2024-03-25 15:54

It remains unclear whether Kwon will eventually be extradited to the U.S. or South Korea to face charges tied to the $40 billion collapse of the Terra ecosystem in 2022. Do Kwon was released from prison in Montenegro on Saturday pending extradition to either the U.S. or South Korea Kwon has missed the start of a civil fraud trial against him and Terraform Labs that kicked off in Manhattan on Monday Terraform Labs co-founder Do Kwon has been released from prison in Montenegro as the Balkan country’s Supreme Court weighs competing extradition requests from the U.S. and South Korea. Both countries want to try Kwon on criminal charges, including fraud, tied to the $40 billion collapse of the Terra ecosystem in May 2022. After the Terra implosion, Kwon spent months on the lam before eventually being arrested in Montenegro for attempting to use fake Costa Rican travel documents en route to Dubai. Kwon was initially given a four-month sentence for his crime, but remained in Montenegrin prison until his release on Saturday. According to local media reports, Kwon has been released to a shelter for foreigners and has had his real passport confiscated to prevent him from leaving the country. Kwon is expected to ask the court for permission to remain at large in the country until a decision on his extradition is reached, local media reported. While he was in custody, Kwon and his lawyers fought extradition efforts by challenging court decisions, but his eventual extradition to South Korea seemed certain earlier this month when an appellate court confirmed a lower court’s decision to send him back to his native country to face charges. That decision was upended last week, when Montenegro’s top prosecutor intervened and asked the country’s Supreme Court to overrule the decision and stay Kwon’s extradition. The Supreme Court complied and is currently weighing the two competing requests. No timeline on a decision has been given. Civil fraud trial kicks off in New York Kwon’s extended stay in Montenegro has not stopped the cases against him from moving forward. A civil fraud trial brought by the U.S. Securities and Exchange Commission (SEC) against Kwon and Terraform Labs kicked off in New York on Monday. The SEC has accused Kwon and Terraform Labs of lying to investors about the stability of Terra, their “algorithmic stablecoin,” and deceiving investors about the integration of the Terra blockchain into a Korean mobile payment app. Kwon also faces criminal charges in New York, as well as in South Korea. https://www.coindesk.com/policy/2024/03/25/do-kwon-released-from-montenegrin-prison-on-bail-terraform-labs-civil-trial-begins-in-nyc/

2024-03-25 14:59

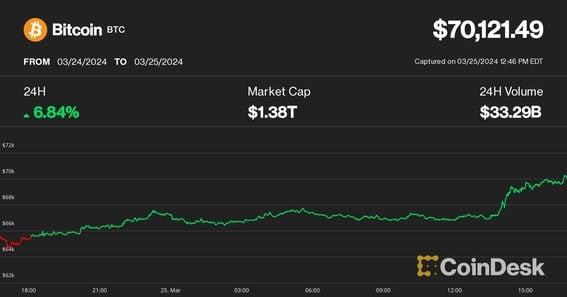

The gains were broad-based, with SOL and AVAX advancing more than 10% over the past 24 hours. Bitcoin took out the $70,000 level after a 10-day cool-off. The rally didn't trigger mass short liquidations, suggesting there weren't many market participants using leverage to bet on falling prices. Bitcoin could reach $83,000 after breaking upwards from its consolidation pattern, 10x Research said. Cryptocurrencies started the week with a strong rally, bouncing back from recent losses as bitcoin (BTC) once again traded above its 2021 peak. Bitcoin (BTC) surged past $70,000 on Monday during U.S. trading hours, surpassing the level for the first time in 10 days and gaining more than 7% over the past 24 hours. Ethereum's ether (ETH) was up 6% during the same period, while tokens for major layer-1 blockchains Solana (SOL) and Avalanche (AVAX) advanced more than 10%. The rally extended to virtually all digital assets, with all constituents of the broad-market CoinDesk 20 Index (CD20) being in the green and the gauge up 6.1% for the day. The sudden resurgence liquidated $195 million of leveraged derivatives positions across all crypto assets, some $129 million of them being short positions seeking to profit from lower prices, CoinGlass data shows. Bitcoin short liquidations reached $53 million, less than the average daily figure of the recent period. The relatively modest amount of short liquidations despite the price surge suggests there weren't many market participants using leverage to bet on continued weakness. Bitcoin targets $83,000 and higher after breaking out from consolidation pattern Monday's surge signaled a potential end of the recent correction for crypto markets, which saw BTC drop below $61,000 last week from record prices above $73,000, coupled with tepid inflows to new U.S.-listed spot bitcoin ETFs and increased selling of Grayscale's GBTC fund. Bitcoin could target new all-time highs after breaking out to the upside from its consolidation pattern, analytics firm 10x Research said in a Monday report. Based on a symmetrical triangle formation, a chart pattern in technical analysis, the breakout could foreshadow a $15,000 to $20,000 price increase for bitcoin's next move from around the $63,000 level, the report said. That would drive BTC as high as $83,000. Another critical level that BTC cleared today was the 2021 peak at $68,000, given that when previous market cycle tops were "retested and broken once more, BTC has tended to put in significant rallies," said Markus Thielen, founder of 10x. The uptrend is supported by several central banks tilting toward dovish stances, which should benefit bitcoin, the report said. "The Fed signaled that they are willing to accept higher inflation for longer and are eager to slow down quantitative tightening," Thielen said. "The Bank of Japan and the Swiss National Bank also surprised on the dovish side." The report highlighted that bitcoin tends to perform well during U.S. election years – and 2024 is one – historically advancing 100%-200%, which also supports the case for higher prices later this year. "Our upside targets of $83,000 and $102,000 could slowly be at play," Thielen said. Updated (15:45 UTC, 3/25/24): Notes price moving past $70K. https://www.coindesk.com/markets/2024/03/25/bitcoin-pumps-above-69k-as-crypto-rally-resumes/

2024-03-25 12:56

Plus: Tesla's delivery numbers will fall short of record, Kalshi traders signal; "Ghostbusters" fandom underestimated. Prediction markets can be silly, but they can be serious, too, as a tool for investors to hedge their exposure to a certain stock or engage in price discovery on the future growth of one given the market success of its products. In this week's roundup, we're setting aside politics for popcorn and electric dreams, diving deep into Tesla deliveries and box office openings. But first… Sentencing Sam Bankman-Fried FTX's founder and former CEO Sam Bankman-Fried is scheduled to be sentenced this week (a position he was put in after an award-winning CoinDesk scoop revealed how precarious his empire's finances were), and the proverbial jury on Polymarket is out on how long the sentence will be. A death sentence for Bankman-Fried isn't on the table as one juror (the real kind, not the Polymarket hive mind) initially feared in the early days of the trial. But it's almost evenly up in the air as to if he'd get between 20-50 years with the U.S. Department of Justice proposing five decades behind bars. Bad news for those who would like to see Bankman-Fried leave jail old and gray: he might be out in less than a decade. In prior interviews with CoinDesk, lawyers familiar with white-collar cases prosecuted in the Southern District of New York say there's a possibility his sentence might be significantly reduced as creditors have been made whole although his lack of remorse could undo this. Kalshi's Electric Clash On Kalshi – the more buttoned-up, CFTC-registered prediction market platform – traders had a busy week monetarily debating how many electric vehicles Tesla would report it delivered this quarter as part of its earnings statement. There's a lot at stake for Tesla. Its stock price directly moves on this number. Elon Musk's electric car giant confidently hit an all-time high for shipments last quarter at 485,000, but the global economy is giving mixed signals. China's economy is cooling, and homegrown BYD has matured to the point where it has become so competitive that it has usurped Tesla as the world's largest electric vehicle maker. Currently, the market doesn't think Tesla will beat the record set last quarter (remember there is an element of seasonality to the sales cycle), and the money has closed in just below UBS' estimate of 432,000. The company is scheduled to report earnings in mid-April. Volume for this contract is lower than what you'd find on a comparable contract on Polymarket, a crypto-based platform that can do business just about everywhere but the U.S. and Taiwan. Perhaps that's the cost of doing business as a CFTC-registered entity limited to the U.S. Betting on Butts in Seats Critics of Polymarket and prediction markets as a whole say it only encourages crypto-degeneracy because of the amount of money being placed on trivial things like Taylor Swift's potential pregnancy or if former President Donald Trump would smile in his mugshot. Certainly, the tone of Polymarket's marketing efforts encourages the behavior. At the same time, it's important to highlight the many contracts on the platform that might aid in proper – adult – uses of prediction markets. Like price discovery, hedging, or derivatives. One popular category of contracts on the site is betting on the box office performance of recently released movies. The performance of these movies has a material impact on their studio's stock price, as well as the stock of large theater chains like AMC, and you'll find some guidance on how these companies expect films to do in their respective quarterly earnings. A moderately clever bettor could read the tea leaves alongside the pop culture temperature and model out a number predicting performance. An example of this could be found in a recent contract asking bettors to take a guess on the box office performance of the new "Ghostbusters: Frozen Empire." Initial reviews of the movie were pretty bad; the Rotten Tomatoes score is at 43%, with early reviews calling it witless and joyless. Early money had predicted it would be a modest performer at the box office and long-range forecasts from Box Office Pro put it at $35 million to $49 million. But these bettors underestimated the power of fandom. Despite a less-than-stellar script, the movie took in over $45 million during its U.S. opening weekend, in line with the opening weekend of the previous installment of the series, showing that fans were hungry for more Ghostbusting content. Some say it is a revenge spend of fans showing studios they want this version of Ghostbusters, and not the woke 2016 reboot. Culture war win or not, the reality is publicly listed Marcus Theaters said it would be a hit in its recent annual report, as did its competitor Cinemark. The weekend itself was fairly light in competition from other films, and there isn't a holiday or other significant culture event scheduled against it. Is it really degenerate gambling when you can model out a forecast with Excel using SEC guidance? https://www.coindesk.com/tech/2024/03/25/how-many-years-will-sbf-get-jurys-out-on-betting-platform-polymarket/

2024-03-25 12:32

Recent DOGE price developments are strikingly similar to those seen in late 2020 when the meme token bounced from a bear market to rally over 1,000% in early 2021. There are striking similarities between DOGE's price action today and in late 2020. The so-called fractal is noteworthy as dogecoin surged over 1,000% in early 2021. One key principle of the Dow Theory is that asset price trends are self-repeating, functioning along Mark Twain's famous quote: "History never repeats itself, but often rhymes." Hence, traders often check if the ongoing price action resembles anything from the past to understand what lies ahead. Dogecoin, the world's largest meme cryptocurrency, has recently risen above the widely tracked 50, 100, and 200-week simple moving averages of its price, ending a prolonged 20-month consolidation at bear market depths. The 50-week SMA has moved above the 100-week SMA, signaling a bullish shift in momentum. Both developments are strikingly similar to those in late 2020. The so-called fractal is noteworthy because DOGE witnessed an explosive rally in the first five months of 2021. Doge spent 20 months in the depths of the bear market, between 5 and 15 cents, before breaking higher from the range late last month. A similar 20-month bear market consolidation through the second half of 2019 and 2020 set the stage for a big rally in early 2021. Back then, the cryptocurrency chalked out 3,600% surge to 37 cents by May 2021. So, if the 2019-20 fractal is a guide, DOGE's path of least resistance could be on the higher side. A closer look at the chart shows that DOGE's uptrends are sharp but rarely last more than six months. Meanwhile, the subsequent crash and the bottoming/consolidation process take nearly three years. Another similarity between now and 2020 is that major central banks, including the Federal Reserve, are widely expected to cut interest rates in the coming months. The expectations for renewed liquidity easing bodes well for assets far out on the risk curve. In 2020, central banks worldwide had rates pinned near zero. Still, past data is no guarantee of future results, especially with non-serious cryptocurrencies like DOGE and other memecoins. A potential bearish turnaround in bitcoin, the crypto market leader, could single-handedly drag DOGE lower. https://www.coindesk.com/markets/2024/03/25/is-it-late-2020-all-over-again-for-dogecoin/

2024-03-25 10:07

There were $836 million in net outflows between March 18 and March 21, the report said. Spot bitcoin ETFs recorded their first week of net outflows. Outflows from the Grayscale Bitcoin Trust reached $1.83 billion over 4 days, Coinbase noted. Selling pressure may have come from the bankruptcy estate of Genesis Global, the report said. The cryptocurrency market remains fixated on spot bitcoin (BTC) exchange-traded fund (ETF) flows rather than fundamentals, as the recently approved products saw their first week of net outflows in two months, Coinbase (COIN) said in a research report on Friday. Coinbase noted that net outflows amounted to $836 million between March 18 and March 21. Bitcoin slipped below $63,000 last week as the outflows sped up. It was recently trading at around $66,800. There is little insight into what drove the surge in outflows from the Grayscale Bitcoin Trust (GBTC), which reached $1.83 billion in total over four days, the report said. In previous weeks, positive inflows into other spot ETFs more than offset outflows from GBTC, suggesting “some capital rotation at that time,” analysts David Duong and David Han wrote. GBTC charges higher fees than the other funds. One source of potential selling pressure that has been expected is from the bankruptcy estate of Genesis Global, amounting to the sale of 35.9 million GBTC shares, Coinbase said. This is separate from the 30.9 million shares Genesis pledged in collateral to borrow $1.2 billion from Gemini Earn users in the third quarter of 2022, the report noted. Gemini has settled with Genesis to return those assets in kind and payment is expected in a few weeks, following court approval. Coinbase said it's not clear whether the recent GBTC outflows are linked to these sales, and that “we can only infer that the size and scope of the change in GBTC shares outstanding coincide with recent developments on Genesis’ payment obligations.” “More importantly, given that the majority of creditor payments will be made in crypto and not cash, the market effect on bitcoin performance should eventually be net neutral,” the report added. https://www.coindesk.com/markets/2024/03/25/crypto-market-remains-focused-on-spot-bitcoin-etf-flows-over-fundamentals-coinbase/

2024-03-25 08:59

One of two senior Binance executives in government custody has escaped, local media reported over the weekend. Nigeria's tax authority charged Binance with tax evasion, local news outlets reported Monday. The charges come after a tense few weeks during which two senior executives of the crypto exchange were detained by authorities. Local media reported that one of the two executives escaped and may have left the country. Binance, the world's largest crypto exchange, was charged with tax evasion by Nigerian authorities as a weekslong standoff between the two parties intensified, local media outlets reported Monday, citing a statement from the country's tax watchdog. The charges, which also name two Binance executives detained by the government, were announced by the Federal Inland Revenue Service (FIRS) and filed at the Federal High Court in Abuja, one outlet reported. The exchange is being charged with four counts of tax evasion, including "non-payment of Value-Added Tax (VAT), Company Income Tax, failure to tax returns, and complicity in aiding customers to evade taxes through its platform." News of the charges follows weeks of scrutiny and criticism of the crypto exchange by the Nigerian government, which went so far as to invite and then detain two Binance executives. The government says the platform processed billions of dollars worth of suspected criminal funds and set an exchange rate for the local currency, the naira. Meanwhile, one of the two executives held by the government, Nadeem Anjarwalla, has escaped, presidential spokesman Bayo Onanuga told Bloomberg. The news service was also told by Binance that the company was made aware Anjarwalla is no longer in Nigerian custody by authorities. The country is working with Interpol to secure an international arrest warrant for Anjarwalla, who is the company's regional manager for Africa, Reuters reported, citing the president's adviser on national security. The case is FHC/ABJ/CR/115/2024. CoinDesk has contacted Binance for comment. https://www.coindesk.com/policy/2024/03/25/nigeria-charges-binance-with-tax-evasion-reports/