2024-03-21 06:55

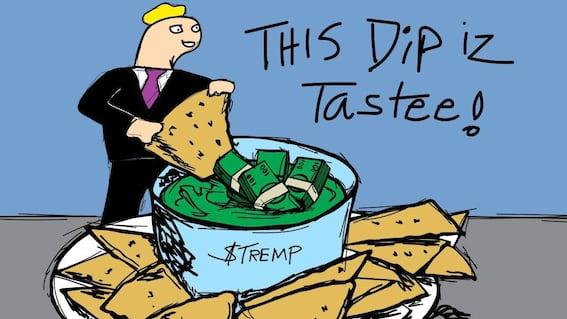

The newly-formed PoliFi category is all about memes and laughs, while making a few bucks along the way, say the team behind the TREMP token. Political finance (PoliFi) meme coins from TRUMP to TREMP are deep in the red, but the woman running the show at the latter, who goes by the handle B, is still having fun. Over the last few weeks, a plethora of politician-themed meme coins have been minted on Solana and all have some resemblance to the Spoderman meme – a poorly drawn version of Spiderman on MS Paint that pays homage to Dolan, a bastardized version of Donald Duck with an attitude problem – complete with misspelled names. The PoliFi cohort is a riff on the original meme but with politicians. Doland Tremp, Jeo Boden, Elizabeth Whoren—the gang’s all here. TREMP was minted on Feb.28 at an initial price of a few fractions of a penny, DEXTool data shows. It has since run to highs of 63 cents and sits at 22 cents on Wednesday, giving the tokens a market capitalization of $22 million. Nearly 20,000 individuals hold the tokens. Its original creator abandoned the project shortly after release, selling their holdings when the project was in its infancy. Community members, such as B and others, took over the reins shortly after - leading to what’s popularly called a “community takeover” in crypto circles. B, a woman who is based in the UK and works in tech marketing, sees the battle for token value between these coins as a blockchain election. “I think that having a crypto election at the same time as a real-life election is something that’s never really been done before in the crypto space,” she said. Although B is a Trump supporter, the project isn’t about partisan convictions but about memes, community, and having fun. B believes Trump has the support of the crypto community because of opposition to the Democrats’ tax policy. “We want to rally all the communities behind us and just make funny memes and videos,” she said, emphasizing that they are working on a long-term road map. I’ve taken time off my real-life job to focus on TREMP.” TREMP isn’t the only Trump-themed PoliFi token. There’s MAGA on Ethereum, which has a much larger market cap and is held in the former President’s official wallet. But there isn’t a rivalry, B says, as they view themselves as a counterpart to Solana. Meme coin March isn’t dead Meme coins like TREMP and BODEN have been minted on Solana, and the price of SOL has shot up 60% over the last month, according to CoinDesk Indices data. There’s another side to this as well. Memecoins are such a hit that they have started to strain the Solana network, with users complaining about congestion causing transactions to fail. 3fn, B’s partner in the TREMP project, explains that these meme tokens use Solana because of its low transaction fees, fast speeds, and community. Ethereum won’t work because of its high fees – something that was the genesis for Solana and its competitors in the first place. “I think Solana is going to onboard a bunch of people just because it’s accessible,” he said, pointing out that the gas fees on Ethereum are too high at $100 a swap. Don’t overthink it Some in the legacy financial media space approach this burgeoning PoliFi sector with scorn. B and 3fn say that these critics are missing the point. Yes, it seems silly and absurd, but PoliFi coins now have a market cap of almost $220 million, according to CoinGecko data. And this is crypto, so it’s perfectly reasonable to create a category trading on the names of politicians and have it worth hundreds of millions of dollars. Even Solana co-founder Anatoly Yakovenko doesn’t quite understand it, telling CoinDesk during an interview for The Protocol podcast that it’s a product of people being “terminally online and having nothing better to do.” That’s directionally accurate, according to B. “We make funny memes, and we just want to make people laugh,” B said. “We haven’t come out to make any enemies.” https://www.coindesk.com/markets/2024/03/21/meet-the-woman-behind-solana-hit-meme-coin-doland-tremp/

2024-03-20 23:37

The asset management giant also made a strategic investment in asset tokenization company Securitize. BlackRock to start a new real-world asset (RWA) tokenization fund on the Ethereum network. The asset management giant also made strategic investments in asset tokenization company Securitize. Asset management giant BlackRock (BLK) officially unveiled its tokenized asset fund on the Ethereum network on Wednesday. The BlackRock USD Institutional Digital Liquidity Fund is represented by the blockchain-based BUIDL token, is fully backed by cash, U.S. Treasury bills, and repurchase agreements, and will provide yield paid out via blockchain rails every day to token holders, according to a press release. Securitize will act as a transfer agent and tokenization platform, while BNY Mellon is the custodian of the fund's assets, BlackRock said. Anchorage Digital Bank NA, BitGo, Coinbase, and Fireblocks also participate in the fund's ecosystem. BlackRock also made a "strategic investment" in Securitize, the press release added, but the terms of the deal weren't disclosed. "This is the latest progression of our digital assets strategy," said Robert Mitchnick, BlackRock’s Head of Digital Assets. "We are focused on developing solutions in the digital assets space that help solve real problems for our clients, and we are excited to work with Securitize." The announcement came after a regulatory filing revealed that BlackRock incorporated a fund with Securitize, spurring speculations of a tokenized fund as observers pointed to blockchain transactions to seed the vehicle, CoinDesk reported Tuesday. BlackRock is the latest traditional finance giant to enter the tokenization field after Citi, Franklin Templeton and JPMorgan have already made headways with the technology. Creating blockchain-based tokens of traditional investments such as bonds and funds – known as tokenization of real-world assets (RWA) – is a fast-growing use case for blockchains as digital assets and traditional finance (TradFi) are becoming more intertwined. Tokenized U.S. Treasuries, for example, have grown to $730 million from $100 million in early 2023 as crypto firms seek to earn a steady yield by parking their on-chain funds. BlackRock CEO Larry Fink said earlier this year in a CNBC interview that the company's spot BTC ETF was "stepping stones towards tokenization." https://www.coindesk.com/markets/2024/03/20/blackrock-enters-asset-tokenization-race-with-new-fund-on-the-ethereum-network/

2024-03-20 23:13

Ray said Bankman-Fried’s victims “will never be returned to the same economic position they would have been in today absent his colossal fraud.” Current FTX CEO John J. Ray III is pushing back against his disgraced predecessor Sam Bankman-Fried’s claims that customers lost “zero” money in the exchange’s 2022 collapse, calling them “categorically, callously, and demonstrably false.” In a victim impact statement penned by Ray on behalf of FTX and its subsidiaries, Ray told New York District Court Judge Lewis Kaplan that Bankman-Fried’s “delusional” claims that his exchange was solvent are a “mischaracterization” of the estate’s January statement that they expect to pay customers back in full. Bankman-Fried and his legal team have leaned heavily on the estate’s recovery, arguing in his February sentencing submission that the “harm to customers, lenders, and investors is zero” and, as such, Judge Kaplan should consider a maximum sentence of 6.5 years in prison – far less than the 40-50 year sentence recommended by prosecutors or the 100 year sentence suggested by the probation department. But just because the FTX estate was able to scrape together enough money to pay back the exchange’s customers – massively aided by the run-up in bitcoin’s price as well as the “tens of thousands of hours…spent digging through the rubble of Mr. Bankman-Fried’s sprawling criminal enterprise to unearth every possible dollar, token, or other asset” – does not mean that Bankman-Fried’s behavior was not criminal, Ray argued. Ray told the court that, when he took over, the exchange’s coffers were nearly empty – a mere 105 bitcoins remained on the platform, compared with the nearly 100,000 bitcoins customers were entitled to. Some of the lost assets were recovered, Ray said, while others, including bribes to Chinese officials and the “hundreds of millions of dollars” Bankman-Fried spent on various investments or buying access to celebrities and politicians are gone for good. “The harm was vast. The remorse is nonexistent,” Ray wrote in the Wednesday court filing. “Effective altruism, at least as lived by Sam Bankman-Fried, was a lie.” Ray told the court that, despite the current plan to get their money back, many of FTX’s customers remain “extremely unhappy” with the valuation of their funds. Because customers will be refunded based on the value of their portfolios at the time of the bankruptcy – not today’s much higher value – they will “never be returned to the same economic position they would have been in today absent [Bankman-Fried’s] colossal fraud,” Ray argued. In their own victim impact statements filed earlier this week, dozens of FTX customers detailed the emotional and financial toll the exchange’s collapse had on their personal lives. “There should be no delusion that because assets have increased in value or that the professionals have been able to recover funds and assets taken or stolen from the estate, that there was no need [to file for bankruptcy],” Ray wrote. “Make no mistake; customers, non-governmental creditors, governmental creditors, and non-insider stockholders have suffered and continue to suffer.” Bankman-Fried is scheduled to be sentenced on March 28. https://www.coindesk.com/policy/2024/03/20/ftx-was-down-to-last-105-bitcoins-when-bankruptcy-rescue-crew-arrived-john-ray/

2024-03-20 20:38

Fed policymakers maintained their outlook for three rate cuts by the end of the year, alleviating market concern of a more hawkish stance. Bitcoin topped $67,000, a more than 10% jump from lows hit hours earlier, after the Fed's decision on rates and comments about interest rates. Ether rebounded from a drop prompted by fears of more SEC regulation, while dogecoin soared on Coinbase's plan to list futures contracts. Crypto markets bounced sharply higher and bitcoin (BTC) targeting $67,000 on Wednesday as U.S. Federal Reserve Chair Jerome Powell hit a dovish tone after and the central bank maintained its outlook for three rate cuts this year despite hotter-than-expected inflation figures. Bitcoin (BTC) hit a $67,781 daily high, recording a more than 10% recovery from level seen hours earlier. Ether (ETH) erased its 6% dip earlier in the day that had been triggered by news reports about the Ethereum Foundation facing a confidential inquiry from an unnamed government and the U.S. Securities and Exchange Commission considering classifying the asset as a security. Dogecoin (DOGE), litecoin (LTC) and bitcoin cash (BCH) led gains among major cryptocurrencies as people finally noticed a Coinbase plan, posted on a U.S. regulator's website several weeks ago, to offer futures contracts on them. The broad-market CoinDesk 20 Index (CD20) was up nearly 3% over the past 24 hours. Traditional markets also climbed higher. The S&P 500 index jumped nearly 1% to a fresh all-time high, while the tech-heavy Nasdaq-100 gained 1.3%. The U.S. dollar index (DXY), which measures the strength of the dollar against other major currencies, declined nearly 0.7% from its session high, signaling a greater risk appetite among investors. Digital asset prices suffered a steep correction over the past week, with BTC enduring its largest daily loss since the collapse of FTX in November 2022, as market participants turned risk-averse ahead of the Fed's Wednesday decision, fearing that last month's stickier inflation reports could deter the Fed rate cut plans. Wednesday's Federal Open Market Committee (FOMC) concluded with policymakers keeping interest rates and rate cut plans steady, removing the risk of a more hawkish scenario that had weighed on asset prices. Powell said during a press conference that "we are making good progress on bringing inflation down," despite the higher inflation readings. "Fed expects slightly higher inflation but not enough to derail their dovish inclination," Fejau, an analyst at market analytics firm Reflexivity Research, said in an X post. "Up only." https://www.coindesk.com/markets/2024/03/20/bitcoin-targets-67k-on-dovish-fed-remarks-ether-rebounds-from-sec-fears/

2024-03-20 18:19

Policymakers forecasted Wednesday they would lower interest rates to 4.6% by year-end, similarly to their December projection. Bitcoin traded over $64,000 after the Fed's decision. It would have been bearish for bitcoin if Fed projected less than three rate cuts, QCP Capital said. The U.S. Federal Reserve left the interest rates steady at 5.25%-5.5% Wednesday, as expected, and held its projection of three rate cuts for this year, alleviating market concerns it would adopt a more hawkish stance. Policymakers on the Federal Open Market Committee (FOMC) forecast they would lower interest rates to 4.6% by the end of 2024, according to the March meeting's economic projection, the same median level as their December outlook. However, the so-called "dot plot" showed only one participant expected more than three cuts this year, compared to five members in December. The dot plot is the Fed committee members' outlook on interest rates over the next year and offers investors a glimpse into policymakers' expectations. Crypto hedge fund QCP Capital said earlier Wednesday that if the dot plot were to show less cuts for this year instead of three, it would be bearish for bitcoin. Before the FOMC announcement, most market participants had priced the first rate cut for June. Now, the market puts 70% odds for at least one rate cut by June, up from over 60% earlier, according to CME FedWatch Tool data. The decision followed hotter-than-expected Consumer Price Index (CPI) and Producer Price Index (PPI) reports, sparking concerns that inflation might accelerate and forcing the U.S. central bank to keep financial conditions tight and delay rate cuts, potentially weighing on asset prices. "Tighter monetary policies dampen risk appetite in financial markets while lower rates increase the allure of asset classes such as crypto," digital asset management firm 21Shares noted Wednesday. Bitcoin (BTC) was trading around $64,000 before the meeting from its overnight low of $60,700, then spiked to $64,700 in the immediate aftermath of the decision. The CoinDesk Bitcoin Index (XBX) was up 0.5% over the past 24 hours, while the broad-market CoinDesk 20 Index (CD20) declined over 2% during the same period. https://www.coindesk.com/markets/2024/03/20/federal-reserve-keeps-interest-rates-rate-cut-outlook-steady-for-this-year/

2024-03-20 16:33

In an exclusive interview with CoinDesk, Solana co-founder Anatoly Yakovenko weighs in on the meme coin frenzy that has brought attention and activity to the blockchain – along with complaints that transactions aren't going through. Solana is having a moment, and it's largely related to the frenzy of meme coin trading suddenly taking place - in tokens built around images of dogs and sloths, general ridiculousness and even the very concept of memes themselves. Users have complained and posted screenshots of transactions failing to go through. Solana Labs CEO Anatoly Yakovenko says he thinks meme coin trading is "bizarre," though he said the episode has provided a welcome stress test for the fast-growing network. The Solana blockchain is in the midst of what some might call a renaissance, its SOL token rebounding almost entirely from all-time-lows in 2020. But recently, it's the source of activity on the chain that might give some analysts pause: Meme coins built around images of dogs and sloths, general ridiculousness and even the very concept of memes themselves. The chain, which aims to offer cheaper and quicker transactions than rival networks like Ethereum, has become the go-to platform for meme coins like dogwifhat (WIF), bonk (BONK), and book of meme (BOME) – tokens whose value lies principally (and unabashedly) in their ability to generate internet buzz. A new arrival is SLERF, a sloth-themed token. Hordes of "degens" – the accepted jargon for crypto traders who are, well, really into it – have flocked to Solana, chasing the trend. Mature observers might call it a display of some of the crypto industry's worst excesses, morphing the Solana ecosystem into a carnival of scams, schemes and screw-ups. "To me, it's just a bizarre thing, I think, of people being terminally online and kind of having nothing better to do," Solana co-founder Anatoly Yakovenko told CoinDesk this week in an interview for The Protocol podcast. The meme coin boom has triggered a flurry of activity for the wider Solana ecosystem, with decentralized exchanges on the network surpassing those on Ethereum in terms of overall transaction volume this week. But users are beginning to notice a problem: Many transactions on Solana are failing to go through – highlighting the consequence of meme coin-induced volatility and congestion. The meme craze has ultimately been a mixed bag for Solana, leading to an influx in usage and liquidity, but dredging up problems with its architecture that have left a sour taste in the mouths of some traders. "My guess is within five years, there's going to be a trillion dollars with the stablecoins in crypto, and that's an astronomical amount of real money," said Yakovenko. "Working out all the kinks now with memes is a blessing." Meme coin madness Meme coins are not new to Solana, but they're having a moment. Dogwifhat, the breakout star of Solana's meme coin explosion, skyrocketed to a market cap above $3 billion at its peak last week, boasting a high of almost $1 billion in daily trading volume according to CoinGecko. It is, literally, just a digital token associated with an image of a dog wearing a hat. Bonk, an irreverently-named Solana meme coin mainstay, boasted an all-time-high market cap of over $2.5 billion earlier in March. While the coins have helped bring cash into the Solana ecosystem, they've both strained and stained the network. Meme coins have fueled the rise of so-called "presales," with developers raising millions of dollars for tokens that don't exist yet. The trend has led crypto sleuth ZachXBT to warn users against the possibility of rug pulls – where tokens are unceremoniously ripped from the hands of investors or are dumped in large volumes onto the market, depleting them of any value. In a recent example of a presale gone wrong, a developer raised $10 million for the sloth-themed SLERF token and subsequently lost all of the funds by sending them to a "burn" address on the Ethereum network. The token's pseudonymous developer chalked it all up to an honest mistake. Yakovenko, for his part, has urged users against preselling tokens, posting "stop doing this" in response to a ZachXBT post that showed over $120 million worth of inflows into meme coin presales. As for why Solana has become the ecosystem of choice for degen meme traders rather than Ethereum, its biggest competitor, Yakovenko said he wasn't sure. Some have speculated that it comes down to Solana's fees, typically much lower than those on other networks. There exist layer-2 blockchains that work atop Ethereum to handle transactions with comparable fees to Solana, like Coinbase's Base network. But Ethereum liquidity is fragmented between all of them, and moving funds between them can be arduous and costly. Solana, by contrast, is more of a one-stop shop. Network clogs Aside from the worrisome potential for exit scams, the meme craze has exposed more existential problems for Solana's core infrastructure. Solana monitoring services like Solana Beach show that, at any given moment, most of the transactions on the network are currently failing. Last week, an X user who goes by the handle rektbuildr found one block on the network in which 100% of the transactions failed. According to Yakovenko, Solana's traffic problems have been exaggerated on social media, and the "failed" status tags on Solana's monitoring services have been misrepresented by the network's critics. Many of the failed transactions aren't from humans, asserts Yakovenko, but from "machines" that are programmed to spam the network with hundreds of transactions that have a small chance of going through – taking advantage of the cheap fees. Even if the machine has "a one percent probability of success," he explained, "It's still net positive for them." Although the transaction-spamming bots might explain some of the story, social media is awash with reports from real Solana users who claim they've struggled to use the network – sometimes needing to repeatedly issue transactions to force them through. The complaints have spurred dunks from Ethereum fans who say their network of choice is more stable, but Yakovenko doesn't see it as an apples-to-apples comparison: "When a user has transaction failures on Solana, it's more or less an insignificant amount of money. When they have a failed transaction in Ethereum, it's hundreds of dollars potentially." Priority fee problems There's no single diagnosis for Solana's networking woes, but much of the issue appears to stem from two sources: priority fees and block sizes. Similar to other blockchains, "blocks" of transactions submitted by users of the Solana network get added to the chain by validators – a large community of hardware operators that help run the network behind the scenes. Solana, like many of its peer networks, allows users to attach a "priority fee" to help ensure transactions are added to a block – an allotment of tokens paid to validators as an incentive to give a transaction a coveted block spot. Unlike on Ethereum, where higher-paying transactions generally have a better chance of reaching the network, priority fees on Solana are frequently ignored. Every so often, this means that a user will pay a high fee and still see their transaction fail or, conversely, see it succeed alongside a bunch of transactions that paid less in fees and were processed anyway. There are plenty of reasons why Solana's fee-accounting system doesn't work as intended, including that the fees can be difficult for protocols to implement: Many Solana developers appear to have ignored priority fees when building out their programs, and the Solana Foundation has begun explicitly urging developers to implement the tech as a way to improve network performance. According to Yakovenko, future Solana updates are likely to target how priority fees are accounted for and used to schedule transactions. "There's a bunch of fixes to how transaction flow and scheduling works that are coming up in [upgrade] 1.18," which is expected sometime in April, said Yakovenko. Even with the updates, fixing Solana's transaction-scheduling mechanism by improving the priority fee system will ultimately present a challenge: "Nobody wants a lot of fees to go as high as Ethereum just to make it easier for that $200 fee-paying transaction to land faster," Yakovenko said. Solana, in contrast to Ethereum, was specifically designed to keep costs down – in part by removing the ability for people to pay big money for preferential treatment. "These are challenging constraints we put on ourselves," said Yakovenko, "but people obviously see the benefit of it." Bigger blocks For Solana to scale without compromising on its core ethos, it will need its network capacity to expand without increasing fees for users. Beyond making some additional tweaks to how transactions are scheduled, Solana will probably need to expand the size of its blocks. Yakovenko frequently talks about how Solana, in contrast to other networks, is designed to scale with hardware; the chain's proof-of-history model is supposed to increase transaction capacity as validators adopt more powerful machines to interact with the network. Solana isn't really taking advantage of its hardware-scaling abilities, however, if it doesn't expand block sizes. For a network that has struggled in the past with reliability, a change to block sizes would be major, and despite Yakovenko advocating on X for an increase to block sizes, he wouldn't say whether more changes to block sizes would be coming anytime soon. Solana has addressed the network struggles in an official note on its website, calling out priority fees, the 1.18 upgrade, and other measures that it is taking in the short-term to improve performance for users. Bigger picture changes to the Solana network will take time, however, and the ecosystem's co-founder is urging patience. "There's about one major release per year on Ethereum. There's three or four in Solana," said Yakovenko. "Solana moves quite a bit faster than that, but it's still not instant." https://www.coindesk.com/tech/2024/03/20/solanas-yakovenko-welcomes-meme-coin-traders-with-nothing-better-to-do/