2024-03-20 15:15

After the publication of this article, Fortune reported the SEC seeks to classify ETH as a security. The Ethereum Foundation – the Swiss non-profit organization at the heart of the Ethereum ecosystem – is facing questions from an unnamed "state authority," according to the group's website's GitHub repository. The confidential inquiry comes during a time of change for Ethereum's technology and at a possible inflection point for its native asset, ETH, which many American investment companies are seeking to offer as an exchange-traded fund. The Securities and Exchange Commission (SEC) has slow-walked their efforts despite recently approving a series of Bitcoin ETFs. After the publication of this article, Fortune reported the SEC is seeking to classify ETH as a security, a move that would have major implications for Ethereum, an ETH ETF and crypto as a whole. The financial regulator has sent investigative subpoenas to U.S. companies in the past several weeks, according to Fortune's reporting. The scope of the investigation and its focus was unknown at press time. According to the GitHub commit dated Feb. 26, 2024, "we have received a voluntary enquiry from a state authority that included a requirement for confidentiality." The Ethereum Foundation did not return a request for comment. Previously, the Ethereum Foundation's website contained the following disclosure: "The Ethereum Foundation (Stiftung Ethereum) has never been contacted by any agency anywhere in the world in a way which requires that contact not to be disclosed. Stiftung Ethereum will publicly disclose any sort of inquiry from government agencies that falls outside the scope of regular business operations." That footer was removed in the Feb 26, GitHub commit along with the website's warrant canary, according to the changelog. A warrant canary is usually some form of text or visual warning (like a colorful bird, in the case of the Ethereum Foundation), which some companies include on their websites to indicate they've never been served with a secret government subpoena or document request. If a government agency does request information, the company may remove the text, suggesting they received the request without explicitly saying so. The Ethereum Foundation's warrant canary was previously removed in 2019 in error and was quickly added back to the website. Possible explanations An attorney familiar with the situation said a Swiss regulator may have served a document request to the Ethereum Foundation and may be working with the U.S. Securities and Exchange Commission (SEC). "I also think it's fair to say the Ethereum Foundation is not the only entity that they are seeking information from," the attorney told CoinDesk, saying other overseas entities are receiving scrutiny. The SEC is evaluating multiple applications for an Ether ETF, but analysts following the process are becoming less optimistic that any such applications will be approved by the federal regulator, citing a lack of engagement between applicants and SEC officials. "Any rumors of any activity" that the SEC and its overseas counterparts are engaging in may be correlated with the May 23 deadline the SEC faces, the attorney said. https://www.coindesk.com/business/2024/03/20/ethereum-foundation-under-investigation-by-state-authority/

2024-03-20 14:33

The decision is now final and cannot be appealed by either Kwon or the U.S., the Terra founder's lawyer told CoinDesk. A Montenegro appeals court won't overturn a previous ruling approving Do Kwon's extradition to South Korea to face criminal charges over the collapse of his crypto enterprise Terra. The U.S. Department of Justice is also seeking Kwon's extradition and has said it will appeal Montenegro's decision to send him to South Korea. Kwon's lawyer told CoinDesk that Wednesday's decision is final and added that there is no timeline for the extradition. A Montenegro appeals court has rejected a bid from Terraform Labs founder Do Kwon to reverse a ruling approving his extradition to South Korea, an official notice from Wednesday shows. Earlier this month, a high court in the Balkan nation ruled that Kwon can be extradited to South Korea to face criminal charges concerning the collapse of his multi-billion dollar crypto enterprise in May 2022. Wednesday's notice shows Kwon had unsuccessfully appealed that decision. Do Kwon's attorney, Goran Rodic, told CoinDesk that the extradition was now final, and neither the U.S. nor Kwon could further appeal the decision. There is no timeline yet for when he might be extradited, he added. A U.S. Department of Justice spokesperson did not immediately return a request for comment. Kwon, who was arrested in Montenegro and charged with carrying falsified official documents, successfully appealed previous high court decisions approving his extradition to the U.S. The appeals court rejected previous extradition decisions by the high court saying the extradition requests approved weren't legally sound. "Deciding on the appeal of the defendant's counsel, the panel of the Court of Appeals assessed that the first-instance court had correctly established that the request of the Republic of South Korea arrived earlier in the order of arrival compared to the request of the USA, so it correctly assessed this and other criteria," Wednesday's notice said. The U.S. Department of Justice has said that it will continue to seek Kwon's extradition to the U.S. Amitoj Singh contributed reporting. https://www.coindesk.com/policy/2024/03/20/do-kwon-appeal-of-south-korea-extradition-rejected-by-montenegro-court/

2024-03-20 14:30

Several months ago, the halving was expected to take place on April 28; now it's on track to land on April 15. Blame the surge in bitcoin's price, which has attracted more mining power and sped up the network. A recent surge in the computing power on the Bitcoin blockchain has sped up the creation of new blocks as mining companies seek to cash in on the bullish trends in the market. Miners are bringing new, more powerful rigs online and even plugging in older machines again, pushing up the network computational power known as the "hashrate." History appears to be repeating itself: A similar dynamic played out four years ago in the months before the last halving, which came earlier than expected. The crypto world is eagerly awaiting next month's bitcoin "halving" – the once-every-four-years event when the reward for adding new data blocks to the network is reduced by 50%. It's a natural, pre-programmed part of the blockchain's underlying code. Astute observers may have noticed, however, that the expected time and date keeps creeping closer. The halving is currently looking likely to fall around April 15, according to Nicehash's countdown. Just a few months ago, it was supposed to come on April 28. A similar phenomenon was observed in the run-up to the last halving four years ago, and history appears to be repeating itself. The halving is considered a momentous event by many, seen as a catalyst for bull runs in the bitcoin (BTC) price and certainly a talking point in this year's runup to an all-time high just over $69,000. As the theory goes, if fewer new bitcoins are being created and demand keeps surging, they're harder to come by, so the value of those already in existence increases. April's halving will see the block reward reduce to 3.125 BTC from 6.25 BTC. But there's another dynamic playing out in the bitcoin market: As the price of the cryptocurrency rises, the rewards of mining it get richer, and more operators are encouraged to turn on their machines or ramp up their computational power, known as "hashrate." Please See: Consensus Magazine's Bitcoin Halving Collection A recent surge in hashrate has sped up the creation of new blocks as mining companies seek to cash in, and they've pushed even harder by bringing newer, more powerful equipment online. Not so long ago, the Bitcoin mining-machine maker Antminer's S19s were all the rage. Now the S21s are the top of the line. "The modern S19 miners series averages around 120 terahashes per second (TH/s), but when you plug in an S21, you're almost doubling that hash rate per slot," Taylor Monnig, senior vice president of technology for bitcoin miner CleanSpark (CLSK), said in an interview. Halvings officially take place every 210,000 blocks, which works out at around once every four years as a new block is added to the network every 10 minutes on average. There are occasional "difficulty adjustments" to maintain the cadence, but over periods of time – and especially in bull markets – the blockchain can speed up. Some firms will reinstall older kit that may soon be obsolete, in order to squeeze every drop of hash power out of their mining fleets as the halving approaches. "Global hash rate was going to grow because lots of people ordered lots of machines. That's the number one factor," Adam Swick, chief growth officer of mining firm Marathon Digital (MARA), said in an interview. "Not as significant, but still evident, is that also people are re-plugging in some old machines due to the prices being high." Read More: U.S. President Again Proposes Crypto Mining Tax, 'Wash Sale Rule' for Digital Assets in New Budget https://www.coindesk.com/tech/2024/03/20/bitcoins-halving-may-be-here-sooner-than-you-know-again/

2024-03-20 10:24

The broad-based CoinDesk 20, an index of various major tokens minus stablecoins, was little changed over the past 24 hours with losses of just 0.34%. Bitcoin experienced a quick recovery after briefly falling below $61,000, with major tokens stabilizing following losses of up to 15%. Analysts lowered the odds of a spot ether exchange traded fund listing, and Bitcoin remains in a downtrend with traders advised to keep an eye on risk appetite in financial markets influenced by central bank meetings. Bitcoin (BTC) rebounded from the day's lows to regain $63,000 in European morning hours Wednesday, staging a quick recovery after briefly falling under the $61,000 level in early Asian trading hours. Still, bets on higher prices saw nearly $600 million in liquidations, data shows, as major tokens declined for a second day. Futures positions showed no bias as of writing time, with longs and shorts equally making up 50% of all futures positions. Major tokens stabilized dropping as much as 15%, CoinGecko data show. The broad-based CoinDesk 20, an index of various major tokens minus stablecoins, was little changed over the past 24 hours with losses of just 0.34%. Ether (ETH) fell briefly under the $3,100 level on Tuesday night as analysts lowered the odds of a spot ETH exchange-traded fund (ETF) listing widely expected for May. Several other layer-1, or base, blockchains also dropped, with tokens of Solana (SOL), Avalanche (AVAX) and Cardano (ADA) losing 8% over 24 hours. Meme coins and exchange tokens outperformed with a 5% drop. Overall market capitalization has declined by almost 15% in the past week. The total cap was down to $2.28 trillion on Wednesday morning, rising to $2.35 trillion by the start of active trading in Europe. Meanwhile, some traders say that bitcoin price action suggests the asset is in a downtrend and investors must look to favorable macroeconomic developments before considering bets. The U.S. Federal Reserve's Open Market Committee (FOMC) is due to set interest rates and discuss the economy later today. "Bitcoin remains in a downtrend, with a series of lower lows and lower highs,” Alex Kuptsikevich, a senior market analyst at FxPro, wrote in an email to CoinDesk. “We will pay attention to bitcoin’s dynamics at the following support levels: $60.3K (correction to 61.8% of the last rally), $56K area (50-day average and 50% level) and $51.5K (consolidation area in February).” “Crypto traders should now keep a close eye on the appetite for risk in the financial markets. Today, it will be heavily influenced by the FOMC and other major central bank meetings later in the week,” Kuptsikevich said. https://www.coindesk.com/markets/2024/03/20/bitcoin-climbs-above-63k-crypto-longs-take-on-600m-in-liquidations/

2024-03-20 10:04

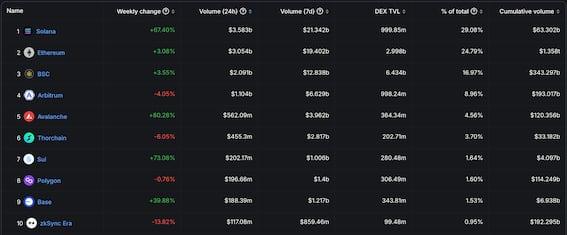

The meme coin frenzy seems to have catalyzed higher volumes on the Solana blockchain, which also boasts greater capital efficiency than Ethereum. Solana-based decentralized exchanges have been busier than their Ethereum counterparts over the past seven days. The meme coin frenzy seems to have catalyzed higher volumes on Solana. Solana also boasts of higher capital efficiency than Ethereum and other chains, according to one research firm. Solana has replaced Ethereum as the No. 1 smart-contract blockchain by trading volume. Trading volume in Solana-based decentralized exchanges (DEX) has increased 67% to $21.3 billion in seven days, data tracked by DeFiLlama show. Volume in Ethereum-based decentralized exchanges rose 3% to $19.4 billion over the same period. There are 17 DEXes on Solana. Orca, the largest, accounts for 88% of the total volume. On Ethereum, Uniswap leads the pack of 46 DEXes. The so-called flippening seems to have been catalyzed by speculative fervor in Solana-based meme coins dogwifwhat, bonk, book of meme, and slerf. At press time, the top trending tokens for the past 24 hours on the DEX Screener were from Solana. Such has been the speculative frenzy that 2,300 meme coins came into existence in a single hour on March 13 and the supply of stablecoins on Solana hit a multiyear high of $2.80 billion. According to Reflexivity Research, the surge in Solana's volume began in fourth-quarter 2023 as a result of the proliferation of points programs and airdrops like the Solana DEX Jupiter. Solana also boasts a higher capital efficiency than Ethereum and other smart-contract blockchains. In other words, the blockchain can support higher trading volumes with a lower dollar value of assets locked in its DeFi ecosystem. "The DEX volume-to-total value locked (TVL) ratio, has recently highlighted Solana's notable performance over Ethereum. This ratio, one measure of capital efficiency, suggests that Solana has recently begun to significantly outpace Ethereum, suggesting a higher level of operational efficiency within its ecosystem," Reflexivity Research said in a recent report commissioned by Solana Foundation. Solana's SOL token has jumped 68% to $170 this year, while ether has rallied 40% to $3,214 and the CoinDesk 20 Index, a measure of the broader crypto market, added 33%, CoinDesk data show.The SOL/ETH ratio hit a record high of 0.059 on Monday and was hovering near 0.053 at press time, according to data tracked by TradingView. Ethereum remains the world's biggest smart-contract blockchain in terms of the total value locked in the DeFi ecosystem. At press time, the TVL in Ethereum stood at $46.44 billion versus $3.6 billion in Solana. https://www.coindesk.com/markets/2024/03/20/solana-leapfrogs-ethereum-on-dex-volume/

2024-03-20 07:59

Davies also said he wouldn't return to Singapore "immediately" in order to effectively avoid jail and wait for some sort of settlement. Kyle Davies refused to apologize for his role in his crypto hedge fund going bankrupt. Davies was speaking on the Unchained podcast and refused to reveal his current location. Kyle Davies, the co-founder of the now-defunct Three Arrows Capital (3AC), has stated that he is not sorry for the crypto hedge fund going bankrupt. Davies was speaking on an episode of the Unchained Podcast on March 19. “Am I sorry for a company going bankrupt? No, like companies go bankrupt, almost every company goes bankrupt, right?” Davies said about the public sentiment that he had not shown remorse. “It’s how you build or what you do about it. We’re definitely trying our best. We can add value in various ways. At a minimum, we can even tell the next Three Arrows how to do things better when they go bankrupt.” Davies and Su Zhu co-founded Three Arrows in 2012 but suffered heavy losses in the mid-2022 crypto market downturn. The crash led to 3AC’s insolvency proceedings, starting in the British Virgin Islands, but reaching both Singapore and the U.S. Zhu was arrested at the Singapore airport in September 2023 for allegedly failing to help liquidate 3AC and sentenced to four months’ imprisonment. Zhu was released early, in December 2023, based on standard provisions for good behavior. Davies said both he and Zhu did not know about a court date, otherwise, why would Zhu enter Singapore? They were in contempt of court, and that is why Zhu was apprehended, Davies said. “Maybe we should (sack our lawyers for not informing us about the court date),” Davies said when asked whether he had fired his lawyers. Davies, who renounced his U.S. citizenship to acquire Singapore citizenship, has not returned to Singapore since then to face the same four-month sentence that Zhu faced. Davies said he would not be returning to Singapore “immediately” but "obviously these things just resolve at some point, there are settlements.” During the interview, Davies also said he didn’t see any reason why he couldn’t return to the U.S. where his family is, but that so far, he had not returned to the U.S. He claimed he was “in Europe” but did not confirm whether he was in Portugal, something he told New York Magazine. In April 2023, the 3AC founders, who were in Dubai, set up OPNX, a bankruptcy claims exchange. Within a month, OPNX was formally reprimanded by Dubai’s crypto regulator for operating an unregulated exchange, and by Feb. 2024, the exchange was shut down. However, during the current bull run in the crypto market, OPNX seemingly relaunched as $LAMB. “Lamb is a token focused on the concepts of Sacrifice, Servant Leadership and the Kingdom of God being within you,” OPNX's X profile said. In September 2023, Singapore’s central bank issued a nine-year ban against the 3AC founders, prohibiting them from operating in the country’s regulated financial services industry. In December 2023, a worldwide court order from a British Virgin Islands court froze more than $1 billion in assets belonging to the 3AC founders. Read More: Worldcoin’s Rocketing WLD Token Could Benefit Creditors of Three Arrows Capital, FTX https://www.coindesk.com/policy/2024/03/20/3ac-co-founder-kyle-davies-says-he-wont-apologize-for-crypto-hedge-fund-going-bankrupt/