, while bitcoin has jumped 64%. The persistent rally in bitcoin and the crypto stocks has taken some toll on the bearish bets. At the time of the report, S3 has observed that short sellers of crypto stocks have incurred $4 billion in losses month-to-date, with MicroStrategy leading the pack. If a sector becomes too crowded with short sellers, such a trade can become dangerous if the share price of a shorted stock continues to climb, forcing investors to scramble to cover their shorts, leading to massive losses. In recent years, short squeezes in GameStop (GME) and Tesla (TSLA) led to disaster for short sellers. The S3 report also echoed the sentiment, cautioning against doubling down on a crowded trade. "Crypto stock short sellers have been selling into a rallying market – either looking for a pullback in the Bitcoin rally or using the short positions as a hedge versus actual Bitcoin holdings. For the trades that are risk positions, there is a strong squeeze possibility in the more unprofitable shorts in the sector like MSTR, COIN and CLSK," the report said. "If the short exposure is a Bitcoin hedge, then short interest should remain relatively flat, regardless of the Bitcoin rally," Dusaniwsky concluded. https://www.coindesk.com/business/2024/03/27/crypto-stocks-like-microstrategy-coinbase-could-shoot-up-if-short-sellers-exit/

2024-03-27 16:31

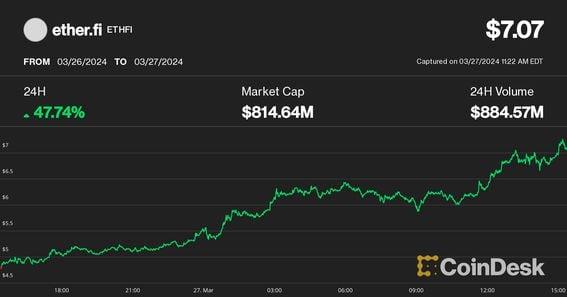

Restaking has become one of the hottest sectors in DeFi, with new protocols leveraging Ethereum's proof-of-stake blockchain to secure other networks. ETHFI hit a record high $7.2 Wednesday, withstanding the declines in ether and the broad-market CoinDesk 20 Index. The performance could bolster valuations for other liquid restaking tokens ahead of their airdrops, one analyst noted. Liquid restaking protocol Ether.fi's governance token (ETHFI) jumped to a record high Wednesday as hype over restaking continued to captivate crypto investors. The token, which represents voting power in the protocol's decision-making process, surged as much as 50% in the past 24 hours to $7.2. It outperformed ether (ETH), bitcoin (BTC) and the broad-market CoinDesk 20 Index (CD20), which all posted slight declines during the same period. With the rally, ETHFI recovered from a price slump following its March 18 airdrop, when, after initially rising to $5 on Binance, it slumped below $3 in the following days. Airdrops are distributions of free tokens, usually to early investors, users and adopters, which protocols leverage as incentives to bootstrap demand for their services. Liquid restaking protocols such as Ether.Fi have emerged as one of the hottest new sectors in decentralized finance (DeFi), and are designed to reuse Ethereum's proof-of-stake blockchain to secure other networks through the original restaking platform, EigenLayer. Ether.fi has become the leader in the liquid restaking field, and its total value locked (TVL) has ballooned to over $3 billion from $100 million since the start of of the year, DefiLlama data show. Rival platforms such as Kelp DAO, Puffer Finance, Renzo and Swell also attracted significant deposits, ranging from hundreds of millions of dollars to over $1 billion. The strong price performance of ETHFI, the protocol's governance token, could bolster valuations of other liquid restaking tokens (LRT) airdropped in the future, Ignas, a prominent DeFi analyst, noted. "The higher the ETHFI price, the higher relative valuations of all other LRT governance tokens will be," Ignas said in an X post. "Our Swell, Renzo, Puffer, Kelp, and obviously EigenLayer airdrops will get juicier the higher ETHFI goes." https://www.coindesk.com/markets/2024/03/27/etherfis-ethfi-jumps-50-to-record-may-boost-valuations-for-liquid-restaking-token-airdrops-analyst/

2024-03-27 14:11

A judge ruled that the SEC made a plausible argument that Coinbase is operating as an unregistered broker, exchange and clearinghouse. A federal judge ruled that the U.S. Securities and Exchange Commission brought enough of a case arguing that Coinbase is operating as an unregistered broker, exchange and clearinghouse that its suit against the cryptocurrency company should move forward. Judge Katherine Polk Failla, of the U.S. District Court for the Southern District of New York, on Wednesday ruled against most of Coinbase's motion to dismiss the SEC lawsuit, finding that the regulatory agency had a "plausible" case against the exchange. She set an April 19 deadline for the parties to agree on a case scheduling plan. The SEC sued Coinbase last year, the same week it sued fellow exchange Binance, alleging that it was violating federal securities laws by making trading and staking services available to the general public. It also argued that Coinbase Wallet acted as an unregistered brokerage. "We're pleased that yet another court has confirmed that, while the term 'crypto' may be relatively new, the framework that courts have used to identify securities for nearly 80 years still applies," an SEC spokesperson said in an email. "It's the economic realities of a transaction, not the labels, that determine whether a particular offering constitutes a security." While the judge said that the SEC seemed to have an argument that some of the tokens listed on Wallet might meet the standards for "investment contracts," Coinbase didn't seem to be acting as a brokerage, dismissing that part of the suit. The other aspects of the suit can proceed, she ruled, dismissing claims that the SEC is violating the Major Questions Doctrine (a U.S. Supreme Court ruling prohibiting federal agencies from exceeding their congressional mandates) or the Administrative Procedures Act. Indeed, Coinbase had ample notice the SEC was pressing cases against crypto companies, the judge ruled, pointing to the DAO Report and previous cases. "When a customer purchases a token on Coinbase's platform, she is not just purchasing a token, which in and of itself is valueless; rather, she is buying into the token's digital ecosystem, the growth of which is necessarily tied to value of the token," she said. "This is evidenced by, among others, the facts that (i) initial coin offerings are engineered to have resale value in the secondary markets and (ii) crypto-asset issuers continue to publicize their plans to expand and support the token's blockchain long after its initial offering." Similarly, token developers "advertise the fact that capital raised through retail sales of tokens will continue to be re-invested," she noted. These cases often survive past motions to dismiss, such as the SEC's case against Ripple. The judges are required to take the allegations as facts, but the substantive parts of the case will be argued later. The case is one of many that may define how the crypto industry can operate in the U.S. If a judge rules that exchanges must be treated similarly to national securities exchanges, as the SEC seems to want, it would impose new restrictions and disclosure regulations on these trading platforms, as well as potentially limit the number of tokens available to retail investors. https://www.coindesk.com/policy/2024/03/27/coinbase-loses-most-of-motion-to-dismiss-sec-lawsuit/

2024-03-27 13:43

Since the approval of spot bitcoin ETFs in January, DeFi looks ascendant, triggering memories of 2020, aka DeFi Summer, when the space bustled with activity. DeFi yields have exceeded yields from conventional investments like U.S. Treasuries, raising hopes for rekindled interest and maybe another DeFi Summer. MakerDAO's DAI Savings Rate provides users with a 15% yield, while riskier corners of DeFi can earn 27% through the likes of Ethena Labs. "The bull market saw prices slowly start going up, and now, two months later, it's completely opposite again, in terms of looking at rates in DeFi and TradFi," one expert said. Decentralized finance, or DeFi, languished in 2023, one of many hardships the cryptocurrency industry faced. Because the Federal Reserve and other central banks were hiking interest rates, conventional – and, in many cases, less risky – investments looked more appealing. Why stick your money in some DeFi pool when safer U.S. Treasuries had higher yields? But DeFi now looks ascendant as the cryptocurrency industry roars back to life, triggering memories of 2020, aka DeFi Summer, when the space bustled with activity. Whereas the median DeFi yield, averaged over seven days, dwelled below 3% for most of 2023 and dipped below 2% several times, earlier this month it leapt to almost 6%, according to data from DefiLlama. Plugging collateral into MakerDAO's DAI Savings Rate provides users with a 15% yield. Those comfortable enough to delve into the riskier corners of DeFi can earn 27% through the likes of Ethena Labs. These higher levels exceed the Secured Overnight Financing Rate, or SOFR, the interest rate banks use to price U.S. dollar-denominated derivatives and loans, which is currently around 5.3%. Strong institutional tailwinds have driven the current crypto bull market, which was kicked off by the January arrival of spot bitcoin exchange-traded funds from the likes of BlackRock and Fidelity, but also by traditional financial firms' interest in the so-called tokenization of real-world assets – representing ownership of conventional assets via blockchain-traded tokens. Over the past year or so, with yields from fixed-income products rivaling what was on offer at DeFi platforms, traditional finance firms like JPMorgan and BlackRock and crypto startups like Ondo Finance have focused their crypto efforts on tokenizing higher-yielding assets like U.S. Treasuries and money-market funds. Outgunning TradFi rates But crypto and DeFi began heating up in October, according to Sébastien Derivaux, co-founder of Steakhouse Financial. It was the point at which DeFi rates began to compete with and later outgun SOFR. Crypto-native DeFi products, rather than tokenized conventional financial products, began looking more appealing. "It is customary that when there is a bull market, rates go up in lending protocols," he said via Telegram. "It was even more in perpetual markets (assuming it is because retail degens find it easier to use offshore exchanges providing perp markets than leveraging on DeFi)." The couple months following the approval of spot bitcoin ETFs have seen this trend intensify, a parallel to the relatively rapid hike in interest rates that followed the intensification of the Covid crisis in early 2020, said Lucas Vogelsang, CEO of Centrifuge, a firm that has pioneered the tokenization of real-world assets, or RWAs. "We've actually had two complete changes in the market. You had the Fed change rates overnight, basically; at least it went from zero to 2% or 3% pretty quickly and that completely changed the face of DeFi," Vogelsang said in an interview. "The bull market saw prices slowly start going up, and now, two months later, it's completely opposite again, in terms of looking at rates in DeFi and TradFi." 'Sign of immaturity' Because the crypto industry remains relatively small, there's simply not enough capital to lend to people who are bullish and, as a result, they don't mind borrowing at high rates. While institutions are clearly interested in crypto, they are not actually filling gaps in market demand, Vogelsang pointed out. "A money market off-chain wouldn't yield 12% just because there's a lack of supply; someone would fill it. On-chain, that's not the case," he said. "It's a sign of immaturity in that way." Some DeFi lending rates might look unsustainably high, an uncomfortable reminder of crypto projects that blew up in years past. But the loan-to-value (LTV) ratio is relatively low on platforms like Morpho Labs, for instance, said Rob Hadick, general partner at Dragonfly. "I don't actually think lending is back; I think deposits are back," Hadick said in an interview. "I think that's because people want yield. But there's not as much rehypothecation happening right now as there was a few years ago." Hadick, whose firm is an investor in Ethena Labs, pointed out the super-high yields available on that platform are not underpinned by pure leverage, but rather follow a basis trade – long spot markets and short the related futures. "As the markets change, the rate might come down. But it's not like leverage in the traditional sense," Hadick said. "People are just going to unwind the trade when it's no longer economic, as opposed to 'I'm going to blow up and my collateral is gonna get liquidated.' That's not a thing that happens in this type of trading." https://www.coindesk.com/business/2024/03/27/hopes-for-another-defi-summer-soar-as-tradfi-markets-suddenly-look-less-appealing/