2024-03-13 17:16

Anthony Grabiner alleged that some of COPA's fraud claims had no exact proof. Craig Wright's legal team denied the Crypto Open Patent Alliance's arguments in its closing argument Wednesday. COPA took Wright to court last month to try and prove he is not Satoshi Nakamoto, the creator of Bitcoin. Craig Wright's team started its closing submissions on Wednesday by rebutting the Crypto Open Patent Alliance's fraud allegations against Wright in a trial that is set to find out whether or not Wright is Satoshi Nakamoto, the creator of Bitcoin. Anthony Grabiner, Wright's attorney, hit back at COPA's argument that private signing sessions Wright hosted to prove he was the Bitcoin founder had been subverted, saying that no proof had been presented. He also argued that COPA's witness Patrick Madden's evidence was inadmissible due to his ties with COPA. Madden had testified that many of Wright's reliance documents had been altered "often with the apparent purpose of supporting his claims," a court document seen by CoinDesk showed. Grabiner later added that in Wright's defense, he had not said that his reliance documents had never been edited. COPA's counsel said in his closing statements on Tuesday that the evidence shared during the trial shows “beyond doubt” that Wright isn’t Satoshi. COPA's representatives also said they plan to ask U.K. prosecutors to consider if the computer scientist perjured himself during the trial. The results of the case could have repercussions on other existing trials against crypto exchanges and developers. Wright's counsel will continue giving their closing statement on Thursday. https://www.coindesk.com/policy/2024/03/13/craig-wrights-counsel-hits-back-at-copas-fraud-allegations-in-closing-argument/

2024-03-13 16:48

While Ethereum's rollup-centric roadmap could help the ecosystem reach new levels of scale, some developers think relying on third parties to improve access to Ethereum could backfire. Ethereum's biggest update in over a year, Dencun, finally arrived on Wednesday after years of planning. It's seen as a good thing. But maybe not universally so. Proto-danksharding, the main change coming with the Dencun update (a portmanteau of two simultaneous updates: "Deneb" and "Cancun"), marks Ethereum's first step down the road of "sharding," a method for increasing the chain's transaction capacity by adding new lanes to its proverbial blockchain highway. The feature is specifically aimed at reducing fees for layer 2 "rollup" networks – chains like Optimism, Arbitrum and Coinbase's Base network that run on top of Ethereum and offer users the ability to transact for cheap without leaving the ecosystem entirely. While many developers are celebrating Dencun for its potential to accelerate Ethereum towards improved affordability, others worry that it risks setting the ecosystem down a path that could, in the long run, come back to bite it. "The Dencun upgrade is Ethereum’s response to clear needs for greater scalability," Rich Rines, an initial contributor at Core DAO, which develops blockchain infrastructure, said in a message to CoinDesk. With Dencun, Ethereum is "focusing on empowering Layer 2 solutions," but "questions remain whether this is a long-term fix." Read More: Ethereum Finalizes 'Dencun' Upgrade, in Landmark Move to Reduce Data Fees Proto-danksharding Ethereum has higher fees than many competing networks and has struggled as a result of that. Dencun doesn't do much to address the issue – at least not directly. "Ethereum is not planning on bringing down fees for its users, and that's a reality that people need to understand," Christine Kim, vice president of research at crypto investment firm Galaxy Digital, told CoinDesk. Instead of bringing down Ethereum's gas fees, which could take years to plan and implement, the network's co-founder, Vitalik Buterin, has been among the leading voices to push the network towards a "rollup-centric" roadmap that places the onus of scaling primarily into the lap of third-party layer-2 networks. Proto-danksharding is the first big step towards this vision – optimizing the network to better accommodate rollups, which have steadily grown to surpass Ethereum in overall transaction volume. The feature works by introducing "blobs," which are a new data structure that layer-2 rollups can use to post data back to the base Ethereum chain. "We're increasing supply significantly for exactly the type of data that rollups need, and also the type of data that's not really useful for any other applications on L1," explained the Ethereum Foundation's Tim Beiko, who leads Ethereum's biweekly "All Core Devs" calls and helped coordinate the Dencun upgrade. "This creates much more room for them to post their data, and therefore lowers the fees." Fears of fragmentation While pushing users towards cheaper layer-2s can help make the Ethereum ecosystem more accessible, some developers warn that embracing third-party networks could backfire – fragmenting the Ethereum ecosystem, and diluting its primary use-case as the premier blockchain "settlement layer." "The natural outcome of wanting to push users from Ethereum to other L2s means that you are ceding your dominance as a general purpose platform for general purpose compute," said Kim. "You're saying that other protocols should do that responsibility of general purpose computation." "While L2s are supposed to service the base layer, their proliferation may compete with the base layer for resources such as fees, developers, and liquidity," said Rines. "If the bulk of transactions take place on L2s, the economic incentives upholding the L1 may be diluted as validators’ fees evaporate. Furthermore, reliance on L2s could also fracture activity, weakening the cohesion and interoperability of the Ethereum ecosystem." In the interview Tuesday, Beiko waved away the fragmentation concerns. Developer fragmentation, according to Beiko, is "more a feature than a bug." "Different people being able to deploy different types of rollups and experiment with that is hugely valuable," he said. Read More: Arbitrum's ARB, Polygon's MATIC Lead Gains as Ethereum's Dencun Upgrade Goes Live Ethereum rollup security But there are also concerns with the security of rollups. Whereas rollups are ultimately designed to "borrow" Ethereum's security apparatus – bundling up transactions from users, and then passing them down to the base chain with the same security guarantees – "L2s have varying designs, so any user who wants to access the full gamut of Ethereum use-cases may need to trust numerous different blockchain rulesets," said Rines. Not all layer-2 rulesets are created equal: Despite billions of dollars in transaction volumes, all of today's biggest rollups have "training wheels" – things like centralized sequencers or non-existent proof systems that rely on user trust to operate. The training wheels help keep down fees and protect users from certain kinds of bugs, but they place the rollups out of step with key Ethereum values like decentralization and permissionlessness. "Rollups today are definitely not as secure as Ethereum L1 for a bunch of reasons," said Beiko. "It does fall on us as a community to educate people around that." As users become more comfortable transacting on compromise-laden layer-2 networks, there's concern that Ethereum's decentralization-purist pitch might hold less sway. But according to Beiko, a shift towards cheaper networks may be inevitable, and Ethereum is simply adapting to reality. "I don't think it's Ethereum's role to dictate how the whole market structure should evolve," he said. "I'm glad there's just more options for users." https://www.coindesk.com/tech/2024/03/13/debating-dencun-will-ethereums-big-update-help-or-harm-the-network/

2024-03-13 10:17

Spot bitcoin exchange-traded funds took in 14,706 BTC, or over $1 billion, in net inflows on Tuesday, data tracked by BitMEX Research shows. Bitcoin reversed Tuesday's decline to climb above $73,000 early Wednesday. Spot BTC exchange-traded funds noted the highest inflows in both bitcoin and dollar terms since they started trading in January. Bitcoin's price behavior suggests institutional investors are leading the market activity, some observers said. Bitcoin (BTC) climbed above $73,00 early Wednesday, adding 2.5% in 24 hours to reverse Tuesday’s losses after a $360 million liquidation event sent prices tumbling. The gain followed a record day of exchange-traded fund (ETF) inflows in terms of both dollars and bitcoin. Data tracked and cited by BitMEX Research shows spot bitcoin ETFs took in 14,706 BTC, or over $1 billion, in net inflows on Tuesday, surpassing a February record of $673 million. Blackrock posted a record $849 million of inflows while Grayscale led outflows at $79 million. Total inflows crossed the $4 billion mark. Some traders said that the bitcoin price action suggested institutional buying. “The intraday nature of the move is reminiscent of the behavior of large institutional traders, with trading algorithms intercepting the move and retail traders often joining in,” Alex Kuptsikevich, a senior market analyst at FxPro, said in an email to CoinDesk. “Either way, the overall trend remains bullish, and bitcoin is back towards its highs as we head into early European trading.” General market sentiment remains bullish among professional investors, as reported, with some expecting the market to run into a “sell-side crisis” later this year as buying demand from ETF continues to increase. https://www.coindesk.com/markets/2024/03/13/bitcoin-eyes-74k-as-btc-etfs-see-record-1b-in-net-inflows/

2024-03-13 09:30

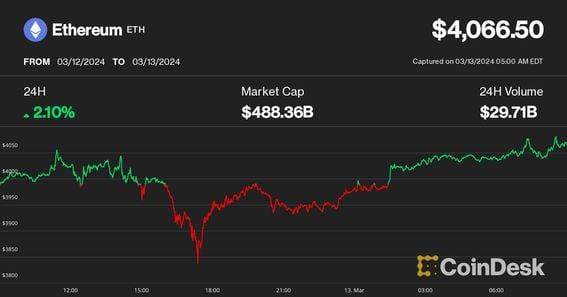

QCP's sentiment towards ether is cautiously optimistic, with concerns about potential corrections and the impact of leverage in the market. QCP Capital warns of a potential price correction for Ether despite its recent surge past $4,000, noting a shift in market sentiment and a low probability of a spot ether ETF approval in the near future. The firm remains cautiously optimistic about Ether’s long-term potential, citing the possibility of price reflexivity with current market dynamics and network upgrades while also expressing concern about the amount of leverage in the market. Ether (ETH) prices could see a possible correction, Singapore-based digital assets trading firm QCP Capital said in a series of recent notes published to its Telegram channel. The trading firm is still cautiously optimistic about the long-term potential of ether. Although ether has sailed past $4,000, its highest price in two years, QCP writes that it’s observing a shift in market sentiment, marked by negative risk reversals. These reversals measure the difference in implied volatility between call and put options and have turned negative, likely due to the low probability of a spot ether ETF being approved in the near future. Historically, network upgrades like Bitcoin’s Taproot and the Ethereum merge have had minimal impact on pricing under bearish and sideways market conditions, but with current market dynamics, there could be price reflexivity on Ethereum and its Layer 2s, potentially influenced by the already priced-in Dencun upgrade or a positive knee-jerk reaction, along with possible capital inflows into Layer 2 ecosystems, QCP analysts wrote in a Telegram interview with CoinDesk. A Polymarket prediction market contract only gives a 31% chance of an ether ETF being approved by May 31. CoinDesk recently reported that market data shows a rise in demand for ether put options as traders prepare for short-term weakness. This is reflected in the negative skew of one-month and 60-day call-put ratios, while longer-term sentiment remains positive. QCP also wrote that it is concerned about the amount of leverage currently in the market, but traders will quickly buy back any dips. Excessive leverage in the market is said to have caused the May 2021 crash, where prices fell by 30% over the course of 24 hours, and a 10% correction in bitcoin’s price in January. Ether has outperformed the CoinDesk 20 (CD20), which tracks the world’s largest and most liquid cryptocurrencies, gaining 54% in the last month versus the CD20’s 50% rise. https://www.coindesk.com/markets/2024/03/13/ether-could-see-price-correction-after-dencun-upgrade-qcp-capital-says/

2024-03-13 07:50

Nigeria is also demanding all transaction history spanning the past six months from Binance. Nigeria wants Binance to give information regarding its top 100 users in the country and all transaction history spanning the past six months. Neither Gambaryan nor Anjarwalla have been charged with an offense but were being held “simply as hostages,” the FT reported. Nigeria wants Binance to give information regarding its top 100 users in the country and all transaction history spanning the past six months, the Financial Times reported on Tuesday. The demand comes as Nigeria’s detention of Binance’s compliance head and Africa region manager moves into a third week. Binance’s Tigran Gambaryan and Nadeem Anjarwalla have been held against their will in a “guesthouse” run by Nigeria’s National Security Agency after arriving in Abuja on Feb. 25 on the Nigerian government’s invitation. By Feb. 29, the news of the detention had emerged without the names of the executives. The titles and names emerged on Tuesday. Nigeria’s government and Binance have been involved in a dispute about some $26 billion of untraceable funds. According to the FT, Nigeria sees Binance as a crucial link undermining government efforts to stabilize its currency, the naira. Additionally, Nigeria is asking Binance to resolve any outstanding tax liabilities. Binance has removed the naira for trading from its website. Neither Gambaryan nor Anjarwalla have been charged with an offense but were being held “simply as hostages,” the FT reported, citing "one person briefed on the situation.” The person also said they were being well treated. In the past 24 hours, a Binance spokesperson has stated that “we are working collaboratively with Nigerian authorities to bring Nadeem and Tigran back home to their families.” The FT cited a court order that allowed the detention of the Binance executives for 14 days, ending Tuesday, with an extension hearing scheduled for Wednesday. Read More: Nigeria Invited, Then Detained Binance’s Compliance Head and Africa Manager for Two Weeks: Reports https://www.coindesk.com/policy/2024/03/13/binance-nigeria-brawl-continues-as-country-asks-exchange-to-submit-list-of-top-100-users/

2024-03-13 07:02

The study comes despite warnings about the risks associated with NFTs due to bad actors around correcting misinformation or misappropriation of trademarks. Current laws around intellectual property are enough to deal with concerns around NFTs, a government study has found. The study was requested by Former Democratic Senator from Vermont, Patrick Joseph Leahy and Democratic Senator from North Carolina, Thom Tillis, in June 2022. The current intellectual property laws are adequate to deal with concerns about copyright and trademark infringement associated with non-fungible tokens (NFTs), a 112-page long study by the United States Patent and Trademark Office (USPTO) and the U.S. Copyright Office has concluded. The study was requested by Former Democratic Senator from Vermont, Patrick Joseph Leahy and Democratic Senator from North Carolina, Thom Tillis, in June 2022. The USPTO and the Copyright Office conducted three public roundtables and solicited comments from interested stakeholders. The offices found that most stakeholders that the current laws were adequate, even though “trademark misappropriation and infringement are common on NFT platforms.” “The Offices agree with these assessments and do not believe that changes to intellectual property laws, or to the Offices’ registration and recordation practices, are necessary or advisable at this time,” the study concluded. The stakeholders also expressed concerns that NFT-specific legislation would be premature at this time and could impede the evolving development of the tech around NFTs. This despite a technology industry association warning "that bad actors misappropriate trademarks to solicit, and then exploit, consumers’ personal information and urged the Offices to consider this risk in the context of NFTs." U.S. regulation around NFTs has had a shade of ambiguity, if not a spectrum. In August 2023, Impact Theory, a California-based media company, settled charges brought by the U.S. Securities and Exchange Commission (SEC), the first NFT-related enforcement action by U.S. regulators. Impact Theory sold three tiers of NFT offerings, and because the company promised investors would profit off the collectibles, the SEC deemed these NFTs to be securities. Impact Theory agreed to set up a fund to reimburse investors and pay a fine of $6.1 million. The case did not suggest regulators consider all NFTs to be securities. The study said the lack of "controlling judicial precedent regarding whether a trademark registration for physical goods can be enforced against the use of that mark on similar digital goods tied to NFTs complicates enforcement efforts." Still, the likes of even Donald Trump have introduced and sold out their NFT collections. Read More: NFT Providers May Need Registration to Comply With UK Money Laundering Rules https://www.coindesk.com/policy/2024/03/13/us-govt-study-concludes-no-nft-specific-legislation-needed-yet-current-copyright-laws-adequate/